Payroll administration is the process of administering employees’ payrolls and expenses, which seems simple enough. Deposit your employees’ wages or salaries in their accounts, and you’re all done, right?

Except…there’s a little more to it than that.

In fact, it would be more accurate to say that payroll management is all about calculating employee compensation. It starts with working out an employee’s exact wage or salary for the payment period, and then commissions, deductions, benefits, and tax regulations come into play.

It’s a complex process that involves meticulous calculations and careful documentation. But anything less than perfection means dissatisfied employees and could lead to hefty fines or legal consequences. So, getting it right is non-negotiable.

What is Payroll Administration?

Payroll administration is a systematic process of managing all the financial records related to employee remuneration. It is typically handled by your finance, accounting, or human resources (HR) departments, who may use business software to assist them with the task.

This depends on how big your company is and how it’s structured, though. The goal of payroll accounting is staying compliant with relevant labor laws and tax regulations while making sure that your employees are fairly and accurately compensated for their work.

This also supports your company’s financial health by aiding employee retention, keeping cash flow stable, and avoiding costly compliance issues.

Core Tasks Involved in Payroll Processing

To manage payroll effectively, your administrators must handle a variety of tasks that include:

- Accurate Pay Calculations: This includes calculating the income for both hourly and salaried employees. It also takes into account their overtime, bonuses, and any other adjustments.

- Managing Deductions: Payroll management involves deducting mandatory deductions like taxes and social security. And also voluntary contributions like retirement plans and health benefits.

- Compliance with Labor and Tax Laws: Payroll administrators have to make sure your company stays compliant with various labor laws and tax requirements in any region where you operate. This includes sticking to wage regulations, withholding taxes correctly, and filing the necessary documentation on time. If you’re unsure about these complex requirements, a detailed payroll guide can provide clarity and ensure compliance.

- Generating Payroll Reports: Payroll reports track payroll calculations that include details on employee earnings, taxes, and benefit costs. They give you valuable insights that assist with budgeting, transparency, and business planning. They also help when it comes to annual tax filing or conducting audits.

- Maintaining Payroll Records: Keeping detailed records of each payroll transaction neatly organized is essential for internal audits and payroll compliance. These records include information on your employee’s earnings, how much you withheld for tax, and proof of payments you made.

How Payroll Administration Works?

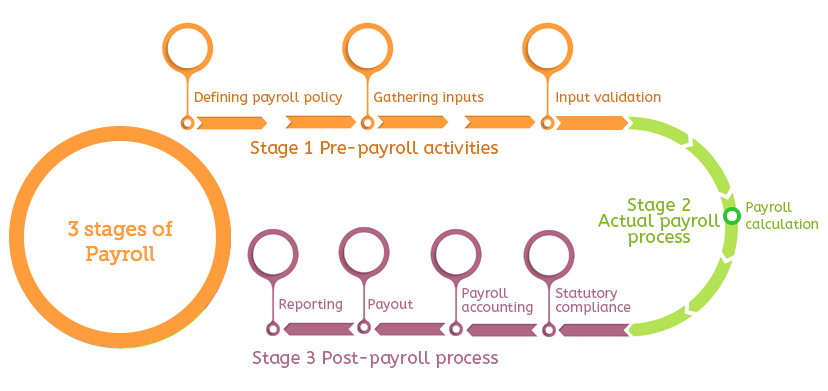

Payroll management is a structured process with key steps that help you pay your employees accurately and on time. Here’s how it works, step-by-step:

- Collect Employee Data: To manage payroll you start by gathering necessary information about your employees. This includes their details (address, tax ID), employment details (contract, part-time, full-time), their hours worked, bonuses, overtime, and details about any applicable deductions.

- Calculate Wages and Deductions: Now, payroll administrators will use the collected data to calculate gross wages. Once they’ve subtracted each employee’s mandatory and voluntary deductions, they’re left with the net, or take-home, pay.

- Process Payments: Next, payments are processed based on your company’s pay schedule (weekly, fortnightly, or monthly). Payroll administrators are responsible for making sure that the correct funds are deposited into the right employee’s bank accounts. Or properly distributed via other payment methods (PayPal, etc.) where applicable. They will also issue pay stubs that outline earnings, deductions, and net pay for the given pay period.

- File Taxes: Avoiding penalties and staying compliant with tax laws requires filing payroll taxes quarterly and annually. This step includes reporting on both the taxes you’ve withheld from your employees and your contributions.

- Maintain Records: You have to keep detailed records of all your payroll transactions for legal and compliance reasons. These records include sensitive information such as payment details, tax withholdings, benefit deductions, and proof of payments — so secure storage is essential. Keeping good records helps you with future audits, preserves transparency, and protects your company from the risk of legal issues.

Why is Payroll Administration Important?

We’ve already mentioned that managing payroll is the most important function in running a successful business. Now, we’ll explain why.

Employee Satisfaction

Properly managing your payroll directly impacts the satisfaction of your employees by making sure that they’re paid accurately, consistently, and punctually. Building a foundation of reliability and respect, and reducing your employee’s frustration and stress, depends on them trusting that they’ll receive the correct pay on time.

The sense of security boosts employee morale and productivity, leading to a more positive work environment. It also means better retention because a satisfied employee is unlikely to leave for greener pastures.

Legal Compliance

A critical part of managing risk and establishing your company as a trustworthy employer is complying with local labor laws and tax regulations. And every company — from small businesses to multinational corporations — has to follow laws related to minimum wage, overtime pay, and tax deductions.

Payroll managers also have to submit tax payments on time and make sure all deductions are in line with legal requirements. Non-compliance with these rules can lead to serious consequences that include fines, audits, and even legal action from employees or regulatory bodies.

Financial Management

Payroll is one of the biggest recurring expenses for most companies. So, precise payroll calculations are essential for cash flow management. Accurately working out and tracking payroll costs means you’re better equipped to forecast expenses, create budgets, and avoid cash flow issues.

Payroll records provide insights into your labor costs and benefits, which allows you to make informed decisions regarding hiring, salary adjustments, and benefit offerings.

Accurate Record Keeping

Keeping detailed records of all your payroll data is essential for:

- Audits and Compliance: These records serve as proof of compliance if a regulatory body or tax agency audits your company, which reduces your risk of penalties.

- Employee Queries: An accurate payroll history helps you provide clarity and address any issues or disputes if an employee has any questions about their pay or deductions.

- Historical Data: Your payroll records allow you to analyze trends in your labor costs over time, which can guide your future budgeting or payroll decisions.

In short, keeping accurate records supports both transparency and compliance. Which gives your company a reliable basis for answering questions, complying with audits, and making data-driven decisions.

Company Reputation

A reliable payroll process strengthens both the internal and external reputation of your company. Consistent and timely payments build trust and loyalty among your employees, which enhances your image as a responsible employer.

Externally, a dependable payroll process signals that you’re professional, financially stable, and legally compliant. This makes your company a more appealing place to work, so it’s easier to attract top talent. And it can also attract new investors or customers.

Best Practices for Effective Payroll Administration

Each of the practices below contributes to a reliable and efficient payroll system that builds trust with employees, maintains compliance, and protects sensitive information.

Use Payroll Software

Payroll management software automates a lot of the payroll process, which saves time and reduces the risk of human error. Tasks that these software solutions handle without human intervention include tracking time worked, calculating pay, and how much tax to withhold.

Other tools you might see in modern payroll software are those designed to make tax filings, direct deposits, and reporting easier. They may also include employee self-service features that allow your staff to manage their personal information and view their payslips.

Regular Payroll Audits

Regularly auditing your payroll documentation is essential to catching and correcting any inconsistencies, mistakes or compliance issues before they become major problems. Internal audits involve reviewing your historical payroll data, calculations, tax fees, and benefits deductions to make sure they’re accurate.

Conducting audits not only helps with the early identification of errors but also with maintaining compliance, protecting your company’s reputation, and reinforcing your financial stability.

Stay Updated on Tax and Labor Laws

Tax regulations and labor laws change all the time, and staying informed about these changes is critical to keeping in line with them. So you should implement regular training and/or consulting with legal or tax experts, so your payroll team is always current with the latest local, state and federal requirements.

Many payroll software solutions offer automatic updates to reflect new laws, but it’s still important for you and your team to check for updates from tax agencies and labor departments.

Maintain Clear Communication with Employees

Transparent communication with employees about payroll is essential for fostering trust and transparency. This includes providing clear information on pay dates, how payroll deductions work, and where employees can view their pay information. You should also make it easy for employees to get answers to their questions or resolve pay-related issues.

It’s also important to notify employees of any changes to existing payroll policies well in advance of the change being made. Your employees understanding of their payment structure and schedule means they’re more likely to feel satisfied and confident in the process. And that means their overall job satisfaction improves.

Ensure Data Security

Payroll data is sensitive information that includes your employees’ personal, financial, and tax details. So, data security is a top priority. You’re responsible for making sure you comply with relevant data protection regulations (GDPR, CCPA, etc), that access to payroll data is limited to authorized personnel only, and that your systems are secure.

Security measures like encryptions, two-factor authentications (2FA) and regular backups help prevent data breaches. By protecting your employee’s personal information, you’re reducing the risk of fraud, compliance violations, and also identity theft.

Challenges in Payroll Administration

Each of these factors can complicate your payroll processes, so you must find effective solutions to manage them.

- Complex Regulations: Payroll administrators must navigate an evolving landscape of tax, wage, and labor laws that vary by region, which can make compliance difficult and time-consuming.

- Manual Errors: Human errors in data entry or calculations can lead to costly mistakes and employee dissatisfaction, making accuracy a constant challenge.

- Time-Consuming Processes: Payroll processing demands significant time, especially in large or complex organizations, as it involves precise calculations and compliance checks.

- Tax Compliance: Staying current with tax requirements and accurately calculating withholdings is essential to avoid penalties and ensure compliance, but it requires up-to-date knowledge.

- Data Security: Payroll data contains sensitive information, making robust security measures vital to protect against breaches, identity theft, and regulatory violations.

Comparison of In-House vs. Outsourced Payroll Administration

Here’s a quick comparison summary of In-house and outsourced payroll administration.

| Basis | In-house Payroll | Outsourced Payroll |

|---|---|---|

| Cost | Typically, it involves a higher initial cost for software, personnel, and training. However, it can still be more cost-effective for larger organizations whose payroll needs are consistent. | Reduces the need for dedicated payroll staff and software investments. So it’s often more cost-effective for small to medium-sized businesses. Note that it may involve a monthly fee or per-employee rate. |

| Control | You have full control over the payroll process, so you can customize it as needed to suit your company policies and practices. | Payroll processes are managed by an external provider so you have limited direct control. Any adjustments or customizations will likely require additional coordination. |

| Accuracy | Accuracy here depends on the expertise and consistency of your internal team. So it may be prone to human error if they’re not supported by up-to-date tools. | Professional payroll providers often have dedicated teams and automated systems, which can reduce the likelihood of errors and improve consistency. |

| Scalability | Generally requires additional resources and scaling efforts (e.g., hiring, software upgrades) as your company grows, which may increase costs and complexity. | Easily scalable, as most providers offer flexible solutions that can accommodate your business growth without you needing to make major internal adjustments. |

| Resource Management | Payroll management takes up internal time and resources, especially for smaller teams that may be stretched thin. | Frees up internal resources, allowing HR and finance teams to focus on other core tasks and strategic initiatives. |

| Data Security | You have direct control over data security measures and systems, but you’ll need internal capabilities and resources to maintain high-security standards. | Reputable providers often use advanced, dedicated security protocols and compliance measures, though data is stored outside the company’s direct control. |

| Employee Satisfaction | On-site payroll teams can address employee concerns and questions directly, offering more immediate support for payroll issues. | External providers often offer 24/7 support services and resources but may lack the personal touch of an in-house team. |

Final Words

As you can see, payroll administration is vital to maintaining accurate, timely employee compensation and ensuring compliance with legal regulations. By following the best practices we listed here, your business can manage payroll efficiently, reduce errors, and foster employee trust.

More Readings on Payroll

-

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.