Global Payment APIs that are secure and fast are integral for enhanced customer experience, especially in e-commerce.

In this era, starting an online store has become so easy that more self-fashioned entrepreneurs are entering the market to capture a massive share.

Suppose you’re one such aspiring e-commerce store owner. In that case, you have your plate full of some of the most critical business and financial decisions you would have to make, including choosing a global payment API to accept payments from anywhere on Earth.

With the payment gateway market also projected to expand and reach a whopping $106.4 billion, you’re spoiled for choices when it comes to the APIs. Which global payment gateway is perfect for your eCommerce site? In this post, I discuss some of the best Global Payment APIs that allow you to accept payments internationally.

Why You Need Global Payments API

If you own an eCommerce site, however big or small, you need a streamlined online payment solution that makes it easier to receive payments from anyone, anywhere in the world. Global Payments API is your ticket🎫.

Here is why you need it to boost your business globally.

#1. Expanding Your Reach 🌏

The prime benefit of having a global payments API is that you can receive payments from anywhere worldwide, expanding your customer base beyond borders. You can support payments from countries across the globe where you wish to ship your products and enjoy a diverse audience, increased sales, and more revenue opportunities.

#2. Multi-currency Support 💵

Your customers hate converting dollars to their currency as much as you do! If you’re shipping to several countries, you must display your products in their native currency as they surf through your eCommerce website. This will improve your customer’s user experience, making them more likely to get stuff from your online store.

A Global Payments API allows people to pay in their preferred currency, reducing friction in the buying process.

#3. Diverse Payment Methods 🏦

Credit cards, debit cards, digital wallets, bank transfers, local payment methods, yada yada yada. We have been exposed to endless payment methods now, catering to the needs of every kind of buyer. Naturally, your customer would expect you to offer several payment options, too, which can be done using a global payments API. The more options, the more the business!

#4. Reduces Cart Abandonment Rates 🛒

I have lost count of how many things I was close to buying something but didn’t finish the purchase because the e-commerce site was testing my patience with its complex payment gateway. Complex payment procedures can result in cart abandonment.

Imagine all the money you’re setting yourself up to lose because your payment system is not streamlined. Global Payments API takes care of that. It boasts an easy and user-friendly checkout experience.

Global Payment API also helps in compliance and security, global expansion, and customization, among other things. The bottom line is that if you’re running an eCommerce store, it makes sense to invest in a good Global Payment API to streamline your payment processes.

If you’re struggling to find a suitable payment gateway for your business, the next section discusses some of the best ones. Let’s see if we can find a perfect match for you!

Stripe

Since they have offices in countries worldwide, moving money using their integrated network is as easy as moving data. This is what they market, and having used it myself, I can vouch for their promises.

The one thing I love the most about the platform is its integrated suite of payment products, which empowers online retailers, subscription businesses, software platforms, and digital marketplaces.

Regardless of the nature of your business, you’d find the interface and features of Stripe right up your alley, as it has finished its offerings over the years and actively continues to do so. The payment options are endless, too, from credit cards, pay later options, international cars, and 135+ currencies available.

Stripe caters to the needs of businesses of all sizes, from startups to multinational companies. It also uses machine learning to reduce fraud and maximize conversions and profits. If you want to associate with the hotshot of the industry, Stripe’s your guy.

Square

If you’re looking for an easy-to-use payment processing platform, Square is a great option. It’s more popular because of its customization options, as it lets you build your own payment form from scratch with Square Web Payments SDK.

The software integration capabilities are massive, as you can seamlessly use the API with Acuity Scheduling, GoDaddy Websites, Marketing, Wix, Jot Form, WooCommerce, etc.

Moreover, no additional fees are charged for international credit cards, giving much relief to your customers. Some of the prominent APIs, like Stripe, have some charges involved, and this is where

GlobalPay

The API of GlobalPay supports a range of payment methods, including credit card payments and popular digital wallets. Additionally, it integrates with local and regional payment options, allowing businesses to accommodate customers’ payment preferences worldwide.

Integrating GlobalPay into your eCommerce platform or website is generally straightforward. You don’t have to deal with the nitty-gritty of a complex process, as it is well-documented, and developers can access the necessary resources to streamline the integration process. You’d love it for its ease of use, competitive pricing, and integration capabilities.

Toast

Toast’s API is uniquely designed for restaurant owners, hence the name. If you own a restaurant and offer your delicacies online, you can use the specialized payments API to seamlessly accept payments, enhancing user experience while getting your money on swiftly. The interface of the API is quite simple and user-friendly.

The rates are generated based on you and your business’s unique needs, so you get the worth of your money. Moreover, their prices are pretty competitive, so if you want to be frugal with your cash, you can try Toast.

The platform offers various other facilities to restaurant owners, apart from accepting payments, becoming the one-stop solution. From reservation, gamification, engagement, technology, payment, and delivery solutions, Toast partners with all the platforms that can make your restaurateur a breeze.

Shopify

Shopify is an all-inclusive and comprehensive platform that helps businesses set up and manage their online stores by providing a host of tools. One of their offerings includes Shopify Global Payments API, a powerful solution designed to facilitate seamless payment processing for eCommerce businesses around the world.

So, while it’s not a dedicated API like Square or Stripe, it’s still a fantastic option to consider, especially if you’re also looking for supplementary tools to manage your eCommerce website. It has a massively global reach, with merchants able to sell in multiple currencies with Shopify Payments while supporting multiple languages.

Customers can select their preferred currency and language, and the platform would switch to their preferences, leading to the best possible user experience. While several other APIs offer the currency advantage, few offer the language advantage, which sets Shopify apart.

Moreover,

PayPal

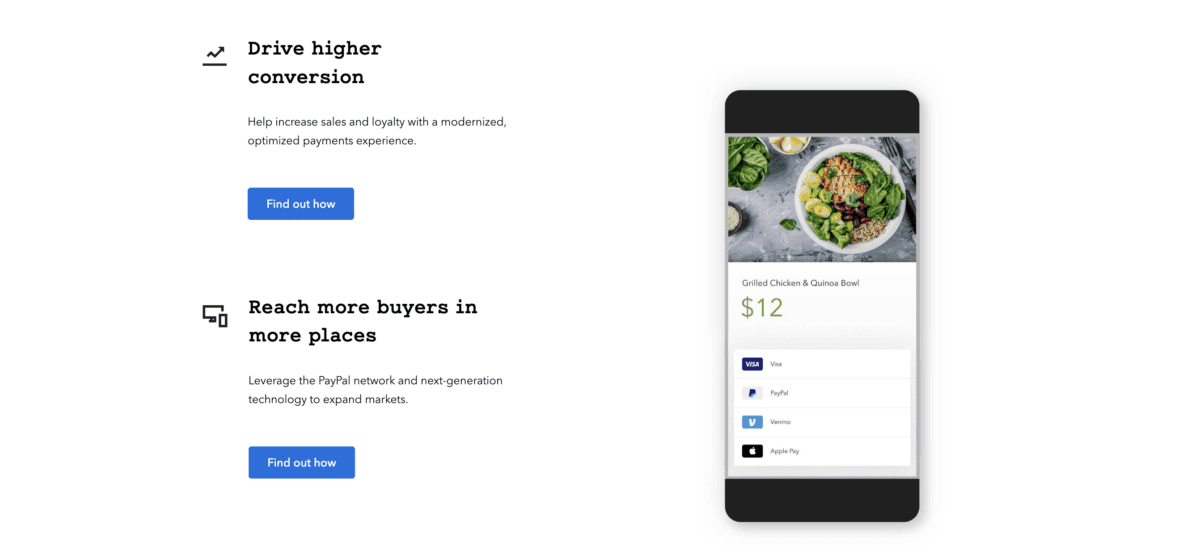

If there’s any name in the payments domain that needs no introduction, it’s PayPal. It’s one of the oldest APIs that provide a full range of payment services.

Using PayPal, you can accept international payments, make payments, manage risk, accelerate growth, and streamline your business operations, regardless of which industry you’re operating in or the scale of your business.

One of the offerings that gives PayPal an edge in the market is its Pay in 3 feature. It’s an interest-free loan that splits the user’s basket into 3 payments.

It also comes with a mobile app, which makes it even easier to make payments, so your customers always have an easy way of sending money your way during the checkout.

In addition, if you provide subscription-based products or services, PayPal can help you set up a robust mechanism and generate a regular revenue stream. It can also help you create professional and customizable invoices.

The platform caters to the needs of small or medium-sized e-commerce platforms, businesses, marketplaces, developers, or enterprises.

Check out some of the PayPal alternatives.

Global Payments

Global Payments processes over 1.2 billion payments each year. Moreover, its merchant roster includes the names of various merchants across 29 countries while supporting all the major debit and credit cards, including China’s UnionPay.

The diversified payment options, massive global reach, and a host of other e-commerce solutions and merchant account services make it worth considering if you’re looking for an API for your e-commerce website.

While Global Payments has been in the headlines quite a few times for freezing funds (as a result of their robust security measures), they are lauded for their quick payment processing, excellent customer service, and competitive pricing.

Cardholders can complete the payment on a laptop or phone while staying on the merchant page, improving the user experience manifold. This way, your customers would be less likely to abandon the cart🛒 since they can finish the payment seamlessly.

Tipalti

For flexible and tailored payment solutions, Tipalti is the go-to payment gateway. It’s pretty easy to integrate the API and get it running, so if you’re a business owner with little to no experience managing an eCommerce site’s payment processes, Tipalti is perfect for you.

The one thing that makes this payment gateway a powerful one is that it’s available for 196 countries and supports 120 currencies, with 6 payment methods, while boasting a multi-entity architecture.

The suite of services makes it easy for you to scale your business online. The 26,000 rules that Tipalti follows also protect the merchants from payment errors. This tool is a must-have for safe, secure, and compliant payment processing.

Braintree

Backed by PayPal, Braintree is an all-in-one API platform that supports PayPal, Venmo, credit and debit cards, and widely used digital wallets like Apple Pay and Google Pay. With such a powerful integration, an e-commerce merchant can ask for nothing more.

Since it partnered with the Financial technology giant PayPal, it has access to its massive network and next-gen technology, which can help your business expand and scale.

Access WorldPay

Access WorldPay makes receiving payment relatively easy, even for small businesses. Using the platform, you can authorize payment to reserve the funds in the customer’s account.

Moreover, it’s easy to manage payments, such as cancellation, settlement, or reversal. You can query a payment and receive changes to your payment status or use their recurring sale resource to settle payments.

With these many functions, WorldPay streamlines the entire payment process.

Amazon Payment Services

Being an arm of the multinational corporation Amazon – one of the biggest e-commerce websites in the whole world, no wonder Amazon Payment Services can be relied upon for payment processing for business merchants.

It’s a wholesome platform that supports nearly all prominent payment methods. It provides easy website integration with a quick, low-code solution with maximum customization, depending on your needs, mobile integration, and localization options.

Besides, Amazon Payment Services also provides monitoring and reporting services, using which you can stay on top of your merchant account using your live and customizable dashboard. You’d also be able to generate reports for analysis.

Rapyd

Another excellent Global Payment API is Rapyd, which offers a single API integration for more than 100 countries and 100s of payment methods. Apart from providing what every other payment API offers, it comes with Rapyd Protect, a global fraud monitoring tool that protects you from financial frauds and scams.

To build a perfect payment solution, you can get the necessary developer tools, code samples, online documentation, and webhooks. Set up recurring payments, split payments, subscriptions, next-day settlement, and more, with global reach and built-in compliance.

Everything you could need is all in one place with Rapyd!

Closing Thoughts

You’re indeed spoilt for choice when it comes to Global Payment APIs. But every business has its requirements, which means there can only be one fit.

While picking one API from 100s out there can seem overwhelming, with adequate research, you’ll land on “the one” quite easily. Hence, the curated list!