Mileage tracker apps give businesses the means to log the kilometers or miles.

It helps them in proper reimbursement from the client or make proper tax deductions.

With mileage tracking software growing at 14% CAGR until 2031, it’s common to see many players emerge.

By using Mileage tracker apps, you benefit from:

- Accurate tracking while following strict government guidelines

- Reduced errors with minimal human interference

- Proper records are helpful during audits

- Money and time saved

- Comprehensive reports

To narrow your search, I’ll list 10 best mileage tracker apps in this review article. I’ll discuss the below 7 in detail.

- 1. MilesIQ – Best Automatic Mileage Tracking for SMBs

- 2. Everlance – IRS-Compliant, Automated GPS-based Mileage Tracking

- 3. TripLog – All-in-one Mileage, Expense and Time Tracking Software

- 4. Hurdlr – Best for Self-employed

- 5. Zoho Expense – AIl-in-one Expense Management Solution

- 6. Timeero – Best for Automatic Geofence Tracking

- 7. Driversnote – Best for Mileage Reimbursements

Mileage Tracker Apps Comparison

Below is a mileage tracker apps comparison table based on existence of mobile apps, integration with payroll and accounting software, time tracking, price and Geekflare’s rating for each of these tools.

|  |  |  |  |  |  | |

✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | |

✅ (via third-party) | ✅ (via third-party) | ✅ | ❌ | ✅ | ✅ | ❌ | |

Yes (via third-party) | ✅ | ✅ | ✅ | ✅ | ✅ | ❌ | |

✅ | ✅ | ✅ | ❌ | ✅ | ✅ | ✅ | |

✅ | ❌ | ✅ | ✅ | ❌ | ✅ | ❌ | |

✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | |

✅ | ✅ | ✅ | ✅ | ✅ | ❌ | ✅ | |

$7.50 | $8.99 | $4.99 | $9.99 | $4 | $4 | $11 | |

Geekflare’s editorial team determines ratings based on factors such as key features, ease of use, pricing, and customer support to help you choose the right business software. | |||||||

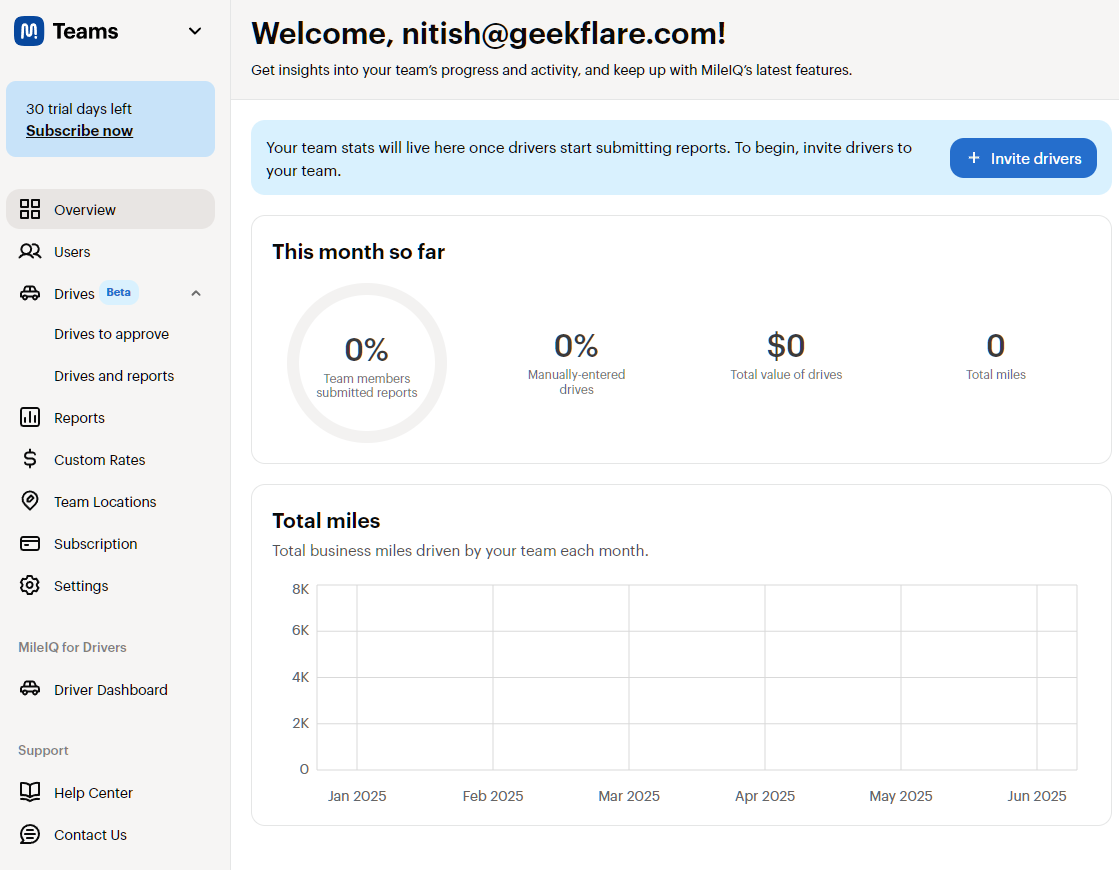

1. MilesIQ

Best Automatic Mileage Tracking for SMBs

MilesIQ is an excellent mileage tracker app for teams and individuals. It offers a clean dashboard with a focus on usability. They are popular with 1M+ active users and 100B+ miles logged.

Currently, at the time of writing, MilesIQ is available for these three regions: the United States, the United Kingdom, and Canada.

They offer a free version that captures 40 free drivers every month.

MilesIQ offers a 30-day free trial (without a credit card). It is useful as it lets you test-drive their app.

Once signed up, you’re directly redirected to the dashboard, which gives you an eagle-eye overview, along with access to all the features from the side menu.

MilesIQ automates mileage tracking and doesn’t require the rider to log the drives manually. Additionally, it gives riders an easy way to classify drives as business or personal. All they need to do is swipe left for personal and right for business drive.

Teams can set custom mileage rates per mile and set working hours for easy business drive classification.

Overall, I found MilesIQ a great mileage tracker app that focuses on both individual/team needs. However, it can get costly for smaller or medium-scale businesses with most features locked behind its costliest Teams Pro plan.

MilesIQ Features

- iOS and Android apps that help easy mileage tracking

- Detailed maps with route info, including start and end points

- Generate and send custom reports with a tap.

- Easy approval drives from team members

- Simple onboarding process with automated email invite

- Ensures accurate payroll with tax-compliant mileage reports

MilesIQ Limitations

- Large teams might find MilesIQ costly

- The free version is limited to 40 drivers per month

- No route planning option

- No clock-in/clock-out feature

MilesIQ Pricing

MilesIQ price starts at $7.50 per month for individuals. It offers unlimited drives.

For teams, the price starts at $8 per user per month. The Teams Lite plan offers automatic mileage tracking and streamlined billing. However, I suggest its Team Pro plan that offers all features, including access to integrations and the ability to set custom rates and reminders.

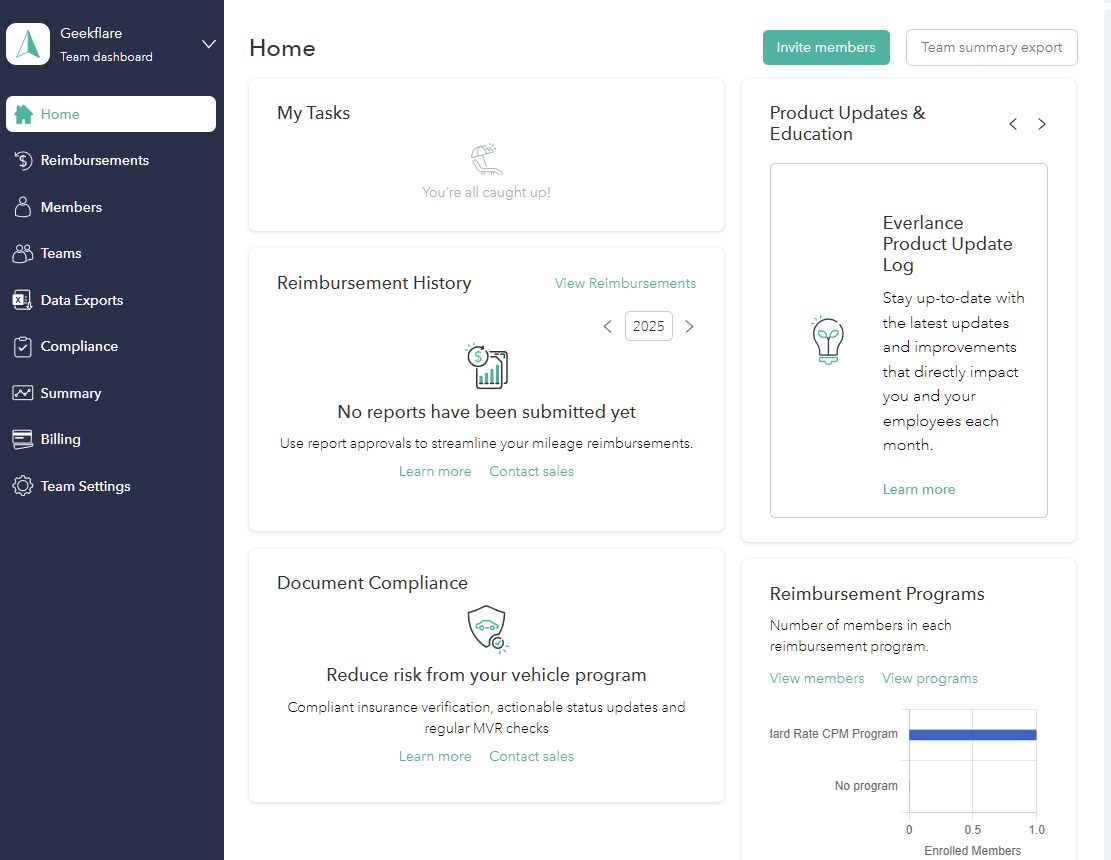

2. Everlance

IRS-Compliant, Automated GPS-based Mileage Tracking

Everlance is an IRS-compliant automated mileage tracker. It automates mileage and expense logging, which can result in 25% average savings. Everlance also offers individual and team-based features and works similarly to GPS tracking timesheet software.

Once you sign up, it’ll ask if you want to use Everlance.

Depending on your choice, it’ll ask you related questions. For individuals, it asks if you drive for taxi apps such as Uber, and for companies, it asks for company name and other info.

I also found its onboarding intuitive. It gives you a small tour with videos and pointers.

The dashboard is also well-designed with a focus on usability. It lists all tasks, reimbursement history, document compliance, and access to most features via left-side navigation.

Overall, Everlance is a great pick for teams looking for proper mileage tracking. It offers iOS and Android tracking. Additionally, all their reports are IRS-compliant, which is useful for tax filing.

Everlance Features

- Unlimited receipt upload for proper expense tracking

- Offers an excellent business expensive tracker via an additional app

- Ability to track trips together in single sessions

- Automatically categorize trips based on day and time

- One-swipe classification for non-auto-classified

Everlance Limitations

- Limited free plan with just 30 automated drives

- Everlance mobile apps are not optimized for low-battery use

- Lacks invoicing or other advanced accounting features but does offer expense tracking

Everlance Pricing

Everlance plans start at $69.99 per year or $8.99 per month. This starter plan offers custom IRS-compliant reporting and no limits on automatic mileage tracking.

You can also use Everlance for free with its Basic plan. It has a limit of 30 automatic tracked trips a month.

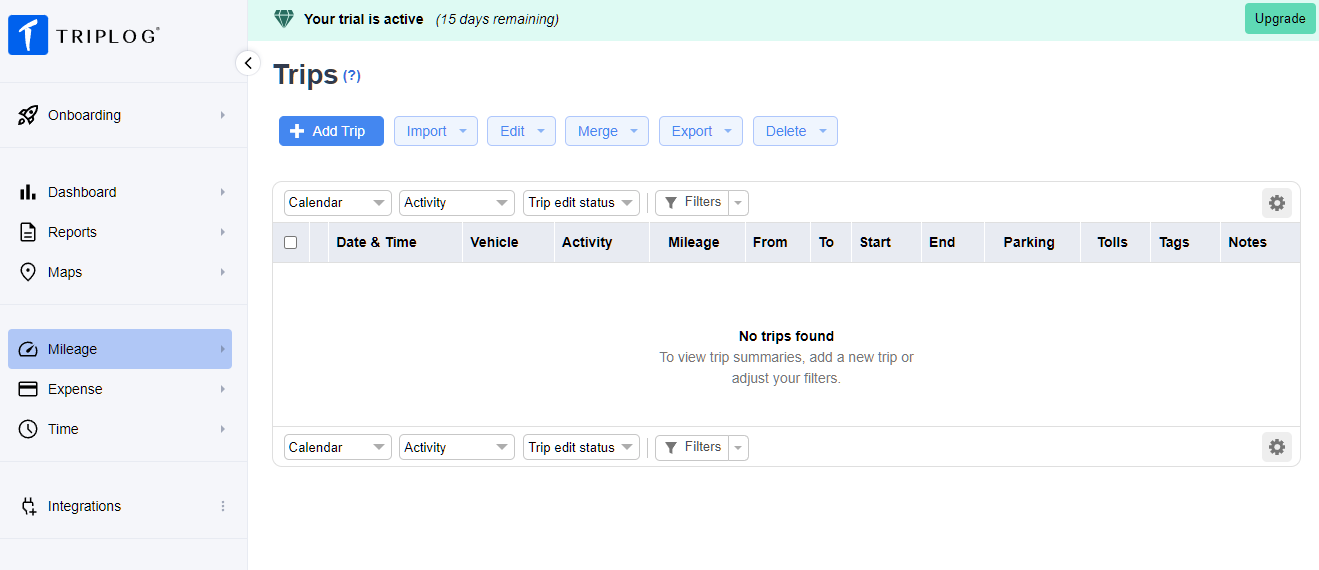

3. TripLog

All-in-one Mileage, Expense and Time Tracking Software

TripLog is my number one choice for a complete package when it comes to mileage, expense, and time tracking.

It offers tax-compliant mileage detailed reports where you can know how much you’re spending and earning back.

I found TripLog support for multiple countries beneficial, with support for countries like Venezuela, Yemen, Thailand, the United States, and others. It also supports local languages such as Hindi for India and Arabic for Iraq.

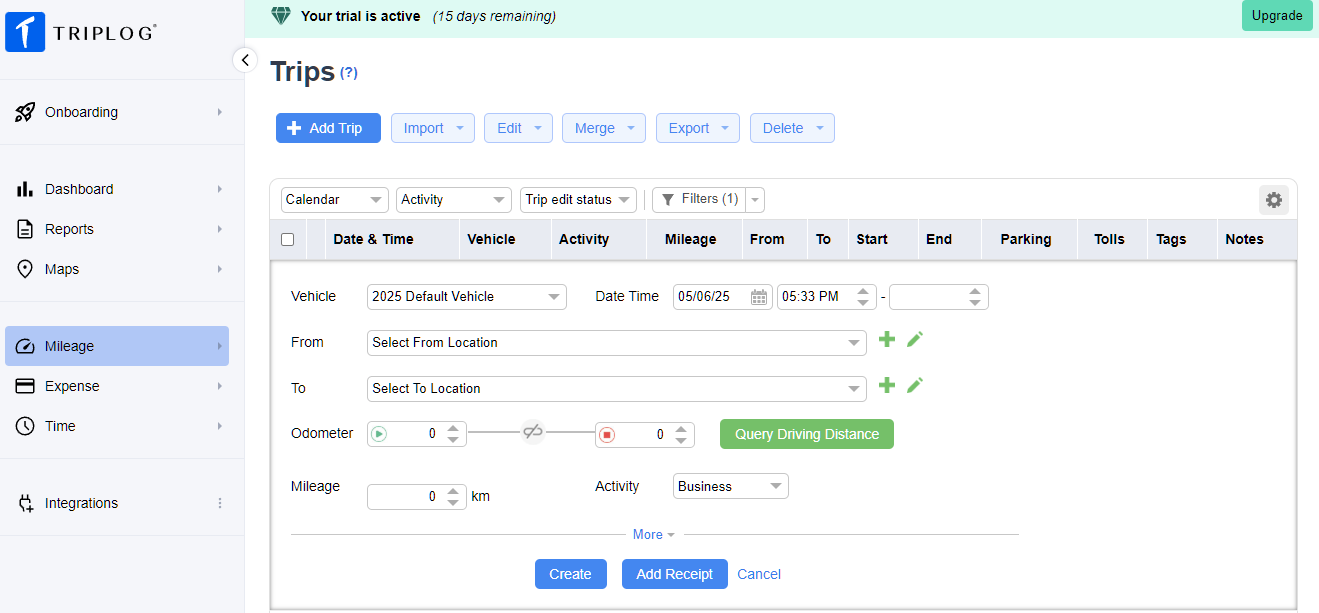

As soon as you create an account (they offer a 15-day free trial), it’ll ask you for details such as company name and the purpose for which you want to use TripLog — Tax Deductions and Reimbursement.

I found the TripLog user interface neat. It lists all trips cleanly with a focus on giving all information instantly.

Similarly, it lists expenses and time tracking. You can add trips manually (with full details) or let TripLog automatically detect and add them.

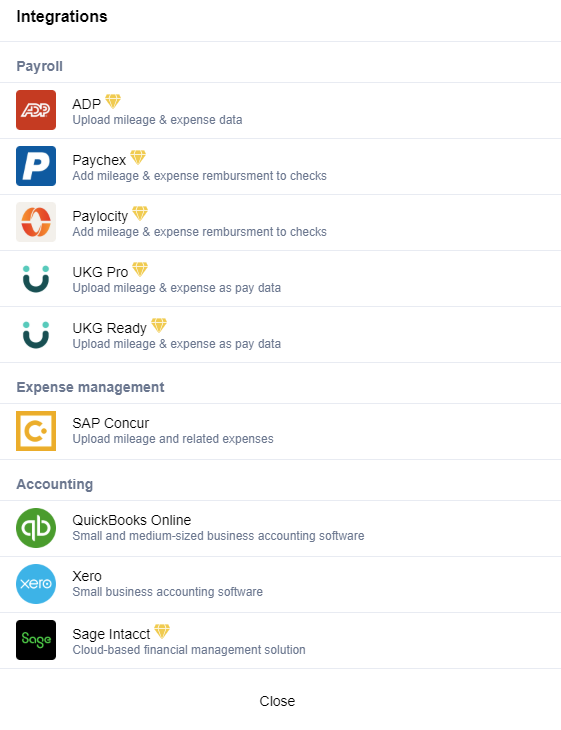

TripLog offers excellent integration capabilities. It has built-in integration options and doesn’t rely on third-party integration options. Currently, TripLog has integration options for Payroll, Expense management and Accounting.

All of these make TripLog the perfect choice for businesses and individuals looking for a complete solution for mileage, expense, and time tracking.

TripLog Features

- Unlimited reporting and automatic mileage tracking

- Offers detailed income and expense tracking

- OCR receipt capture

- Auto-classification rules

- Cloud backup support

- Fuel tracking, MPG calculation, and tax-compliant reports

TripLog Limitations

- Drains battery heavily while in operation mode

- Doesn’t offer reminders

TripLog Pricing

TripLog pricing is as follows:

- Single user: $4.99 per month

- Multi-user: $4 per user per month

The Single User plan comes with a free forever plan, which offers unlimited automatic GPS mileage tracking and basic expense management.

4. Hurdlr

Best for Self-employed

Hurdlr is best suited for self-employed individuals such as drivers, real estate agents, freelancers, and others. However, it is only accessible to US and Canada users.

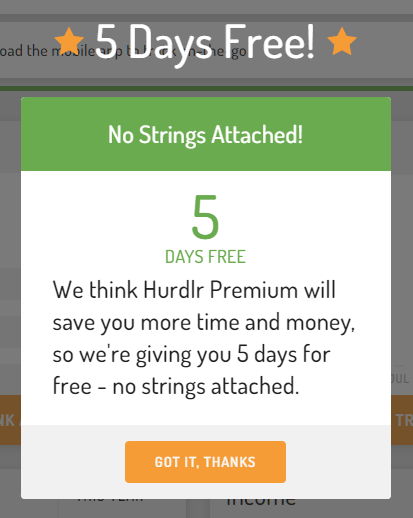

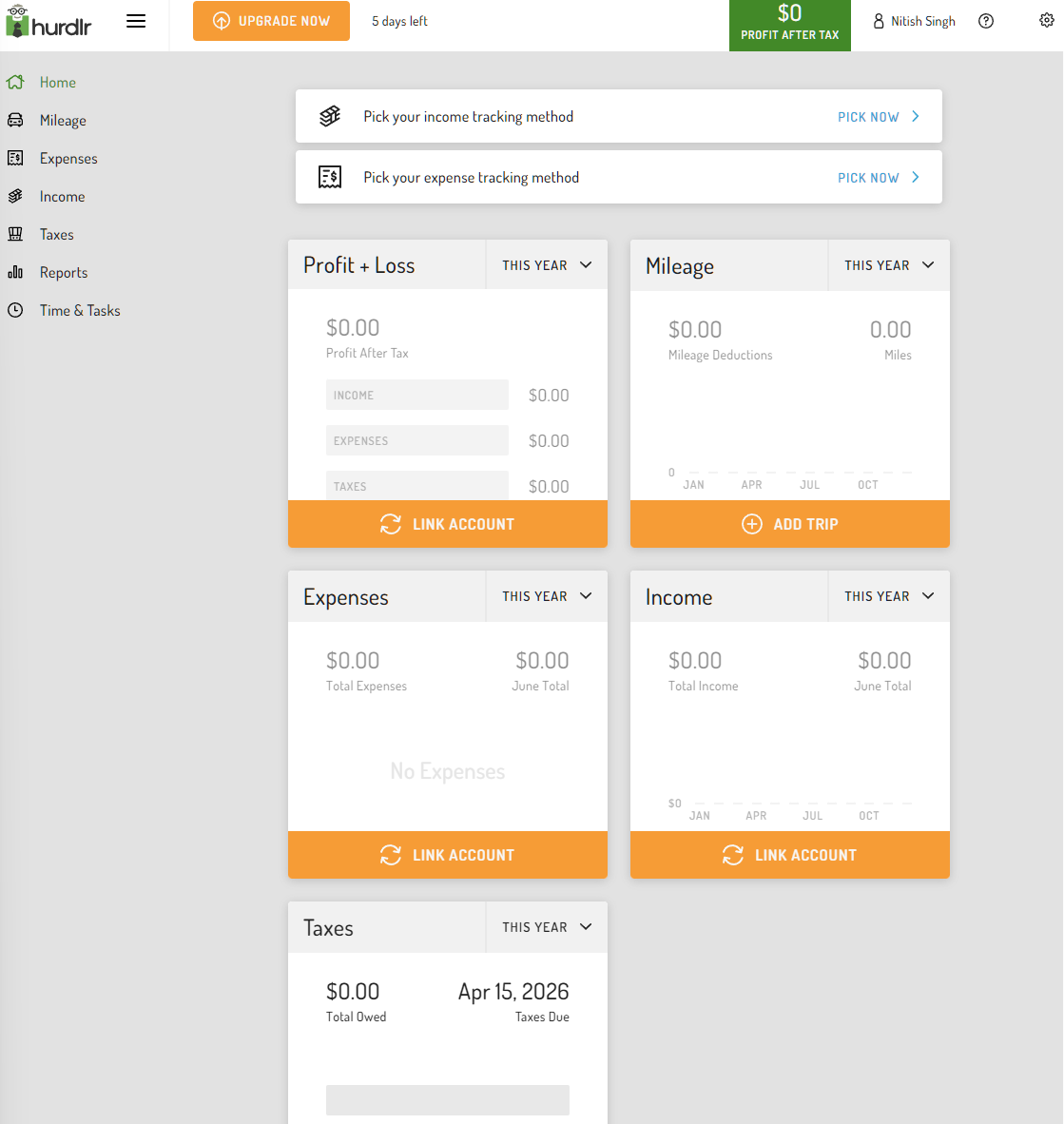

Once you sign up, you get the option to try its Premium free for 7 days. I suggest checking it out, as it helps test all the Hurdlr features. It asks for a credit card, but if you cancel it, Hurdlr will give you a 5-day free option, and that too without any credit card option.

I found Hurdlr basic setup listicles useful. It asks you to set up tax calculations, enable automated reports, pick income tracking methods, and install mobile apps for easy tracking. This makes Hurdlr beginner-friendly, even for new users.

For example, you can set up a tax calculation by entering your state, salary, and marital status. The tax calculations improve your business as you can focus on other important aspects.

The dashboard is well-designed with simple user interface elements. It gives an eagle-eye view of profit-loss, mileage, expenses, income, and taxes.

Overall, I found Hurdlr, an impressive mileage tracker. It offers excellent reporting functionality with useful tax calculation features built-in.

Hurdlr Features

- Automated monthly reports on expense, income, and mileage

- Easy income and expense tracking by connecting your bank account or manually

- Mobile apps available on iOS and Android ecosystem

- Offers notifications for expenses, drives, and getting paid

- Extensive reporting options, including mileage, profit & loss, income, etc.

Hurdlr Limitations

- Bank connectivity can glitch, resulting in duplicate entries

- Sometimes it doesn’t fetch entries automatically and requires manual entry

- Lacks advanced accounting features

Hurdlr Pricing

Hurdlr offers its premium plan at $9.99 per month. It provides all the features, including automated expense, income, and mileage tracking.

They don’t offer a free plan.

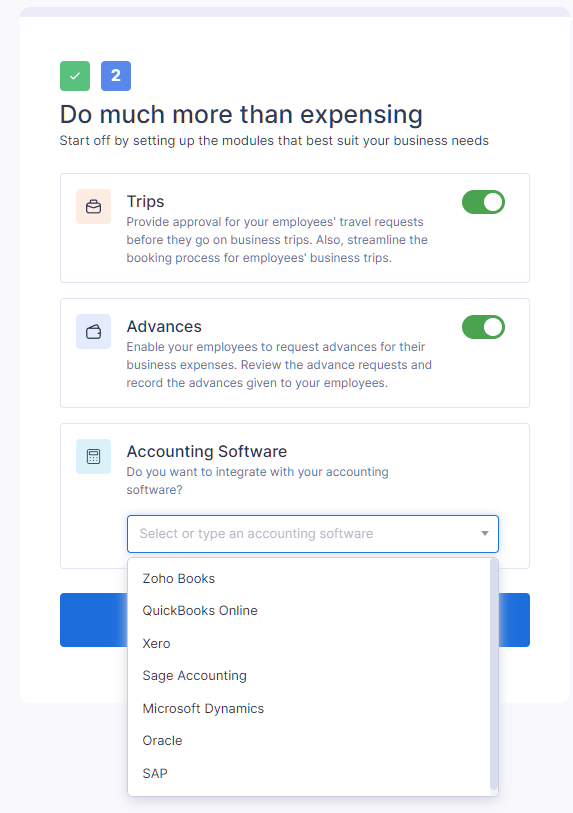

5. Zoho Expense

AIl-in-one Expense Management Solution

Zoho Expense is an extensive expense management solution that covers everything that a business would want. It offers an automated way to track trips and in-built integration for accounting software such as Zoho Books, Zero, Oracle, SAP, and others.

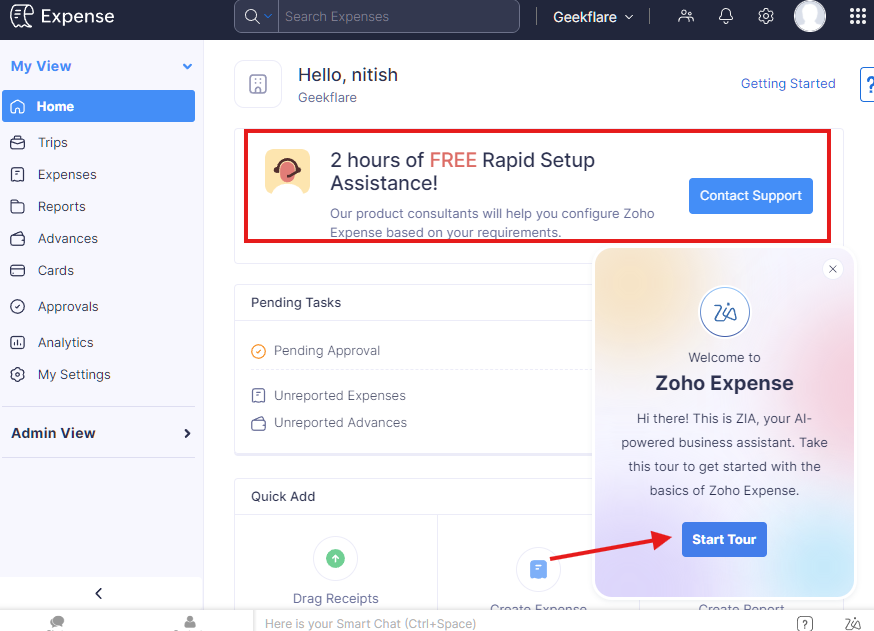

I found Zoho Expense very comprehensive in what it offers. For example, you get a tour powered by Zoho’s AI ZIA, which explains all the basics in six steps. If you’re new, Zoho also offers 2 hours of free rapid setup assistance, which is great for small businesses.

Among the best mileage tracker listed here, Zoho Expense is the most feature-rich. It has detailed features for each aspect of expenses, reports, approvals, analytics, and more.

For example, in Expenses, you can auto-scan receipts, manually add expenses, auto-forward email receipts, use GPS via mobile app (supports both iOS and Android), and convert card statements.

Teams can use Zoho’s automatic mileage mode for easy capturing and expense reimbursements.

Overall, I’ll recommend Zoho Expense as it is one of the best expense management tools. It offers a complete package at an affordable price. It is available for different companies with specific editions for countries like the UK, USA, Canada, Saudi Arabia, UAE, Australia, India, and global editions. These editions ensure compliance with the respective regions.

Zoho Expense Features

- Proper receipt management with auto-scan, email forward, and track & store digital receipts

- Supports multicurrency, billable, and non-billable with automated tracking

- Design and implement proper policies with expense rules

- Offers detailed reports on expenses automatically

- Simplified approvals to cover all requests

- Ensure audit-ready with instant audit trail

Zoho Expense Limitations

- Delay in mobile app synchronization

- Limited reports customization

- Limited free plan

Zoho Expense Pricing

Zoho Expense US pricing starts at $4 per user per month. Its premium plan is at $7 per user per month.

They also offer a free plan for small businesses with a maximum of 3 users. It has 5 GB receipt storage and 20 receipt auto-scans.

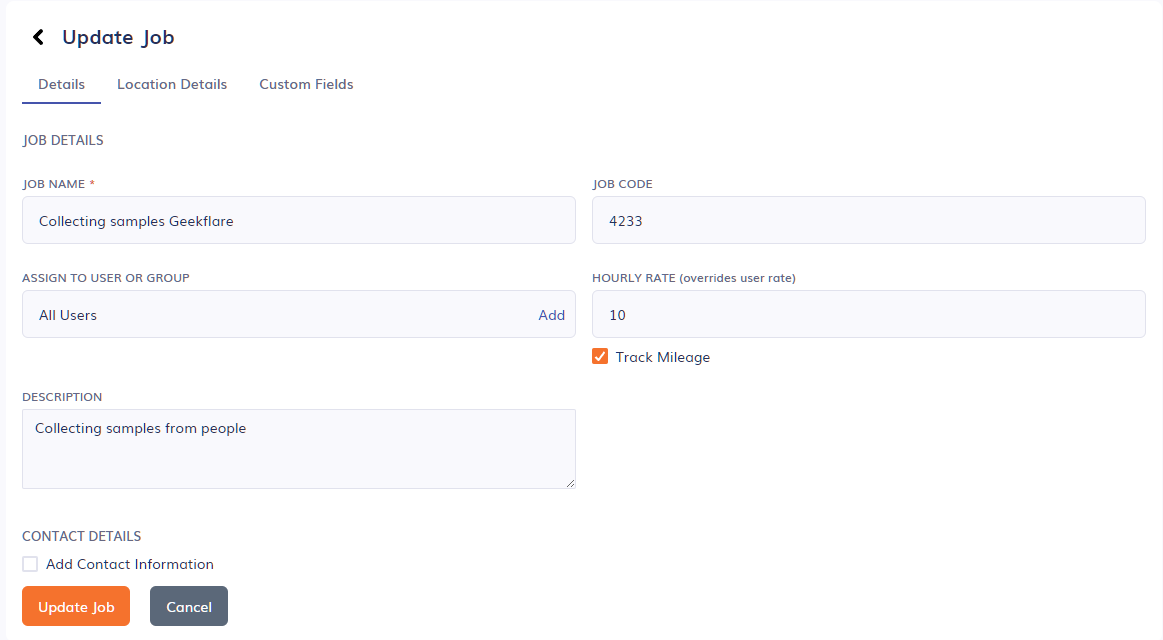

6. Timeero

Best for Automatic Geofence Tracking

If your business depends heavily on accurate geofence tracking, then Timeero is a great pick. It helps track employee hours with its GPS time tracking app (Android and iOS) and mileage tracking for proper reimbursement.

Timeero has excellent integration capabilities as you can connect it with payrolls, such as QuickBooks and Gusto, or payment platforms, such as Paychex and Paylocity.

As a business owner, you can take advantage of its 14-day free trial (no credit card requirement). Once you sign up, they offer a quick 2:50-minute video on how to use Timeero.

I loved it! It explains all the basics clearly and helps you get started as quickly as possible.

As for the dashboard, Timeero is well-designed. I was able to add people, create jobs, and set up mileage with ease.

Additionally, Timeero offers excellent reporting with the option to create reports based on tasks, date range, mileage and much more.

Overall, I found Timeero a worthy option for businesses looking for mileage tracking. However, it does lack a free plan.

Timeero Features

- Excellent geofencing with clock-in restriction and automatic clock-out capabilities

- Proper mileage logging that doesn’t rely on odometer or third-party readings

- Offers time-tracking with timesheet management

- Easy-to-use scheduling for employees

- Face recognition for easy employee clock-in

- File and photo attachment for better communication

Timeero Limitations

- Lacks free plan

- Mobile apps can glitch sometimes

- Limited integration options

Timeero Pricing

Timeero plans to start at $4 per user per month. This basic plan offers time, GPS, and mileage tracking with a 10-user limit.

They don’t offer a free plan. However, you can use their 14-day free trial with no credit card requirement.

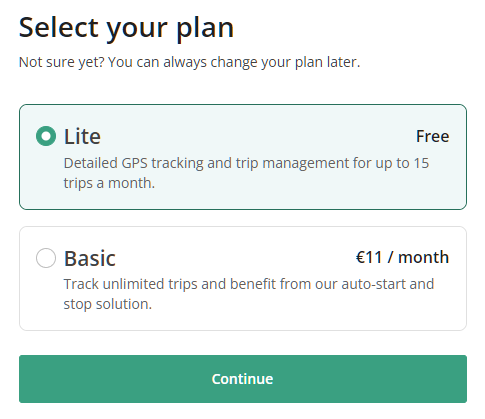

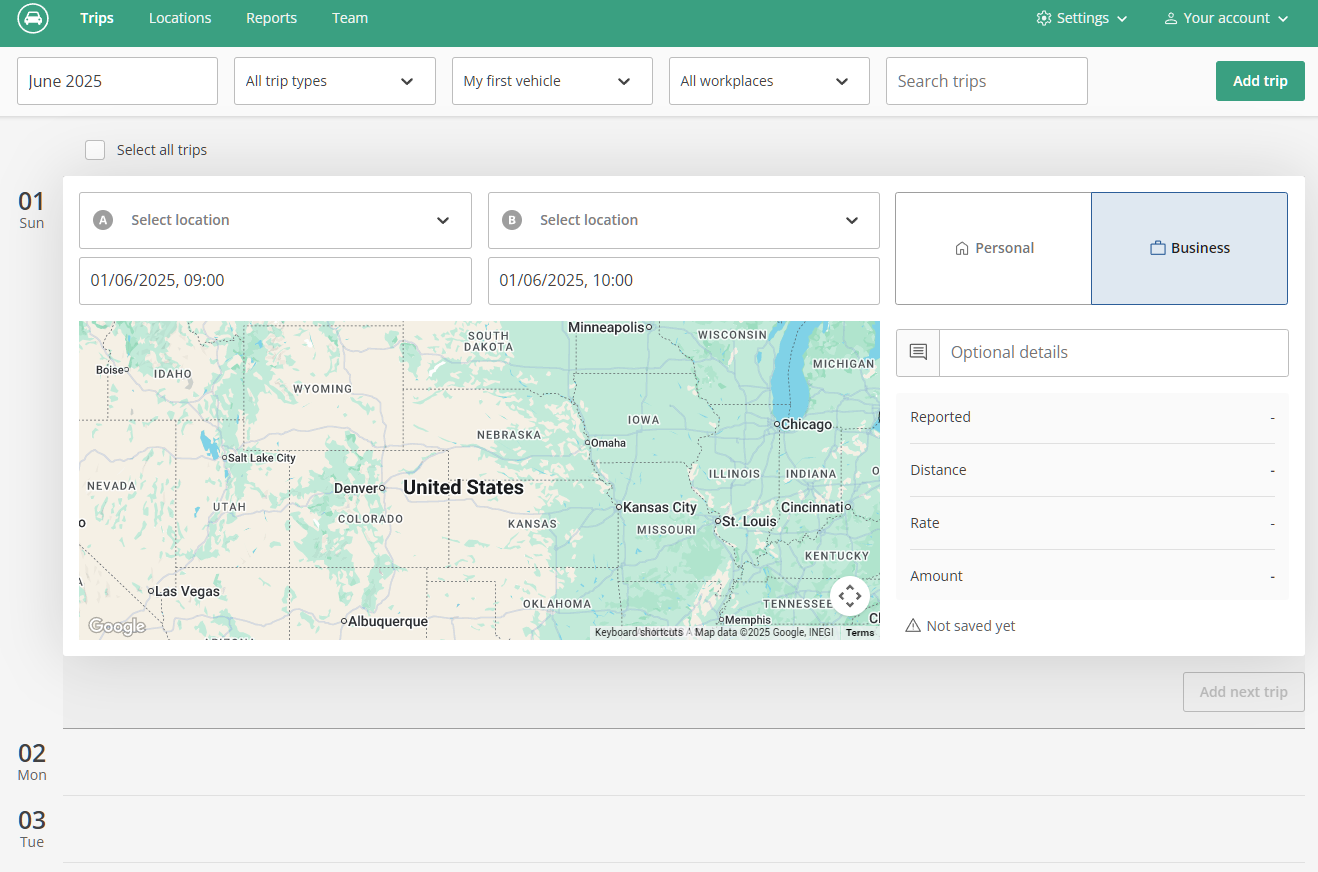

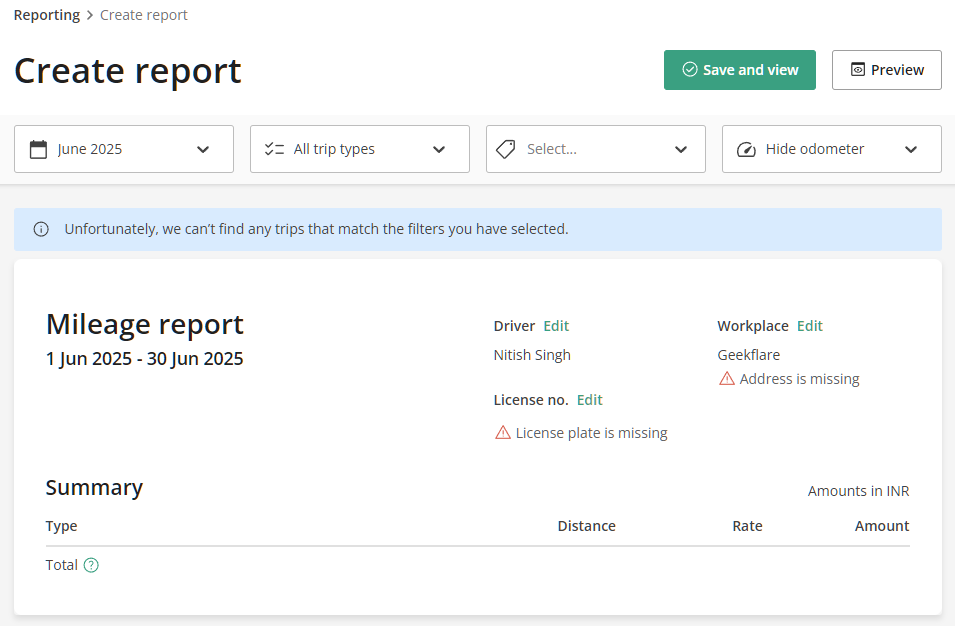

7. Driversnote

Best for Mileage Reimbursements

Driversnote offers freemium mileage tracking with a focus on easy automated logging. Like Everlance, MileIQ, and others, Driversnote helps generate tax-compliant mileage reports.

Once the app is installed (iOS or Android) and set up, the app automatically tracks trips with the option to add manual trips.

As Driversnote offers a free plan, I went ahead and tried it.

As soon as you log in, it asks you to load an app on your preferred phone (iOS or Android).

Driversnote dashboard is not advanced, but offers visibility to trips and locations. For example, you can find all trips listed by day under the Trips bar. You can add trips manually as well.

I found Driversnote’s reporting capabilities sufficient. It lets you create a tax-compliant report. Here, you can create reports based on different filters, including meetings, site visits, trip types, and so on.

Overall, I found Drivernote simple to use for teams and individuals.

Driversnote Features

- Automatically tracks trips without the need to open the app

- Save frequently visited locations

- Supports multiple vehicles and workplaces

- Set work hours for automated tracking

- Offers Odometer logs for transparency

Driversnote Limitations

- Expensive for the features offered

- Lacks route optimization

- Lacks integration with accounting software

Driversnote Pricing

Driversnote pricing starts at $11/ month. Drivernote’s free plan is only for individuals with 15 trips per month limitation.

Other mileage tracker apps worth mentioning:

- Rydoo: A simple-to-use mileage tracking solution with features like real-time mileage approvals, built-in compliance, a receipt scanner, automated approvals, and much more.

- Intuit Quickbooks: Quickbooks is online accounting software that also offers built-in mileage tracking with an automatic GPS feature. Some of its notable features include detailed mileage reports, a cheap starting price point, and IRS compliance. You can learn more about Quickbooks.

- Stride: A mobile app (iOS and Android)based on a mileage and tax tracker solution that is free to use. The app lets you save taxes, automatically track distance, trips, and miles, file taxes, and much more.

What is a Mileage Tracking App?

Mileage Tracking app enables individuals and businesses to automate trip tracking with GPS functionality.

Most of these apps come with additional features such as a receipt scanner, built-in compliance (such as IRS), team management, and integration options to accounting solutions such as Zoho or Intuit Quickbooks.

Some of the notable mileage tracking apps include Miles IQ, Hudlr, and Zoho Expense.

Mileage tracking apps offer the below benefits.

- Automated tax information capture

- Ensure proper mileage tracking

- Detailed mileage reports to optimize paths

- Easily share mileage reports with interested parties

How Do Mileage Tracking Apps Work?

Mileage tracking apps work by automatically monitoring trips using built-in GPS technology.

The GPS tech tracks how long you’re traveling, including starting and ending points.

The automated system stores the data, which can be verified and approved by managers.

The accuracy of GPS tracking differs from solution to solution.

As a user, you need to install its mobile app (iOS or Android) and turn on GPS to start tracking. Administrators can set up working hours or use geofencing to set up virtual parameters and boundaries.

Additionally, most mileage trackers offer integration with accounting and payroll for improved workflow when it comes to billing.

Frequently Asked Questions (FAQs)

Some of the notable free mileage tracker apps include:

Miles IQ (limited to 40 drives per month)

Everlance (limited 30 automated drives)

TripLog (free individual plan with no limitation)

Zoho Expense (limited)

There are many mileage tracker apps, including MilesIQ, Everlance, TripLog, and Hurdlr.

Almost all the listed mileage trackers offer iPhone support. This includes the likes of TripLog, Hurdle, Timeero and others.

-

EditorUsha, the editor-in-chief of Geekflare, is a tech-savvy and experienced marketer with a Master’s degree in Computer Applications. She has over a decade of experience in the tech industry, starting as a software engineer and then moving into digital marketing and team management.

EditorUsha, the editor-in-chief of Geekflare, is a tech-savvy and experienced marketer with a Master’s degree in Computer Applications. She has over a decade of experience in the tech industry, starting as a software engineer and then moving into digital marketing and team management.