A sales tax compliance software takes care of all the calculations and federal rules for your eCommerce store.

The thing with sales tax rules is that they’re dynamic. A lot of regulations keep changing, and new rules keep adding.

If you want to expand your business into several regions, it’s beneficial to have software to take care of changes and calculations as necessary.

This article will tell you about the benefits of leveraging sales tax compliance services and reveal the top seven software that will take the burden of sales tax off of your hand. But first, let’s tell you why it’s essential to have proper eCommerce sales tax compliance software,

Benefits of Having A Proper Sales Tax Compliance Software

- Meeting Deadlines: Tax compliance software has an alert system that reminds you about timely file returns.

- Makes Management Easy: Sales tax-related work could be exhausting and keep your whole accounting team on its heels; instead of repeating the same work like researching rates and filing forms, leverage sales tax compliance software.

- Time-Saving: With simplification and automation, you can save time and invest in other important work.

- Improved Accuracy: You don’t have to worry about thousands of rules and regulations. The software keeps updating its rules and policies when the government changes them.

Now that you know why you should use sales tax compliance software, here are the seven best ones to leverage.

Quaderno

Quaderno has all the tools you might need for your e-commerce business. The software is compatible with WooCommerce, Shopify, and Amazon FBA.

With Quaderno, it doesn’t matter if you’re selling a digital product or selling from the most remote part of the world. Quaderno’s system has tax information for every country/region globally.

The Quaderno’s API securely accesses your sales data and automates all the sales tax processes in seconds.

You can integrate it with a content platform, shopping cart, or payment processor to get started. It also supports multi-channel selling. So when you want to launch your product in a new region, you can rely on Quaderno for sales tax compliance.

It tracks your sales in 1000+ jurisdictions and alerts you of any complications or registrations required.

Features

- Know the tax threshold in every region, get registered in every region you sell, and start collecting taxes accordingly.

- Lets you verify buyers’ tax IDs to see the tax rates for each sale you make.

- Automate tax-compliant invoices for each transaction on your store all across the globe

- Quaderno reports give you a quick and better understanding of the tax situation so you can fill out the returns with ease.

- Automate billing and send a personalized bill to each customer; you can even provide a personal dashboard to enhance the customer experience.

You can start using Quaderno with a 7-day free trial. The software has four paid plans starting at $49 per month.

TaxJar

TaxJar is a product launched by Stripe. This cloud-based platform can automate your entire sales tax life cycle. Over 20,000 high-growth businesses trust it.

It does calculations and even files reports, making it one of the best sales tax compliance software in the market.

Let’s look at some of the most prominent features that TaxJar offers.

- Deadline: Auto file fills all your reports and remittances automatically to all the enrolled states on your behalf; thus, with TaxJar, you don’t need to worry about deadlines

- Processing Time & Cost: Handles all the data input as you grow your business with sales tax collection in several states and prepares files state-wise for you to go through

- Human Errors: Automate the whole sales tax collection process and get rid of any human error

- TaxJar API: Has a 99.99% uptime; this helps your customer see accurate sales tax data during checkout

- Monitoring & Updating: The sales tax team of TaxJar monitors all the sales laws in every country, state, and city; it keeps updating them as and when they change

- Product Classification Tool: AI-powered classification tool evaluates the products in your store and suggests you their sales tax accordingly

TaxJar Integration

- Support the entire sales tax process from calculations to reporting

- Access all your integrations via the TaxJar dashboard

- TaxJar API lets you build your own solution via coding

You get to try TaxJar for 30 days with any plan you choose without giving them your credit card details. Paid plans start at $19 per month.

TaxCloud

TaxCloud is a sales tax compliance platform helping ecommerce businesses simplify and automate the often complex and time-consuming task of managing sales tax.

The platform calculates and collects sales tax instantly and ensures compliance across the 13,000+ jurisdictions in the U.S. while their team of TaxGeeks handles all your filing and remittance needs.

TaxCloud makes it easier for businesses to meet their tax obligations while reducing the risk of errors and penalties. Here’s how:

Features

- Real-Time API sales tax calculation

- Return-ready sales tax reports

- State sales tax filing

- State registration & renewal

- Integrations for your e-commerce store

- Streamlined Sales Tax (SST) discounts

- Nationwide discounts

Integrations

- Shopify

- BigCommerce

- Quickbooks

- Ability Commerce

- Odoo

- WooCommerce

- Square

- Stripe

TaxCloud has a variety of pricing plans to choose from, starting at $19 per month.

AccurateTax

AccurateTax is a sales tax compliance software owned by NetBlazon. The company’s vision is to provide an affordable tool for everyone from micro to macro eCommerce businesses.

Features of AccurateTax Sales Tax Software

- The tool provides exact and updated tax rates for every region in the US

- To make your sales tax return filing easy, Accurate Tax gives you interactive reports of usage and transaction details

- Has an address scrubbing tool that helps with sales tax calculations as well as ensures that no parcel is delivered at a wrong address

- Streamlined Sales Tax Project (STTP) certified software

AccurateTax Integrations

The tool can be integrated with:

- Abilitycommerce

- Magento

- MIVA

- Stone Edge

- Opencart

- osCommerce

- ShopSite

- WooCommerce

- Zen Cart

You can take a free trial of the tool first and then contact the company for a customized plan depending on sales and a few more parameters.

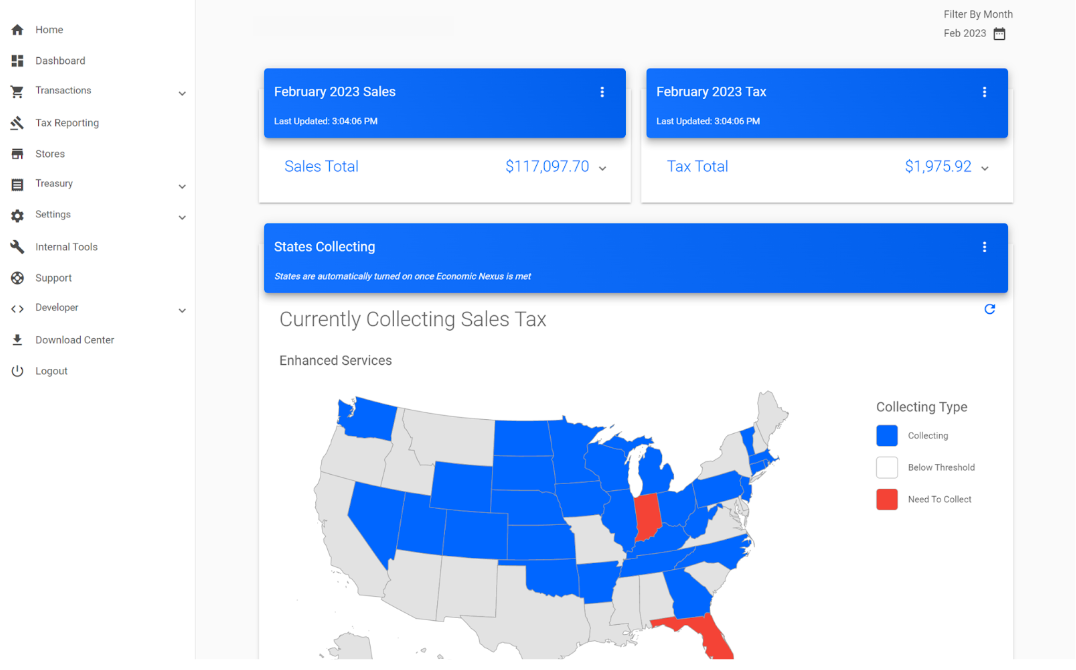

Avalara

Avalara has a 30k+ customer base in 95 countries.

With Avalara, you can manage customers worldwide. It doesn’t matter if you have customers inside or outside the US.

Here are the tools that end-to-end sales tax compliance solution of Avalara has:

Avalara Sales Tax Registration

- Get Registered: Just fill a form on Avalara and get registered in all the states and countries you have your customers in

- Get Store License: Fill Avalara’s questionnaire and get a federal, state, country, or local license.

- Manage License Portfolio: You get a secure database to manage all your spreadsheets and automate the manual workflow with Avalara.

Rate Calculation

AvaTax is the rate calculation tool built in-house to take care of all the calculations you might need for sales tax reporting.

You can calculate rates for the following types of taxes:

- Sales and use

- Custom and duties

- Value-added tax (VAT)

- Goods and service tax (GST)

- Communications

- Excise

- Consume use

- Lodging

- Beverage alcohol

Here are some benefits you get when you leverage AvaTax:

- Get reliable and accurate data from a team of experts

- No downtime even at peak times like cyber Monday or black Friday

- Has over 1000 signed integration partners

Return Filing & Remittance

With Avalara, you can automate your return filing. The return filing and remittance tool lets you:

- Export sales data in just one click

- Use a single dashboard for all your needs

- Digitally archive and store records

All in all, when you leverage Avalara for return filing – you save time.

Certificate Management

- Collect certificates and apply exemptions to the customer’s bill at the time of sale

- Auto validates certificates and helps customers find the right certificate to save time.

- Streamline certificate collection process and fasten up the sales

- Upload certificate online with just a click

- Also, let customers upload certificate photos lightning your workload

The software comes with a 60-days free trial. When the trial is done, you can choose from the paid plans, which start at $19 per month, according to your business requirements.

Wix eCommerce

If you’re planning or have an existing eCommerce business on Wix, Wix eCommerce is the best way to automate your sales tax compliance process.

Wix eCommerce integrates with Avalara to completely automate all sales tax processes you’d ever encounter for an eCommerce store.

With this, you get:

- Geo-specific tax rates for any region your sales happen

- Transparent checkout process for all the customers worldwide

- Customizable tax groups for all the products

Setting up sales tax automation in Wix is a 5 step process:

Step 1: Log in to Wix

Step 2: Click the Get Automated Tax button you will see on the dashboard

Step 3: Set Up Avalara on Wix

Step 4: Select the regions for sales tax automation

Step 5: Customize tax settings to suit your needs

The integration part of Wix with Avalara to automate sales tax compliance is free. But you will have to pay for Avalara. You can see the pricing of Avalara in the previous section.

Vertex

Vertex has 40+ years of experience in tax compliance with over 4000 customers in 130+ different countries. The company aims to simplify tax compliance with flexible and configurable solutions.

Here’s why you should use Vertex.

Reduces Global Tax Complexity

Whenever you step into a new market and expand your eCommerce store to a new country, you have many calculations to take care of.

You need to know the sales tax, VAT, and local taxes for all the products you sell. And you need them quickly.

Doing this manually can take time and some serious workforce. However, with Vertex, you can automate this process.

Keep Up With Legislation

The tax compliance rules in every country keep changing. Tracking every rule and then changing your business sales tax compliance strategy accordingly could keep your finance team busy.

With Vertex, you can improve your VAT accuracy, centralize visibility, and keep up with all regulations that have been introduced/modified by the government. You can ease the process of sales tax compliance.

Quickbooks

Last but not least, sales tax compliance software is Quickbooks. It’s one of the most widely used tools for sales tax purposes.

Quickbooks has over 7 million customers globally.

When it comes to sales tax compliance, QuickBooks has a sales tax calculator that helps you automate the calculations.

Here’s how:

- Just add the sales tax option to the invoice, and QuickBooks will do the calculations automatically based on the date, location, and type of product your customers buy.

- QuickBooks categorizes your products according to tax rates and ensures that every invoice you send has accurate calculations.

- QuickBooks’ sales tax liability report lets you view sales tax information at any point in time so that you know how much tax you have collected and how much you owe.

Quickbooks has a free trial plan of 30 days, and paid plans start at $12.50 per month.

Final Words

Deciding upon the best sales tax compliance software depends on what kind of services you need from it.

If you want a tool for calculation purposes, QuickBooks is the best on the market.

If you’re planning to launch your store on Wix or already have one, consider leveraging Wix eCommerce, which integrates your store with Avalara to help automate the sales tax process.

Accurate tax and Quaderno are the best to get accurate and real-time tax rates for every region.

Lastly, Vertex and TaxJar are the tools that’d save you time and let your finance team work on other important things rather than being engaged in sales tax calculations 24/7.

So choose a sales tax compliance software you think is the best fit for you by knowing where your business lacks.

You may also be interested in the best invoicing software.