FreshBooks

FreshBooks is accounting, and billing software for startups, small businesses and freelancers. The platform offers features such as invoicing, accepting payments, proposals and estimates, time tracking, and mileage tracking – all in one place.

I’ll share my experience to help you decide if it is good for your new business.

Features

-

Offers customizable invoice templates

-

Use checkout links to accept online payments

-

Native time tracking feature to track billable hours

-

Award-winning customer support for all paid users

Pros

-

Offers seamless onboarding and navigation through its user-friendly interface

-

Integrates with over 150 third-party apps

-

Highly rated mobile accounting app for iOS and Android users

-

Accepts over 200 international currencies

-

Offers a 30-day free trial to experience the features before finalizing a paid plan

Cons

-

Adding a team member costs an extra

-

Basic inventory tracking, which is not suitable for large enterprises

-

Batch invoicing is not available

Accounting Software Review Methodology

Geekflare tested the core accounting features of FreshBooks through hands-on subscriptions. We evaluated essential features and calculated a combined overall rating for each. To ensure an unbiased review, we gathered factual data from official websites and analyzed user feedback from various sources to provide comprehensive insights and detailed reviews.

What is FreshBooks?

FreshBooks is a comprehensive cloud-based account and invoicing software suitable for service-based businesses, freelancers, and independent contractors. Founded in 2003 by Mike McDerment, FreshBooks started as a small agency in a basement.

Today, the company serves over 30 million customers in 160+ countries and has more than 500 employees worldwide. This accounting software helps businesses and solopreneurs across various industries, including IT, legal, construction, creative, consulting, marketing, and advertising agencies.

In addition to the cloud-based software, they have a FreshBooks invoicing mobile app for Android and Apple devices.

FreshBooks Features

FreshBooks has evolved into a comprehensive accounting software not limited to accounting, invoicing, or bookkeeping but also facilitates payments and team communication. Here are the key features that FreshBooks offers for businesses and freelancers:

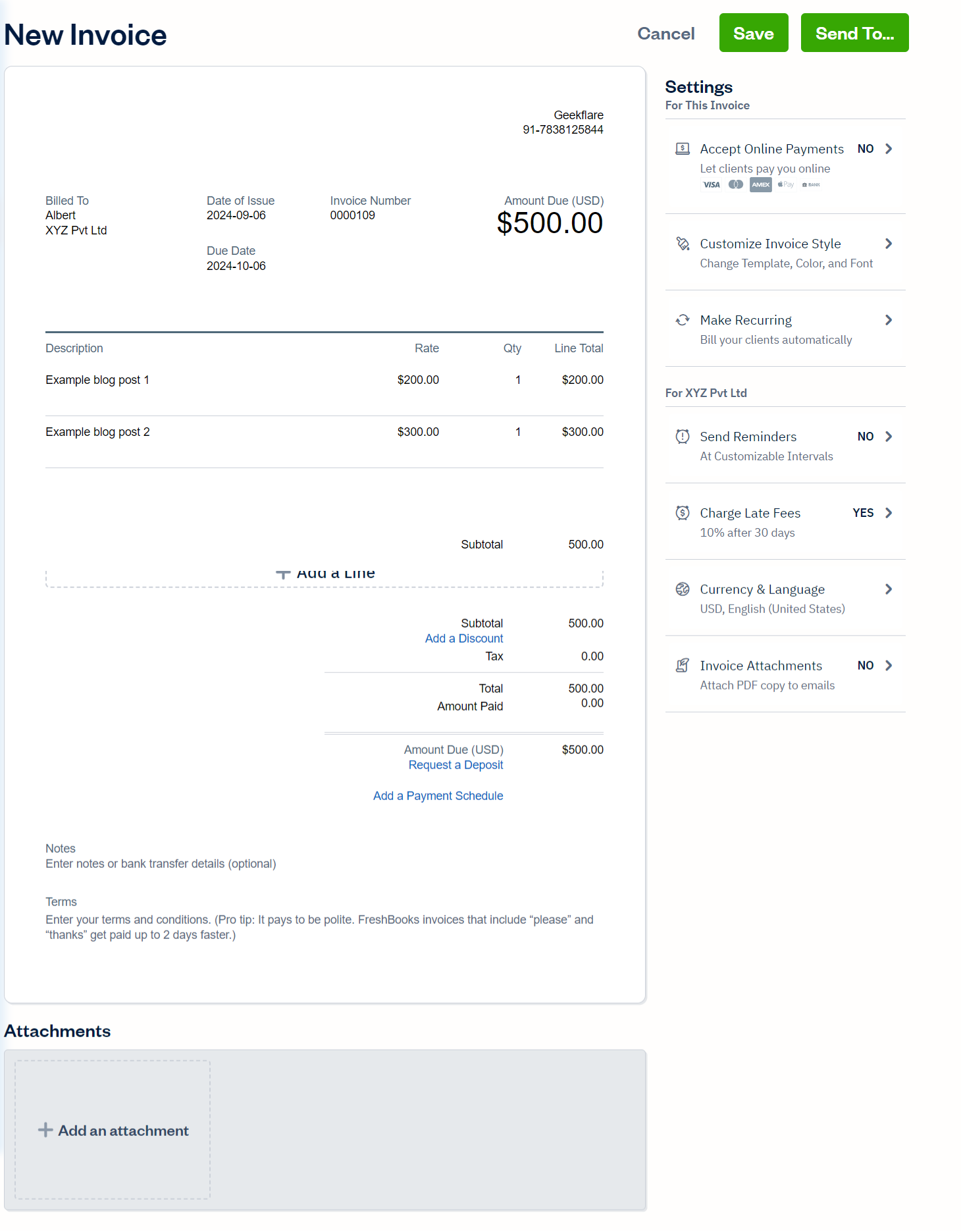

Invoicing

FreshBooks has a simple invoicing style that allows users to send and receive invoices on the go. The dashboard gives users all the information about invoices and payments.

You can view the overdue amount, the total outstanding, and the invoices in the draft. One thing to appreciate about FreshBooks is its ability to customize the invoices and add new columns accordingly.

You can add new columns or remove the existing ones. I use the following invoice format for most clients.

FreshBooks offers three invoicing templates: Simple, Modern, and Classic. You can also customize the color and fonts and add a logo to reflect your brand through invoice.

FreshBooks also allows you to set up recurring invoices and accept online payments through credit cards. Moreover, it offers multi-currency invoicing, allowing you to send invoices in your local currency.

Once you’ve sent the invoice, you can set up automatic email reminders to ensure you’re paid on time. FreshBooks allows you to share invoices through the link or email.

Payments

FreshBooks tracks all your payments through the payment dashboard. Whether you’re being paid through the invoice or a payment link, FreshBooks keeps a separate record for each income.

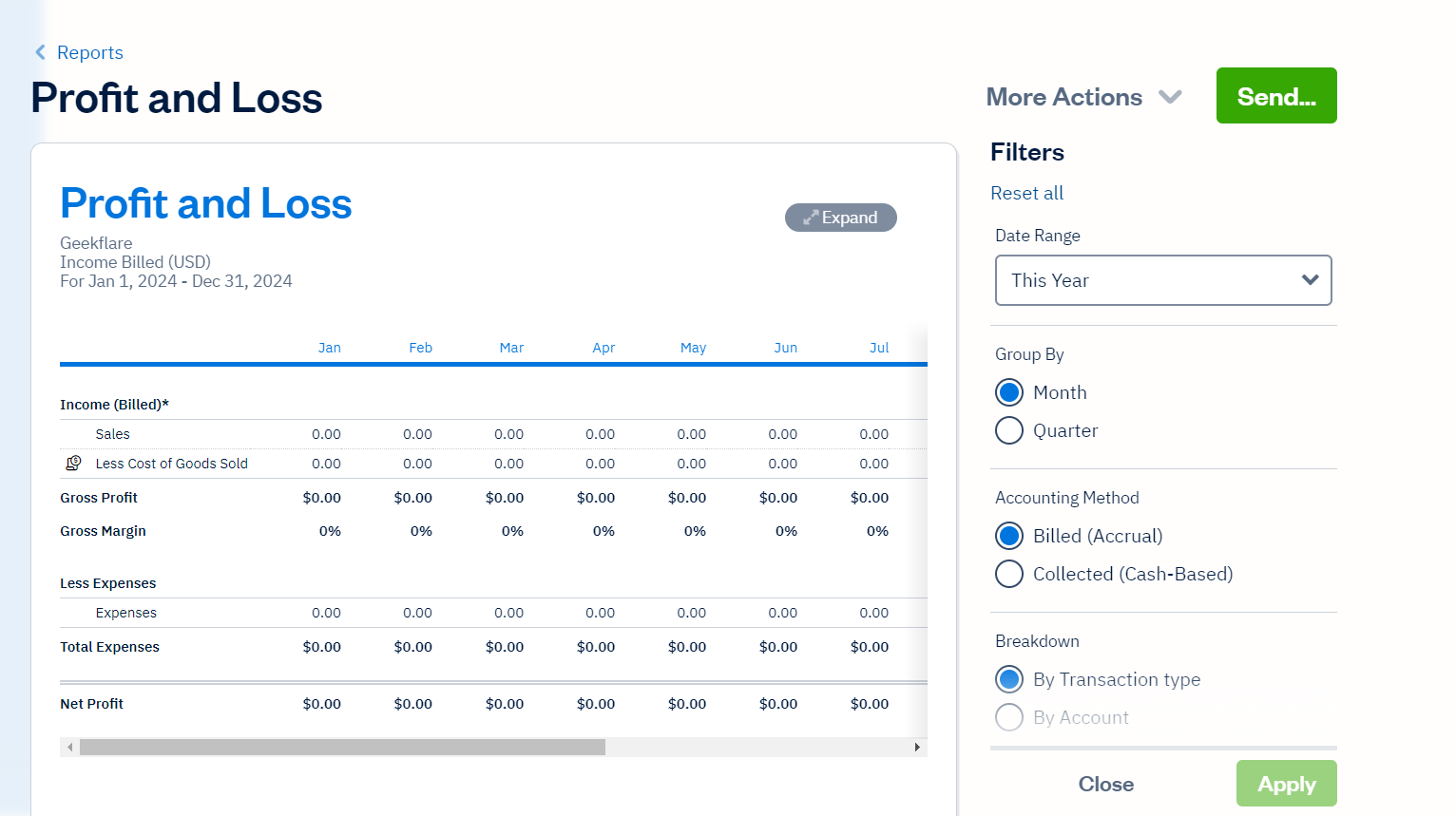

At the end of the payment cycle, you can use a comprehensive Profit/Loss report to keep your finances at bay.

Additionally, FreshBooks allows you to set up checkout payment links through Stripe and PayPal. These links can be used on websites, shared on social media channels, or sent via email.

These methods charge a standard fee of 2.9% + $0.30 per transaction for most cards and 1% for direct bank ACH transfers.

As an add-on, the Advance Payments feature lets you accept credit card payments from the phone. This feature costs $20 monthly for the three cheapest plans and is included in the Select plan.

Upon payment, FreshBooks sends an automatic receipt to customers and merchants.

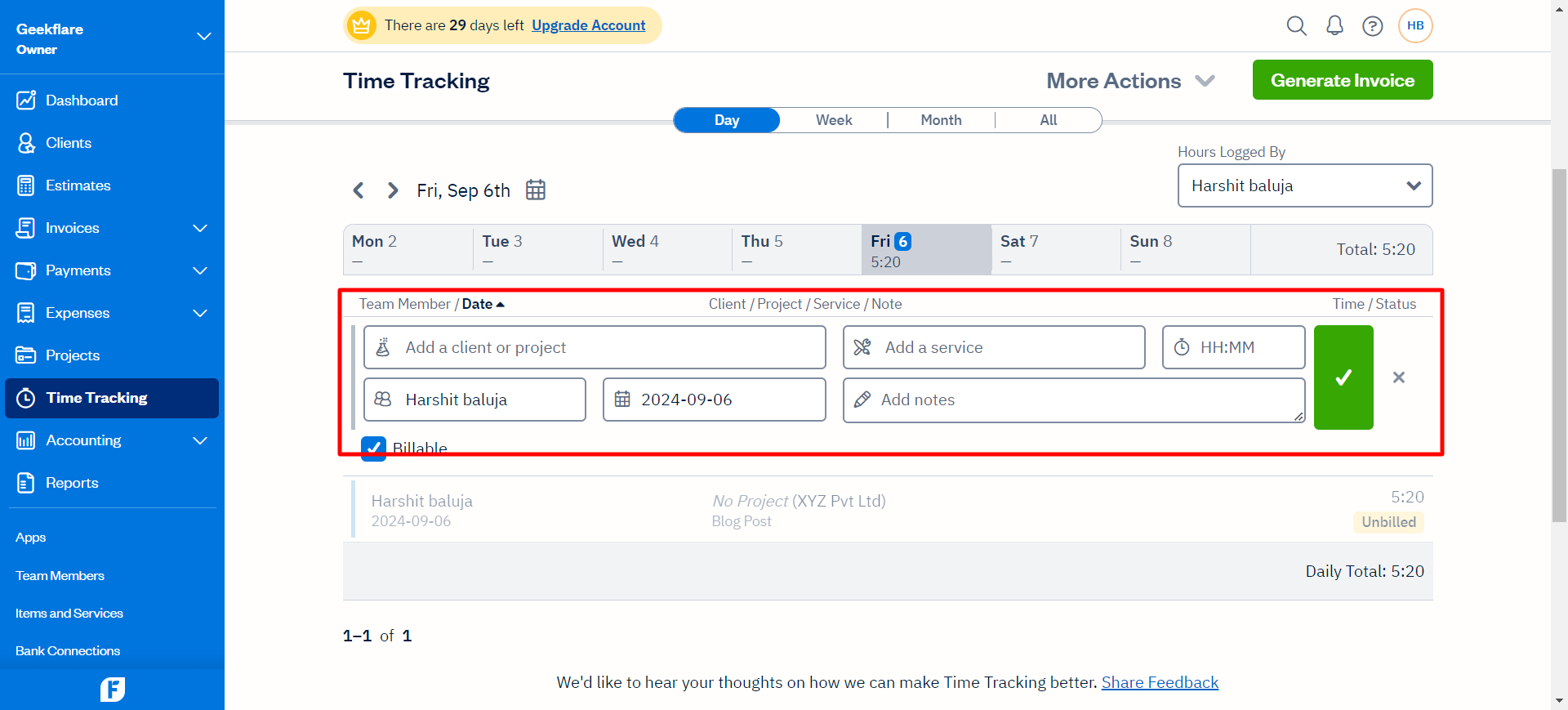

Time Tracking

FreshBooks’ time-tracking feature is most suitable for freelancers and contractors who are paid hourly. I found this time tracker intuitive and easy to set up, and it converts billable hours into invoices.

All you have to do is add the client’s name, date, and time and set off the timer to start with your working hours. Once you’ve completed the project, navigate to Expenses and create an invoice based on the hourly rate multiplied by the working hours.

If you are in the fieldwork, you can use this feature to record your working time and convert the timesheet into an invoice. You can also choose to create invoices for weekly or monthly hours.

Users can assign a task to a team member and use the timer. Even if your team has different departments, you can create different time trackers for each of these teams. I liked this in-build time feature instead of relying on third-party timers.

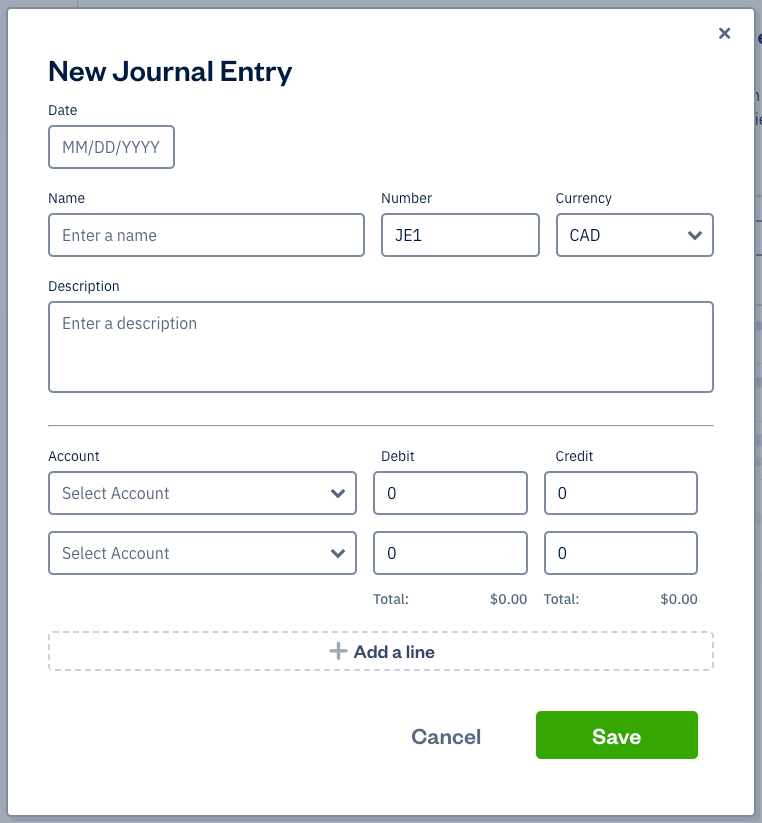

Accounting

Accounting is FreshBooks’s most intriguing feature, as it covers all the basic accounting needs of businesses, even freelancers. The platform stands out for its easy-to-use double accounting feature that lets businesses keep track of their income and expenses without needing bank statements.

Additionally, FreshBooks allows you to connect with the bank of your choice and supports over 14,000 financial institutions. I even liked the journal entry interface, which transparently records credited and debited accounts. The higher tier plan offers an option to invite your accountant and work with them to maintain the journal entries.

Once you connect your bank accounts to their accounting system, FreshBooks automatically updates the books and keeps a detailed record of statements. For businesses with high-volume transactions, FreshBooks has a bank reconciliation feature that matches the transactions within the bank accounts and detects any discrepancies.

Here, the bank reconciliation summary compares your bank account with FreshBooks balance to find mismatches. The good part is that it can export and customize these reconciliation reports using the filters.

If you’ve just started, FreshBooks also offers a range of templates, such as reconciliation, P/L, general ledger, and more, which, I think, is better than the Excel sheet.

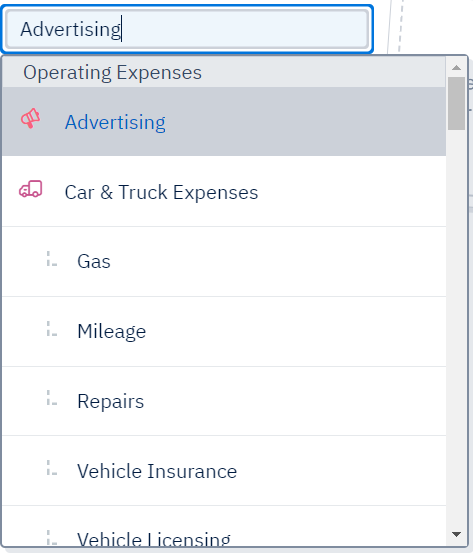

Expenses & Receipts

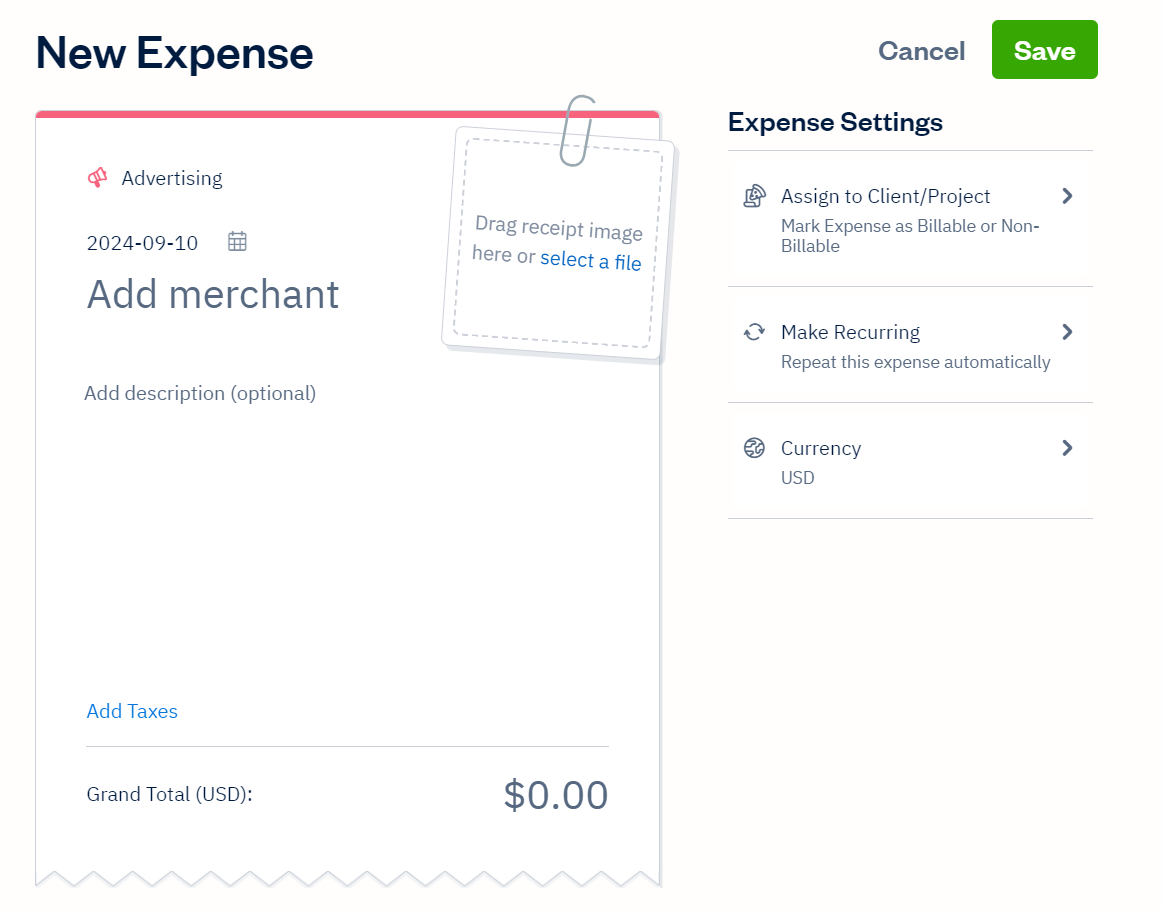

Expense tracking allows users to keep track of their invoices, receipts, and spending. Instead of manually entering the invoices and expenses, FreshBooks fetches them automatically from your bank account.

You can also scan or upload the pictures of receipts to enter them into your expense tracking. FreshBooks also stands out for its ability to categorize expenses so that you have all the information during the tax period.

After selecting the category, you can add the merchant, expense amount, and any description. It allows you to create recurring expense receipts and mark them as billable or non-billable.

Even the Lite plan offers unlimited expense tracking, so you’ll be ready to start immediately after integrating your bank.

FreshBooks offers a robust vendor management feature that allows you to track invoices and manage expenses on the go. You can add multiple vendors and track each of their expenses individually.

Financial Reports

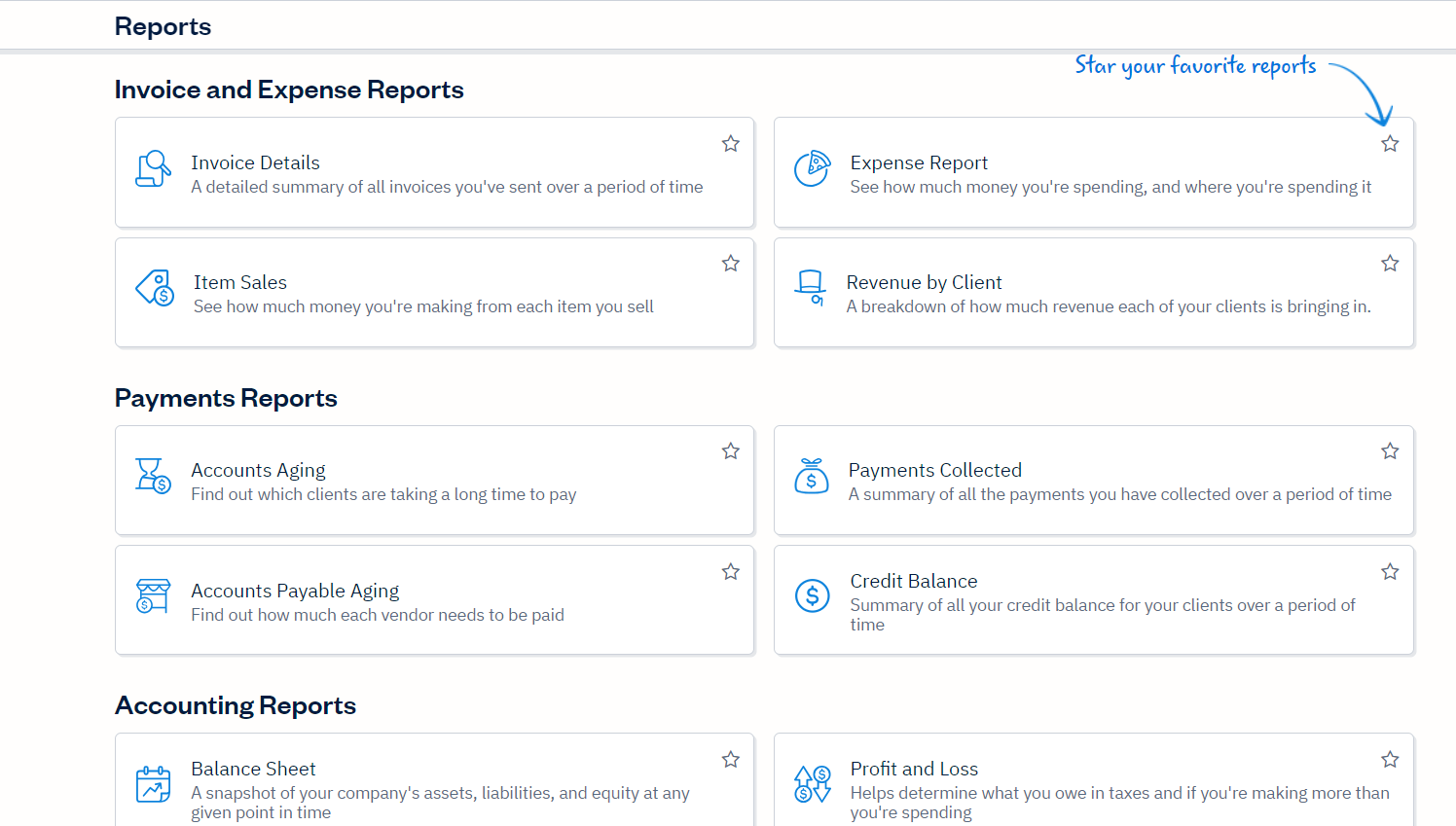

FreshBooks offers numerous financial reports for businesses, individual users, or even agencies. It tracks various accounting aspects in automation and gives a clear picture.

These reports can be exported into various formats and are stored in your dashboard.

Once you click on the Reports tab, you’ll have options to choose from a vast array of reports, such as:

- Invoice and Expense Reports

- Account aging

- Bank reconciliation summary

- General ledger

- Profit Loss Reports

- Cash Flow

- Audit logs

- Time entry details

- Time tracking and more.

To simplify the process, you can set a start and an end date to create reports for the fiscal year. This helps track expenses and budgets year by year.

These reports can be emailed to clients, stakeholders, or anyone outside of your organization.

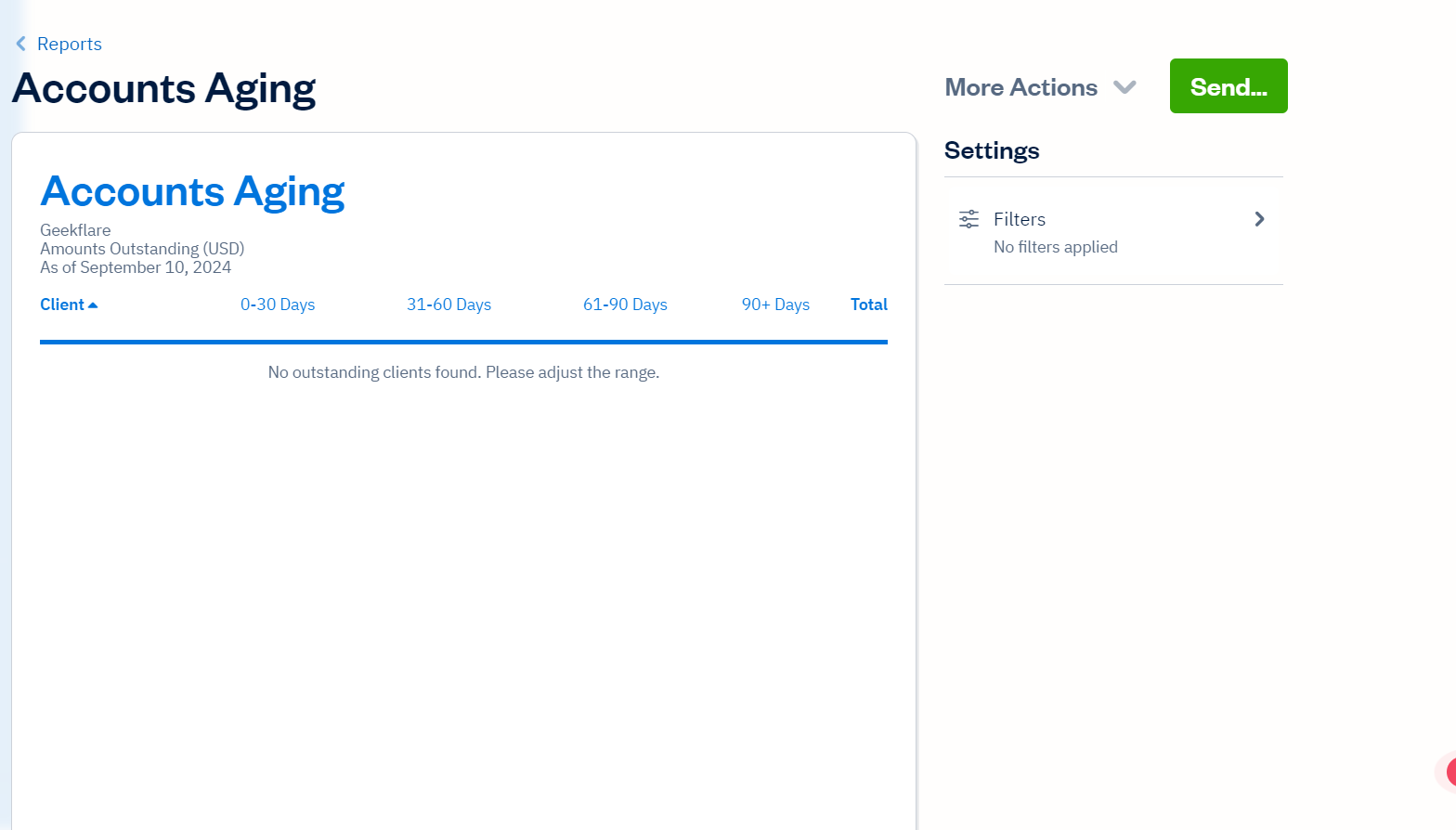

For instance, the account aging report gives a total outstanding amount and tracks your finances over a period of time. The report keeps track of finances for a range of days, say, 0-30 days, 31-60 days, 61-90 days, and so on.

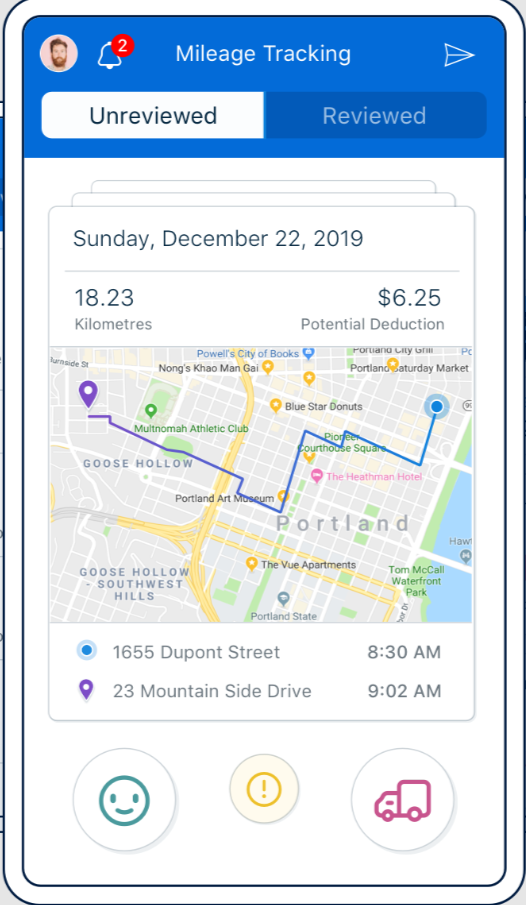

Mileage Tracking App

Mileage tracking is a hidden gem if you want to calculate tax deductions through your professional trips. Through its mobile app, FreshBooks offers mileage tracking for people who drive for work because it automatically records your mileage as you drive.

The mileage tracker labels each trip as business or personal and calculates the tax deductions you could claim for each. These tax deductions get added to your expenses or accounting systems automatically.

Unlike other accounting software, mileage tracking is included with all paid plans for Android and iOS apps.

Bookkeeping

FreshBooks, in collaboration with Bench Accounting, offers a seamless bookkeeping solution to facilitate financial transactions, credits, and debits. Though bookkeeping only provides an overview of individual transactions, its accounting software gives a detailed analysis of financial records.

Bench provides year-round bookkeeping, unlimited tax advisory support, and the ability to track payments. Plus, you can invite a dedicated bookkeeper from your team so that you don’t need to create an accounting system of your own.

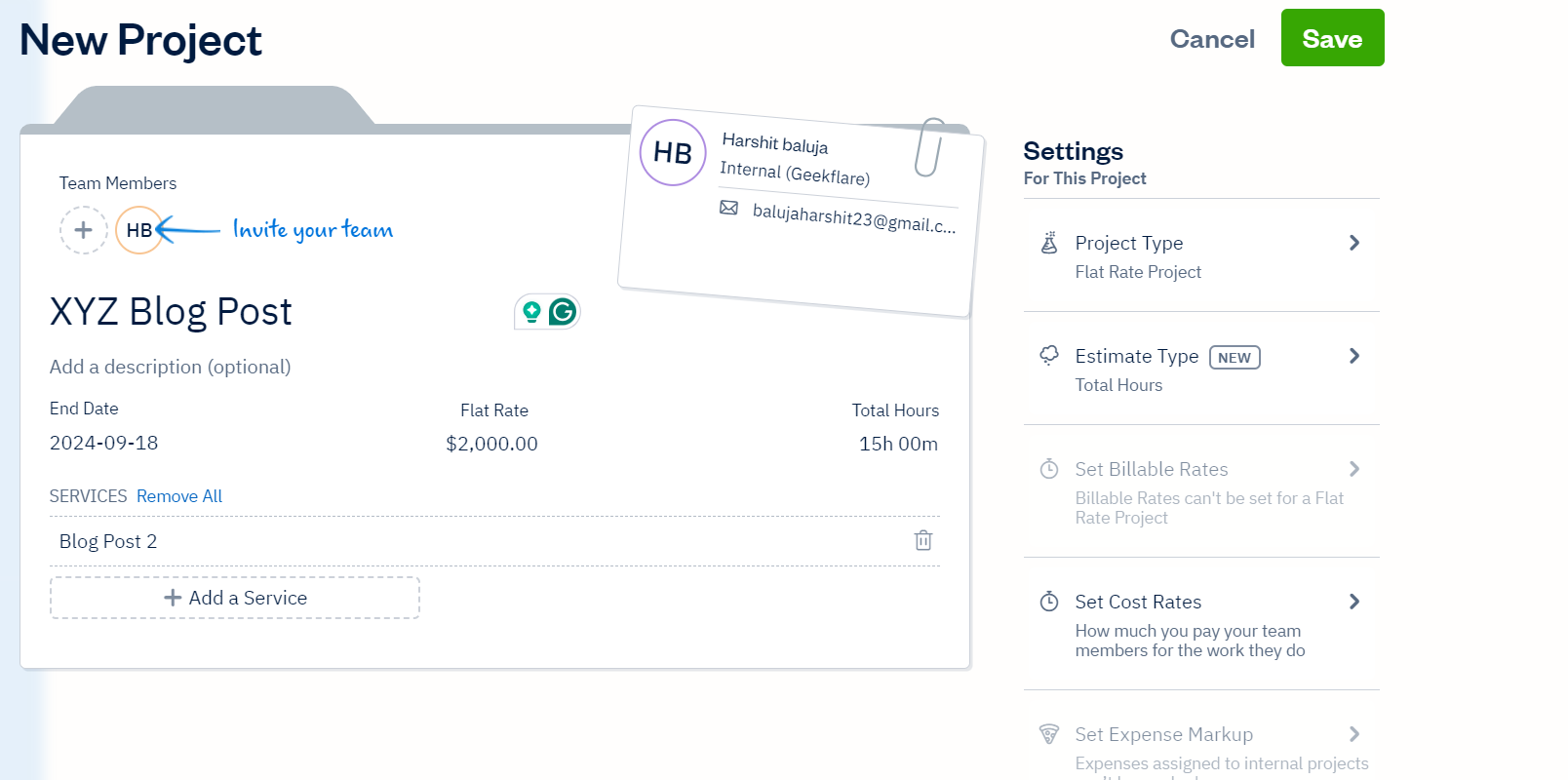

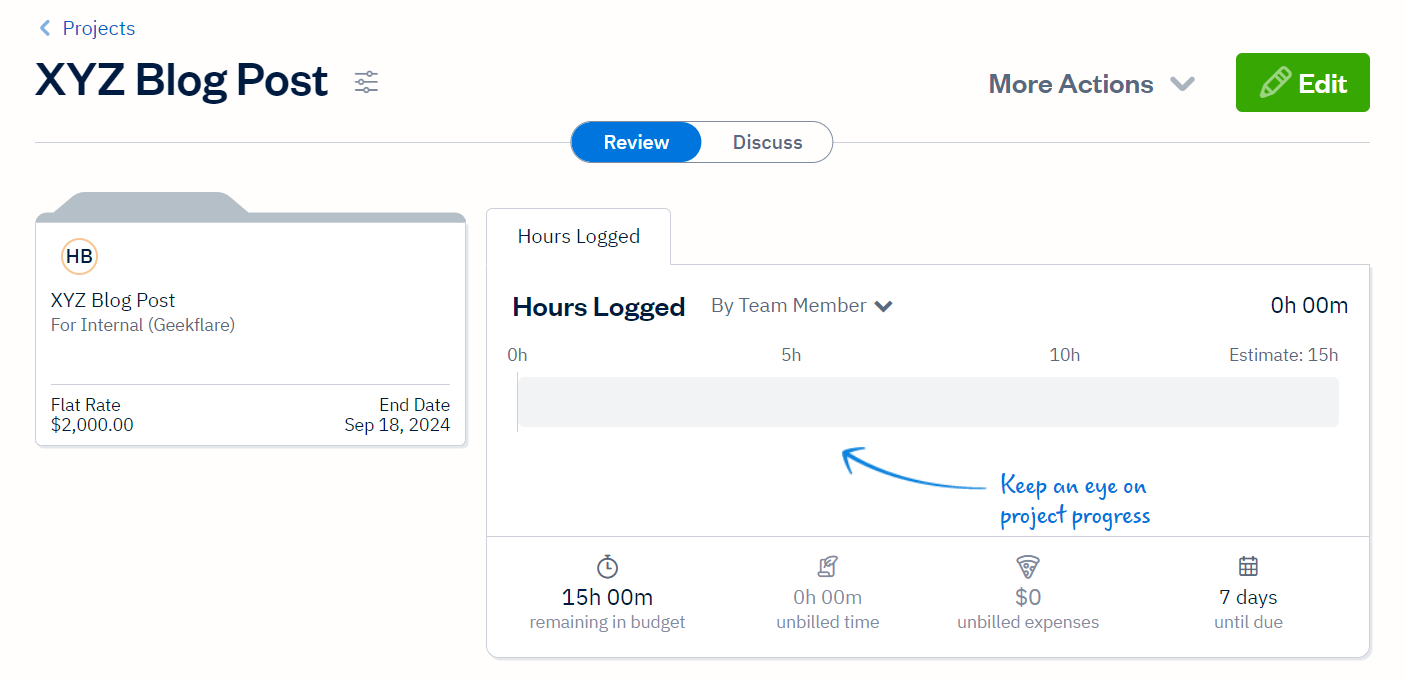

Project Collaboration

FreshBooks is moderately good at project management. Before creating a project, the platform allows you to choose between an hourly rate and a flat price. You can invite your team members, add stakeholders or clients to the existing project, and keep them on the same page.

I like this feature for its simplicity and ability to create projects quickly. Enter the project details, such as the client name, end date, pricing, and time period. You can also set cost rates in advance to maintain transparency.

Like other project management and collaboration tools, admins can limit the accessibility and permissions. FreshBooks offers a range of features for seamless collaboration. These include:

- Project status overview

- Task deadline dates assigning

- Client rate/hour assigning

- File sharing

- Live chat

After creating the project, you can run a time tracker to estimate its cost and create invoices accordingly.

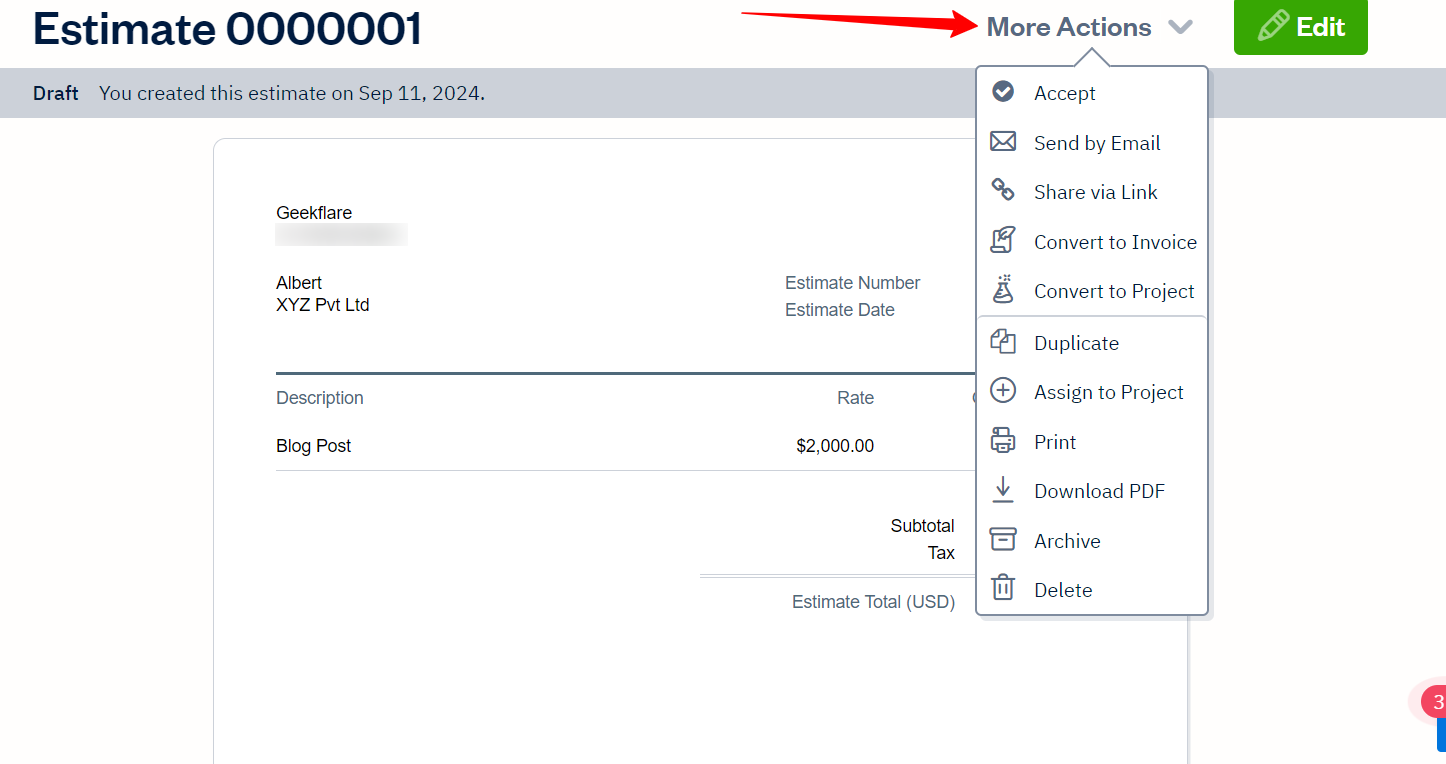

Estimates

Estimates are a good starting point for creating an outline of the items or services to send to the clients for approval. FreshBooks lets you create a project estimate with an outline of all the services and an estimated cost.

You can customize the estimate style or choose from a range of templates. These estimates can be shared directly with the clients so that you don’t need to switch to email for approval. FreshBooks saves time by creating a smoother workflow and connecting all the features.

For instance, the estimate can be converted into an invoice or added as a new or an existing project.

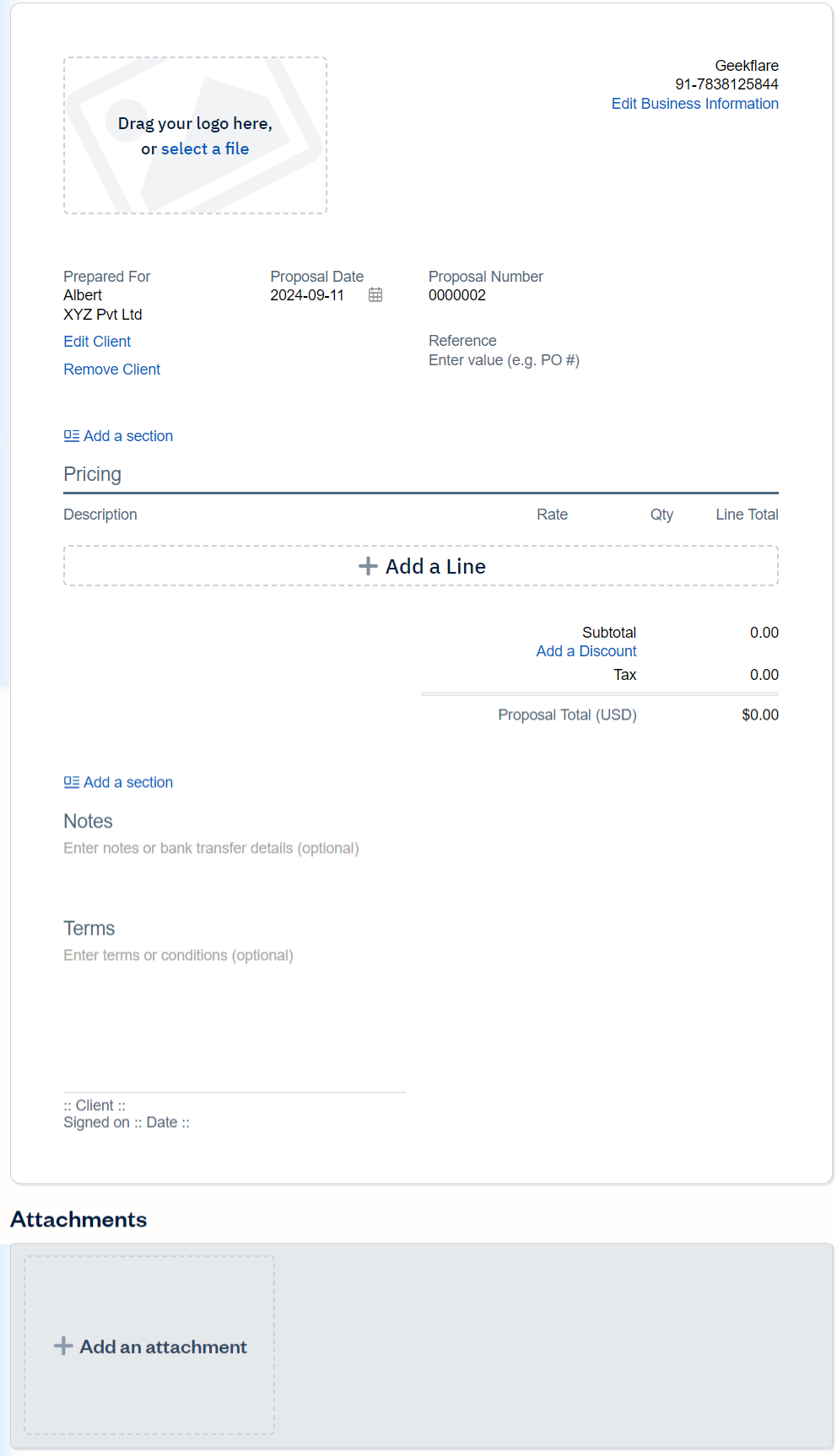

Proposals

While the estimate is non-binding and serves as a guideline, proposals are usually more detailed and give a more accurate picture of the final pricing. A project proposal is a written document outlining details such as the timeline, budget, objectives, and goals for external stakeholders, clients, and project managers.

FreshBooks has a proposal template similar to the estimates. Users can create a brandable proposal and list their items. The template allows users to share the proposals with clients and get their electronic signatures right away.

However, it lacks specific fields such as goals, timelines, and objectives. In my opinion, this template might not be suitable for high-ticket clients and only serves the needs of freelancers or solopreneurs.

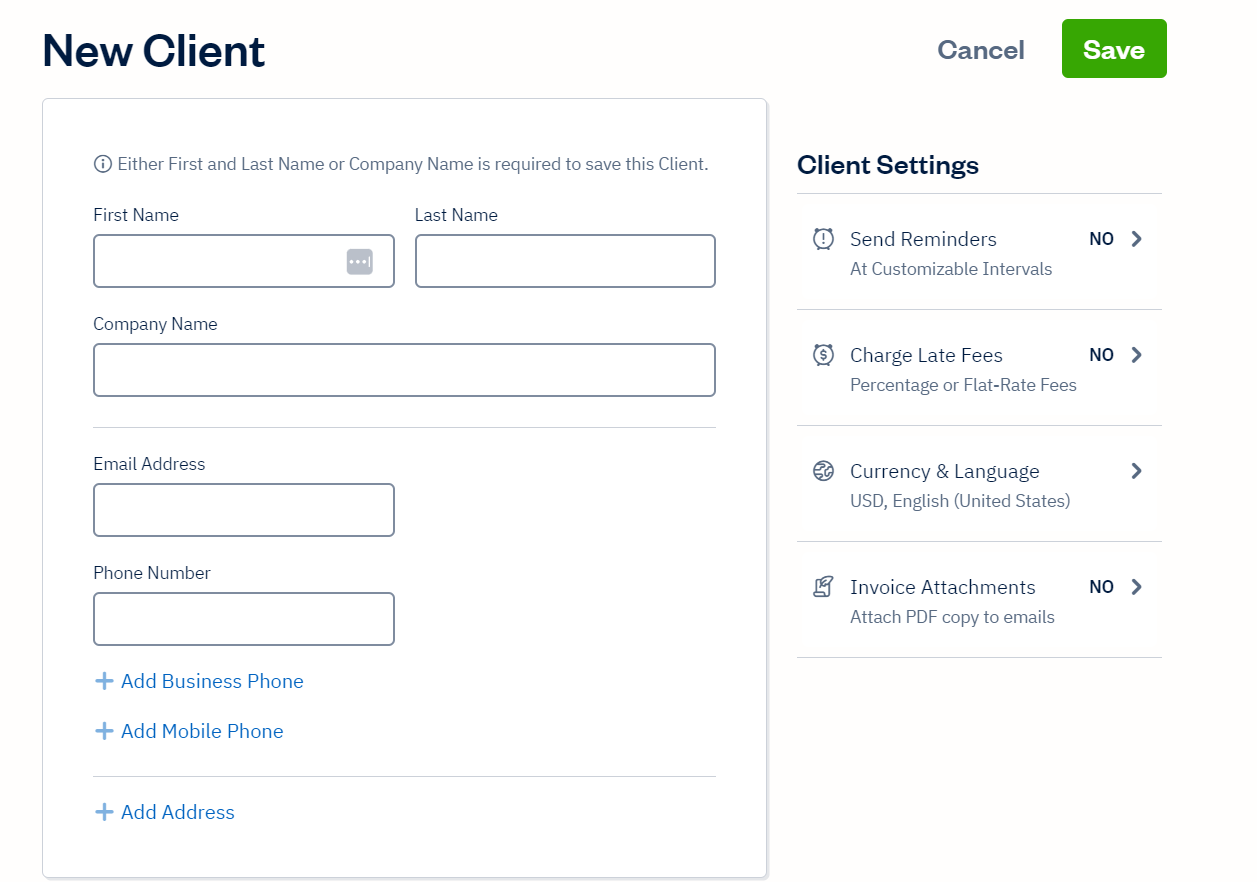

Clients

FreshBooks is a repository for all your clients in a single place. It offers a cost-effective client management solution for small businesses that creates robust workflows, from client onboarding to ongoing projects and final invoicing.

The client creation process is quick and smooth. You must fill out fields such as the client’s name, company, email address, or business phone number. If you have various clients to import at once, upload a CSV file containing the client’s first name, last name, and company name.

The client dashboard also gives insights into the total outstanding amount, overdue amount, or pending transactions.

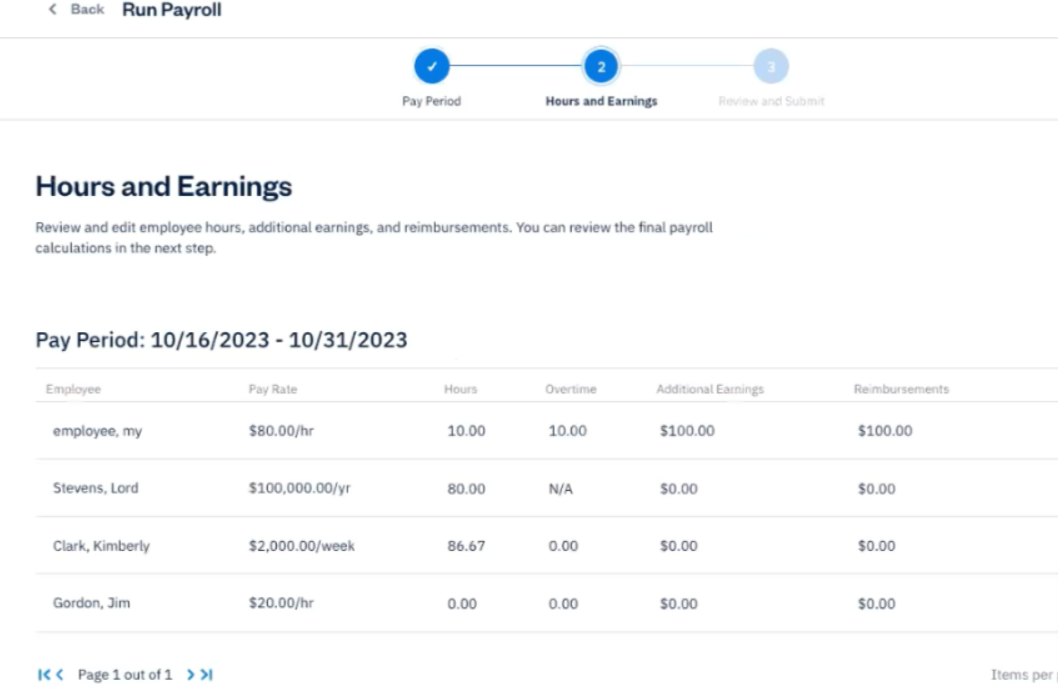

Payroll

Payroll management isn’t an in-built feature of FreshBooks. Powered by Gusto, this payroll solution keeps unlimited payrolls and automated tax calculations and filings, all within minutes.

Here’s how the Payroll dashboard looks:

However, getting free payroll software may require you to get Gusto’s approval, which may take around sixty days. The platform provides a long payroll history and detailed insights into payroll expenses.

Additionally, it improves compliance and helps calculate tax deductions by implementing state and federal tax laws of your choice. After the first free month, the payroll management software costs $40, with an additional $6 per person per month.

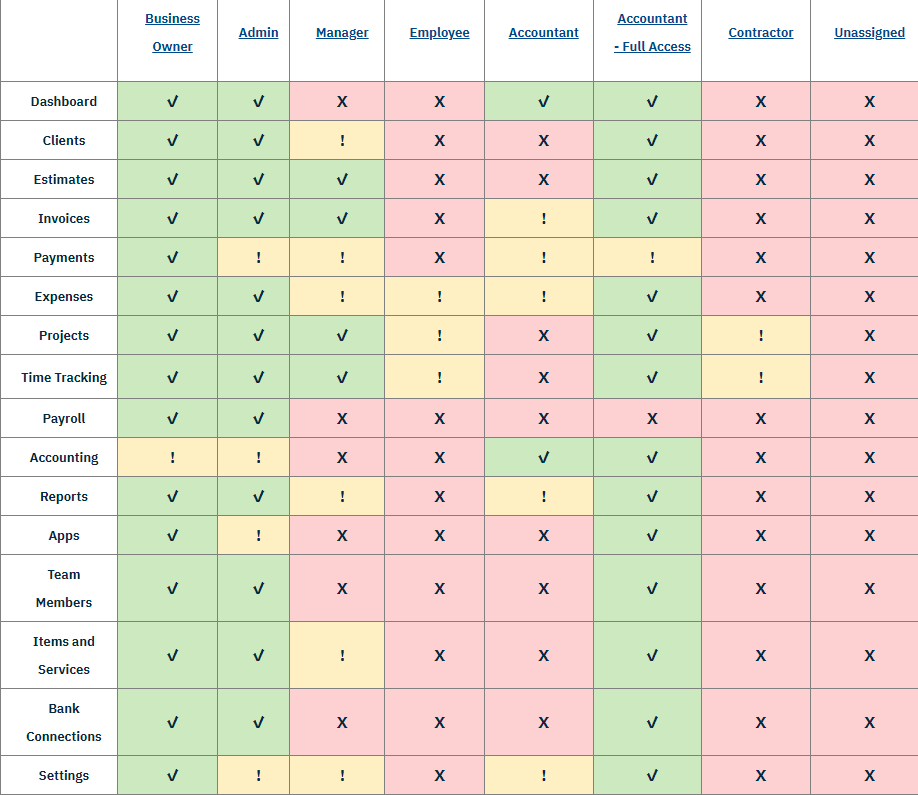

Team Management

Besides the accounting accolades, FreshBooks has an intuitive team management feature that lets you add your team members and assign them roles and permissions accordingly. This comes as an add-on, which costs $11 per user per month. Using the team management profile, you can streamline payrolls and generate invoices.

Here’s what FreshBooks offers to different users:

What are the Benefits of FreshBooks?

FreshBooks offers several benefits to businesses, freelancers, and accountants, and its unique features aren’t limited to accounting.

Here are some of the significant benefits of FreshBooks accounting software:

- Customizable invoices: FreshBooks lets you create professional invoices by offering customization in texts and fonts and the ability to add brandable logos. You can also set up recurring invoices and add late charges if the invoice has passed the due date.

- Payment links: You can’t send invoices to everyone. Say you’re organizing a paid webinar. Instead of invoices, you can create customizable payment links on your website, blog, or social media. Payment links enable customers to pay through credit cards or bank transfers.

- Payment reminders: FreshBooks sends automatic payment reminders to the clients before or after the due date has passed. It lets you customize the reminders and send them as an email message.

- Bank reconciliation: Bank reconciliation allows you to match bank transactions to FreshBooks entries in your account. This helps detect discrepancies in cash entries. You can assign categories and approve matching suggestions to make sure entries align with your business.

- Financial reporting: One of FreshBooks’ unique offerings is its vast array of reporting. The platform offers a range of reports, such as P/L reports, general ledger reports, reconciliation, expense tracking, taxation reports, and more.

- Accepts international currencies: If you have an international business and clients worldwide, FreshBooks makes it easier to accept payments. Powered by PayPal and Stripe, FreshBooks accepts payments in over 200 currencies, making it convenient for you to get paid.

- Tax filing: With reports such as Profit/Loss reports, expense reports, and account aging, FreshBooks offers a single place for tax filing. You can collaborate and invite your accountant to calculate tax deductions.

FreshBooks Pricing

FreshBooks offers three pricing plans, with a monthly or yearly subscription. An annual plan provides a 10% savings. Also, they are providing a limited-period offer of 70% off for 4 months. Before you decide on the best plan for your needs, you can take advantage of the free 30-day trial to see how its features work.

| Plan | Pricing | Offerings |

|---|---|---|

| Lite | $6.30/month | – Send unlimited invoices to up to 5 clients – Track unlimited expenses – Send unlimited estimates – Get paid with credit cards and bank transfers (ACH) – Run reports for an easy tax time |

| Plus | $11.40/month | Everything in Lite plan plus: – Send unlimited invoices to up to 50 clients – Set up recurring invoices and client retainers – Send unlimited estimates and proposals – Get paid with credit cards and bank transfers (ACH) – Automatically capture receipt data – Invite your accountant – Run financial and accounting report |

| Premium | $19.50/month | Everything in Plus plan and: – Send unlimited invoices to an unlimited number of clients – Set up recurring invoices and client retainers – Send unlimited estimates and proposals – Get paid with credit cards and bank transfers (ACH) – Automatically capture bills and receipt data – Invite your accountant – Track project profitability -Customize email templates with dynamic fields |

FreshBooks also offers some add-ons, which come at an additional cost. Here are the add-ons that you can get along with your paid plans:

- Team Members ($11/user/month)

- Advanced Payments ($20/month)

- FreshBooks Payroll (talk to a Specialist)

FreshBooks recommends the best plan for your business needs. For instance, the Lite and Plus plans are considered best for freelancers, and the Plus and Premium plans are the best options for self-employed professionals.

If you do business with contractors, choose from any of the three high-tier pricing options. Premium and Select plans are considered the best choice for businesses with employees.

Is FreshBooks Invoice Free?

Yes. FreshBooks invoice generator is free to use. The software offers a range of customizable invoice templates across various industries, such as legal, business, marketing, medical, and automobile. These templates are available in various formats, including Excel, Docs template, PDF, Word invoice template, and Google Sheets template.

FreshBooks Customer Support

FreshBooks offers various support channels, including phone, email forms, and chatbots. For the Select plan users, the company provides dedicated customer support with full onboarding and training.

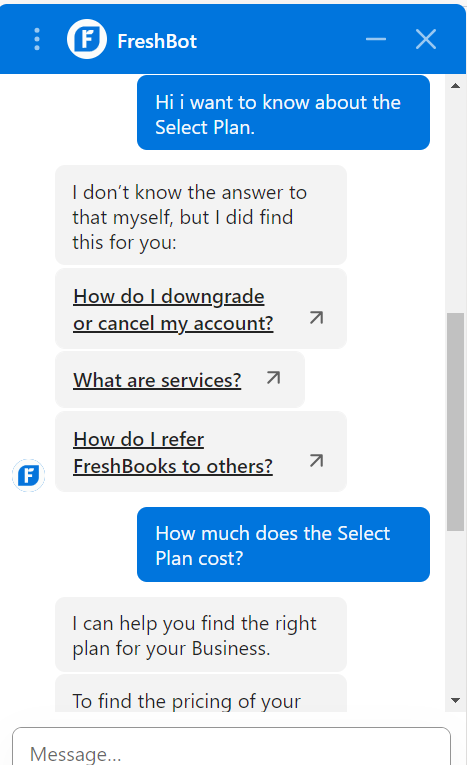

FreshBooks’ live chat agent, FreshBot, was quick and replied to my queries within seconds. However, the bot’s response isn’t as good as the human response, but it does give you a link to the resources or knowledge bases.

For instance, I asked about upgrading to the Select plan and its pricing. Here’s what FreshBot responded:

In my opinion, FreshBooks does a decent job with its support team through phone and email responses. However, their live chat needs a more human touch.

FreshBooks Integrations

FreshBooks is primarily known as accounting software, but it offers various features to improve cash flow, business budgets, and tax filing.

FreshBooks offers integration with over 150 third-party tools to streamline your accounting process. These tools include data analysis, appointment booking software, finance management, project management, time tracker, tax preparation, and more.

Does FreshBooks Have Mobile Apps?

Yes, FreshBooks has mobile apps for iOS and Android devices. These apps let you manage your invoices, track expenses, and check your finances while on the go, making it easy to handle your business from your phone or tablet.

What is the difference between FreshBooks and QuickBooks?

The major difference between FreshBooks vs QuickBooks is its user base. FreshBooks is ideal for freelancers, self-employed, and small businesses that need invoicing, time tracking, and basic accounting features. On the other hand, QuickBooks is best suited for small to medium businesses that need bookkeeping automation, payroll, invoicing, and bill management.

Who Should Use FreshBooks?

FreshBooks is best suited for freelancers, self-employed, and small businesses with fewer employees. It works best for businesses that require basic accounting features. With its range of templates and downloadable formats, FreshBooks caters to a wide range of industries, such as:

- Marketing & Agencies

- Construction & Trades

- Consulting

- IT & Technology

- Legal

- Business & Prof. Services

Who Shouldn’t Use FreshBooks?

FreshBooks is not for medium to large businesses with many employees and contractors that need advanced features like inventory management, integrated payroll, and advanced financial reporting.

FreshBooks Verdict

With its extensive range of features, FreshBooks is one of the best accounting software for small businesses and freelancers. From invoicing to expense tracking, bookkeeping to payroll, it offers everything under one roof.

It’d be great to start with a free trial and give it a shot. I even found FreshBooks more affordable than most accounting software like Zoho, QuickBooks, and Xero, considering their basic plan offerings.

FreshBooks receives the Geekflare Value Award for its robust features that don’t feel overwhelming. Most importantly, FreshBooks is fairly easy to use and perfectly suitable for fresh businesses, freelancers, and consultants.

More Readings on Accounting

-

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.