Mobile money transfer apps enable users to send and receive money electronically using their smartphones.

These apps are secure and convenient for sending money to your loved ones internationally without any extra effort.

They often save a lot of time that goes into manual checks, depositing cash in bank accounts, and visiting banks to make international money transfers.

In this article, we’ll briefly discuss money transfer apps and which are the most popular for transferring money internationally.

What are Money Transfer Apps?

Money transfer apps allow you to send and receive money to a person or a business quickly and securely. These apps make money transactions easier, and you do not need to visit banks in person to manage an account.

Normally, money transfer apps offer a digital wallet linked to your bank account or credit card where you can store money and use it for online bill payments.

Most money transfer apps are designed for use within the local boundaries of the country. However, there are some money transfer apps that allow international payments, pay international bills, and offer digital wallets.

International money transfer apps normally have in-built currency conversion services that allow you to send money in your local currency, and it gets converted automatically to the recipient’s local currency. The apps particularly charge a small fee for handling conversions and international money transfers.

Let’s begin by exploring the best money transfer apps list.

Remitly

Remitly is a fast and secure money transfer app that allows money transfers to 3000+ banks and 350,000+ cash pickup locations over the globe. Some trusted bank names include Bancoppel, BDO, Banreservas, GT Bank, Bank Alfalah, Polaris Bank, ICICI, MCB, and more.

You can use your bank account, credit card, or debit card to send money worldwide. With Remitly, you get guaranteed delivery times and real-time transfer updates, and recipients can collect the cash without paying a fee.

Remitly has an average rating of 4.9 stars on the Apple app store because of its customer support, no hidden fees, and offers. The platform has a dedicated customer care team available 24/7 to help you in English and Spanish languages.

Features:

- Multiple layers of security

- No fees for receiving money

- Network coverage of 150+ countries

- 24/7 customer care support

It works on:

- iOS

- Android

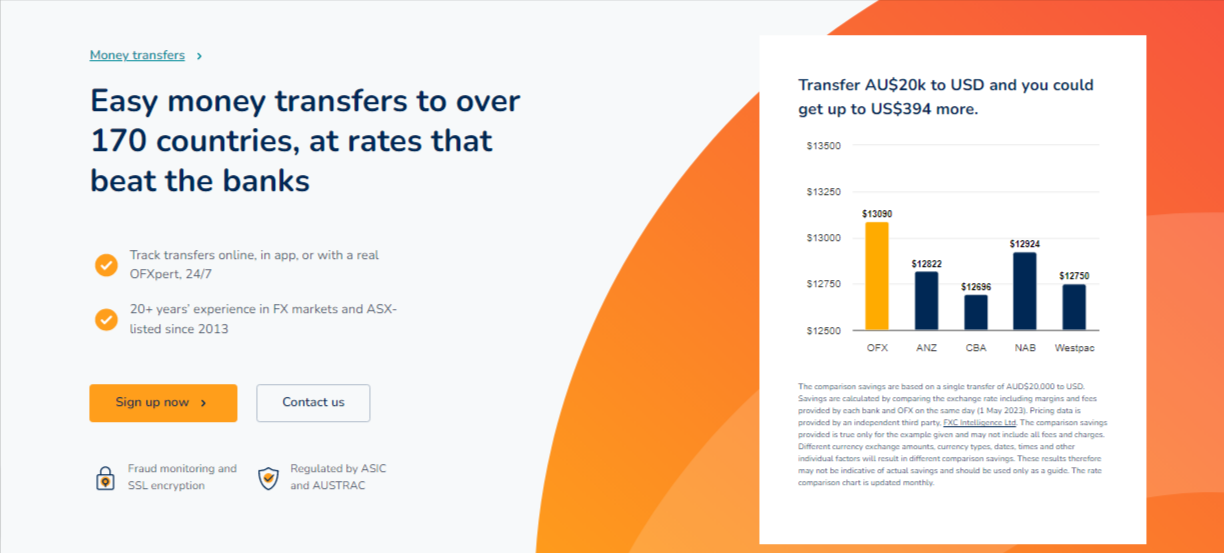

OFX

OFX is an Australian-held financial service company that allows users to make international money transfers. More than a million users use OFX to transfer money in more than 170+ countries.

It is available as an online platform and as a mobile app. OFX offers competitive exchange rates and lower fees, making it a lucrative option for individuals to transfer money across countries.

Besides, it also provides features like forward contracts, stock market commentary, price alerts, rate charts, and limit orders. OFX operates under regulatory frameworks and follows advanced security protocols and end-to-end encryption techniques to safeguard customers’ transactions.

Features:

- Support 50+ currencies

- Transfer network of over 170 countries

- Easy transfer tracking

- Lower fees as compared to banks

- 24/7 global customer support

It works on:

- iOS

- Android

Wise

Wise is a fintech company that has gained popularity for its cost-effective international money transfer services. It supports 50+ currencies, and you can send money to more than 170 countries using the Wise app by paying a minimal exchange rate fee.

Signing up on Wise is easy. You can sign up online on their website or use the free Wise App. To send money, you need to fill in the recipient’s bank account details and pay through ACH, wire transfer, or debit/credit cards. Once the amount transfer is initiated, the recipient can track the payment using the Wise payment transfer link.

Apart from the standard money transfer service, Wise also offers Borderless accounts that users can use to hold funds. The feature is particularly suitable for business owners that deal with multiple currencies or pay their employees in different countries. It adheres to Anti-money laundering rules to ensure secure customer transactions.

Features:

- 50 currencies supported

- Transfer network of 170+ countries

- Two-factor authentication

- Integration with Amazon, Stripe, and Xero

It works on:

- iOS

- Android

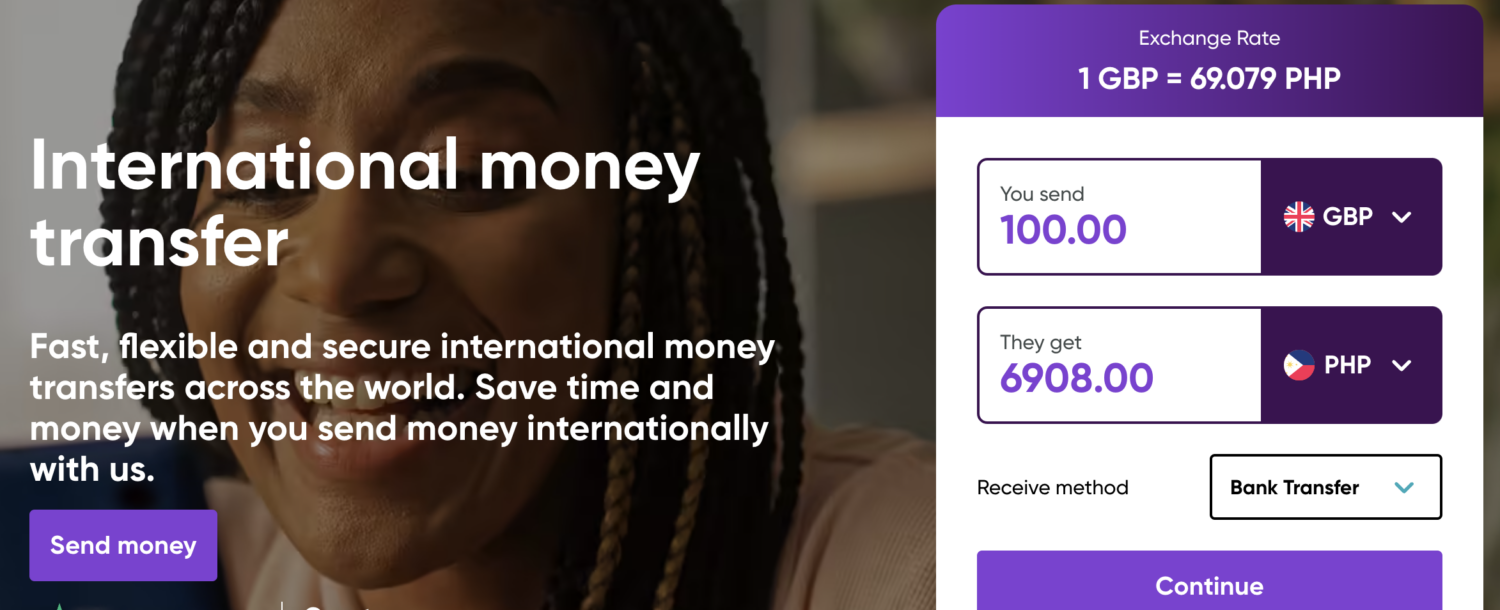

WorldRemit

WorldRemit offers international money transfer services, including mobile wallet transfers, bank deposits, and cash pickup centers. The app supports 70+ currencies and covers 130+ countries where you can send money almost instantly.

In order to start, you need to download the WorldRemit app and open an account using your email address. Next, you can start sending and receiving money internationally. You can pay the transferred money using your debit/credit card or via a bank account.

With WorldRemit, you can send money directly from your bank account to the recipient’s bank account. The platform also has a mobile money feature that lets you store money on your mobile phone. It’s a safe and easy way to transfer money, pay bills and fees, and make payments for your online shopping.

Features:

- Mobile airtime top-up feature

- Money transfer network support in 150 countries

- Low-cost transfer fee

- 24/7, 365 days customer support

It works on:

- iOS

- Android

PayPal

PayPal is one of the most widely used payment transfer apps, trusted by over 400 million users. You’ll find it in most checkout processes on online shopping apps or while paying bills online. Owing to its compliance with Anti-money laundering and know-your-customer policies, international money transfer is secure with PayPal.

Getting started for transferring money is easy with Paypal. You need to sign up for a PayPal account from their official website and add a funding source like a bank account or credit card. Once the online verification is complete, you can send and receive money across international borders.

While sending money internationally, PayPal automatically converts the amount from your currency to the recipient’s currency based on the current exchange rate. There’s also a fee for currency conversion and a money transfer fee. Sometimes, you may find a difference in the exchange rate compared to the current market rate.

Features:

- Supports ACH Payments and eCheck Processing

- Secured Two-Factor Authentication

- CountryPCI Regulation Compliance

- eCommerce Management

- Multi-Period Recurring Billing Option

It works on:

- iOS

- Android

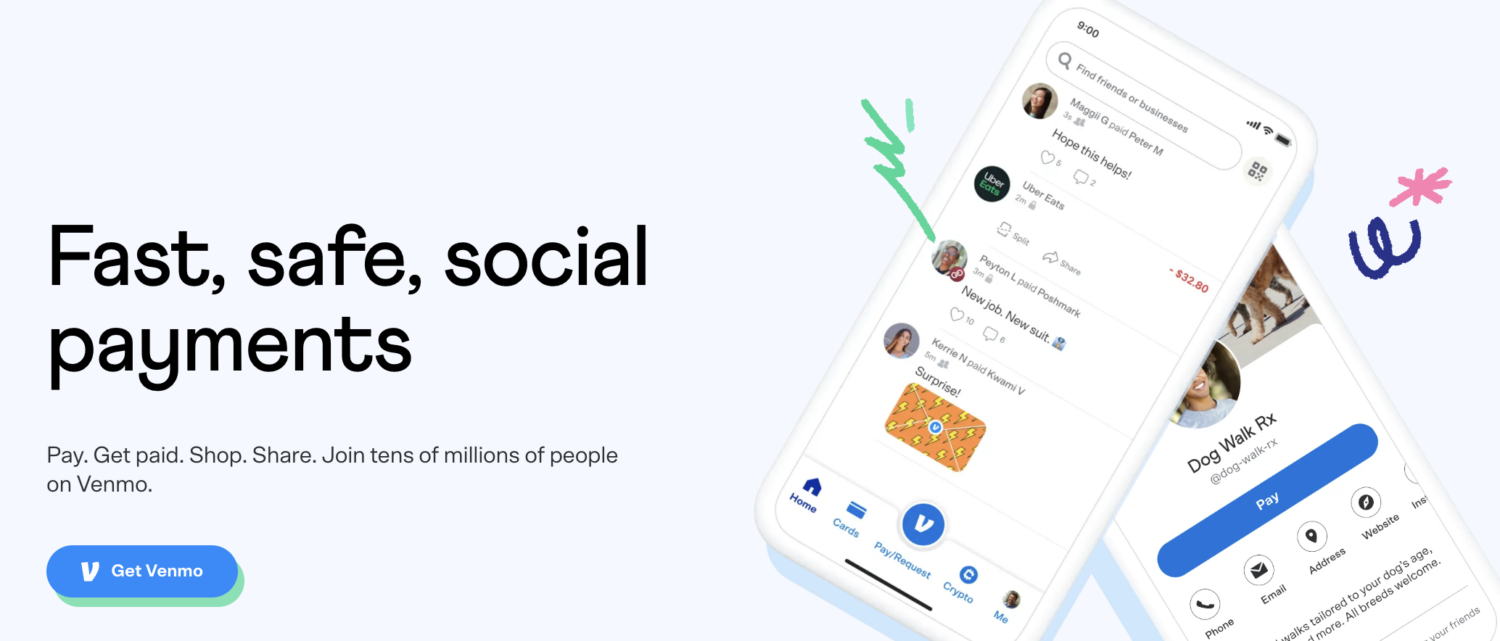

Venmo

Venmo is a social payment app that allows users to send and receive money. It allows you to split bills, makes utility payments, and transfer money anywhere to your friends and families across the globe.

One of the features that stand out in Venmo is the social feed aspect. It allows users to see and comment on their friend’s transactions based on the privacy settings. The social feed and descriptions add a social networking element to this payment app.

This user-friendly interface and social networking features make it a popular money transfer app among young individuals.

Venmo also provides a physical debit card that users can use like normal bank debit cards. Security-wise, it uses end-to-end encryption and modern anti-fraud measures like two-factor authentication.

Features:

- ACH Payment Processing

- Partial Payments feature

- Offers Venmo debit and credit card

- Free to send money compared to credit cards

It works on:

- iOS

- Android

MoneyGram

MoneyGram provides money transfer services and other financial services around the globe through both its digital platforms and retail locations. It allows users to send money across borders and pay international bills at budget exchange rates.

MoneyGram has apps that make it easier to transfer money. It provides a feature to calculate the estimated transfer fees before you make money transfer transactions.

The app has an aggregate listing of over 13,000 companies for making your bill payments. You can also set automatic recurring money transfers on a required basis. With MoneyGram’s newly launched feature, you can buy, sell and hold crypto using the app.

Features:

- Money transfer services in 200+ countries

- Dedicated iOS and Android app

- 24/7 online activity monitoring security

- Biometric login

It works on:

- iOS

- Android

Revolut

Revolut is a financial service provider app founded in 2015 to simplify complex financial proceedings. The app offers a number of financial services, including online merchant payments, investment options like crypto, stock trading, insurance, and money-related tools.

Revolut has an international money transfer feature lets you send money to trusted bank accounts in foreign countries from their app. It has competitive exchange rates and also has the option to choose between standard or express transfer speeds.

Features:

- Smart budgeting features

- Inbuilt stock trading feature

- Low fees on international transfers

- Clean UI interface

It works on:

- iOS

- Android

Zelle

Zelle is a money transfer app usually used to send money across U.S. bank accounts. It’s an easy app, and if your bank or credit union integrates with Zelle, there are high chances it will be available in your mobile banking app.

After you enroll on the Zelle app, you can send or receive money via your United States mobile number or recipient’s email address. The app can be used by individual consumers and small business owners for day-to-day transactions. It is free, and there are no charges for sending and receiving money through Zelle.

Zelle is primarily designed for domestic transfers within the United States. The app has gained popularity because the payments are processed quickly, and it’s adopted by major institutions, making it easier for individuals to transfer money securely.

Features:

- Split Payments

- Widespread availability in the United States

- Integrations with many banks

- Free and secure

It works on:

- iOS

- Android

Meta Pay

Meta Pay is Facebook’s payment platform, previously known as Facebook Pay. It’s an easy and secure way to make payments from Facebook, Instagram, and WhatsApp Messenger.

Setting up and using Meta Pay is easy. All you need to do is add your preferred payment on Facebook for the first time, and then you can connect it across Instagram without the need to re-enter checkout details. The platform can detect unauthorized activities using its anti-fraud technology, making it more secure.

One feature that stands out in Meta Pay is that you can pay from within Instagram without leaving the platform.

Features:

- In-built social media platform payment

- Anti-fraud security technology

- Biometric login

- Fast customer support

You can even contribute to fundraising cause by sending donation stickers on Instagram Stories.

FAQs

With most money transfer apps, you need to create an account and verify your identity. After verification, you can start sending and receiving the money to your friends, family members, or employees across borders. You can either pay the transfer amount via bank account, debit, or credit card.

Money transfer apps usually charge a fee per transaction. This fee depends on a number of factors, like which country you’re sending money to, the transfer amount, the currency involved, the market rate, and so on. Some apps charge a fixed amount or a certain percentage of the transfer amount.

Money transfer apps follow international rules and regulations for securely transferring money globally. Most of these apps also have anti-fraud detection security features that make it difficult for cyber attackers to access your money.

Author’s Note

Now that we have overviewed the most widely used international money transfer apps, it’s hard to conclude which is the best.

And the absolute answer varies with your requirements, like where you wish to transfer money, the exchange rates, and the fees applicable.

In addition to the above points, it’s also noteworthy to check if the apps follow the rules and regulations to make international payments secure.

On an ending note, Revolut applies the cheapest transfer fee, Wise is also a cost-effective solution, and PayPal because of its wide range of integrations.

Next, check out the best PayPal alternatives for freelancers to receive payments.