Digital workspaces have completely changed the way we work. However, few people think about their impact on how companies hire, manage, and interact with their employees. Gone are the days when companies were restricted to hiring locally.

Now, businesses of all sizes—tiny startups or large corporations—can build remote-first teams and fill skill gaps by tapping into talent worldwide. While exciting, this shift brings with it new responsibilities, particularly around employer responsibilities.

Two key models you’ll encounter when managing remote or international talent are the Employer of Record (EOR) and Common Law Employer (CLE) models. Both of these are types of employers. However, each has distinct differences in handling their legal responsibilities and managing employees.

What is an Employer of Record?

An EOR is a third-party organization that takes on all the regulatory responsibilities of an employer on behalf of another company, generally referred to as a client company. Navigating complex international employment laws can be time-consuming and risky, so this model is especially useful if you’re hiring across borders.

An important thing to understand is that while the EOR handles all the administrative and legal obligations for your remote workers, you’re responsible for everything else. So you’re still in charge of your employee’s daily activities, work assignments, and performance management.

In other words, you can think of an EOR as a middleman acting as a legal employer for tax and compliance purposes. Which means they handle everything from payroll processing and administering benefits to adhering to local labor laws. So, you’re free to focus on managing your teams and achieving your business goals.

What is a Common Law Employer?

When people talk about the traditional employer-employee relationship, they are actually referring to a Common Law Employer (CLE). Under this framework, your company handles payroll service, provides employee benefits, ensures compliance with local labor laws, and manages employee tax obligations.

This model is ideal if your company plans to have a physical presence in the state or country you’re hiring. And you want more hands-on control over compliance and aspects of employment administration. In other words, you’ll have full autonomy in structuring and managing your teams.

However, the most important characteristic of a CLE is that you have to establish a legal entity in the country where you operate. This means you’re accountable to that region’s employment laws and regulations. However, it also means that you need to invest more in your HR support and compliance resources.

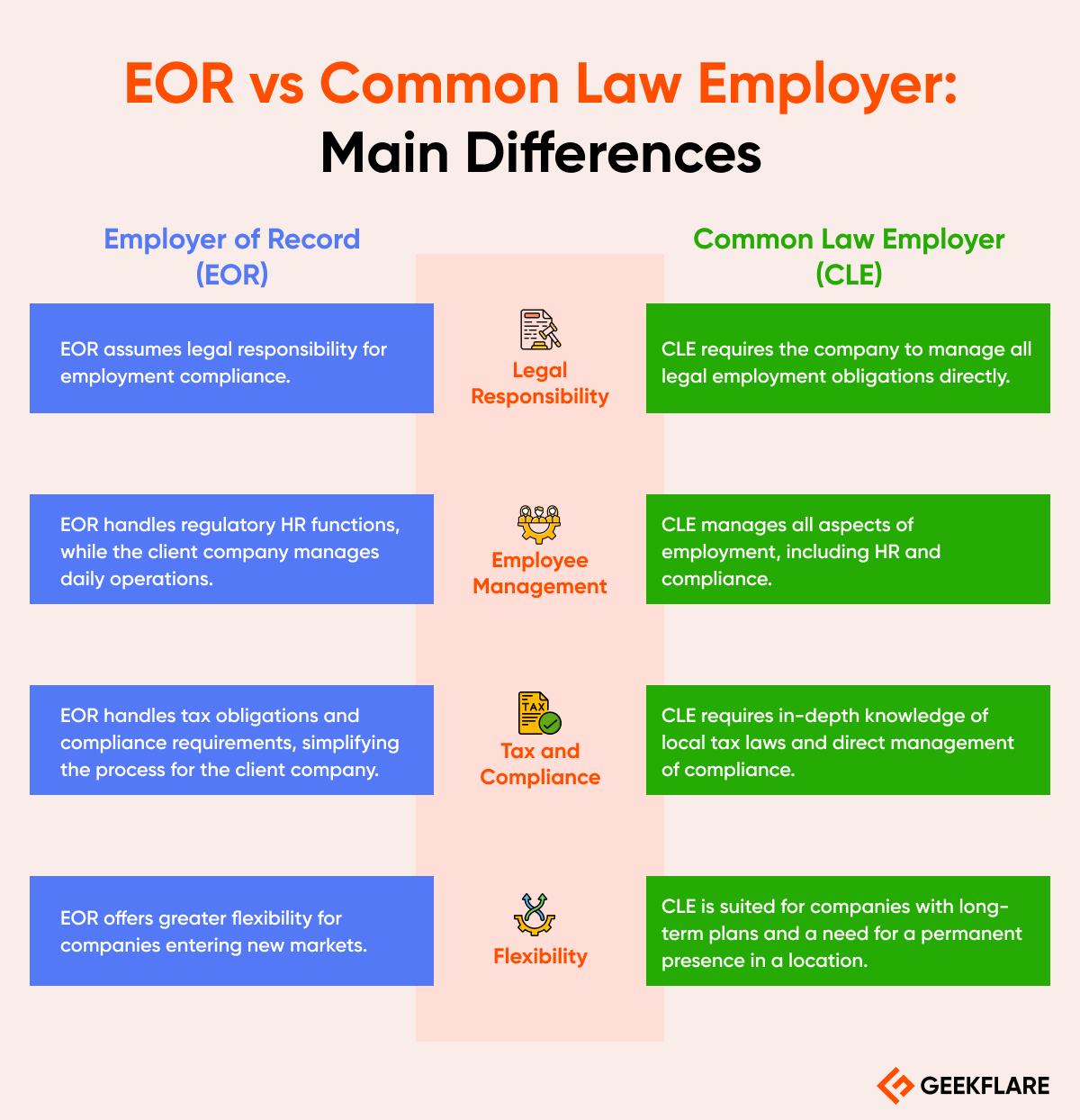

EOR vs Common Law: Main Differences

Here are the main differences between an EoR and a Common Law.

Legal Responsibility

We’ve mentioned this difference before, and we’ll keep mentioning it — because this is the fundamental difference between an Employer of Record services and a CLE. As a CLE, you’re directly responsible for managing all the employment-related legal obligations.

So you’re liable for everything from the initial setup of employment contracts to ongoing adherence to government regulations. When partnering with an EOR, you trust a locally based third party to take on this role. So, while you’re still responsible for oversight, they will take care of any necessary documentation, filings, and statutory requirements.

Employee Management

In a CLE arrangement, your company oversees every aspect of employee management. So hiring, training, remuneration, leave, career development, and more all fall under your purview. Now, with the EOR model, your employees technically have two employers.

The EOR is their locally-based legal employer and handles all regulatory HR functions, like issuing contracts and managing employment documentation. You, the client company, (often remotely) directs day-to-day tasks, manages goals, and supervises these employees’ performance.

Tax and Compliance

As a CLE, you’re responsible for meeting all your employee’s tax obligations. This includes income tax withholding, social contributions, and regulatory filings. This would mean you need a deep understanding of local tax laws, and you may also need to set up a local legal entity so you can comply fully.

With an EOR, they handle all these tax and compliance requirements on your behalf. This way, you can operate in a new region without worrying about figuring out and navigating the local tax codes.

Flexibility

Of the two employment models, a CLE is typically less flexible. This is simply because the logistics of setting up a legal presence and all the obligations related to running it require a longer-term commitment. So, it’s most suitable for companies that have fixed, long-term plans in a specific location.

An EOR, on the other hand, allows companies to quickly enter and exit a market without needing any legal setup. This inherent flexibility means partnering with an EOR that’s ideal for small businesses who want to hire remotely on a trial basis or are investigating operating in a new region.

Benefits of Each Model

There are simple but important benefits to each of these employment models that you should note.

EOR

- Compliance Management: An EOR helps you avoid legal complications by taking on the responsibility of adhering to local laws, tax regulations, and employment standards.

- Simplified Global Hiring: An EOR eliminates the need to set up a local presence, so you can quickly hire international talent without many administrative barriers that usually hamper global expansion plans.

- Risk Mitigation: By assuming the liabilities and requirements related to employment, an EOR reduces your exposure to the potential legal and financial risks of navigating an unfamiliar employment market.

Common Law Employer

- Full Control: As a CLE, your company has complete authority over everything related to managing your business and your international employees. This means there’s no confusion when it comes to your internal standards and policies.

- Direct Relationship: The CLE model allows your company to build a direct employment relationship with your staff, which fosters a stronger sense of loyalty and engagement.

- Legal Consistency: With the CLE structure, you retain full oversight of your compliance and HR standards, ensuring consistent legal compliance and employment practices across all your regions.

Drawbacks of Each Model

Potential challenges come with each employment model, which are outlined below.

Employer of Record (EOR)

While employer of record services simplify many aspects of international hiring, it can also lead to higher costs over time. This is particularly true for long-term employees or larger teams. There’s also the fact that you have less direct control over HR processes and the overall employee experience, which impacts your staff’s integration with workplace culture.

Common Law Employer

With the CLE mode, you have to set up legal entities in each country or state where you operate. This can be costly and time-intensive, especially for small or temporary expansions.

Managing local tax, compliance issues, and HR regulations also demands considerable resources and expertise, which may strain internal teams and add to operational complexity.

Which is Right for You?

So, how do you choose which employment model you should use? Let’s figure out.

Hiring an EOR

Partner with an Employer of Record if your teams are small or you’re only interested in short-term hires in new markets. Remember that while it simplifies compliance and HR management, it can also limit your control and become costly over time.

Becoming a Common Law Employer

Establish a legal entity if your company has larger teams, especially when they’re involved in long-term operations. Remember that higher upfront costs and complex administrative tasks are involved. However, you also get full control over your compliance and HR processes.

Ultimately, your choice will depend on your business goals, team size, and market entry plans. Understanding the strengths and weaknesses of each model will help you make the best decision for your needs.

More Readings on EOR

-

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.