Spend management software helps you optimize every expense you disburse from source to pay to stay within the stipulated budget and pay vendors according to the contract. It automates tracking, organization, and optimization of spending across operations so that you can save and re-invest in business growth.

You get real-time visibility into organizational spending, allowing managers, CMOs, CFOs to find alternatives or remove unnecessary costs to fit budgets and procurement contracts.

- 1. Pleo – Best for Employee Spending Management

- 2. Wallester Business – Best for Monitoring Spending Limits

- 3. Rippling Spend – Best for Automated Policy Controls

- 4. Ramp – Best for Corporate Card Management

- 5. Moss – Best for Financial Transparency and Control

- 6. Payhawk – Best for Global Spend Management

- 7. Airbase – Best for Procure-to-pay Software

- 8. Precoro – Best for Full Spend Control

- 9. Spendesk – Best for Real-Time Spend Visibility

- 10. Brex – AI-powered Expense Review Management

- 11. Emburse – Best for Small Business

- 12. Bill.com – Best Free Spend Management Software

- Show less

You can trust Geekflare

At Geekflare, trust and transparency are paramount. Our team of experts, with over 185 years of combined experience in business and technology, tests and reviews software, ensuring our ratings and awards are unbiased and reliable. Learn how we test.

Spend Management Software Comparison

Below I have compared the best spend management tools based on whether they offer corporate cards, support multiple currencies, the integrations they offer with your existing tools, pricing, and Geekflare’s rating out of 5.

|  |  |  |  |  |  |  |  |  |  |  | |

✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ❌ | ✅ | ✅ | ✅ | ✅ | |

❌ | ✅ | ✅ | ✅ | ❌ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | |

Accounting, NetSuite, HRIS | Via API | Accounting, Payroll | Accounting, Security, Expense Automation | ERP, SSO, HRIS | ERP, Accounting, HR, SSO | ERP, HRIS | ERP, Accounting, Analytics, Security | Accounting, Travel, HR, SaaS | ERP, Accounting | NetSuite, Paycor, QuickBooks, Sage Intacct | Accounting, HRIS | |

£39 | Lifetime free, pay for card usage | Custom | FREE | On request | On request | On Request | $499 | On Request | FREE | On Request | FREE | |

Geekflare’s editorial team determines ratings based on factors such as key features, ease of use, pricing, and customer support to help you choose the right business software. | ||||||||||||

I will now discuss the top features of each of these spend management software, their user experience and pros/cons.

1. Pleo

Best for Employee Spending Management

Pleo helps centralize all employee expenses, invoices, and reimbursements in a single spend management solution. You can pay, manage, and optimize expenses using its smart corporate cards, automated account payable solutions, and spend management tools. This includes managing multi-entity transactions as well – you get holistic visibility into complete employee expenses at the organizational level.

Pleo’s focus on European markets makes it a suitable choice for businesses operating or targeting this market to simplify accounting and banking workflows. It is also ideal for companies wanting to track employee expenses that involve lots of petty cash, receipt management, or approval flows to control them.

Pleo gives teams a clear overview of spending, ensuring every transaction is tracked and categorized. The interface allows users to upload receipts, assign expense categories, and add contextual details, reducing manual reconciliation work. It also offers wallet balance tracking, team-based spend insights, and automated reporting, to let finance teams maintain full control over business expenses.

Top Features

- Smart Company Cards: Powered by Mastercard, Pleo offers physical, virtual, and temporary corporate credit cards for safe and flexible business expenses, vendor payments, and petty cash.

- Accounts payable: Avoid data entry to perform bookkeeping, manage invoices, and track accounts payable. Includes approval workflows and payment solutions. It also includes reconciliation features and integrations with leading accounting software like Sage50, QuickBooks, Xero, and more.

- Spend controls: Use multi-step approval workflows and custom spend limits to track and control spending across multi-entity organizations.

- Automation: Design automation workflows to chase receipts, invoices, and report generation to analyze employee spending.

- Recurring payments: Handle subscriptions seamlessly on autopilot and catch any duplicates or remove unused services.

Pros

User-friendly mobile app and website for both user and admin profiles

Provides both physical and virtual corporate credit cards

OCR technology to scan receipts and invoices

Responsive and effective customer support

Offers good integration options across accounting, communication, HRIS, procurement software, etc.

Cons

Users report glitches like invoice document uploading errors, misaligned tags, transaction failures, etc.

Features focus on employee spending use cases rather than complete spend management

Pleo focuses on the European market

Pricing

Pleo offers 4 plans.

- Starter: Free

- Essential: £39/month

- Advanced: £89/month

- Beyond: £179/month

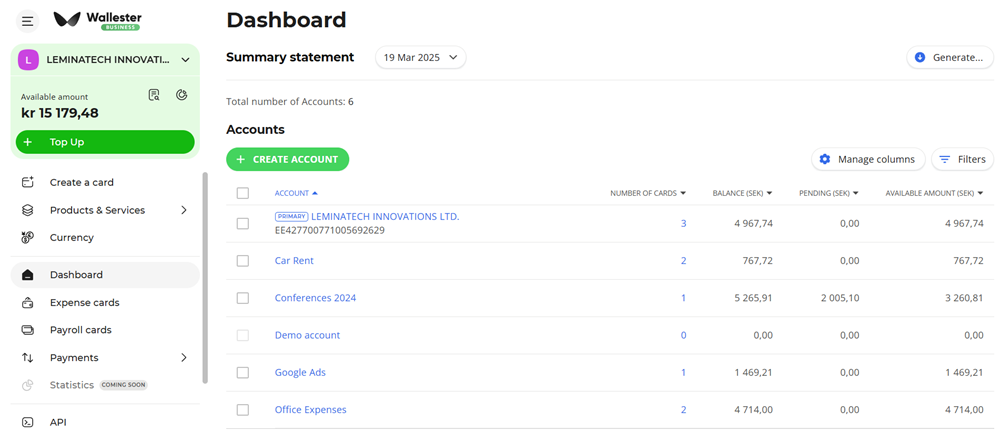

2. Wallester Business

Best for Monitoring Spending Limits

Wallester Business is an all-in-one business expense control software. Companies can manage all corporate spending from one platform as you can track all the expenses in real-time. Using this platform, you can issue virtual cards to your employees in minutes to cover corporate expenses.

You can even offer shared access to virtual cards to multiple people working on the same project. These business cards are highly secured with a 3D secure 2.0 system. Moreover, it shares instant notifications to reduce the chance of fraud cases.

Businesses can even track their progress toward budget limits and get alerts when they exceed their limits. Setting up daily and monthly limits for individuals, multiple payment methods and cash withdrawals, categorizing transactions and attaching receipts to these are other highlighted features of this software.

Above is Wallester’s dashboard showing account balances, available funds, expense categories, and pending transactions. It allows businesses to manage multiple accounts, create new accounts, and filter financial data for better insights. You can issue and track corporate cards, categorize expenses, and monitor available balances in real time, making it easier to control spending.

Top Features

- Physical and Virtual cards with spend control services

- Real-time transaction monitoring and limit regulation

- Budget Management and integrated accounting

- Payment approval system

- Mobile app for invoice uploading

Pros

No sign-up fees

Individual limit-fixing available for each employee

API available to integrate with any other business software

Cons

Some Reddit users have expressed difficulty with using Wallester virtual cards for online purchases

Fees for low-value transactions are on the higher side.

Pricing

Wallester is free forever, but charges for your card usage.

3. Rippling Spend

Best for Automated Policy Controls

Rippling is a unified platform to manage spending, HR, payroll, and IT. You can centralize expenses across corporate cards, travel, bills, and more. You can set up approval chains and spending limits to make sure employees adhere to spending policies and maintain operational budgets.

There are 3 main modules offered by Rippling Spend.

- Corporate Cards – you can issue branded cards to your employees. It comes with an automation to apply custom policies.

- Bill Pay – pay using corporate cards, ACH, or wire transfer. You can route bills to the right person in the department with workflow automation.

- Expense Management – you can track, automate general ledger sync, and reimburse employees in over 100 countries.

Rippling spend offers an excellent user experience as it lets you manage expenses through the mobile app and have detailed spend analytics. I like the workflow automation and policy builder, it allows you to stay compliant and control the budgets.

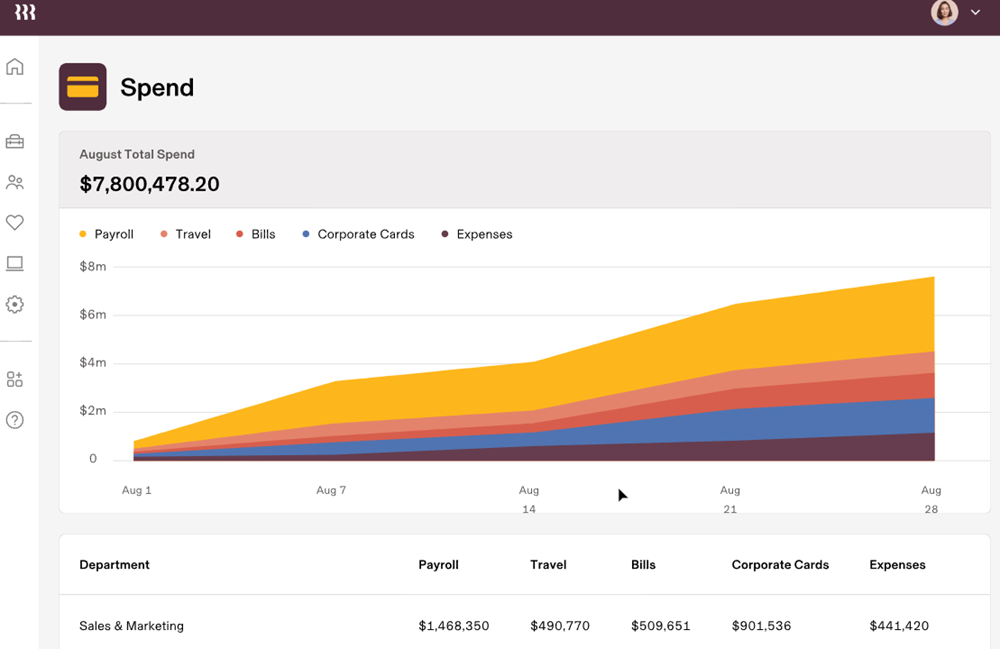

Rippling Spend Management’s dashboard provides a breakdown of the month’s total spend across categories like Payroll, Travel, Bills, Corporate Cards, and Expenses.

The graph offers a clear trend analysis of spending over time, making it easy to identify cost spikes and optimize budget allocation. The department-wise expense tracking and automated reporting helps businesses gain better control over financial planning and ensure spending aligns with company goals.

Top features

- Corporate credit cards: Allows issuing branded physical and virtual corporate credit cards to track business spending in real-time. You can apply custom spend policies, generate reports on tracked transactions, and block/revoke access on non-adherence to rules.

- Workflow automation: Use no-code to create custom fields and design workflows to automate manual tasks like assigning corporate cards, handling reimbursements, generating business expense reports, and more.

- Permission profiles: Control data access for employees or departments, design expense approval chains, route approval requests to the right managers, etc.

- Policy control: Rippling allows you to create ‘supergroups’ to dynamically assign employees based on their location and role. This avoids independently setting up manual policies like corporate card limits for each employee.

- Bill payments: Automate bill generation when employees or vendors submit invoices or receipts. In a single dashboard, track overdue bills, generate forecast reports, and prioritize accounts payable.

Pros

600+ integrations make it a flexible spend management software

Rippling product ecosystem makes employee expense management seamless from hiring to payroll with dedicated HRIS, IT, and global payroll solutions

The dashboard is intuitive and easy to navigate.

Cons

Lacks accounting tools

Users report a poor onboarding process and a difficult setup

Provides modular pricing, which can get expensive for small businesses as most features are inter-dependent to function properly

Pricing

Rippling Spend offers custom pricing. Contact the sales team with your requirements.

4. Ramp

Best for Corporate Card Management

Ramp is designed for finance teams to streamline business spending across travel, procurement, administration, and other accounts payable transactions. Its software and pricing structure have been designed to meet unique needs ranging from startups to small businesses, mid-market companies, and enterprises.

You can implement extended payment terms and design unlimited custom virtual cards for various company spending categories. You can also link different virtual cards to your physical card for seamless card management. These features make Ramp a great option for companies of all sizes looking for corporate card management features.

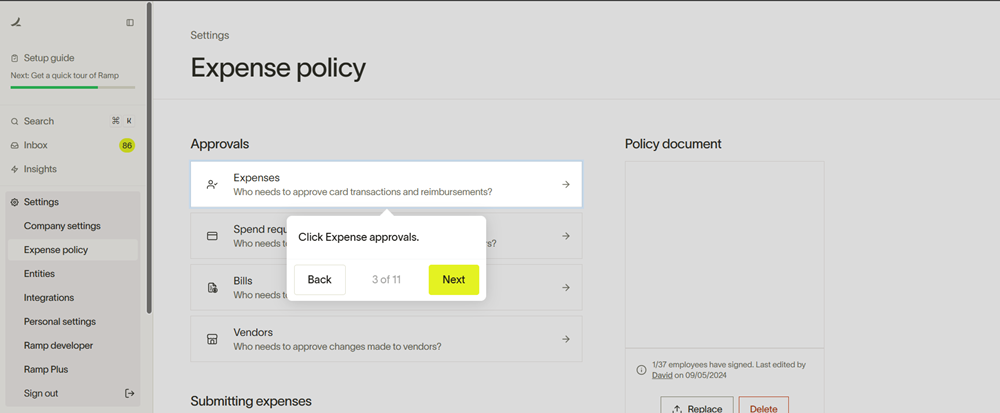

Ramp lets you set up expense policies and define who approves transactions at different levels. It has automated approval workflows for expenses, bills, and vendor payments, ensuring that every request goes through the right channels without bottlenecks. The policy document on the right and the acknowledgment tracking clearly shows how many employees have viewed and signed off the expense policies, keeping teams accountable for their spending.

Top Features

- AI automation: Use AI algorithms to automate receipt collection, extract data from them, generate missing receipt data based on sales data, automate invoice workflows, and more.

- Accounts payable: Categorize transactions using AI and historical transaction patterns. Ramp’s AI also helps review transactions based on designed spending policies to reduce manual work.

- Budgeting: Create pre-defined budgets and include relevant stakeholders in designing custom approval chains and travel routes. Use AI-led expense analysis to gain insights into business spending patterns.

- Procurement: Centralize procurement workflows and use AI to create or manage contract documents. Includes 3-way matching to validate submitted invoices with receipts and purchase orders.

- Global corporate card and payments: Ramp allows spend management across 40 currencies, provides global reimbursement support in their local currency in 70 countries, and supports international taxation for seamless accounting.

Pros

Provides unlimited virtual cards

Includes dedicated features for mileage reimbursements and enforcing travel policies

Includes multi-entity and multi-currency support

Integrates directly with Gmail, Amazon, and Uber to capture receipt data

Cons

Pricing plans are user-based, making it not ideal for organizations with large teams

Navigation is not intuitive – for example, the menus are difficult to explore for available customization options

Reporting is limited to dashboards – and may require using third-party analytics tools for deeper insights

Pricing

Ramp issues unlimited corporate cards for $0 with no charges for spend management. However, there are charges for card usage.

5. Moss

Best for Financial Transparency and Control

Moss is a spend management provider with procurement and accounting tools for complete spend tracking, assessment, and control. It uses corporate cards to decide spending limits and track transactions for easier and faster month-end closing accounting. Its integrated procurement process solutions further help automate purchase requests, invoice approvals, and budget tracking to save on spending and simplify audits.

Moss provides dedicated ERP integrations, and its pricing is not based on the number of users. This makes it a practical option for enterprises or organizations with large teams looking to control their finances.

Moss makes submitting reimbursements straightforward by clearly distinguishing between general business expenses and mileage claims, helping employees quickly pick the right category.

I found it particularly convenient how all reimbursement requests are neatly organized into drafts, open requests, and archives for easy tracking. This ensures that accounting teams spend less time chasing details and more time on meaningful tasks.

Top Features

- Accounts payable: Automate manual tasks to save time on tasks like data entry, data extraction, bulk payments to vendors, recurring payments, and invoice follow-ups.

- Corporate cards: Get use-case-specific cards to handle subscriptions, one-time transactions, or projects. Place approval workflows and spending limits to control the budget and track expenses in real-time.

- Purchase requests: Streamline the procurement process by designing spend policies, creating custom purchase requests, automating invoice generation, and using budget alerts when spending doesn’t adhere to imposed compliance.

- Integrations: Moss provides 2-way integrations with major HR, ERP, SSO, and accounting tools like Oracle, QuickBooks, Workday, Deel, Azure, TravelPerk, and others.

- Automated accounting tools: Moss uses AI to place captured data into the right accounting fields. It also alerts about empty fields and missing information, flags unauthorized transactions, analyzes business expenses for cost-cutting, and more.

Pros

Single platform pricing – No user-based pricing makes it cost-effective for organizations with high headcounts

Responsive customer support

User-friendly and modern interface design

Seamless corporate credit card management with unlimited physical and virtual cards

Cons

Does not support multi-entity visibility

Inadequate receipt management features – users report Moss does not automatically capture receipts from emails; there are occasional issues in data extraction from receipts.

Pricing

Pricing for Moss is available on request.

6. Payhawk

Best for Global Spend Management

Payhawk supports multilingual data extraction for multi-entity companies with a global presence. This means it can process invoices and receipts in 60+ languages, saving you time translating them manually. Additionally, it provides a ‘One Global Card Program’ to consolidate and centralize card management across currencies, countries, and entities, further streamlining global operations.

Payhawk offers ERP integrations, unlimited users, and customizable spending policies for effective budget control. This makes it ideal for multi-entity companies with large teams looking for exhaustive finance management features. It provides a unified platform for tracking spending across departments and global branches, enhancing visibility and control.

Payhawk’s mobile app as shown below simplifies capturing and submitting expenses on the go, letting employees quickly snap receipts and automatically attach them to transactions. I liked how it pulls relevant data directly from the invoices, reducing the hassle of manual data entry. Plus, categorizing each expense and adding notes makes expense tracking effortless, even when traveling.

Below is the approval dashboard clearly displaying payment details, including any foreign exchange or POS fees, which simplifies expense reconciliation. The built-in commenting feature is pretty impressive – it lets teams clarify transaction details directly, reducing confusion and speeding up the approval process.

Top Features

- AI-enabled accounting software: Uses AI algorithms to simplify accounting, including bank reconciliations, receipt data entry, match fields, expense codes, and more.

- Analyze spend data: Understand spending patterns across global entities, current funds vs. upcoming spending to make strategic decisions, or track workflow status on ‘Group’ levels in a centralized spend dashboard.

- Security: Includes provisions to comply with local regulatory laws and is SOC1, PCI DSS, and SOC2 compliant with 24/7 monitoring for added security.

- Global payments: Issue cards and create dedicated IBANs worldwide, covering Europe, the US, and the UK. It also offers single-click, cost-effective transfers to over 160 countries in 50+ currencies.

- Cost savings: Provides cashback on corporate card spending, makes VAT reclaim processing more efficient with receipt management, and aggregates multiple spend management tools into a single platform.

Pros

Good customer support and handholding for integrations set up

Features go beyond spend management to handling finances with integrations and automation

Exhaustive mobile app features are on par with web apps.

Unlimited users across all pricing plans

Cons

Setup is time-consuming due to the variety of available customizations and features

Limited customization for approval workflows, data export, and reporting

Occasional glitches like sudden logouts, upload or data sync issues, etc.

Pricing

Payhawk offers 3 options – Premium Cards, All-in-one Spend, and Enterprise. Pricing for all these plans is available on request.

7. Airbase

Best for Procure-to-pay Software

Airbase’s spend management solutions focus on automating procurement to payment workflows. They streamline those workflows by providing corporate cards, accounts payable automation, expense reporting tools, and 70+ ERP integrations. These tools bring much-needed visibility into business spending so that you can optimize them and stay compliant with your budget.

Airbase suits multi-entity companies looking for guided procurement software with ERP integrations and multi-currency to manage business spending.

The Airbase dashboard consolidates approvals, payments, and accounting tasks into one place, making it easy to see what needs immediate attention. The clear separation of tasks, like virtual card sync rules and ledger entries awaiting review, helps avoid confusion and ensures you don’t miss any critical financial checkpoints. The quick access to receipts and expense reports on the right side is another handy feature I noticed.

Top Features

- Guided procurement process: Automates complete procure-to-pay process with approval workflows without writing code.

- 360° spend visibility: Track service-level agreements across vendors and procurement metrics, identify risky or dormant payments, find cost-saving opportunities, and more with integrated spend analytics.

- Fraud detection: Airbase can detect any attempts to change bank account details or card pins or modify spending limits.

- Vendor portal: Manage vendor contracts, communication, invoices, payments, and purchase requests with a dedicated vendor dashboard.

- Bill payments: Centralize and manage accounts payable using Airbase’s OCR technology to capture invoice or receipt details with 3-way matching for accuracy.

Pros

Businesses can create vendor-specific virtual corporate cards to avoid fraud or data breaches

Provides automated audit trail features like the record of approvals made, invoice inbox, documentation tracking, and more

Mobile app for on-the-go spend management

Cons

There are inconveniences, such as having to manually enter transactions, not being able to clone or copy similar transactions, and not being able to edit submitted requests.

Limited options to create custom reports

User interface is not adequately intuitive

Pricing

Airbase has 3 plans – Standard, Premium and Enterprise, the price for which are available on request. They also offer custom packages.

8. Precoro

Best for Full Spend Control

Precoro provides business spend management solutions that strongly focus on business expenses to simplify procurement process workflows. It follows a 2-4 week quick implementation procedure such that everyone from finance teams to procurement can stay on the same page to navigate and manage spending.

Precoro is suitable for medium to large businesses that want faster processing cycles, reduce purchase order costs, and control spending within their budgets.

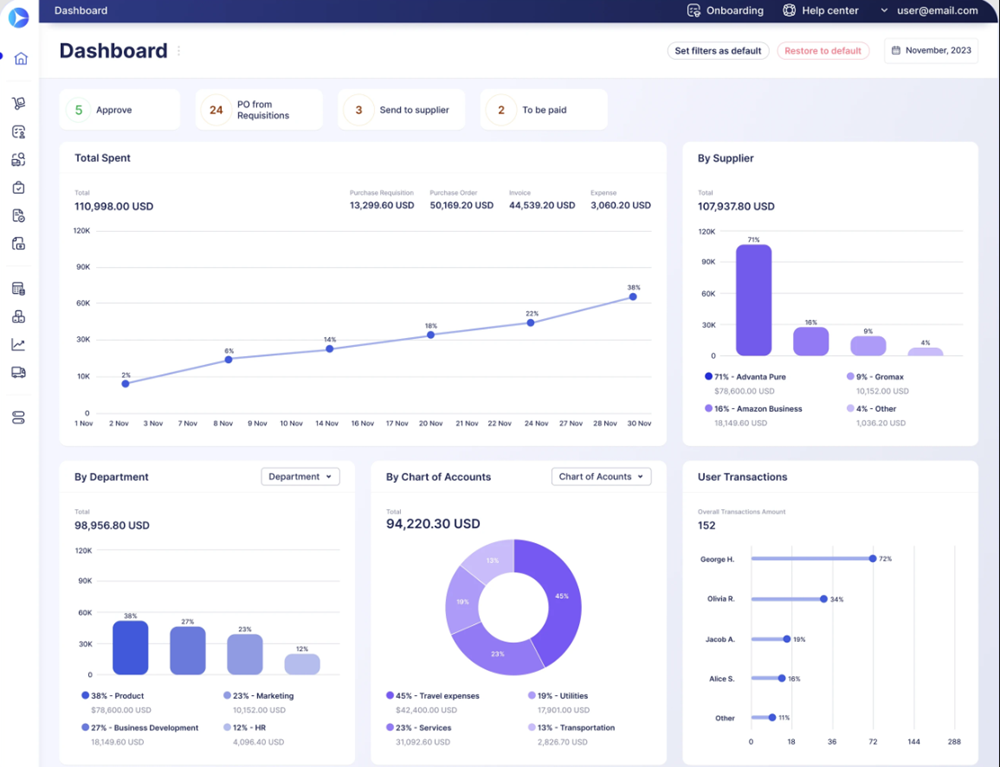

Precoro’s dashboard offers a clear overview of spending, breaking it down by suppliers, departments, and expense categories. It’s easy to monitor ongoing approvals and track transactions, making sure nothing slips through unnoticed. I especially like the user transaction insights, showing who’s spending the most, which can help in proactively managing budgets.

Top Features

- Spend optimization: Precoro’s procurement software offers visibility to identify cost-saving opportunities and optimize your purchasing approach by seamlessly modifying workflows.

- Budgeting: Manage procurement expenses with the ones from other departments, track spending behavior, and forecast to prepare for cost-cutting to meet budgets.

- Supplier management: Find the best suppliers that meet your spending budgets and timelines, set up supplier approval workflows, streamline contracts, and more.

- Accounts payable automation: Remove manual paperwork and data entry from invoicing workflows and manage billing cycles. This includes using OCR technology to match invoices with receipts and purchase orders 3-ways to ensure accuracy and avoid duplicates.

- Interactive reporting: Create automated and custom reports using 120+ fields and 20+ filters. This includes tracking audit trails by comparing document versions

Pros

Includes supplier and procurement management features for end-to-end spend management

ESG reporting features for companies maintaining sustainability compliances

Good customer support

Allows complete data export

Cons

Does not offer corporate cards

Integration options are limited to 10 nos. only

Does not allow advance or partial payments

Pricing

Precoro offers the below 3 plans.

- Core: Starting $499/month

- Automation: Starting $999/month

- Enterprise: Custom pricing

9. Spendesk

Best for Real-Time Spend Visibility

Spendesk focuses on streamlining operational spending for better finance management. It centralizes budgeting, invoicing, business spend tracking, and smart corporate cards to capture every current and potential transaction for better financial planning.

Spendesk includes dedicated features for managing company spending across travel expenses, team perks, subscriptions, and digital advertising. This makes Spendesk ideal for small to medium businesses looking to streamline business expenses across multiple departments without facing complexity or added costs due to too many features.

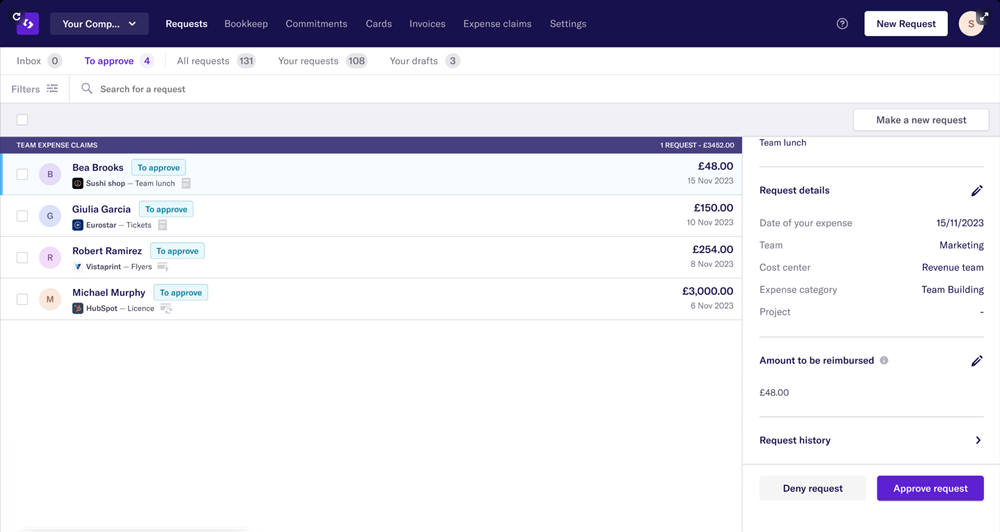

As you can see in the above screenshot, Spendesk clearly lays out pending expense requests, making it straightforward to quickly approve or reject reimbursements. The interface provides details about expenses, such as dates, categories, and teams involved in the spending, so managing approvals is frictionless. Having a summary of all team expense claims greatly simplifies spending oversight, keeping the whole process transparent and efficient.

Top Features

- Corporate credit cards: Get single-use physical and unlimited virtual cards with approval workflows and company spending limits to track every expense as your employees use them to make payments.

- Contract management: Provides an interface for negotiating vendor terms with a better price structure, renewing contracts on time, viewing contract status and progress, implementing approval processes, and more.

- Business travel expenses: Centralize booking travel tickets, track on-the-road receipts, and seamlessly reimburse employees for out-of-pocket expenses.

- Budgeting: Pay invoices in bulk, track expenses in real-time, forecast expenses, and find ways to control them for better budgeting.

- Payment solutions: Centralize expenses across subscriptions, team perks, reimbursements, and other online payments. Includes audit trailing of transactions and approvals for better transparency.

Pros

Tracks multiple payment formats across subscriptions, travel, ads or marketing, reimbursements, and more.

Provides on-time use and unlimited physical and virtual cards with no extra fees

Allows unlimited users for all pricing plans

Cons

Limited features compared to competitors – for example, there are no accounting features, although you can integrate with other specialized accounting tools

Users report glitchy virtual card instances like failed transactions, inaccuracy in filling data fields, etc.

Pricing

Spendesk offers 3 plans – Essentials, Scale, and Premium. The pricing for these plans is available on request.

10. Brex

AI-powered Expense Review Management

Brex provides exhaustive card management features to help businesses automate and streamline their spend management workflows. It is designed for ‘continuous close’ – which means it uses AI-powered automation to help with real-time management of accounts payable, bookkeeping, reporting, invoice management, and more.

It syncs and shares data with leading ERP solution providers like NetSuite or Quickbooks for seamless accounting. It also helps manage global business spending and reimbursements. Such features make Brex ideal for companies overseeing transactions and expense reviews in depth for better budget controls.

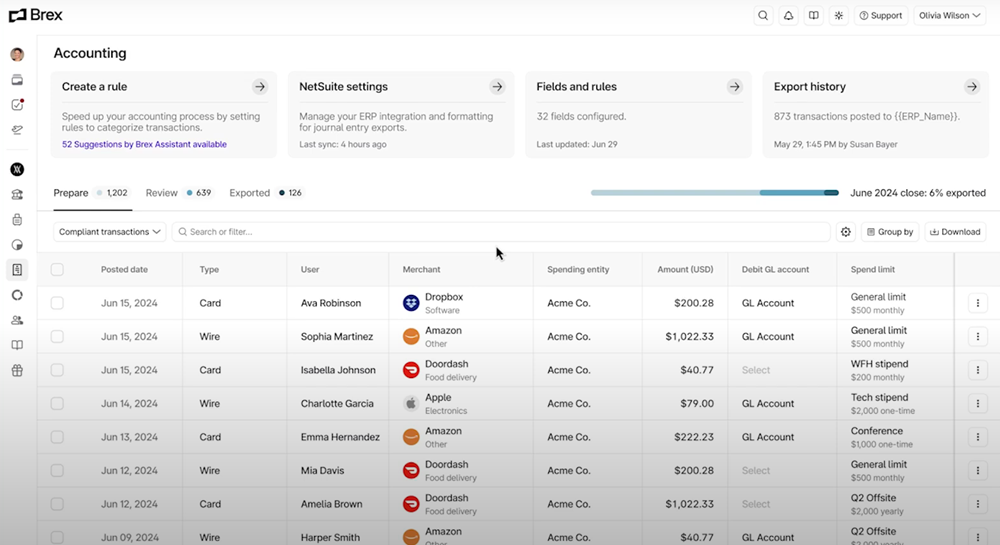

Brex offers a clean interface where you can easily create custom accounting rules to speed up transaction categorization, making the monthly close process smoother. The software integrates effortlessly with ERPs like NetSuite, providing real-time syncing for journal entries, which reduces manual data entry and its potential errors. Also, having detailed transaction tracking and export history gives clear visibility into company spending.

Top Features

- Corporate cards: Brex cards (issued over Mastercard) are globally accepted for their physical and virtual cards. They support tracking expenses in 100+ currencies and reimbursing employees in 30+ currencies in the local bank account.

- Multi-entity spend controls: Track business spending and add spend limits across headquarters and subsidiary transactions in real-time.

- Travel expense management: Brex provides a single platform for managing global travel booking, controlling group spending, and navigating itinerary changes. It also provides exclusive airline deals with carriers like EasyJet or Frontier.

- Enforce spending policy: Brex helps implement rules on spending across bill payments, cards, reimbursements, and travel. Using AI, you can determine which expenses adhere to the spending policy for approval and gain insights into the effectiveness of your policies.

- Live budgets: Monitor company spending patterns in real-time and strategize budgets by setting up ‘pre-approved’ spending. Generate reports across various expenses to optimize budgets further.

Pros

Allows B2B software companies to integrate Brex cards into their product suite to earn additional revenues

No FX markups

Multi-currency and multi-entity support

Effective expense reporting features across spending, compliance, budgets, travel, and more

Cons

Slow onboarding and difficult setup

Users report a long and time-consuming verification process

User-based pricing may not be suitable for large teams

Pricing

Brex offers the below 3 plans.

- Essentials: $0/user/month

- Premium: $12/user/month

- Enterprise: Custom pricing

11. Emburse

Best for Small Business

Emburse (Formerly known as Certify) is a travel and spend management software designed for the unique needs of mid-sized companies. It focuses on improving business spending visibility to help you perform reimbursements on time according to strict policy compliances set by your finance teams.

SMEs can take their ventures global as Emburse supports 64 languages and 140+ currencies for spend management. With its auditing, 40+ standard expense reporting, and integrations with other accounting tools, you can further streamline and simplify your finances.

Emburse Spend provides a dashboard that neatly summarizes spending through detailed visual charts, making it easy to quickly understand the company’s spending habits. It also allows you to manage card transactions, approvals, and reimbursements directly within the interface.

It has a convenient mobile app (shown on the right), which automatically suggests expenses that require categorization or receipts, significantly reducing manual effort. This mobile feature is particularly helpful for busy teams frequently traveling or working remotely, ensuring expense reports and approvals remain timely and accurate.

Top Features

- Emburse cards: Issue virtual and physical cards to allow employees to make pre-approved business purchases. Set up custom policies and budgets for every transaction category to block unauthorized transactions at the point of sale itself.

- Certify payments: Perform transactions globally to instantly reimburse employee expenses as per local regulations across various supported payment modes, including checks.

- Track and audit: Emburse tracks complete expense-to-payment flow to help generate 40+ exhaustive reports across reconciliation, client billables, expense policy metrics, travel expenses, taxes, and more.

- Travel spend management: Implement pre-trip approvals and access corporate rates for travel bookings to save on travel expenses. Capture, sync, and share travel expense data for seamless accounting.

- Invoice management: Use OCR technology and approval automation to get visibility into the complete invoice cycle. You can also automate manual tasks to improve business cash flows and navigate compliance risks with vendors.

Pros

Simple and easy-to-use spend management software

Allows check payments

Cost-effective option for global and multi-entity businesses

Responsive and effective customer support

Cons

Lacks procurement expense management features to handle and control vendor payments

Users report poor recognition of handwritten receipts

Compared to the web app, Certify’s mobile app features are limited to receipt capture only

Pricing

12. Bill.com

Best Free Spend Management Software

BILL provides finance management solutions for streamlining and automating accounts payables, accounts receivables, expenses, and spend management workflows. Such holistic coverage helps BILL enable businesses with exhaustive spend tracking, payments, and automation features for simpler accounting.

It also provides corporate cards with automatic expense categorization. This quickens the pace of effective reconciliation to get visibility into business spending and feed the data into accounting systems. BILL is a great choice for businesses looking for a single platform to capture data across payables, receivables, and expenses for improved accuracy and continuous accounting workflows.

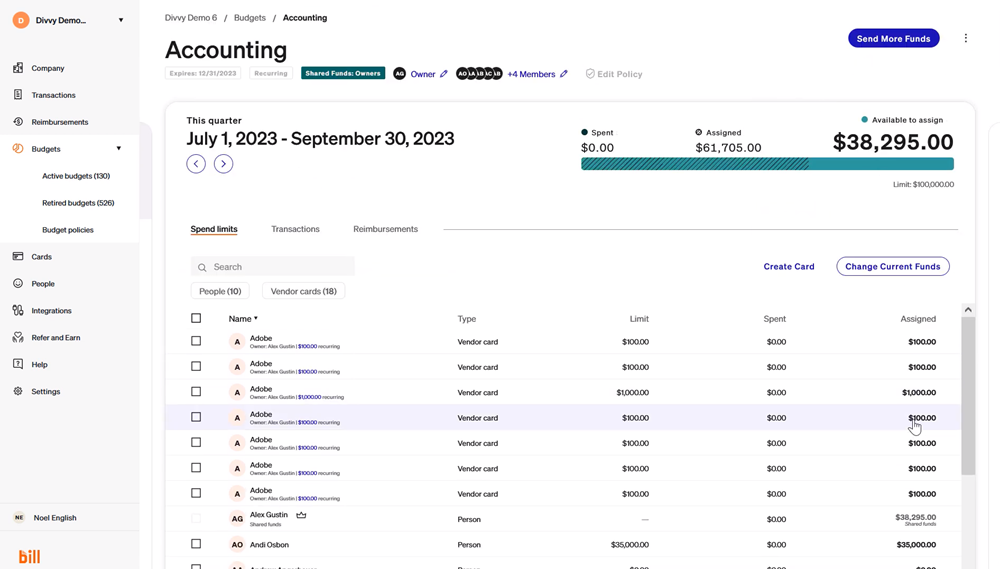

Bill.com’s spend management tool neatly lays out spending limits and vendor cards, which helps in clearly seeing where funds are being allocated. It instantly shows what’s spent and what’s available, giving a clear financial snapshot.

It provides an option to quickly change current funds or issue new vendor cards, which is very useful for managing budgets flexibly. It clearly presents budgets, transactions, and reimbursements all in one place.

Top Features

- BILL Divvy card: Powered by Visa, the BILL Divvy Card allows implementing spending limits and earning rewards on transactions. Includes access to business credit ranging from $1000-5M and a contactless payment feature.

- Budget management: Design custom spending policies for employees based on their roles and ownership. Review company spending on a real-time dashboard to adjust budgets for better spending management.

- Accounts payable: Automate end-to-end payables process, from capturing bills to making payments and syncing data for further accounting.

- Expense reimbursements: Track reimbursements in one place with real-time visibility into company spending. A payroll system can manage employee payouts using automatic ACH transfers.

- Expense reporting: Helps catch unauthorized payments, generates financial reports to track historical expense vs. budget, and performs forecasts.

Pros

No annual corporate card fees

US-based businesses can build their credit score with Small Business Financial Exchange (SBFE®)

Allows check payments

Forever free expense and spend management software

Provided dedicated ‘Accountant console’ for better visibility on managing cashflows

Cons

Limited integrations – BILL’s expense and spend management solutions offer a 1-way sync with Oracle NetSuite, QuickBooks Online/Desktop, and Sage Intacct

No dedicated procurement management features for handling vendor-related spending

Pricing

BILL platform is free forever.

More Business Spend Management Software

The below spend management tools, though not discussed in detail, deserve honorable mentions.

- SAP Concur – Best for Global Enterprises

- Workday – All-in-One Finance, IT, and HR Management platform

- Mesh Payments – Best for Real-Time Reporting

- Coupa – AI-driven Business Spend Management

- Tipalti – Best for Automated Payment Processing

What is Spend Management Software?

Spend management software centralizes the tracking, extracting, managing, and analyzing your complete spending data across business operations. The aim is to reduce expenses, vendor risk, and budget fluctuations by placing automated spend control measures.

Effective spend management solutions typically include accounts payable, procurement, and expense management tools. Together, they work to automate end-to-end spend management with the five key processes:

- Collect company spending data from receipts, invoices, emails, bills, purchase orders, etc.

- Categorize spend data into spend types like employee expenses, travel, vendor fees, etc.

- Optimize budget by comparing expense data with modelled financial budgets and forecast deviations or future risks.

- Implement approval workflows and spend control measures to reduce the gap between business spending and budget.

- Prepare expense reports to track KPIs, identify business spending patterns, strategize for optimizing spending, and more.

Performing the above tasks manually will consume your finance team’s productive time.

Spend management tools automate manual tasks across these 5 processes so that your finance teams can focus on the spend control strategy and its implementation.

What is the Difference Between Expense Management Software and Spend Management Software?

Expense management software focuses on tracking and reimbursing expenses made by employees after the transaction has occurred. In contrast, spend management software focuses on proactive control of total business expenditures across operations even before the transactions have occurred.

Let’s understand this better with key differences across their primary functions and use cases:

| Criteria | Spend Management Software | Expense Management Software |

|---|---|---|

| Primary function | Manage overall business expenditures across procurement, travel, adminstration, and more. | Track, control, and reimburse employee-initiated costs as per the company’s expense policy. |

| Approach | Proactive (strategically managing all expenditures) | Reactive (responding to submitted expenses) |

| Scope | Broad focus on business spending. | Narrow focus on employee expenses. |

| Users | Finance, procurement, and HR management teams. | Employees and HR departments. |

| Key features | Automate and manage procurement processes, suppliers, contracts, and budgets. Includes performing forecasts and spending analysis for decision-making. | Receipt capture, policy enforcement, automated reimbursements, expense reporting, and approval workflows. |

| Key integrations | Typically integrates with ERP systems for holistic financial management. | Travel management apps, hotel bookings, cabs, or HRIS systems. |

| Use case example | Source and negotiate with vendors that comply with procurement budgets and forecasts. | Manage employee travel or engagement activities. |

What are the Benefits of Using Spend Management Software?

Spend management software provides visibility into your expense transactions, which leads to the below key benefits. To address specific challenges in telecom expenditures, businesses might consider specialized Telecom Expense Management solutions that offer tools tailored for telecom cost optimization

Save Costs

Spend management tools like Coupa, SAP Concur, and Workday help you source relevant suppliers or alternative cheaper options using historical purchase data and current requirements. Other tools analyze spending patterns to identify vendors that deviate from your budget or spending policy. Thus, spend management software helps negotiate better deals with suppliers and eliminate unnecessary expenses to save costs.

Improve the Finance Team’s Efficiency and Productivity

Spend management software helps automate manual workflows like creating invoices or contracts, recurring payments, receipt data extraction, and more. It can also sync business spending data with third-party software like accounting tools, HRIS, and IT – thus effectively reducing the need for data migration and minimizing errors.

Advanced spend management tools like Rippling, BILL, Precoro, Coupa, Payhawk, Tipalti, and more can do more with AI automation capabilities. They can perform tasks that require intelligence – like determining eligible transactions for reimbursements as per spend policy, preparing expense reports, or suggesting budget adjustments.

These features free finance teams to focus on strategic budgeting and its implementation rather than administrative tasks.

Manage Risks and Compliances

Procurement processes are often riddled with compliance or overspending risks.

For example, some vendors may suddenly increase prices or cease to operate, which can disrupt your procurement budgets. A global company may experience a sudden increase in business spending due to local market dynamics in a foreign subsidiary.

Spend management software like Coupa, Airbase, Certify, SAP Concur, and Workday make you resilient to vendor risks by improving your business agility with their risk management solutions. For example, these tools can suggest relevant vendors to replace them beforehand or on time. Other spend management tools like Mesh Payments, Ramp, Certify, Sap Concur, and Tipalti offer tax automation capabilities that help avoid taxation risks, especially for globally-operated companies.

Future Trends in Spend Management Software You Must Know

Choosing a spend management software that regularly updates existing features and upgrades with new technologies is always beneficial. Here are some key trends to keep track of:

- Predictive analytics: Using data analytics and Generative AI to effectively use historical and real-time business spending data to forecast complex procurement scenarios. This is crucial to strategize navigating dynamic supply chain markets and adjust your budgets accordingly.

- User-centric approach: Look for spend management software with a mobile app, modern user interface design, and intuitive navigation. This is key to improving software adoption by vendors and employees to realize the return on investment, especially for remotely operated companies.

- Cybersecurity: Having provisions for enterprise-grade data security via user roles and permission workflows, data encryption, real-time transaction monitoring, multifactor authentications to prevent unauthorized access, and audit logs help with fraud detection and prevention.

Frequently Asked Questions (FAQs)

Emburse (formerly Certify) is the best spend management software for small businesses due to its simplicity, affordability, strong reporting features, global currency support, and ease of use. Ramp is also a solid option, providing unlimited virtual cards, automated expense management, and corporate card controls

Rippling Spend offers the best integrations with HR systems and accounting software, supporting 600+ integrations across HRIS, payroll, and accounting tools. Alternatively, Moss provides dedicated ERP and accounting integrations, including Oracle, QuickBooks, and Workday, for comprehensive financial and HR management.

Key Takeaways

- Effective spend management software helps businesses gain real-time visibility and proactively manage organizational spending, helping CFOs and finance teams eliminate unnecessary costs.

- Platforms like Ramp and Rippling Spend use automated policy controls and corporate card management features to ensure compliance with budgets, thus optimizing the entire spend cycle.

- Many spend management solutions, such as Payhawk and Brex, offer robust global capabilities, supporting multiple currencies and seamless international expense tracking.

- Advanced features, including AI-driven spend categorization and automated accounting integration, significantly reduce manual tasks, freeing finance teams to focus on strategic financial decisions.

- Modern spend management tools emphasize proactive risk management, robust compliance measures, and predictive analytics to help businesses stay agile in dynamic procurement environments.