I assume crypto staking as fixed-term deposits, but with the added volatility of stocks. It’s a complicated mix that needs thorough understanding before any investment.

And you can’t stake just about every cryptocurrency. Only the ones that support the Proof-of-Stake (PoS) consensus protocol can be staked. Others, like Bitcoin, which have Proof-of-Work (aka crypto mining) for transaction validation, don’t allow crypto staking.

In a nutshell, crypto staking puts your cryptocurrencies in hibernation on an exchange or staking pool to get rewards after the lockup period. However, there are programs that allow flexible term staking as well.

Sounds easy!

But factor in the swinging prices of crypto coins, and you soon get the full picture.

Your staked crypto can plummet to the ground during the staking contract. Or everything can be super positive, with your coin touching the never-imagined peaks, but you can’t sell them because of the staking terms. Taking into account this uncertainty, I suggest reading the following warning carefully before proceeding.

Disclaimer: Crypto staking doesn’t guarantee listed returns. The annual yields or profits (APYs, RPYs, or APRs) mentioned in the subsequent sections only highlight past performance. Besides, one must know of the staking risks upfront. Therefore, stake only what you can afford to lose.

Here’s the list of the best crypto staking platforms.

- 1. Nebeus

- 2. ByBit

- 3. Atomic Wallet

- 4. Bake

- 5. Kraken

- 6. Binance.US

- 7. Coinbase

- 8. Crypto.com

- 9. Stakely

- 10. Rocketpool

- Show less

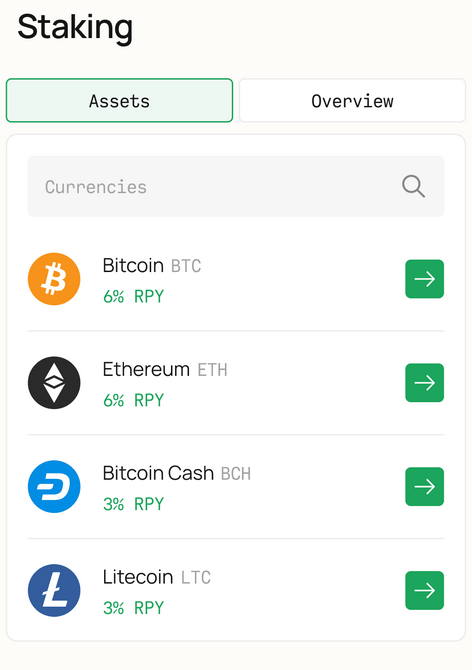

1. Nebeus

Nebeus has two different services to earn on your crypto: staking and renting.

By staking crypto with Nebeus, you can choose to stake 20+ cryptocurrencies to earn up to 7.5% rewards per year (RPY). Moreover, you can unstake anytime with no additional cost or penalties.

The alternative to staking is crypto renting, where Nebeus offers 4 different programs to gain rewards up to 13%. These programs vary in their lock-in periods, RPY, and currency support (renting and payout).

Nebeus’ crypto renting is unique in the sense that you can earn interest on a different crypto than the one rented. So if you plan to buy a new coin, you can avoid conversion fees this way. It pays rewards every 30 days from the start of staking/renting. The best part is the option to cash in fiat (USD, Euro, & GBP).

Nebeus is authorized and registered by the Bank of Spain as a cryptocurrency custodian.

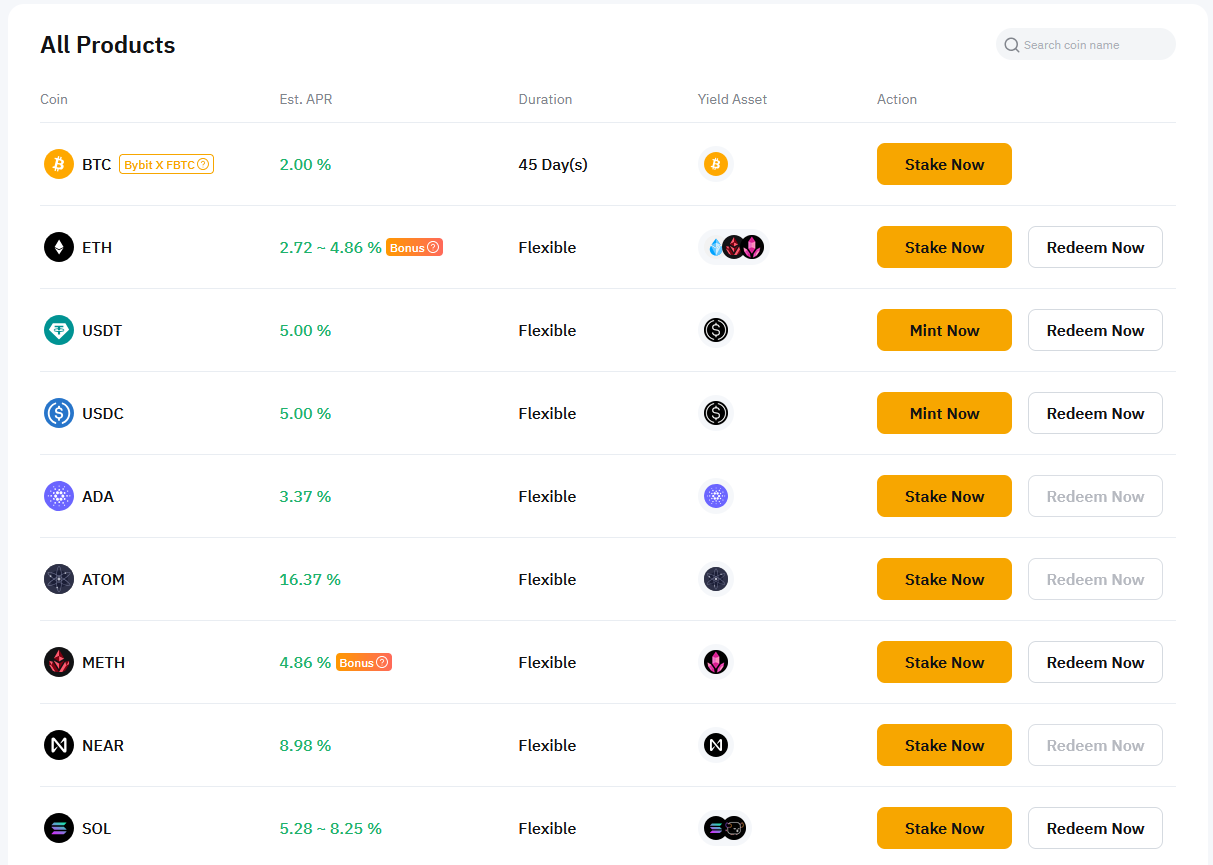

2. ByBit

ByBit has an additional flexible staking to ease investor concerns about locking up their funds. This allows for anytime redemption. Bybit provides a great choice of 200+ cryptocurrencies to stake from.

Flexible term staking comes with daily yields based on real-time 24-hour APR (annual percentage rate) that are automatically deposited into the user’s funding account. Fixed-term staking runs with the purchase APR and matures at the end of the contract.

What’s missing is compound staking, and you will have to reinvest manually for greater earnings. However, its auto-savings functions will auto-reinvest yields, but only if the account has a surplus stake balance.

Regardless, ByBit staking is one of the most flexible offerings in the crypto verse with industry-leading APYs that you should at least take a look at. 👀

3. Atomic Wallet

Atomic Wallet isn’t a typical staking platform but a self-custodial crypto wallet from which you can buy, exchange, and stake without looking outside.

The staking on this crypto platform is simple and starts with setting up the Atomic wallet. Afterward, you can enter the staking section and select the coin of your choice.

As of this writing, there were 25+ coins to pick from with varying minimum staking amounts, ROI (up to 156%), reward frequency, etc.

In addition, there are detailed staking guides for every coin, indicating specifics you should go through before jumping in.

There is no consistent reward payout frequency across the coins. It depends on the blockchain network, and you must check it before investing. The same goes for the locking period, which varies among the coins. Since checking these figures for every cryptocurrency isn’t easy, you can look over this Atomic Wallet staking guide for a quick go-through.

Overall, the ease of staking and 24/7 live support make Atomic Wallet a decent staking destination for beginners and experts alike.

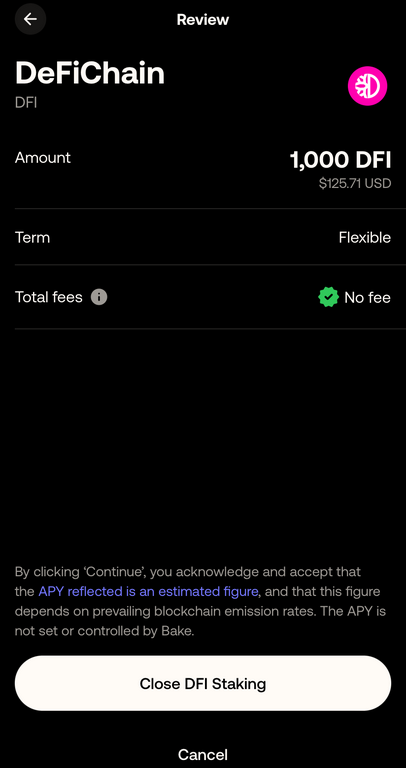

4. Bake

Bake’s (formerly Cake Defi) staking program is crystal clear. The APY mentioned includes all fees and indicates the amount you’ll finally get. Additionally, Bake supports one-click anytime unstaking, without any fees.

However, you can also choose a fixed term (up to 10 years) for better rewards.

Bake has migrated to a unit-based staking system. This converts staked coins into units, and rewards are realized only when a user opts to exit for better tax efficiency.

Bake also has Smart Bundles, which feature rewards auto-compounding to get the highest possible returns. These “bundles” are investment-worthy cryptocurrencies you can buy and sell (for USDC) for lucrative exits.

You can begin staking at Bake without any minimum amount limitations.

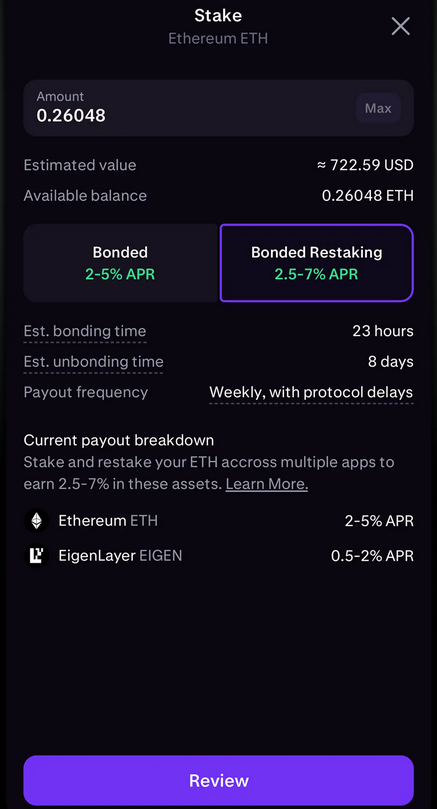

5. Kraken

Kraken offers staking in 24+ cryptocurrencies with up to 19% APY.

The easiest way to do it is to activate auto-earn. This route is free from any lock-in periods, allowing the users to trade or withdraw without any worries.

Another, and a better APY, option is on-chain bonded staking, where you lock crypto for a set duration. However, bonded staking is subject to wait times (3 or more days, based on the coin) for which a user must “wait” before using those unstaked assets again. You can check the unbonding period for different cryptocurrencies on Kraken’s website.

Finally, you can also opt for a more rewarding and riskier option—Ethereum restaking. This is where you allow (via an opt-in) restaking of your ETH to secure dApps (known as Actively Validated Services) built on the Ethereum network. This grants you additional rewards, which are paid in AVS tokens.

Kraken features weekly payouts, irrespective of the staked coin, and you get complete transaction history. You can also stake your rewards to maximize your earnings.

You’ll pay 10-26% commission to Kraken, depending on the coin and the staking type.

Due to regulatory restrictions, citizens of the US can only participate in bonded staking at Kraken via Kraken Pro.

6. Binance.US

Binance.US is the separate arm of the biggest crypto exchange for the citizens of the United States. It offers decent support to 20+ staking coins, including Ethereum, Solana, BNB, Cardano, and Polkadot, where you can earn rewards up to 14.10%.

You can only stake at Binance.US for a fixed period. This scheme has bonding and unbonding periods, applicable before the staking goes live and when you can use the funds again after unstaking, respectively.

Binance.US dispatches staking rewards on a weekly schedule. These rewards are auto-restaked unless a user opts out.

Based on the coin, Binance.US takes up to 30-35% commission from the earned staking rewards.

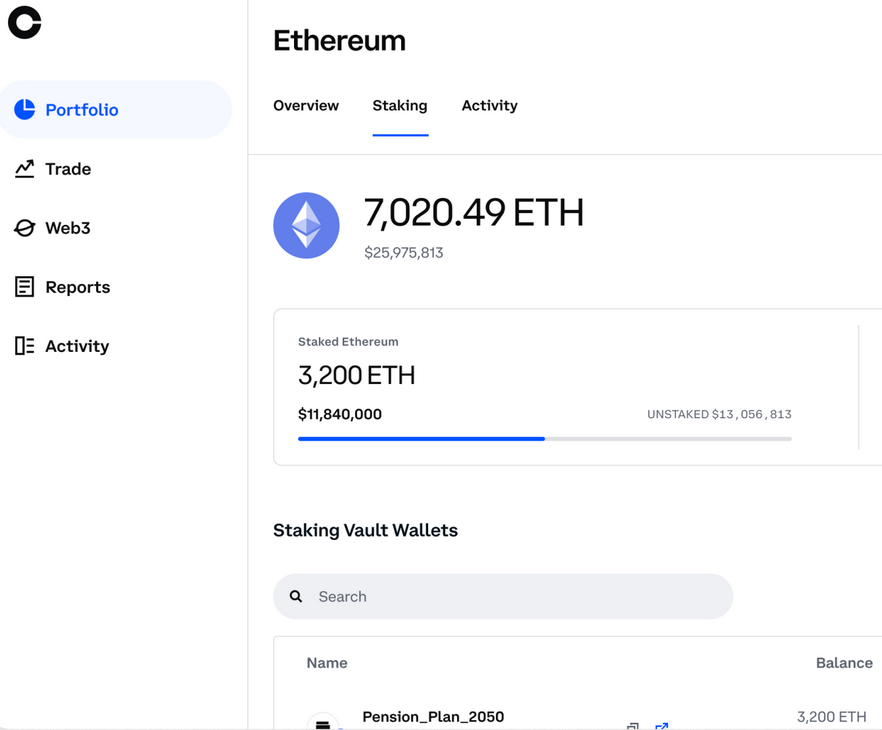

7. Coinbase

Coinbase lets you stake over 130+ assets to earn up to 14% APY. While the APY indeed looks great, you should know that 35% of the Coinbase commission is levied on the rewards earned. That said, there is no staking or unstaking fee.

Still, I would recommend Coinbase for its ease of staking and that it’s the third-largest crypto exchange by trading volume, where you can start staking with as little as $1.

To begin, you can buy staking-supported crypto at their exchange or transfer from any external crypto wallet to your Coinbase account. Subsequently, the staking is available at the specific assets page within your portfolio.

Coinbase lets you unstake at will, but you must keep in mind the bonding and unbonding periods, which can stretch up to weeks.

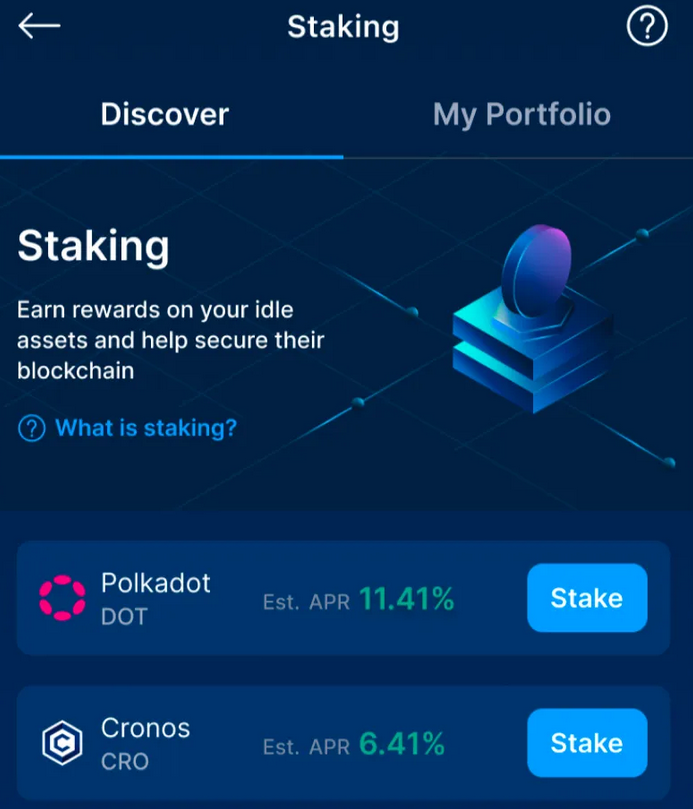

8. Crypto.com

Crypto.com has on-chain and DeFi staking offerings with rewards up to 19.07% APY and 212.10% per annum, respectively.

On-chain staking is the simplest form of staking, where the participants support the underlying blockchain for a fixed or flexible term. DeFi staking, on the other hand, contributes to a specific DeFi project for comparatively longer durations.

On-chain staking is available in 30+ coins. Crypto.com provides flexibility to unstake at one’s convenience. Rewards are distributed up to three times a week.

You can choose a staking period at will and unstake without any penalties. However, one must know about the commission, which varies from 15-35% of the rewards, based on the coin.

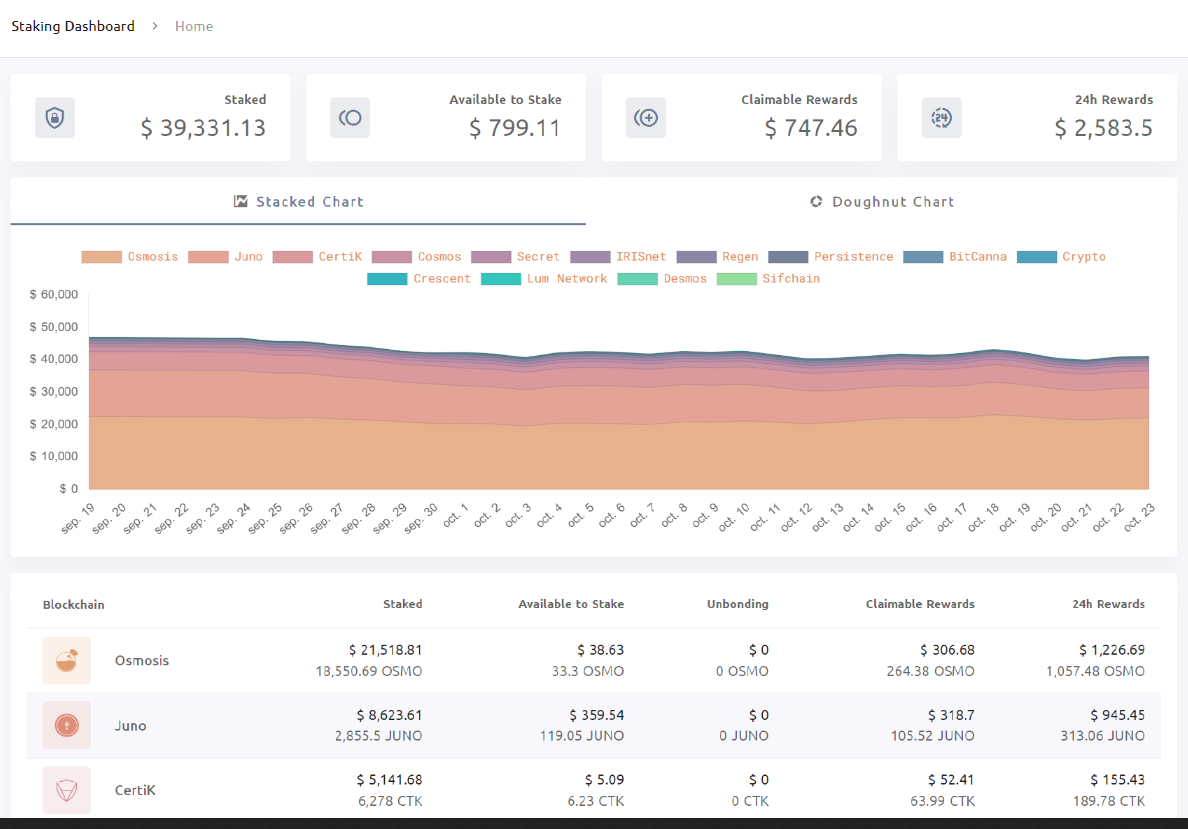

9. Stakely

Stakely lets you stake 30+ cryptocurrencies with APYs up to 33.29%. The best way to begin is to check the individual staking sections for profit estimates, price history, minimum amounts, unbonding periods, and any other terms specific to a coin.

In spite of a good informational dose upfront, I recommend doing your due diligence, as everything depends on the coin you’ll stake. There are no universal protocols for a reward system or minimum staking thresholds.

For instance, Stakely charges 6% commissions for Solona, and the rewards are issued 48 hours after staking. And there is no minimum amount to stake SOL. However, for Kusama, one can claim rewards anytime, minus a 10% Stakely’s cut, with the minimum staking amount being 0.1 KSM. Likewise, it’s different for Ethereum staking, where you can let Stakely manage Ethereum validators on your behalf or join a liquid staking protocol, such as Lido and Stader.

Stakely is ISO 27001, GDPR, and SOC 2 Type II compliant. Besides, it provides slashing insurance as a measure to safeguard user investments.

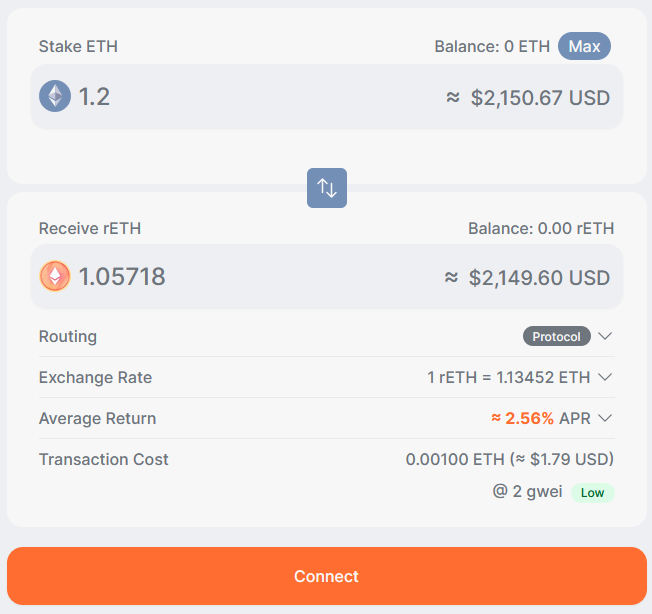

10. Rocketpool

Rocketpool lets you liquid stake or run your own validator node to secure the Ethereum network.

You can liquid stake as low as 0.01 ETH without any lock-in periods. The current 7-day average APR is 2.56%. Rocketpool simply links liquid stakers with node operators without charging any fee. However, node operators charge 14% of rewards for carrying out staking operations.

Alternatively, you can run a validator node for a better 4.31% APR. This constitutes a validator’s own rewards and a 14% reward commission on ETH that a node stakes on behalf of liquid stakers. The best part is you don’t need 32 ETH to run a validator node at Rocketpool; instead, only 8 ETH will do. That said, running a node is technically and financially demanding, and it is not recommended for beginners.

Hourable mentions….

11. Staking Rewards: Find your staking providers across multiple options from a single platform.

12. Polkadot: Native staking platform for DOT

13. AAVE: Native staking platform for AAVE, GHO, and ABPT holders.

14. Polygon: Native staking platform for POL

15. Lido: For liquid staking and running validators to support Ethereum & Polygon.

A Few Pointers Before You Begin

Please note that the mentioned APY is generally awarded in the same coin. So, be extra careful while staking any specific crypto. Because even a seemingly lucrative return won’t mean much if the underlying assets plummet in market value.

In addition, choosing a reputable staking platform is a no-brainer, even at the cost of lesser returns, as you can also be subjected to slashing, which is a penalty dealt by the network upon the validator nodes for malicious behavior or just being offline. And every event of slashing eats away at your staking rewards.

Finally, don’t get fooled by the no-staking fee banners. Instead, compare the APY between different platforms for the subject coin.

Words of Caution…

You have seen many platforms for crypto staking—from liquid staking to “economically” running a validator node yourself. However, owing to crypto volatility, I must remind you again that Don’t Invest More Than You Can Afford To Lose because there are staking risks that can affect your returns.

Besides, stick with popular platforms and don’t get swayed by higher APYs on an unknown staking portal.

And yeah, beginners should absolutely start small before committing big sums.

Explore more on Crypto

-

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.