Cloud accounting software is a web-based solution. It helps businesses manage finances, automate tasks, and access real-time financial data from anywhere.

Cloud-based accounting systems eliminate the need for manual data entry and provide real-time financial insights. This streamlines bookkeeping and financial management — enabling seamless collaboration among team members.

Compared to traditional downloadable software, users don’t have to worry about security issues, data backups, or software updates. Cloud accounting is also accessible from any device and often provides APIs for connecting third-party software.

In this article, we will explore the best cloud accounting software options for small businesses. We will discuss their key features, pricing, the ideal use cases for each platform, pros & cons, and more.

- FreshBooks – Best for Service-based Businesses

- Intuit QuickBooks – Popular Choice Among Accountants

- Xero – Automate Accounting Tasks

- Kashoo – Best for Small Businesses

- Zoho Books – Best to Integrate with Zoho Suite

- Wave – Best for Beginners

- Odoo – Modern Accounting Software

- Sage 50 – Desktop Accounting Software

- FreeAgent – Best for Freelancers

- Show less

Review Methodology: Cloud Accounting Software for Small Businesses

At Geekflare, we strive to provide thorough and unbiased reviews. For our analysis of the best cloud accounting software for small businesses, our experts conducted hands-on testing across various platforms, evaluating both free and paid plans. We focused on essential accounting features, user experience, pricing, and customer feedback to ensure a comprehensive assessment. Our team also gathered data from official sources and user reviews, allowing us to deliver practical recommendations tailored to the unique needs of small businesses.

FreshBooks

Best for Service-based Businesses

- Core FunctionalityInvoicing, Expenses, Time Tracking

- Ideal forFreelancers, Small Businesses

- Ease of UseUser-Friendly

About FreshBooks

FreshBooks is designed to handle financial tasks for small businesses, especially those in service-based industries. FreshBooks simplifies invoicing, expense tracking, and time management, making it easier for business owners to stay on top of their finances.

The platform offers essential features like automated invoicing, double-entry accounting, and smooth integration with various payment processors.

FreshBooks also supports project management, allowing businesses to track time and collaborate with clients efficiently. Additionally, FreshBooks offers strong customer support and a range of scalable and affordable pricing plans to suit different business needs.

FreshBooks Features

Create and send professional invoices quickly, with the option to set up automated reminders and recurring billing to improve cash flow.

Accept payments easily with various options, including credit cards, ACH transfers, and PayPal, helping you get paid faster.

Capture and categorize expenses effortlessly by snapping photos of receipts, forwarding email receipts, or importing from your bank.

Log billable hours for projects with a built-in time tracker, ensuring you don’t miss out on any revenue.

Collaborate with your team and clients in real time by sharing files, discussing project updates, and keeping everyone on the same page.

Access insightful reports that help you understand your business’s financial health, from cash flow to profitability, all in a user-friendly interface.

Manage payroll seamlessly within FreshBooks through integrations like Gusto, simplifying your employee payment process.

Track business-related mileage automatically, making it easy to categorize trips for tax deductions directly through the FreshBooks mobile app.

FreshBooks Pros/Cons

User-friendly interface designed for non-accountants.

Comprehensive invoicing features, including customization and automation.

Integrated time tracking and project management tools.

Double-entry accounting offers detailed reports for deeper financial insights.

The highest-tier plan only includes two users by default.

The Lite plan limits billable clients and lacks key features like bank reconciliation and double-entry accounting.

Higher-tier plans are expensive for small businesses/freelancers

A hefty fee per month for an additional team member.

Intuit QuickBooks

Popular Choice Among Accountants

- Core FunctionalityInvoicing, Payroll Management, Bookkeeping

- Ideal forSMBs

- Ease of UseModerate

About Intuit QuickBooks

QuickBooks Online is a powerful accounting software designed for small businesses, freelancers, and self-employed individuals. The software automates critical tasks like invoicing, expense tracking, and payroll processing, making financial management more efficient.

QuickBooks lets users easily link bank accounts, categorize transactions, and monitor cash flow in real-time. QuickBooks also supports integration with various third-party applications, enhancing its utility across different industries.

QuickBooks provides a user-friendly experience for beginners, simplifying financial management. And experienced users can leverage its comprehensive features for detailed financial analysis. QuickBooks also offers one of the top accounting apps for smartphones.

QuickBooks Features

Manage vendor bills effectively. Track payments, schedule payments, and apply credits for efficient bill handling.

Get access to tax resources and connect with qualified professionals to ensure accurate tax filing and maximize deductions.

Generate customizable reports to gain insights into your business performance. Track income, expenses, profit and loss, and other key metrics.

Track your miles effortlessly for business purposes with integrated mileage tracking tools.

Organize projects, manage tasks, collaborate with team members, and track profitability for efficient project execution.

Streamline your online sales process by integrating with popular e-commerce platforms.

Receive payments easily through various online options and automate bill payments for improved cash flow management.

Manage your bank accounts directly within QuickBooks for effortless reconciliation and real-time financial data.

QuickBooks Pros/Cons

Extensive feature set catering to various business sizes and types.

Strong integration with third-party apps and services like CRM software, e-commerce platforms, and payment processors.

Industry-standard accounting software trusted by accountants.

Advanced reporting and analytics for detailed financial insights.

For users with limited accounting experience, QuickBooks may have a steeper learning curve.

Higher-tier plans with advanced features are expensive for small businesses.

Overall expensive subscription with no free forever plan.

QuickBooks is not available in some regions like India.

Xero

Automate Accounting Tasks

- Core FunctionalityAccounting, Payroll, Bank Reconciliation

- Ideal forSmall Businesses, Self-employed

- Ease of UseUser-Friendly

About Xero

Xero is easy to use and is favored by growing businesses that need scalable accounting solutions. Xero stands out for its real-time financial data access, allowing business owners and accountants to monitor cash flow, manage expenses, and track financial performance with up-to-date information.

The software’s comprehensive reporting capabilities make it easy to generate detailed financial statements, helping businesses make informed decisions.

In addition, Xero places a strong emphasis on security, ensuring that sensitive financial data is encrypted and stored securely in multiple locations. Its commitment to providing reliable, secure, and efficient accounting solutions has made Xero a trusted choice for businesses worldwide.

Xero Features

Access bank data from over 21,000 global institutions for easy reconciliation.

Track and manage expenses, submit claims, and handle reimbursements efficiently.

Plan, budget, and track project costs with integrated job tracking tools.

Monitor stock levels and auto-populate invoices and orders with items.

Handle transactions in multiple currencies, making it ideal for global business operations.

Ensure your transactions are up-to-date with automatic bank reconciliation.

Generate accurate financial reports and collaborate with advisors in real time.

Automatically capture and store documents and key data with Hubdoc integration, simplifying data entry and organization.

Xero Pros/Cons

The Xero App Store has over 800 apps that integrate with Xero, including inventory, CRM, payments, and more.

Strong security through multi-factor authentication, continuous monitoring, and regular audits.

Provides scalability so a small business can grow without running into early limitations.

Inventory management is basic and not suitable for complex needs.

Customer support is primarily online, with no phone support.

Some businesses find invoice and report customization options limiting, which hinders branding consistency.

Take a look at our review of Xero Accounting for more details.

Kashoo

Best for Small Businesses

- Core FunctionalityInvoicing, Expense Tracking, Accounting

- Ideal forSMBs

- Ease of UseUser-Friendly

About Kashoo

Kashoo is designed for small business owners, freelancers, and entrepreneurs who need a simple yet effective tool to manage their finances. Kashoo calls itself “The World’s Simplest Accounting Software” as the platform doesn’t want the users to get overwhelmed.

Kashoo includes built-in tax features that help users prepare for tax season by organizing income and expenses into appropriate categories — simplifying the tax filing process.

Kashoo offers two variants: Trulysmall accounting and Kashoo. Trulysmall offers automated & easy accounting for growing small businesses, whereas Kashoo works as advanced & personalized accounting software for established businesses.

Kashoo Features

Manage all your accounting tasks in one place, from invoicing to expense tracking, with an intuitive interface.

Create and send professional invoices quickly, allowing for efficient payment processing and tracking of outstanding payments.

Automatically import and categorize transactions from your bank, simplifying the bookkeeping process and reducing manual data entry.

Capture receipts on the go using the mobile app, ensuring that all expenses are recorded accurately and promptly.

Generate real-time financial reports to get insights into your business’s financial health, helping you make informed decisions.

Manage client information and keep track of communications, making it easier to follow up on unpaid invoices and maintain client relationships.

Use simple project management tools to track time and expenses associated with specific projects, ensuring accurate billing.

Kashoo maximizes tax deductions with automated data entry, ML-powered categorization, and IRS & CRA alignment.

Kashoo Pros/Cons

Designed to be user-friendly and easy to navigate, making it a great option for businesses needing a simple solution.

Prints traditional paper paychecks using a step-by-step guide.

Offers an unlimited number of users and is overall inexpensive.

Great customer support with live chat and phone assistance.

Offers only two plans, limited options for those seeking more flexible pricing options.

Reporting capabilities are relatively basic and do not meet the needs of businesses requiring detailed financial analysis.

Limited integration options compared to other software.

Lacks advanced features like time tracking, workflow management, and document management.

Zoho Books

Best to Integrate with Zoho Suite

- Core FunctionalityInvoicing, Expenses, Inventory Management

- Ideal forSmall Businesses, Startups

- Ease of UseModerate

About Zoho Books

Zoho Books is a versatile cloud accounting solution designed for small businesses looking for seamless financial management. It offers extensive features including invoicing, expense tracking, and automated workflows.

The platform’s integration with the Zoho suite enhances its functionality, allowing users to synchronize data across various Zoho applications. Zoho Books supports multi-currency transactions and provides in-depth financial reporting to aid business decisions.

Its user-friendly interface and customizable templates make managing finances straightforward. The software also includes solid automation features like recurring billing and auto-payment reminders.

Zoho Books Features

Automate tax calculations, manage multiple tax rates and generate tax summary reports, making tax filing easier and more accurate.

Connect your bank accounts for seamless reconciliation, ensuring that all bank transactions are accurately recorded and matched.

Track and manage inventory levels, set reorder points, and integrate with sales and purchase orders to maintain control over your stock.

Monitor project expenses, billable hours, and profitability by linking expenses and time tracking directly to specific projects.

Access plenty of customizable reports, including profit and loss, balance sheet templates, and cash flow statements, providing comprehensive insights into your business’s financial health.

Automate repetitive tasks like payment reminders, recurring invoices, and approvals, improving efficiency and reducing manual work.

Integrate Zoho Books with other Zoho apps and third-party applications like Stripe, PayPal, and Office 365 to streamline your business operations.

Ensure your data is secure with advanced encryption, role-based access, and multifactor authentication.

Zoho Books Pros/Cons

Offers a comprehensive set of features, including invoicing, expense tracking, project management, inventory management, and payroll.

Integrates seamlessly with other Zoho applications, such as CRM, marketing, and HR software.

Comes with a free forever plan (conditions apply).

Automates recurring tasks and bank reconciliation.

Steep learning curve for those unfamiliar with the Zoho suite.

Imposes restrictions on the number of users, which can be limiting for growing businesses.

Third-party integration is relatively limited.

The most expensive plan (premium) caps at 10 users only.

Wave

Best for Beginners

- Core FunctionalityInvoicing, Expense Tracking, Financial Reporting

- Ideal forSmall Businesses, Freelancers

- Ease of UseUser-Friendly

About Wave

Wave accounting comes with a popular free forever plan tailored for small businesses and freelancers with essential features. Wave’s intuitive interface makes it easy to create and send invoices, manage receipts, and track cash flow.

The software simplifies payment collection by allowing clients to pay directly from invoices through integrated payment gateways. Wave also includes basic accounting reports and integrates with bank accounts for automatic transaction syncing.

Besides the free plan, Wave offers a Pro plan for businesses seeking more customization. This plan allows users to personalize invoices, use reusable message templates, capture receipts digitally, and more

Wave Features

Create professional invoices with custom branding and flexible payment options.

Accept online payments securely, send automated payment reminders, and track outstanding invoices to get paid quickly.

Manage your finances with ease—automate bank account imports, categorize income and expenses, and reconcile bank transactions for accurate bookkeeping.

Capture receipts on the go using the Wave mobile app for effortless expense tracking.

Run payroll in minutes with Wave. Pay your employees quickly and electronically, handle taxes effortlessly, and streamline the payroll accounting process.

Leverage the expertise of Wave Advisors whenever you need help with accounting, tax, or business matters.

Easily categorize and track your business expenses for better financial control and informed decision-making.

Generate customizable financial reports to analyze your business performance. Track income, expenses, profit and loss, and other key metrics.

Wave Pros/Cons

Free forever plan with all essential features, perfect for budget-conscious users.

Unlimited numbers of users, even in the free plan.

Offers unlimited estimates, invoices, bills, and bookkeeping records in the free plan.

Easy to navigate even for beginners.

No native time-tracking feature.

Additional fees for accepting online payments per transaction, with charges applied after the first 10 transactions each month.

Accounting features are less advanced compared to QuickBooks, Sage, or FreshBooks.

Limited customization, support, and scalability.

Odoo

Modern Accounting Software

- Core FunctionalityInvoicing, Expense Management, Customizable Modules

- Ideal forSMBs

- Ease of UseComplex

About Odoo

Odoo calls itself “a modern accounting software” and is known for its extensive suite of business applications. Odoo integrates financial management with a wide range of other business functions like CRM, inventory, and project management.

Odoo’s accounting module supports multi-currency transactions, automated reconciliation, and comprehensive financial reporting. The platform allows for customizable workflows and reports, catering to specific business needs.

Odoo features advanced automation for tasks like invoicing, expense tracking, and bank synchronization. The software’s user-friendly interface facilitates seamless navigation and integration with other Odoo modules. Additionally, Odoo has a vibrant community and extensive documentation that offers valuable support and resources.

Odoo has one of the world’s largest business app store thanks to its open-source nature. The store has 40k+ apps.

Odoo Features

Maintain accurate financial records with double-entry accounting principles, ensuring data integrity and facilitating financial reporting.

Streamline reconciliation by automatically matching bank statements with your Odoo transactions, saving you time and effort.

Gain instant insights into your business performance with customizable financial reports generated in real time. Track income, expenses, profit and loss, and other key metrics for informed decision-making.

Manage multiple companies in a single database with separate charts of accounts and consolidation reporting.

Comprehensive expense management features, allowing you to capture receipts, categorize expenses, automate expense reports, and track spending trends.

Securely store and organize all your business documents within Odoo, including invoices, contracts, receipts, and reports, ensuring easy access and retrieval.

Odoo integrates with e-signature solutions like DocuSign, allowing you to securely collect electronic signatures on documents for streamlined approval processes.

Odoo Pros/Cons

Provides a comprehensive suite of business applications, including CRM, sales, and inventory management.

Designed to scale with your business, accommodating businesses of all sizes.

It has a large and active open-source community, providing resources, support, and customization options.

Offers a free forever plan with no limit on features or data.

The paid plan starts with a high price tag, billed on a per-user basis.

Businesses needing only basic accounting functionalities will find the features overwhelming

Extensive feature sets and customization options make it complex to learn and use.

Complex customizations may need expert skills and increase costs, requiring professional assistance.

Sage 50

Desktop Accounting Software

- Core FunctionalityJob Costing, Inventory, Reporting & Analytics

- Ideal forSmall Businesses

- Ease of UseComplex

About Sage 50

Sage 50 is a powerful cloud-based accounting software designed for small businesses, offering comprehensive tools for managing finances and inventory. With over 40 years of experience, Sage 50 combines the reliability of desktop software with the flexibility of cloud connectivity.

Key features include invoicing, expense tracking, advanced inventory management, and efficient tax handling. Users can also benefit from real-time reporting, advanced budgeting tools, and seamless collaboration through cloud access.

Sage 50 Accounting is designed to handle complex financial tasks — ensuring small businesses can efficiently grow while maintaining financial control. Check Geekflare’s detailed Sage 50 Accounting review to know more.

Sage 50 Features

Automate data entry by capturing data from bills, receipts, and bank statements.

Gain insights into your cash flow with features like cash flow forecasting and projections.

Effortlessly reconcile your bank statements with automatic bank feeds, saving time and ensuring accuracy.

Simplify recurring payments by integrating with GoCardless to collect payments directly from customers’ bank accounts.

Track stock levels, manage product variants, and generate inventory reports.

Generate comprehensive reports to analyze financial performance, including income, expenses, profit and loss, and other key metrics.

Enjoy secure access controls that protect your financial data.

Sage 50 Pros/Cons

Has a long-standing reputation as a reliable and robust accounting software.

Provides advanced tools for accounting, job costing, payroll, tax compliance, and reporting & analytics.

Offers advanced inventory management suitable for product-based businesses.

Supports multi-company management in a single dashboard.

Seamlessly integrates with other Sage products like Sage Payroll or Sage CRM, streamlining workflows.

On the expensive side — starts at $60.08/user/month.

Advanced features and comprehensive functionality make it difficult to use, especially for non-accountants.

Limited mobility as the software is primarily desktop-based.

The interface can feel outdated and less intuitive compared to more modern accounting software.

FreeAgent

Best for Freelancers

- Core FunctionalityInvoicing, Time Tracking, Project Management

- Ideal forSmall Businesses, Consultants

- Ease of UseUser-Friendly

About FreeAgent

FreeAgent is designed specifically for freelancers and small businesses. It provides essential features such as invoicing, expense tracking, and financial reporting packed in a user-friendly interface.

FreeAgent simplifies tax management with built-in VAT and self-assessment tools, ensuring compliance and accurate submissions. The platform offers automatic bank feeds for easy bank reconciliations and real-time financial insights.

FreeAgent’s time-tracking and project management features help users manage client projects and billable hours effectively. The software also supports multi-currency transactions and integrates with various third-party applications. Additionally, FreeAgent is known for its straightforward setup and excellent customer support.

FreeAgent Features

Leverage “Radar,” a built-in tool that provides personalized insights and recommendations, helping you make informed decisions based on your financial data.

Create and send invoices, track expenses, capture receipts, review reports, and stay organized while you’re out.

Enjoy peace of mind knowing your financial data is protected with FreeAgent’s high-level security protocols, including data encryption, firewalls, and access controls.

Save time and effort with automated features like recurring invoices, automatic bank feeds, and expense categorization, streamlining your financial processes.

Create and send polished estimates and invoices with ease. Customize them with your branding, track time and expenses, calculate taxes automatically, and offer a variety of payment options.

Connect your bank accounts with FreeAgent for automatic bank feeds, allowing for effortless reconciliation and real-time financial data.

Organize projects efficiently by grouping expenses, invoices, and time entries by project for a clear overview. Track project progress, collaborate with team members, and ensure accurate billing for each project.

FreeAgent offers tax management features like sales tax calculations and expense categorization to help you stay on top of your tax obligations.

FreeAgent Pros/Cons

Tailored specifically for freelancers and small business owners.

Allows users to create, send, and automatically chase invoices.

Offers a great deal with 50% off for your first six months as a new customer.

User-friendly interface with a focus on simplicity.

Limited features for larger businesses with complex needs.

Not as scalable due to a single pricing plan, making it less suitable for growing businesses.

Limited integration — relies on Zapier for many integrations.

Reporting and customization features are limited.

What is Cloud Accounting?

Cloud-based accounting software is hosted on remote servers rather than being installed locally on your computer. This eliminates the need for installation, maintenance, and updates — offering several advantages over traditional software. Although some cloud accounting solutions might offer a desktop client or application that you can download. However, this client still connects to the internet to synchronize data with the cloud.

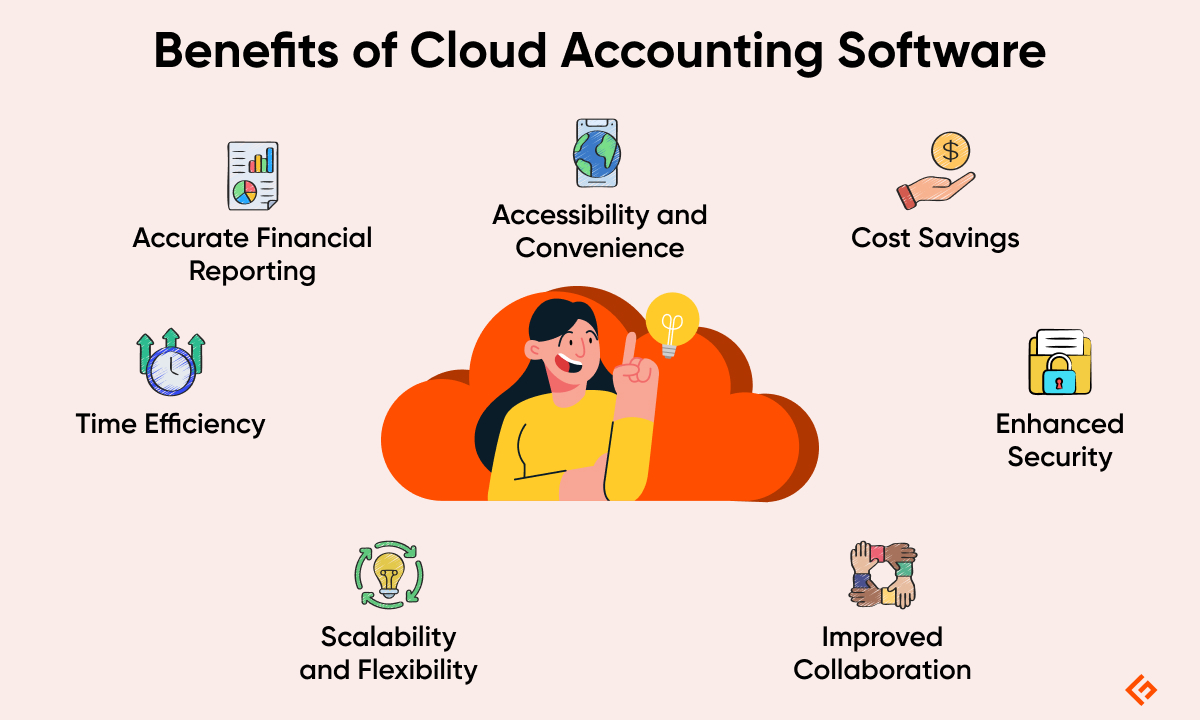

Benefits of Using Cloud Accounting Software

Below are 7 key benefits of accounting software over traditional desktop-based applications that can significantly improve your financial management.

- Accessibility and Convenience: Access your financial data anytime, anywhere with an internet connection, using any device, including smartphones, tablets, or laptops.

- Cost Savings: Cloud accounting eliminates upfront software costs and hardware upgrades, offering subscription-based pricing that saves time and money through streamlined processes.

- Enhanced Security: Your data is protected in secure data centers with encryption, firewalls, and access controls, often providing better security than local storage.

- Improved Collaboration: Easily work with your accountant or team members in real-time, letting them access and update financial data on the go.

- Scalability and Flexibility: Cloud accounting grows with your business, offering tiered subscription plans to add features gradually. You don’t need to download software upgrades or replacements as you scale.

- Time Efficiency: Automate tasks like data entry, bank reconciliation, and invoicing to save time and focus on strategic business activities.

- Accurate Financial Reporting: Access real-time data to generate up-to-date financial reports on income, expenses, and profitability for better decision-making.

Note: For those starting with a limited budget, there are several free accounting software options available to explore.

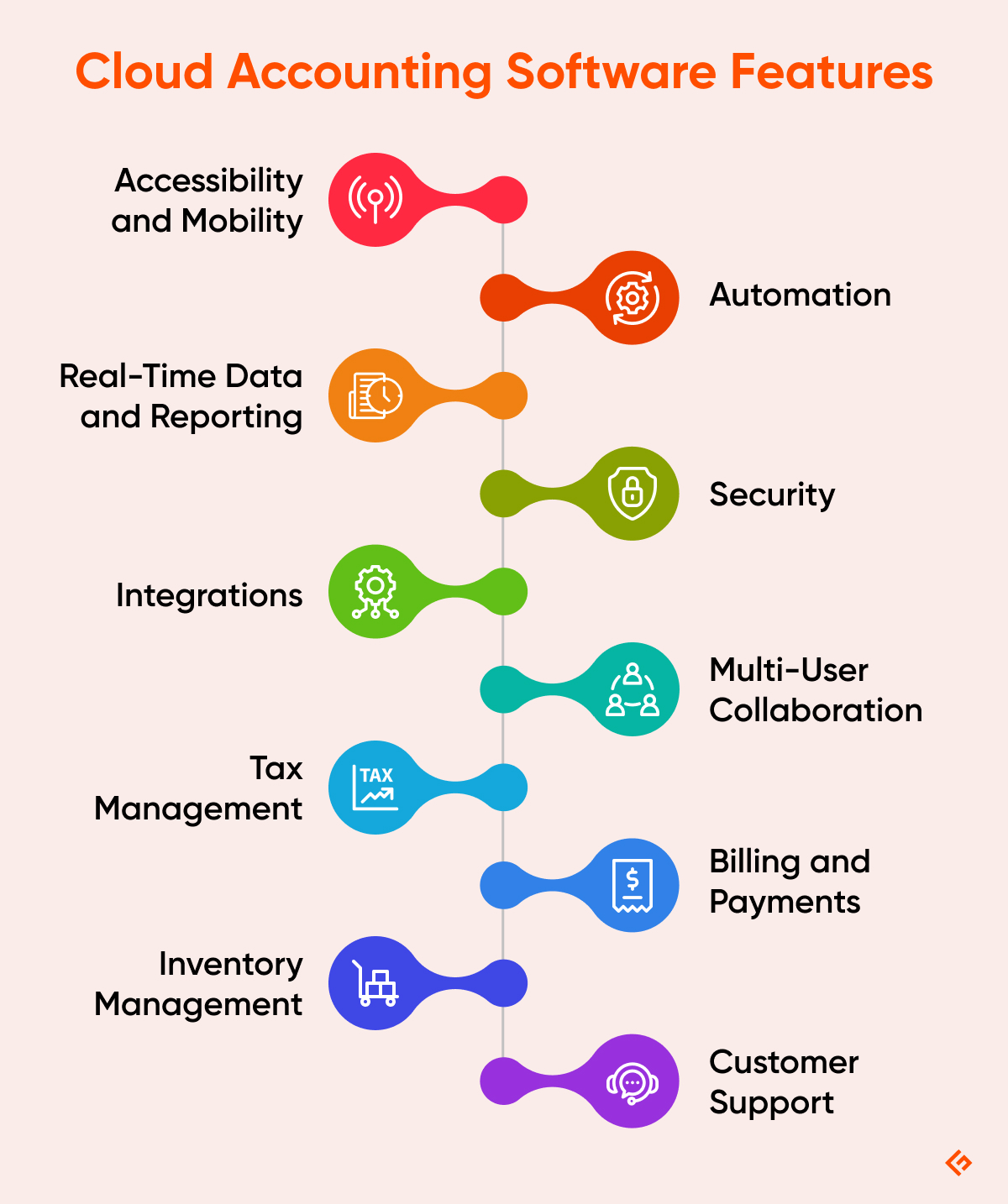

Features of Cloud Accounting Software

Here are some of the key features to look for in a cloud-based accounting solution.

- Accessibility and Mobility: Stay connected to your finances, no matter where you are. All you need is a device and an internet connection. This accounting process is especially valuable for businesses with remote employees or those who travel frequently.

- Automation: Cloud accounting software can automate many tedious and time-consuming tasks, such as bank reconciliation, data entry, and recurring invoicing. This frees up your time to focus on more strategic financial planning.

- Real-Time Data and Reporting: With cloud accounting, your financial data is constantly updated, providing you with real-time insights into your business performance. You can easily generate reports on income, expenses, cash flow, and other key metrics to make informed decisions.

- Security: Cloud providers regularly update their software with security patches to protect your data from emerging threats. They use multiple data centers and undergo regular audits and certifications like GDPR and SOC 2. Cloud accounting platforms also employ dedicated security teams that monitor threats, respond to incidents, and ensure system integrity.

- Integrations: Seamlessly integrate with a variety of other business applications, such as CRM software, e-commerce platforms, and payment processors. This helps automate data flow between systems and streamlines your workflows.

- Multi-User Collaboration: One of the best features of cloud platforms is that all users can see the updates made by some other user in real-time. This seamless collaboration fosters transparency and accountability, ensuring all team members and stakeholders work with the latest information.

- Tax Management: Simplify your tax processes with built-in tax management tools that offer features like expense categorization, tax rate calculation, tax planning, and so on. However, for more comprehensive solutions, take a look at our tax planning software list.

- Billing and Payments: Manage billing and payments efficiently with features that allow you to create and send invoices, track payments, handle credit card payments, and manage accounts receivable.

- Inventory Management: Cloud accounting solutions are equipped with inventory management features, which is great for businesses that handle physical products. This allows businesses to track stock levels, monitor product costs, and generate reports to optimize inventory management.

- Customer Support: Accounting software can be complex to navigate. You will encounter issues, especially if you’re new to the platform. And even if you are a pro, software sometimes can be glitchy. Thankfully, most cloud accounting software providers offer a variety of support options, including email, phone, and live chat, to ensure you get timely assistance.

More on Business Software

-

EditorUsha, the editor-in-chief of Geekflare, is a tech-savvy and experienced marketer with a Master’s degree in Computer Applications. She has over a decade of experience in the tech industry, starting as a software engineer and then moving into digital marketing and team management.

EditorUsha, the editor-in-chief of Geekflare, is a tech-savvy and experienced marketer with a Master’s degree in Computer Applications. She has over a decade of experience in the tech industry, starting as a software engineer and then moving into digital marketing and team management.