Efficient payroll management in India is becoming more challenging day by day, thanks to its complex web of ever-changing labor laws and tax regulations. Companies don’t just face trouble performing the task of payroll calculation, but they also find it hard to stay compliant with the state and central regulations, particularly when integrating with global payroll solutions.

Preventing costly penalties and legal issues while ensuring employee trust and satisfaction through timely and correct payments is not an easy goal to achieve. For that, you need payroll software to automate payroll processes. These solutions not only enable you with a complaint and cost-saving payroll run but also save you from manual errors and administrative burdens.

After testing 20 software, here is my list of the best payroll software for small businesses in India, based on automation, compliance, and pricing.

- 1. Zoho Payroll – Free Indian Payroll Software

- 2. RazorpayX – Best for Automated Tax Filing & Payments (TDS, PF, PT, ESIC)

- 3. Keka – Popular Choice Between Indian Employers

- 4. greytHR – Ideal for MIS & Compliance Reports with Advanced Analytics

- 5. Paybooks – Mobile-ready Payroll Software

- 6. Empxtrack – Integrated Payroll, HRIS, and Employee Portal

- 7. Sumopayroll – Integrated Leave and Shift Management

- 8. HROne – AI-Powered Payroll Analytics & 3D Salary Reports

- 9. Wallet HR – End-to-end Payroll Automation with a Unified HR Solution

- Show less

You can trust Geekflare

At Geekflare, trust and transparency are paramount. Our team of experts, with over 185 years of combined experience in business and technology, tests and reviews software, ensuring our ratings and awards are unbiased and reliable. Learn how we test.

Best Payroll Software Comparison

Below, I’ve compared the payroll software based on factors such as compliance, reporting, pricing, integrations, and more.

|  |  |  |  |  |  |  |  | |

PF, ESI, LWF, PT, IT | PF, PT, ESIC | ESI, electronic challan filing | PF, ESI, PT | PF, ESI, LWF | ESIC, PF, PT, LWF | Provident Fund (PF), ESI, Profession Tax | EPF, TDS, ESI, LWF, PT | PF, ESI, VPF | |

Form 16, TDS, 12BB, 24Q | TDS | Tax, TDS, Form 24Q | eTDS, Form 24Q, Form 16 and 12BA | IT, Form 16 | TDS, Professional tax | Income tax | Tax declaration | Income tax, professional tax | |

Compliance, audit trail, journal | Payroll, contractor payments, reimbursements | Payslips, compensation planning | MIS, statutory compliance, reconciliation | Cost analysis, payroll summary | Payroll, statuatory | Employee info, tax liabilities | Employee cost | Salary distribution, liabilities | |

Banking, Zoho Apps | HRMS, benefits, insurance | Accounting | Accounting | Attendance, finance | HR | NA | HR, benefits planning | Attendance devices | |

Startups, enterprises | Startups, SMEs, enterprise | Small businesses, enterprises | Payroll service providers, SaaS | Growing SMEs, small startups | SMBs | Startups, SMBs | SMEs | Startups, small business | |

₹40 | ₹2499 | ₹9999 | ₹3495 | ₹2499 | ₹134 | ₹35 | ₹ 4250 | NA | |

Below, I’ve reviewed each of the software, highlighting their key features, USP, pros, cons, and pricing.

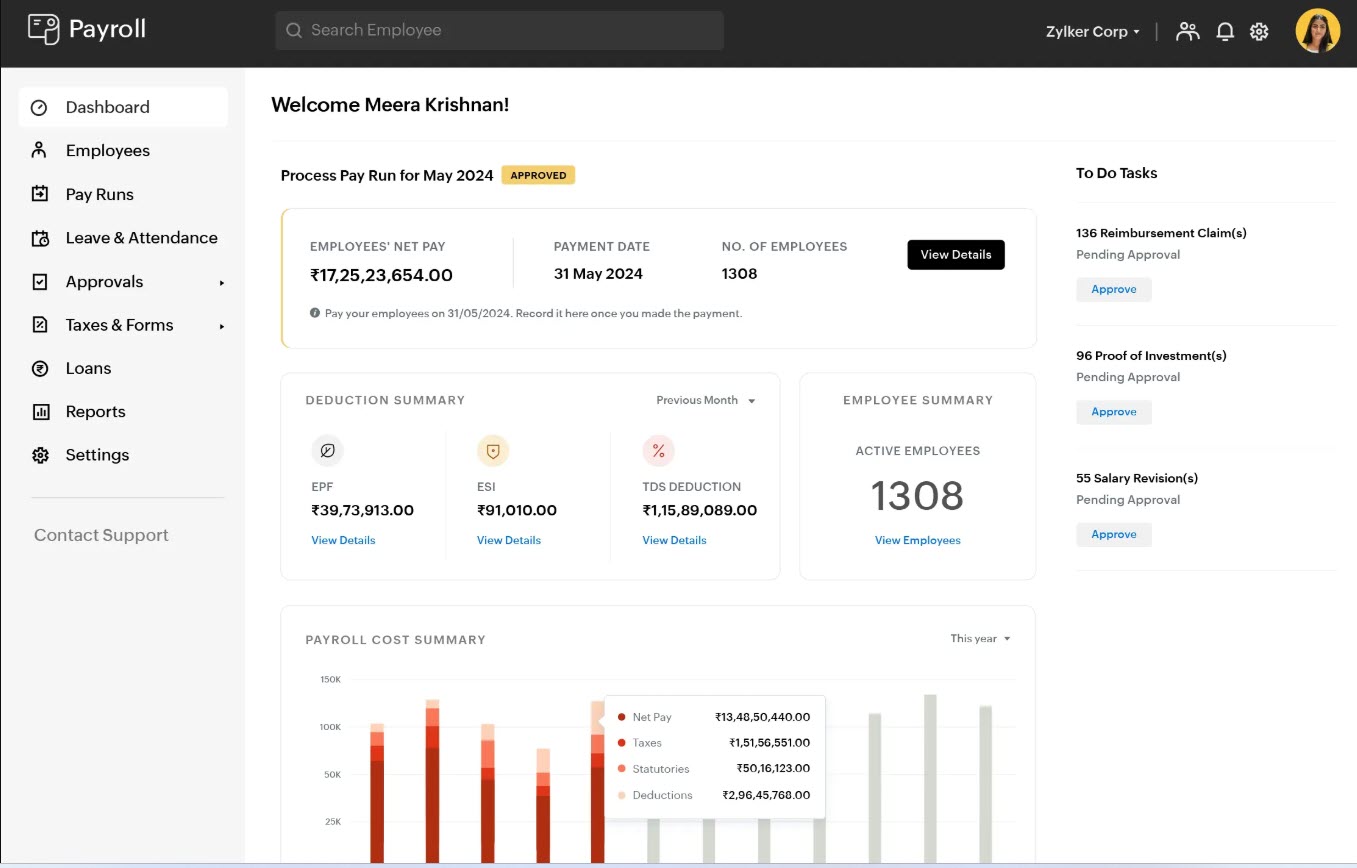

1. Zoho Payroll

Free Indian Payroll Software

Each month, over 15,000 employees get paid by Zoho Payroll, and you can include your team members in this growing platform. It collaborates with the top banks of India so that you can pay your employees online directly to their bank accounts.

Zoho Payroll automates payroll and post-payroll activities, such as choosing an industry-specific pay schedule, running off-cycle payroll, sharing payslips online, and notification on upcoming tax submission dates. Its multi-level approval feature makes the payroll process secure and reliable. You can even integrate with Zoho applications such as Zoho One.

Moreover, it lets you quickly onboard employees and customize benefit plans, saving you valuable time and resources while ensuring employee satisfaction and retention. Additional features of this platform include advanced salary, employee reimbursement, employee self-service portal, and company policy implementation.

Zoho Payroll not only provides you with payroll features but also generates 40+ reports to provide real-time visibility into payroll operations. I like how it allows you to include personalized salary components. Thus, you can use it with custom earnings and deductions according to your organizational hierarchy and requirements.

Pros

Android and iOS mobile apps.

Intuitive interface with a minimum learning curve.

Free calculator for income tax, bonus, and gratuity.

Cons

24/7 phone service is not available.

Limited number of third-party integrations.

Zoho Payroll Pricing

- Free — ₹0 [Up to 10 employees]

- Standard — ₹40/employee/month [Minimum 25 employees]

- Professional — ₹60/employee/month [Minimum 50 employees]

- Premium — ₹80/employee/month [Minimum 50 employees]

2. RazorpayX

Best for Automated Tax Filing & Payments (TDS, PF, PT, ESIC)

RazorpayX is compliance-focused and automated payroll software. Besides tax filing, it lets you automatically pay TDS, PF, PT, and ESIC from the same dashboard. You can access challans on the self-service dashboard for simplified record keeping and audit trail.

Razorpay’s primary functionality is not restricted to payroll automation in both regular and off-cycle. It complies with multi-state compliance laws and regulations and alerts you in real-time whenever any regulatory changes take place, minimizing compliance errors.

It supports integration with 45+ HRMS, attendance, and benefits software such as Zoho People, Zaggle, Plum, Jibble, and Ubitech. Whether you use HRMS software or not, its integration helps you keep accurate track of attendance and leaves.

Its reimbursement feature is worth trying. RazorpayX enables you to reimburse your employees instantly or with their monthly salary, allowing you to conveniently pay while ensuring employee satisfaction. I personally like that RazorpayX allows you to provide a loan to your employees and let them repay in installments, as shown in the screenshot below. Besides helping employees in need, it helps you build a positive reputation as an employer.

If you want to simplify your payroll process—from onboarding to compliance—a payroll automation guide can show you the best practices, setup tips, and tool options to help you choose the right solution.

Pros

1-hour employee onboarding.

360° payroll for employees, interns, and freelancers.

Free GST calculator and ROI calculator tools.

Cons

Pricing includes an additional 18% GST.

Live chat is only available from 10 am to 10 pm.

RazorpayX Pricing

- Prime — ₹2499/month [Max. Employees Supported: 20]

- Elite — ₹5499/month [Max. Employees Supported: 100]

- Enterprise — Custom [For Organizations with 100+ Employees]

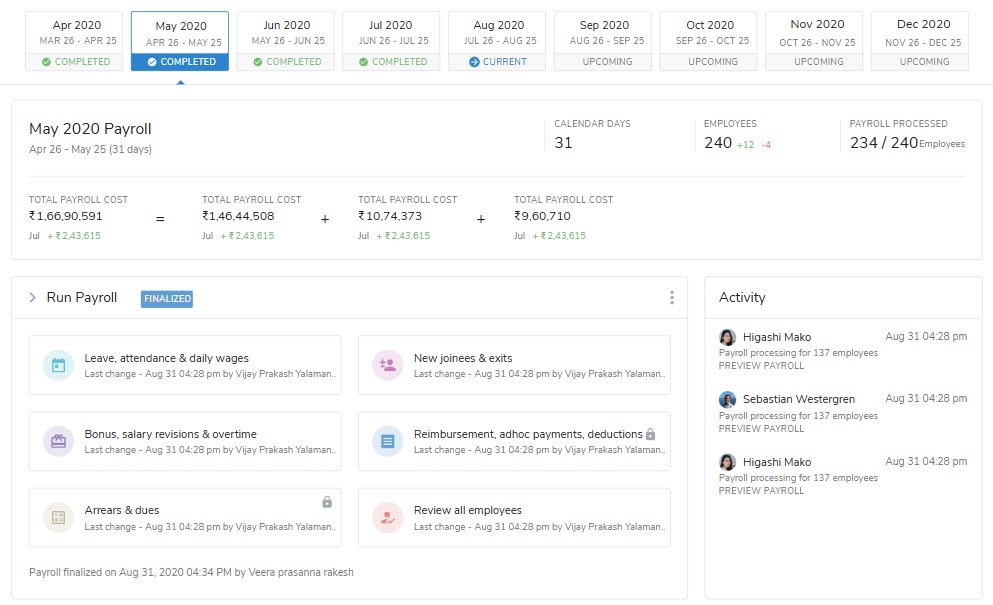

3. Keka

Popular Choice Between Indian Employers

With a global presence in 150+ countries, Keka processes salaries of 3.2 million employees each month. It makes the payroll completely automated yet fully configurable with a range-based salary structure. It lets you manage local and national compliances without having extensive payroll knowledge.

You can set up provident fund rules according to salary range or management bands. It supports ESI computation rules and generates filing outputs in ESI standards. Even if you are unaware of the tax and compliance rules of each state, Keka removes this burden by automatically deducting professional tax and generating locally compliant forms.

It enables you to keep track of salary revision cycles and lets you revise your salary anytime. Keka’s analytics data makes compensation planning easier for you by identifying pay gaps between genders and departments. You can even set up loan policies and eligibility criteria while tracking the loan EMIs from one place.

The finance management functionalities of this employee-centric payroll software caught my attention. It makes income tax calculation and declaration effortless for your employees, including for those who are not aware of the jargon. It also enables them to claim expenses and get reimbursements without switching the platform.

Pros

Cloud-based payroll management.

Smooth migration from other solutions.

Employee mobile app for tax declaration and payslips.

Cons

Setup fees for onboarding.

Comparatively costly for large enterprises.

Keka Pricing

- Foundation — ₹9,999/month

- Strength — ₹12,999/month

- Growth — ₹15,999/month

4. greytHR

Ideal for MIS & Compliance Reports with Advanced Analytics

greytHR boasts 27,000 clients in 25 countries, and it is one of India’s best payroll software applications. It enables you to run payroll on time every month with 100% statutory compliance. Payroll processing takes only a few minutes on this application, and you get error-free salary disbursement, which saves you time and effort.

This highly configurable payroll engine allows you to extensively customize the salary structure and unlimited payroll components, coinciding with the company structure. It enables you to handle complex payroll use cases.

greytHR supports various statutory compliances, such as PF, ESI, PT, TDS (IT), Form 24Q, Form 16 and 12BA, and the Labour Welfare Fund, saving you from calculating and submitting these manually. You can directly debit the payment from your account and transfer it online to all major banks.

On greytHR, you can release the employee payments batch-wise and bank-wise, according to your choice, and track the status of cash and cheque payments. Thus, you can have better control and flexibility over payments and manage cash flow. However, after signing up for the 7-day free trial, I was unable to log in to this software. I had to sign up again using the same email address but with a different domain name to access the platform. The below screenshot shows the overview of the dashboard with employee details, payout details, etc.

Pros

99.5% uptime to prevent month-end stress.

Transparent self-help ESS portal.

Payroll Statement Builder.

Cons

Free trial comes with feature limitations.

Trial sign-up does not always work.

greytHR Pricing

- Essential — ₹3495/month

- Growth — ₹5495/month

- Enterprise — ₹7495/month

5. Paybooks

Mobile-ready Payroll Software

Paybooks let you get through the complex labor laws of India through payroll and compliance automation. Automated salary calculation, auto salary slip generation, and flexible payment methods ensure timely and accurate salary payments.

Here, you can accurately calculate Employees’ State Insurance (ESI), Professional Tax (PT)

Tax Deducted at Source (TDS), and PF, making filing and deposit hassle-free. Paybooks offers an employee-friendly mobile app from where your team can track leave balance and attendance, access pay history, plan taxes, and manage the investment. It makes their life so much easier by bringing everything to their fingertips.

Paybooks have an advanced attendance tracking system to track time, overtime, and absence. You can also use it to approve leave requests and schedule shifts and integrate it with biometric devices for secure time tracking.

Its reporting capability is my personal favorite, as it can generate a wide range of reports covering salary, compliance, FBP, leave and attendance, reimbursement, and more. Besides choosing from one of the templates, you can create your own ad hoc reports, as shown below, including your preferred pay components, employee details, and filters.

Pros

Regular audits and data encryption.

Support via phone, email, and live chat.

Leave policy configuration.

Cons

Limited third-party integration support.

Free trial is only available for 7 days.

Paybooks Pricing

- Essential — ₹2499/month

- Regular — ₹4999/month

- Premium — ₹9999/month

6. Empxtrack

Integrated Payroll, HRIS, and Employee Portal

Being a highly customizable and self-configurable payroll software, Empxtrack empowers you with secure payroll management. Trusted by 15000+ companies worldwide, it helps small and medium businesses with self-service, configuration, and compliance.

It calculates employee salary after taking into account incentives, areas, leave, etc., to make the process easy and quick. Interestingly, Empxtrack captures payments made out of the payroll, including rewards, bonuses, incentives, and commissions.

Features like multi-step approval workflow and maker-checker reduce the chances of error and offer full control over the process. It offers multiple dashboards, generates 30+ reports, and 256-bit encryption.

While I was trying to open an account and log in to Empxtrack, it was having a clash with a Chrome extension. I had to uninstall the add-on to be able to complete the onboarding steps. After logging in to the software, I found the interface to be outdated and shabby, as shown below.

Pros

Free for 25 users, making it ideal for small businesses.

Supports Form 24Q and Form 16.

Exemptions and deductions mapping for income tax.

Cons

Leave management module comes as an add-on.

Custom pay cycle available only for Enterprise plan users.

Empxtrack Pricing

- Free for up to 25 users.

- ₹134/month for every additional employee.

7. Sumopayroll

Integrated Leave and Shift Management

Sumopayroll is an intuitive application that facilitates a fully compliant and accurate payroll process. It lets you directly deposit the salary with online salary credit. Here, you can create different payroll batches based on departments or branches for flexibility and organizational efficiency.

It handles all major payroll compliances, such as PF, ESI, professional tax, and TDS, and adherence to government regulations. Thus, it ensures that you avoid penalties and legal issues due to non-compliance. Sumopayroll supports employee loans and advances and their auto repayments directly from their salaries, reducing manual tracking and potential errors.

The screenshot below shows the salary setting components, which include allowance types and deduction types.

Before making the payment, Sumopayroll users can review it to identify and rectify any discrepancies or errors in payroll. As a result, you can make more accurate salary payouts and avoid post-payroll corrections. Moreover, it supports generating, viewing, and downloading monthly, quarterly, and annual payroll reports in spreadsheet or PDF formats.

I like how Sumopayroll allows employees to download their estimated tax sheets based on their current salary. It helps you get a clear understanding of their potential tax deductions and plan their tax savings effectively.

Pros

Ideal for startups and small businesses.

GPS-based mobile apps.

Settlement payroll for resigned or terminated employees.

Cons

Additional GST will be included in the pricing.

Employee mobile app incurs extra charges.

Sumopayroll Pricing

- Free for up to 10 employees.

- ₹35/month/employee if the employee count is above 10.

8. HROne

AI-Powered Payroll Analytics & 3D Salary Reports

Switching to HROne payroll software saves you 20+ working hours every week. It minimizes your payroll grievances and ensures accurate and compliant payout. Here, you can configure pay groups aligned with the organizational structure, simplifying processing for different employee segments.

Its automated Cost-to-Company (CTC) calculator accurately determines compensation packages. The highlighted feature of Sumopayroll is 3D reports. It visualizes a detailed analysis of various payroll queries such as month-by-month salary trends, salary overview, and specific pay components.

As you run the payroll on Sumopayroll, it automatically deducts PF and ESI to ensure compliance. Its automatic approval workflow and EMI deduction reduce the workload of your accountants. Its smart algorithm enables you to pay error-free payroll in a single click. It even generates an error list to address post-payroll errors.

When I registered for its free trial, it said that someone from their team would contact me for a demo. However, I could not enter the platform, probably because it did not create an account with my details. When I tried to log in using my email address, it claimed that it sent me OTP in my email and mobile phone, but I did not receive the OTP in either of my communication modes.

Pros

3D reports with detailed analysis.

Powerful and intuitive dashboard.

Auto-database sync with integrated apps.

Cons

Trial enrollment is a time-consuming process.

Limited number of integrations.

HROne Pricing

- Basic — ₹4250/month

- Professional — ₹5750/month

- Enterprise — Custom

9. Wallet HR

End-to-end Payroll Automation with a Unified HR Solution

Wallet HR functions as an end-to-end payroll management system. This scalable software makes it easy for Indian organization to manage their payroll with its user-friendly interface and integration capabilities.

It accommodates complex payroll calculations, regardless of salary structure and tax. Using its automated workflow, you can manage their leave requests easily. The software supports financial document download, payslips, and integration with top business and HRMS software.

Wallet HR comes with comprehensive analytics and reporting tools that enable you to make smart business decisions. Generating year-end reports of earnings, deductions, and benefits helps your employees in personal financial planning and tax preparation.

I like how Wallet HR enables employees to see updated salary details through the self-service portal. Thus, they can identify increments and enjoy transparency in the payment process. Speaking of transparency, it informs the employees whenever there is a payroll change, leave approval or tax filing deadline.

Pros

Automatically calculates payable days.

Encryption and secure servers.

Supports importing previous payroll records.

Cons

Lack of transparent pricing.

Does not offer any free trial.

Honourable Mentions

Continuing my search, I found some more excellent payroll software that could fit your business needs.

10. Saral PayPack: Saral PayPack enables you to maintain an extensive database of employees, such as classification and statutory details, for accurate paycheck calculation. One-time licensing starts from ₹53,700.

11. Kredily: Kredily offers you freedom and flexibility in terms of having payroll details and generating independent pay slips. Pricing starts from ₹1499/month/up to 25 employees with a free forever plan.

12. Pocket HRMS: Pocket HRMS uses ML technology to reduce payroll processing time to some minutes while supporting multi-company and multi-structure payroll. Pricing starts from ₹2499/month.

13. Nitso Payroll: Nitso Payroll smoothly integrates with the attendance management system to facilitate one-click payroll processing. Pricing starts from ₹3000/month.

What’s Next?

Now that you have gone through the details of the best payroll software for Indian small businesses, let’s explore some more guides on payroll management.

-

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.