The 2008 recession and COVID-19 pandemic have shed light on a safe investment haven–Fine Wine Investing.

Investments are all about strategy. While it’s easy to follow the conventional methods, trying times ask for unorthodox planning.

However, you won’t call Fine-Wine Investing anything offbeat or radical after checking this out:

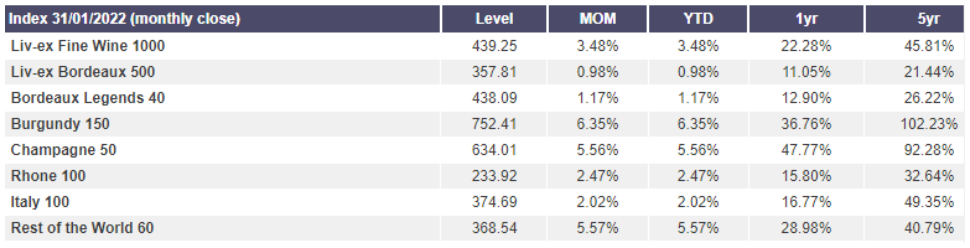

So, fine wine presents itself as an excellent alternative to global equities. Even some real estate investments look pale against it.

Here are a few more reasons favoring fine wine as a perfect investment opportunity:

Great Returns

Depending upon the brand and the scarcity, it can have exceptional returns. For instance, DRC La Tache (2009) had over 800% return in a decade, according to Yahoo Finance.

In the last 15 years, fine wine has seen a 13.6% annualized return compared to Dow Jones and S&P 500, performing 7.8% & 8.58%, respectively.

Physical Asset

Wine is a real, physical asset. It’s not something mentioned on a spreadsheet. You represent actual ownership, unlike a stock that’s a paper asset.

In addition, it always remains a limited supply tangible asset appreciating in value with each consumed bottle. Moreover, depending upon the source, each batch is unique to others which further increases the cost.

Inflation/Recession Resistance

Investment-grade wines have excellent inflation resistance.

Besides, the period you hold it while it gets consumed everywhere else makes it even more resilient.

Similarly, factors like a pandemic or geopolitics that can wipe out equity gains have little effect on wines.

In addition, it’s a simple game of demand and supply in which the latter frequently lags behind.

Now it comes to…

How to Invest in Wine?

There are a few ways to invest in wine.

Do-It-Yourself

The most reliable and risk-free way is to purchase, store, and sell at opportune times. But you have to be an expert to go this way.

So, the unforeseen problems of doing this may massively outweigh the benefits for most people. The bottom line: proceed with extra caution.

Wine Stocks

Another way is to invest in wine companies doing well. But, this won’t be an investment in wines directly.

Moreover, the demerits will be similar to buying stocks.

Wine Investment Platforms

Then there are platforms that handle everything for you in exchange for a small fee.

They are generally experts who purchase, take care of storage, do periodical reporting, and finally sell, giving returns to you.

These are the platforms that we’ll discuss in further sections, starting with the first:

Vint

Founded in 2019, Vint is an SEC-qualified wine investing platform for US citizens.

So, you basically invest in Vint LLC, which owns every bottle in the collection.

Depending upon your accreditation, you may have 10-20% in a single offering. Notably, you can’t sell the shares as per will. The website clearly says it’s a long-term (3-7+ years) investment.

However, Vint is planning to create a secondary market for its wine investment shares. So, you’ll be able to trade Vint shares if that comes into the picture.

Conclusively, Vint has no annual fees but takes an undisclosed sourcing fee in each collection.

Cult Wine Investment

Cult Wine Investment stores your wines at the London City Bond warehouse. While you can start with as little as 100$ with Vint, you need at least USD 10k to register with Cult Wine Investment.

Cult Wine Investment, which started in 2007, has a global footprint in 83 countries. There is no trading fee, and you can sell anytime through their trading team to global wine markets. Interestingly, you can request to have pictures of your wine bottles.

You pay a monthly fee starting from 2.25% of your investment based on your portfolio size. This goes up to 2.95% for the base USD 10K subscription.

There is a minimum of 6-8 weeks period for liquidating assets.

But Cult Wine Investment is not just about investing in wines. You’ll enjoy access to wine tastings, cult wine events, curated vineyard experiences, and much more based on your investment package.

ALTI Wine Exchange

ALTI Wine Exchange is a blockchain-based wine-trading platform. Their head office is based in Hong Kong, while wine storage is located at Bordeaux City Bond, France.

Each bottle is assigned a token representing ownership, similar to a Non-fungible token. They have a secondary market to sell your wine anytime you see fit.

In addition, you can begin with even a single bottle of wine, so there aren’t any hardcore minimum investment limits. You can also direct ALTI exchange to deliver your wine to your physical address.

Notably, the ALTI exchange doesn’t support margin trading and short-selling.

Finally, their LinkedIn post reveals that they charge a 2% trading fee on every transaction.

VINDOME

VINDOME is another blockchain-based wine trading platform tailored for your smartphone.

You can buy from VINDOME collections at the set price or choose delivery if desired.

An alternative option is to buy from the live market connecting worldwide collectors & investors. You can buy with the listed price or bid your own price and wait for the seller to respond.

VINDOME is headquartered in Monaco, Europe. They store wine in J.F. Hillebrand’s warehouses, which is a multinational logistics company.

Ultimately, each transaction has some extra fees attached like insurance, storage, & commission (4%) which are shown with the final payment.

WineFunding

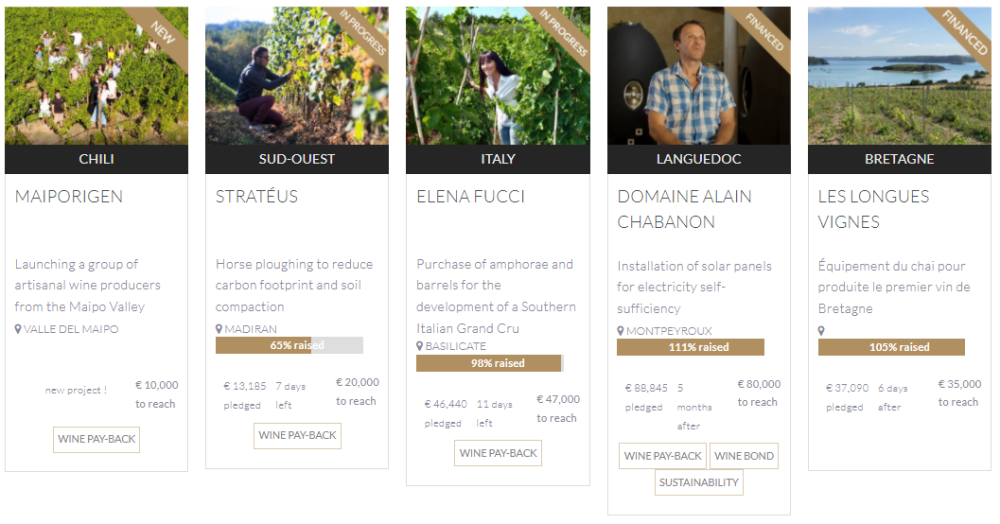

Located in France, WineFunding is way different from the others we have talked about yet. Simply put, you just don’t invest in Wines, but in wine projects and the people behind them.

So you practically risk it with WineFunding-vetted small and medium wine businesses. You purchase their wine bonds without becoming a shareholder or having any say in the company operations.

There are three wine investment models to get started:

- Pay Back– Get completely paid in wine and/or stays at wine estates.

- Bond–Get the principal amount in euros and interest in wine.

- Equity–Become a shareholder.

WineFunding is free for investors. However, the success of your investment is defined by the project you’re aligning with. This makes it one of the most uncertain wine investment adventures of this lot.

Vinovest

Vinovest is a California-based AI-powered wine investing platform having various tiers with specific fees and benefits.

Your wines are stored in worldwide storage locations in France, the USA, the UK, Denmark, etc. There is also an option to tour the facilities.

The base plan starts from USD 1000 and has a 2.85% annual fee. This fee covers insurance, storage, and everything else for your wine investment account. Needless to say, this management fee goes down as you expand your investment and sets at a minimum of 2.25% for a USD 250k account balance.

Further, there are two types of accounts: trading and managed. While trading gives you complete control over which wine to buy and sell, managed accounts are maintained by Vinovest. Notably, trading accounts have separate fees for buying, selling & storage.

The typical hold period is stated as 5-10 years based on your portfolio. However, Vinovest can help you sell within 2-3 weeks. But there is a 3% early-liquidation penalty if you withdraw before three years.

They also accept payment in cryptocurrencies like BTC, ETH, USDC, etc. And there are mobile apps for Android & iOS to track your portfolio on the go.

Wine Investing: Conclusion

Irrespective of how it might have sounded to you, the real purpose of this article is to inform you about wine-investing platforms and not give any investment-related advice.

And like any investment, wine investment is not guaranteed good returns. Depending on the platform and other conditions, you can make good money or lose everything.

Conclusively, go through the fine print and gauge your risk appetite before jumping in.

You may now look at some of the best apps for investing in ETFs and Stocks.