A payroll cycle is the fixed period between two consecutive employee paydays, such as weekly or monthly. It depends on company policies and the employee’s role, influencing both the employee’s expectations and the company’s cash flow.

So, is it just another HR term, or does it hold a deeper significance?

In this guide, I’ll explain the payroll cycle, how it works, how to choose one, and best practices for managing it.

What Is a Payroll Cycle?

A payroll or pay cycle is the recurring period when a company pays its employees, ensuring they receive their compensation regularly. Common cycles include monthly, semi-monthly, weekly, and bi-weekly.

But a payroll cycle isn’t just a timeframe from one paycheck to the next. It also includes all the activities carried out by the HR department in managing employees’ wages. These include performance evaluations, employee benefits administration, earnings calculations, and compliance management.

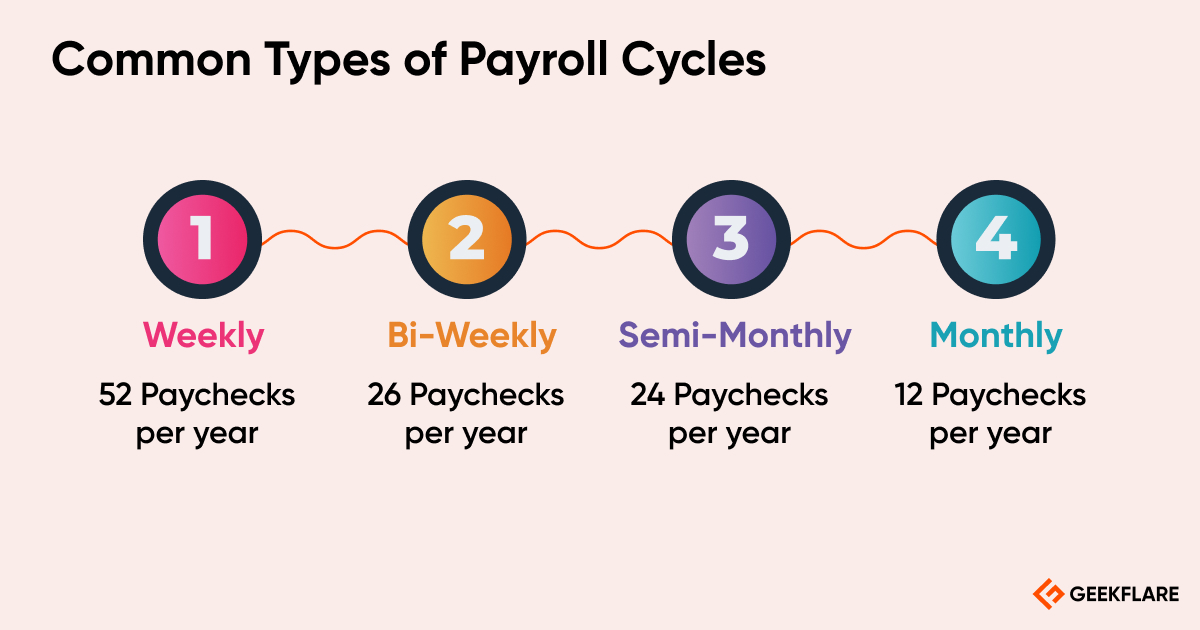

4 Common Types of Payroll Cycles

The length of a payroll cycle can vary from a week to a month. It depends upon factors like company policies, industry standards, company’s cash flow, and administrative efficiency.

Below are a few common payroll cycles:

1. Weekly Payroll

Employees are paid once a week, resulting in 52 paychecks per year. This arrangement is common in industries like retail and hospitality, which have more hourly or part-time workers.

Since weekly payroll gives quick and frequent access to their wages, employees can better manage their expenses, especially those living paycheck to paycheck.

For employers, it improves job satisfaction but increases administrative effort due to the frequency of payroll processing.

2. Biweekly Payroll

Employees are paid every two weeks, usually on a Friday, which adds up to 26 paychecks in a year. This is the most common pay frequency in the US, used by 43%[1] of private establishments. Suitable for both hourly and salaried positions, it provides a balance between pay frequency and administrative effort.

However, there are at least two months in a year when employees receive three paychecks instead of two, potentially straining the company budget.

3. Semi-Monthly Payroll

Similar to biweekly pay schedules, semi-monthly payroll employees are paid every two weeks. But instead of a designated day, payments are sent out on fixed dates (e.g., the 15th and 30th of a month). This frequency results in 24 paychecks each year.

Semi-monthly payroll is typically used for salaried employees. With two paychecks each month, it is easier for them to manage their finances.

However, if used for hourly employees, calculating weekly overtime becomes complex and prone to errors.

4. Monthly Payroll

Employees are paid once a month, typically on the last day of the month or a designated date, resulting in 12 paychecks annually. This pay schedule is commonly used for salaried employees with a fixed income.

Although this schedule reduces administrative workload, it can impact employees’ financial stability, especially those needing frequent cash flow.

Monthly payroll is commonly used for paying expatriates in global companies. In these cases, employers may run a shadow payroll—where pay is reported in the host country for tax and compliance purposes, but not actually paid there. If you’re managing international employees, a Shadow payroll guide can help you stay compliant and avoid double taxation.

How the Payroll Cycle Works?

A payroll cycle involves several key steps to ensure accurate employee compensation and compliance with regulations.

- Tracking Hours: Employees’ hours, including overtime, are tracked using a time-keeping system to ensure fair compensation and compliance with labor laws.

- Calculating Pay and Deductions: The gross pay is calculated based on hourly rates, overtime, bonuses, or commissions. The payroll system also includes mandatory deductions (e.g., social security, taxes) and voluntary ones (e.g., health insurance, retirement plans).

- Processing Payroll: Once all the calculations are validated, it’s time to process all payments. Automating this step streamlines disbursement by enabling companies to generate pay stubs and send payments through direct deposits.

- Payment Distribution: Payments are disbursed via direct deposit, checks, or other methods based on company policies.

- Payroll Reporting: Detailed payroll reports are generated for record-keeping and payroll tax compliance. These reports help businesses track expenses, verify payment accuracy, and ensure compliance with both federal and state tax regulations.

How to Choose the Right Payroll Cycle?

Below are a few factors to consider while choosing the right payroll cycle.

Step 1: Consider Business Size

Small businesses often opt for less frequent payroll cycles, like monthly or semi-monthly, due to cash flow constraints and the administrative workload involved. The large time gap between each employee’s paycheck helps such organizations better allocate their resources without overwhelming their limited HR capabilities.

On the other hand, large-scale businesses typically use a weekly or bi-weekly payroll cycle. They employ a diverse workforce, including hourly and low-income employees who benefit from frequent paychecks.

Step 2: Assess Cash Flow

Businesses should align their pay frequency with their cash flow to avoid financial strain. Shorter pay periods result in more frequent cash outflows, which can affect a company’s ability to manage other expenses, especially if the cash inflow isn’t stable.

Step 3: Understand Industry Norms

Different industries have different payroll norms based on workforce needs. For example, the construction and retail industries prefer weekly or biweekly pay cycles due to the nature of hourly work.

In contrast, professional service firms prefer a monthly cycle because most workers earn a fixed salary. This makes it easier for them to manage the payroll process and plan cash flow.

Step 4: Employee Preferences

Most employees, especially hourly workers, expect a weekly or bi-weekly payroll cycle. 25%[2] of Americans who live paycheck to paycheck depend on frequent paydays to manage their finances.

However, employers mustn’t forget their own operational efficiency and cash flow stability when considering employee preferences.

For example, a biweekly payroll may satisfy employees with timely payments and overtime flexibility, but it can strain resources and cash flow. The key here is to strike a balance between employee satisfaction and business sustainability.

Step 5: Compliance with Regulations

Employers must ensure they adhere to these regulations to avoid legal complications. Many jurisdictions have laws governing minimum pay frequencies:

- California requires employers to pay employees at least twice a month.

- New York mandates that manual workers be paid weekly and clerical workers at least semi-monthly.

- Texas allows employers to choose their own pay periods but mandates at least monthly payments.

Employers must ensure they adhere to these regulations to avoid legal complications. Additionally, understanding overtime regulations is important when determining payroll cycles to avoid violating the Fair Labour Standards Act (FLSA).

Step 6: Payroll Resources

A company must consider its administrative capacity when choosing a payroll cycle. Small businesses often have limited HR resources and may prefer less frequent cycles like monthly payroll to ease administrative workloads and cut processing costs.

In contrast, larger companies have dedicated HR teams and advanced systems. They can easily handle more frequent payroll cycles, such as biweekly or weekly, without risking errors or compliance issues.

Investing in payroll software further bridges this gap. It lets businesses of any size automate processes, ensure accuracy, and reduce the time spent on manual calculations.

Why Is the Payroll Cycle Important?

A payroll cycle is more than an assurance of fair and timely employee pay. It supports the overall health of an organization. Here’s why it is important:

- Cash Flow Management: A well-planned payroll cycle is instrumental in managing a company’s cash flow since it provides predictable cash outflows. This helps in smoother budgeting and accurate financial forecasting and reduces liquidity strain while ensuring timely payments.

- Employee Satisfaction: Timely and predictable paychecks boost employee satisfaction by reducing financial stress. According to a 2024 ADP survey[3], organizations looking to enhance workplace satisfaction and engagement prioritize improving their payroll systems.

When employees know when they’ll be paid, they can better manage personal finances and meet financial obligations like rent on time. Moreover, a payroll cycle that matches their expectations (for example, hourly employees may expect a bi-weekly payment) improves job satisfaction as employees feel valued by the organization.

- Administrative Efficiency: A structured payroll cycle boosts administrative efficiency by automating repetitive tasks like wage, overtime, and tax calculations. It centralizes employee data, ensuring timely payments through direct deposits, requiring minimum human intervention, reducing errors, and saving time.

- Compliance with Labor Laws: A payroll cycle standardizes timely wage processing, tax deductions, and statutory contributions. For example, labor laws often mandate the deadline for each paycheck—something a systematic payroll cycle can meet consistently. Without such a system, businesses risk compliance-related issues and facing penalties, potentially harming their reputation and employee trust.

Off-Cycle Payroll vs. Regular Payroll Cycle

The key difference between off-cycle payroll and regular payroll cycle is as follows:

Regular Payroll Cycle

Regular payroll is paying employees on a consistent payment schedule. A monthly payroll is an example of a regular pay cycle in which payments are processed on a specific day each month.

Such a cycle is heavily regulated by federal and state laws to ensure employees receive timely and fair compensation.

Although it’s predictable, it requires careful planning to avoid legal pitfalls. Companies must balance meeting deadlines with maintaining accurate records to avoid legal or financial penalties.

Off-Cycle Payroll

Off-cycle payroll involves paying employees outside their regular payday to handle unique payment needs such as bonuses, correcting errors, late overtime, or expense claims.

For example, businesses often implement off-cycle payroll during layoffs to ensure immediate severance payments. The retail industry also uses it to pay seasonal bonuses during peak shopping seasons.

An off-cycle payroll offers employers the flexibility to address immediate payment needs without waiting for the next payday. However, it comes with challenges. While federal laws offer leeway, many states, like California, require strict adherence, such as immediate payouts upon termination.

Off-cycle payroll also increases costs due to administrative efforts and banking fees, requiring precise record-keeping to stay compliant with tax laws and regulations.

5 Payroll Cycle Management Best Practices

Properly managing a payroll cycle may not be the most exciting task in the workplace. Yet, organizations spend an average of 29 workweeks[4] fixing common payroll errors for every 1,000 employees.

Below are a few best practices that help you save time, avoid exorbitant fines, and safeguard employee trust and company reputation.

1. Update Employee Information Regularly

Regularly updating employee data ensures operational efficiency, legal compliance, and employee satisfaction. When a company fails to update employee information like bank details, promotions, or benefit adjustments, it risks facing lawsuits and penalties.

For example, if an employee is underpaid because their promotion went undocumented in the payroll system, it’s a breach of the Fair Labour Standards Act (FLSA)[5]. If this employee is underpaid consistently due to outdated information, they may lose trust in the company.

An overpayment, on the other hand, may incur financial loss to the company.

Once a discrepancy occurs, it must be rectified immediately when identified. While an underpayment is easier to correct, correcting an overpayment requires enforcing laws and obtaining employee consent, which costs significant time and money.

To avoid that, verify key details for accuracy after employees complete their W-2 forms, including:

- Full name

- Current address

- Social Security Number

- Current designation

- Employment start and end dates (if applicable)

- Date of birth

- Payroll information, such as hourly rates and overtime.

For detailed labor and payroll tax recordkeeping requirements, you may consult the IRS[6] or Department of Labor (DOL)[7] websites.

2. Integrate Payroll Software

Imagine dealing with a flood or fire while also going nuts over damaged payroll records. Perishable and fragile punch sheets are a liability since they can be altered, missing, or destroyed.

Payroll software eliminates this risk by securely storing data in the cloud. As per Eightfold AI, 77%[8] of HR leaders already use AI to process payroll and benefits. By automating repetitive tasks like calculating taxes, generating payslips, and updating deductions, payroll software saves time, reduces human error, and ensures compliance with laws.

3. Communicate with Payroll and Finance Teams

Maintaining open communication between HR, payroll, and finance departments ensures smoother operations and mitigates the risk of payroll errors. For example, a delayed or incorrect payment is inevitable if HR fails to inform payroll about approved bonuses.

But there’s a catch.

When it comes to payroll, there’s a fine line between communication and confidentiality. Information like salary, deductions, medical information, and appraisals shouldn’t be casually discussed outside the payroll department.

Steve Hodgson, the Director of Payroll Training for the American Payroll Association, recalled an incident where a payroll clerk’s private conversation about an executive’s garnishment was overheard. The result was the loss of two employees over the breach of confidentiality.

4. Regular Payroll Audits

Payroll errors can cost you money, reputation, and employee trust. Conducting regular payroll audits can help identify discrepancies before they can cause huge damage.

For instance, audits highlight outdated employee information, missed tax deadlines, or unpaid overtime. Companies can also use payroll software to automate parts of the audit, such as cross-checking records and generating compliance reports.

Regular audits reduce the risk of penalties, legal disputes, and inefficiencies, protecting the business and its workforce.

5. Prioritize Employee Concerns

Employees rely on timely, accurate compensation. A delayed paycheck or incorrect deduction can escalate quickly into dissatisfaction or even a legal dispute.

Therefore, it is vital for businesses to prioritize payroll-related concerns. When employees feel their concerns are heard and valued, it strengthens the workplace. This fosters trust and minimizes turnover.

Setting up tools like a feedback portal helps employees report payroll issues easily. Quickly resolving payroll problems not only boosts morale but also helps retain employees.

References

View Details

1. BLS Current Employment Statistics (CES) Survey

4. EY Survey on Payroll Errors