Fuel prices are making headlines these days, and if you run a small business, you’ve probably felt the pinch. Rising fuel costs can significantly impact your budget and affect your pricing and profits.

Fuel cards can resolve your problem by helping you keep tabs on spending, tracking expenses, and often getting you discounts or cashback at the pump. Moreover, they reduce the chances of misuse and keep things more transparent with built-in controls.

Fuel cards aren’t just for big companies — they can make life easier for freelancers and small logistics teams. They let you manage a large fleet and stay on top of your fuel expenses by cutting costs, and saving time. Below, I have listed of the best fuel cards that small businesses can use.

I will now discuss the features and benefits of these fuel cards in detail.

1. WEX Fuel Cards

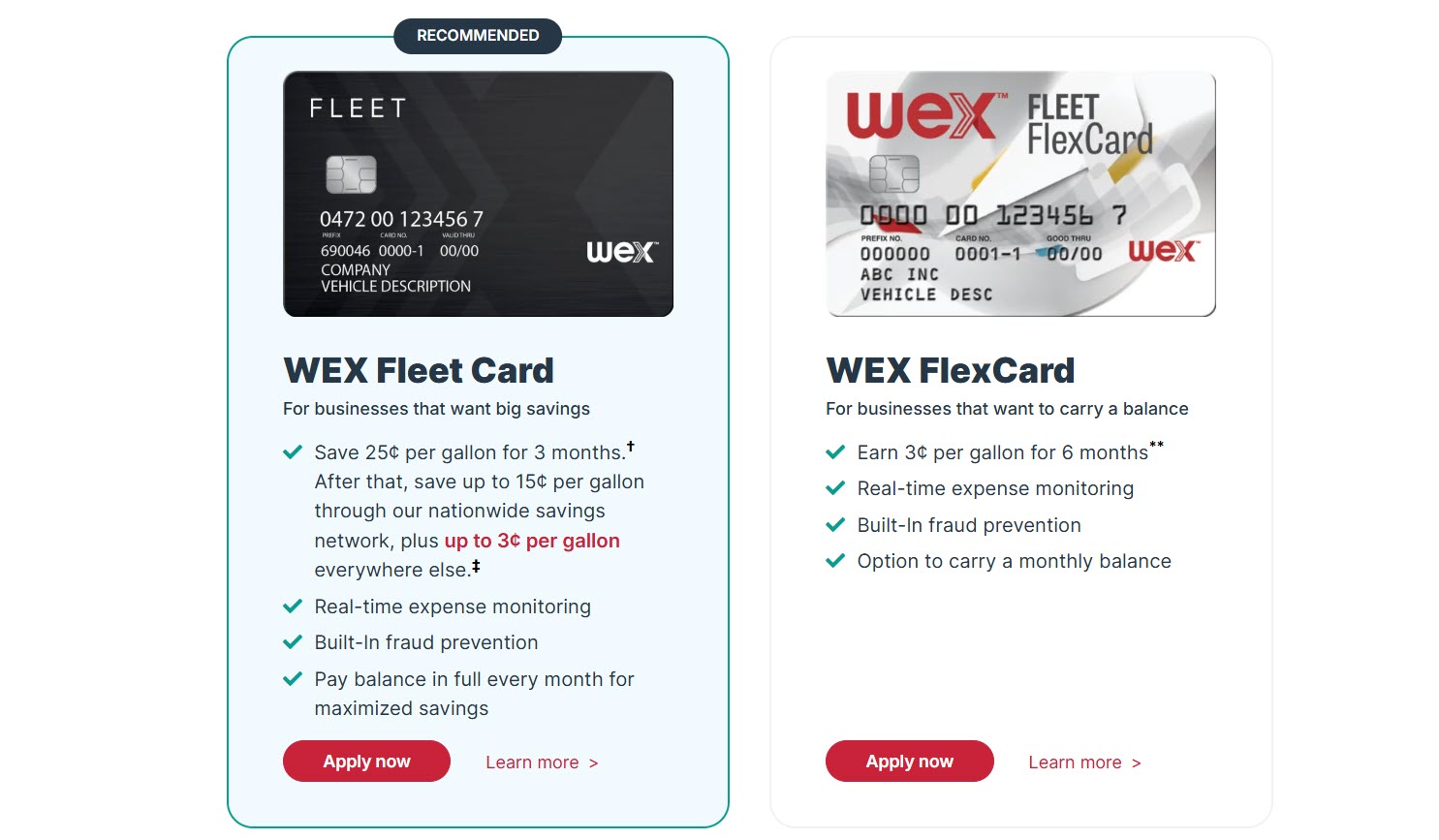

WEX Fleet Card is built to make life easier for businesses of all sizes by giving you solid control over fuel spending and real-time insights. Since it’s accepted at over 95% of gas stations across the country, your drivers won’t have to go out of their way to fill up.

You can set spending limits, restrict purchases, and decide what your team can spend on — fuel, maintenance, or other essentials. Its detailed reporting tools offer a clear view of spending habits.

This card syncs nicely with most fleet management software. It means you can track fuel use right alongside vehicle performance. You’ll get solid security features, including PIN protection and alerts for any unusual activity, as well as the option to receive real-time transaction notifications.

If you’re trying to simplify day-to-day operations, the WEX Fleet Card can help you with fuel discounts and access to a wide network of service stations. It gives you the flexibility and control you need to keep things running smoothly—and affordably.

2. Coast

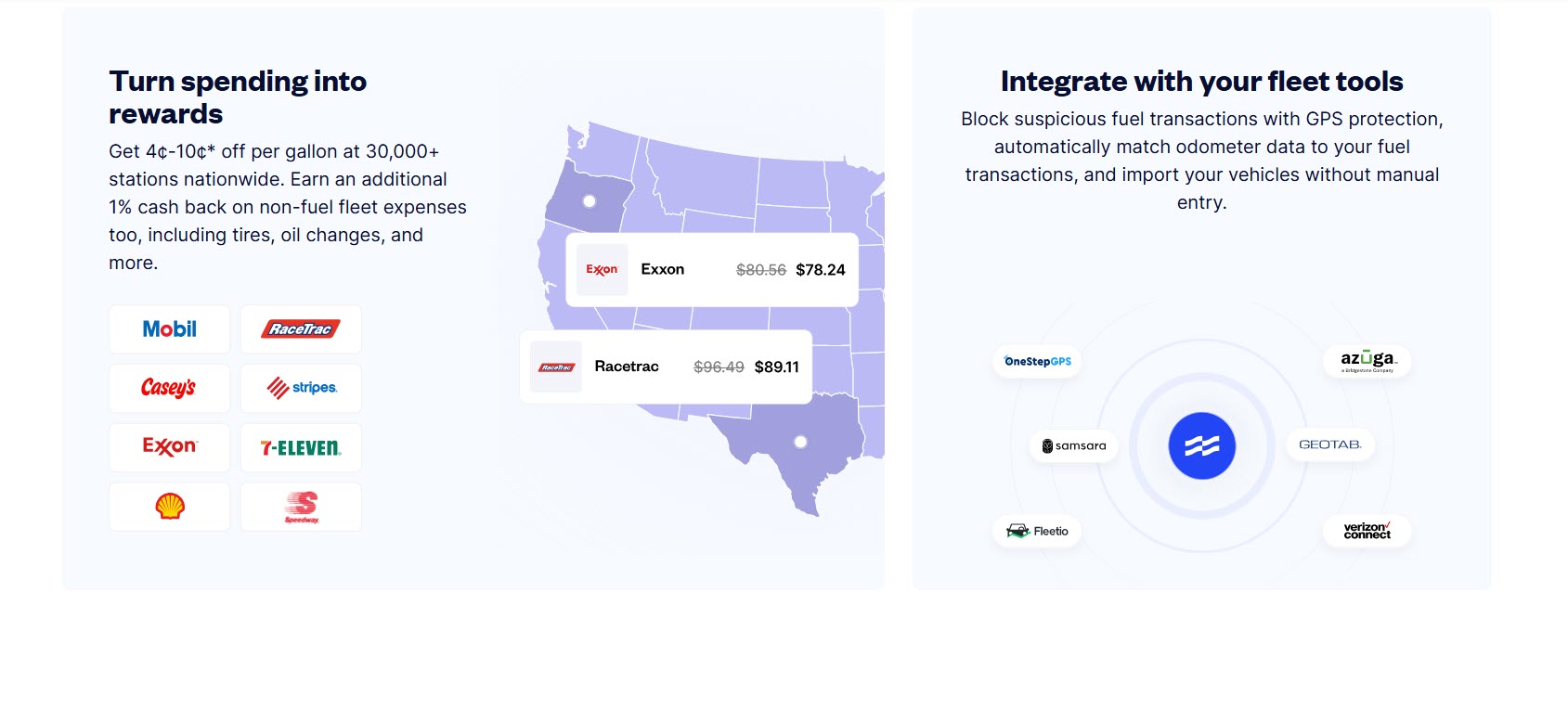

Businesses reported cutting their fleet fuel bill by 10% on average just by switching to Coast, and you can do that too. Accepted at 30,000+ stations nationwide, this card lets you save 4 cents to 10 cents per gallon on fuel cost.

Use it everywhere that supports Visa cards so that your team can go to the closest and most cost-effective station. On top of that, you get 1% cashback on non-fuel purchases like oil changes, new tires, and repairs.

Security is a big deal with Coast, and that’s why you can set your own spending limits, block certain types of purchases, and get real-time alerts. It even comes with a fraud guarantee that protects you against unauthorized charges for up to $25,000 a year.

If you use fleet tracking software, the Coast card fits right in. It can automatically match fuel purchases with odometer readings, import vehicle data without manual entry, and even offer GPS tracking. All these let you keep accurate records without the extra work.

Managing cards is simple, too, as you can create new cards on the fly, assign them to drivers or vehicles, and set custom rules for limiting purchases to specific locations or flagging unusually large fuel-ups. With real-time tracking and detailed reports, you’ll spot issues quickly and keep spending under control.

3. AtoB

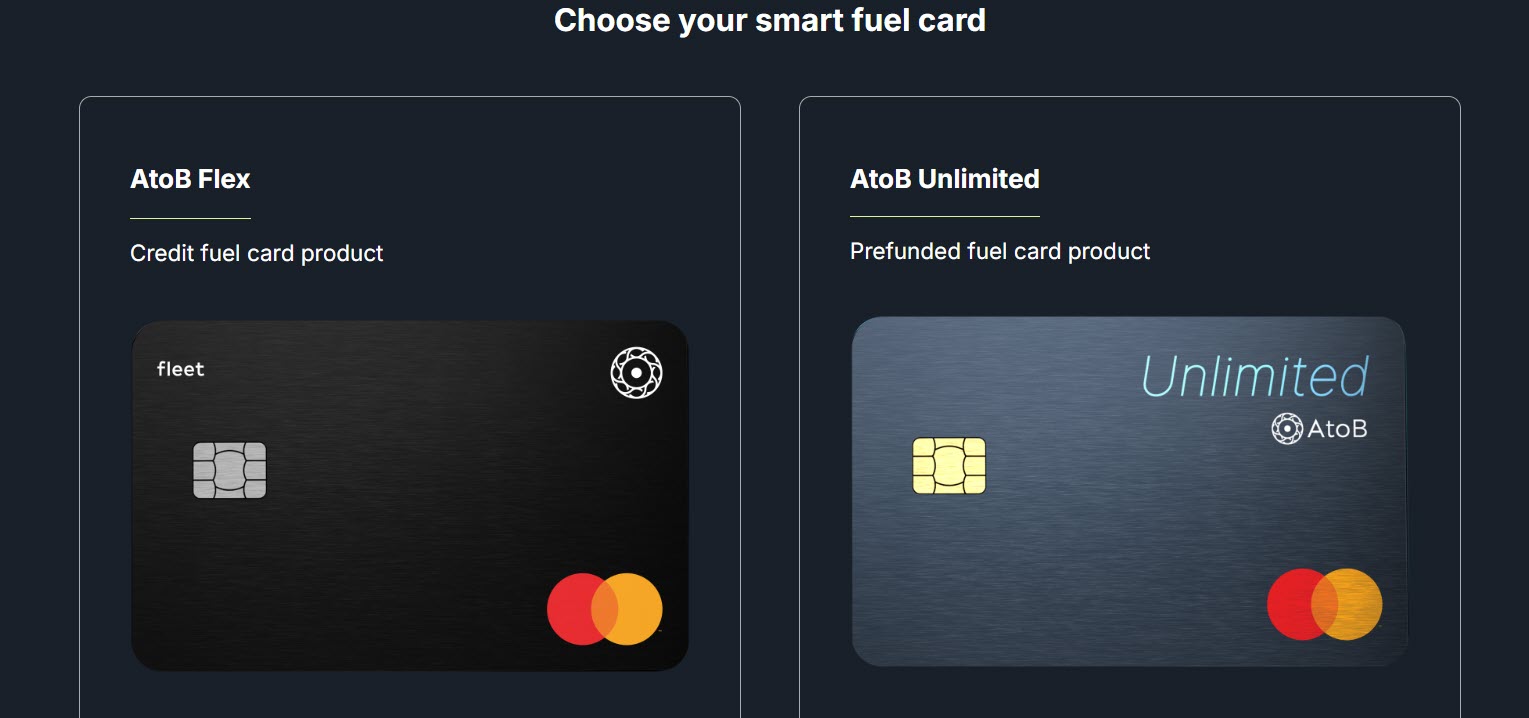

The AtoB fuel card helps businesses save money and stay in control of fuel expenses. It offers strong security, such as blocking charges made outside a vehicle’s location or beyond its tank size, and tracking fuel levels in real time to prevent misuse.

Your drivers can find the cheapest stations using the AtoB app’s Fuel Map, as the card works anywhere Mastercard is accepted. You can also pay for maintenance or car washes with the same card.

You can easily set spending limits, block merchants, or disable cards. AtoB also supports IFTA, accounting, and integrates with fuel and fleet management systems. It sends real-time alerts and custom reports to keep things transparent.

On AtoB, you get two cards; AtoB Flex offers fuel on credit, while AtoB Unlimited is a pre-funded fuel card. Both give you an average discount of 45 cents and up to $2 off per gallon of fuel.

4. Fuelman

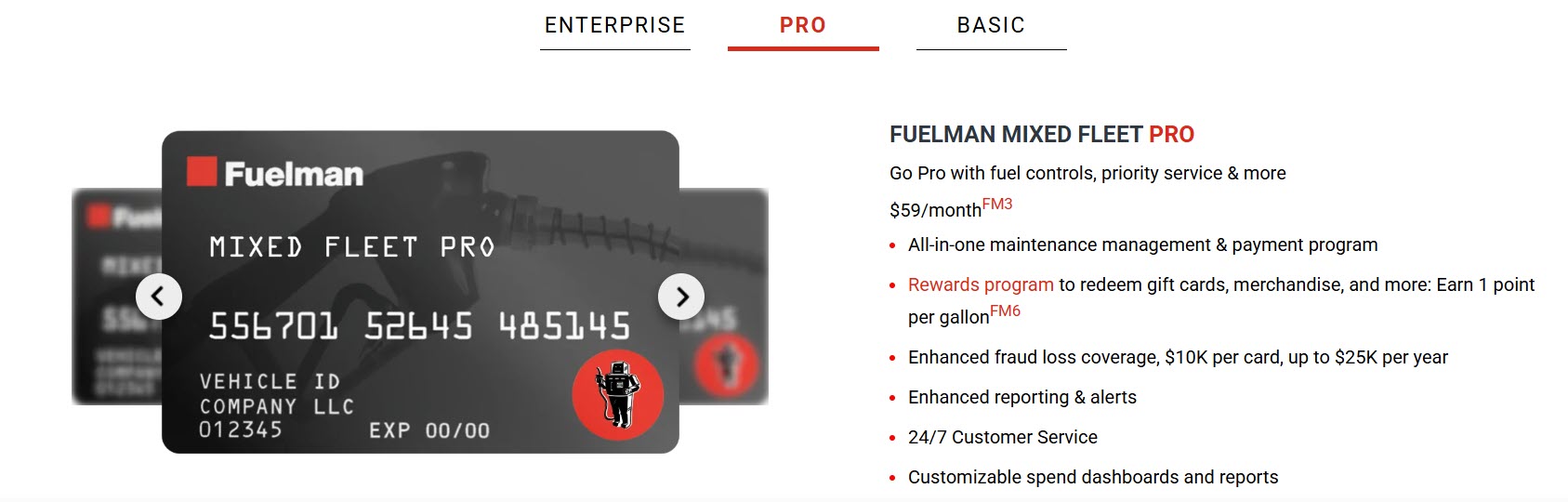

Fuelman has three fuel cards for businesses: the first one is the Fuelman Mixed Fleet Card, which saves 8 cents on every gallon of diesel or unleaded fuel at the 40,000+ fueling locations of its network.

Fuelman Diesel Fleet Card is designed for deep fuel rebates up to 12 cents on every gallon of diesel at the 40,000+ fueling locations. The last one is the Fuelman Mastercard, which helps you save 3 cents per gallon on unleaded and diesel fuel and gets accepted everywhere in the US where the Mastercard is accepted.

Beyond rebates, Fuelman allows you to view detailed expense data by driver and by vehicle, making it easier to analyze usage patterns. It also includes tax reporting features, which help save time and reduce manual effort during audits or filing.

Fuelman’s cost control tools prevent misuse as you can set up driver profiles, apply custom fuel purchase restrictions, and receive real-time alerts to catch any unauthorized activity immediately. Moreover, its maintenance manager feature lets you oversee all vehicle maintenance needs directly through your Fuelman account.

5. Comdata

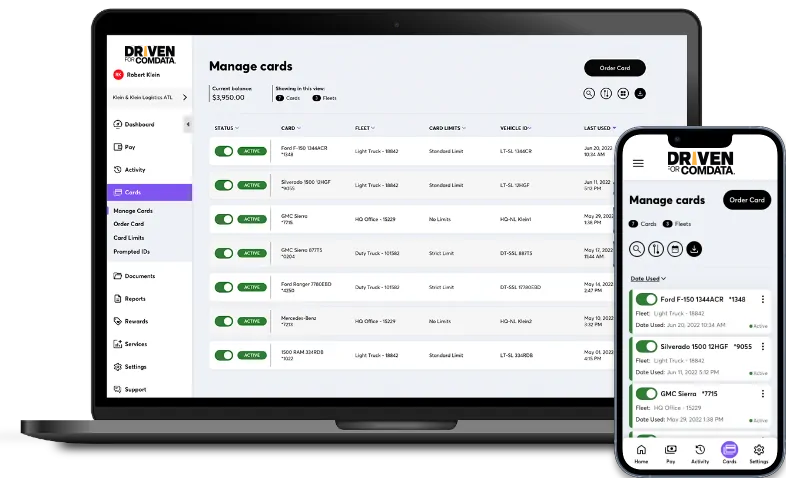

With Comdata, you can get either of its two offerings: Comdata Fleet Card and Comdata Connect Card. The first one requires a credit check and helps you build your credit. It also supports ACH for regular invoice payment. The second card does not need any credit check, but it does not offer any credit line either. You can pay using credit or debit cards without any late fees.

These cards offer discounts at the pump where you can pay the cash price and enjoy up to an additional $0.40 off per gallon at TA/Petro, plus competitive savings at other major fuel stations.

These also come with customizable controls and robust reporting tools where managers can set detailed parameters for spending limits, gallon caps, time-of-day restrictions, etc. Real-time alerts and transaction monitoring make it easy to detect suspicious activity and ensure that purchases are authorized and in line with company policy.

With best-in-class fraud controls, the Comdata Fuel Card helps reduce misuse at the pump while keeping your fuel budget in check. Additionally, 24/7 customer support ensures that issues are addressed quickly.

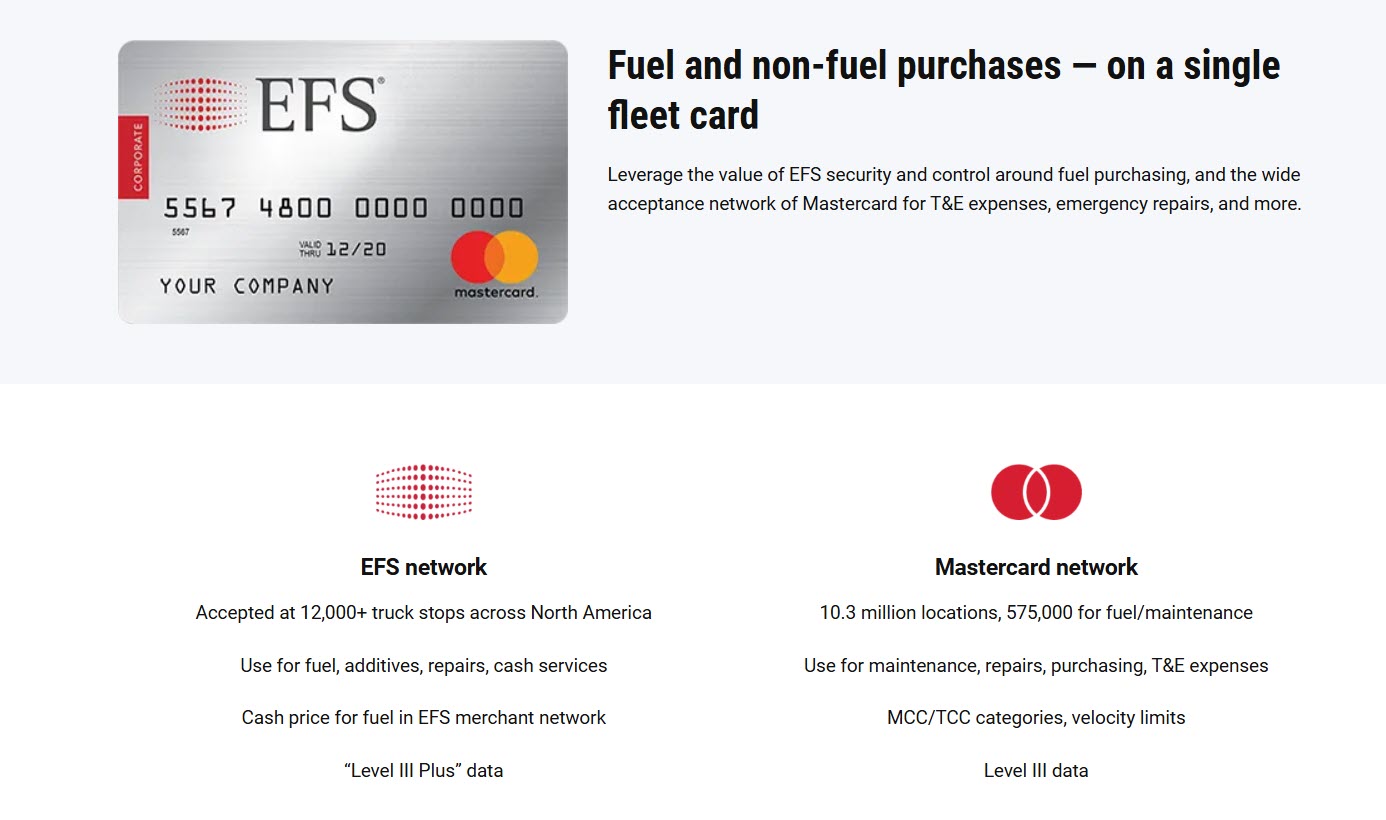

6. EFS Fleet Card

The EFS Fleet Card is accepted at over 12,000 truck stops across North America, giving drivers the flexibility they need and managers the control they want. You can set spending limits for each card, get real-time purchase alerts, and add prompts at checkout to reduce fraud.

It integrates smoothly with most transportation management and accounting systems, making it easy to track expenses, handle settlements, and even issue cash advances.

For on-the-go access, your managers can use the WEX CarrierControl app to control driver cards and monitor activity. Drivers get their own WEX CardControl cards for checking balances, transferring funds, and finding fuel stops.

The card also supports tools like SmartFunds for payroll and SecureFuel for fraud protection. Additional features like toll payments, fuel tax reports, and audit tools help fleets stay efficient, compliant, and cost-effective.

7. Shell Fleet Cards

Shell Fleet Card comes in two variations. The first one is Shell Card Business, which is designed for small businesses. Ongoing savings of up to 6 cents per gallon at Shell stations, along with no card fees. Additionally, it is accepted at over 12,000 Shell stations.

Another card is Shell Card Business Flex, which offers 95% US gas station coverage. With this, you can enjoy universal acceptance at non-Shell locations and get an ongoing savings of up to 5 cents per gallon at Shell stations. It is accepted at over 95% of all U.S. fueling stations and 45,000+ service locations.

Integrated with transport management systems, Shell Fleet Cards streamline operations by syncing fuel data directly with your logistics platform. Its ClearView tools give you easy-to-understand reports on fuel usage and lets you spot patterns. It works at over 12,000 Shell stations—and even more if upgraded.

You can manage everything online or on your phone, anytime. Plus, save up to 6¢ per gallon and get Jiffy Lube discounts. Built-in security features like real-time card cancellation help prevent misuse, giving you confidence and control.

Honorable Mentions

Here are some additional fuel cards you can use as a small business.

- DAT: DAT lets you find nearby pumps and hotels, and compare fuel prices at nearby pumps. Its mobile app is also the most-used trucker app in the industry, with access to the largest load board network in North America.

- TCS Fuel Card: TCS Fuel Card allows you to manage and control fuel expenses. Ideal for truck drivers, this cash-secured fuel card supports funding using third-party checks, ACH, and Western Union.

- Exxon Mobil Fleet Cards: Using Exxon Mobil Fleet Cards, your team can have access to 95% of gas stations in the US and earn up to 6 cents per gallon at Exxon and Mobil stations.

- Circle K Pro Fleet Card: Circle K Pro Fleet Card helps you save 5 cents per gallon. Moreover, it enables you to take fuel at more than 6,000 locations without any fees.

Compare and save big on Fleet Cards.

Benefits of Fuel Cards for Small Businesses

Here are some benefits small businesses will get from fuel cards.

1. Fuel Cost Savings

Fuel cards often provide discounts on fuel purchases, which can benefit small businesses with frequent travel or delivery operations by adding up significantly over time. Some cards offer flat-rate savings per liter, while others provide percentage-based rebates based on the monthly fuel volume. It directly impacts a business’s bottom line, freeing up cash for other operational needs.

2. Better Expense Tracking

With a fuel card, you get the record of all fuel-related expenses in one place without needing to collect paper receipts or reconcile multiple credit card statements. This centralization makes bookkeeping more accurate and less time-consuming.

Most fuel card solutions give you detailed digital reports with a breakdown of spending by driver, vehicle, date, time, and location. Hence, small businesses can track trends, identify inefficiencies, and simplify their accounting or tax filing processes without using separate expense management tools for SMBs.

3. Control Over Spending

Fuel cards enable you to set purchase limits for each cardholder, preventing overspending or unauthorized purchases. For example, you can restrict the card to fuel-only purchases, set daily or weekly spending caps, or limit usage to specific locations or timeframes. This control is particularly useful when managing multiple drivers. These also reduce the risk of budget leaks, giving you peace of mind without the need for micromanagement.

4. Fraud Protection

Fuel cards with built-in fraud detection protect businesses from misuse or theft. Real-time alerts notify managers of suspicious activity, such as fuel purchases outside of normal hours or excessive fill-ups mismatching vehicle capacity. Some cards also use PINs or driver’s licenses to verify transactions, ensuring only authorized personnel can use the card.

In the case of a lost or stolen card, it can be immediately deactivated online, minimizing potential damage. These security features make fuel cards safer than manually reimbursing employees or giving them access to company credit cards.

5. Fleet Management Integration

Many fuel card systems provide a complete view of vehicle usage, fuel efficiency, and driver behavior through integration with fleet management software. By syncing fuel data with GPS or telematics, you can analyze the most fuel-efficient routes, identify underperforming vehicles, and track maintenance needs.

Thus, small businesses can improve operational efficiency and reduce overall fuel consumption. Integration of fuel cards with fleet management software also supports long-term planning by identifying trends and enabling forecasting.

6. Build Business Credit

Using a fuel card responsibly enables small businesses to establish or improve their business credit profile. Many fuel card providers report payment activity to commercial credit bureaus. By paying the balance on time and maintaining good standing, a business shows financial reliability when applying for loans, credit lines, or vendor accounts. Establishing a strong credit history through consistent fuel card usage is a practical way for newer businesses to gain financial credibility.

FAQs on Fuel Cards

Yes, a fuel card is definitely worth it for small businesses, especially those with regular travel, deliveries, or fieldwork. It helps them reduce fuel costs, simplify expense tracking, limit misuse, and have better control over spending.

Fuel card rebates work by giving a fixed discount or cashback on each liter or gallon of fuel purchased with that card. The rebate is usually credited to the business account monthly or reflected as a reduced charge on the invoice.

Yes, you can get some fuel cards without a credit check. They are suitable for businesses with limited or poor credit history, but often offer fewer benefits compared to traditional fuel cards.

Fuelman Diesel Fleet Card and AtoB offer the best rewards. These cards are also accepted at a large number of fuel stations.

-

EditorUsha, the editor-in-chief of Geekflare, is a tech-savvy and experienced marketer with a Master’s degree in Computer Applications. She has over a decade of experience in the tech industry, starting as a software engineer and then moving into digital marketing and team management.

EditorUsha, the editor-in-chief of Geekflare, is a tech-savvy and experienced marketer with a Master’s degree in Computer Applications. She has over a decade of experience in the tech industry, starting as a software engineer and then moving into digital marketing and team management.