Travel agencies operate in a fast-paced industry with unique accounting needs. They handle commissions from bookings, manage multi-currency transactions for international clients, and need accurate invoicing and expense tracking to stay organized. These complexities require specialized tools to ensure smooth financial management.

Proper accounting software enables travel agencies to manage cash flow, track bookings, and reconcile payments efficiently. Without this software, this can lead to financial errors, missed opportunities, and lost revenue.

Geekflare has tested the best accounting software for travel agencies based on key features, user reviews, pros & cons, pricing, and more.

- 1. FreshBooks – Best For Freelancers And Small Agencies

- 2. Crunch – Best For UK-based travel Agencies

- 3. QuickBooks – Best For Quickbooks Accounting Users

- 4. Travelopro – Best For Enterprise Requiring GDS

- 5. Xero – Budget-Conscious SMB Travel Agencies

- 6. Wave – Best For Free And Simple Accounting Tool

- 7. TallyPrime – Best For GST Compliance Indian Agencies

You can trust Geekflare

At Geekflare, trust and transparency are paramount. Our team of experts, with over 185 years of combined experience in business and technology, tests and reviews software, ensuring our ratings and awards are unbiased and reliable. Learn how we test.

1. FreshBooks

Best For Freelancers And Small Agencies

FreshBooks is intuitive and user-friendly accounting software designed for small businesses. It simplifies essential financial management tasks like invoicing, double-entry accounting, expense tracking, and time management. FreshBooks is ideal for travel agents who juggle multiple bookings, track billable hours and manage diverse payment schedules. The software supports features like recurring billing, multiple currencies, and client communication, making it a comprehensive solution for the travel industry.

The cloud-based platform allows users to access their accounts from anywhere, ensuring they can manage finances. Travel agencies benefit from expense-tracking capabilities that automatically import and categorize expenses when linked to a bank account. FreshBooks also provides professional invoicing templates that can be customized to reflect a brand’s identity, allowing travel agents to maintain a polished image.

FreshBooks works great for cash flow management with automated payment reminders, recurring billing, and secure online payment options. Furthermore, the platform’s powerful reporting tools provide insights into spending, income, and profitability, helping travel agents make informed decisions about their business. Whether you’re a startup or an established agency looking to simplify your financial management, FreshBooks offers the right mix of features to support your needs.

A Reddit user shared their frustration with FreshBooks, stating that their expenses weren’t importing correctly, causing significant delays in reconciliations.

Note: While many users continue to highly regard FreshBooks for its ease of use and overall functionality, this particular issue points to an area where the platform could improve—particularly in terms of syncing expenses and addressing support delays.

FreshBooks Key Features

- Professional Invoicing: Create branded invoices with options for retainers, commissions, and discounts, and automate recurring billing schedules.

- Time Tracking: Use the timer to log billable hours for clients and convert these logs into invoices effortlessly.

- Cloud Accessibility: Manage accounts from any device with automatic syncing for seamless updates across mobile and desktop.

- Multi-Currency Support: Handle international transactions with support for multiple currencies and languages.

- Integrated Payments: Accept secure online credit card payments directly through invoices, with notifications for real-time updates.

- Comprehensive Reporting: Gain insights with easy-to-understand income, expenses, and business performance reports to aid decision-making.

FreshBooks Pros

Intuitive and easy-to-navigate interface, making it accessible for travel agencies without accounting expertise.

Offers one of the most powerful integration ecosystems in the market.

Exceptional customer service with real humans on the line.

Offers some of the most affordable pricing plans.

FreshBooks Cons

Travel agencies needing more comprehensive project tracking and resource management may find it insufficient.

Features like advanced payments or payroll are add-ons that incur additional costs.

Offers a limited selection of templates and fonts, which restricts invoice customization options compared to industry leaders.

FreshBooks Pricing

| Plan | Pricing (monthly) | Offerings |

|---|---|---|

| Lite | $3.80 | Unlimited invoices for up to 5 clients, Expense tracking, Estimates, Reports for tax time, Credit card & ACH payments |

| Plus | $6.60 | Up to 50 clients, Recurring invoices, Proposals, Receipt data capture, Accountant access |

| Premium | $12.00 | Unlimited clients, Project profitability, Customized email templates, Advanced reporting |

| Select | Custom | Lower payment fees, Data migration assistance, Dedicated support, 2 included team accounts |

2. Crunch

Best For UK-based travel Agencies

Crunch is one of the best travel business accounting tools, and it is built with ease of use in mind. This software lets you handle invoicing, expenses, and tax filings with just a few clicks. The software seamlessly integrates with popular banking platforms, allowing you to link your bank accounts for easy reconciliation and real-time financial tracking.

Crunch has a feature called ‘receipt capture’, which lets you upload and organize documents effortlessly, ensuring that all your expenses are accurately recorded. Furthermore, Crunch’s intuitive dashboard provides insightful reports to help you monitor cash flow and make informed business decisions.

Crunch also comes with access to expert Chartered Certified Accountants available on demand. They offer advice tailored to your needs, ensuring compliance with tax regulations and giving you peace of mind. This solution is perfect for travel agencies, from solo agents and individual freelancers to startups and established businesses looking to streamline their accounting processes.

Crunch Key Features

- Invoicing on the Go: Create and send customized invoices from your computer or mobile device with ease.

- Automated Expense Tracking: Save time by scanning and organizing receipts for instant expense management.

- Bank Reconciliation: Quickly match transactions to invoices and expenses through automated bank syncing.

- Open Banking Integration: Import bank transactions weekly for up-to-date financial records.

- Comprehensive Reporting: Generate real-time reports to gain insights into cash flow and support strategic decisions.

- On-Demand Accountant Access: Get expert advice and guidance from Chartered Certified Accountants whenever needed.

- HMRC-Compliant Tax Filing: Ensure accurate and timely submission of tax returns with support from Crunch’s expert team.

Crunch Pros

Crunch is HMRC and ACCA certified, which helps with UK tax regulations.

Unlimited tax advice.

Simple and intuitive software interface designed for busy professionals

Free forever plan available.

Crunch Cons

The platform is only available in the UK.

Larger travel agencies might find the features somewhat limited.

Invoice templates and other design elements offer less customization compared to competitors.

Crunch Pricing

| Plan | Pricing (monthly) | Offerings |

|---|---|---|

| Sole Trader | £26.50 + VAT | All-in-one business tools, Automated expense tracking, On-demand Accountant, Tax filing |

| Pro | £86.50 + VAT | Year-end accounts, Directors payroll, Unlimited tax advice, Ideal for over £40k earners |

| Premium | £86.50 + VAT | Self-Assessment included, Tax optimisation review, Extra business support |

| Enterprise | £159.50 | E-commerce linking, Dedicated bookkeeper and accountant |

3. QuickBooks

Best For Quickbooks Accounting Users

QuickBooks Online is an accounting software designed for small to medium-sized businesses that help manage finances, track expenses, and handle invoicing effortlessly. The platform integrates seamlessly with other tools to simplify bookkeeping, making it ideal for business owners who want to stay on top of their finances without needing an accounting background. With its cloud-based structure, the software allows businesses to access their financial data anywhere. Users can set up personalized invoicing and track sales and expenses in real-time, making it a versatile solution for keeping a business’s books in order.

QuickBooks Online also offers scalable plans to accommodate businesses as they grow. The ability to connect multiple sales channels and manage payroll offers everything from basic income and expense tracking to more complex reporting and inventory management. The software also provides automated tax calculations, invoicing, and expense categorization, which helps to save time and reduce the risk of human error. With various customer support options, including live expert assistance, users can rely on QuickBooks for guidance when needed.

It offers intuitive features like receipt capture and mileage tracking, making financial management straightforward. The platform also includes key business insights through detailed reports that help users make informed decisions. QuickBooks works great for freelancers, small businesses, and growing startups that need an intuitive, flexible accounting solution.

A Reddit user points out that while QuickBooks isn’t the most advanced tool, its user-friendliness makes it a great choice.

QuickBooks Key Features

- Income and Expense Tracking: Easily track and categorize income and expenses to stay on top of your finances.

- Automated Tax Calculations: Let the system calculate your taxes, reducing the risk of errors and saving time.

- Invoice Creation and Payment: Send professional invoices and accept payments directly within the platform.

- Inventory Management: Track stock levels and sales automatically with integrated inventory management.

- Multi-user Support: Allow multiple users to access and work on your financial data, making collaboration easy.

- Mobile App: Manage your finances on the go with QuickBooks Online’s mobile app.

QuickBooks Pros

Effortless access to customer information.

Seamlessly accessible from any device: phone, tablet, or computer.

Affordable plans with a wide range of options to choose from.

Integrates well with other systems.

QuickBooks Cons

Expert assistant is free for 30 days only.

24/7 support & training is only available in the highest tier plan.

Limitations on the number of users and no free trial.

QuickBooks Pricing

| Plan | Pricing (monthly) | Offerings |

|---|---|---|

| Simple Start | $10.50 | Income & expenses, Banking (5.00% APY), Bookkeeping automation, Invoice & payments, Tax deductions, and more. |

| Essentials | $19.50 | Enhanced reports, 3 sales channels, Multiple currencies, Includes 3 users. |

| Plus | $29.70 | Comprehensive reports, Connect all sales channels, Inventory, Project profitability, Includes 5 users |

| Advanced | $70.50 | Auto-track fixed assets, Batch invoices & expenses, Workflow automation, Data restoration, 24/7 support & training, Includes 25 users |

4. Travelopro

Best For Enterprise Requiring GDS

Travelopro offers comprehensive and scalable accounting software for travel agents tailored to meet the needs of car rental companies, tour operators, and destination management companies. With over 12 years of experience in the travel technology space, Travelopro has developed a sophisticated platform that integrates booking systems for flights, hotels, transfers, sightseeing, and excursions. Their solution streamlines business processes, increases direct sales, and reduces operational costs, helping travel businesses grow and enhance customer satisfaction.

Travelopro provides a fully integrated software solution, combining both forward and backward integration to help businesses manage their operations seamlessly. It supports many modules, including flight booking engines, hotel booking engines, car rental systems, and more. With the ability to integrate XML data feeds, businesses can access real-time information and maximize their profitability by providing customers with competitive rates and better services.

In addition to its comprehensive booking systems, Travelopro offers a fully integrated customer relationship management (CRM), accounting, and back-office management system. The platform supports B2B and B2C operations, making it a great fit for businesses of all sizes. Travelopro is ideal for small agencies, growing startups, large travel agencies, tour operators, and corporate travel consultants.

Travelopro Key Features

- Customizable Booking Engines: Tailor your flight, hotel, car rental, and bus booking engines to match your unique business needs.

- Cloud-Based System: Access your travel management software securely anywhere, ensuring up-to-date functionality.

- XML/API Integration: Seamlessly integrate with suppliers and partners to access real-time inventory and provide competitive pricing.

- Comprehensive CRM & Back-Office Solutions: Manage customer data, reservations, accounting, and more in a single, integrated platform.

- B2B and B2C Support: Serve business clients and consumers with flexible solutions for all travel businesses.

- Secure Payment Gateway Integration: Offer your customers secure, seamless payment options for bookings across various channels.

- Advanced Reporting & Analytics: Track sales, customer preferences, and operational performance to make data-driven decisions.

Travelopro Pros

Integrates with major Global Distribution Systems (GDS) like Amadeus, Sabre, Galileo, and Worldspan.

Provides customizable travel portal development (B2B, B2C, B2B2B), allowing businesses to tailor the system to their needs and scale.

Built to scale and accommodate growing businesses.

Travelopro Cons

Pricing is not listed, and there’s no free trial.

Given the depth and breadth of the platform, there is a learning curve for new users.

While the SaaS model lowers hardware costs, large enterprises may incur significant customization and setup costs when implementing Travelopro’s system.

Travelopro Pricing

| Plan | Pricing | Offerings |

|---|---|---|

| Basic | Custom | Hotel Booking Engine, Pre-integrated GDS & API, Booking Engine Development with B2C & B2B and more. |

| Advanced | Custom | Flight Booking Engine, Admin Module, B2C & B2C User Creation, Analytics, Web Hosting and Server Maintenance and more |

| Premium | Custom | Holiday Package CRS, B2B User Creation, TOP Up System / Credit Management, and more |

| Platinum | Custom | Car Booking Engine, Secure authentication via HTTPS, Live chat, and more |

| Enterprise | Custom | Sightseeing Booking Engine, Transfers Booking Engine, Hotel Extranet, Custom Design & Development, and more |

5. Xero

Budget-Conscious SMB Travel Agencies

Xero is intuitive and comprehensive cloud-based accounting software for small—to medium-sized businesses, including travel agencies. It connects directly to your bank, automating transactions and reconciliation and significantly reducing the time spent on manual data entry. With its user-friendly interface and real-time collaboration features, Xero helps travel agencies manage everything from invoicing and payments to inventory and payroll in a streamlined, efficient manner.

One of Xero’s standout features is its seamless bank feed integration. The software automatically imports and categorizes transactions from over 21,000 global financial institutions, saving you time and ensuring accuracy in your financial records. This feature helps travel agencies reconcile their bank accounts in real-time, offering a clear, up-to-date view of their financial position.

It offers powerful tools to help travel agencies track expenses, manage cash flow, and create customized reports. This ensures businesses can get a clear picture of their financial health at any time. Furthermore, Xero’s intuitive reporting and analytics features make it easy to track income and expenses, project future cash flow, and prepare for tax season. Users can also automate invoicing, pay bills, and manage contacts easily, giving you more time to focus on growing your business. Xero is perfect for small to mid-sized travel agencies, freelancers, and growing startups looking for an easy-to-use, secure, and scalable accounting solution.

An accountant shared his review on Xero, highlighting its intuitive design, continuous improvements, and excellent training resources.

Xero Key Features

- Bank feed integration: Automatically imports and categorizes transactions from over 21,000 financial institutions, simplifying reconciliation and saving time.

- Real-time collaboration: Share financial data with your team and accountant, ensuring everyone is on the same page.

- Customizable reporting: Create tailored reports to track your agency’s finances and gain insights into income, expenses, and cash flow.

- Multi-currency support: Easily Manage international bookings using Xero’s built-in multi-currency accounting.

- Automated invoicing: Send professional invoices automatically and set up reminders for overdue payments.

- Mobile app: The Xero mobile app allows you to access your financial data from anywhere, keeping your business on track while on the go.

- Secure data protection: Xero uses encrypted connections and multiple layers of security to keep your financial data safe.

Xero Pros

Provides customizable reports and tools designed specifically for travel agencies.

Offers 24/7 customer support.

User-friendly interface simplifies financial management.

With pricing plans that start as low as $2.90/month (with promotional discounts), Xero is accessible to businesses of all sizes.

Xero Cons

Features like tracking projects or advanced analytics are only available through optional add-ons.

Does not include core travel management features such as booking management, client itinerary tracking, or integration with major Global Distribution Systems (GDS).

Check out our Xero review for more details.

Xero Pricing

| Plan | Pricing (monthly) | Offerings |

|---|---|---|

| Starter | $2 | Send quotes and up to 20 invoices, enter 5 bills, reconcile bank transactions, and business snapshots. |

| Standard | $4.7 | Unlimited invoices and bills, and bulk reconcile transactions. |

| Premium | $8 | Support for multiple currencies. |

6. Wave

Best For Free And Simple Accounting Tool

Wave offers various tools for invoicing, estimates, payments, and accounting. Wave streamlines administrative tasks and ensures smooth financial operations by managing customer invoices and tracking payments. Wave is designed to simplify the accounting process for travel agencies, providing features like customizable invoices, automatic payment tracking, and real-time status updates.

Wave has a key feature that helps users create professional estimates and seamlessly convert them into invoices. This is ideal for travel agencies that need to provide quotes to clients before booking travel services. Wave integrates these features with powerful invoicing and payment management, helping agencies keep track of all financial transactions in one place.

It includes advanced features such as automatic reminders, secure payment processing, and detailed transaction records. With Wave’s Pro Plan, agencies can automate recurring billing for repeat clients, making managing subscriptions or frequent bookings easier. Wave’s integration with accounting tools ensures that all financial data is kept in sync, offering complete transparency and ease of use for business owners. Wave is ideal for small travel agencies, freelancers, and startups seeking a simple, reliable, and cost-effective accounting solution.

A user notes that while Wave is suitable for micro-businesses with limited budgets, it falls short in a few key areas such as advanced tracking, audit trails, etc.

Note: Wave is a cost-effective solution for small businesses but might not be the best fit for more complex businesses. Therefore, in such cases, consider alternatives like QuickBooks or software designed specifically for your niche, such as Travelopro.

Wave Key Features

- Invoice Management: Quickly create and send professional invoices to clients with customizable templates.

- Estimates to Invoices: Convert estimates into invoices instantly without the need for manual copying or editing.

- Mobile Compatibility: Access and manage your accounts on the go using the Wave mobile app for iOS and Android.

- Payment Processing: Accept payments online via credit card, bank transfer (ACH/EFT), or Apple Pay, and get paid faster.

- Automatic Reminders: Set up automatic reminders for overdue invoices and payment due dates to ensure timely collections.

- Recurring Billing: Automate recurring billing for regular clients to simplify subscription or repeat service payments.

- Integrations: Sync payments, invoices, and transaction data directly with Wave’s accounting tools for seamless financial management.

Wave Pros

Offers a free plan with essential accounting features like invoicing, bookkeeping, and estimates.

Dashboard is intuitive and simple to use.

Agencies can create professional-looking, branded invoices with customizable templates.

Automatic bank transaction imports and categorization help streamline reconciliation.

Wave Cons

Lacks specialized features for the travel industry, such as integrations with booking systems or tools for managing complex travel itineraries.

Payroll is an add-on that costs $ 20/month, which is more than the pro plan itself.

While Wave facilitates online payments, there is a 2.9% + $0.60 fee per transaction for credit card payments.

Wave Pricing

| Plan | Pricing (monthly) | Offerings |

|---|---|---|

| Starter Plan | $0 | Create unlimited estimates, invoices, bills, and bookkeeping records; Option to accept online payments and more. |

| Pro Plan | $16 | Discounted rates for online payments, Auto-import, merge, and categorize bank transactions, and more. |

7. TallyPrime

Best For GST Compliance Indian Agencies

Tally is one of the oldest software programs, founded in 1986, and has since been an extremely trustworthy business management solution. Its versatile features cater to the diverse needs of accounting, inventory management, taxation, payroll, and more. Tally is a powerful system that ensures seamless automation, accurate reporting, and enhanced security.

The software’s capabilities cover everything from invoicing and accounting to inventory control and business reports. TallyPrime also offers advanced features like cost tracking, financial forecasting, and real-time access to business data on mobile devices. With TallyPrime, businesses can effectively manage financial operations while complying with tax regulations. The software’s secure user management system ensures that sensitive financial data is protected with the highest level of security, and audit trails provide full traceability of changes made within the system.

TallyPrime includes integrated tools for banking and e-payments, simplifying cash flow management. The ability to generate e-invoices and file GST returns further enhances its appeal to businesses operating in India, ensuring seamless compliance with local tax laws. Overall, TallyPrime is perfect for small to medium-sized travel agencies and independent contractors that need an efficient and secure accounting solution to manage their finances and grow their business.

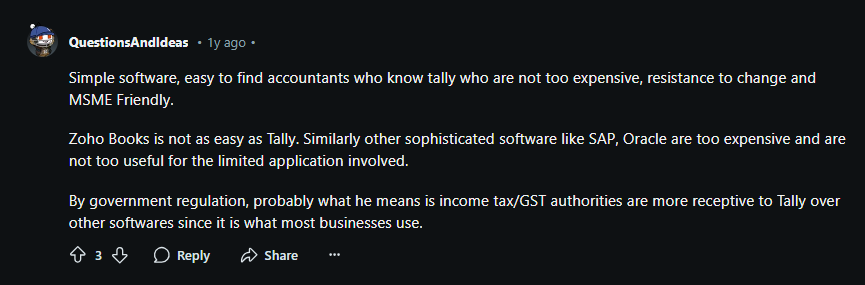

A user shares their experience with Tally, praising its simplicity, affordability, and widespread use among MSMEs (Micro, Small, and Medium Enterprises).

TallyPrime Key Features

- Invoicing and Accounting: Create, manage, and track invoices, receipts, and payments while maintaining accurate accounts and books.

- Inventory Management: Track stock movements, manage suppliers and customers, and easily generate inventory reports.

- Business Reports: Access various reports, including ledger reports, cash/bank books, purchase/sales registers, and bills receivable/payable.

- Bank Reconciliation: Automatically reconcile bank statements with imported e-statements for over 100 supported banks.

- GST Compliance: Generate e-invoices, file GST returns, and maintain compliance with the latest tax rates and regulations.

- Enhanced Security: Maintain secure business data with multi-level security, user management, and audit trails to track changes.

- Cost and Profit Centre Management: Track and analyze cost and revenue across various departments, projects, and cost centers.

TallyPrime Pros

Integrates seamlessly with the GST portals.

Multiple layers of security, including TallyVault encryption.

Supports unlimited users (depending on the subscription).

Offers flexible monthly and quarterly rental plans, affordable one-time perpetual licenses, and scalable cloud-based solutions with user packs.

TallyPrime Cons

Lacks features specifically tailored for the travel industry.

Staff without an accounting background might find it challenging to use effectively.

No integrations with third-party software.

Can be expensive, especially for smaller travel agencies.

TallyPrime Pricing

| Plan | Pricing | Ideal For |

|---|---|---|

| TallyPrime Silver (Rental) | $99 | Single-user edition for standalone PCs. |

| TallyPrime Silver (Perpetual) | $855 | Single user edition, For Standalone PCs |

| TallyPrime Gold (Rental) | $297 | Unlimited multi-user edition, For multiple PCs on LAN environment |

| TallyPrime Gold (Perpetual) | $2,565 | Unlimited multi-user edition, For multiple PCs on LAN environment |

Key Features to Look for in Accounting Software for Travel Agencies

Running a travel agency involves complex financial operations, from managing multi-currency transactions to tracking agent commissions. Look for these features before choosing the best travel agency software.

Multi-Currency Support: Travel agencies often handle transactions in multiple currencies, including payments to international suppliers and receipts from global clients. Therefore, your accounting software should automatically convert currencies at real-time exchange rates, ensuring financial accuracy and simplifying reconciliations.

Automated Invoicing and Billing: Travel businesses process numerous bookings daily, making manual invoicing impractical. Software with automated invoicing generates accurate invoices instantly, supports payment reminders, and integrates payment gateways for faster transactions.

Expense Management: Effective expense management is essential for handling costs like flights, accommodations, and operations. That’s why you need to pick a platform that offers precise tracking, receipt scanning, and real-time updates to maintain compliance and control over budgets. You can also look for an accounting tool that can easily integrate with third-party expense management software.

Commission Management: Managing agent commissions requires precision, especially with varying percentages or conditions. Your software should automate commission calculations, link them to bookings, and generate detailed payout reports, saving time and avoiding disputes.

Integration with Booking Systems: Accounting software should integrate seamlessly with booking platforms like Amadeus, Sabre, or Expedia. This reduces manual entry, syncs booking data with financial records, and ensures that revenue and costs align accurately with bookings.

Reporting and Analytics: Detailed reports on metrics like profit margins, revenue per destination, or client spending patterns help optimize business decisions. Moreover, your software should have advanced analytics that offers visual dashboards and exportable reports tailored to travel-specific KPIs.

Customer and Vendor Management: Efficient customer and vendor management tools are critical for tracking outstanding payments, reconciling supplier invoices, and managing credit terms. Therefore, your preferred accounting software should centralize these records to ensure smooth financial relationships with stakeholders.

Final Words

The right accounting software can simplify financial management for your travel agency. It helps you easily handle multi-currency transactions, automate invoicing, and track expenses. Whether you’re a small agency, a growing business, an independent contractor, or a large enterprise, choosing the right software ensures smooth operations and better compliance. This guide helps you evaluate your needs and pick the best solution for your goals.

-

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.