Open banking refers to the practice of providing access to the bank customers’ financial data to third-party financial service providers with the help of APIs.

Traditionally, only you and the bank could access the financial data, but with open banking, third-party services can also use some of that financial data and implement new features in their applications to improve user experience.

How Does Open Banking Work?

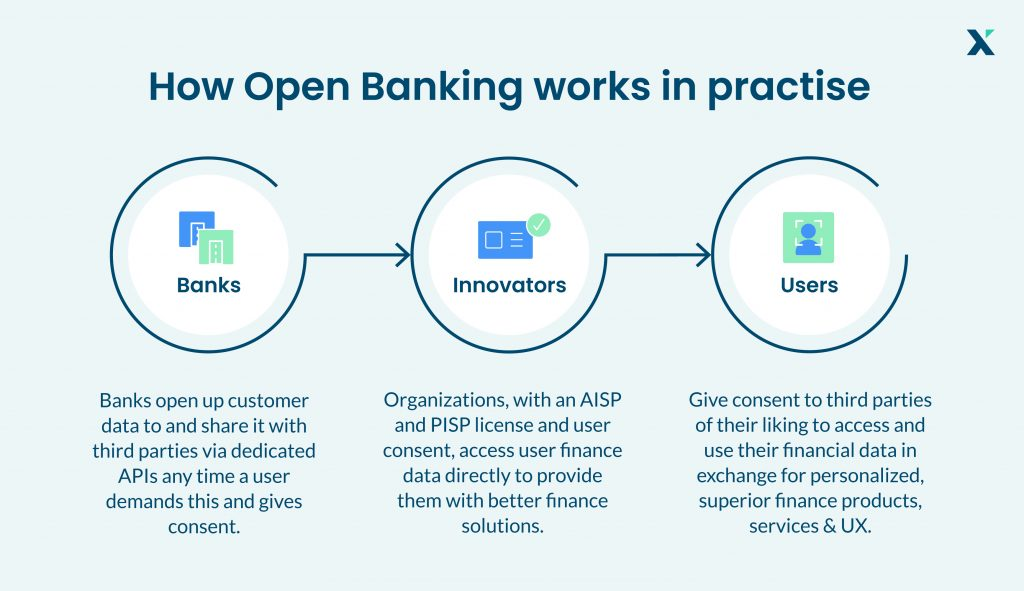

Open banking works by securely exposing a customer’s financial data to a third-party service, such as a payment application or a financial analysis tool.

With the help of open banking, you can make payments, receive rewards and analyze your transactions using third-party applications.

There are some variations in open banking across the globe. In some parts of the world, it’s regulated; in others, it’s industry-driven.

The best example of open banking is the UPI (Unified Payments Interface) service in India. It allows users to manage multiple bank accounts on a single mobile application and also make real-time instant transactions.

What’s an Open Banking API?

An open banking API is a secure channel through which banks and other financial institutions can share customer data with third-party service providers. It’s a gateway for the seamless transfer of data without compromising security.

Benefits of Open Banking API

There’s not just one single beneficiary of open banking APIs. It benefits customers, banks, financial institutions, and businesses collectively.

Here are some of the benefits of open banking APIs:

- Personalization: It is useful for businesses because they can convert the data about the customers into a personalized experience.

- Customer Experience: Consumers are benefitted from this because of innovation and competition to create better services.

- Higher Conversion Rate: Personalization and great customer experience lead to higher business conversion rates.

- Personal Finance: Users can make informed decisions and spend wisely using various financial tools provided by third-party services.

- Reduced Service Cost: Customers benefit from this because of competition in the market.

- Security: The data is transferred securely between a financial service provider and the data holder using robust APIs.

With that being said, let’s look at some open banking APIs and see what they have to offer.

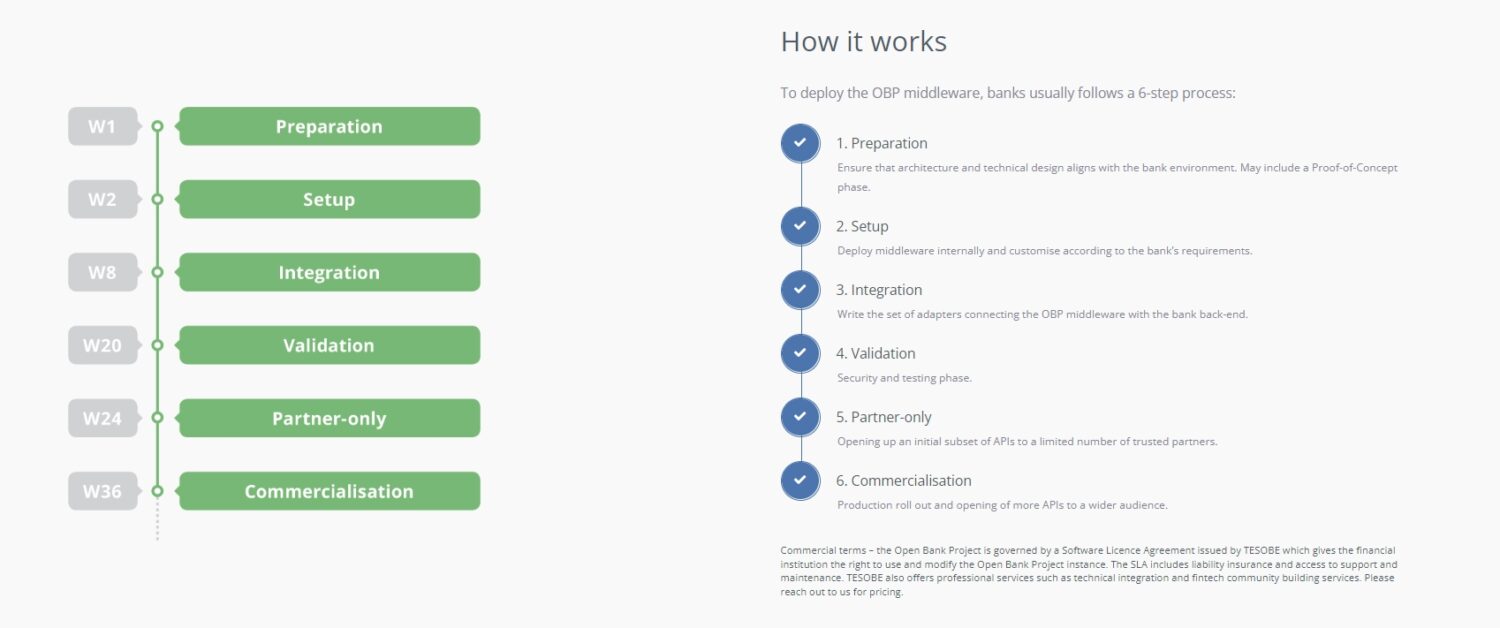

Open Bank Project

The open bank project is a collection of open-source APIs used by over 11,000 developers and fintech companies. It’s created with keeping the fintech developers in mind and provides access to various tools for better developer productivity.

Some of the APIs provided under the open banking project include:

- Accounts – You can access the list of accounts and their balance.

- Transactions – The transaction history is made available to you through this API.

- Payments – You can initiate payments through it.

- KYC – Perform KYC (Know Your Customer) using this API.

It supports regional open banking standards and frameworks like UK Open Banking & Berlin Group.

Basiq

Basiq is a platform that allows you to access the financial data of users through a single API. It does this in a CDR (Consumer Data Rights) compliant way. CDR is a system operated by ACCC (Australian Competition & Consumer Commission) for consumers to securely access and share the data which businesses possess about them.

Basiq is only available across Australia and New Zealand and supports 146 financial institutions. Here are some of the features of Basiq’s API:

- Secure Connectivity to Data – CDR compliance makes the API secure and consent driven.

- Real-Time Dashboard – Retrieve bank transactions and account balances on demand.

- Financial Insights – Analyze expenses, assets, and liabilities.

It provides data related to accounts, transactions, expenses, income, assets, liabilities, mortgages, and the identity of a user.

Finicity

Finicity is an open banking platform by Mastercard. Its open banking APIs put the customer in charge of their data for better security. It supports more than 10,000 financial institutions across the US.

The finicity API supports the management of:

- Accounts

- Assets

- Bank Statements

- Payments

- Portfolios

- Reports

- Transactions

- Analytics and attributes

- Institutions

On top of that, it can manage student loans as well. According to Mastercard, “Finicity’s open banking platform modernizes the student loan ecosystem with seamless access to high-quality, normalized, comprehensive student loan data in real-time.”

Integrating AI and deep learning to deliver sophisticated insights is the key feature of finicity’s open banking platform.

Plaid

Plaid is a fintech tool that allows businesses to securely access customers’ financial data through APIs and, in turn, gets a fee from the businesses using it.

It acts like a middleware between businesses and banks. Venmo, Chime, Dave, and other end-user applications use Plaid to provide financial services to their users.

It currently connects with over 11,000 financial institutions across the US, Canada, and Europe. Here’s how it works:

You can use Plaid for the following features it offers:

- Consumer payments

- Bank onboarding

- Loan management

- Bill payments for businesses

- Personal finance management

Plaid is free for development purposes, but it also offers a pay-as-you-go pricing plan as well as a custom pricing plan.

Tink

Tink is an open banking platform based in Europe, providing access to the financial data of consumers to businesses, banks, and fintech startups. It allows them to create more innovative and better financial services to attract consumers.

Tink was founded in 2012 and later got acquired by Visa in 2022.

Banks can get the following benefits by using Tink:

- Attract new customers

- Increase engagement

- Improved money lending

Apart from banking, Tink has other use cases in industries like lending and payments. Tink provides only one API, which is enough to manage bank accounts on end-user applications. It is PSD2 compliant too.

It supports over 3400 banks and financial institutions and has around 10,000 developers using the API.

Tink offers a demo of its front-end SDK which you can use to try various services.

Truelayer

Truelayer is a developer API platform that provides open banking services to fintech. It aggregates the APIs of various banks and combines them into a single API for businesses to use.

Truelayer’s API is divided into multiple products:

- Payments API

- Data API

- Connections API

- Signup+ API

- Verification API

It is spread across the UK, Europe, and Australia and makes up 50% of the open banking traffic in the UK, Spain, and Ireland.

Final Words

Open banking APIs use a modern approach to represent data to the consumer instead of traditional banking. It allows various businesses to innovate and compete with each other, which eventually leads to better products and services.

Security and regional compliance are the key things you need to keep in mind when choosing an open banking API. It also depends on the use case of your application.

Next, check out the best APIs for traders to integrate into financial products.