Real estate accounting comes with unique financial challenges, such as managing multiple properties, tracking rental income, and handling complex expense categories like maintenance and property taxes.

This is where real estate accounting software helps by streamlining financial processes, saving time, and improving accuracy. These platforms also provide valuable insights, helping property managers make informed decisions.

With AI integration, real estate accounting software is evolving to offer predictive analytics, automated property management, personalized customer experiences, and the ability to extract actionable insights from vast datasets — all shaping the future of real estate financial management.

After analyzing 19 options, I’ve shorted the following top 13 real estate accounting software considering the key features, integrations, and pricing.

- 1. Buildium – All-in-one Property Management Software

- 2. REI Hub – Best for Rental Owners to Manage Accounting and Reporting

- 3. Baselane – Best for Landlords to Manage Rental Businesses

- 4. AppFolio – Best for Advanced Accounting and Reporting

- 5. Xero – Best for Small Real Estate Businesses

- 6. FreshBooks – Best for Rental Businesses

- 7. Sage 300 – Best for Construction and Real Estate Firms

- 8. DoorLoop – Supports Multi-property Accounting

- 9. TenantCloud – To Manage Tenants and Finances

- 10. Stessa – Best to Automate Rental Property Accounting

- 11. Landlord Studio – Inbuilt Receipt Scanner and Mileage Tracking

- 12. Propertyware – End-to-end Rental Property Management Software

- 13. QuickBooks – To Simplify Construction Accounting

- Show less

Real Estate Accounting Software Review Methodology

At Geekflare, we are committed to providing thorough and unbiased reviews. For our evaluation of the best real estate accounting software, we assessed core features like income and expense tracking, property management, ease of use, and AI integration. Additionally, we analyzed pricing, customer feedback, and official documentation to ensure our recommendations are practical and suited to businesses of all sizes, helping you choose the best software for your real estate accounting needs.

Real Estate Accounting Software Comparison

Here’s a quick table comparing top real estate accounting software based on key features like customer reports, property management, and income & expense tracking, along with starting pricing to help you find the right solution for you.

| Product | Customer Reports | Property Management | Income & Expense Tracking | Starting Price (monthly) |

|---|---|---|---|---|

| Buildium | ✓ | ✓ | ✓ | $58 |

| REI Hub | ✓ | ✓ | ✓ | $15 |

| Baselane | ✓ | ✓ | ✓ | Free |

| AppFolio | ✓ | ✓ | ✓ | Custom Pricing |

| Xero | ✓ | X | ✓ | $15 |

| FreshBooks | ✓ | X | ✓ | $5.70 |

| Sage 300 | ✓ | ✓ | ✓ | Custom Pricing |

| DoorLoop | ✓ | ✓ | ✓ | $59 |

| TenantCloud | ✓ | ✓ | ✓ | $15.60 |

| Stessa | ✓ | ✓ | ✓ | Free |

| LandlordStudio | ✓ | ✓ | ✓ | Free |

| Propertyware | ✓ | ✓ | ✓ | $250 |

| QuickBooks | ✓ | X | ✓ | $49.50 |

Real Estate Accounting Software Reviews

Below, I’ve reviewed each option in detail, focusing on key features, what problem it solves, strengths, weakness, pricing and given an overall rating.

1. Buildium

All-in-one Property Management Software

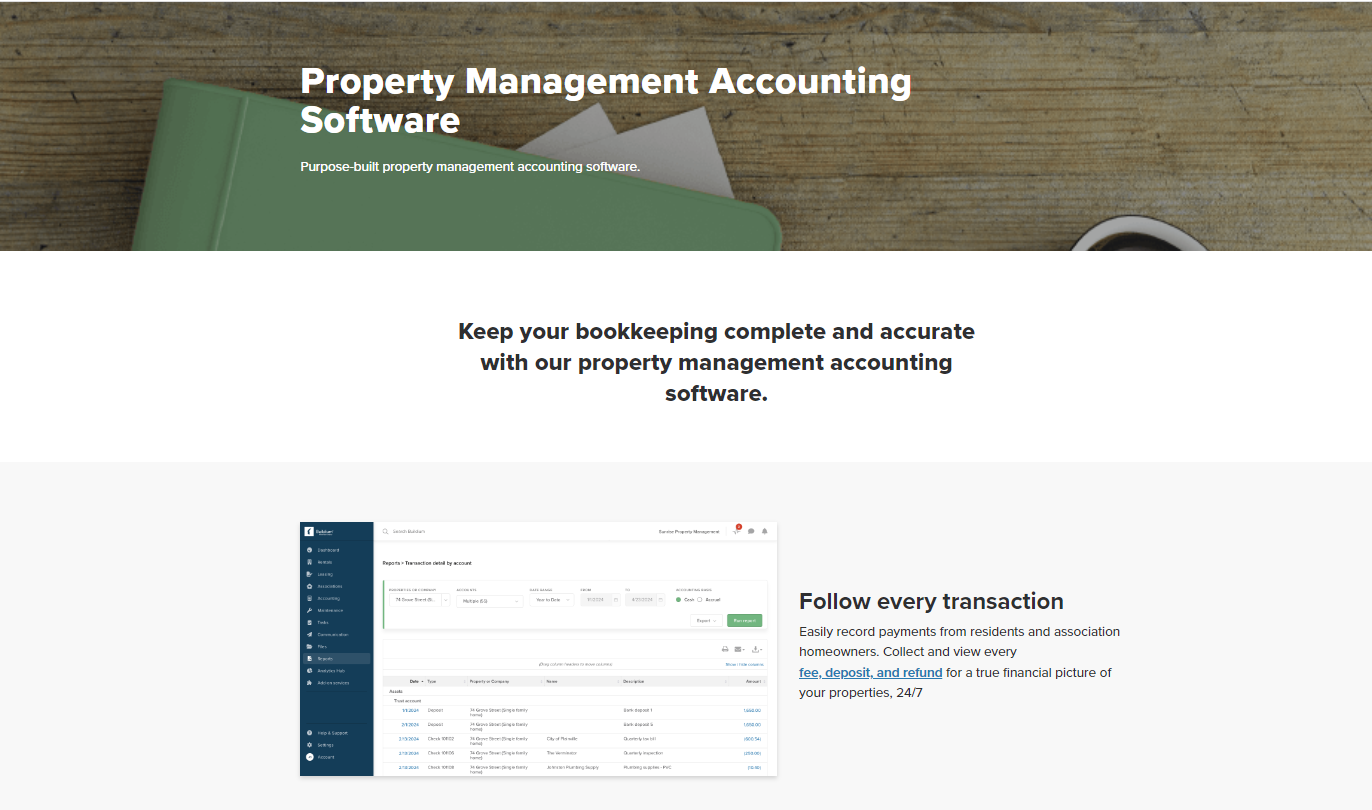

Buildium is a purpose-built property management software designed to simplify accounting and operations for property managers. It offers a full suite of features tailored specifically to property management, helping users streamline daily tasks and maintain complete financial accuracy. Buildium’s accounting tools allow users to easily track payments, reconcile accounts automatically, and manage accounts payable with a clear financial view of their properties at all times.

Buildium is great at automating bookkeeping tasks such as managing rent collection and payments. Property managers can follow every transaction, from payments made by residents to refunds, ensuring no details are missed. The system also supports automatic reconciliation of bank accounts, which helps save time by matching statements to transactions without manual input. For those managing multiple properties, Buildium offers comprehensive financial reporting. This feature helps managers stay compliant with trust accounting rules and keep track of their finances.

Buildium supports various property types, including single-family, multi-family, and commercial properties. Its flexibility extends to pricing, as there is no minimum unit count, meaning users only pay for what they need. The software also offers built-in tools for leasing, such as online rental applications and tenant screening, to help streamline the entire rental process. It allows property managers to customize lease templates and collect signatures digitally, making the workflow seamless and paperless.

With its well-thought-out features for business performance, Buildium provides managers with tools to monitor portfolio performance, track analytics, and integrate data with other business applications using its Open API. From tracking maintenance requests to managing property inspections, Buildium ensures that property managers have the tools they need to grow their businesses while efficiently handling day-to-day tasks.

Buildium Pros

Offers automatic bank reconciliation, saving time and reducing manual errors, with detailed reporting to maintain compliance with trust accounting rules.

Manages accounts payable efficiently, allowing users to turn work orders into bills and set up automatic payments for recurring expenses.

Offers extensive features; online payments work flawlessly, and the pricing page is detailed and easy to compare.

Offers a 14-day free trial.

Buildium Cons

Open API is only available in the most expensive plan.

eSignature will incur an extra $5 every time in the essential plan.

Incoming EFT transactions cost more in the lower-tier plans ($1.25 per transaction in the Essential plan compared to waived fees in the Premium plan).

Bank account setup fees apply for all plans, with only a limited number of free bank accounts included in the Growth and Premium plans (5 and 15, respectively).

Buildium Pricing

| Plan | Pricing (monthly) | Offerings |

|---|---|---|

| Essential | $58 | Accounting, Maintenance, Tasks, Violations, Resident & Board Member Communications, Online Portals, Property Inspections, Tenant Screening, eSignatures ($5 each), Online Payments (EFT/Credit Card fees) |

| Growth | $183 | All Essential features, Additional features and support, Property Inspections, Enhanced Tenant Screening, Unlimited eSignatures, Online Payments (Lower EFT fees), 5 free bank accounts |

| Premium | $375 | All Growth features, Open API, Business Analytics and Insights, Performance Analytics, 15 free bank accounts, Unlimited eSignatures, Waived EFT fees, Priority Support |

2. REI Hub

Best for Rental Owners to Manage Accounting and Reporting

REI Hub is professional accounting software built for rental property owners to streamline rental bookkeeping and financial reporting. From property and unit-specific level reporting to automated transaction feeds, REI Hub is the best comprehensive solution for real estate investors – no matter if you specialize in short-term rentals, long-term rentals, residential, commercial, or somewhere in between.

Tax season can be complicated. That’s why real estate investors need a solution tailored to their business. REI Hub automatically tracks your finances on a property-by-property (or unit) basis, configures your accounting for easy IRS Schedule E reporting, includes preset rental transaction templates, and helps you maximize your tax deductions based on real estate-specific tax benefits.

For savvy investors looking to know the score, REI Hub’s dashboards and reports display key metrics like cash flow, equity, debt, and property-specific profitability. As a passive (or full-time) investor, you shouldn’t have to worry about DIY-ing your financial reports.

All REI Hub landlords have access to an in-house Virginia-based customer support team. No more waiting on hold for hours or talking to a computer – REI Hub hires real humans available to you when you need them the most. If you’re stressed about moving over to an upgraded accounting system, REI Hub’s support team offers onboarding support to make this transition as smooth as possible.

While REI Hub specializes in accounting, REI Hub also has integrations with popular all-in-one rental management platforms so you can find and manage tenants while taking advantage of advanced accounting solutions.

REI Hub Pros

Offers a 14-day free trial

Virginia-based support team and personalized onboarding support

Property, unit, and portfolio-level reporting

REI Hub Cons

Tiered pricing based on unit count

No features to send out payments or invoices

Specializes in accounting software and does not provide full rental management solutions

REI Hub Pricing

| Unit Count | Pricing |

|---|---|

| Up to 3 | $15/month |

| Up to 10 | $25/month |

| Up to 20 | $45/month |

| Unlimited units | $80/month |

*Annual discounts available.

3. Baselane

Best for Landlords to Manage Rental Businesses

Baselane is a modern financial platform for real estate investors and landlords. It offers an all-in-one solution for managing rental properties, streamlining finances, and enhancing rent collection processes. Baselane Banking provides a user-friendly experience, making it easy to open multiple accounts for each property, manage security deposits, and earn competitive interest rates on savings.

One of Baselane’s standout features is its seamless rent collection system, which allows landlords to collect payments through ACH or card and get paid within 2-5 days. The system also includes automated invoicing, reminders, and late fee settings, ensuring a smooth process for landlords and tenants. Tenants benefit from a dedicated portal where they can make payments from any device, set up auto-pay, and track their rent history.

Baselane also provides powerful bookkeeping and accounting tools integrated directly with its banking platform or external accounts. These tools allow landlords to tag transactions by property, generate real-time financial reports, and track income and expenses for accurate tax filing. With real-time cash flow insights, Baselane helps landlords stay on top of their financial performance and streamline the often tedious task of property management accounting.

The platform’s security features are worth mentioning — offering Visa Zero Liability Protection, FDIC insurance of up to $3 million through Thread Bank, and two-factor authentication (2FA) with end-to-end encryption. This ensures that funds are safeguarded, giving users peace of mind while managing their properties.

Update: Baselane now offers tenant screening which includes income verification, eviction history checks, ID verification, criminal report checks and Equifax credit report. This is great to avoid fraud tenants.

Baselane Pros

Offers a free platform for landlords, which is rare in property management accounting software.

Landlords can set up automatic rent collection and receive rent payments directly into Baselane accounts.

Provides detailed financial insights and analytics, helping landlords make informed decisions.

Doesn’t charge fees for account opening, monthly account fees, minimum balance fees, ACH transfer and return payment, or overdraft fees.

Integrated tenant screening for detailed verification and reporting.

Baselane Cons

While great for smaller landlords, it lacks some of the more advanced features of larger property management systems.

Does not provide integrated native tenant communication tools for interacting with tenants.

Better suited for small to medium-sized property owners, which may not scale as effectively for large portfolios.

While it offers financial insights, report customization options are limited compared to other platforms.

Baselane Pricing

| Plan | Pricing (monthly) | Offerings |

|---|---|---|

| Banking | Free | Unlimited banking accounts, FDIC insured up to $3M, Earn up to 3.77% APY, Physical & virtual debit cards, No account fees. The only fees charged: $2 per mailed check, $15 per checkbook. |

| Rent Collection | Free | Automated invoices, tenant portal, ACH & card payments, automated late fees, Fast payments in 2-5 days. The only fees charged are $2 via ACH if deposited into an external bank, 3.49% via card. |

| Bookkeeping & Accounting | Free | Sync transactions, single-entry books, cash flow insights, and Schedule E-reporting are free with no additional fees. |

4. AppFolio

Best for Advanced Accounting and Reporting

AppFolio Property Manager is designed to simplify property management for businesses of all sizes. It offers real-time data insights and powerful automation tools that streamline day-to-day accounting, leasing, and operations. AppFolio’s accounting system is built to help property managers make faster, data-driven decisions while minimizing manual errors. With its secure, centralized database, all transactions are captured in one place, offering a single source of truth for your business.

AppFolio has a feature called Smart Bill Entry. This tool uses AI technology to automatically read and input data from PDF invoices, reducing the time spent on manual entry. Users can simply upload, review, and approve bills, allowing them to focus on higher-value tasks. The software also enables flexible reporting, offering customizable reports such as income statements, balance sheets, and cash flow summaries. These reports are tailored to even the most complex portfolios, providing the insights needed to make strategic decisions quickly.

For those who need advanced customization, AppFolio offers a robust Database API. This feature allows businesses to build custom analytics, integrations, and workflows essential for growing their operations. The API includes enterprise-level control and access to the AppFolio database, with thorough documentation and testing environments validated by AppFolio Stack partners. The platform also supports automated late fees, CAM tracking and reconciliation, and bulk tenant charges, all aimed at streamlining property management.

AppFolio also offers seamless online payments and bank reconciliation — making managing cash flow easier and reducing human error. By integrating with Plaid, AppFolio ensures that bank transactions are matched automatically. AppFolio’s flexibility extends to its plans, allowing users to scale and pay only for the features they need, making it a versatile solution for property managers across residential, commercial, and community associations.

AppFolio Pros

AppFolio’s Smart Bill Entry feature uses AI to read and process PDF invoices automatically, significantly reducing time spent on manual data entry.

Offers customizable reports with in-depth financial insights, allowing users to drill down into specific data points.

Provides extensive API access, enabling businesses to build custom analytics, integrations, and data workflows.

AppFolio Cons

For pricing information, the user needs to contact the sales team.

Some users may find the software complex to navigate, particularly when utilizing advanced features like the API.

Features such as custom fields and database API access are only available in higher-tier plans, limiting flexibility in lower plans.

AppFolio Pricing

For pricing information, contact the sales team.

5. Xero

Best for Small Real Estate Businesses

Xero is a cloud-based accounting software designed to meet the diverse needs of small real estate firms. Users can easily manage finances from any location, ensuring that critical accounting tasks are handled efficiently. The platform offers a variety of features tailored to streamline financial management, from invoicing to tracking expenses and reconciling bank accounts.

Xero comes with a user-friendly dashboard, which provides real-time insights into your business’s financial health. Businesses can monitor cash flow, view outstanding invoices, and track expenses all in one place. The ability to customize the dashboard allows real estate professionals to focus on the metrics that matter most to their operations. Additionally, Xero supports fixed asset management, making it simple to track and manage property assets, including depreciation and disposals.

Xero excels in its invoicing capabilities, allowing users to create and send invoices instantly. This feature is particularly beneficial for real estate businesses that require timely payments. Users can filter invoices by due dates, amounts owed, and overdue statuses, ensuring they stay on top of their receivables. Furthermore, Xero’s mobile app ensures that real estate agents and managers can handle financial tasks on the go, making it easier to manage their accounting processes in real-time.

Security and support are also great. Xero provides an affordable solution for real estate businesses looking to enhance their accounting practices while maintaining the flexibility of cloud-based technology.

For those looking to streamline accounting processes, Xero offers a free 30-day trial, allowing potential users to explore all features before committing to a plan. Whether managing invoices, tracking cash flow, or handling fixed assets, Xero is an invaluable tool for real estate professionals aiming to optimize their financial management. You may read our Xero review for more details.

Xero Pros

Xero allows real estate agents to manage bookkeeping and track performance from anywhere using its mobile app.

Connects with over 1,000 apps, including property management tools like Rentancy, Re-Lease, and stripe

Overall a balanced software with affordable plans, 24/7 online support, easy to use and decent features.

Xero Cons

Starter plan allows sending only 20 invoices and entering only 5 bills, which may be restrictive for growing businesses.

While Xero has basic payroll features, you will need third-party apps for more advanced payroll management.

Features like expense tracking and project management come at an additional monthly cost for all plans.

Xero Pricing

| Plan | Pricing (monthly) | Offerings |

|---|---|---|

| Early | $15 | Send invoices and quotes (20 invoices limit), Enter 5 bills, Reconcile bank transactions, Short-term cash flow and business snapshot |

| Growing | $42 | Everything in Early, plus: Bulk reconcile transactions |

| Established | $78 | Everything in Growing, plus: – Claim expenses, Analytics Plus, Use multiple currencies |

6. FreshBooks

Best for Rental Businesses

FreshBooks simplifies financial management, enabling users to focus on what they do best. This platform stands out for its user-friendly interface and powerful features tailored for various industries, including real estate. FreshBooks allows users to streamline their billing processes, track expenses, and manage client communications effortlessly.

One of FreshBooks’ key features is its invoicing capability. Users can create professional-looking invoices in seconds, ensuring they project a polished image to their clients. The software supports multiple payment options, making it easier for clients to pay on time. FreshBooks even automates late payment reminders so users can stay on top of their receivables without additional effort. This efficiency allows real estate professionals to get paid faster, enhancing their cash flow.

Expense tracking is a vital feature of FreshBooks. The platform enables users to manage their business expenses seamlessly, reducing the hassle of manual entry. FreshBooks also offers a mileage tracking app, helping users monitor travel expenses related to their real estate activities.

Collaboration tools within FreshBooks are designed to improve team efficiency. Users can manage projects and communicate with clients all in one place. This feature mainly benefits real estate teams, allowing them to stay organized and share updates quickly. The software’s time-tracking capabilities ensure users can accurately bill clients for hours worked, reducing the risk of undercharging.

FreshBooks provides various reporting features that help users analyze their financial health. It connects seamlessly with various applications, allowing users to customize their accounting solutions to their specific needs. This flexibility and extensive feature set make FreshBooks an excellent choice for real estate accounting.

FreshBooks Pros

Simplifies complex tasks, enabling easy invoicing for tenants and quick estimates for potential buyers.

Offers late payment reminders and recurring invoices to streamline financial management.

Provides various financial reports, including profit and loss, sales tax summaries, and accounts aging.

FreshBooks Cons

While FreshBooks offers competitive pricing, additional features (like team member access and advanced payments) require extra costs in every plan, which can add up quickly for growing businesses.

The lite plan caps at 5 clients when sending invoices and offers minimal features.

FreshBooks Pricing

| Plan | Pricing (monthly) | Offerings |

|---|---|---|

| Lite | $5.70 | Send unlimited invoices to 5 clients, Track unlimited expenses, Send unlimited estimates, Get paid via credit cards & ACH, Run reports for an easy tax time |

| Plus | $9.90 | Everything in Lite, Send unlimited invoices to 50 clients, Set up recurring invoices & retainers, Automatically capture receipt data, Invite your accountant |

| Premium | $18 | Everything in Plus, Send unlimited invoices to unlimited clients, Track project profitability, Customize email templates with dynamic fields |

| Select | Custom | Everything in Premium, Access lower credit card transaction fees, Remove FreshBooks branding from client emails, 2 team members included- Dedicated support line |

7. Sage 300

Best for Construction and Real Estate Firms

Sage 300 Construction and Real Estate is a powerful software solution designed for contractors, developers, and property managers. It provides comprehensive project visibility and streamlines complex projects with precision. With Sage 300, users can manage risks associated with subcontractors and vendors, enhance visibility with custom reporting, and facilitate collaboration across all project phases in real-time.

The software is built to meet the unique needs of the construction and real estate industries. Its features include project management, service operations, and real estate management. Users can connect the field with the back office seamlessly, ensuring all team members can access critical information. This integration allows for improved communication and simplified accounting, enabling businesses to focus on delivering exceptional service to their customers.

Sage 300 offers extensive reporting capabilities, featuring over 1,400 prebuilt report formats. Users can also create custom reports to gain deeper insights into their business operations. This ability to access vital information empowers users to make informed decisions and enhances profitability. Additionally, Sage provides powerful add-ons like MyAssistant and Office Connector, which further streamline processes and optimize productivity.

Sage’s construction management solutions help users win bids, connect teams, and deliver projects on time and within budget. By simplifying service operations and optimizing service dispatching, the software ensures that companies can respond quickly to client needs and maintain high standards of service. Whether managing residential properties or large construction projects, Sage 300 provides the tools necessary to achieve business goals effectively.

Sage 300 Pros

Offers over 1,400 prebuilt report formats and the ability to create custom reports for better decision-making and increased profitability.

Connects various aspects of a business—people, projects, processes, and properties — helping streamline operations and achieve financial goals.

Offers organization of essential files like contracts and invoices, which reduces risk and improves efficiency.

Sage 300 Cons

Extensive features may overwhelm smaller businesses or those with less complex needs.

Pricing information is not available on the website.

Sage 300 Pricing

Pricing information is available on request.

8. DoorLoop

Supports Multi-property Accounting

DoorLoop simplifies the rental management process for landlords, property managers, and real estate investors. It caters to a diverse range of properties, including residential, commercial, student housing, and more. DoorLoop allows users to manage all aspects of their rental portfolio from a centralized platform.

The software offers a variety of features that enhance operational efficiency. Its robust tenant communication tools ensure seamless interactions, while the mobile apps enable property managers and tenants to access essential functionalities on-the-go. Users can manage applications, collect rent, handle maintenance requests, and generate financial reports, all from any device. The ability to upload files and receive maintenance requests directly through the app adds to the convenience.

DoorLoop offers excellent support and onboarding services. Users receive unlimited training and assistance, ensuring they can navigate the software with ease. The platform boasts fast response times via live chat, along with access to a wealth of helpful articles. Additionally, its open API facilitates integration with thousands of applications, making it versatile and adaptable to various workflows.

Another unique aspect of DoorLoop is its RapidRent feature, which automates rent collection. Tenants can pay via credit card, eCheck, or cash, and automated reminders help ensure timely payments. This feature streamlines cash flow management for property owners, allowing them to focus on growth rather than payment tracking.

DoorLoop Pros

Offers real-time reporting that enables users to track transactions and financial data instantly.

Integration with QuickBooks Online and other banking services simplifies the accounting process, making it easier to reconcile transactions.

Offers excellent customer support by email and chat.

DoorLoop Cons

Onboarding fees are based on portfolio size, potentially making it costly for larger portfolios.

While the free tier includes basic features, many advanced functions, such as additional eSignatures and customized dashboards, require higher-tier plans, which may limit access for budget-conscious users.

DoorLoop Pricing

| Plan | Pricing (monthly) | Offerings |

|---|---|---|

| Starter | $59 | Online rent & fee payments, Tenant portal, Maintenance management, Accounting & reporting, Rental applications & screening, Lease management, World-class support, eSignature, CRM for tenants |

| Pro | $119 | Advanced accounting and reporting, Live bank connect, QuickBooks online sync, Two-way communication, Tenant announcements, Advanced maintenance management, Outgoing payments, Budgeting, Email, chat, phone & Zoom support |

| Premium | $169 | VIP Priority Support, Free incoming ACH payments, Free personalized website, Zapier Integration, Free eSignatures, Free bank account setup, Custom convenience fees, Unlimited additional users, Unlimited data storage, Advanced customizable dashboards, API access |

9. TenantCloud

To Manage Tenants and Finances

TenantCloud streamlines operations for landlords, property managers, and tenants. Its versatile feature set includes online rent payments, tenant screening, maintenance requests, and rental applications. TenantCloud makes listing properties easy, communicating with tenants, and managing accounting in one centralized system, helping users efficiently oversee their portfolios from anywhere.

One of its standout features is the team management functionality, which allows landlords and property managers to add team members, assign specific properties, and set customized permissions. This feature enables teams to collaborate, track activity, and complete tasks seamlessly, ensuring every property is managed effectively. TenantCloud’s messaging platform keeps communication between tenants, landlords, and maintenance crews organized, minimizing confusion.

TenantCloud offers rent reporting, where tenants can build their credit history by reporting on-time rent payments to major credit bureaus. This encourages timely payments and enhances the tenant-landlord relationship. Additionally, landlords can use the Rentability Report feature to set optimal rental prices by analyzing local market trends and similar listings. This tool helps fill vacancies faster by providing accurate rent insights.

The platform offers a range of pricing plans, from Starter for DIY landlords to Business for large property management firms, with options for custom solutions based on portfolio size. With its comprehensive tools, TenantCloud empowers landlords and property managers to grow their businesses while simplifying property management tasks.

TenantCloud Pros

Supports unlimited units on all plans

Automates accounting tasks such as creating invoices, tracking payments, and managing financial data, reducing manual effort and errors.

Includes functionalities for online payments, tenant screening, maintenance requests, and property management, making it a versatile choice for landlords.

TenantCloud Cons

Higher-tier plans can become costly, particularly for property managers with larger portfolios or those needing extensive features.

‘Team management tools’ are only available in the most expensive plan.

Advanced features, such as the amortization tracker, depreciation tracker, and listings auto-refresh, are only available on the most expensive plan.

TenantCloud Pricing

| Plan | Pricing (monthly) | Offerings |

|---|---|---|

| Starter | $15.60 | Rent Payments, Maintenance Management, Listings and Applications |

| Growth | $29.30 | Everything in Starter, plus: Lease Builder, Landlord Forms, Property Message Board |

| Pro | $50.40 | Everything in Growth, plus: Tax Reports, Application Customization, Reconciliation |

| Business | Custom | Everything in Pro, plus: Team Management & Tools, Task Management, Listings Auto-Refresh |

10. Stessa

Best to Automate Rental Property Accounting

Stessa is a financial technology platform for property owners and real estate investors. It offers tools to streamline property management and enhance financial tracking. Stessa empowers users to manage their portfolios efficiently, from rent collection to integrated accounting, making it ideal for both novice and experienced investors.

Like many competitive platforms, Stessa also has a feature that automates rent collection. Users can set up recurring ACH payments, allowing tenants to pay rent easily and consistently. This service minimizes the hassle of manual collection and provides the option for automatic late fees, encouraging timely payments. Stessa also simplifies communication by sending reminders, enabling landlords to maintain a professional relationship without the stress of constant follow-ups.

In addition to rent collection, Stessa integrates strong accounting functionalities. The platform captures every rent payment and automatically assigns it to the appropriate property. This real-time accounting capability means that property owners can effortlessly update their financial records. Users can also generate key financial reports, helping them make informed decisions about their investments.

Overall, Stessa offers an effective blend of property management and accounting tools, making it easier for landlords to manage their portfolios efficiently. Its user-friendly interface and powerful automation features set it apart in financial technology, allowing property owners to focus on growing their investments.

Stessa Pros

Offers a completely free essentials plan, which includes features like unlimited property management and automatic bank feeds. This plan is ideal for newer investors looking to get organized.

Pro plan offers a competitive 4.58% annual percentage yield (APY) on cash balances, making it attractive for users looking to grow their funds.

Tax package features are useful as they save a lot of time while preparing for tax returns.

Stessa Cons

Does not offer an API like many competitive software solutions — limiting integration with other tools and services.

Free plan has no eSignature functionality.

Stessa Pricing

| Plan | Pricing (monthly) | Offerings |

|---|---|---|

| Essentials | $0 | Unlimited properties, Automatic bank feeds, Basic financial reports, Vacancy marketing, Tenant screening, Online rent collection, 2.83% APY on cash balances |

| Manage | $12 | Everything in Essentials, plus: One (1) eSignature/month, Schedule E report, 60+ legal forms and templates, Priority chat support, Accelerated rent payments |

| Pro | $28 | Everything in Manage, plus: Unlimited portfolios, All advanced reports, Advanced transaction tracking, Budgeting and pro-forma, Unlimited receipt scanning, Unlimited chart history, Seven (7) eSignatures/month, 4.58% APY on cash balances, Priority phone support |

11. Landlord Studio

Inbuilt Receipt Scanner and Mileage Tracking

Landlord Studio offers an accounting solution designed specifically for rental property management. With features tailored for landlords, this cloud-based software streamlines the financial aspects of managing rental properties, making tax season hassle-free. Users can easily automate income and expense tracking through a user-friendly mobile app that allows them to categorize expenses, generate instant financial reports, and even track mileage related to property management.

Landlord Studio has a great feature called bank feed integration which securely connects users’ bank accounts to the app. This functionality automates the import of transactions, minimizing manual data entry and reducing errors. The software utilizes Plaid for secure connections ensuring that users can reconcile their income and expenses with just a few taps. For those who prefer a paperless solution, the Smart Receipt Scanner digitizes expenses by allowing users to snap photos of their receipts, automatically extracting relevant details.

Landlord Studio also provides a powerful dashboard that offers real-time insights into portfolio performance. Customization options enable users to filter reports by category, date range, and property, facilitating detailed financial analysis.

For added convenience, Landlord Studio integrates seamlessly with Xero, allowing users to sync their financial data effortlessly. This integration eliminates the risk of double data entry and ensures accounting accuracy. The software also includes advanced reporting tools to help landlords maximize their return on investment and simplify tax filing.

Overall, Landlord Studio empowers landlords with the tools they need to manage their rental properties effectively while minimizing the complexities of real estate accounting. With its focus on ease of use and robust reporting capabilities, Landlord Studio stands out as a go-to solution for landlords looking to enhance their financial management processes.

Landlord Studio Pros

Users can instantly generate over 15 customizable reports, including the Schedule E-report, providing valuable insights into their portfolio’s financial performance.

Comes with a free plan that supports 3 units with essential features, including support.

Pricing plans are reasonable.

Landlord Studio Cons

Absence of advanced functionalities such as tenant-submitted maintenance requests and vendor assignments for job coordination compared to premium software.

Lacks a straightforward way to message tenants directly through the app, forcing landlords to rely on texts and emails. This can make tracking communications across multiple properties cumbersome, raising the likelihood of errors.

Landlord Studio Pricing

| Plan | Pricing (monthly) | Offerings |

|---|---|---|

| Go | $0 | Up to 3 units, 1 user, Limited document storage, Find & Screen Tenants, Create property listing, Up to 48 hours property listing review, Manage applications, Manual income/expense tracking, Limited automated rent reminders, Basic reporting (PDF only), Tenant portal, Maintenance management, Tenant maintenance requests |

| PRO | $12 | Unlimited units, 5 users, Priority support, Unlimited document storage, Automated tasks, Online rent collection, Automated rent reminders, Rental accounting, Advanced reporting (CSV, PDF), Xero integration |

12. Propertyware

End-to-end Rental Property Management Software

Propertyware is designed for the unique needs of single-family rental businesses. It streamlines operations with its robust features, empowering property managers to enhance efficiency and drive growth. The platform’s strength lies in its customizable options, allowing users to tailor workflows and processes to match their specific business requirements. This flexibility sets Propertyware apart in a competitive market, enabling property management professionals to operate on their own terms.

Propertyware offers a suite of powerful tools that simplify various aspects of property management. Its intuitive dashboards provide real-time insights into business performance, while customizable reports enable in-depth analysis. The platform also supports online leasing, tenant screening, and payment processing, all through a user-friendly interface. Notably, Propertyware includes an open API, facilitating seamless integration with third-party applications. This integration capability minimizes manual data entry and enhances operational efficiency, making it easier for property managers to focus on providing excellent service.

Propertyware emphasizes customization and data-driven decision-making. The platform allows property managers to create unique workflows, ensuring that they can operate efficiently while maintaining high standards of service. Users benefit from an extensive self-service owner portal that fosters transparency and trust. Furthermore, the reporting capabilities offer actionable insights that help property managers make informed decisions, ultimately improving their bottom line.

Propertyware is a great option because it combines powerful features with well-known customization options. Its commitment to helping property managers optimize their operations makes it a valuable tool for those looking to thrive in the competitive real estate market.

Propertyware Pros

Highly customizable platform allows users to tailor workflows and processes to meet their specific needs, enhancing efficiency and service quality.

Effectively manages properties across multiple locations, providing a holistic view of operations.

The pricing page is clear and to the point, with no hidden fees.

Propertyware Cons

Extensive features and customization options may be overwhelming for smaller property management businesses with simpler needs.

Has a learning curve, and simple tasks might feel cumbersome.

Propertyware Pricing

| Plan | Pricing (per unit/month) | Offerings |

|---|---|---|

| Basic | $250 | Global Customization & Reports, Marketing, Property Management, Owner Portals, Tenant Portals, Maintenance, Accounting, Screening, Payments, Unlimited Support, Unlimited Storage, Unlimited Online Training, Two-Way Text Messaging, eSignature, Inspections, Maintenance Projects, Vendor Portals |

| Plus | $350 | Everything in Basic plus additional features for comprehensive property management |

| Premium | $450 | Everything in Plus with even more advanced options and premium support |

13. QuickBooks

To Simplify Construction Accounting

QuickBooks is designed specifically for the construction industry. It provides tools that simplify various aspects of construction accounting, enabling businesses to manage finances with ease and efficiency. QuickBooks helps users run their construction businesses more effectively by automating tasks, enhancing tracking capabilities, and providing in-depth insights into financial performance.

One of the standout features of QuickBooks is its seamless invoicing process. Users can create and send invoices and estimates on the go, attaching necessary documents such as plans and contracts. This feature allows instant notifications when invoices are viewed or paid, making it easier to stay on top of receivables. QuickBooks online also facilitates quick payment processing — accepting various payment methods, which help users get paid faster — up to four times quicker, according to the company. The mobile card reader lets users accept credit and debit card payments directly on-site, streamlining the payment experience.

Job costing is a critical aspect of QuickBooks. The software provides robust tools for tracking time and expenses associated with each project. Users can generate profit reports and comprehensive job cost reports, giving them visibility into which projects are profitable and which may require additional attention. This feature is essential for making informed business decisions and ensuring financial health.

The software excels in reporting capabilities, allowing users to create customizable reports that offer insights into income statements, balance sheets, and cash flow. The software enables users to manage their contractors efficiently by simplifying tax form preparation. Subcontractors can easily input their W-9 and tax ID information directly into QuickBooks, ensuring accurate 1099 forms are generated for tax reporting.

The QuickBooks mobile app further enhances usability, allowing users to manage their accounting tasks from anywhere. This accessibility ensures users can monitor their finances, track expenses, and receive alerts on their mobile devices. QuickBooks integrates with various apps tailored for the construction industry, making managing leads, scheduling projects, and streamlining operations easier.

QuickBooks Pros

Mobile app allows users to manage accounting tasks on the go, including sending invoices, tracking expenses, and accessing financial reports from anywhere.

Pricing page is very detailed, offering plenty of packages to choose from.

Offers a 30-day free trial.

QuickBooks Cons

The ‘expert assisted’ feature is free for only 30 days, even for the most expensive plan.

New users may find navigating and fully utilizing the software challenging without dedicated support.

QuickBooks Pricing

| Plan | Pricing (Monthly) | Offerings |

|---|---|---|

| Plus | $49.50 | Comprehensive reports, Connect all sales channels, Includes 5 users, Inventory, Project profitability, Financial planning |

| Advanced | $117.50 | Everything in Plus, plus: Powerful reports, Auto-track fixed assets, Data sync with Excel, Batch invoices and expenses, Custom access controls, Workflow automation, Data restoration, 24/7 support & training, Revenue recognition, Includes 25 users |

What Is Real Estate Accounting Software?

Accounting software for real estate is designed to meet the financial needs of property managers and real estate professionals. It tracks income, expenses, and leases while generating sector-specific financial reports. The software also automates routine tasks like rent collection and invoice generation, ensuring accurate records. Additionally, such platforms centralize financial data — giving property managers a clear view of performance. This helps them make informed decisions and stay compliant with financial regulations and tax requirements.

What are the Benefits of Real Estate Accounting Software?

Real estate accounting software offers a range of benefits that can greatly improve property management efficiency and effectiveness. Here are some key advantages:

- Automation of Routine Tasks: Automation reduces the time spent on repetitive tasks such as generating invoices, sending payment reminders, and tracking expenses. This frees up valuable time for property managers and minimizes the risk of errors that can occur with manual entry.

- Efficient Rent Collection: Simplifies the rent collection process by enabling online payment options and automatic reminders for tenants. This ensures timely payments, improves cash flow, and reduces late fees. To make it even easier, these platforms have built-in tracking features that property managers can use to stay updated on rent collection.

- Property-Specific Accounting: Managing multiple properties can complicate accounting practices. Real estate accounting software provides property-specific accounting features that allow managers to maintain separate financial records for each property. This clarity helps in analyzing the profitability of each asset, making it easier to identify which properties are performing well and which may require attention.

- Financial Forecasting: Real estate accounting software includes advanced reporting and analytics tools that help property managers make accurate financial forecasts. By analyzing past data and market trends, users can predict future cash flows, expenses, and potential investment opportunities.

- Tax Compliance: Navigating tax regulations can be complex, especially for property managers with multiple income sources and expenses. Real estate accounting software simplifies tax compliance by organizing financial data and generating reports needed for accurate tax filings. By maintaining up-to-date records, property managers can ensure they meet all legal requirements while minimizing the risk of costly penalties or audits.

- Audit Trail: A robust audit trail feature within real estate accounting software provides a complete record of all financial transactions. This level of transparency is essential for accountability, as it allows managers to track changes and identify who made specific entries. In the event of an audit or dispute, having a clear trail of transactions helps to resolve issues more effectively and maintains trust with stakeholders.

- Decision-Making: Access to real-time financial data and detailed reports empowers property managers to make informed decisions. With accurate insights into revenue, expenses, and cash flow — real estate professionals can quickly assess the financial health of their properties and implement necessary changes. This data-driven approach enables better strategic planning, ensuring that resources are allocated efficiently and effectively to maximize returns.

How To Choose the Best Real Estate Accounting Software?

Selecting the right real estate accounting software is essential for managing your properties effectively. Here are some key factors to consider:

- Analyze Your Needs: Start by evaluating your specific property management and accounting requirements. Consider the size of your portfolio, the types of properties you manage, and the features that are essential for your operations. For example, if you need advanced reporting or tenant screening capabilities, look for an accounting software option that offers these features. For instance, software like Buildium, AppFolio, or DoorLoop could be suitable choices for such use cases.

- Consider Your Budget: Determine how much you are willing to invest in accounting software. Prices can vary significantly based on features, so it’s important to find a solution that fits within your budget while still meeting your essential needs. Keep in mind any additional costs for integrations or add-ons that may be required. For example, if you are working with a limited budget, software like Baselane, Stessa, and LandlordStudio offers free plans.

- Try Free Trials: Many software like Buildium, Xero, and QuickBooks offer free trials or demo versions of their products. Take advantage of these opportunities to test the software’s features and usability. This hands-on experience will help you assess whether the software aligns with your workflow and if it meets your expectations.

- Integration Capabilities: Evaluate how well the software integrates with your existing systems and tools. For instance, if you use other construction accounting software or accounting platforms, ensure that the new solution can seamlessly connect with these systems. Good integration capabilities can save time and improve overall efficiency.

Is There Free Real Estate Accounting Software?

Yes, there is free real estate business accounting software available for landlords and property managers. While these options may have basic accounting features compared to their paid counterparts, they still provide essential functionalities for managing finances and tracking income and expenses. Some of the free platforms include Baselane, Xero, Stessa, and LandlordStudio. For a more comprehensive list of options, check out these free accounting software.

-

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.