If you’re running a business or offering services online from India, having a payment gateway to accept payments in Indian Rupee (INR) is a necessity.

Why? Because India has one of the world’s largest labor markets, filled with freelancers, small businesses, and tech-savvy consumers. Millions of people are looking for products and services they can pay for easily in their own currency. When you offer payments in INR, you remove a major barrier and offer them a familiar experience that builds trust and encourages purchases.

Moreover, Indian consumers tend to favor local payment options, like UPI, wallets, and net banking, over international cards. A local gateway can easily integrate these popular methods, enabling you to access a wide range of paying customers.

On the other hand, if you’re a freelancer or an entrepreneur working with global clients, receiving payments in INR means faster settlements, lower fees, and smoother financial planning.

If you want to receive domestic or international payments in INR, this article is for you. Here, I’ve compiled the best payment gateways to accept INR and international payments.

- 1. Razorpay

- 2. Paytm PG

- 3. Cashfree Payments

- 4. CCAvenue

- 5. BillDesk

- 6. PhonePe PG

- 7. HDFC Bank SmartGATEWAY

- 8. Instamojo

- 9. Zaakpay

- Show less

Payment Gateways in India Comparison

Here is a comparison table of the top payment gateways for accepting INR.

|  |  |  |  |  |  |  |  | |

100+ | 180+ | 200+ | 130+ | UPI, credit and debit cards | 150+ | 100+ | 100+ | ||

PayPal | Zoho, Urban Piper | Shopify, WordPress, Wix | Magento, Drupal, WordPress | WordPress, Magento | Shopify, WooCommerce | Not Mentioned | Drupal, WordPress, Prestashop | Shopify, WooCommerce, Magento | |

Instant | Instant | Instant | NA | NA | Not Mentioned | Not Mentioned | Not Mentioned | Not Mentioned | |

2%/transaction | 1.99% platform fee per transaction | 1.95% | 2.00%/transaction | NA | 1.95% | Not Mentioned | 5%+₹3 transaction fee | 1.99%/transaction | |

3% platform fee per transaction | 1.99% platform fee per transaction | 2.95% | 4.99%/transaction | NA | Not Mentioned | Not Mentioned | Not Mentioned | Not Mentioned | |

Now, let’s dive deep into the detailed discussion on the payment gateways.

1. Razorpay

If you’re running a business in India, Razorpay is a reliable platform to accept online payments. It supports over 100 payment methods, including credit and debit cards (domestic and international), net banking from 58 banks, UPI, mobile wallets, EMIs, and PayLater, offering flexibility to your customers and clients.

Its onboarding takes a few minutes with minimal paperwork, and you can integrate Razorpay using APIs and SDKs, or plug-and-play with Shopify, WooCommerce, and Magento. It also offers Flash Checkout that automates the payment experience with faster OTP and a sleek interface. If you save the card details, it even speeds up the process for returning customers.

Razorpay comes with a useful dashboard, equipped with real-time payment insights, downloadable settlement reports, and one-click refunds, to ensure your complete control over the cash flow. Security-wise, it’s PCI DSS Level 1 compliant, uses strong encryption, and has an internal team to strictly monitor everything.

This scalable platform can handle even if you are dealing with high transaction volumes. Moreover, it automatically tries again if an API refund fails due to a bank-side issue. Razorpay includes extra tools like Invoices, Payment Pages, and Smart Collect, which make tasks like billing and reconciling NEFT, RTGS, or IMPS payments easier. Additionally, for businesses seeking India payroll software solutions, Razorpay offers RazorpayX Payroll.

2. Paytm PG

Paytm Payment Gateway fits smoothly into your existing systems by setting up smoothly and letting you accept payments from customers in India and around the world.

I would call its all-in-one SDK its USP that helps you integrate one-tap payments, EMI, and bank offers directly into the Paytm app. That means your customers get a quick checkout experience. It even offers you a custom UI SDK and JavaScript components to build your own payment flow right into your app or website.

You can either use its REST APIs for a personalized checkout experience or use plugins for 25 e-Commerce platforms such as Shopify, WooCommerce, or Magento. It also supports Android, iOS, React Native, and Flutter, enabling seamless payments across various devices and apps.

The Paytm PG dashboard is packed with useful features, such as automatic reconciliation, settlement tracking, instant refunds, and real-time analytics. If your business serves international customers, its dynamic currency conversion feature will be of great benefit. It supports over 70 currencies and uses live exchange rates for accuracy and transparency.

Paytm PG comes with PCI-DSS compliance, so you can handle sensitive data with confidence. With no setup fees or maintenance charges, it has a simple cost structure.

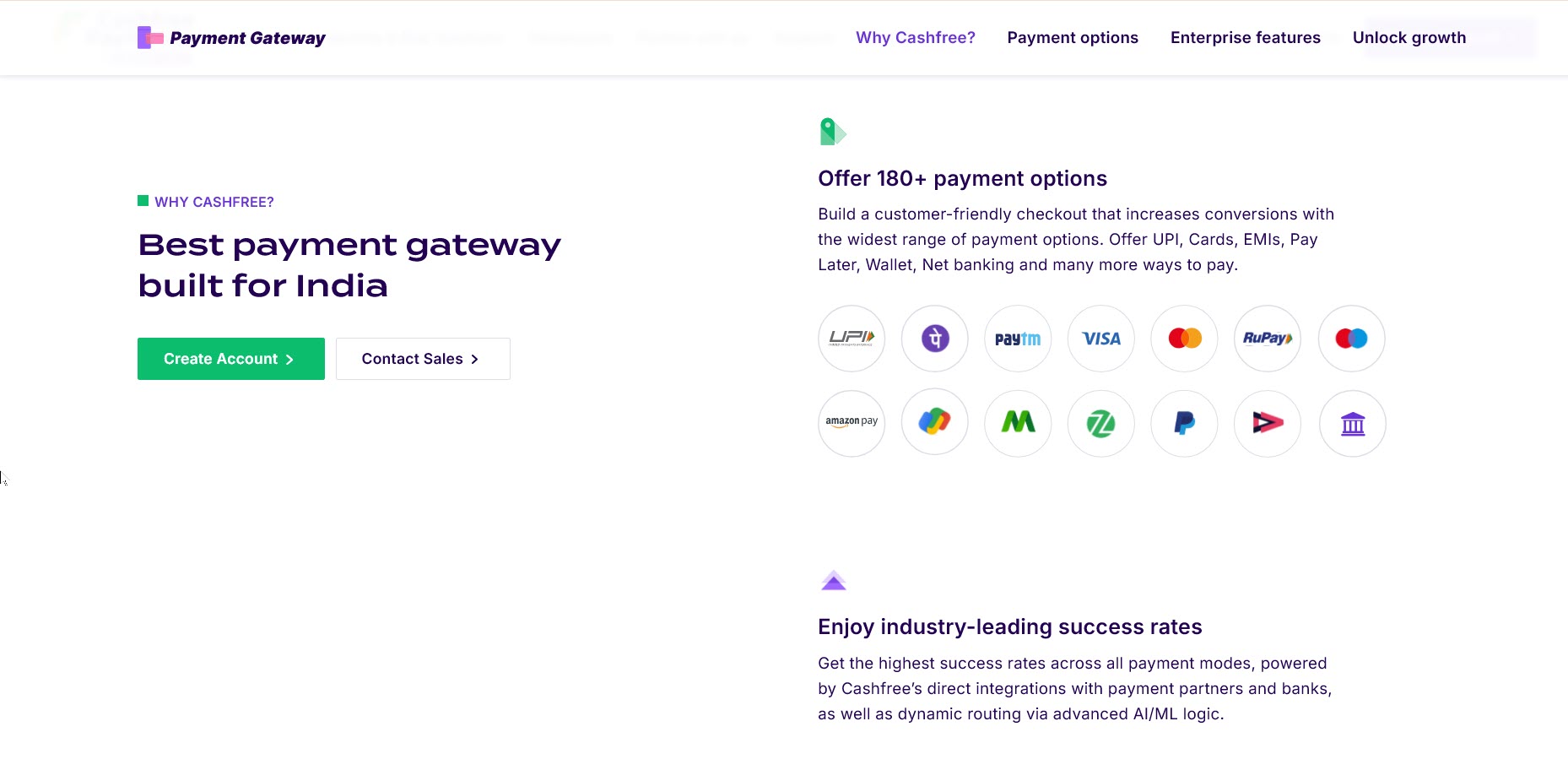

3. Cashfree Payments

For businesses looking for digital payments without complexity, Cashfree Payment Gateway is worth a try. It supports over 180 domestic modes and 100 international ones, including cards, UPI, net banking from 70+ banks, mobile wallets, EMIs, and even Pay Later, helping your business reduce drop-offs at checkout.

Cashfree offers integration support for companies using REST APIs, JavaScript SDKs, mobile SDKs for Android and iOS, React Native, and Flutter. If you’re using Shopify, WooCommerce, or Magento, try their plug-and-play option to save time and hassle.

Its instant settlement feature allows you to receive funds in just 15 minutes, that too on weekends and holidays. Instant refund and disbursement management are additional features of Cashfree.

Being PCI DSS Level 1 and ISO certified, Cashfree uses tokenized card storage, dynamic routing for better success rates, supports the latest 3DS 2.0 protocols, and boasts in-house fraud management for an added layer of protection.

It can handle up to 3,000 transactions per second, ensuring top-notch performance even during high traffic. E-commerce brands benefit from their Buy Now, Pay Later support from over 30 providers.

You can use tools like Payment Links, Payment Forms, and Cashgram to collect payments over WhatsApp, SMS, or social media. For international sellers, Cashfree displays prices in over 100 currencies and settles payments in INR within two days.

4. CCAvenue

CCAvenue ensures a smooth user experience for you and your customers. Besides managing payments in 27 major currencies, it supports credit and debit cards, net banking, UPI, mobile wallets, EMI plans, and other regional methods.

Considering security is a crucial concern for payment gateway users, CCAvenue gives you the peace of mind with PCI DSS compliance, SSL encryption, and its own risk management system that watches for fraud and monitors transactions in real time.

Its customizable checkout flow can be tailored to match your brand. You can even switch between languages and confirm its mobile compatibility. CCAvenue’s built-in smart transaction routing and retry logic boost your success rates and reduce the number of failed payments.

There’s a central dashboard to track payments in real time, create invoices, and manage everything in one place without feeling overwhelmed. And if you don’t have a website yet, no worries. CCAvenue includes a ready-to-use online store that gets you selling fast.

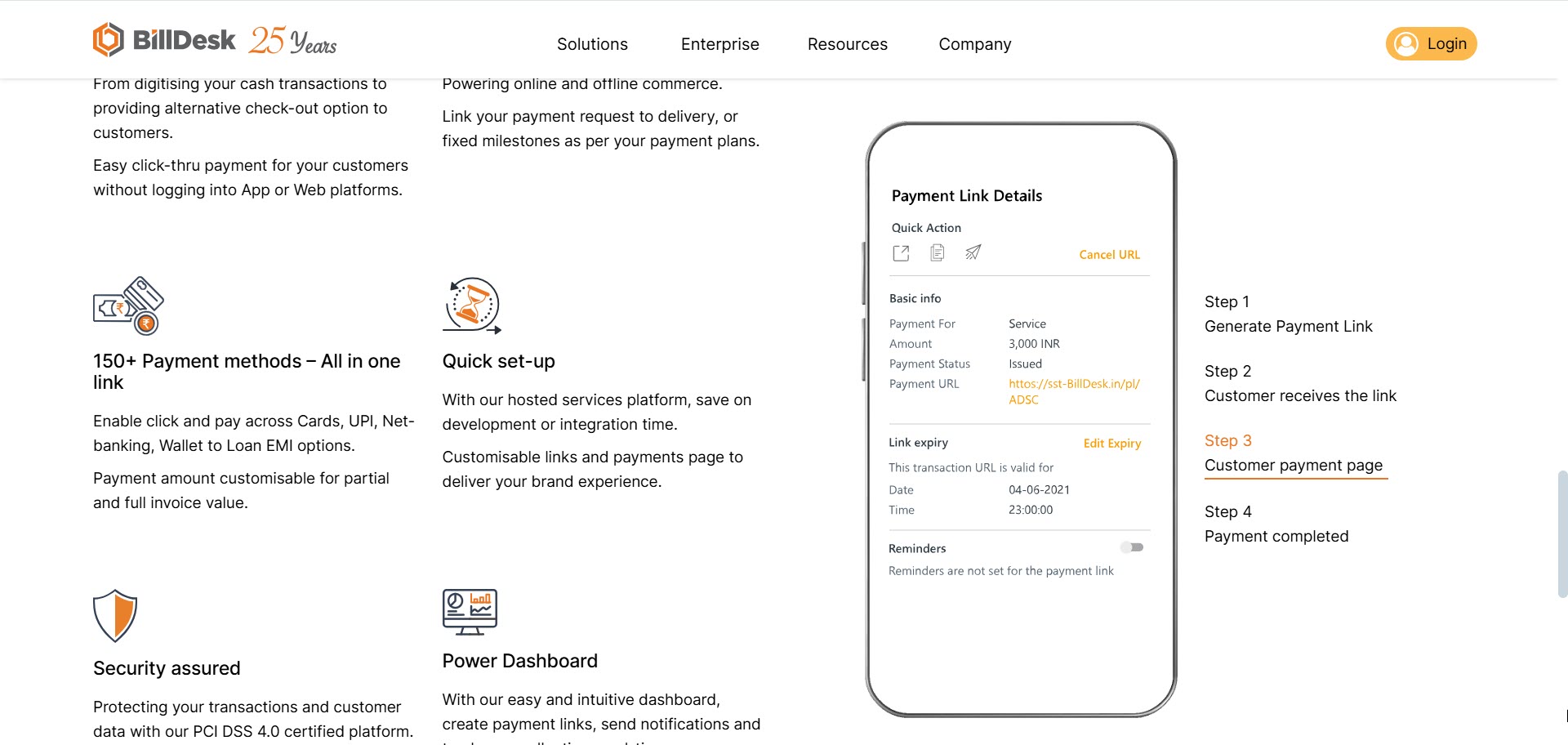

5. BillDesk

BillDesk is one of the most dependable online payment solutions that provides access to over 150 payment options, ranging from credit and debit cards to net banking, UPI, wallets, EMIs, and recurring payments like eNACH.

And if you’re working with international customers, BillDesk supports multiple currencies while still settling everything in INR, which keeps things simple on your books. What really helps improve payment success rates is their smart routing engine. It figures out the best channel to process a transaction and will automatically retry for failed transactions.

If your business relies on subscription billing, BillDesk handles that too with features like automated billing cycles, alerts, upgrades or downgrades, and refunding all from a clean interface. Apart from the usual PCI-DSS certification, SSL encryption, and its own fraud detection system, it also monitors blacklisted users, IP behavior, and transaction velocity to keep you covered on that front.

The platform stays stable with high uptime and smooth performance, even with a high number of transactions. The dashboard is intuitive, and their support team is responsive when you need them.

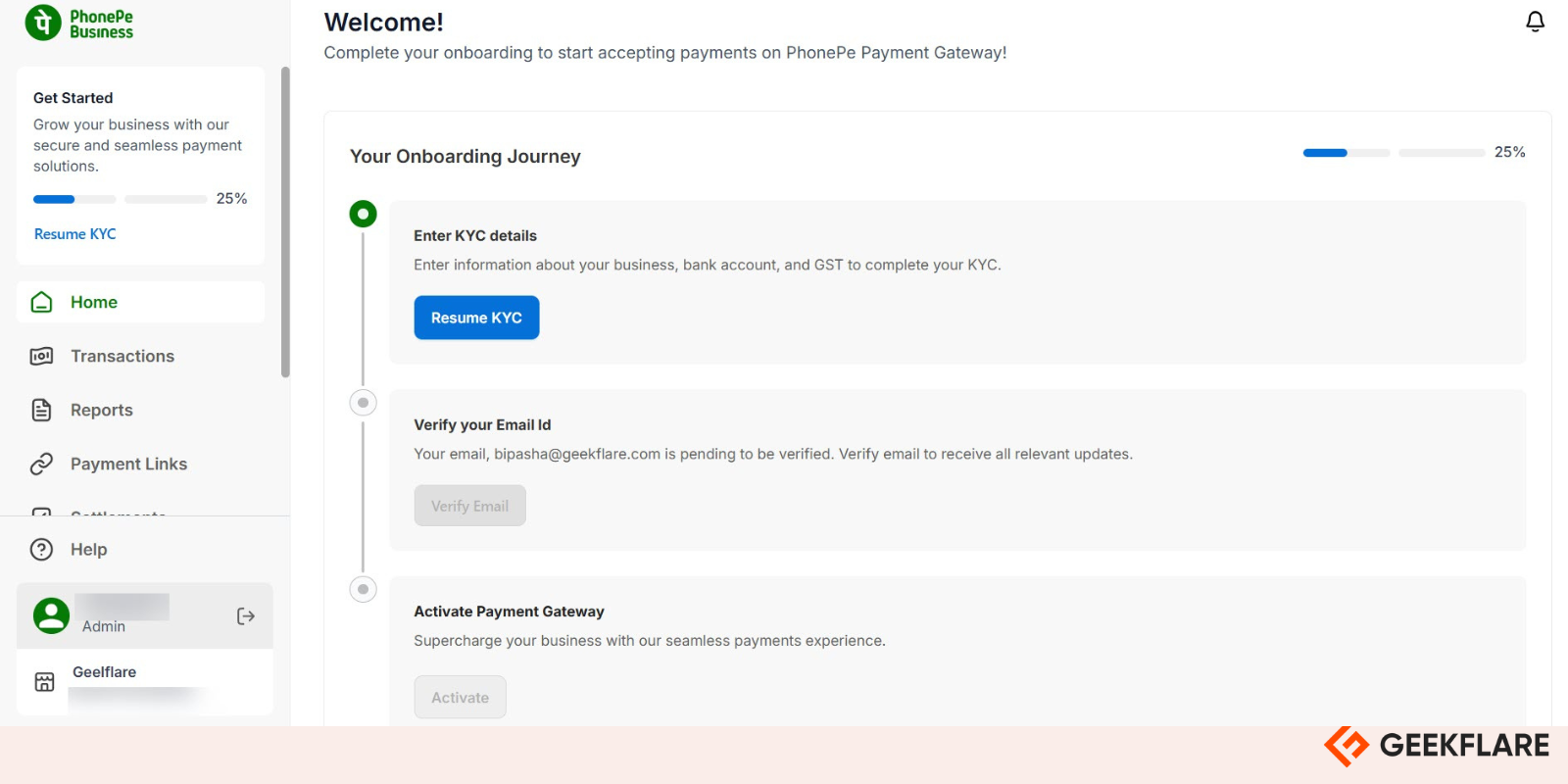

6. PhonePe PG

PhonePe Payment Gateway lets you access all the major payment methods, such as UPI, cards, net banking, wallets, and QR-based payments. Big names like Airtel, Oyo, PharmEasy, and Meesho use it, so you can also use it to accept payments.

Features like one-tap UPI and the Fast Forward option for returning customers speed things up and reduce drop-offs. You can choose from APIs, lightweight SDKs, or plugins for your existing platform to integrate without much effort.

One thing I believe startups and small businesses will really appreciate is the zero setup and maintenance fees. The entire onboarding process is digital, so you won’t waste time on paperwork or wait to go live.

PhonePe PG is PCI DSS compliant and uses end-to-end encryption, tokenization, and real-time risk checks to keep everything safe. You also get next-business-day settlements, useful for managing cash flow.

7. HDFC Bank SmartGATEWAY

HDFC Bank’s SmartGATEWAY is built with both businesses and customers in mind. It’s flexible and supports over 150 payment methods such as net banking, credit and debit cards, UPI, wallets, QR code payments, and multi-bank EMIs. It also works with international cards and can handle payments in more than 22 currencies.

Its APIs and SDKs are lightweight, which means you can plug it into your setup quickly without a lot of back and forth. One-click card payments, auto OTP reading, and a checkout page that remembers what your customer prefers, all lead to fewer abandoned carts.

SmartGATEWAY’s use of dynamic routing and retry features increases your transaction success rates. It also has a strong ML-powered analytics layer powered by machine learning. You get real-time insights into how customers are behaving, how your transactions are performing, and where your costs are going.

You can even send payment links through SMS, email, or WhatsApp for remote collections or follow-ups. Moreover, there’s room to get creative with sponsor-led offers and personalized promos to keep your customers engaged. Additional features include recurring billing, automated reconciliation, and multi-batch settlements.

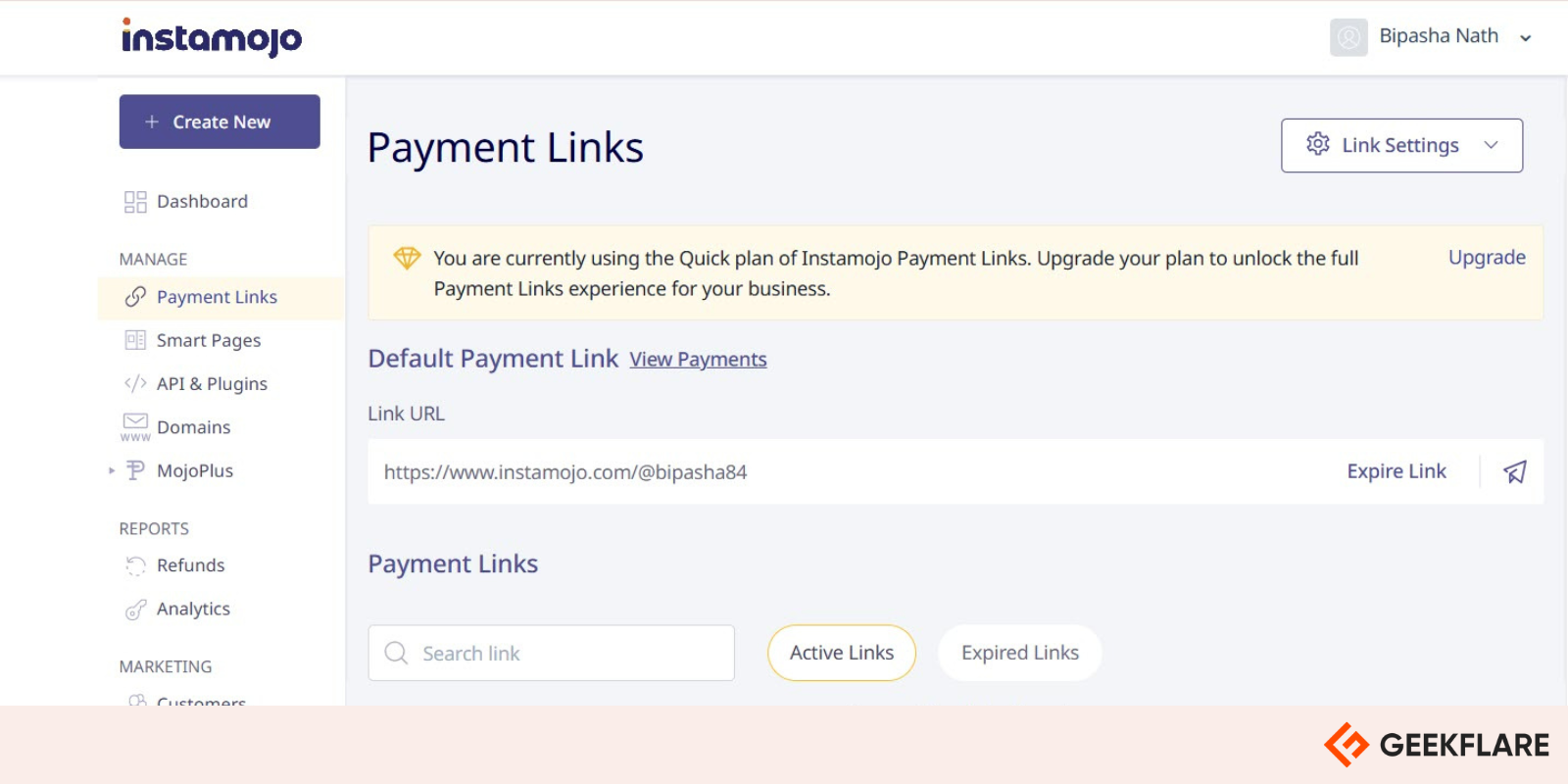

8. Instamojo

Instamojo is an affordable and beginner-friendly payment gateway, supporting over 100 payment methods. From credit and debit cards to UPI, wallets, net banking, EMIs, and pay-later options, no matter how your customers prefer to pay, they’re covered.

To get it integrated with your website or app, you can use their plug-and-play features, developer-friendly APIs, or even embed payment buttons. And if you’re not selling through a site, you can still send payment links through email, SMS, or WhatsApp with just a couple of clicks.

On Instamojo, payouts are typically settled within three working days. Its dashboard allows you to track real-time payments, download reports, send invoices, and manage your customers. Security-wise, its PCI-DSS compliance and SSL encryption keep your transactions safe.

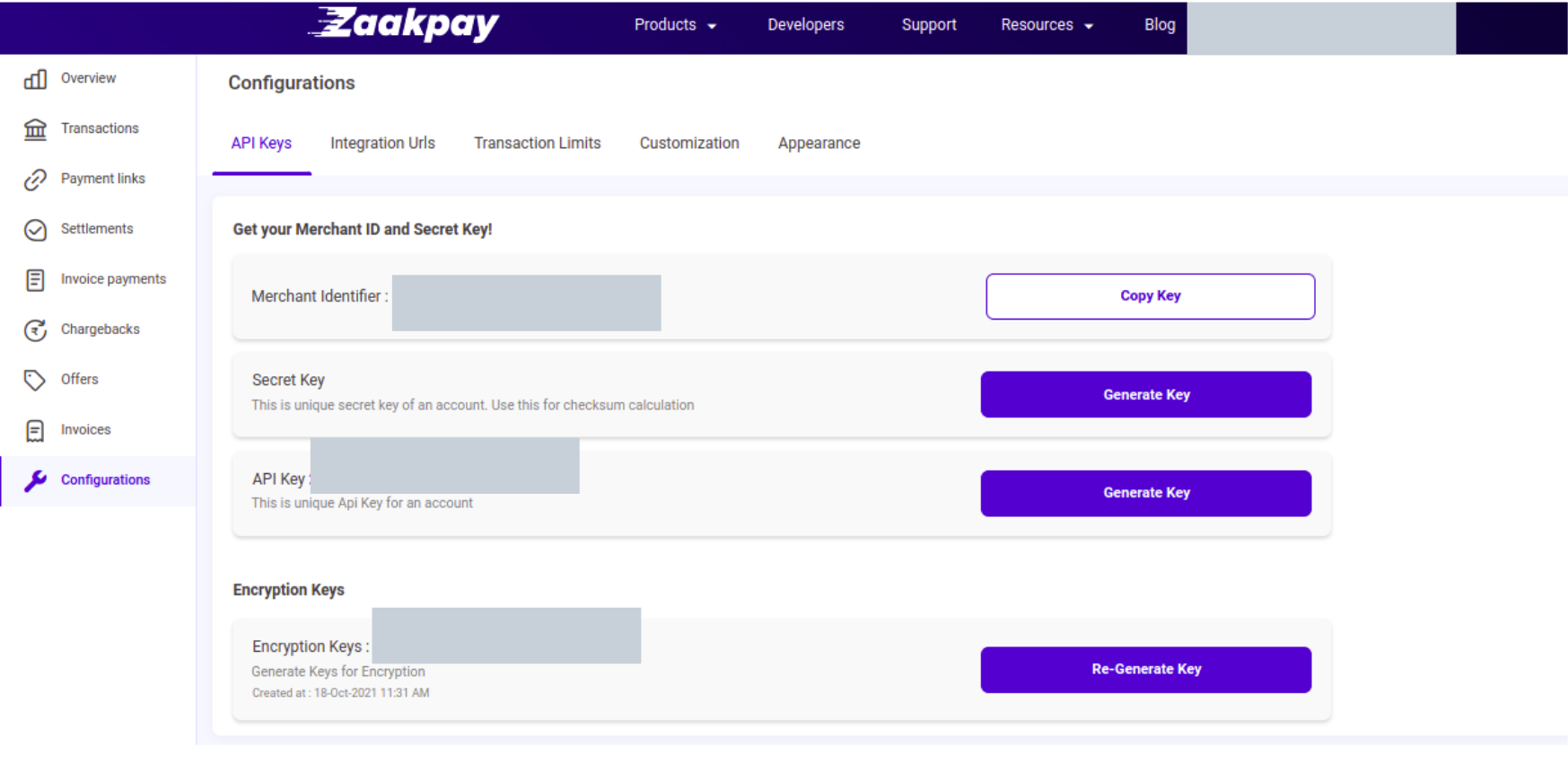

9. Zaakpay

Zaakpay is built with a solid infrastructure that supports 100+ payment methods. Using credit and debit cards, UPI, mobile wallets, and net banking from over 50 banks, your customers can pay with fewer drop-offs and more completed checkouts.

There’s no need for customers to register; they can just provide the essentials, and the payment process runs quickly without a bunch of redirects. Its merchant dashboard automates reports that sync with your accounting tools and shares real-time updates on sales patterns and customer locations.

Speaking of security, Zaakpay follows PCI DSS guidelines while using SSL encryption, tokenization, constant transaction monitoring, and two-factor authentication.

You can also get a no-code setup, use ready plugins, or build a custom experience with REST APIs and mobile SDKs. Express Checkout, full customization, 24/7 support, and near-instant settlements are other highlighted features of this platform.

Other Notable Payment Gateways

Apart from the above payment gateways, here are some platforms that made it to our list of honorable mentions:

- PayKun: PayKun supports 120+ payment methods, including net banking, all major credit/debit cards, mobile wallets, UPI, EMI, and QR codes.

- Airpay: As a dynamic payment gateway, Airpay accepts payments from cash, credit cards, debit cards, net banking, wallets, RTGS/IMPS/NEFT, Bharat QR, UPI, corporate cards, loyalty cards, and prepaid cards.

- PayU: PayU enables businesses to accept payment using 150+ methods, such as EMIs, net banking, debit cards, credit cards, BNPL, and UPI.

How about Stripe, PayPal and others?

When it comes to accepting international payments, platforms like Stripe, PayPal, and similar payment processing solutions are widely trusted. Besides being easily integrable, they offer multi-currency support and competitive FX rates.

However, if your primary concern is getting paid in INR, it’s more practical and cost-effective to use Indian payment gateways like Razorpay, Cashfree, CCAvenue, or other payment gateways mentioned above. They offer local compliance, faster INR settlements, and support for UPI, net banking, wallets, and Indian domestic cards. They also save you from longer settlement cycles or regulatory hurdles, common with international platforms.

What are the common payment methods in India?

Currently, India has a diverse and rapidly evolving payment landscape due to digitization. Its Unified Payments Interface (UPI) enables instant bank-to-bank transfers via a single mobile app for payments, money transfers, and bill settlements.

Traditional methods like debit and credit cards, supported by Visa, Mastercard, American Express, and RuPay, are also widely used. Net banking is another popular method that offers online transfers through NEFT, RTGS, and IMPS.

Digital wallets like Paytm, PhonePe, and Google Pay have been the real gamechangers, changing payment habits by allowing quick payments via QR codes and bank account linking.

Despite the digital growth, cash remains the most common mode of payment, especially in rural areas. Bank transfers continue to be essential for both individuals and businesses. Newer methods, such as Buy Now Pay Later (BNPL), are also gaining popularity for higher-value purchases.

-

EditorUsha, the editor-in-chief of Geekflare, is a tech-savvy and experienced marketer with a Master’s degree in Computer Applications. She has over a decade of experience in the tech industry, starting as a software engineer and then moving into digital marketing and team management.

EditorUsha, the editor-in-chief of Geekflare, is a tech-savvy and experienced marketer with a Master’s degree in Computer Applications. She has over a decade of experience in the tech industry, starting as a software engineer and then moving into digital marketing and team management.