Generative AI finance chatbots handle transaction queries, open accounts, schedule meetings, and more with a personalized experience and 24/7 availability. This frees human agents from mundane work while reducing the operational overhead.

Their ease of use and automation capabilities haven’t gone unnoticed. In fact, the finance services industry invested $35 billion for AI adoption in 2023, with banking at the forefront, accounting for a $21 billion share. Some leading banks in America and Europe in this AI race are Capital One, JPMorgan Chase, and the Royal Bank of Canada.[1]

AI could potentially drive global banking industry profits to $2 trillion by 2028, a 9% increase over the next five years.

Citi GPS Report

You don’t have to look elsewhere if you’re interested in joining this AI bandwagon, as I have invested my expertise to curate this list of AI chatbot solutions that can help you stay ahead of the curve. These tools were reviewed and picked based on their price, performance, features, and ease of use.

- 1. Devexa – Best for Engagement & Retention

- 2. IBM Watsonx Assistant – AI-based Banking

- 3. ChatBot – Best for Developing Custom AI Chat

- 4. Tidio – Best for Reducing Repetitive Customer Queries

- 5. Botpress – Best for KYC Automation

- 6. Tars – Finance Specialist AI Models

- 7. ProProfs Chat – Simple Customer Support Automation

- 8. Haptik – Best for WhatsApp Commerce

- 9. Ultimate – Extensive AI Automation

- 10. Kasisto – Purpose-built for Financial Industries

- Show less

You can trust Geekflare

At Geekflare, trust and transparency are paramount. Our team of experts, with over 185 years of combined experience in business and technology, tests and reviews software, ensuring our ratings and awards are unbiased and reliable. Learn how we test.

1. Devexa

Best for Engagement & Retention

Devexa transforms client interactions with AI-powered support that drives satisfaction, inspires loyalty, and enhances trading activity. From handling customer queries and opening accounts to delivering tailored news and actionable insights, Devexa enriches every touchpoint with precision and speed.

But that’s not all. You can configure it to do more as required, thanks to Devexa’s no-code builder. It lets you tweak the chatbot with inbuilt trading-specific workflows.

Devexa supports users’ text and voice-based messages and responds while keeping context. I liked that it’s also compatible with customers sharing documents, images, and video, and can hop on audio/video calls for a personal touch. Even users can share their screens for visual assistance.

The tool lets admins broadcast important announcements, updates, and trading signals to their users. Teams can also gather detailed user activity history for feedback and analysis.

As a business, you can add preferred news sources and educational materials to re-engage users, enforce legal documents, automate investments, and provide proactive support. You can also use its management API to configure workflows and integrate your preferred tools.

A standout feature is Devexa’s omnichannel capability, which brings user integrations across platforms (such as Telegram, Facebook Messenger, WhatsApp, and Viber) in a single interface. Developers can also integrate even more channels with Devexa’s conversational API.

Devexa Pros

Design customizations to match brand voice

Excellent integration capabilities

Seamlessly processes customer documents for more contextual answers

Has a free tier to test the features

Devexa Cons

User community is still growing

Some advanced features may require short training sessions to maximize benefits

Devexa Pricing

Devexa offers 2 pricing plans, as shown in the table below.

| Plan | Monthly Pricing | Features |

|---|---|---|

| Devexa Free | N.A. | Regular polls, limited broadcasting, automated operations, feedback, and polls report (first 10 responses) |

| Devexa Pro | Custom | Personal communication, media sharing, broadcasting, polls, full reports, analytics, white label |

2. IBM Watsonx Assistant

AI-based Banking

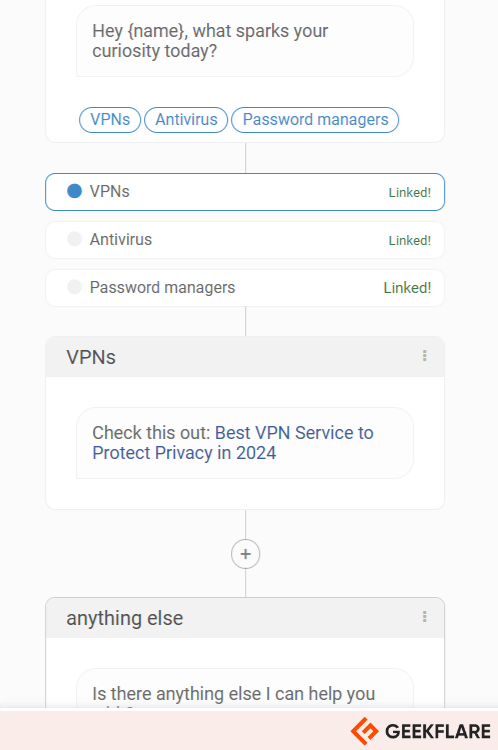

Watsonx assistant from IBM is a generative AI solution that provides a self-service digital banking experience to your customers. It comes with pre-configured banking templates and a no-code, drag-and-drop builder for professionals to create custom conversational flows.

This empowers your customers to find branch locations, check account balances, track transactions, navigate online banking, and do much more on their own without needing any human intervention from the other side.

IBM Watsonx uses natural language processing (NLP) to understand day-to-day language. Its support of 12+ languages combined with an omnichannel deployment, helps users get the answers they need in real-time, at the place of their choosing.

IBM developed Watsonx with built-in data protection and privacy policies, including encryption at rest and in transit. As a business owner, you can also configure Watsonx to store and share data selectively. It allows you to choose physical data isolation in single-tenant data storage. Admins can also provide granular access to AI assistants and track activity for better teamwork.

Watsonx works as a website widget, over the phone, and on popular messaging platforms, including Slack, Facebook Messenger, and WhatsApp. Plus, it has pre-built extensions for Salesforce, Zendesk, Twilio Flex, Hubspot, Mailchimp, Oracle Cloud, etc.

IBM Watsonx Pros

Multiple integrations covering messaging platforms and business apps

Flexible deployment options, such as cloud and on-premises

Enterprise-grade security and trust of IBM

Support for HIPAA, GDPR, and PCI-DSS compliance

IBM Watsonx Cons

Designing custom workflows is complex for a beginner

Higher costs for small businesses

IBM Watsonx Pricing

IBM Watsonx has 3 pricing tiers:

| Plan | Monthly Pricing | Features |

|---|---|---|

| Lite | Free | Up to 1000 monthly active users (MAUs), Web, SMS/MMS, messaging channels, 7-day data retention, 5-minute session timeout |

| Plus | $140/month+ | Everything in Lite plan + Over 1000 MAUs, Custom channel API, 30-day data retention, 24-hours session timeout, chat export, autolearning, existing IVR integration, private endpoints, 99.5% uptime SLA |

| Enterprise | Custom | Everything in Plus plan + Over 50,000 MAUs, up to 90-day data retention, 7-day session timeout, activity tracker, 99.9% uptime SLA, data isolation add-on |

3. ChatBot

Best for Developing Custom AI Chat

I recommend ChatBot to every industry (finance included) trying to build a custom AI support agent enriched with their own content.

ChatBot lets you combine data from websites, help centers, articles, internal documents, etc., to develop an AI model for specific use cases. You can keep adding resources, as and when required, and also train the AI for specific queries.

The tool is configurable to collect customer data, suggest services, take feedback, create tickets, and transfer the conversation to a live agent. In addition to the pre-built templates, ChatBot’s Visual Builder is your companion for designing specific workflows (like redirecting users to a section of your website) and conducting A/B tests.

ChatBot analytics lets you check all chats, monitor activity heatmap, and measure overall engagement. You will also have a dedicated profile for each user and segment for further analysis and targeting.

It’s interesting to note that ChatBot isn’t a white-label solution and is entirely independent. So, you won’t have to worry when some popular service (such as OpenAI’s ChatGPT or Google’s Gemini) is down, which has now become a general trend in the genAI industry.

ChatBot integrates readily with LiveChat, HelpDesk, Facebook Messenger, Shopify, Slack, Zapier, and WordPress. You can also connect ChatBot with external services via webhooks.

ChatBot Pros

All data stays with ChatBot without any third-party interference

Easy to learn and implement

Great for conversation customization and A/B tests

ChatBot Cons

Use cases are primarily limited to conversations

Smaller userbase to take feedback from

ChatBot Pricing

ChatBot’s pricing tiers are shown below.

| Plan | Monthly Pricing | Features |

|---|---|---|

| Starter | $52 | 1 Active bot, 12k chats/year, 7-day training history, visual builder, model training, A/B testing, user management, integrations, GDPR compliance, SSO |

| Team | $142 | + 5 Active bots, 60k chats/year, unlimited training history, team collaboration, version history |

| Business | $424 | + Unlimited active bots, 300k chats/year, white label, automatic data removal, |

| Enterprise | Quote-based | + Custom integrations, custom SSO, personal onboarding, priority support, bot building, bot maintenance, dedicated account manager |

4. Tidio

Best for Reducing Repetitive Customer Queries

Tidio’s Lyro AI chatbot handles basic customer queries with a specific knowledge base of your own. You can add FAQs, articles, or simply provide the website URL for Lyro to scrape data.

Lyro allows you to take over the conversation whenever needed. This makes it better than the chatbots which don’t because conservations with AI can go offroad really quick. However, the possibility of AI hallucinations is low with Lyro since it relies solely on a curated dataset provided by the business.

Lyro is based on Anthorpic’s Claude, an LLM I personally like for its accuracy and creativity.

The best part about Lyro is you don’t need to switch customer service platforms. Instead, you can connect Lyro with your existing solution, including Shopify, WordPress, Squarespace, PrestaShop, HubSpot, Mailchimp, Zendesk, Zapier, WhatsApp, Salesforce, etc.

Tidio is built over AWS, benefitting from industry-leading data security protocols. Everything is encrypted in transit and at rest, including the backups. Plus, this platform is GDPR and CCPA compliant and currently undergoing a SOC 2 audit, demonstrating Tidio’s commitment to user data privacy.

Tidio Pros

Highly customizable chatbot

Helpful customer support

Works well with other Tidio customer service solutions, including Live Chat, Help Desk, and Flows

Tidio Cons

Expensive for small businesses

Tidio branding, even with the entry-level paid plan

Tidio (Lyro Chatbot) Pricing

The pricing for Tidio is highlighted below. Note that these prices are valid for the lowest number of monthly conversations (50).

| Plan | Monthly Pricing | Features |

|---|---|---|

| Free | $0 | 50 handled conversations, live chat, help desk, social media integrations |

| Growth | $59 | Everything in Free + up to 2,000 handled conversations, advanced analytics, Tidio power features, no Tidio branding (add-on), permissions |

| Plus | $749 | Everything in Growth + custom quota of handled conversations, dedicated success manager, custom branding, multisite, departments, multilanguage, Open API |

| Premium | $2,999 | Everything in Plus + unlimited handled conversations, guaranteed 50% Lyro AI resolution rate, priority service, premium support, super admin role, analysis & monitoring, Lyro as a managed service |

5. Botpress

Best for KYC Automation

Botpress gives you the flexibility to build an AI agent for your financial (or any) service with the latest LLMs from OpenAI, Anthropic, Groq, Cerebras, and Fireworks AI. You can also import a custom LLM if the available ones don’t fit your bill.

After selecting the LLM, you can ingest additional knowledge sources, such as websites and documents.

Botpress AI bots assist in loan approvals, adjusting assets based on market dynamics, KYC automation, detection of frauds, risk management, and compliance support.

It comes with a visual building interface to build conversations and configure action items. You also have a built-in simulator to test conversation flows.

Botpress is collaboration-friendly with role-based access control and supports versioning. So, you can invite your teammates to build chatbots faster and revert to previous versions if required.

I liked that Botpress has provisions to let admins see what their bot is doing in real-time. Botpress AI agents also feature AI caching to store responses to repetitive queries to minimize AI spending.

Botpress has its own analytics to let you know about the bot’s performance and give access to the actual conversation data. Admins can also monitor customers’ feelings about their brand with native sentiment analysis capabilities.

On top of this, the tool has excellent support for communication platforms and business applications. You get integrations for Instagram, WhatsApp, Slack, Telegram, Asana, HubSpot, Google Analytics, Jira, Salesforce, Shopify, SendGrid, Zapier, Zendesk, Trello, and more.

Botpress Pros

Guided video tutorials and support documentation

Multiple LLM support

Wide range of integrations for plug-and-play

GDPR compliance and SOC 2 certification

Botpress Cons

Despite the tutorials, it has a slightly steep learning curve

Lacks 24/7 support for pay-as-you-go plan

Botpress Pricing

Botpress’s pricing is shown below.

| Plan | Monthly Pricing | Features |

|---|---|---|

| Pay-as-you-go | NA | Visual builder, integrations, API access, analytics |

| Team | $445.5/month | Everything in PAYG plan + Live agent handoff, custom analytics, rule-based access control, collaboration, live-chat |

| Enterprise | Custom | Everything in Team plan + Custom workspace limits, dedicated terms |

6. Tars

Finance Specialist AI Models

Tars has multiple AI models targeted at specific industries, including finance & banking, insurance, healthcare, real estate, and education.

For finance, Tars has Financial Concierge AI and Financial Advisor AI.

Financial Concierge AI helps automate account opening, credit card & loan approvals, consulting, and answers to standard customer queries. It easily integrates with existing banking systems and CRMs. Plus, you can deploy this AI on multiple channels, such as WhatsApp, SMS, banking apps, and the web interface.

Concierge AI analyzes customer concerns, which a business can use to optimize interactions to reduce churn. It also refers to human support via live chat when the query exceeds its scope.

On the other hand, Financial Advisor AI is used to recommend services based on the customer’s risk tolerance and personal interests. It sends customized offers on WhatsApp to cross-sell relevant financial products. Similar to Concierge AI, it hands over to human agents and monitors users’ pain points, improving customer engagement.

Though not directly related to AI bots, Tars does have a Finance Workflow AI, offering AI search, agent support tools, HR automation, and reporting from multiple sources.

Tars has integrations for Google Calendar, Zendesk, Twilio, Slack, Salesforce, SendGrid, Trello, Zapier, HubSpot, Airtable, Shopify, Google Analytics, and more.

Tars Pros

AI chatbot with support for over 100 languages

Industry-optimized chatbots with 950+ templates

SOC 2, GDPR, ISO 27001, and HIPAA compliance

Tars Cons

Smaller community for feedback and help

High cost per conversation

Tars Pricing

Tars offers quote-based pricing for different use cases. You’ll have to contact the sales department to get a tailored price.

7. ProProfs Chat

Simple Customer Support Automation

ProProfs Chat lets you automate conversations and allows human takeover.

Its AI bots support over 70 languages and can handle images, documents, and links to accurately answer end-user queries. The chat interface also suggests possible concerns upfront and offers personalized help.

What caught my eye is that you can create multiple-choice and open-response questions, which is starkly different and superior to minimal, single-liner interactions.

You can visually build custom chatbots without writing a single line of code. It allows adding interactions with branching logic via a drag-and-drop interface and testing it before pushing the bot live.

While you can always build a bot from scratch, ProProfs has multiple templates to get started quickly that you can edit as needed.

ProProfs Chat can serve your customers on websites, iOS & Android apps, email, and social media platforms (Facebook, WhatsApp, and Instagram). This also works via simple chat links (that you can share via SMS) and audio/video calls.

Admins can track a customer journey, make announcements, set personalized greetings, and track user behavior. The reporting section presents insights regarding chats, customer satisfaction, and more.

ProProfs integrates with 50+ business applications, such as Salesforce, Zoho CRM, Microsoft Dynamics 365, Drupal, Joomla, WordPress, Magento, Shopify, PrestaShop, Bigcommerce, OpenCart, and Mailchimp.

ProProfs Chat Pros

Hosted on IBM Cloud (Softlayer) for enterprise-grade security

Automatic routing to human agents

Comprehensive forever free plan for a single operator

ProProfs Chat Cons

Limited knowledge base customization

Lacks finance specialty

ProProfs Chat Pricing

ProProfs offers the following plans:

| Plan | Monthly Pricing | Features |

|---|---|---|

| Single Operator | Free | Unlimited domains, unlimited chat history, chat routing, API, SSO, ratings & surveys |

| Team (2+ Operator) | $19.99/month | Everything in Single Operator + Dedicated onboarding and success manager |

8. Haptik

Best for WhatsApp Commerce

If you want to utilize your WhatsApp customer base, I highly recommend Haptik’s Interakt. It allows businesses to scale their messaging and boost conversions via hyper-personalization.

Interakt has event-based triggers that tailor AI responses to match customer profiles. It also sends visually appealing product catalogs with interactive CTA buttons, offering a mini e-commerce store inside the chat itself. You’ll have actionable analytics, including open/read rates, CTR, etc., for future campaign optimizations.

Users can open their WhatsApp to schedule appointments, feedback, track orders, and more, getting a 24/7 service at their fingertips. Interakt lets you send automated cart abandonment notifications with personalized offers to get things going.

However, Haptik isn’t limited to WhatsApp. It lets your business connect with customers on Instagram and Facebook to ride on the conversational commerce wave.

Onboarding, creating accounts, accepting payments, advising investments, sending transaction updates, and more, are possible with Haptik’s ChatGPT-powered chatbots.

Haptik has 100+ pre-built conversation flows and extensive support for 130+ languages.

You can easily integrate Haptik with WhatsApp, Instagram, Facebook Messenger, SMS, Microsoft Teams, Google Business Messages, and Line. Likewise, it has connectors for Stripe, PayPal, Razorpay, PayU, Salesforce, Zendesk, Twilio, Zoho Sales, HubSpot, and more.

Haptik Pros

Compliant with multiple privacy and security frameworks, including GDPR, CCPA, PDPA, HIPAA, ISO 27001, etc.

Deployed on AWS and Azure for performance, scalability, and data security

99.9% Uptime and 24/7 on-call support

Haptik Cons

Limited customization and a learning curve

Lacks upfront pricing

Haptik Pricing

Haptik has a quote-based pricing structure that is based on the exact business needs.

9. Ultimate

Extensive AI Automation

Ultimate is a generative AI-based platform for support automation. It works across many industries; however, I will focus on its use in the finance domain.

You can deploy Ultimate’s AI chatbot to allow customers to track transactions, add or adjust bank debits, and troubleshoot payment failures. It automates user authentication, and allows customers to report stolen/lost cards and file a claim against frauds. A few more AI-assisted activities involve resolving login issues, profile updates, account upgrades, card activation/unblocking, and generating account statements.

Ultimate has a visual dialogue builder to create custom conversation flows. It lets you configure the AI to take care of simple to complex custom queries and hand off to the live agent automatically.

This AI finance chatbot is hosted over the Google Cloud Platform, which ensures you get one of the highest standards set across the industry for data security, including encryption at rest and in transit.

Ultimate has pre-built integrations for Zendesk, Sunshine Conversations, Freshworks, Salesforce, Dixa, and Intercom. Moreover, you can integrate Ultimate with other apps using their API.

Ultimate Pros

SOC 2 Type II compliant

User interface is highly intuitive

Benefits from GCP data security and redundancy

Ultimate Cons

Limited integrations compared to other popular finance chatbots

Its dialogue builder is buggy at times

Ultimate Pricing

You need to contact Ultimate’s sales to get the pricing estimate.

10. Kasisto

Purpose-built for Financial Industries

According to me, the most significant benefit of choosing Kasisto is that they are the domain specialists, and the platform is built from the ground up with banking in mind. This ensures a tailored consumer experience compared to the solutions catering to a broad list of industries.

For starters, Kasisto’s generative AI isn’t limited to your customers; it also helps the in-house employees bring their best. The agents can provide the required information by scraping scores of internal documents, website content, and more, paving the way for a quick and superior customer experience. Kasisto’s AI (KAI) also saves time with employee onboarding and reduces unnecessary calls for greater throughput.

KAI lets customers block/replace/apply for credit cards, check loan status, search transactions, set financial goals, get notified of pending payments, upgrade accounts, purchase services, and more, with a personalized experience.

Customers can leverage KAI across websites, apps, email, and phone. KAI seamlessly hands off to your employees when needed and gets back in action after the live call.

Kasisto Pros

Banking-specific expertise

AI assistance for customers and agents

Kasisto Cons

Limited pre-built integrations

Negligible public feedback on UGC platforms; needs to build a bigger user community

Kasisto Pricing

You’ll have to contact Kasisto’s sales department for a custom package.

What Are Finance Chatbots?

Finance chatbots are generative AI-based solutions that provide elementary banking support without including human agents. These bots understand organic conversational language and respond in kind.

GenAI chatbots offer personalized recommendations, understand context, and hand over calls to live agents if needed or asked.

The core idea behind these chatbots is to provide 24/7 customer assistance without wasting precious human hours on tasks that can easily be automated.

4 Benefits of AI Chatbots in Finance

I’ve listed 4 benefits of using AI chatbots in finance below, explaining why you should consider implementing genAI chatbots on your website/apps and everywhere else.

- 24/7 Customer Support: Arguably, this is the number one reason that drives decision-makers to get an AI chatbot for their business. AI agents can assist customers and remain active all day (and night) without getting tired.

- Personalization: Generative AI agents can customize consumer experiences based on past interactions and user profiles. This helps tailor the interaction to feel more human and deliver value.

- Multi-lingual Capabilities: Reaching out to the users in their native tone is crucial. With GenAI-powered AI chatbots, you can have this luxury in a single interface without switching agents.

- Reducing Costs: Of course, cost is another primary reason why business owners are turning to support automation. AI chatbots can work 24/7, replacing at least one, if not a few, first-level support agents.

4 Use Cases of AI Chatbots in Finance

Though there are multiple ways to put AI chatbots to work in any industry, I have highlighted 4 major use cases in the finance domain, which you can check below.

1. Answering FAQs

Though you can post tons of FAQs on your website, it’s generally difficult for consumers to get hold of all the information. Plus, it takes a lot of time to find your query in the listed FAQs, making the process feel tedious and outdated. GenAI chatbots, on the other hand, are an optimized way of providing requisite information inside a user-friendly chat window.

2. Basic Activities

GenAI agents can help consumers complete KYC, track transactions, check account balances, block/replace/issue cards, book services, claim refunds, and more. Additionally, they can automatically hand off calls to human agents, sensing advanced queries or upon user request.

3. Employee Assistance

AI cannot entirely replace human intervention. However, a business can boost its employees’ productivity with AI. Such tools empower live agents to provide up-to-date information to customers and improve overall support quality.

4. Customer Onboarding

While it’s not the best use case since customer onboarding leaves a critical first impression, a business can still AI-onboard its users with strict supervision. You can do this by feeding AI models with onboarding-specific data, followed by detailed test runs to see if it delivers in line with your expectations.

What’s Next?

My primary purpose in creating this list was to give business owners a head start in AI agent implementation. I would suggest trying out the free services and conducting a pilot run to witness the impact.

However, everyone should know AI isn’t without its caveats. For one, AI bots can provide inaccurate information to end users without showing any hesitation or doubt. That’s why I suggest training AI from scratch with case-related data. Even so, human oversight is needed in the initial stages, if not throughout.

Finally, I would like to conclude this with a slightly reworked version of a now-famous phrase, “People using AI will replace those who don’t”.

While AI can’t replace finance professionals, those using automation will ultimately outperform the ones who don’t.