Subscription management software enables SaaS companies to bill their customers through various payment options and efficiently manage billing cycles and transactions.

Relying solely on spreadsheets and other manual methods for managing all billing cycles and transactions is not that easy, especially when you have many customers. Collecting customer details and tracking their subscription status, generating invoices and receiving payment, and so many things in between could be tiring.

Therefore, it is necessary to have subscription management software in place to manage all your needs and increase your productivity at work.

So, let’s talk about subscription management software and how it can help! Furthermore, if you are new to this concept, I’ve added a bit of a walkthrough as to what it is, why it is required, and how to choose the best subscription management software.

Below is the list to showcase the top subscription management software based on engagement, personalization, and more.

- 1. BareMetrics

- 2. Maxio

- 3. MRR.io

- 4. ProfitWell

- 5. ChartMogul

- 6. Chargebee

- 7. Verifone

- 8. Zoho Billing

- 9. Recurly

- 10. Billforward

- 11. Zuora

- 12. Stripe

- Show less

You can trust Geekflare

At Geekflare, trust and transparency are paramount. Our team of experts, with over 185 years of combined experience in business and technology, tests and reviews software, ensuring our ratings and awards are unbiased and reliable. Learn how we test.

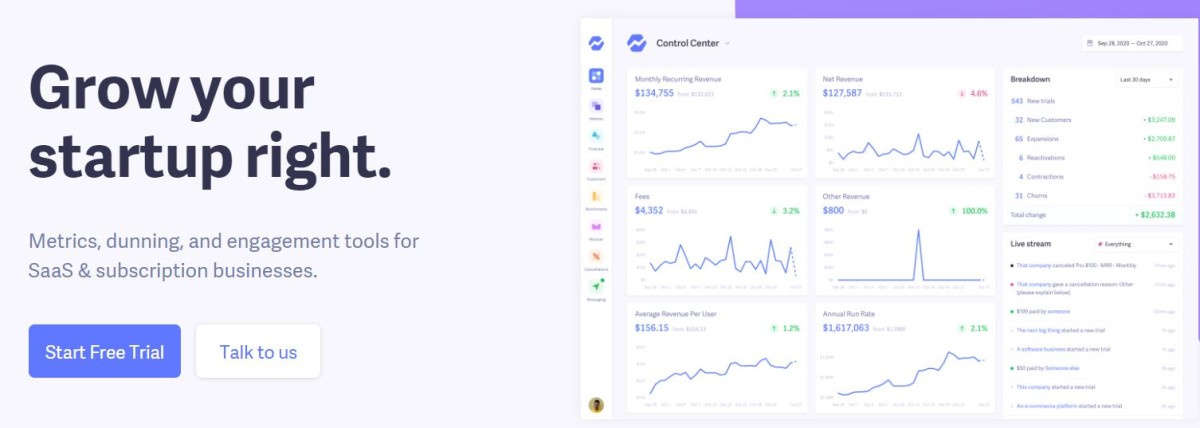

1. BareMetrics

Grow your business effectively with BareMetrics, which helps you with precise metrics, engagement tools, and dunning for SaaS businesses.

The software displays useful insights such as activity trails, transactions, events, and numbers from the control centre that help you make better, profitable decisions to advance your business. You can visualize data from the present and past and then plan and strategize for the future.

Using people insights, you can segment customers based on location and other metrics. The software helps you even to create and handle new customers manually via the subscription form. BareMetrics comes with a smart dashboard that helps you make complex comparisons effortlessly, such as numbers, dates, customer segments, and plans.

Normalize charts by choosing trendiness, creating business goals, adding comments, and more. Use Recover to avail of a dunning solution and save your business from loss due to insufficient funds, expired credit cards, bank issues, etc.

It comes with tools for customizing email campaigns, paywalls, in-app reminders, capture forms, deep analytics, etc. BareMetrics forecasts help you predict the future through smart MRR projections, churn percentage, growth type, customer counts, cash flow forecasting, and more.

Get email reports to stay tuned with monthly, weekly, or daily reports and track progress. Its augmentation feature allows you to merge external information with your own metrics so you can take deep insights into your business and customers.

You can integrate with Zapier, and Slack, import CSV files, and use their API to send additional data. There are many other features included in BareMetrics, such as segmentation, benchmarking, Slack tools, analytics API, cancellation insights, and more.

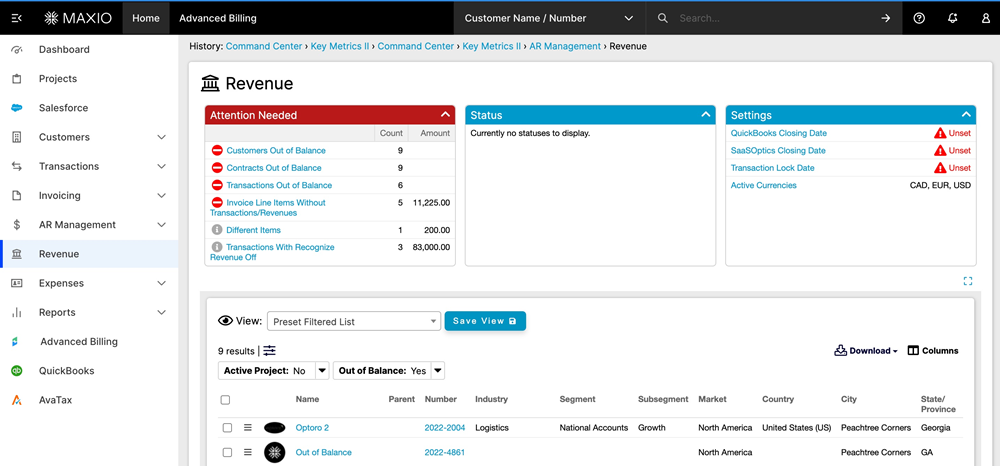

2. Maxio

Maxio is an all-in-one financial operations platform for B2B SaaS companies, enabling them to manage their subscription and revenue with ease. It helps these businesses offer flexible pricing and packaging options while automating a range of processes from rating and invoicing to reporting and analysis.

The platform also ensures the highest compliance standards as it’s Level 1 PCI Compliant – delivering customers peace of mind when it comes to managing payment information securely whilst streamlining order processing, reducing churn, and eliminating revenue leakage.

The platform enables Automation of billing, subscription management, collections, and reporting, allowing businesses to focus on growth rather than financial processes.

| Pros | Cons |

|---|---|

| ✅ Cohort reporting | ❌ High cost for small businesses |

| ✅ End to end Automation | ❌ Lack of customization |

| ✅ Automates GAAP compliance | ❌ Challenges with Billing API |

| ✅ GL & ERP integrations | ❌ Interface limitations |

How Much Does Maxio Cost?

Maxio pricing is based on trailing twelve-month billing volume. The price starts at $599/month. The software also provides options to add or remove modules such as Advanced Revenue Management, Expense Amortization, Milestone-Based Projects, etc, as needed.

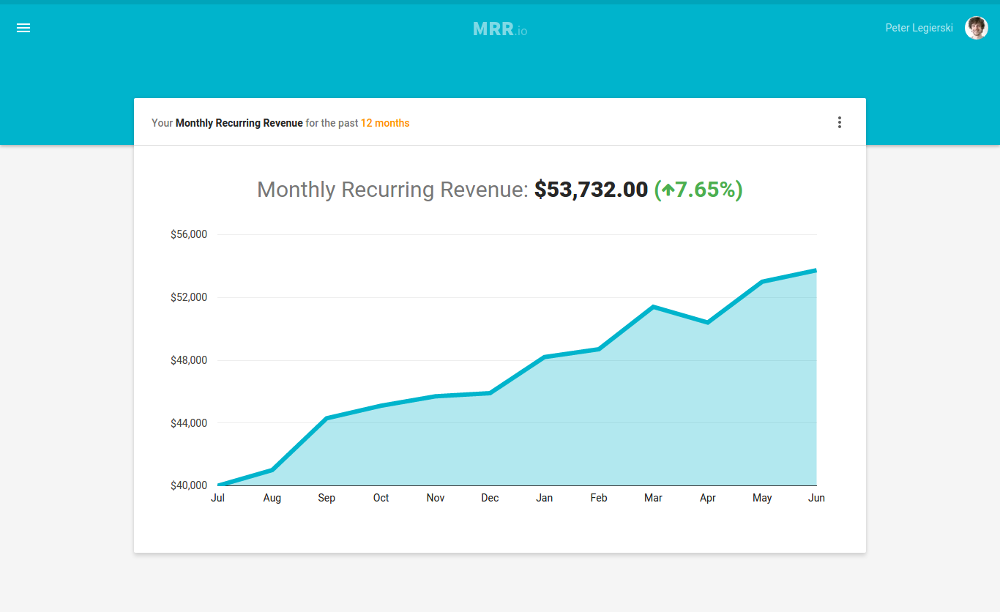

3. MRR.io

Track your recurring revenue every month using MRR.io, regardless of what payment processing service you use. They provide you with accurate metrics automatically, so your SaaS business can thrive.

The features included in MRR help you calculate: monthly recurring revenue, MRR movement, net revenue, net revenue churn, customer churn, and gross revenue churn, new churn, contraction and expansion MRR, upgrades and downgrades, annual run rate and refunds, average revenue per customer, paying customers, new paying customers, failed charges, lifetime value and cancellation.

The pricing structure of MRR.io consists of two plans:

- Basic Plan with all the metrics explained above and allowed a maximum of 3 users and 100 paying customers. It is completely free.

- Pro Plan with all the above metrics, additional 4 features explained, and unlimited users and paying customers. Its pricing is $19/month.

In addition to these metrics, MRR.io also provides additional features such as cohort analysis, metric forecasts, multiple data sources, and advanced email reports. It supports integration with Paddle and Stripe, and there is the availability of manual data entry and APIs.

4. ProfitWell

The goal of ProfitWell is to manage your subscriptions smoothly without any confusion around. Whether you need subscription reporting, free analytics, or to become a pricing strategy expert, they provide accurate services to you.

As a result, it optimizes your revenue and monetization and reduces churn. Using that analytics and reporting, you can identify areas where you are already working great in addition to those where you are not strong.

It helps you see the way you are positioned against your competitors with similar stages for comparison. Use their mobile app to stay notified in real-time on your Android or iOS smartphone. ProfitWell allows you to benchmark your pricing strategy and monetization health so you can improve.

You can perform a retention audit to find the areas where there are a revenue leakage and the ones where you can increase your retention. They enrich data with Clearbit and Full Contact to discover customer segments driven or distracted out of subscription growth.

Analyze based on location, gender, and 107+ other segments for free. Share your metrics wherever you want, and integrate with multiple platforms such as Stripe, Google Sheets, ReCharge, Chargebee, Braintree, Recurly, Zuora, Chargify. ProfitWell is secure and compliant with GDPR, so you don’t get into any legal trouble.

5. ChartMogul

ChartMogul is probably one of the best subscription data platforms, which is thriving since 2014. The software makes it effortless to clean and consolidate billing data and then analyse it using efficient subscription analytics.

It helps you comprehend your business dynamics and visualize where you must channel your efforts to. You can explore subscription data, including MRR, MRR movements, MRR breakdown, net cash flow, and more.

Turnkey integrations and APIs help you import your revenue and subscription data into one single source in no time via an import tool or CSV upload tool, so you see everything clearly and organized.

ChartMogul supports integration with Stripe, Braintree, Recurly, App Store Connect, PayPal, Chargebee, Chargify, Gocardless, Shopify, Zuora, and Google Play. Using Data Enrichment, you can add more data in ChartMogul, segment customers, and analyse the information.

Bring more data using tools like Intercom, MailChimp, HubSpot, Pipedrive, Wootric, Close.io through Zapier, or create one on your own. Perform data exports to display insights and metrics when your team requires them by connecting ChartMogul with Zendesk, CSV Export, Geckoboard, Slack, Visible, etc.

6. Chargebee

If you are looking for subscription management software that can be scaled up with your growing business, Chargebee should be your choice. It lets you explore new opportunities for revenue as well as retain more subscribers through self-service and proactive engagement.

Users get a unified view of all the customer and subscription data for contextual engagement. It also recommends add-ons and bundles for upselling opportunities. Companies can manage their pricing using any subscription pricing model.

They can also use Chargebee to create recurring billing workflow and automate invoicing rules. The software removes developer dependencies and lets you have control over complex recurring billing scenarios.

It supports 100+ currencies and payment methods for global subscriptions. The software also offers comprehensive subscription analytics to provide you with 360° business visibility into all the key metrics.

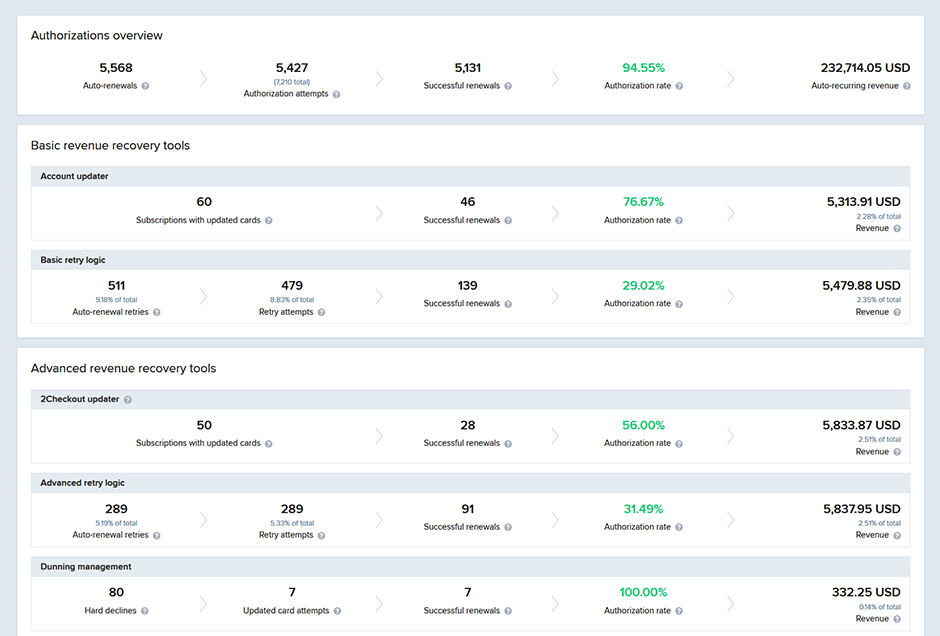

7. Verifone

When it comes to dealing with recurring billing and invoice management, Verifone is here to help you. This subscription billing solution helps you improve your revenue by managing the entire subscription lifecycle.

It lets you sell subscriptions across multiple channels and offers an enhanced experience to the customers through optimized carts. Features like Order, invoicing, and recurring billing automation are also useful for getting the customers onboard quickly.

Verifone also lets you easily handle any subscription upgrade and downgrade. The solution also comes with tools that prevent churn (involuntary and voluntary). It also offers global payment support for recurring billing.

The Authorization and Revenue Recovery Dashboard can be used to monitor the strategy and get insights into important subscription data. It also offers reports to monitor renewal forecasts and other crucial metrics.

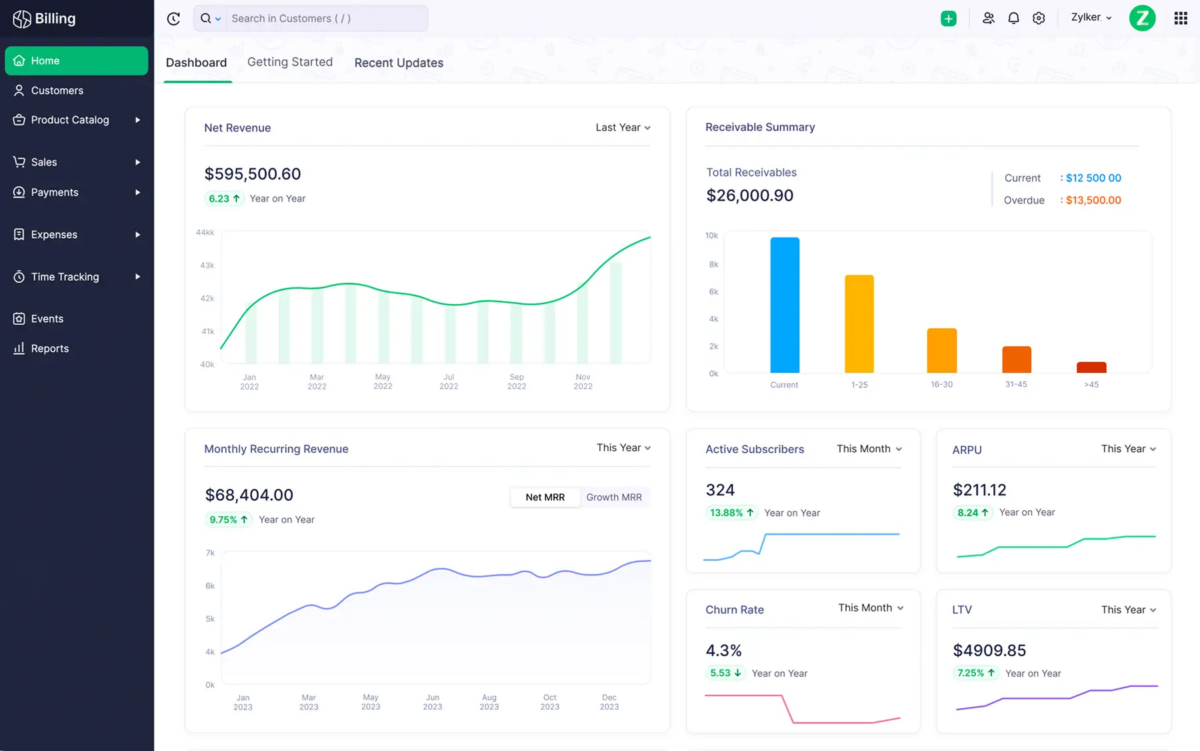

8. Zoho Billing

Zoho Billing makes the end-to-end subscription billing lifecycle easy for growing businesses. Get rid of the hassle of manually sending invoices to each subscriber and use this software to automate the billing and invoice-sending processes.

Here, you get the freedom to choose the billing frequencies and cycles for each of your customers. It can be used to send bills anywhere in the world and still stay tax-compliant. It also stores personal customer information like credit cards securely.

When you use Zoho Billing, your customers can pay you in multiple currencies using online and offline modes. For any involuntary failed payments, it lets the customers retry. It also offers a self-service portal to customers and lets them manage multiple subscriptions.

The platform also offers you a collection of invoice templates and 30+ types of analytics reports for sales revenue, subscription, and churn rate. You can also view the KPIs from the dashboard and generate tax reports to learn about your tax liabilities.

9. Recurly

Recurly is a subscriber management solution that helps you manage all stages of a subscription lifecycle. It offers robust and flexible tools to maximize subscription values and grow confidently as a company.

Its intuitive toolsets simplify the subscription process by maintaining all subscriber data in one location. Its subscription dashboard is all you need to manage subscriptions with full visibility, whether they are active, paused, or cancelled.

Using Recurly, companies can increase customer satisfaction and business goodwill by letting subscribers effortlessly add, change, pause, and cancel their subscriptions anytime. For B2B contracts, it supports setting up a future date for subscription.

The software also offers you reports on subscription status for proactive actions from your side. It also has a postponement option to change the current billing cycle of a customer.

10. Billforward

Billforward is a comprehensive subscription and recurring billing software designed to meet the varied needs of businesses. It enables customers to sign up, collect payments, and manage subscriptions with options for usage-based and event-based billing, as well as volume and tiered discounts.

Built by developers with API access for integrating external tools into its headless architecture, Billforward works in tandem with any payment gateway, allowing total control over operational direction. It offers intelligent dunning services that make sure missed payments are recovered automatically using preconfigured schedules.

Easily build the ideal subscription plan for your business with Billforward’s Subscription Builder. The platform offers multiple types of pricing components, volume pricing tools, comprehensive management capabilities, and automated emails/ notifications to optimize customer experience.

| Pros | Cons |

|---|---|

| ✅ Intelligent Dunning Techniques | ❌ Dependency on payment processing |

| ✅ Location-based tax rate automation | ❌ Security, Compliance, and Safety measures may require direct inquiry with the company |

| ✅ Multiple integrations | |

| ✅ Automated Invoices |

Is Billforward Costly?

The pricing structure is primarily divided into Growth and Scale editions. The price starts at £139 per month for up to 12 team members. The company also offers a customer pricing structure based on individual requirements.

11. Zuora

Zuora Revenue is the most used industry-leading automated revenue management solution that automates your quote-to-cash process. With Zuora’s suite of comprehensive products, robust capability is offered – from contract review to subscription optimization, bill automation, and many more.

This award-winning platform is trusted by some of the best organizations, viz Microsoft, Zendesk, Cloudflare, Salesforce, McGraw-Hill, Zoom, Canon, Ford, Honeywell, Caterpillar, etc.

Zuora’s low-code SDK and API platforms offer easy integrations to existing applications. Such annalizations can lead to quick compliance rate assessments, SSP establishment, transaction price calculations as well automatic revenue reconciliation for faster book closing processes.

Research conducted by Forrester Consulting outlines that this company’s clients have reported results, as they reduced their contract reviews by up to 85% and spent 75% less time in the implementation of new strategies, along with a 50% acceleration in month-end closings.

| Pros | Cons |

|---|---|

| ✅ 60+ prebuild reports | ❌ Limited customization |

| ✅ Real-time revenue analytics | ❌ Reporting issues |

| ✅ End-to-End Revenue Automation | ❌ No compliance with GAAP ASC 606 |

| ✅ Cost and Risk Minimization |

Is Zuora Expensive?

The price information is not available on the site and may be disclosed after getting in touch with their sales team. The software does not even offer a free trial period.

12. Stripe

Stripe helps millions of companies automate financial processes and accept payments from customers online and in person. Its products offer solutions to improve revenue for retailers, subscription businesses, software platforms, and marketplaces, among others.

The Stripe Billing platform has been adopted by Slack, Atlassian, Notion, OpenAI, Udacity, Amazon, Shopify, Whatsapp, Google, BMW, etc.

Experience greater efficiency and profitability with Stripe Billing. With its user-friendly interface, powerful management tools, flexible billing logic, automated retries for failed payments, expert reporting capabilities, and more – you can accelerate your business’s growth.

The platform helps to streamline revenue processes from start to finish – easily implement per-seat pricing or metered billing models that fit your needs, and take advantage of automated card updates to reduce churn with ease.

| Pros | Cons |

|---|---|

| ✅ Granular control on pricing | ❌ High processing fees |

| ✅ Unified API for global payments | ❌ Limited in-person payment options |

| ✅ Minimizes churn | ❌ Chargeback fees |

| ✅ Developer-friendly | ❌ Pricing limitation |

How Much Does Stripe Billing Cost?

The pricing structure is designed to suit all business needs, and the price starts from 2 percent and above for card transactions. They even have a customer pricing structure.

What is Subscription Management Software?

The software that helps businesses power up their product/service billing and sales based on a recurring period is subscription management software. It aims to provide customers with better services and streamlined revenue management for SaaS and other related businesses.

It stores all the payment details along with processing charges to manage recurring revenue automatically. The software also makes sure you charge the right amount of fee to the right subscriber or customer in the right intervals.

For this, the software is added over the one-time payment function of a payment gateway. Your products here are provided as a software suite, otherwise a standalone software or tool. It also integrates with other tools, including eCommerce platforms, catalog management tools, payment gateway, etc.

However, many people get confused with other similar tools, such as payment gateways, merchant accounts, etc. In reality, subscription management software or recurring billing software works on top of a payment gateway like Stripe to let them handle subscriptions while ensuring no errors happen in charging the right amounts from customers based on their plan.

Similarly, SaaS analytics software works on top of a subscription management tool that lets you analyze your MRR, churn, number of active customers, and other important metrics.

What is the Need for Subscription Management or Analytics?

If you have an e-commerce store, app, delivery service, etc., that serves many customers, a subscription management system can boost your revenue. It’s because this software helps your customers to implement subscriptions easily into their preferred payment gateway.

And when they sign up for any of your services or products, they easily become your customers or subscribers by entering their bank details right away and using the same information during renewals also.

As a result of this convenience, ease, and speedy workflow, your subscriber base increases; besides, your fulfillment and sales team can also monitor and manage subscribers’ accounts effortlessly using the subscription management software for a smooth workflow.

In addition to those aspects, the software offers some more important functionalities to you, like analytics, dunning, and real-time actionable data that you can use in your marketing campaigns.

As your customers advance with their subscription periods, you can also offer interesting opportunities to them, such as renewals, upsells, and cross-sales, by healthily following up with your customers.

Your outreach and marketing teams could view subscriber information along with their chosen plans to reach out to them with product tips, collect feedback, and offer special discounts.

As a result of such personalized interactions, your churn rate decreases while customer engagement and revenue increase.

Next, let’s discuss how to choose the best subscription management software.

How to Choose a Good Subscription Management Software?

Choosing a good subscription management software entails the following:

- Choose the software that can align with your company’s goals in terms of what services you actually need, like just subscription management or additional services like analytics, dunning, merchant stores, or all of them.

- The software must be scalable to satisfy the needs of your growing business.

- It must support customization, which helps you to adjust based on your challenges.

- It must be flexible enough to provide different plans you can choose to move up/down.

- You must be able to manage your coupons, promotions, and discounts easily with a re-activation or cancellation option.

Now that you know what to look for, revisit the list and see which one most fits your business requirement, as there cannot be a one-software-fits-all when it comes to business goals.

Conclusion

Subscription management software has become a huge necessity for SaaS companies, and now you know the reason behind it.

So, choose any of the above-mentioned services to streamline your billing, subscription analytics, and other important things and boost your revenue.