A global payroll service helps businesses manage timely, accurate, and compliant payroll for their international employees.

As businesses expand operations across borders and embrace remote work, managing payroll has become more complex than ever due to local regulations, currency conversions, and country-specific employee benefits.

There are two common ways to manage global payroll for your company:

- Payroll Provider – This is the most cost-effective option, in which you use a third-party payroll provider to handle payroll processing for international employees. Typically, costs range from $15 to $30 per employee, per month.

- Employer of Record (EOR) Provider – An EOR provider manages payroll and employment compliance directly, acting as the legal employer in foreign countries. This option is more comprehensive but also more expensive, typically ranging from $399 to $599 per employee, per month.

You can trust Geekflare

At Geekflare, trust and transparency are paramount. Our team of experts, with over 185 years of combined experience in business and technology, tests and reviews software, ensuring our ratings and awards are unbiased and reliable. Learn how we test.

Filter Global Payroll Solutions

Global Payroll Services Comparison

Before reviewing each payroll provider in detail, I’ve prepared a comparison table to compare them based on number of countries supported, mobile app availability, tax filling support, additional services offered, starting price and overall Geekflare rating.

|  |  |  |  |  |  |  |  |  |  |  |  |  | |

120+ | 140+ | 185+ | 180+ | 180+ | 150+ | 160+ | 170+ | 170+ | 130+ | 135+ | 200+ | 28+ | 165+ | |

HR, EOR, COR, PEO | HR, PEO, Benefits | HCM, Spend, EOR, IAM | EOR, Contractor, Visa | EOR, COR, Insurance | AOR, EOR, COR, Immigration | Payments, Workforce | EOR | EOR, COR, Equity, Recruit | Payments | Accounting, HR | HR, Talent, Workforce | EOR, COR | EOR, PEO, Contractors | |

$29 | On request | Custom | Custom | $199 | On Request | $15 | €19 | $29 | On request | On request | On request | $29 | £29 | |

Geekflare’s editorial team determines ratings based on factors such as key features, ease of use, pricing, and customer support to help you choose the right business software. | ||||||||||||||

I will now discuss the above global payroll platforms in detail with their features, benefits, pros, and cons and pricing.

1. Deel

Best for Small Businesses

Deel is a global payroll provider that seamlessly handles the complexities of international tax laws and employment law regulations. This makes it an excellent payroll solution for small businesses looking to scale without the usual administrative burden.

Deel offers easy-to-understand reports that provide stakeholders with valuable insights into employer costs, bonuses, tax payments, and other financial parameters—all standardized in a single currency for easy comparison across entities. This unified view helps businesses keep a clear handle on their global expenses.

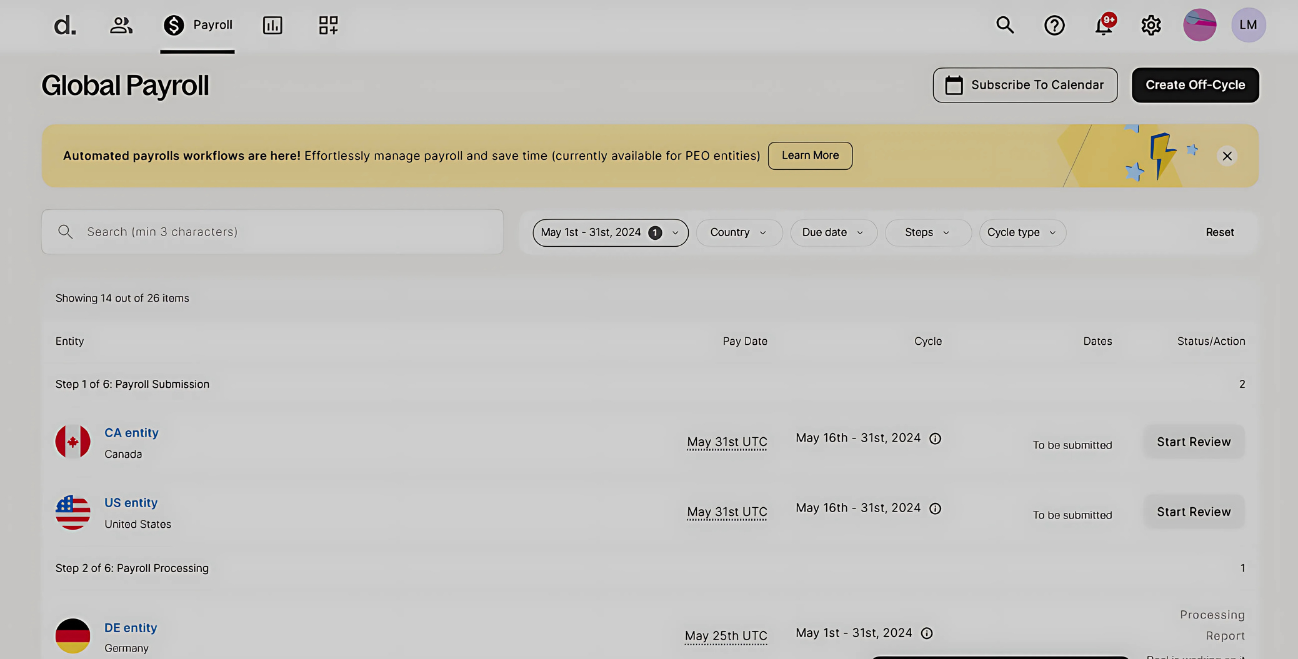

Below is Deel Global Payroll’s payroll management interface. The dashboard allows users to track payroll cycles across multiple countries, automate workflows, and review pending submissions.

Read our detailed Deel review.

Top Features

- Creates and delivers payslips tailored to local standards, ensuring accuracy and transparency for all team members.

- Offers localized contracts and onboarding tools, simplifying the process for compliant hiring and offboarding internationally.

- Integrates with HR software, automatically syncing employee records to reduce manual entry and keep information up-to-date.

- Customizes dashboards to provide insights on spending, social security, pensions, and other benefits, making reports easily digestible for stakeholders.

- Provides dedicated points-of-contact and 24/7 in-house support from local payroll experts, offering guidance in each country.

Pros

Combines payroll, HR, benefits administration, and reporting in one easy-to-use platform.

Provides legally compliant contracts tailored to the requirements of each country.

Employees and contractors can receive payments in their local currency.

Automatically syncs with HR platforms, reducing manual data entry and minimizing errors.

Cons

Businesses with very limited global employees may find the software too complex or robust for their needs.

Challenges with fluctuating exchange rates or fees associated with international transfers.

Pricing

Deel global payroll starting price is $29 per employee, per month which includes unlimited payroll processing, employee self-service portal and multi-currency payments support.

2. ADP Global Payroll

Trusted by Top Global Companies

ADP Global Payroll offers services in over 140 countries and allows global organizations have one single platform to manage payroll and payments. It provides a unified solution to run tax calculations and generate payslips in multiple countries. ADP has global service centers in 18 locations globally catering to 35 local languages to help with local laws and compliance.

ADP Global provides a centralized view of multi country payroll data and a future-proof reporting system. It is a cloud-based system that scales up as your business grows. It easily integrates with HR systems like Workday and Sage Intact via the ADP Global HR Connectors to allow easy update of payroll data as new employees join. ADP is trusted by over 1.1 million clients worldwide, including 90% of the Fortune 100 companies.

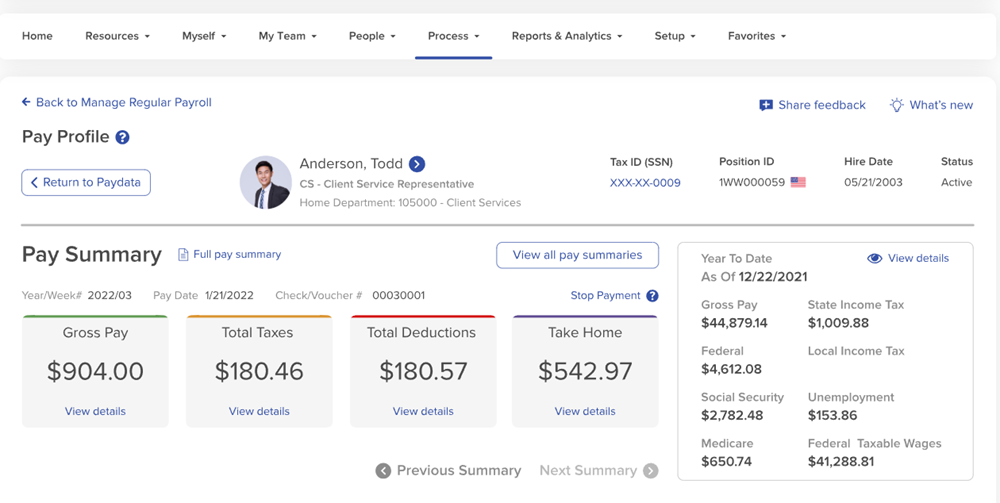

This payroll management interface of ADP global payroll, as shown above provides a detailed pay summary of each employee, including gross pay, deductions, taxes, and take-home salary, along with a year-to-date earnings breakdown.

The top menu features navigation options for HR professionals managing payroll across multiple regions. The system also includes features for pay summaries, tax breakdowns, and stop payments, making it one of the best tools for global payroll management and compliance tracking.

Top Features

- Localization and multilingual support

- Global reporting features to allow strategic decision-making

- Regular compliance monitoring to ensure all the local regulations are met on a timely basis

- Security experts to ensure security of sensitive data

- Payroll, tax calculation, payslip generation and reporting under a single solution

- Industry-specific solutions to manage complexities in schedule, work location and mobile staff

Pros

Compliance professionals to help companies update themselves with the latest regulations

Local experts to help with regional payroll and tax rules

Global reporting and analytics of payroll data with data from multiple countries the ADP Global Insights Dashboard

Reputation and trust factor

Cons

Expensive for small businesses

Steep learning curve for beginners

Pricing information is available only on request

Pricing

You need to contact ADP to get a demo and custom quote for the Global Payroll service.

3. Rippling

Best for Seamless Integration with HR and Spend

Rippling enables smart people to tackle the big challenges while eliminating the hassle of running a business. With its single source of truth for employee data, this software enables businesses to effortlessly streamline their global payroll solutions and other key operations.

Whether you’re managing international employees, full-time employees, or even independent international contractors, Rippling simplifies the process. Plus, with integrations for over 600 apps, your business can run smoother than ever.

It provides strong global payroll reporting that allows businesses to analyze costs across salaries, taxes, and reimbursements at a glance.

Rippling has an excellent customer support system, and they even publish their real-time ticket status and response time live on their site.

Above is Rippling’s global payroll software with its well-organized payroll review dashboard. It provides a clear view of employees across multiple countries, payment schedules, payroll status, and tax breakdowns.

If you want to dive deeper into its capabilities, refer to our Rippling review.

Top Features

- Orchestrates seamless reimbursements by integrating with expense management tools to handle payments efficiently.

- Facilitates shorter lead times for payroll processing, allowing payroll to be run just days before payday.

- Supports global equity grants and automatically includes them in payroll.

- Monitors tax compliance on a global scale, automatically handling country-specific tax calculations, deductions, and tax filings to meet local regulations.

- Consolidates payroll and benefits administration into one platform, syncing automatically to ensure deductions and contributions are up-to-date.

Pros

Monitors and handles certifications and payroll taxes at regional, national, and industry-specific levels, ensuring compliance across multiple countries.

Automatically calculates and transmits payroll taxes.

Syncs payroll data with popular accounting tools like QuickBooks Online, Xero, and Sage Intacct, with custom mapping for easy financial management.

Provides employees with visibility into their earnings, hours worked, reimbursements, and benefits, boosting trust.

Cons

If one integration fails, it could disrupt multiple aspects of payroll, requiring troubleshooting.

With its complex feature set, users might need to frequently rely on customer support, which could slow down processes.

Pricing

Rippling pricing is available on request.

4. Globalization Partners (G-P)

Best EOR + Global Payroll

Globalization Partners (G-P) has been named industry leader in the IEC Group Global EOR Study 2025 and NelsonHall’s 2024 Global EOR Research. As part of its comprehensive Employer of Record (EOR) solution, G-P enables businesses to pay global employees and contractors in over 180 countries, claiming a 96% customer satisfaction rating.

With G-P, paying your global team consisting of full-time EORs or contractors is both effortless and compliant. It lets you choose the currency and payment method that suits your people best, across 180+ countries. The platform also takes the legal responsibility of adding new team members to the globally compliant payroll system.

G-P has an experienced team of legal, tax, and payroll advisors that help you every step of the way, making international growth smooth and stress-free. It gives your team the reliability in terms of on-time, accurate payments and offers support to your global workforce, no matter where they are from.

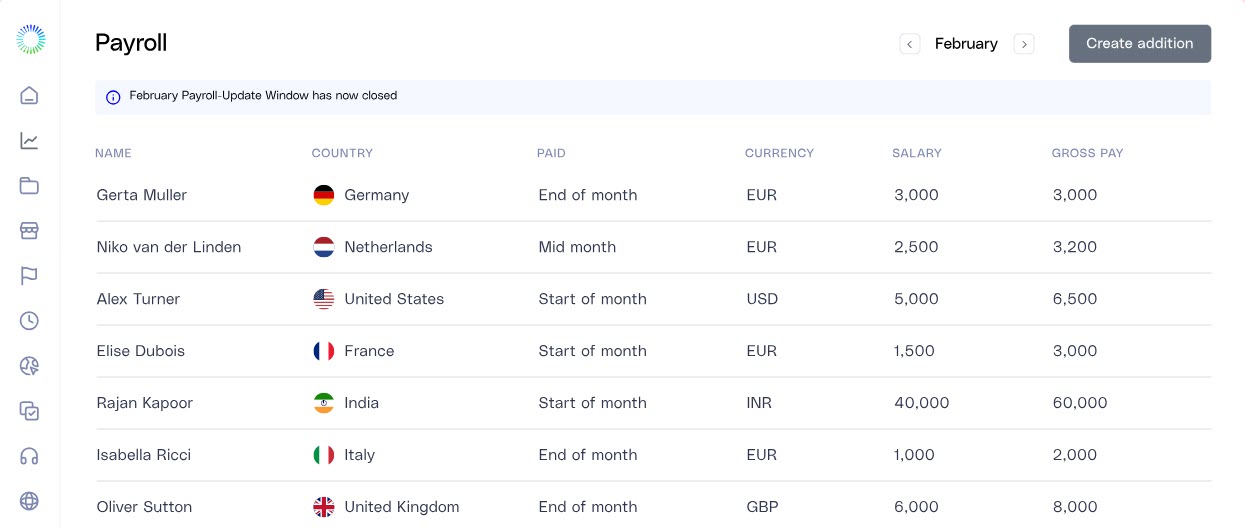

Above, you can see the interface of G-P’s payroll software, where the names of the employees are visible along with other crucial parameters. It also includes the name of the country, payroll cycle, payment currency, salary amount, and gross amount.

Top Features

- Enables you to make payments in 50+ global currencies.

- Offers complete fintech flexibility by supporting a digital wallet, ACH, bank transfer, wire transfer, or credit/debit card.

- Payment tracking takes only a few clicks, with the option to run multi-cycle payroll.

- Payment summaries to review transactions and monitor rates and fees.

- Processes multiple invoices across the same or different currencies in a single transaction.

Pros

99% payroll accuracy across all clients.

In-region HR experts available 24/7/365.

200+ global partners to ensure customized services.

Cons

Very limited third-party integration support.

The website does not contain transparent pricing.

G-P Pricing

You need to fill out a form to get a custom proposal based on your organizational requirements.

5. Remofirst

Best for Fully-Remote Businesses

Remofirst is a remote-first company founded in 2021 with a simple mission: to make it easier for businesses to build and manage remote teams’ payroll, no matter where they’re located. By removing the barriers of geography, Remofirst allows companies to access talent from around the world while helping employees pursue opportunities without being tied to a specific location.

As a remote-first company, they understand the challenges and rewards of distributed teams, and they’re dedicated to helping businesses succeed in the global marketplace.

The above global payroll management interface from RemoFirst provides an easy way to approve employee payments, showing a clear breakdown of pending payroll approvals, total amounts, and assigned payroll managers.

The left-side menu includes essential global payroll functions like invoices, payment methods, salary revisions, and contractor payments, making it easier to manage international teams. The approval workflow is streamlined with a one-click “Approve” button, additional payment options, and direct actions, ensuring payroll processing is efficient and error-free for remote and distributed teams.

Top Features

- Automates the provision of locally compliant contracts for contractors, streamlining the onboarding process while ensuring compliance with local regulations.

- Tracks payroll spending in one currency while enabling payouts in multiple currencies, giving businesses clear financial insights without currency complications.

- Supports employee onboarding and compliance through a same-day process that takes care of all local regulations and administrative tasks.

- Manages payroll for employees and contractors across 180+ countries, ensuring local currency payments are made on time and in compliance with regional laws.

- Monitors time off, holidays, and bonuses automatically, incorporating them into payroll calculations for seamless processing.

- Offers local and global benefits management, including health insurance and stock options, tailored to the employee’s location and legal requirements.

Pros

Removes the need to set up local entities.

Covers both full-time employees and contractors, making it a one-stop solution for managing a diverse workforce.

Handles the global shipping of work equipment for new hires, making remote work setup easier for international employees.

Each client gets a dedicated account manager to ensure smooth operations and provide personalized support.

Cons

Although the platform provides compliance services, businesses still need to stay informed about changing local laws.

If equipment or benefits providers experience delays, employee satisfaction could be affected despite Remofirst’s involvement.

The platform may be overwhelming for users who are unfamiliar with global payroll or international HR systems.

Pricing

Remofirst’s global payments processing in 150+ countries is available with its Premium Contractors plan, starting at $25/person/month.

6. Multiplier

Offers EOR and Immigration Service

Multiplier is the go-to partner for companies ready to embrace a borderless future. With its cutting-edge EOR solution, it’s helping businesses hire the best talent from over 150 countries without the headache of setting up shop in each one.

Multiplier allows global teams to be built seamlessly, with compliance and payroll sorted out. It has partnerships with giants like PwC and Uber. But Multiplier’s impact isn’t just in the figures—it’s in how they’re reshaping work. They’re proving that opportunity can be anywhere and making it happen for companies bold enough to think bigger.

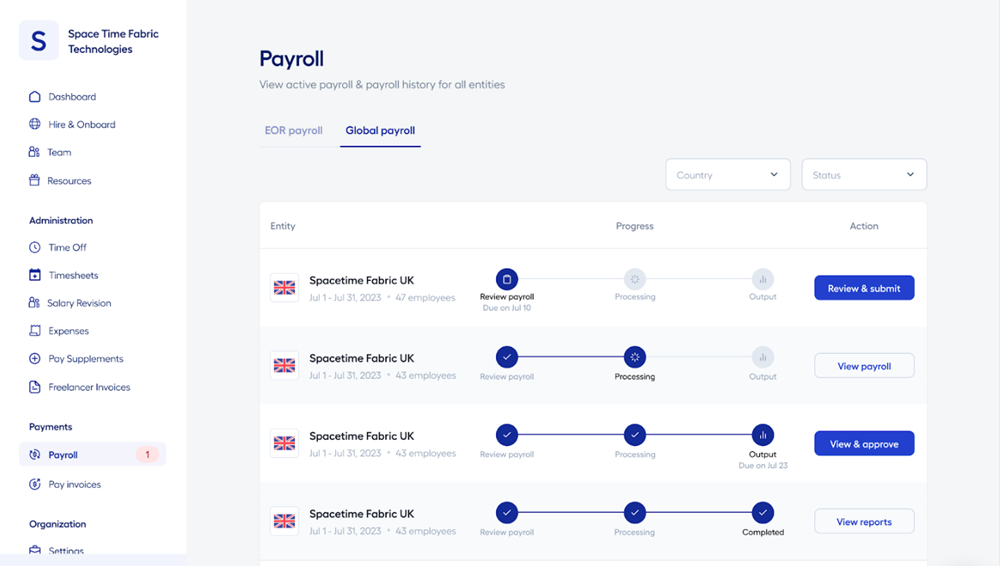

The global payroll dashboard from Multiplier provides a clear view of payroll progress across different entities, making it easy to track payments and approvals.

The left-side menu includes key administrative functions like timesheets, salary revisions, freelancer invoices, and expense management, ensuring smooth payroll processing for a distributed workforce. The step-by-step payroll status tracker helps users review, process, and approve payroll seamlessly, reducing errors and ensuring timely salary payments across multiple countries.

Read our Multiplier review to learn more.

Top Features

- Calculates and applies local tax regulations, benefits, and compensation to ensure accurate, compliant payments in every country.

- Offers complete transparency with smart previews, enabling you to track who’s getting paid, when, and how much in real-time.

- Updates payroll for any changes like time off or expenses, ensuring accurate pay cycles.

- Tracks, reviews, and approves employee expenses as part of the payroll process, minimizing manual work.

- Simplifies the onboarding process for international employees, ensuring all payroll and legal documentation is processed smoothly across different countries.

- Ensures all HR practices align with country-specific labor laws, providing HR teams with confidence that they are operating within legal guidelines globally.

Pros

Compatible with other systems, allowing smoother workflow integration across departments.

Compliance support across 100+ countries

Consolidates multiple vendors into one platform, significantly reducing administrative overhead.

Responsive 24/5 customer support, providing help when needed, regardless of time zone.

Cons

Complex onboarding for smaller teams, as the platform is designed with large, distributed teams in mind, which may feel overwhelming for smaller operations.

The extensive data and reports may be more than necessary for smaller teams with straightforward payroll needs.

Potential for additional costs for advanced features like multi-country tax management or deep integrations with external platforms.

Pricing

Pricing for the global payroll system is available on request. You need to talk to their sales team to get a custom quote.

7. Papaya Global

Best Unified Payroll and HR Solution

Papaya Global offers a tailored payment platform specifically for payroll, handling the complexities of global payments with precision. With over 700 employees in 21 locations, the company continues to grow, serving clients ranging from emerging businesses to large multinational corporations.

Through partnerships with companies like Workday and Oracle NetSuite, Papaya Global is helping organizations navigate the challenges of managing a global workforce with a focus on efficiency and security.

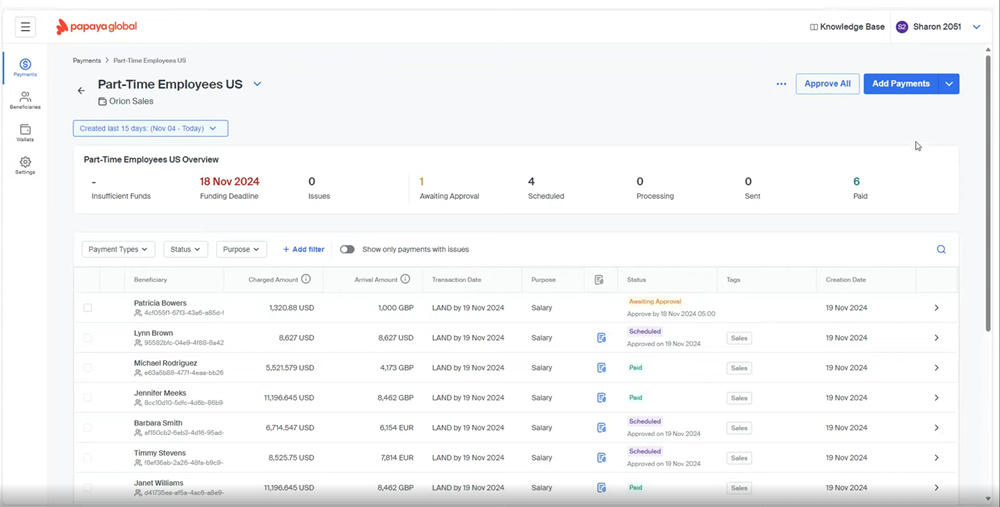

Papaya Global provides a clear snapshot of payment statuses, allowing payroll managers to track approvals, scheduled transactions, and completed payments in real time. It includes essential payroll functions like payments, beneficiaries, wallets, and settings, helping businesses manage multi-currency transactions across different regions. The top panel highlights key payroll metrics such as funding deadlines, pending approvals, and processed payments, ensuring smooth and timely salary disbursements.

Top Features

- Splits payments across multiple currencies in one click, simplifying multi-country payroll arrangements.

- Guarantees timely payments with a customizable “land date” setup, ensuring payments arrive exactly when needed.

- Manages payroll processing and payments across 160+ countries, ensuring seamless global operations for distributed teams.

- Monitors and automates payments in 130+ currencies, including direct payments to bank accounts, card accounts, and virtual wallets.

- Integrates payroll data with payments using advanced APIs, ensuring smooth, real-time connections between systems.

- Automates recurring payments, allowing businesses to set predefined intervals and avoid manual payment tasks.

Pros

Processes mass payments of up to 10,000 transactions at once

Funds payroll is in 15 major currencies, keeping funds segregated and safeguarded until payouts are needed.

AI-powered payroll validation engines to monitor global payroll with 99% accuracy

Ensures adherence to AML, account validation, and compliance standards in real-time, reducing risk.

Employs strict fraud prevention measures, safeguarding financial transactions and minimizing compliance issues.

Cons

While AI-driven, occasional manual oversight may still be needed for special cases or nuanced payroll rules.

Onboarding process, particularly for large datasets, might take some time and could delay the first payroll cycle.

Some advanced features like payment APIs or multi-currency transactions incur additional costs not included in base pricing.

Pricing

Papaya Global offers 3 plans. The monthly charges per month per employee are as given below.

- Grow Global (101–500 employees): Starts $25

- Scale Global (501–1000 employees): Starts $20

- Enterprise Global (over 1000 employees): Starts $15.

You need to contact the sales team to get custom quotes for all the above plans based on the features opted for.

8. Lano

Best to Automate International Payments

With a team that spans 19 countries and speaks 22 languages, Lano is all about making payroll and HR management as seamless as possible for businesses operating in over 170 countries.

Lano has created a platform that simplifies global payroll, consolidating data and automating processes, so businesses can focus on what really matters—growing and thriving without the usual hassle of multi-country operations. With this software, global payroll isn’t just about numbers; it’s about unlocking possibilities.

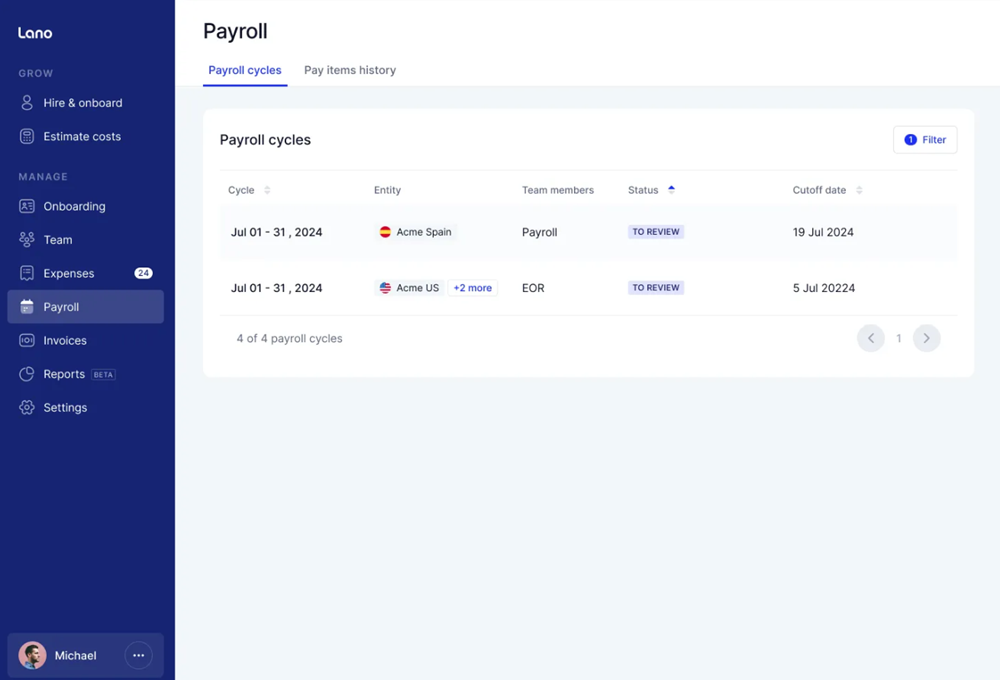

Lano’s global payroll system provides a structured way to track payroll cycles across different countries, ensuring teams stay on top of approvals and deadlines. With clear status indicators, users can quickly identify payrolls that need action, reducing delays. It also includes features for claiming expenses, invoices, and reports, and helps in managing global workforce payments efficiently.

Top Features

- Automates global salary payments in 28 currencies, offering competitive exchange rates and eliminating hidden fees.

- Simplifies multi-country payroll by unifying data from different providers, allowing businesses to keep track of payroll operations seamlessly.

- Executes same-day international payments, enabling businesses to pay their global workforce quickly and efficiently.

- Facilitates free local payments while offering a flexible setup to integrate payroll systems with existing financial workflows through APIs.

- Manages global workforce onboarding, saving hours in administrative tasks by automating employee setup in new countries.

- Provides SLAs for top-tier customer support, giving HR teams peace of mind and quick resolutions for any payroll or compliance questions.

- Supports seamless onboarding with pre-vetted local payroll partners, reducing the time HR spends setting up payroll for new hires in new countries.

Pros

Allows businesses to integrate their existing payroll providers or use pre-vetted local partners, offering flexibility.

Enables businesses to quickly set up payroll in new countries, accelerating global growth without the need for local entities.

Ensures that payroll and employee data is protected and compliant with global data protection standards.

Supports payroll in 170+ countries, making it ideal for companies with a global workforce.

Cons

Some countries are excluded from coverage due to legal restrictions, potentially limiting its use for companies with global ambitions.

While automation is a strength, errors in data entry or compliance settings could lead to payroll mistakes if not regularly monitored.

Local payroll processing relies on a network of partners, which could introduce delays or issues if third-party providers face challenges.

Pricing

Lano’s Multi-Country Payroll plan starts at €9/employee/month. You need to schedule a demo and get the exact pricing based on then number of employees and the features you require.

9. Remote

Best for Pay Anyone, Anywhere

Remote provides robust payment services to global businesses. Its services make hiring, onboarding, and paying employees worldwide easier.

Remote integration with popular HR tools ensures a seamless flow of data, simplifying the entire process from hire to paycheck. Plus, with a transparent pricing model and top-tier security, Remote guarantees businesses and their teams are well-protected every step of the way.

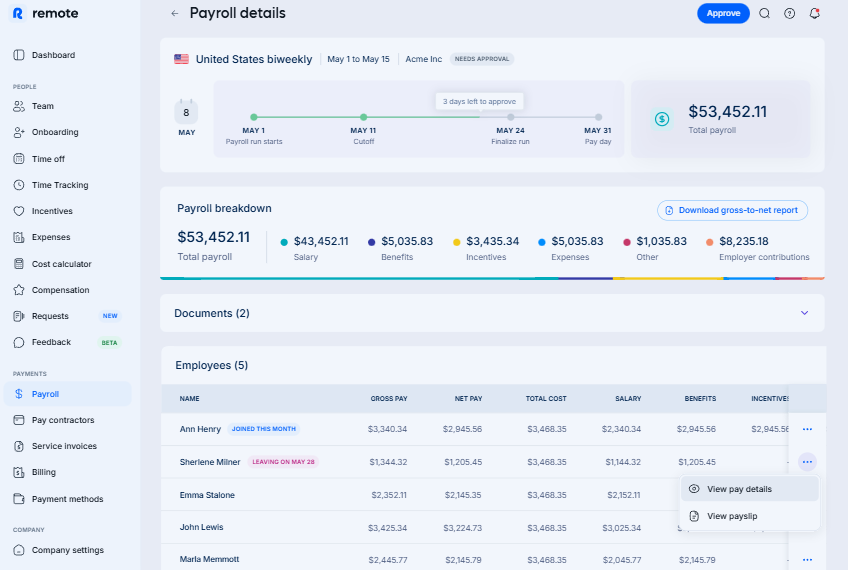

Remote’s payroll system offers a detailed breakdown of salary, benefits, incentives, and employer contributions. The approval workflow ensures payroll stays on schedule, with clear timelines from payroll initiation to finalization and pay day. Additional tools like pay details, payslip viewing, and gross-to-net reporting provide transparency to employees and tax admins of any country.

Top Features

- Reduces administrative burden by offering flexible payroll setup with Remote Embedded and APIs, allowing businesses to integrate payroll seamlessly with their existing tools.

- Monitors global payroll with in-house local experts, ensuring compliance with regional regulations while eliminating reliance on third-party vendors for faster and more reliable service.

- Manages IP protection globally with Remote IP Guard, securing company intellectual property wherever employees are based.

- Handles payments in 28 currencies with no hidden fees, allowing companies to secure local and international payments to employees, tax authorities, and providers.

- Automates the entire payroll process, from onboarding to pay distribution, allowing HR and finance teams to focus on scaling their workforce while Remote manages the admin work.

- Manages payroll across multiple countries, providing full visibility and control over salary, tax, and benefit payments for employees and contractors

Pros

Simplifies the hiring process for international contractors and employees by offering Employer of Record (EOR) services, allowing companies to hire without establishing local entities.

Includes built-in intellectual property protection, which gives companies peace of mind when hiring abroad.

Implements top-tier security measures, including SOC 2 compliance and ISO27001 certification, to protect sensitive employee data.

Cons

Advanced integrations or custom features might require significant technical support or incur additional costs.

While payments in 28 currencies are supported, fluctuating exchange rates could create budgeting challenges for businesses operating in multiple regions.

Pricing

Remote’s payroll plan starts at $29/employee/month. You need to book a demo to purchase it.

10. CloudPay

Best to Drive Efficiency with Automation

Since 1996, CloudPay has been pushing the boundaries of payroll technology, offering end-to-end global pay solutions that unify payroll, finance, and HR processes for companies across 130 countries. With over 1 million payslips processed annually and over $24 billion in payment transactions managed, CloudPay is trusted by multinational organizations to handle their most complex payroll challenges.

From onboarding to payments, CloudPay provides a seamless experience through a single portal, helping businesses simplify the complexities of managing a global workforce. At the heart of it is a leadership team with deep experience in finance and technology, driving innovation and setting a high bar in the world of global pay.

Top Features

- Manages payroll in 160 currencies, ensuring your global workforce gets paid accurately and on time every time.

- Facilitates communication between in-country payroll experts and your internal teams through a centralized platform, minimizing delays and improving collaboration.

- Offers monthly service reviews, leveraging anonymized customer data to benchmark performance and identify areas for continuous improvement.

- Supports salary payments, tax disbursements, and payslip generation in a single cloud-based ecosystem, simplifying global payroll management.

- Provides employees with on-demand access to earned wages through the CloudPay NOW app, enhancing the employee experience by providing immediate pay access.

- Automates payroll processes to reduce manual tasks, improving efficiency and cutting up to five days off typical payroll cycles.

Pros

Operates in over 130 countries, making it a strong solution for companies managing a diverse, international workforce.

Uses anonymized customer data to benchmark performance and identify areas for improvement, fostering continuous optimization.

Monitors and updates international payroll regulations, reducing non-compliance risk in various regions.

Cons

Customizing the platform to accommodate highly specific payroll requirements or non-standard processes might require additional support.

For companies with rapidly changing payroll data (e.g., frequent bonuses or commission adjustments), the platform may not update as quickly as needed.

While CloudPay is excellent for large multinational operations, it might not scale as effectively in smaller or niche markets with highly specific payroll needs.

Pricing

CloudPay has not mentioned their pricing on their website. You need to talk to the sales team to get a custom quote.

11. IRIS Payroll

Best for Global Workforce Management

IRIS Global Workforce Management is the behind-the-scenes partner that makes global payroll less of a headache. With operations in 135 countries, they’re the ones ensuring your employees get paid on time, no matter the currency, language, or local legislation.

With over four decades of experience, IRIS has become a go-to for businesses of all sizes. They’ve helped 90,000 clients navigate the complexities of global payroll, processing billions in payments while covering 90% of the global workforce.

But it’s not just about getting the numbers right. IRIS takes on the grunt work like onboarding and offboarding employees, managing benefits, and handling year-end reporting—things that are easy to mess up when you’re working across borders.

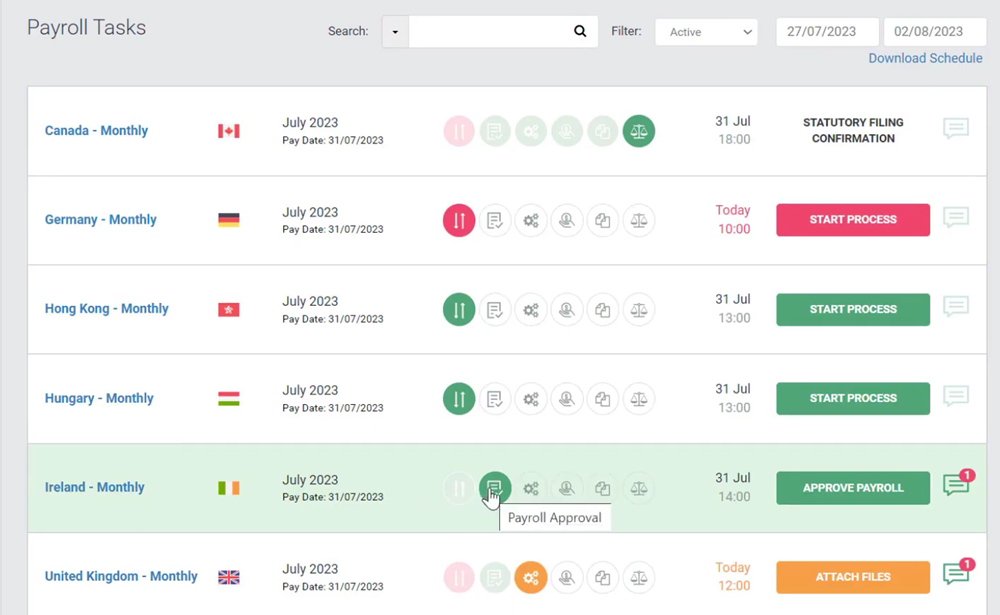

As shown above, IRIS Global Payroll provides a centralized payroll task manager that allows users to track and process payroll across multiple countries in one place. The system highlights key actions like approvals, statutory filings, and payroll processing, ensuring compliance with local regulations. It has status indicators and country-wise segmentation, through which payroll teams can efficiently manage deadlines and ensure timely salary payments worldwide.

Top Features

- Handles the entire payroll onboarding and offboarding process for international employees in 135 countries, from registering new hires with local tax authorities to ensuring proper deregistration when employees leave.

- Prepares year-end statutory filings in every country where the business operates, automatically generating the necessary documents for tax filings and government reporting.

- Manages in-country registration with local authorities, setting up necessary accounts for payroll, taxes, and social security, ensuring that businesses are fully compliant before making their first hires.

- Connects businesses to in-country payroll specialists who provide detailed advice on local labor laws, tax codes, and benefits programs to ensure payroll is handled correctly from day one.

- Processes direct employee payments and local tax remittances efficiently, ensuring that both employees and relevant authorities receive payments accurately and in compliance with local laws.

- Customizes payroll services based on regional needs, allowing businesses to select from flexible service packages that include payroll processing, benefits management, and HR support tailored to specific countries and business requirements.

- Tracks and manages payroll complexities such as supplementary benefits, pension contributions, and benchmarking data.

Pros

Offers analytics and reporting, helping businesses track payroll performance and spot issues early across multiple countries.

Provides peace of mind by ensuring all payroll operations adhere to local laws and regulations in 135 countries.

Earned numerous industry accolades, enhancing trust and credibility for businesses looking for a reliable payroll partner.

Cons

Businesses may face delays or interruptions if local experts are unavailable or overwhelmed during busy periods.

Although IRIS covers 135 countries, businesses in more niche regions might not find as much local expertise or support.

Even with a dedicated point of contact, internal HR or payroll teams may need additional training to utilize the platform’s capabilities fully.

Pricing

Pricing for IRIS Payroll Software is available on request.

12. Dayforce

Best All-in-One Payroll Solution

Dayforce is a platform that grows with businesses and empowers people while focusing on what really matters: making work better for everyone involved.

The way we work has shifted—teams are spread across the globe, working in different time zones, and everything is more fluid. Dayforce gets that. They’ve built a platform designed to help organizations manage this new reality with ease, from hiring people to handling payroll, career development, and everything in between.

Top Features

- Supports proactive compliance risk management, with international payroll service professionals ensuring all payroll operations meet local regulatory requirements and flagging potential issues early.

- Manages multi-jurisdictional payroll from a single platform, simplifying the process of paying employees across borders while ensuring compliance with different tax laws and labor regulations.

- Manages payroll across 200+ countries and territories, ensuring accurate, on-time payments no matter where your employees are located.

- Enables a mobile-first experience, empowering employees to access payroll information, request updates, and manage details on the go.

- Processes payroll efficiently with continuous calculations, reducing payroll errors and minimizing manual corrections.

- Supports role-based access control, which ensures that sensitive payroll data is only accessible to authorized users, enhancing security and privacy in compliance with regulations such as GDPR.

- Reduces administrative workload by consolidating payroll, compliance, and reporting tasks into a single, automated solution.

Pros

Customizes payroll modules based on regional needs, allowing businesses to purchase only the functionality they require.

Generates global reports for 200+ regions, offering comprehensive insights to support better decision-making.

Offers flexible licensing, with enterprise-wide or per-user options tailored to your needs across jurisdictions.

Cons

Training materials and resources are often kept behind paywalls, making it difficult for users to maximize their understanding and ROI from the platform without incurring additional costs.

Lack of flexibility with SMTP settings, such as testing with services like Mailtrap, can hinder troubleshooting and testing processes.

Support for countries outside of North America, like the UK and Ireland, is not as responsive as in Canada and the US, which can delay issue resolution for global teams.

Pricing

Dayforce has not mentioned their plans on their website. Schedule a demo and discuss your needs with the sales team for a quote.

13. Oyster HR

Best for Multi-country Remote Teams

With a fully distributed team spanning 28+ countries, Oyster embodies the future of work—one where location doesn’t limit opportunity. Their platform streamlines global hiring, offering multi-country payroll and localized benefits, making it easier than ever for businesses to expand their workforce and attract top talent globally.

Oyster HR’s payroll system provides options to select team members, payment types, and schedules in just a few clicks.

The structured payroll cycle view helps companies track upcoming payments across multiple months. The menu on the left has dedicated sections for expenses, invoices, subscriptions, and payment information.

Top Features

- Monitors contractor payments in 180+ countries, simplifying invoice settlements and ensuring timely and accurate compensation for your global contractors.

- Tracks tax and deduction changes to ensure compliance, even when local regulations evolve, preventing costly mistakes across regions.

- Provides expert payroll support from in-house global payroll specialists who are available around the clock to resolve issues and ensure smooth payroll processing.

- Integrates with popular HR platforms like BambooHR.

- Offers real-time, country-specific insights and answers on labor laws to help HR teams navigate complex regulations.

- Supports competitive, localized benefits packages tailored to specific countries, helping businesses attract and retain top global talent.

Pros

Provides discounted pricing for nonprofit organizations, making global hiring more accessible.

Issues are handed over to another team member without interruption, ensuring continuous support even when an account manager is unavailable.

The platform makes it easy to view pay stubs, update personal details, and manage employee data in one place.

Cons

Avoids handling certain high-risk roles (e.g., attorneys), requiring companies to use other EOR services for specific positions.

Some local teams are slower in responding to requests, especially with employment agreements and feedback.

Certain features, like templated incentive schemes, are missing, particularly useful for startups.

Pricing

Oyster’s Global Payroll plan starts at $25/employee/month.

14. Omnipresent

Offers VEO and EOR

The international payroll solutions from Omnipresent cover everything from tax calculations and social security contributions to employee benefits, ensuring that every paycheck is accurate and on time, regardless of where your employees are located.

With a dedicated team of experts in global payroll, Omnipresent provides the human touch and personalized support needed to navigate the complexities of labor laws across jurisdictions.

Founded with the mission to simplify global employment, this company offers payroll services in over 165 countries, helping businesses tap into top talent worldwide without the hassle of managing multiple payroll systems or local compliance headaches.

Top Features

- Processes not only base salaries but also bonuses, commissions, and employee expenses, ensuring accurate and timely payouts across different countries.

- Ensures compliance with global data protection standards like GDPR, safeguarding sensitive employee data during payroll processing.

- Handles payroll cycles, including 13th and 14th-month pay, ensuring payments comply with each country’s specific customs and requirements.

- Adheres to local labor laws and regulations and ensures smooth onboarding and offboarding processes for employees and contractors in over 165 countries.

- Shares employer responsibilities through Professional Employer Organization (PEO) services, reducing compliance risks while offering full control over employee management.

- Offers tailored invoicing options, providing a single consolidated invoice for all global payroll costs or multiple invoices based on business needs.

- Tracks local public holidays and PTO laws, ensuring employees in each country receive the correct time off according to local regulations.

Pros

It provides resources and support for navigating complex international labor laws, making hiring easier for companies across borders.

Consolidates payroll, benefits, and taxes into a single monthly invoice, easing administrative burdens for growing companies.

Offers a user-friendly and efficient onboarding process for employers and employees, ensuring a positive experience.

Cons

Salaries not paid in EUR or USD may incur significant foreign exchange fees, increasing payroll costs for global teams.

The current invoicing system has been reported to cause complications with some customers’ internal accounting processes, leading to late payments.

Some clients report that Omnipresent’s customer service team is not always proactive in resolving issues, requiring follow-ups from the customer.

Pricing

For companies that employ contractors, the pricing starts at £29/contractor/month. As you scale up, you can contact the sales team for a custom quote.

Other Popular Global Payroll Providers

The below global payroll providers also deserve honorable mentions.

15. Velocity Global – Primarily an HR/EOR platform, but offers an excellent global payroll feature.

16. Paylocity – Integrated HR and Payroll platform with expense management and benefits administration.

What is Global Payroll?

Global payroll services provide businesses with a centralized solution for managing payroll across multiple countries, ensuring that foreign workers and full-time employees are paid accurately and on time.

These services help businesses comply with each country’s unique labor laws and tax regulations. A core component of global payroll solutions is payroll accounting, which manages tax withholding, deductions, and financial reporting for international payroll operations.

By automating this process within a global payroll platform, companies can minimize payroll errors, maintain compliant payroll, and reduce the administrative tasks involved in managing payroll for a remote and international team. This improves operational efficiency and gives businesses real-time insights into payroll costs, helping them make better financial decisions as they scale internationally.

Global payroll services are essential for payroll service providers and companies that handle multi-country payrolls. They ensure regulatory compliance for legal entities operating across borders and support contractor management and employee benefits.

Features of Global Payroll Services

When managing international and full-time employees across borders, global payroll services are the secret sauce that keeps everything running smoothly.

Whether you’re juggling teams in multiple countries or just trying to ensure everyone gets paid accurately, here are the key features that make global payroll solutions your go-to tool for international payroll operations:

- Multi-Country Payroll Processing: Forget the hassle of switching between different systems for each country! Global payroll services allow you to handle multi-country payroll from one central platform. This means you can pay your remote and international teams on time, regardless of their location. It’s like having a payroll expert for every country—without the overhead.

- Payroll Reconciliation and Auditing: With built-in payroll reconciliation and auditing, payroll companies can easily spot discrepancies. This feature ensures that your payroll taxes, deductions, and employee payments are correct.

- Automated Tax Compliance: Tax withholding across borders can be a headache, but global payroll solutions remove the pain. They automatically adjust for local tax laws and labor regulations, so you can sit back and let the system handle compliance.

- Currency and Exchange Rate Handling: Global payroll services handle currency conversions and exchange rates like a pro. Whether it’s euros, dollars, or yen, you’ll never miss a beat (or a payment) when fluctuating rates come into play.

- Local and Global Compliance Management: Managing payroll across multiple countries means staying compliant with a maze of local and global regulations. Global payroll providers handle regulatory compliance for you, keeping track of legal entities and ensuring your payroll stays compliant with local labor laws and global standards.

- Employee Self-Service Portals: Give your employees more control with slick employee self-service portals. These payroll platforms let international employees access their pay stubs and manage their benefits and time tracking.

- Multilingual Support: Global payroll solutions come with multilingual support, so your international workforce can access payroll services in the language they’re most comfortable with.

From automated payroll expertise to contractor management, these features ensure that your payroll provider can handle the entire payroll process—leaving you free to focus on growing your business.

What are the Benefits of Using Global Payroll Services?

The 4 benefits of using global payroll services are listed below.

- Enhanced Compliance with Local Regulations: Navigating different labor laws and tax regulations across countries can feel like navigating a minefield. Global payroll services can help businesses automate compliance tasks, ensuring that tax withholding, labor laws, and local regulations are handled seamlessly.

- Centralized Payroll Management: Instead of bouncing between multiple payroll providers and systems, a centralized payroll platform allows you to manage all international payroll operations from one place. This makes handling payroll taxes, contractor management, and other payroll-related administrative tasks far more efficient and drastically reduces payroll errors. It also gives you a clear overview of the payroll process across all legal entities.

- Scalability and Flexibility: Global payroll solutions offer the scalability to onboard international workers and manage payroll across new legal entities without missing a beat. Whether adding international team members or expanding into new markets, these solutions provide the flexibility to handle your evolving payroll needs.

- Enhanced Employee Experience: Empowering employees to manage their payroll data has never been easier. With features like employee self-service portals and multilingual support, global payroll platforms allow international employees to access payroll information, track earnings, and manage benefits in real-time. This reduces the administrative load on HR and boosts employee satisfaction, ensuring a smoother experience for your global workforce.

By leveraging these benefits, businesses can simplify multi-country payroll operations while improving compliance, reducing administrative tasks, and delivering a better experience for their international and full-time employees.

FAQs

Papaya Global, Rippling, and Multiplier are primarily global payroll solutions that include HR features. They are capable of handling multi-country tax regulations.

Deel is the best global payroll service for startups and small businesses looking for a simple, contractor-friendly solution. For small teams expanding internationally, Multiplier is another good option, as it also provides EOR services and automated payroll compliance.

-

EditorChandan Kumar is a founder of Geekflare. He is a technology enthusiast and entrepreneur who loves to help businesses and people around the world. Chandan has worked at BNP Paribas, Citibank, Deutsche Bank, Motorola, and HP. He’s got an in-depth understanding of business software and IT infrastructure.

EditorChandan Kumar is a founder of Geekflare. He is a technology enthusiast and entrepreneur who loves to help businesses and people around the world. Chandan has worked at BNP Paribas, Citibank, Deutsche Bank, Motorola, and HP. He’s got an in-depth understanding of business software and IT infrastructure.