No more late-night number crunching on spreadsheets or frantic Googling of federal and local tax laws. Payroll software handle everything—automating calculations, tracking time, and even ensuring your team gets paid on time.

They offer 5 main benefits to business owners and HR professionals.

- Eliminate manual entry and facilitate automation

- Save time and money for accounting department employees

- Securely store sensitive payroll data of the business

- Offer better compliance with tax regulations

- Generate accurate payroll, avoiding risks of errors

Thanks to these reasons, the market size of payroll software is expected to grow from $24.8 billion to $55.21 billion between 2022 and 2031[1]. This is a clear indication of companies looking to improve payroll processing.

The Geekflare team has researched 25 products and picked 16 best payroll providers in the US, based on payroll-specific features, tax filing, automation, compliance, integration, ease of use, and pricing.

- 1. ADP Payroll – Trusted by Top Companies

- 2. Deel US Payroll – Best for Small to Medium sized Businesses

- 3. Paychex – User-Friendly Payroll Software

- 4. Gusto – Best Payroll Provider for Small Businesses

- 5. Paycor – Best for HR and Payroll Integration

- 6. Rippling – Unified HR and Payroll Platform

- 7. Patriot – Best Payroll for Startups

- 8. QuickBooks Payroll – Best for QuickBooks Integration

- 9. OnPay – Best for Growing Businesses

- 10. Wave Payroll – Best for Freelancers and Small Businesses

- 11. BambooHR Payroll – Best for Customization

- Show less

You can trust Geekflare

At Geekflare, trust and transparency are paramount. Our team of experts, with over 185 years of combined experience in business and technology, tests and reviews software, ensuring our ratings and awards are unbiased and reliable. Learn how we test.

Payroll Software Comparison Chart

Below I’ve summarized the price, companies suitable for, integrations supported, customer support available and Geekflare’s rating out of 5 for the top payroll software. The features and pros and cons will be discussed in detail later in this guide.

|  |  |  |  |  |  |  |  |  |  | |

All Sizes | Small to Medium | Large | US Small Businesses | Small to Medium | All sizes | Startups | Small to medium | Small | Small, Freelancers | Small to Medium | |

24/7 via phone and live chat. | 24/7 via phone and live chat. | Phone, email, and chat support during business hours. | Phone and email support during business hours. | Phone, email, and chat support during business hours. | Phone and email support during business hours. | Phone and chat support during business hours. | Phone and email support during business hours | Email and chat support during business hours | Phone and email support during business hours | ||

Accounting, time-tracking, HR platforms. | Accounting, expense tracking and HR platforms | Financial, productivity, HR platforms. | Accounting, Expense Management, HR tools. | Via API, HR and Productivity tools | Accounting and HR platforms | Accounting, time-tracking tools | Accounting and HR platforms | Accounting and time-tracking platforms | Via Zapier | Accounting, HR, time-tracking tools and also via Zapier | |

On Request | $19/employee | On Request | $40 | On Request | On Request | $8.50 | $42.50 | $40 | $16 | On Request | |

Geekflare’s editorial team determines ratings based on factors such as key features, ease of use, pricing, and customer support to help you choose the right business software. | |||||||||||

Need help in choosing the right Payroll solution?

In this post we are focussing on businesses that operate within the US and need a reliable payroll system for local tax compliance and employee payments. However, if you are managing payroll across multiple countries, check out our list of the best global payroll software for handling multi-currency payments and compliance effortlessly.

Below, I’ll review each payroll software in detail, list the top features, strengths, weaknesses, company size suitability, integrations, and give an overall rating.

1. ADP Payroll

Trusted by Top Companies

ADP’s functionality goes beyond being a basic payroll tool, offering HR features like application tracking system, benefits management, and employee cost insights. Additionally, ADP Payroll is fully scalable and fits companies of every size, making ADP Payroll the best overall payroll software.

For small businesses, ADP Payroll offers plans that include an HR module, recruitment module, ATS etc., so that you don’t have to purchase separate software as your business scales up. For large enterprises, ADP offers APIs for integration with your existing software.

ADP Payroll syncs payroll data with benefits management and time tracking tools to help businesses efficiently manage the payroll process.

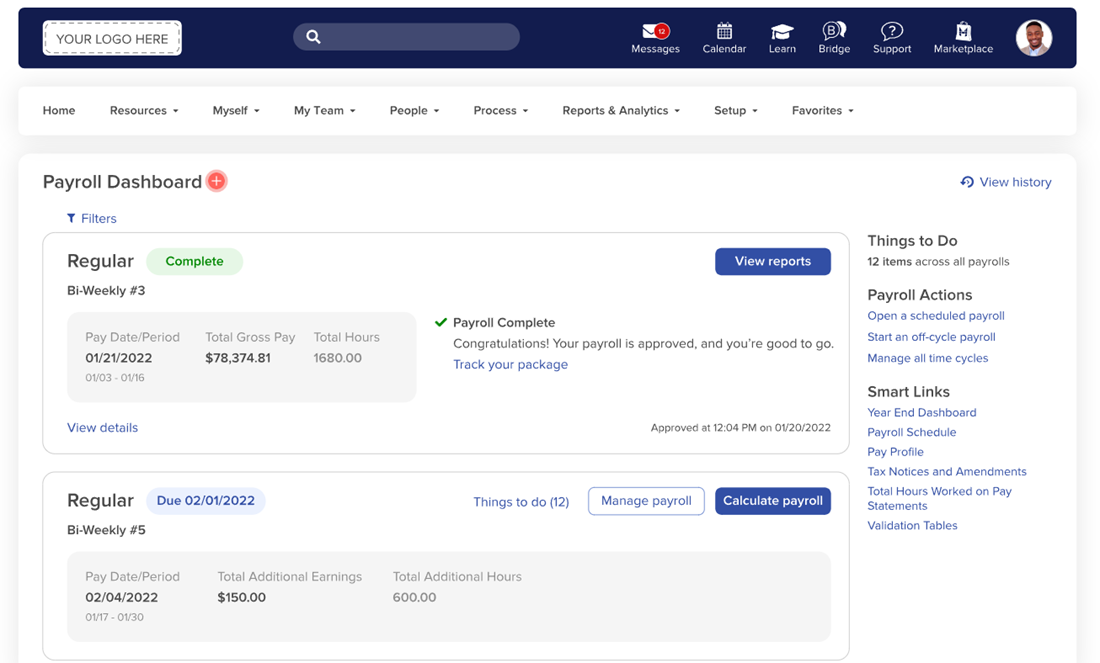

ADP Payroll Software’s dashboard displays payroll status, pay periods, total earnings, and hours worked. It also includes payroll actions, reports, and quick access to essential payroll management features. You can see what’s completed, what’s due, and quick links to reports.

Below is the Pay Profile section. It includes details such as employee information, gross pay, taxes, deductions, and take-home pay. The interface also provides access to pay summaries and year-to-date earnings.

I also like the mobile access feature, as it offers on-the-go payroll management. ADP’s mobile payroll app lets employees view pay stubs, request time off, and record attendance, especially people who travel a lot as part of work. It also helps in quickly submitting claims and expenses.

Top Features

- Direct deposit for timely payment to the employees.

- Fully automated employee data syncing.

- Automatic tax deductions and retirement contributions.

- Federal, state, and local compliance support.

- Manage state unemployment insurance (SUI).

- Create and send Forms W-2 and 1099.

- Securely store employee data.

- Customizable payroll and HR reports

Pros

ADP API Central to build custom integrations

Self-service for both employees and managers.

24/7 access to certified payroll professionals.

Cons

Form fill up needed to get custom quote.

Steep learning curve for novice use.

Pricing

ADP Payroll offers multiple plans for both small business and mid-large sized business. You need to ask for custom pricing for the plan that suits your needs.

2. Deel US Payroll

Best for Small to Medium sized Businesses

Deel US Payroll offers services in all the 50 stated in the US. It simulataneously calculates payroll taxes and syncs the data with your accounting software to ensure compliance. It offers bulk payment option for easy payroll processing and a free HRIS module to manage your workforce.

Deel US also offers the services of in-house experts for registration guidance, and legal advice on tax, labor laws etc. They will help your company file W-2, W-4, new hire and termination details with local and federal authorities.

You can generate custom reports by analyzing gross-to-net, 401k, pensions, etc., that stakeholders can easily understand and gather insights. It allows organizations to compare employer costs, bonuses, taxes, and other parameters.

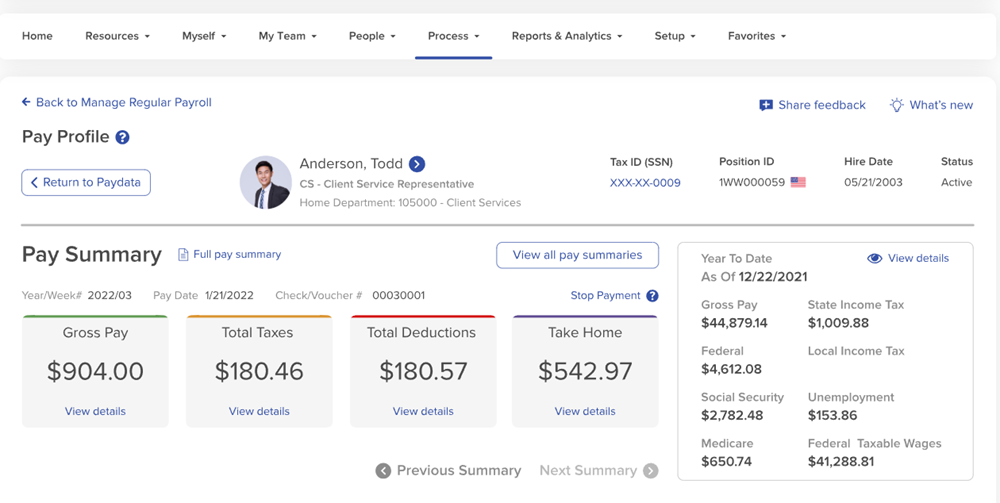

Deel’s US Payroll system shows the complete employee list with details such as status, base pay, and employment type. The interface allows for bulk editing and filtering by employee status for streamlined payroll management.

I am impressed with Deel’s integration support for 80+ business apps, such as Google Workspace, Jira, Slack, QuickBooks, Outlook Calendar, Xero, BambooHR, and Zapier. This integration simplifies businesses management and increases efficiency.

Top Features

- Accurate payroll with tax calculation, benefits, and deductions.

- Compliance management at the local and federal level.

- Create and deliver payslips to the employees.

- Set up payroll schedule and pay dates, and review payroll.

- Instantly pay employees from direct deposit or paychecks.

- Run monthly, semi-monthly or even bi-weekly payroll cycles.

Pros

Deel API to connect with HRIS, finance, and ERP systems.

Payroll support for all 50 states of the US.

Dedicated account management.

24/7 support with dedicated CSM.

No additional charges for off-cycle payroll runs

Cons

Payroll implementation might take up to 3 months.

No free trial available.

Pricing

You can choose from the following subscription plans to use Deel’s payroll service.

- US Payroll at $19/employee/month

- US PEO at $89/employee/month

3. Paychex

User-Friendly Payroll Software

Paychex is a cloud-based payroll software platform where you need only a few clicks to run payroll. Its intuitive and self-explanatory UI makes it the best payroll software for a user-friendly experience.

Your employees can use Pre-Check service to instantly approve their pay check before payday and avoid costly payroll discrepancies. It lets you pay with options such as direct deposit, same-day ACH, paper checks, paycards, eChecks service, Pay-on-Demand (before payroll date), and 24/7 real-time payments.

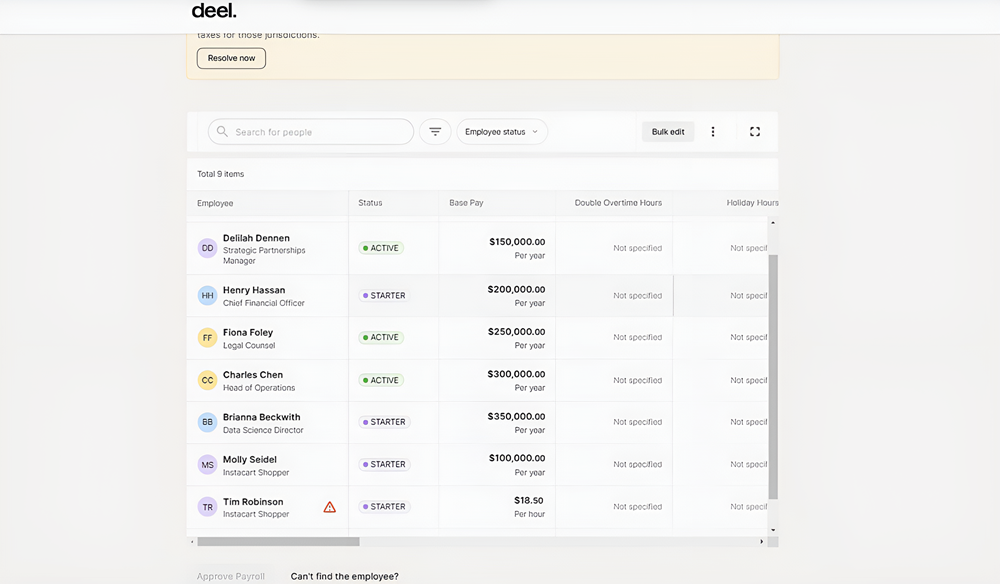

Below is a screenshot of Paychex Flex payroll software. It shows the “Payroll Center” with employee payroll details, check dates, and pay periods. The “More Options” panel on the right provides features like importing payroll data, adding employees, customizing pay entry, and managing check assignments.

The on-site check printing and direct deposit control features give you full flexibility, whether you prefer automated payroll or need to send printed checks to specific employees.

I find Paychex’s ever-expanding API library to be a valuable feature for the companies with in-house developers. It lets you securely integrate with popular business tools like BambooHR, Clover, Deputy, JazzHR, Indeed, Jobvite, and Microsoft Azure AD. It makes hiring, managing, paying, and retaining employees easier.

Top Features

- Accurately calculate, file, and pay payroll taxes.

- Customized earnings and deductions.

- Employee Retention Tax Credit (ERTC) service to determine eligibility.

- Automatic report on job costing, tax deposits, and payroll journal.

- Employee self-service to update personal data and tax withholding.

Pros

Free mobile payroll app for employees.

24/7 US-based customer support.

Automated tax filing.

Cons

A separate tool is needed for time-tracking.

Costly application for smaller teams.

Pricing

Paychex has three plans – Select, Pro and Enterprise. You need to provide your company information to get a custom quote.

4. Gusto

Best Payroll Provider for Small Businesses

Gusto provides industry-specific payroll and HR solutions for US companies. Its proactive compliance alerts and automated tax reporting features prevent businesses from making human errors.

You have the option to sync employees’ working hours, time off etc with the Gusto to ensure accurate payroll calculation. It lets you manage health insurance, paid time off, and 401(k) plans, in one place.

If you are a startup or a small business with no full-time employees and only contractors, Gusto has contractor-only plan at only $6 per person, which makes Gusto the top payroll software small businesses.

Gusto helps you submit various payroll tax forms like Form W-2, Form 940, Form 8974, Form 1099, Form 941, and more. It ensures accurate and timely tax submissions, avoiding potential penalties.

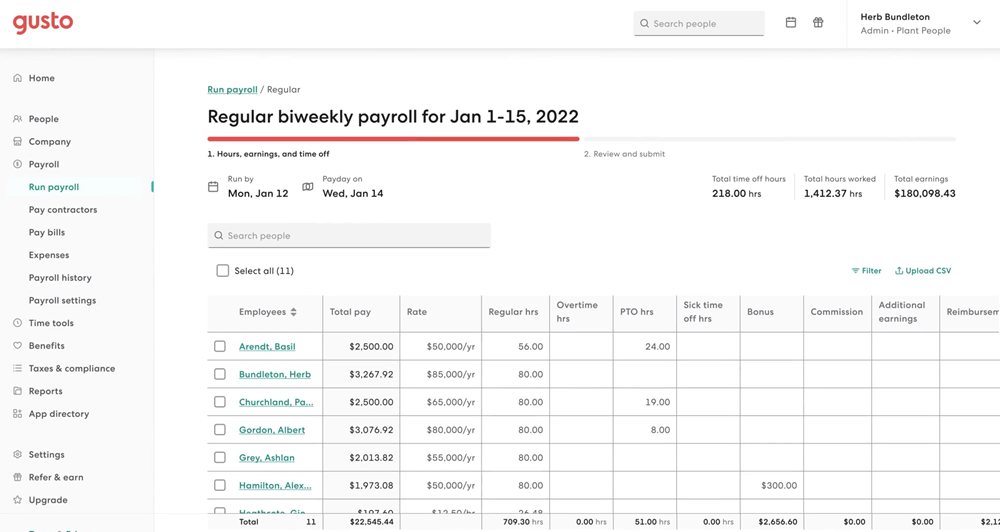

Above is a screenshot of Gusto payroll software, showing regular payroll run, with details like employee names, total pay, hours worked, PTO, bonuses, and total earnings. The interface provides options to filter data, upload CSV files, and review payroll before submission.

The “Payroll history” section is particularly useful for quickly reviewing past payments and ensuring payroll accuracy. Plus, Gusto goes beyond payroll with built-in tax and compliance tools, making it easier to stay on top of tax filings and avoid penalties.

Top Features

- Automatic tax calculation for greater accuracy.

- Pay monthly salaries and hourly rates.

- Run payroll as many times as needed each month.

- Automatic adjustment to the minimum wage.

- Hourly employee tracking with geolocation for compliance.

- Gusto debit card for paperless paydays.

Pros

Built-in time tracking

Integration with 190+ business apps

State tax registration in 50 states in the United States

Cons

Not suitable for large and global companies

Only supports US-based companies

Pricing

Gusto offers 4 plans for its users:

- Simple at $49/month+$6/month/person

- Plus at $60/month+$9/month/person

- Premium at $135/month+$16.50/month/person

- Contractor only at $6/month/person (limited time offer)

5. Paycor

Best for HR and Payroll Integration

Paycor operates as an online payroll software company serving more than 30K businesses across the US. It offers HR functionalities that sync well with the payroll software to simplify the data management process. Its employee self-service portal reduces your HR workload. Businesses looking for HR and payroll integration should opt for Paycor.

Paycor’s in-product compliance updates is a very useful feature. It notifies you of major changes so that you do not have to spend hours researching employment laws in your state or county. You will benefit from its 250+ integration partners for benefits, payments, POS, background screening, and scheduling.

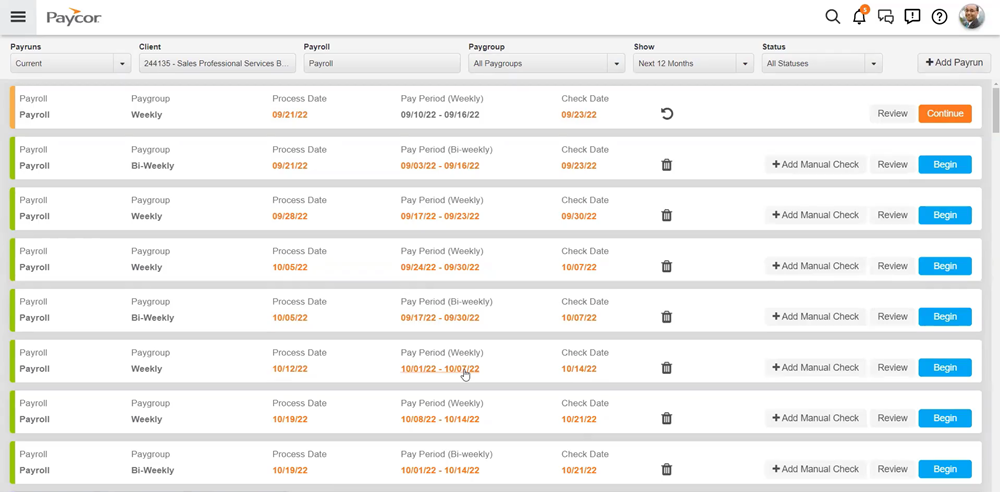

Paycor payroll software’s dashboard, as shown above displays a list of payroll entries with details like process dates, pay periods, check dates, and pay groups (weekly and bi-weekly).

The “Add Manual Check” option is a great tool for handling one-off payments or corrections, ensuring employees can get paid even outside the normal payroll cycle. With the “Review” button, you can double-check payroll details before finalizing and processing payments.

Top Features

- Real-time calculation of payroll skipping batch processing.

- Deposit payments to employee bank accounts or Paycor Visa card.

- Payroll scheduling on preferred date and time.

- Employee self-service to access paystubs, benefits, and W-2.

- Payroll reports to get full transparency on tax, job costing, etc.

- Automatic payroll deduction for workers’ compensation.

Pros

Tax Compliance Dashboard with proactive alerts.

Paycor mobile wallet for employees to access wages and pay card info.

Employee wage garnishments.

Cons

Global payroll feature not available.

Customer support needs to be improved.

Pricing

Paycor offers custom pricing based on the modules opted for (HR, Payroll, Expense Management etc)

6. Rippling

Unified HR and Payroll Platform

Rippling offers a payroll application that comes with a tightly integrated HR service. Hence, its unified system allows smooth syncing of HR data with payroll. Companies can track time and attendance from the same platform, review expenses, and manage employee benefits. If you are looking for comprehensive software to perform HR and payroll tasks from one platform, Rippling is the best bet.

I find Rippling’s extensive integration support to be highly beneficial. It integrates with 600+ applications, including QuickBooks Online, Xero, Sage Intacct, and NetSuite. So, if you are already using these accounting programs, you can easily sync data with fewer chances of errors. It’s reports on payroll analytics help with visualization and informed decisions.

Rippling’s payroll summary, as shown below displays details like direct deposits, employee and employer taxes, and total deductions. It also includes key dates such as the approval deadline and check date, helping businesses stay on track with payroll processing.

Rippling features built-in compliance tools that help businesses stay aligned with tax regulations and labor laws. Its reports on payroll analytics help with visualization and informed decisions.

A particularly useful feature is the automated alerts, like the one flagging “unapproved hours” or “potential missed clockout,” helping you catch errors before processing payroll. You can also download pay stubs and access reports directly from the payroll screen, making it easy to keep records organized and accessible.

Top Features

- Make payments via direct deposit or cheque.

- Compliance through minimum wage alert, overtime, and leave policy.

- Automation of W-2, W-4, 1099, and new hire filings.

- Global payroll and contractor support to pay the entire team.

- Job costing and multiple pay rates for the employees.

- Workers’ compensation and garnishment.

Pros

100% guaranteed error-free payroll.

Run payroll in 90 seconds.

Dedicated mobile app.

Time-tracking and PTOs.

Cons

Pricing information not available.

No free trial available.

Pricing

You need to contact Rippling for a demo and the pricing.

To know more about the features in detail, read our Rippling HR review.

7. Patriot

Best Payroll for Startups

Patriot payroll offers free 2-day and 4-day direct deposit facilities for qualified customers for hassle-free employee payment. Its monthly base pay and per-employee charges are affordable for businesses of all sizes. Hence, Patriot is an affordable payroll and ideal for startups.

Patriot software can be accessed from any device without downloading it. It generates various payroll reports, such as tax filing, tax deposit, pay rate, payroll register, individual paycheck history, payroll tax liabilities, assigned contributions and deductions, and time-off management. These enable businesses easily interpret payroll data.

I would recommend Patriot payroll for its feature of filing company tax on time with 100% accuracy. In case of any mistake, it covers all the penalties and interest, which is a win-win situation for the companies.

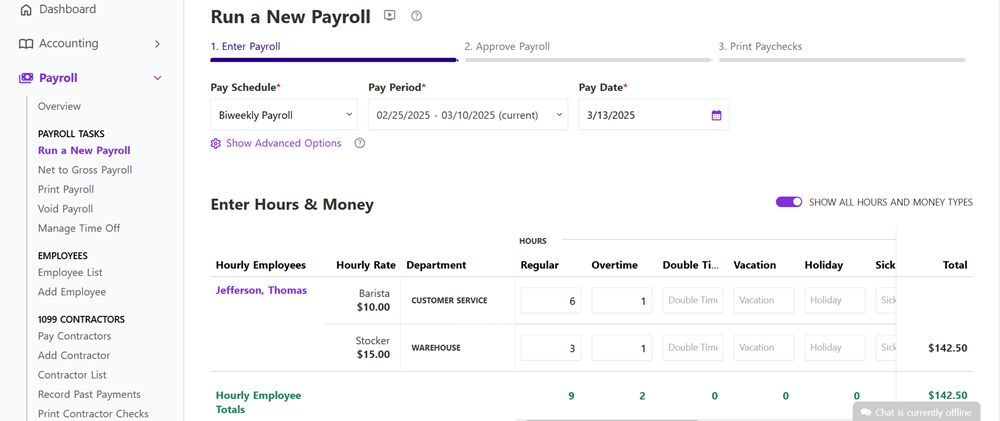

Above is a screenshot of Patriot Payroll software’s dashboard that includes details like the pay schedule, pay period, and pay date, ensuring accurate payroll management for businesses. It also shows employee hours, hourly rates, and department details. It helps track regular, overtime, vacation, sick leave and other pay types, making payroll processing simple and efficient.

Top Features

- Payroll tax calculation based on employee’s primary location.

- Customizable employee deduction and company contribution.

- Free employee portal for pay history, time off balance, and W-2.

- Add unlimited users with permission control.

- Up to five different pay rates for every hourly employee.

Pros

Unlimited payroll runs without extra charges.

30-day free trial

Free integration with 401(k) and workers’ comp.

Integration with Patriot Accounting and QuickBooks.

Year-end payroll tax filing without extra charges.

Cons

Only available to companies in the US.

No mobile app is available.

Pricing

Partiot offers 2 plans on the payroll software.

- Basic Payroll: $8.50/month + $2/worker

- Full Service Payroll: $18.50month + $2.50/worker

There is a 30-day free trial and a 50% discount for the first 3 months.

8. QuickBooks Payroll

Best for QuickBooks Integration

QuickBooks Payroll is a streamlined payroll application that smoothly integrates with other QuickBooks applications like QuickBooks Accounting, QuickBooks POS, and QuickBooks Time for data sync. Hence, QuickBooks Payroll is the best choice for integrating with other QuickBooks products.

I like the feature of syncing QuickBooks Payroll with QuickBooks Time. It increases payroll accuracy and reduce risks involved with manual entry. It also supports managing timesheets and connecting time-tracking data to reduce payroll costs.

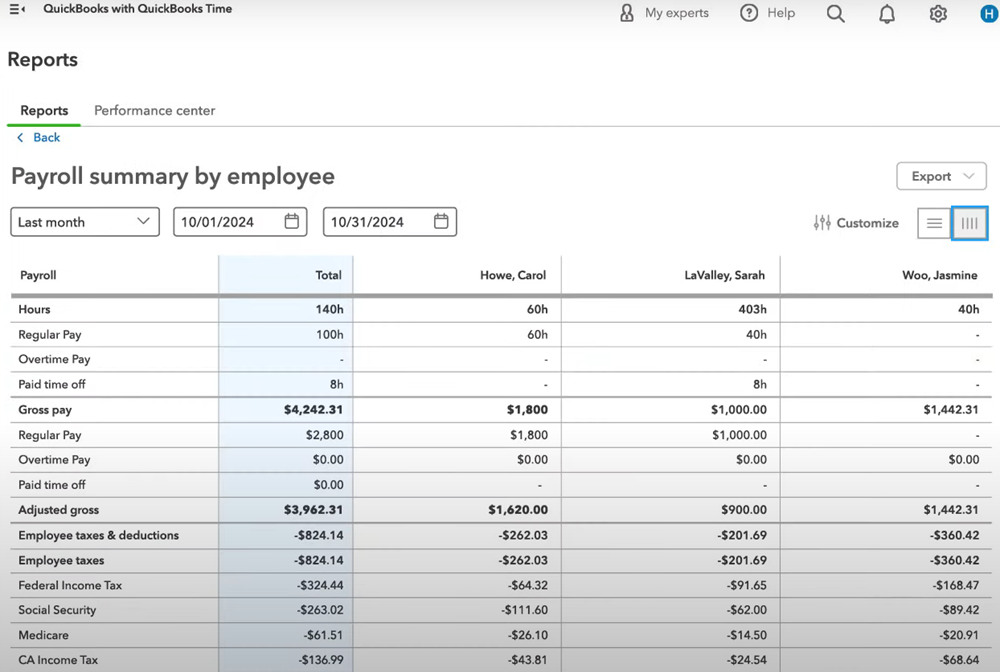

As shown above, the QuickBooks Payroll software displays a payroll summary by employee. It provides details on work hours, regular and overtime pay, and paid time off for each employee within a selected date range.

The summary also includes gross pay, adjusted gross, and tax deductions like federal income tax, Social Security, and Medicare. This report helps businesses track payroll expenses efficiently.

Top Features

- Calculate and submit payroll tax.

- Federal and state tax calculations for complete compliance.

- Automate payroll schedule for salaried employees.

- Same-day direct deposit for quick payment.

- One-tap employee clock-in and clock-out.

Pros

30-day free trial.

100% accurate tax calculation guaranteed.

Tax penalty protection.

Cons

Workflow automation is only available for Advanced plan users.

Time-tracking feature is not available for Core plan users.

Pricing

QuickBooks Payroll is available as standalone and QuickBooks Online add-on plan.

Standalone base pricing starts at $42.50/mo + $6/employee/mo.

Add-on starts at $25/mo + $6/employee/mo.

Add-on subscription will be ideal if you are already using or planning to use QuickBooks Online accounting software.

9. OnPay

Best for Growing Businesses

OnPay is a full-service payroll solution for small businesses, accountants, or non-profits. Its straightforward pricing is suitable for a small team and includes basic HR tools in addition to the suite. So, if you are a growing business, OnPay is the perfect choice for you.

OnPay’s report designer caught my attention. It enables custom views and filtering by employee type, location, or department. Moreover, you can view the reports in real-time online, download them in PDF or spreadsheet format, or move the data to the accounting software.

Its responsive portal design lets you conveniently use it on mobile devices like smartphones and tablets without downloading a mobile app.

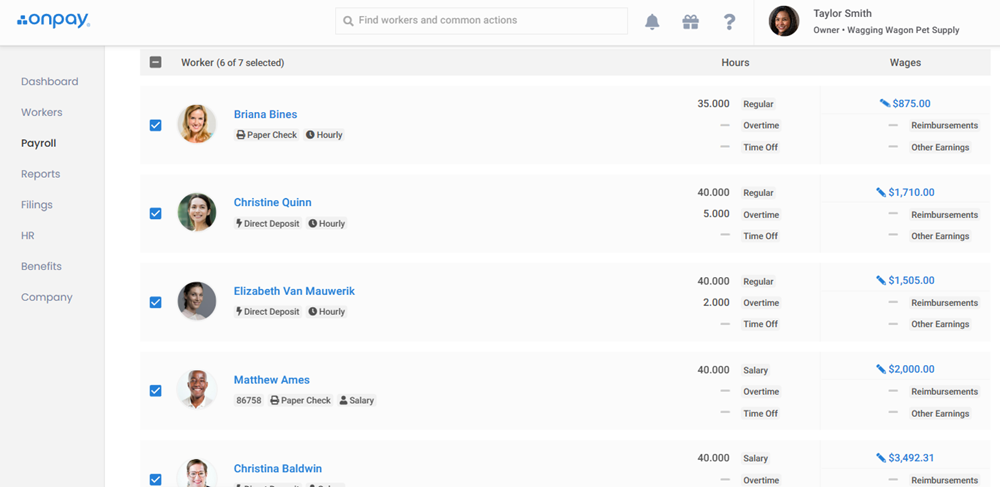

OnPay’s payroll section shows a list of employees with their work hours and wages. You can see which employees are paid via direct deposit or paper check, helping you manage payroll disbursement efficiently. The left-hand menu provides access to key payroll features, such as Filings, which ensures payroll taxes are handled correctly, and Reports, where you can track payroll expenses.

Top Features

- Tax filing and payments with W-2 and 1099.

- Pay from a debit card, check, or direct deposit.

- Multiple pay rates and schedules for different employees.

- Unemployment insurance withholding.

- PTO email notifications and custom PTO policies.

Pros

Unlimited payroll run per month.

Garnishment deduction.

Free setup and data migration.

Includes full suite of HR tools.

Multi-state payroll with no extra fees.

Cons

No phone or chat support on weekends.

Limited third-party integrations.

Pricing

OnPay offers simple pricing of $40/month base fee with $6/person/month.

10. Wave Payroll

Best for Freelancers and Small Businesses

Wave Payroll is developed specifically for small businesses to address industry-based needs. It reduces the workload of payroll management and saves companies from manual, time-consuming calculations. For these reasons, Wave Payroll is ideal for small businesses and freelancers.

Wave Payroll regularly updates its features to incorporate various financial assistance programs for small business, unemployment benefits, and tax relief. Such updates financially and strategically benefit freelancers and small businesses.

Setting up and managing payroll straightforward. The “Add Employee” feature simplifies onboarding by allowing you to input enployee data, followed by tax and direct deposit details in one place.

Wave’s payroll setup tracker shown above guides you through essential steps like adding a company signatory and setting up employee payments.

With payroll transactions, taxes, and timesheets easily accessible from the left menu, you get full visibility into your payroll operations without unnecessary complexity.

Top Features

- One-click employee payment on every payday.

- Automatic tax filings and payments for Tax Service States.

- Direct deposit into bank accounts.

- W2 and 1099 form generation.

- Payroll expense breakdown by employee and expense type.

- Leave time and accrual tracking.

Pros

30-day free trial.

Live chat on weekdays and email support for prompt assistance.

Automatic payroll journal entry.

Cons

Unavailability of live phone support.

Tax filing available in limited states.

Pricing

Wave users can opt for its free forever plan or choose paid subscription at $16/month.

11. BambooHR Payroll

Best for Customization

BambooHR Payroll is an HRIS solution that streamlines your compensation process. It offers customizable workflows, custom reports, and self-service tools for admins and employee management. Thus, BambooHR Payroll is an excellent choice for those looking for customization in payroll software.

I would highly recommend BambooHR Payroll for implementing security measures like advanced data encryption, SOC II audit, diverse data centers, and continuous monitoring, These keep the sensitive business data safe and protected. BambooHR Payroll automatically fetches all time-tracking, benefits, and time off data from one place. It eliminates the need for double data entry or manual approval.

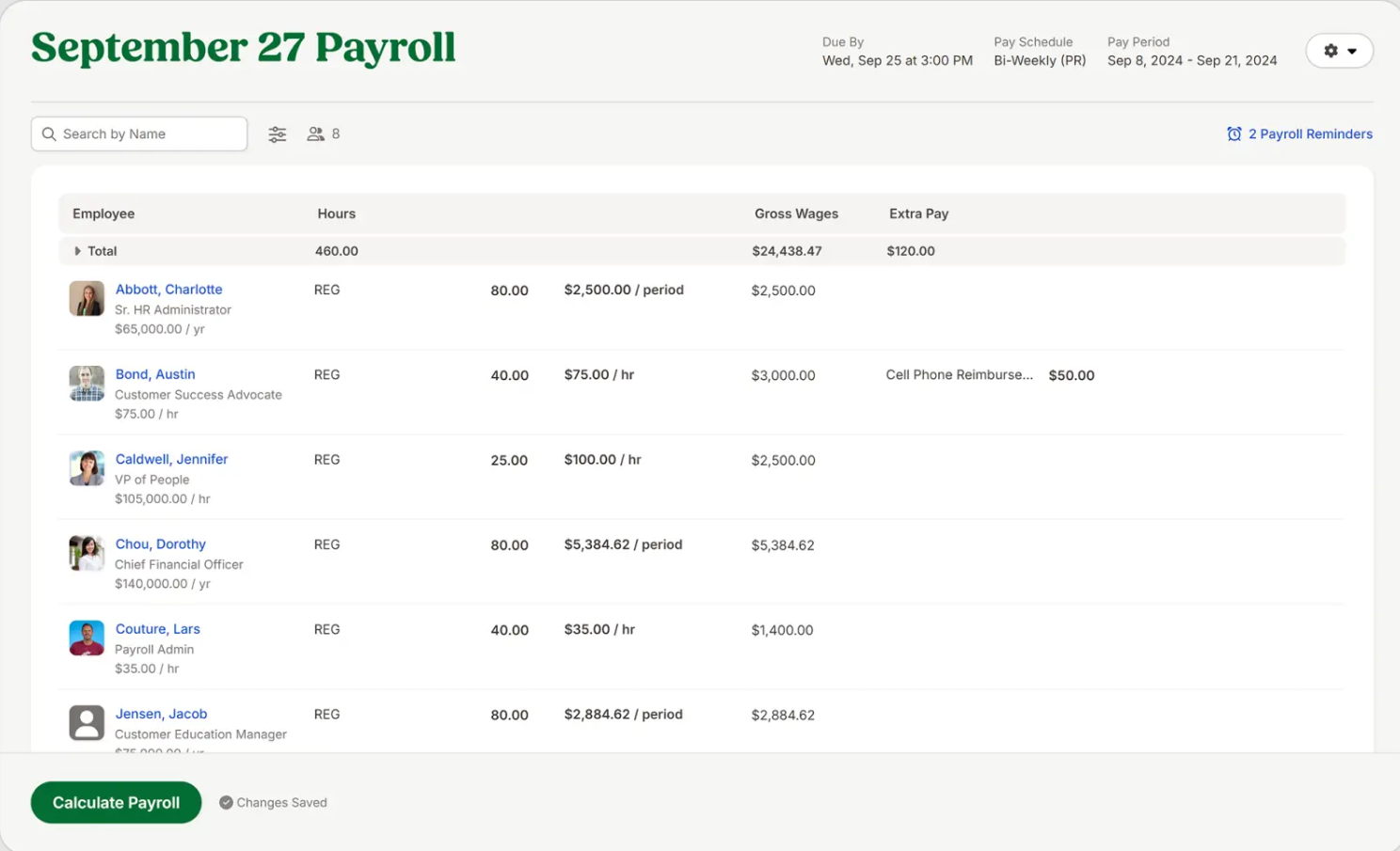

BambooHR Payroll’s dashboard shows employee names, hours worked, gross wages, and any extra pay, along with the bi-weekly pay schedule. The Calculate Payroll button ensures you can finalize payroll efficiently, with changes automatically saved to prevent errors. The Payroll Reminders feature on top right ensures you never miss a pay run. With the wages and reimbursements displayed transparently, you can quickly verify totals before processing payments.

Top Features

- Single platform for time tracking, benefits, and payroll.

- Manage benefits and federal, state, and local taxes for US workers.

- Automatic calculation of overtime, PTO, and holidays.

- Built-in overtime calculation for all US states.

- Custom payroll reports on cash requirements, deductions, etc.

- One-click timesheet approval and automatic reminders.

Pros

Mobile payroll app available.

Compliant tax filing.

120+ software integration support.

Cons

Unavailability of a transparent pricing structure.

The interface is difficult to use.

More Notable Payroll Software

In addition to the above listed software, these payroll processing software deserve honorable mentions for their features.

- PrimePay: Best for Payroll Tax Compliance

- Square Payroll: Best for Existing Square Users

- TimeTrex: Best for Workforce Management

- Papaya Global: Best for Global Teams

- Trinet HR Payroll (Previously known as Zenefits): Best for All-in-One Payroll + HR

Why Do Small Businesses Need Payroll Software?

Small businesses need payroll processing software to calculate employees’ and contractors’ wages and streamline payment processing and payslips. It helps in 5 ways, as listed below.

- Save Time and Money: Payroll is time-consuming and complex, especially for small businesses with low manpower. Payroll software providers automate tasks, helping small businesses avoid costly penalties and utilize their limited resources.

- Seamless Data Access: Small businesses can access employee data, timesheets, PTOs, and other policies using payroll software.

- Enhanced Employee Experience: Many payroll applications have employee self-service portals to access pay stubs, tax documents, and other information. This improves the transparency of the process, leading to better employee experience and satisfaction.

- Improved Security: Personal and confidential data remains safe on a secure payroll server from unauthorized access. Access to personal information is granted by access control management feature by payroll software.

- Streamlined Administrative Work: Businesses streamline administrative tasks by integrating payroll software with benefits providers & software like health insurance, payment processing, employee well-being, and retirement planning.

How Does a Payroll Software Work?

Payroll software automates the process of calculating and making employee payments. It tracks or (collects from integrated applications) employee data like the number of days or hours worked to determine gross pay. If needed, companies can apply different rates for different employees.

The payroll software also withholds taxes, garnishments, and various contributions automatically to calculate the net payable amount to an employee. Then, it pays the employees via direct deposit or cheque on a scheduled date. Some payroll software generates pay stubs for employee records and allows users to print them.

What is the Best Time to Switch Payroll Providers?

The best time to switch payroll providers is the end of the year – December, as there would be less data carried forward to the next year and the yearly tax reporting would have been completed. It will be easier to start using the new payroll software with a clean slate in January.

However, if the situation demands that you switch in the middle of the year, most payroll providers are more than happy to help you migrate. For example, Gusto promises to complete the switch within a week[2] and ADP says it’s possible within 2 days, but some customers may take weeks to transition[3].

What is the Average Pricing for Payroll Software?

The average starting base pay of a payroll system ranges between $10-$30 per month. These applications additionally cost $4-$6 per employee. Deel US Payroll charges $19/employee/month. Wave, on the other hand offers a free forever plan with limited features.

The 5 factors that contribute to the pricing of payroll software are as follows.

- Number of employees for whom the company will use the software

- Advanced features like benefits and garnishment

- On-premise payroll software that requires installation and maintenance

- Add-on services like tax filing, HR, risk management

- Dedicated account manager

What are the Advantages of Payroll Software?

Using payroll software has the 5 following advantages.

- Accuracy: Payroll software calculates and deducts taxes automatically, minimizing the risk of manual error and resulting in accurate payments to employees.

- Time Savings: The automated process saves time in manual payroll management and frees HR managers to focus on other important tasks.

- Efficiency: When payroll software is used, the entire process, from data entry to paychecks, becomes streamlined. With payroll process automation, businesses can standardize repetitive tasks, reduce delays, and enhance end-to-end efficiency.

- Cost Savings: Payroll software services help businesses avoid costly tax and legal penalties by reducing errors and maintaining compliance. Additionally, by automating the entire payroll process, software can significantly reduce the need for dedicated payroll staff, leading to potential cost savings.

- Compliance: Payroll software helps companies stay compliant by ensuring correct tax filing and maintaining an audit trail.

What are the Disadvantages of Payroll Software?

Using payroll software has the following disadvantages.

- Learning Curve: Introducing payroll software to people who don’t want to change the existing process can be challenging and require spending time learning how particular software works.

- Customization: Payroll software may not offer the detailed customization needed for every industry, which can be a disadvantage for many businesses.

- Technical Issues: Payroll software can cause technical issues and if this happens near the payroll processing date, this can delay the payments to employees.

- Regulatory Changes: While many payroll applications update themselves with changes in regulations, some small software providers may miss this on time. Thus, it becomes a challenge for companies to ensure that their payroll is compliant with the latest regulations and laws.

What is the Difference Between Payroll Software and Accounting Software?

Payroll and accounting software differ, though some accounting software like QuickBooks has a payroll feature. With payroll software, companies manage employee compensation, while an accounting software oversees broader financial tasks. Apart from this, there are 6 differences between payroll and accounting software, which are as follows.

- General Ledger: The general ledger is the foundation of accounting software that tracks all financial transactions. Payroll software only focuses on employee and contractor payments.

- Time Tracking: Payroll software like Rippling, Gusto and BambooHR let companies track employee working hours for accurate payroll calculations. Accounting software usually does not offer this feature.

- Tax Calculations and Withholding: Payroll software calculates and files payroll taxes. Some accounting software, like Bonsai and NetSuite, calculates business taxes, but these do not emphasize payroll tax specifics.

- Payslip Generation: Payroll software like ADP, Zoho Payroll, Multiplier generate payslips for employees, mentioning their earnings and deductions. Accounting software isn’t involved in the employee payment functions.

- Benefits Administration: Both applications usually offer this feature but for different purposes. Accounting software uses it to track benefit costs, and payroll software utilizes it to identify deductibles from employee paychecks.

- Financial Reporting: Accounting software generates comprehensive and detailed financial reports. Payroll software only offers limited reporting based on payroll data.

Key Takeaways

Below are 5 main takeaways from the discussion on the top payroll providers.

- Payroll software eliminates manual calculations and automates payments, reducing the time spent on spreadsheets and ensuring compliance with tax laws. Platforms like ADP Payroll and Gusto handle everything from salary processing to tax filings, making payroll management seamless.

- Businesses can save time and money by integrating payroll with accounting and HR tools. Software such as QuickBooks Payroll and Rippling sync with accounting platforms, reducing errors and streamlining financial processes.

- Security and compliance are built into modern payroll software, ensuring sensitive employee data is protected while staying up to date with tax regulations. Providers like Deel US Payroll and Paychex offer automated compliance checks and secure tax filing.

- The payroll software market is growing rapidly, indicating that more businesses are prioritizing efficiency and accuracy in payroll processing. The payroll softare market is expected to grow from $24.8 billion to $55.21 billion by 2031.

- Choosing the right payroll provider depends on company size, integrations, and support needs. If you’re hiring freelancers, consider Wave Payroll; a growing business can consider OnPay, and if you are a large enterprise, ADP Payroll will be ideal for you.

References

-

EditorUsha, the editor-in-chief of Geekflare, is a tech-savvy and experienced marketer with a Master’s degree in Computer Applications. She has over a decade of experience in the tech industry, starting as a software engineer and then moving into digital marketing and team management.

EditorUsha, the editor-in-chief of Geekflare, is a tech-savvy and experienced marketer with a Master’s degree in Computer Applications. She has over a decade of experience in the tech industry, starting as a software engineer and then moving into digital marketing and team management.