Personal Finance apps help you manage your investments, track them regularly, and ensure you are on the path to achieving your financial goals.

It’s essential to know what’s going on with all your investments, not just once a year when you get your tax forms. Luckily, there are investment management apps to help. They monitor and track your portfolio for any changes that might affect you.

Your portfolio might include stocks, bonds, mutual funds, ETFs, 401(k)s, or IRAs. Keeping track of all these assets can be a challenging, if not a daunting, task.

Imagine yourself sitting comfortably in your favorite chair and being able to manage your investment portfolio across all accounts. It is possible to see your net worth per month, week, day, and even second with personal finance tools and apps.

Our list of top personal finance tools and apps to manage wealth includes the best paid and free choices to meet a wide range of financial objectives. Check these out to organize your finances now.

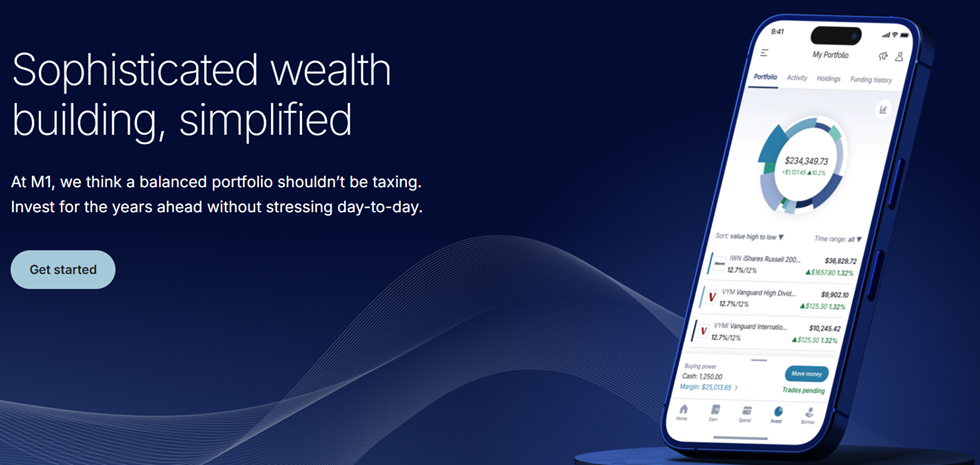

M1 Finance

M1 Finance is a one-stop shop for all your financial needs. With their Invest feature, you can customize your investments the way you want, for free! You can also borrow against your investment at 2-3.5% without any extra paperwork with their Borrow feature. Finally, with their Spend feature, you get the best digital banking effortlessly integrated with your investments.

M1 Finance is a hands-free investment strategy for long-term investors. The platform has been designed to give you the perfect mix of personalization and automation to start making your money moves. It takes care of the day-to-day tasks so you can concentrate on the big picture and is free to use – unlike other investing platforms, which charge a platform usage fee or deposit or withdraw from your connected bank.

You can either set your percentages manually or let M1 Finance take care of it for you. It also offers Dynamic Rebalancing, wherein whenever you deposit new cash into your portfolio, it will automatically identify any underweighted slices and invest the necessary amount to get them back on track.

The Auto Invest feature will make sure your portfolio stays on track with your targets, so you never have to guess what you’re investing for. Plus, plan members get a 1.5% base rate reduction for borrowing, access to their afternoon trade window, and 1% cashback and 1% APY with the spend checking account.

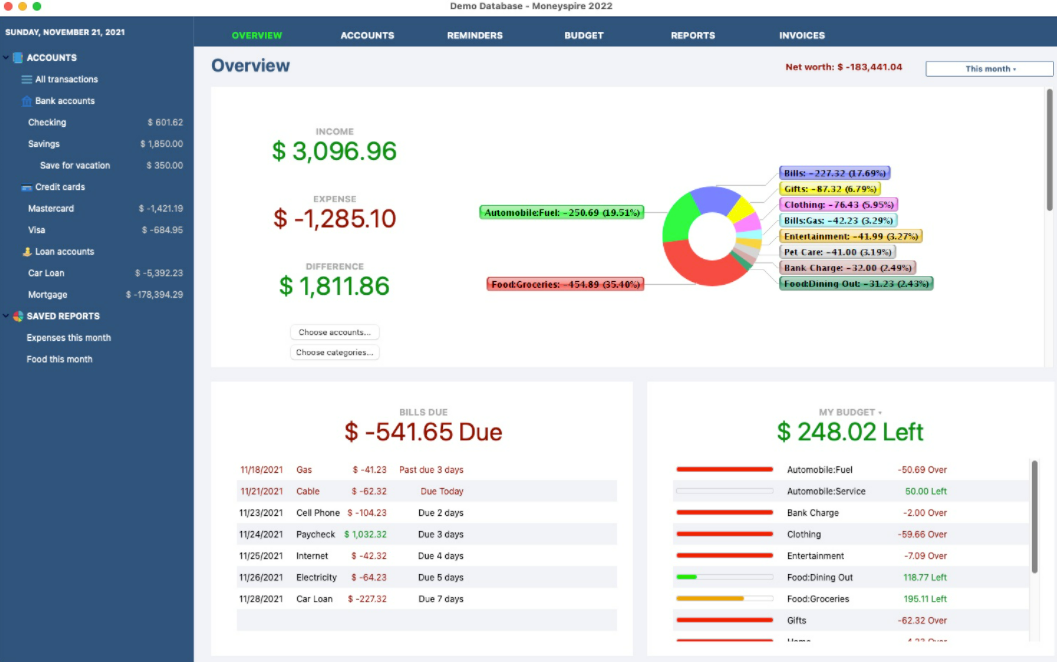

Moneyspire

Moneyspire is a personal finance software that can control budgeting for users. It helps manage the money while deep-diving into the pattern and spending of the users.

It allows:

- To obtain insight into the finances that includes history and how it will affect future decisions.

- Customizable interactive reports.

- Understand the transactions and balances to prepare plans for upcoming expenses.

- Reminder for users to pay bills.

- Setting budgets and goals to ensure that users understand the real-time stats.

- Creating and tracking customers’ invoices instantly.

The software offers fully customizable features for the users to set their finances, supports world currencies and regions making it easier for everyone, transfers finance details from other software quickly, controls the data without third-party interference, etc.

56-bit encryption for banking data transmission to keep the information private.

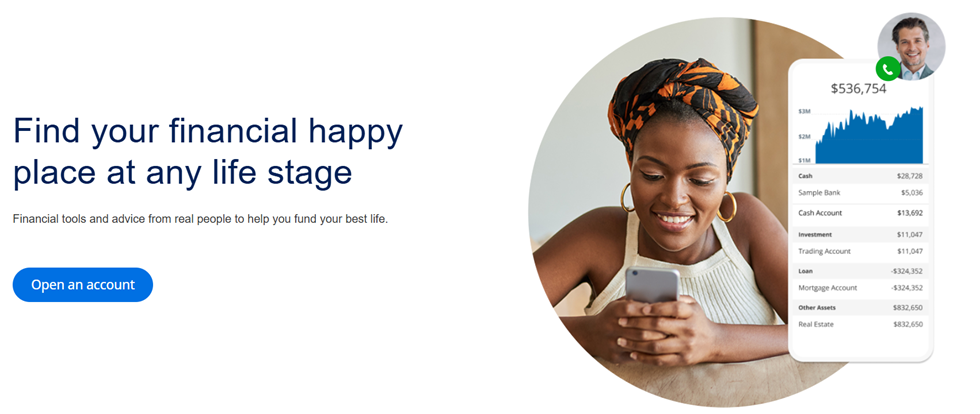

Empower

Empower is an app that allows users to track spending and review their investment portfolios. You can link all your accounts together for easy management and monitoring.

It can be used to calculate your net worth, which will give you an idea of your current position and allow you to set a goal for the future. It provides financial planning advice that will help you create a customized financial plan.

Empower is unique because it offers both superior mobile apps and an intuitive desktop interface. It can also analyze your accounts to uncover hidden fees that may be preventing your portfolio from reaching its full potential.

Anyone can sign up and get access to the money planning tools for free. However, to be eligible for the advisory services, you must have a minimum of $100,000 in an account.

Your data is protected with military-grade encryption algorithms, 256-bit AES. Firewalls that operate under strict financial and international security standards (PCI DSS Level 1 and ISO 27001 certification) protect your data. Information security is under direct management control.

Oportun

Oportun is designed for people looking to save money but don’t mind putting in a lot of effort. This service evaluates your spending habits and then transfers money to your Oportun account from your linked bank account.

It interprets your checking balance, future income, and spending patterns. It uses these variables to calculate a non-essential amount based on your spending habits.

You may think, “Wait! Can’t I do this stuff myself?” Oportun is designed for the generation that trusts technology implicitly and relies on it heavily. It’s worth it for the convenience and fee.

All the customers receive a 1% annualized savings bonus for every three months they save. It also offers a text service that uses SMS messaging to allow customers to view their balances, initiate withdrawals, and view upcoming bills without using a computer.

Oportun was created to help tech-savvy millennials save more. It is FDIC-insured up to $250,000. You can never transfer more than you have the means to pay, and there is no overdraft guarantee.

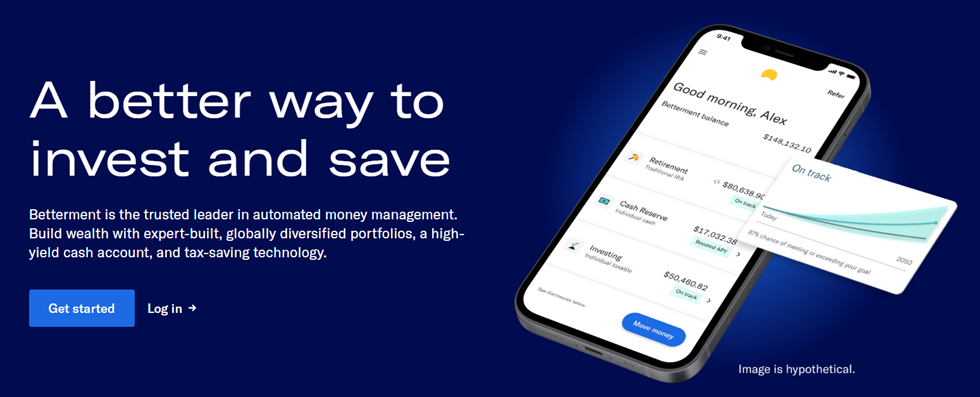

Betterment

Betterment can help you manage your money via cash management, guided investment, and retirement planning. When you connect to your outside accounts, they will also collect information. It helps you to set financial goals and create investment portfolios that will support each plan.

The investment strategy is based on ETFs (exchange-traded funds) that are low-cost and have a risk profile based on the length of your plans to invest. You can use their cash management products, Checking, and cash reserve to save money and spend less.

Betterment Securities is a SIPC Member, protecting securities customers up to $500,000 (including $250,000 cash claims). Deposits into Checking can be insured up to $250k in individual accounts and $250k per depositor in joint accounts.

Wealthfront

Wealthfront is one of the best Robo-advisors apps available in the market. It offers the complete goal-setting, planning, investing, and banking package in an easy-to-use platform.

Its accounts give you free access to the Path, a financial planning tool that integrates account data and uses third-party data to predict your financial future better.

Its fantastic financial planning helps you see the bigger picture. For significant goals such as college savings and home purchases, goal-setting assistance is available. It offers benefits such as a Line of Credit portfolio, tools to help you make the right trade-offs if you have multiple goals, and tax-loss harvesting.

There is no online chat available for prospective or current customers. Higher amounts of mutual funds may be available in larger accounts.

Quicken

Quicken gets high marks for its personalized spending plan that gives you real-time updates on how much money you have left over each month. It syncs with your bank accounts to track your financial progress and show you where you are at. Simplify from Quicken tracks all your subscriptions and bills, even those that you don’t use.

It has a retirement planner, investment tracker, and even a property management section to manage all your investments in one dashboard. It also has a capital gain calculator in case you sell any of your assets.

You will need to connect your bank accounts to get started. Once you do, you’ll have a complete picture of your finances. The app automatically categorizes and tracks your spending and keeps you up to date with any upcoming expenses.

The app’s unique watchlists allow you to limit your spending by payee or category. The app’s custom spending plan monitors your cash flow, so you don’t spend more than what you earn.

Quicken, the parent company of the app, is committed to privacy and security.

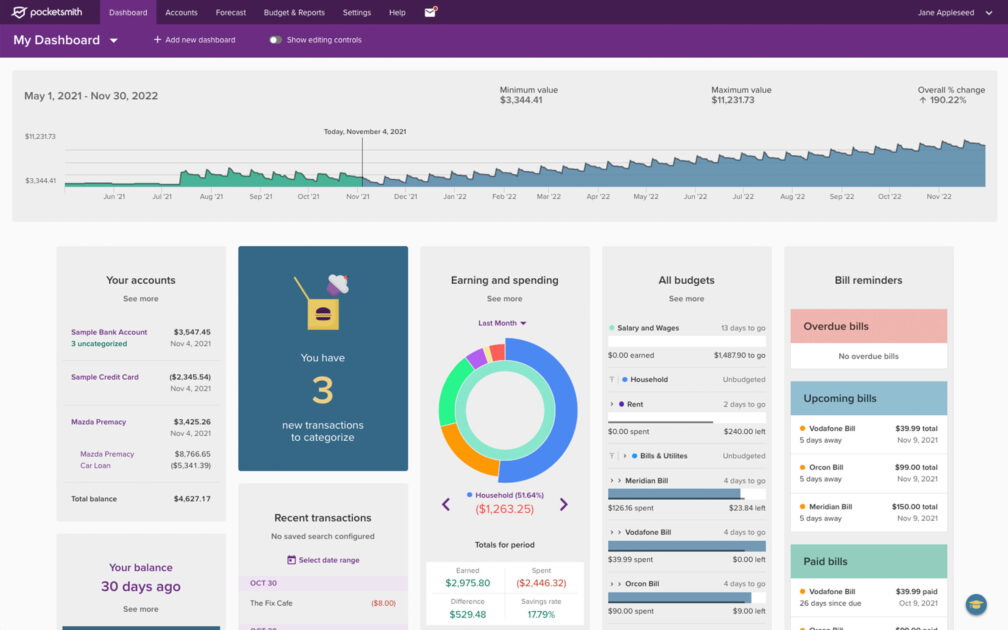

PocketSmith

PocketSmith is a budgeting and personal finance software that can help set the users’ financial paths in three simple steps, get insight into the past, understand the present financial status, and set the finances for the future.

The software gives detailed information and historical reporting to gain insight into the pattern, control the spending, make an informed decision, and understand the impact of decisions on the future. The significant features of PocketSmith are:

- Customizable money plans to achieve the goals

- A money management system with all the essential details

- Finding the right solution as per the expenses

- Automatic bank feedbacks

- Cash flow forecast

- Multi-currency

Wrapping Up

Apps for personal finance continue to gain popularity. Because the apps are so easy to use and commonplace, budgeting has become trendy. Future trends will prioritize a more efficient, quick, and convenient app experience.

Security will be a top priority, especially with concerns about cybersecurity breaches. Because every individual’s situation is unique, it’s challenging to give general recommendations for personal financial apps.

However, one thing is certain. The world has changed. Apps for personal finance are now part of everyday life. The millennial generation continues to embrace financial applications and is changing how they do business.