Crypto trading exchange is an online platform that allows users to buy and sell cryptocurrencies. Crypto trading exchange also offers other advanced features associated with crypto assets, such as staking, mining, or advanced trading.

Crypto trading exchanges work similarly to stock exchanges, but instead of stocks, you can buy crypto assets by paying their market price. Once you complete the purchase, you’ll receive your cryptocurrencies in your exchange’s custodial wallet.

Editor’s Note: Cryptocurrencies are highly volatile, and there is a chance that quick price drops will lead to large losses. Therefore, it’s best to study and understand the risks involved before trading cryptocurrencies. Most importantly, beginners should avoid leverage-based trading as there’s a high probability of losing their entire capital on a single trade.

Below are the best crypto trading exchanges based on user experience, security features, and staking and rewards.

- 1. Coinbase – Best for Beginner Investors

- 2. Uphold – Best to Earn Cashback

- 3. Gemini – Best for Security and Regulation Focus

- 4. eToro – Best for Social Trading

- 5. Crypto.com – Best for Rewards Ecosystem and DeFi Access

- 6. Binance – Trading Bots Included

- 7. Kraken – Best for Margin Trading

- 8. Gate.io – Best for Wide Asset Selection and Startup Tokens

- 9. OKX – Best for Experienced Traders

- 10. KuCoin – Best for Altcoin and Lesser-Known Cryptocurrencies

- 11. Bitstamp – Best for Institutional Traders

- 12. Bitfinex – Best for Advanced Order Types

- 13. CEX.IO – Offer to Buy from Credit/Debit Card

- Show less

You can trust Geekflare

At Geekflare, trust and transparency are paramount. Our team of experts, with over 185 years of combined experience in business and technology, tests and reviews software, ensuring our ratings and awards are unbiased and reliable. Learn how we test.

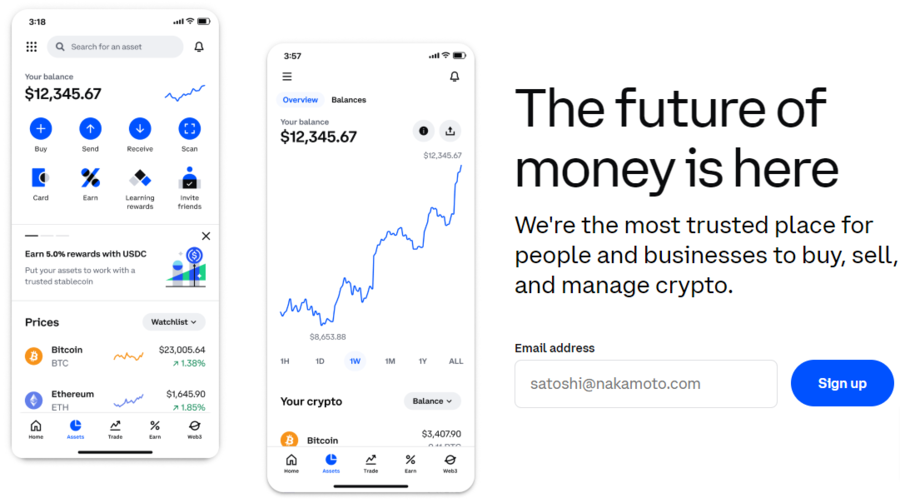

1. Coinbase

Best for Beginner Investors

Coinbase is one of the largest crypto exchanges in the world, and it is best for beginners to buy, sell, and store crypto investments and NFTs. In addition, this exchange is accessible to users from over 100 countries and offers spot, derivatives, and margin trading features.

You can use Coinbase to trade around 250 crypto assets, including Bitcoin (BTC) and Ethereum (ETH). Moreover, you can stake over 120 assets in this exchange and earn staking rewards in return.

Coinbase became a publicly listed company in 2021, and that ensures transparency by publishing quarterly financial statements. In addition, this company uses state-of-the-art security and encryption methods to protect their user’s assets.

Coinbase Pros

User-friendly interface.

Supports 400 active trading pairs.

Coinbase Cons

Has control of your wallet’s private keys.

Poor customer ratings on Trustpilot.

Coinbase Pricing

Coinbase offers free account creation, but you need to pay trading fees based on the maker-taker fee model. Orders that provide liquidity are charged a maker fee. On the other hand, orders that take liquidity are charged a taker fee.

- Maker Fee: 0% to 0.40%

- Taker Fee: 0.05% to 0.60%

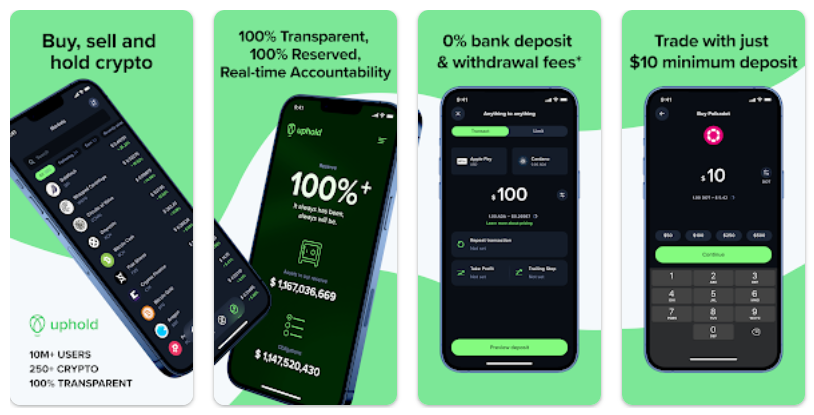

2. Uphold

Best to Earn Cashback

Uphold is a multi-asset crypto trading exchange launched in 2015 that supports services for over 260 cryptocurrencies. You can also use this platform to stake up to 20 cryptocurrencies, such as Solana (SOL), Cardano (ADA), or Avalanche (AVAX), to earn weekly staking rewards.

Seasoned investors and traders can use Uphold to spot trade cryptocurrencies using crypto wallets or bank cards. Moreover, this platform offers cashback on every card purchase.

Uphold offers complete transparency to its users. It reserves 100% of its crypto assets, and its details are updated on its website in real time. The platform also conducts 24/7 security monitoring to detect and fix potential threats.

Uphold Pros

Provides its crypto services to over 180 countries.

Availability of one-step trading.

They reserve 100% of their user’s funds.

Uphold Cons

Limited advanced trading tools.

Crypto staking services are not available in Europe, the U.S., Canada, etc.

Uphold Pricing

The trading fees charged on Uphold vary based on the crypto assets:

- Most Stablecoins: 0.25%

- BTC, ETH: 1.4% to 1.6%

- Other Altcoins: 1.9% to 2.95%

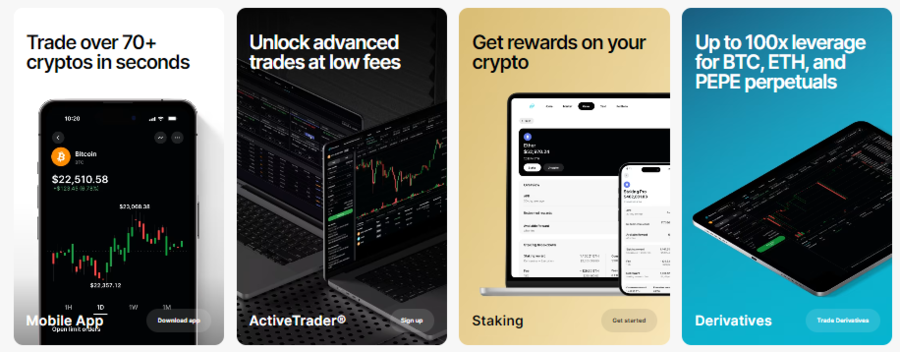

3. Gemini

Best for Security and Regulation Focus

Gemini is a SOC-certified crypto trading exchange that is regulated across various jurisdictions. In addition, traders can use these tools to choose to trade on 300+ trading pairs across 70 cryptocurrencies.

You can use Gemini to trade on crypto spots and derivatives with up to 100x leverage. When it comes to staking, you can stake Solana(SOL), Ether (ETH), and Polygon (MATIC) tokens without any minimum staking amount.

This exchange offers multi-signature features, which require more than two digital signatures to restrict unauthorized fund access or transfer from your wallet. Gemini also stores its users’ private keys at high-security data centers to avoid possible crypto wallet hacks or attacks.

Gemini Pros

Smooth trading interface.

Easy account creation process.

Crypto rewards on Gemini Credit Card purchases.

Gemini Cons

Gemini derivative trading is unavailable in the USA, UK, and The European Union (EU).

Staking is not available in the UK.

US-based users can’t stake their Solana (SOL) tokens.

Gemini Pricing

- Maker Fee: 0% to 0.20%

- Taker Fee: 0.03% to 0.40%

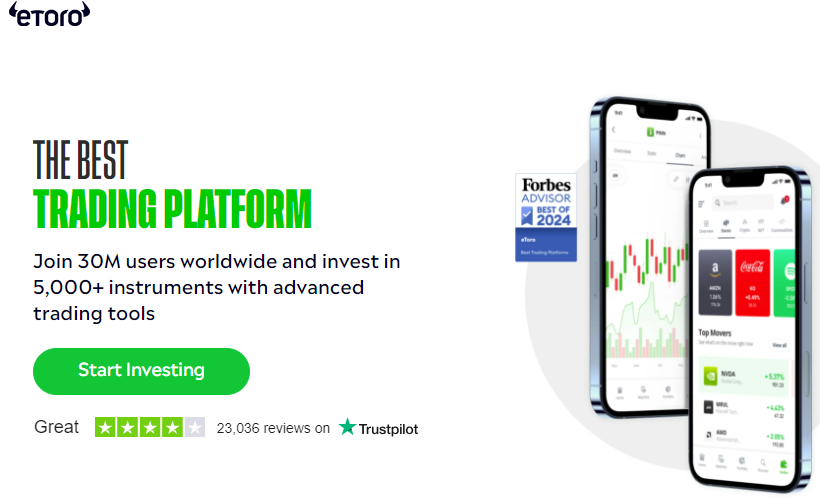

4. eToro

Best for Social Trading

eToro offers crypto trading for over 100 cryptocurrencies and has gained over 30 million users since its launch in 2007. In addition, you can stake your Cardano (ADA) and Tron (TRX) tokens to gain rewards.

Traders can choose spots or derivatives according to their trading style. Moreover, traders can opt for their inbuilt social copy trading features to follow the strategies of expert traders on the eToro platform.

eToro stores its users’ assets in a segregated account and provides a 2FA feature to enhance user security. In addition, this exchange operates according to ASIC, cySEC, and FCA regulations to protect the crypto assets of investors and traders.

eToro Pros

Users receive a $100K demo trading account.

Advanced trading and chart analysis tools.

eToro Cons

Unavailable in U.S. states such as New York, Nevada, and Hawaii.

All withdrawal requests are charged with a $5 fee.

eToro Pricing

eToro charges a flat 1% fee for trading cryptocurrencies.

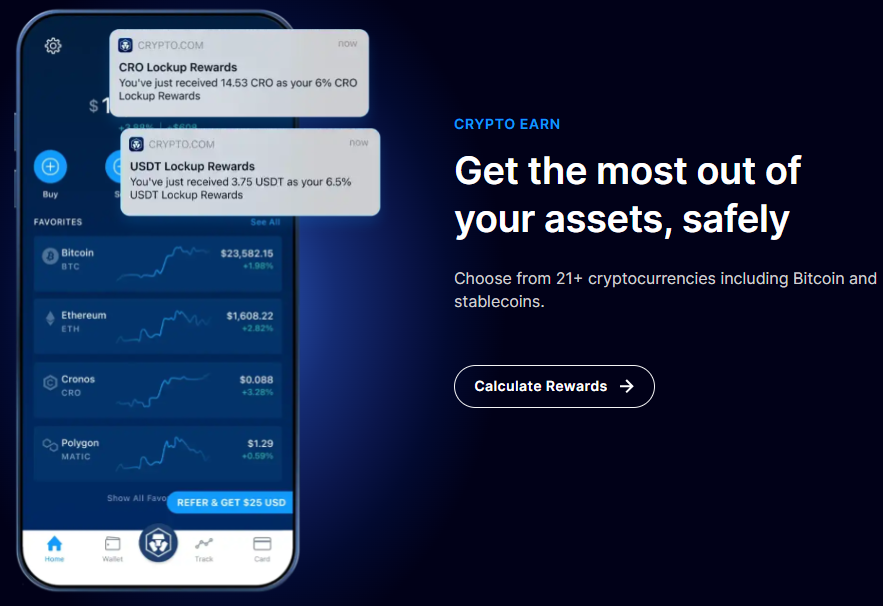

5. Crypto.com

Best for Rewards Ecosystem and DeFi Access

Crypto.com is an all-in-one crypto platform that supports spot, margin, and derivatives trading for beginners and experts. On its advanced trading platform, you can also trade over 350 cryptocurrencies, including Bitcoin(BTC) and Ethereum (ETH).

You can also use Crypto.com to stake almost 20 cryptocurrencies for staking rewards. Not just that, Crypto.com offers a loyalty program to reward its community. It provides crypto wallets for mobile devices, web browsers, and desktops to access various DeFi platforms.

You can use Multi-Factor Authentication (MFA) to protect your assets using various methods, such as biometrics, password, phone, email, or authenticator verification. Moreover, Crypto.com follows the highest-level certification for cybersecurity and privacy framework with regular smart contract audits to ensure foolproof protection.

Crypto.com Pros

Offers 5% back on spending made using Crypto.com Visa cards.

The platform is secured with multiple certifications, including the Singapore Data Protection Trust Mark.

Uses a high-speed matching engine to execute orders.

Crypto.com Cons

Customer support is limited to chats.

Crypto.com Visa card service is not available for U.S. Territories.

Crypto.com Pricing

- Maker Fee: 0% to 0.075%

- Taker Fee: 0.050% to 0.075%

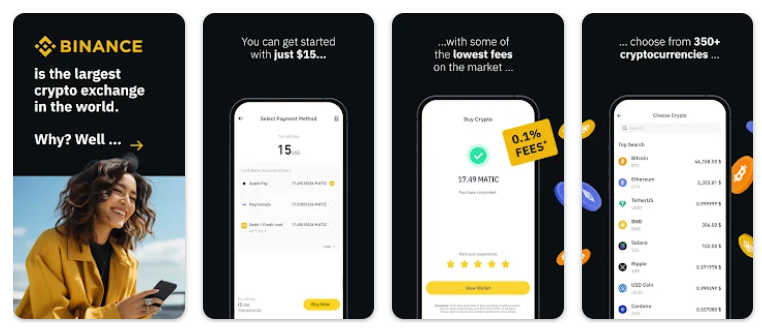

6. Binance

Trading Bots Included

Binance is one of the most popular cryptocurrency exchanges, offering traders spot, derivatives, and margin trading features. In addition, you can use trading bots to place automated strategies and conduct copy trading.

This exchange has a good reputation in the crypto space and supports the trading of 350+ cryptocurrencies, offering quick trade execution on popular trading pairs. Additionally, you can use their platform to stake your cryptocurrencies in exchange for weekly token rewards.

Binance stores most users’ crypto assets in offline facilities, with a real-time monitoring system that detects unusual activities and suspends withdrawals for at least 24 hours. You can also opt-in for security features like API access control and allow transactions only to selected wallet addresses to prevent unauthorized crypto transfers.

Binance Pros

24/7 customer support is available in 40 languages.

Low trading fees for crypto purchases.

P2P trading option.

Binance Cons

Complex trading platform for beginners.

Facing regulatory issues in several countries, including the U.S.

Binance Pricing

- Maker Fee: 0.0120% to 0.1%

- Taker Fee: 0.0240% and 0.1%

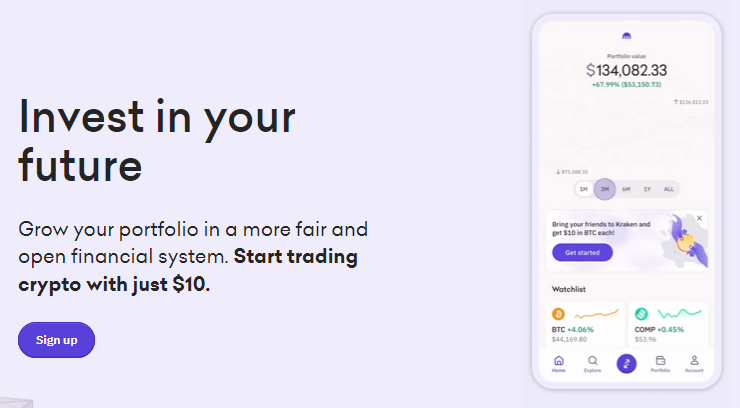

7. Kraken

Best for Margin Trading

Kraken is a popular crypto trading exchange among traders for its user-friendly interface that provides trading features for over 200 cryptocurrencies. Users from over 190 countries can also stake 15+ assets to receive their staking rewards.

Most importantly, it’s best for crypto traders to start their spot, margin, and futures trading journey with Kraken at just $10. Moreover, Kraken Pro, a dedicated trading platform, is also provided to experienced traders for more advanced crypto analysis.

Kraken’s security management system is certified by international security standards like ISO/IEC 27001:2013. In addition, high-priority email and live chat support are available to address users’ urgent security concerns.

Kraken Pros

Good customer care support system.

High trading liquidity for crypto investors and traders.

Supported over 190 countries.

Kraken Cons

Staking is unavailable for U.S. residents.

U.S. users can’t trade in futures.

Margin trading is restricted for Canadian users.

Kraken Pricing

- Maker Fee: 0% to 0.25%

- Taker Fee: 0.10% and 0.40%

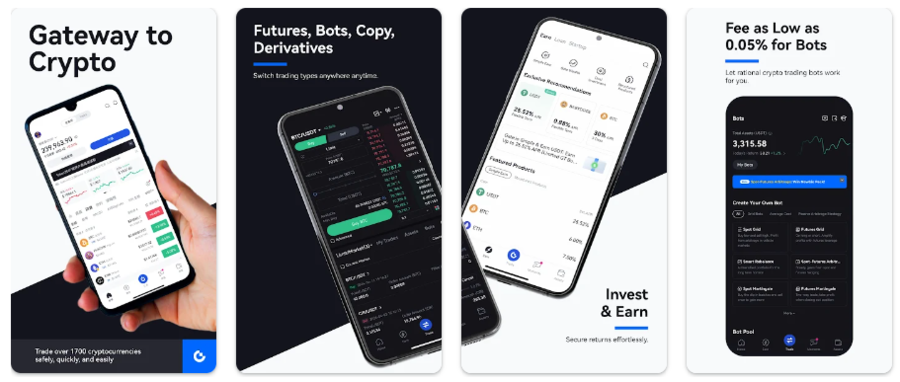

8. Gate.io

Best for Wide Asset Selection and Startup Tokens

With over 1,700 cryptocurrencies listed, Gate.io is an ideal crypto trading exchange for traders who trade on many crypto assets and startup’s native tokens. Likewise, you can use this platform to perform spot, derivative, and margin-based trades.

Additionally, you can use their crypto trading bots and copy trading features. Gate.io also provides cloud mining and crypto staking features to reward their users.

Gate.io’s self-developed trading system is consistently audited to maintain a high level of security and ensure the safety of traders’ assets. Moreover, the Web Application Firewall (WAF) protection system is implemented to handle data tampering, vulnerabilities, and illegal instructions on their trading platform.

Gate.io Pros

Advanced trading tools and charting options.

Block trading availability to execute large transactions at once.

Supports around 100 fiat currencies and over 300 other payment methods, including bank transfers.

Gate.io Cons

Complex trading interface for beginners.

It is not supported in many countries, such as Ireland, Italy, and New Zealand.

Gate.io Pricing

- Maker Fee: 0.055% to 0.2%

- Taker Fee: 0.065% to 0.2%

9. OKX

Best for Experienced Traders

OKX is a leading crypto trading exchange that provides its services and support in over 100 countries. Their major services also include spot, options, P2P, perpetual futures, margin trading, lending, and mining services.

OKX is best for high-volume traders to trade over 350 cryptocurrencies with a wide range of trading pairs. Moreover, you can opt for flexible staking for over 30 crypto tokens and receive daily rewards.

This exchange has a dedicated ‘OKX Risk Shield’ that allocates asset reserve funds to safeguard user’s funds against security risks. Additionally, the user’s private keys are encrypted and stored on an offline computer with the help of Advanced Encryption Standard (AES).

OKX Pros

User-friendly trading interface.

Leverage up to 100x for futures.

Advanced trading data availability.

OKX Cons

Unavailable for users in the U.S., Canada, India etc.

Poor customer reviews on Trustpilot.

OKX Pricing

- Maker Fee: 0.060% to 0.080%

- Taker Fee: 0.060% to 0.1%

10. KuCoin

Best for Altcoin and Lesser-Known Cryptocurrencies

KuCoin is a centralized exchange that offers users over 700 crypto assets, including Bitcoin(BTC), altcoins, and other lesser-known cryptocurrencies. Along with trading, you can also use this platform to explore the staking options for around 40 cryptocurrencies without any lock-in period.

KuCoin offers features such as spot, margin, and derivative trading with a maximum leverage of up to 125x on futures. In addition, they provide Halo Wallet, a self-custody wallet to store, swap, and stake-supported crypto holdings.

When it comes to security, KuCoin protects users’ assets with continuous wallet address monitoring and taking action against suspicious behavior alerts. In addition, they conduct rigorous security architecture reviews, penetration testing, and code audits to avoid possible vulnerabilities in the system.

KuCoin Pros

Advanced trading platform with charts and trading tools.

Availability of 1,300 trading pairs.

Supports over 70 payment methods.

KuCoin Cons

Not suitable for new traders.

Restricted in the U.S., Malaysia, and more.

KuCoin Pricing

- Maker Fee: -0.005% to 0.1%, Maker Fee: -0.005% to 0.1%

- Taker Fee: 0.025% to 0.1%

11. Bitstamp

Best for Institutional Traders

Launched in 2011, Bitstamp is an exchange that offers its trading services to retail and institutional traders alike. Its ‘Pro’ platform offers advanced tools and charts for expert traders, along with live customer support.

This exchange allows spot trading on around 100 crypto assets, including top cryptocurrencies. In addition, Bitstamp helps you stake Ethereum (ETH), Cardano (ADA), and Algorand (ALGO) to earn rewards without any lock-in period.

Bitstamp also offers institutional-grade security to encrypt your data while protecting your privacy. Most importantly, 95% of their crypto assets are stored offline to safeguard their user’s assets from potential online attacks.

Pros

Low fees for stablecoin trading pairs like PYUSD/USD, USDC/USDT, etc.

User-friendly trading interface.

Dedicated platform for professional and institutional traders.

Cons

Only three crypto assets are available for staking.

No margin trading features.

Bitstamp Pricing

- Maker Fee: 0% to 0.30%

- Taker Fee: 0.006% to 0.40%

12. Bitfinex

Best for Advanced Order Types

Bitfinex is one of the earliest crypto trading exchanges, founded in 2012 for retail and professional users. In addition, this platform is best for advanced order types for trading over 200 crypto tokens, including spot and derivatives.

Bitfinex also supports the staking of 10 digital currencies, including Ethereum (ETH), Polkadot (DOT), and Tron (TRX). For new traders, Bitfinex also provides paper trading options to test trading strategies without depositing real funds.

Security audits are conducted annually to ensure that all safety measures on Bitfinex’s trading platform are in ideal condition. Moreover, this platform offers advanced verification tools to its web and mobile device users for added security protection.

Bitfinex Pros

Provides tools to create multiple trading orders at a time.

Low transaction fees.

Demo account availability.

Bitfinex Cons

Limited customer support.

Unavailable for users in the USA, Canada, Spain, etc.

Bitfinex Pricing

- Maker Fee: 0% to 0.1%

- Taker Fee: 0.055% to 0.2%

13. CEX.IO

Offer to Buy from Credit/Debit Card

CEX.IO is a centralized crypto trading exchange that allows you to trade over 200 crypto assets using a credit or debit card. In addition, you can stake over ten cryptocurrencies on this platform to earn rewards.

CEX.IO provides spot trading options with advanced trading instruments and charting tools for traders. Moreover, this platform provides crypto APIs for advanced traders.

The majority of the user’s crypto assets are stored in cold wallets to avoid online security exploitation. Furthermore, CEX.IO has incorporated a self-regulated reserve fund as a part of the platform’s risk management system to help recover users’ assets in adverse situations.

Pros

Smooth user-interface.

Trading pairs availability with high trading volumes.

Cons

Only email-based customer support is available.

High minimum daily deposit/withdrawal limit for U.S. residents.

CEX.IO Pricing

- Maker Fee: 0% to 0.15%

- Taker Fee: 0.01% to 0.25%

Crypto Trading Exchange Comparison Table

| Crypto Trading Exchange | Fees Range | Mobile App | No. of Cryptos Supported | Instant Account Creation |

|---|---|---|---|---|

| Coinbase | 0% to 0.60% | Yes | ~250 | Yes |

| Uphold | 0.25% to 2.95% | Yes | 260+ | Yes |

| Gemini | 0% to 0.40% | Yes | 70+ | Yes |

| eToro | 1% | Yes | 100+ | Yes |

| Crypto.com | 0% to 0.0750% | Yes | 350+ | Yes |

| Binance | 0.012% to 0.1% | Yes | 350+ | Yes |

| Kraken | 0% to 0.40% | Yes | 200+ | Yes |

| Gate.io | 0.055% to 0.2% | Yes | 1,700+ | Yes |

| OKX | 0.060% to 0.1% | Yes | 350+ | Yes |

| KuCoin | -0.005% to 0.1% | Yes | 700+ | Yes |

| Bitstamp | 0% to 0.40% | Yes | ~100 | Yes |

| Bitfinex | 0% to 0.20% | Yes | 200+ | Yes |

| CEX.IO | 0% to 0.25% | Yes | 200+ | Yes |

How Does a Cryptocurrency Exchange Work?

A cryptocurrency exchange operates as an intermediary between a crypto buyer and a seller. All orders placed by sellers and buyers are sorted by price on the order book.

When a buyer matches the seller at the same price, the order is placed, and the cryptocurrency is transferred from the seller to the buyer. Millions of such trades are automated within the exchange in real time.

How Does a Cryptocurrency Exchange Make Money?

A cryptocurrency exchange makes money by charging a fee on every trade. The main fees charged to a user include a maker fee, taker fee, deposit fee, and withdrawal fee.

How to Choose a Crypto Exchange?

When choosing a crypto trading exchange, these are the 5 factors to consider:

- Security Features: Crypto exchange platforms have witnessed numerous hacks and attacks, including the security breach of Bitmart exchange, which led to a $200 million loss. For this reason, it’s one of the important financial decisions to choose exchanges that follow high-end security standards. You can also choose exchanges that offer additional protection methods, like two-factor authentication. Also, check if the exchange’s app supports biometric logins.

- Supported Crypto Assets: There are thousands of cryptocurrencies, and you can’t find all of them in a single exchange. For this reason, always check the availability of your favorite crypto assets with the exchange. You can choose exchanges that support at least 100 crypto assets to avoid switching among multiple exchanges.

- Trading Fees: You need to pay fees for almost every exchange-related activity, including trading. The charged fee percentage might seem low, but it can eat up your profits if you’re placing numerous trades. The best method is to compare the fees of the best crypto trading platforms and pick the one that is most beneficial for your trading style. Suppose you’re a crypto margin trader; choose an exchange with the lowest margin trading fees.

- Customer Service: Choosing an exchange with good customer support can help when something goes wrong. There always exists a possibility for technical glitches on crypto exchanges that a customer care member can solve. Moreover, timely problem-solving helps you to focus on your next trading. It’s better to opt for crypto exchanges that offer multiple 24/7 support options like email, chat, and call.

- Jurisdiction: The government regulations associated with the crypto exchange restrict its operations in various states and countries. Sometimes, certain trading activities, such as futures trading, are restricted to citizens from certain regions. Ensure your preferred exchange is available in your area and complies with the jurisdictional requirements. You can easily find the list of unsupported countries on the exchange’s website.

What’s the Difference Between a Crypto Exchange and a Crypto Brokerage?

A crypto brokerage consists of an individual or a firm that acts as a middleman between the buyers and sellers of crypto assets. Moreover, these brokerages provide a user-friendly interface for those who prefer a simple trading experience.

On the other hand, a crypto exchange is a more complex platform that offers trading between a buyer and a seller. Moreover, these exchanges provide advanced trading features suitable for expert traders.

Frequently Asked Questions (FAQs)

The cost required to trade a cryptocurrency varies based on exchanges, their trading and other fees. The trading fees for the platforms listed above can range from 0% to 1% of the trade amount. For example, if you trade a cryptocurrency worth $1,000 trade amount and the exchange charges 0.1% fees, then you have to pay $1 as the trading fees.

The trading interface of the stock and crypto markets may look similar, but there are major differences, such as:

1. Trading Hours: Stock markets have limited trading hours and are closed on weekends and public holidays. On the other hand, crypto markets operate 24/7, allowing you to trade at any time.

2. Underlying Assets: Stock markets support the trading of shares, ETFs, and other financial products. In contrast, crypto markets facilitate the trading of crypto assets such as utility tokens, stablecoins, and more.

3. Volatility: Crypto assets are highly volatile compared to the stocks. For example, negative market sentiments can lead to a significant price drop for crypto assets within minutes.

Crypto exchanges are not completely safe as there always exists a possibility for hacks and cyber theft. In addition, multiple crypto firms have filed for bankruptcy in the last few years. For example, black swan events like the collapse of exchanges like FTX had led to the loss of millions of user’s assets.

Crypto exchanges must strictly follow the regulatory framework mandated by government authorities to operate in the US. Moreover, exchanges are regulated and monitored by multi-regulators such as the Securities and Exchange Commission (SEC), Internal Revenue Service (IRS), etc., to prevent money laundering and other illegal activities. These complex procedures restrain crypto exchanges from providing their services in the US.