Accounts Payable (AP) automation tools let you automate the process of fulfilling the company’s payments. They handle the below processes:

- Processing invoices

- Managing payments

- Forecasting cash requirements

- Vendor data management

- Compliance to regulations

- Reporting, as required by various stakeholders

The Geekflare team has researched and listed out the best AP automation software based on key features such as optimizing payments, handling reimbursements, and automating OCR data extraction.

- 1. Bill AP – Best for Streamlined Invoicing and Payments

- 2. Payhawk – Best for Growing Businesses With Integrated Expenses

- 3. Melio – Best for Small Businesses

- 4. Kanverse AI – AI-Powered Document Processing

- 5. Tipalti – Best for High-Volume Global Payments

- 6. Airbase – Best for Spend Management and Approvals

- 7. Corpay One – Best for Medium Business

- 8. SAP Concur – Best for Travel and Expense Integration

- 9. Pipefy – Best for Customizable AP Workflows

- 10. Stampli – Best for ERP Integration and Manufacturing Industries

- 11. Spendesk – Best for Spend Control and Expense Tracking

- Show less

You can trust Geekflare

At Geekflare, trust and transparency are paramount. Our team of experts, with over 185 years of combined experience in business and technology, tests and reviews software, ensuring our ratings and awards are unbiased and reliable. Learn how we test.

Accounts Payable Automation Software Comparison

I’ve summarized the key features, target users, AI capabilities, global reach, currencies, starting price and overall rating for each AP automation solution.

|  |  |  |  |  |  |  |  |  |  | |

Invoice capture from email, Custom approval workflows | Multilingual OCR, 2-way and 3-way matching PO Matching, invoice processing | Automated bill capture, Free ACH transfers | Template-free invoice processing, Vendor Self-Service Portal | Global payment processing, AI-powered fraud detection | Automatic Sync with General Ledger, 3-way PO matching | Rebates on using Corpay One Mastercard, Money laundering and fraud detection | Cashflow forecasting tool, Automatic routing and approval of invoices | Process Automation Tool, Custom AI Agent creator | AI Copilot for automatic approval routing, Free Stampli AP cards | Pre-defined workflows, Alerts via Slack | |

US | US, UK, Europe | US | Global | Global | GLobal | US, UK, Denmark | Global | Global | Global | UK, Europe | |

137 countries | 160+ Countries | Data not available | Data not available | 196 countries | 200 countries | 33 countries | 192 countries | No payment feature | 100 countries | Data not available | |

106 currencies | 50+ currencies | 16 currencies | Data not available | 120 currencies | 145 currencies | Data not available | 142 currencies | No payment feature | Data not available | Mastercard supported currencies | |

AR, Spend, Expense, API | Accounting, ERP, API | Accounting, Gmail | ERP systems | Payroll, Expense | Accounting, ERP, API | Accounting, API | HR, Payroll, Finance, CRM, ERP | HR, CRM, Accounting, Productivity | ERP, Accounting, API | Accounting, Productivity, HR, API | |

SMBs | Medium to large businesses | Startups, small businesses | Medium to large businesses | SMBs, Large enterprises | Medium to large businesses | SMBs, Medium to large businesses | Medium and Large Enterprises | Startups, SMBs | Medium to large businesses | Startups, SMBs | |

$49 | Custom | $21.25 | Custom | $99 | Custom | $69 | Custom | Custom | Custom | Custom | |

Geekflare’s editorial team determines ratings based on factors such as key features, ease of use, pricing, and customer support to help you choose the right business software. | |||||||||||

Accounts Payable Automation Software Reviews

Below, I’ve reviewed the top AP automation solutions by considering their core and advanced functionality, their pros and cons, pricing and given overall rating to help you pick the right solution.

1. Bill AP

Best for Streamlined Invoicing and Payments

Bill AP helps US-based businesses streamline their invoicing, bill creation, and payment processes, helping them get paid faster. It is suitable for businesses of all sizes and accounting firms.

Automate your accounts payable process, digitize paper-based payables, and capture invoices from email with Bill AP for a complete view and control of your payables. It supports payments to 137 countries. However, when I signed up, I noticed that your business needs to be based in the US and have a US postal address for you to be able to use this platform.

Bill AP allows you to customize the approval policies, approve bills from any place, and automate approval workflows with a simple swipe or a few steps. It offers a variety of payment options, including credit cards, cheques, international wire, ePayments, and more.

Track both incoming and outgoing payments with a dashboard view that shows all stats; direct data integration or two-way sync with the Bill AP can save time and effort by eliminating manual entry.

Vendor management is simplified by the fact that if you have vendors who are using Bill or Quickbooks/Xero, their details are already available, and you only need to start typing their names to get the details.

Bill AP Pros

Offer a 1-month free trial

Easy to set up the invoice approval process

AI recognition in invoicing

Centralized payment management

Bill AP Cons

No automation when you re-assign the invoices

The reporting feature needs improvement

Available only in the US

Bill AP Pricing

The starting price of Bill AP for businesses is $49/month. Based on the numbers, you’ll get an additional discount of 10-20% on client subscriptions. It also offers a free plan for accountants, and their clients.

2. Payhawk

Best for Growing Businesses With Integrated Expenses

Payhawk provides sophisticated and user-friendly accounts payable and invoice management software designed to help your organization manage and handle invoices effectively.

Payhawk offers a paperless accounting process, adhering to local tax regulations and enabling effortless expense archiving. It guarantees security by carrying out intelligent verifications to mitigate the risk of fraud or inaccurate spending.

Key Features of Payhawk AP:

- Zero touch invoice processing that uses OCR to capture data in more than 60 languages

- Automated multistep approval workflow to minimize delays

- 2-way and 3-way purchase order matching to identify discrepancies and errors

- Centralized payments with a bird’s-eye view of expenses and opportunities for cost reduction

- API-based integration with ERP systems, HR, business travel, SSO, VAT reclaim, and popular accounting software like FreshBooks and Quickbooks, etc.

- Option to link your credit cards (Visa, Master, Amex) or apply for a Payhawk Visa card to make payments

- Payments in 50+ currencies to 160 countries

Payhawk does not offer a trial plan, or the option to purchase the software online. You have to go through their demo process and purchase via their sales team.

Payhawk Pros

Provides multilingual support and a live chat option

Offers cashback when you spend from your card

User-friendly and intuitive interface

Provides a broader view of all the expenses

Payhawk Cons

Non-card expense tracking is only available in higher plans

Features like purchase order generation and 3-way matching are paid add-ons.

Trial plan is not available. Only a demo is offered.

Payhawk is available only in a limited number of countries.

Payhawk Pricing

Payhawk offers three pricing tiers, which can be viewed after requesting a demo to understand the features and usage.

3. Melio

Best for Small Businesses

Melio offers a flexible payment method for invoices, allowing customers to pay with a card (with a 2.9% fee) or ACH bank transfer for free. This helps enhance cash flow and eliminates heavy paperwork.

With Melio, you can easily pay invoices and business expenses online, and vendors can receive instant direct deposits or paper checks without signing up. Multiple payments can be processed at once, saving time and earning reward points when paying by credit card. Melio also integrates with time billing software, making it a great choice for businesses that need to track billable hours alongside payments.

When I signed up for the trial, I found that Melio requires your business to be located in the US to be able to use this tool. Therefore, businesses located in other countries may not be able to use Melio. The dashboard is simple to use, even for beginners.

Your vendors can send your invoices directly to an email address linked to your Melio account (of the form geekflare_1298@invoicesmelio.com), and it will be directly reflected on your Melio dashboard. You need not manually upload invoices. This is a very useful feature and ensures you don’t miss any invoice due to human error.

You have options to set rules for approvals (like amounts exceeding a certain amount to be approved by someone) and multiple options (card/bank transfer) for making payments

Key Features of Melio:

- AI-powered tool to scan and upload invoices

- Multi-level workflows for payment authorization

- Syncing with popular accounting software like FreshBooks, QuickBooks, Zero etc.

- Ability to split bills into different payment methods

- Connect Gmail to Melio and sync invoices

- Forward invoices to Melio email ID and automatically view invoices on the dashboard

- International payments in16 foreign currencies

Melio Pros

Automates bill capture

Vendors can email their bills directly to your Melio account

You can send ACH transfers for free

Earn cashback and points on using credit cards for payments

Offers approval workflows, easy bill capture, payment tracking, and more included in every account

Melio Cons

Charges $20 for faster check processing

Charges 2.9% of the payment amount when you pay using your card

Only available for businesses based in the US.

Melio Pricing

Melio offers a pricing plan with free features like accounting software sync, mobile app, bill management, 5 free ACH transactions per month and more. There are 2 paid plans.

- Core at $21.25/month per user that lets you create approval workflows, integration with accounting tools, priority support and more

- Boost at $46.75/month per user that offers advanced multi-user workflows, premium customer service, etc.

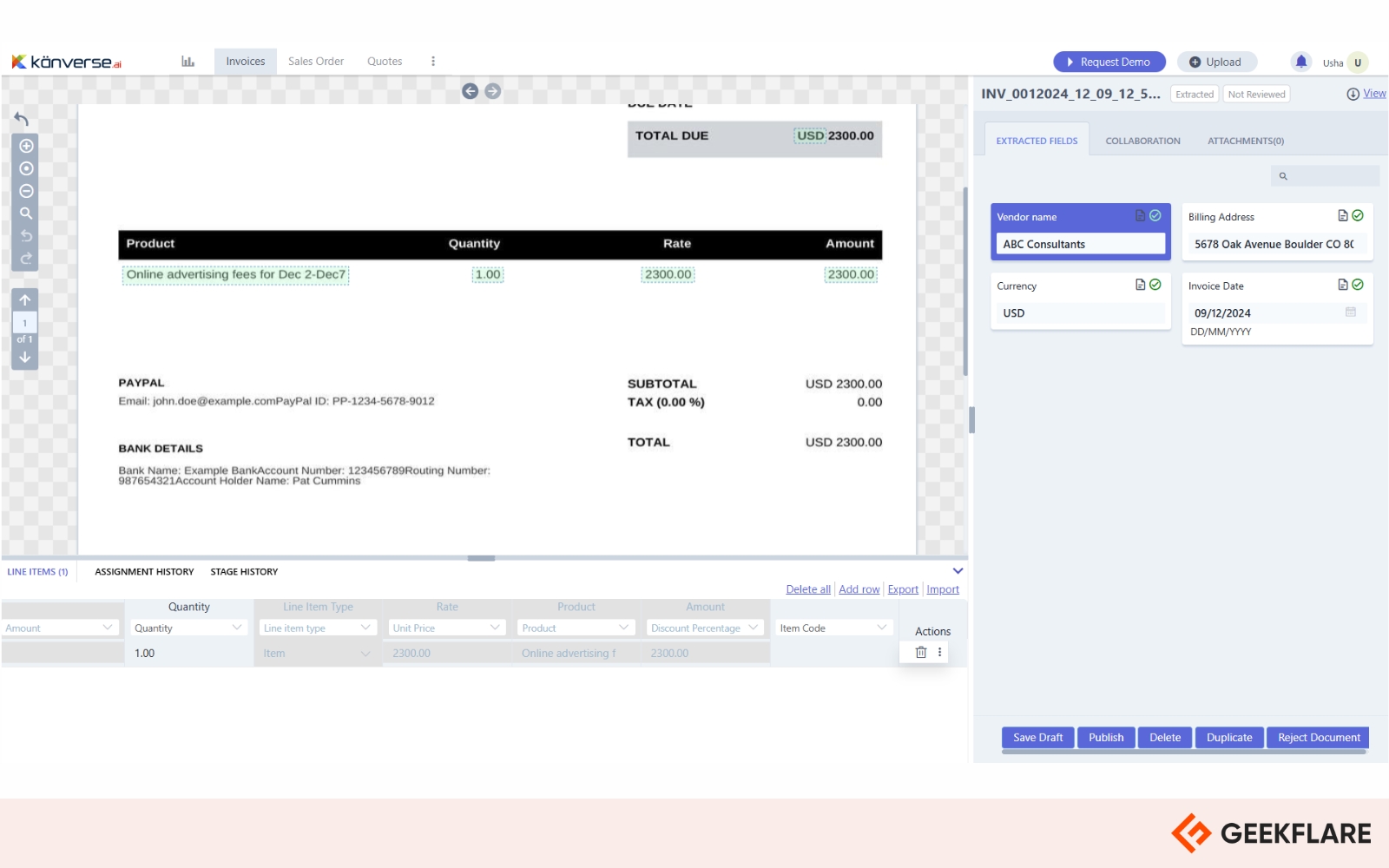

4. Kanverse AI

AI-Powered Document Processing

Kanverse is an AI-powered zero-touch Intelligent document processing platform, with its flagship product being Kanverse AP Invoice Automation. Its Intelligent Document Processing (IDP) cuts short processing times and prevents fraud while delivering up to 99.5% processing accuracy without any manual data entry.

Kanverse AI can handle various accounts payable automation tasks, including processing invoices, PO matching, payment requests, and more, without the need for templates. It can also fetch invoices from different channels like email and SharePoint.

Below is a sample invoice I tried to process with Kanverse AI. It allows collaboration with approvers and options to reject invoices or add comments.

Key Features of Kanverse AI:

- Option to choose individual/batch approval and processing of invoices

- Custom business rule creation with low code process automation

- Dashboard with key AP insights

- Self-service portal for vendors to submit and track invoices and queries

- AI agent for invoice automation and ROI calculation

- AI-powered fraud detection to prevent forgery, multiple payments and ACH fraud

- Integration with existing ERP systems

- Compliance with global privacy laws by protecting personally identifiable information (PII)

Kanverse AI Pros

Up to 80% reduction in costs due to payment automation.

99.5% processing extraction efficiency.

Fraud prevention and data privacy.

Kanverse AI Cons

AI-powered invoice processing can lead to inaccuracies without human oversight.

Requires training for employees to use effectively

Kanverse AI Pricing

Kanverse AI provides custom pricing options along with a free trial.

5. Tipalti

Best for High-Volume Global Payments

Tipalti is a finance automation company that offers a smart AP tool along with multiple business solutions like mass payments, procurement, employee expense management and a connected suite that lets you integrate it with your other ERP systems along with an AI assistant.

Key Features of Tipalti AP:

- AI-powered automated invoice capture

- Multilingual self-service supplier onboarding

- Multi jurisdictional tax compliance engine approved by KPMG

- 2-way and 3-way PO matching to reduce errors

- Integration with payroll accounting systems for claim settlement

- Easy international payments in 196 countries in 120 currencies and 50+ payment methods

- AI-powered fraud protection to prevent suspicious payees from receiving payment

Tipalti Pros

Integration with QuickBooks Online is a bonus

Provides automation for payment processes

Quick and easy payee ID creation

Tipalti Cons

No online signup facility; you need to go through their sales team

Limited customization option

Slow customer support response

Unable to download multiple invoices at a time

Tipalti Pricing

Tipalti offers 3 plans.

- Starter plan at $99/month that includes invoice capture, supplier self-onboarding, integration with ERP tools

- Premium plan at custom price with 2 and 3-way PO matching, mass payments and multi currency payments

- Elite plan at custom price that offers custom approval rules, budget management, slack integration etc.

6. Airbase

Best for Spend Management and Approvals

Airbase’s Accounting Automation solution improves accuracy and saves time by automating the entire lifecycle of transactions, from approval to receipt capture, bill creation, and syncing to the GL. It also includes automated receipt compliance enforcement.

Key Features of Airbase:

- Integration with Xero, QuickBooks Desktop, QuickBooks Online, Oracle NetSuite, and Sage Intacct and automatic sync of transactions to the General Ledger

- Multiple payment modes – one-time virtual card (for ad hoc expenses), recurring virtual cards for periodic payments (office rent etc.) and purchase orders for large contract payments

- Approvals by multiple teams (procurement, IT, finance, and legal)

- International payments in 200+ countries in 145 currencies

- AI-powered OCR for invoice capture

- Automated 3-way PO matching

- Flagging of duplicate payments and fraudulent payees

Airbase allows you to set settings and rules based on your preferences. It learns from your transactions to make intelligent recommendations for the next one. Auto-categorization updates GL fields for physical card transactions based on past entries, including category, line tags, transaction tags, and vendor.

Airbase does not let you sign up online. You need to go through a guided tour or wait for a demo from the sales team. I found the platform to be pretty comprehensive, including multiple features within one dashboard, AP automation being one of them.

The insights and analytics feature is pretty detailed. You have a graphical depiction of AP Aging that shows how many bills are due within the next 1-30 days, 30-60 days and so on. The platform lets you add virtual and physical cards for easy payment processing.

Airbase Pros

Automates routing and approval workflows, payment flow, and entering multiple categories

Automatic invoice scanning and adding details

Imports receipts easily from a mobile application

Integrates with General Ledger (GL)

Excellent guided tour for new users

Airbase Cons

No free plan and trial

No online sign-up facility

Lack of features for larger companies

Airbase Pricing

Airbase gives you custom quotes tailored to your needs. You need to schedule a demo to know whether it can work for your company.

7. Corpay One

Best for Medium Business

Corpay One is a specific product under the Corpay product line that focuses on spend management and accounts payable. It automates business bill payments, offering various payment options such as ACH, checks, credit cards, and Corpay Mastercard to streamline the process and improve cash flow.

Key Features of Corpay:

- Scan and upload bills, invoices and reciepts

- Approval workflows, bill categorization

- Custom spend controls

- Integration with QuickBooks Desktop and QuickBooks Online to sync payments to the accounting system

- Rebates on using Corpay One Mastercard for making payments

- Money laundering and fraud detection

- Identity verification to protect your account and vendors’ information.

- International payments available in 33 countries from the US.

During my trial of Corpay, I found the interface and dashboard to be minimalistic, without any flashy features. It has the account set up option, where you may enter your ID, bank details, auto-pay options, vendors, employees, approvers etc. You also have an option to link it with your accounting system.

This is followed by the Bill Pay option, where you can view all your invoices. The next option is the Bill Pay reports which has an AP aging details, unpaid bills, vendor balances etc. The tools option lets you configure workflows, view credit notes, recurring expenses etc. I liked the simple design of the tool and ease of locating the necessary features.

Corpay is one of the AP platforms that assigns you a custom email ID (of the form geekflare.ltd@bills.corpayone.com) to which you or your vendors may send their invoices to automatically get posted to Corpay without the need for manual upload.

Corpay One Pros

Customized workflows

Simple interface

Easy-to-send international payments from the app

Cost-effective way to send ACHs quickly

Reliable tool for businesses for greater functionality and consistent performance

Corpay One Cons

Limited analytics affecting businesses during decision-making

Limited number of countries to which international payments can be made.

Charges extra for international wire transfers or payment errors

Available only in US, UK, and Denmark

Corpay One Pricing

Corpay One offers 3 plans

- Plus: $69 per month

- Pro: $129 per month

- Premium: $209 per month

In addition, there are extra charges for transactions as given below.

- Faster ACH Payment (Same/Next Day): $2

- Standard ACH: $0.35

- Check: $1

- Foreign Exchange: 1.5% of the transaction

- Payments funded via credit card: 2.9% of the transaction

- International wire: $25

8. SAP Concur

Best for Travel and Expense Integration

Concur (now part of SAP) is an integrated travel, expense, and invoice management solution. Its automated accounts payable solution simplifies the process of managing and paying invoices, resulting in cost and time savings, decreased errors, and improved organization. It offers a solution for automating the account payable process, providing resources and best practices to help identify and address breakdowns in the process.

Key features of SAP Concur:

- Electronic capture of invoices with OCR technology

- Workflows for automatic routing and approval of invoices

- Cashflow forecasting tool

- Integration with ERP systems

- Dashboards to provide full control over the AP automation process

- Easy-to-use mobile and web-based applications

- Make international payments to 192 countries in 142 currencies via integration with Payments Hub by TransferMate

Concur Pros

Capture expenses using mobile app screenshots

Automated expense report filing

Integrates easily with SAP systems and Banks

Provides unique solutions for managing travel expenses, reducing unnecessary spending on travel

Concur Cons

No free trial

No online purchase option

Sometimes, navigation slows down

User reporting functionality could have been better

Concur Pricing

Concur offers custom pricing and can be purchased only via their sales team.

9. Pipefy

Best for Customizable AP Workflows

Pipefy provides intelligent workflows for efficient finance teams to achieve better outcomes. Get complete visibility of the operations at a glance and automate your work with approvers, vendors, and colleagues on its cloud platform for a better finance process.

Key features of Pipefy:

- Single communication flow to stakeholders through email or a customer portal.

- Integration with your financial tools, such as spreadsheets and ERP systems

- Customizable dashboards to measure and control each department’s monthly spending to the complete PO cycle time

- Custom AI agent builder to create alerts and notify designated people

Pipefy offers a free plan, and you can instantly sign up online. You can choose your template from multiple options like Accounts Payable, CRM, HR, Customer support etc. for the process you want to automate. I chose the AP automation and was provided a Kanban board showing all the accounts payable invoices (with dummy data) and the stage at which they are.

I liked the Kanban view of Pipefy as it clearly shows the stages at which each invoice is and the due dates. However, Pipefy has no integrated payment methods. It is more of a process automation tool. You need to make the payments through third-party tools and update the status on Pipefy by uploading the payment confirmation. This process can be prone to human errors or even fraud if other checks are not in place.

Pipefy has an AI chatbot which can help you navigate through the dashboard and get familiar with the interface. When I tried, it first answered in Portuguese, which seems to be its default language. But when asked it switch to English, it did give me instructions in English too.

Pipefy Pros

Provides advanced customization

Offers higher storage and database limits

A custom email domain is a plus

The base plan includes access to its API

Pipefy Cons

No data recovery in the starter plan

Necessary security features are not available in basic plans, such as two-factor authentication, single sign-on, white label, etc.

No integrated payment processing system and automatic payment status update.

Pipefy Pricing

Pipefy offers a free plan with Pipefy AI, 5 processes and 10 users, which is suitable for small businesses. Business and enterprise plans are available for custom prices.

10. Stampli

Best for ERP Integration and Manufacturing Industries

Stampli is a smart accounts payable automation solution that integrates invoice and bill processing, communication, payment options, and credit card management in one convenient system.

Key Features of Stampli:

- Automated invoice capture with OCR

- Billy the Bot – AI Copilot to recognize patterns in approval and route the invoicesto the right person

- Automatic reminders sent by Billy the Bot to prevent payment delays

- Payment integration with international payments in 100+ countries in USD and local currencies

- ERP integration with 70+ tools like Quickbooks, Oracle NetSuite, SAP, Sage etc.

- Free Stampli AP cards to integrate payments into the workflow

- Mobile app access for approvals on the go.

- Vendor onboarding and self-service portal

Stampli does not have a free trial or online sign up option. You need to purchase it by contacting their sales team. I found Stampli to be a complete all-in-one solution for accounts payable with advanced features. Due to its support for industry-leading ERPs like Oracle NetSuite and SAP, Stampli is one of the best AP automation software for manufacturing, logistics and retail industries.

Stampli Pros

Route invoices precisely using its AI

Gives reminders when something needs to be approved

Scans invoices to give you all the details

Excellent customer support

Stampli Cons

Time-taking synchronization process

The flexible pricing option is missing

No free trial

Stampli Pricing

Stampli allows you to request a quote by filling out the form to get a better pricing estimation for your business.

11. Spendesk

Best for Spend Control and Expense Tracking

Spendesk is primarily a spend management solution that offers an accounting automation feature. It has an automated expense account allocation, VAT extraction, and receipt reconciliation to reduce time spent on month-end closing and minimize errors in payment information management.

Key Features of Spendesk:

- OCR-based invoice uploading

- Ability to set pre-defined workflows for approvals

- Integration with Slack for notifications

- Real-time insights into the stage at which each payment is

- Virtual cards and physical cards to automate payments

- Integration with other accounting software and ERPs like NetSuite, QuickBooks, FreshBooks, Xero

- Mobile app to process payments on the go

- International payments in all the currencies supported by Mastercard.

Spendesk is not available to users in the US. It is only available in UK and Europe.

Spendesk does not offer a free trial, but there is an interactive demo available on the site, which I found quite helpful to understand the product features. The dashboard sows the list of invoices to be reviewed, scheduled and confirmed. You may make payments via the Spendesk account balance or from a bank account. If you have integrated your accounting software with Spendesk or are using their own Accounting tool, the payment is immediately synced with the GL.

Spendesk Pros

Cloud-based functionality for quick access from anywhere, anytime

Provides a better view of your expenses and follow-ups

Offers virtual cards

Travel and HR integrations are a bonus

Spendesk Cons

Open API access only in the highest plan

No spend dashboards in the Essential (basic) plan

Available only in UK and Europe

Spendesk Pricing

Spendesk offers custom plans and you need to purchase the software by contacting their sales team.

What is Automated Accounts Payable Software?

Automated Accounts Payable software handles your financial transactions from start to finish. Whenever you receive invoices and bills, you must be aware of clearing all the amounts within the given period.

Automated accounts payable platforms help businesses pay their bills on time through various payment methods, reducing errors and improving trust with suppliers and vendors. It digitizes the supplier/vendor invoice and bill process to create leaner, cost-effective, and faster workflows. Thus, no manual forwardings, cutting paper checks, and no paper invoices anymore.

AP automation software saves time, improves accuracy, enhances insight and transparency, saves unnecessary expenses, prevents duplicate invoices from being processed, offers fraud detection, low-cost data preservation, easy auditing, early payment discounts, and integrates with existing accounting software.

Many modern AP solutions have a business rule engine that helps enforce company-specific policies automatically. This engine can validate invoices, flag discrepancies, and ensure approvals follow pre-defined workflows, eliminating the need for manual checks and reducing human error.

How to Automate Accounts Payable?

You can automate your accounts payable process by following the steps below.

- Assess your current AP process and identify the bottlenecks, sources of error, etc.

- Select one of the above-listed accounts payable software based on your requirements.

- If you are already using accounting or ERP software (QuickBooks, NetSuite etc.), I would suggest that you select an AP software that offers integration with your existing tools. Most of the tools offer a sales demo, and you may check with the sales team before making a purchase.

- Create the AP process automation. Assign approval rights to designated people and customized dashboards as required. The support team of your selected software will assist you with this process.

- Digitize your invoice process. Ensure that your vendors send invoices via email directly to your AP software, or use the vendor portal section on your AP software to upload invoices. Look for an AP tool that has an OCR scanner to capture the details from the invoices without human intervention.

- Add payment methods to your AP platform. Most tools are compatible with wallets, cards, and bank transfers. The support team will be able to help you set up the payment methods.

- Integrate with your accounting and ERP systems for best results. While the accounts payable process can be automated as a standalone process, integrating it with accounting software will ensure automated posting of payments to GL and elimination of human errors.

- Train the team to use the software.

4 Benefits of Using Automated Accounts Payable Tools

AP automation tools save time and reduce costs, while also improving accuracy and providing comprehensive dashboards for better insights. They enhance data accessibility, give you more control over cash flow, and strengthen fraud protection.

The 4 benefits of using cash flow automation have been elaborated upon below.

- Improves Process Efficiency: Automated accounts payable automation tools help manage invoices efficiently and prevent missing any transactions, leading to improved cash flow and business growth. AP departments with automation process 18,649 invoices per full-time equivalent (FTE), compared to 8,689 invoices per FTE in non-automated environments as per research by Institute of Finance and Management. [1].

- Financial Forecasts: Automated AP tools generate smarter data that is not going to come with manual cash flow. It collects data and assists you with the right insights so that you know what is happening in your cash cycle. With the correct insights, you can make smarter decisions for your business.

- Cash Flow Visibility: The accounts payable department is crucial for automated cash flow management in a company. Automation solutions help improve the visibility of accounts and maintain records through accounts payable software.

- Less Processing Fees: Manual cash flow processes can be time-consuming and lead to late payments. Automated accounts payable tools integrate with invoicing software and help speed up invoice processing, and can also save on transaction fees through reward programs. It costs $6.30 per invoice in departments with no automation, compared to $1.45 per invoice in those with end-to-end automation and consistent workflows[1].

References

View Details

What’s next?

I would suggest taking a trial of the above accounts payable software to see what works for your business finance. Further, you can explore the below software to manage your accounting and finance.