QuickBooks Online

QuickBooks Online is a popular accounting software for small businesses. It helps you with invoicing, billing, bookkeeping, expense tracking, financial management, and integrating with payroll. Despite being popular, is it the right solution for your business accounting?

I’m using QuickBooks since 2018 to manage Geekflare accounting, I will share my research and experience in this review guide.

Features

-

Track bills, expenses, mileage, time, receipts and automated categorization

-

Create invoices and receive payments in multiple currencies

-

Capture receipts and automate bookkeeping

-

Integrate PayPal, Banks and over 750 business apps

-

Financial reporting like P&L, balance sheets, AP, AR, profitability

-

Higher plan offers inventory management, workflow automation, batch invoicing

Pros

-

Real-time reporting and bank sync

-

Mobile apps to manage accounting on the go

-

Easy to use dashboard and overall interface

-

Expert accountant assistance

-

Collect sales tax

-

Tax preparation help

Cons

-

24×7 support is only available on Advanced plan

-

No Stripe payment integration

-

Team roles, multi currencies, billable hours are available on higher plan only

Accounting Software Review Methodology

Geekflare researched and tested the core accounting features of QuickBooks Online. We evaluated essential features and calculated a combined overall rating for each. To ensure an unbiased review, we gathered factual data from official websites and analyzed user feedback from various sources to provide comprehensive insights and detailed reviews.

What is QuickBooks Online?

QuickBooks Online is a popular business accounting software for startups and SMBs and well suited for product-based companies. You can manage end-to-end accounting financials for your business and run payroll for your employees.

If you are wondering if you need an accounting software, here is an interesting market trends.

The small business accounting software market is expected to reach $42B by 2032 from $17.71B in 2023.

Business Research Insights

14 Best Features Of QuickBooks Online

From invoicing, accepting payments, bookkeeping, reporting, financial planning to tax preparation support, QuickBooks offers comprehensive accounting features to manage business financial.

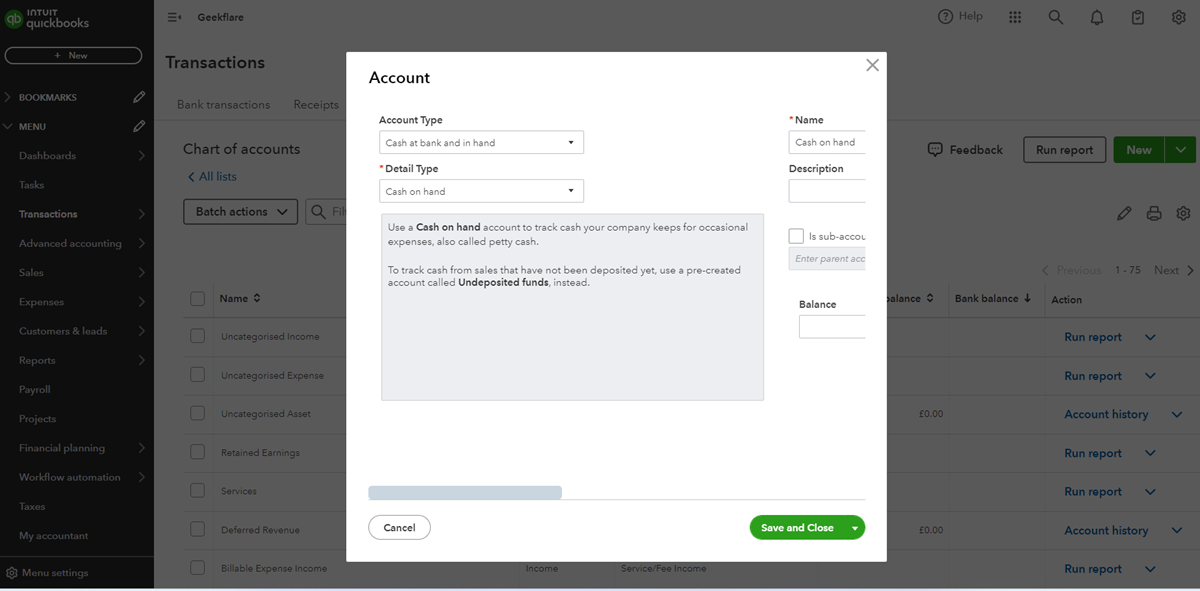

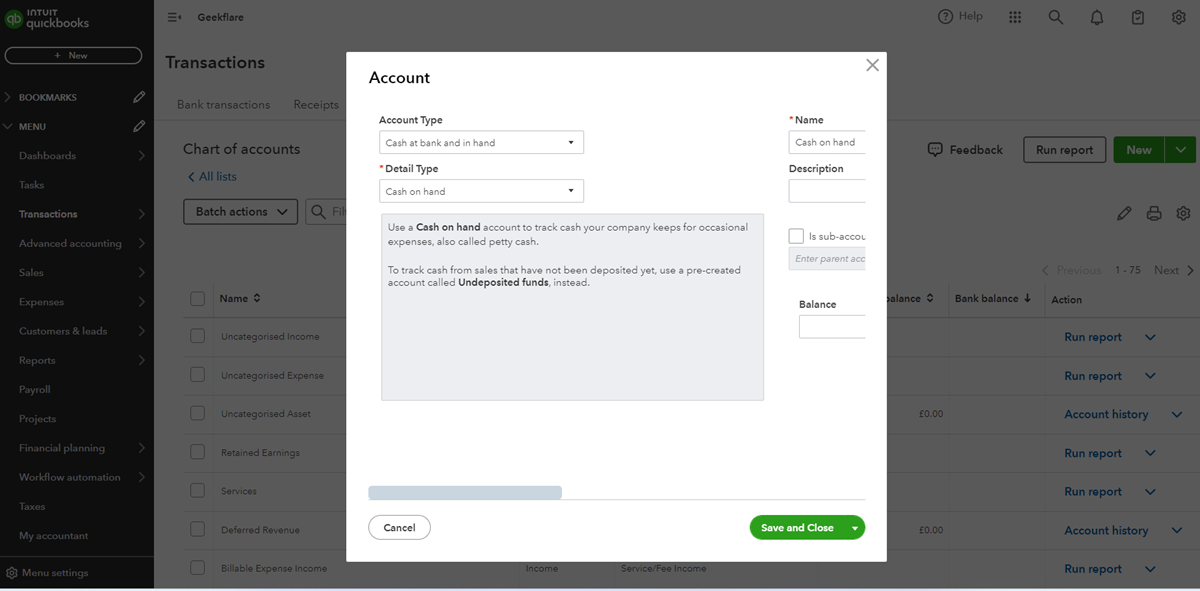

1. Bookkeeping Automation

QuickBooks Online learns from your inputs and applies it intelligently, so you spend less time categorizing bank account transactions. Since it automatically sorts business expenses into the correct categories, tax time becomes more manageable for you or your accountants. QuickBooks also supports setting up rules for automatically categorizing recurring bank transactions.

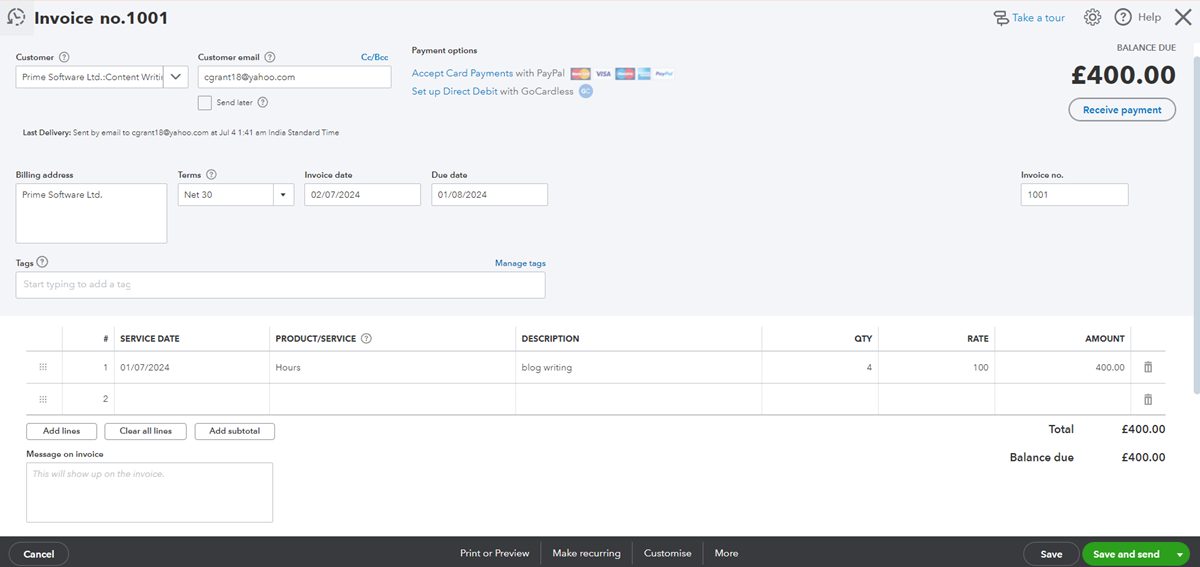

2. Invoice and Payments

You can customize the invoice to match your branding, accept payments through cards, Venmo, and PayPal, send one-time or recurring invoices. On the invoice, as you can see below, you can add customer details, terms, billable hours, tag them and schedule to send later.

QuickBooks invoicing is now powered by AI, which helps you to send invoices faster. On top of standard invoicing feature, I liked the following:

- Split and send progressive invoice, like collecting installments

- Get real-time notification when payment is received

- Cover up to $25,000 pear year dispute protection on cards payment

3. Multiple Currencies

If you are running a SaaS company or selling digital goods, you can collect payments in different from home currency. For example, you can collect payments in GBP, EUR, CAD, etc. And, not just collect, but also send payments in multi currencies.

One thing to note here, currency conversion is managed by QuickBooks and conversions gets updated every 4 hours.

4. Mileage Tracking

Mileage tracking helps businesses with expense management. QuickBooks mobile app supports automatic GPS tracking from mobile phone locations for effortless mileage tracking. It also has the option to add trips and categorize business trips for tax deductions manually. If companies need to comply with IRS standards, QuickBooks allows them to keep a mileage log.

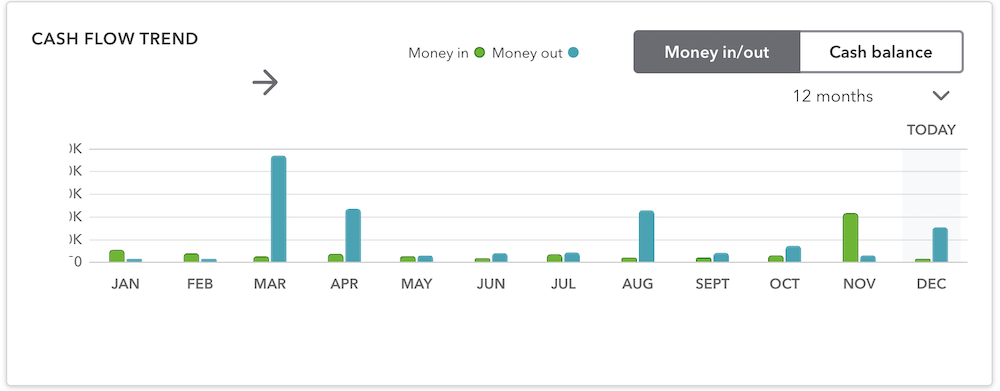

5. Cash Flow

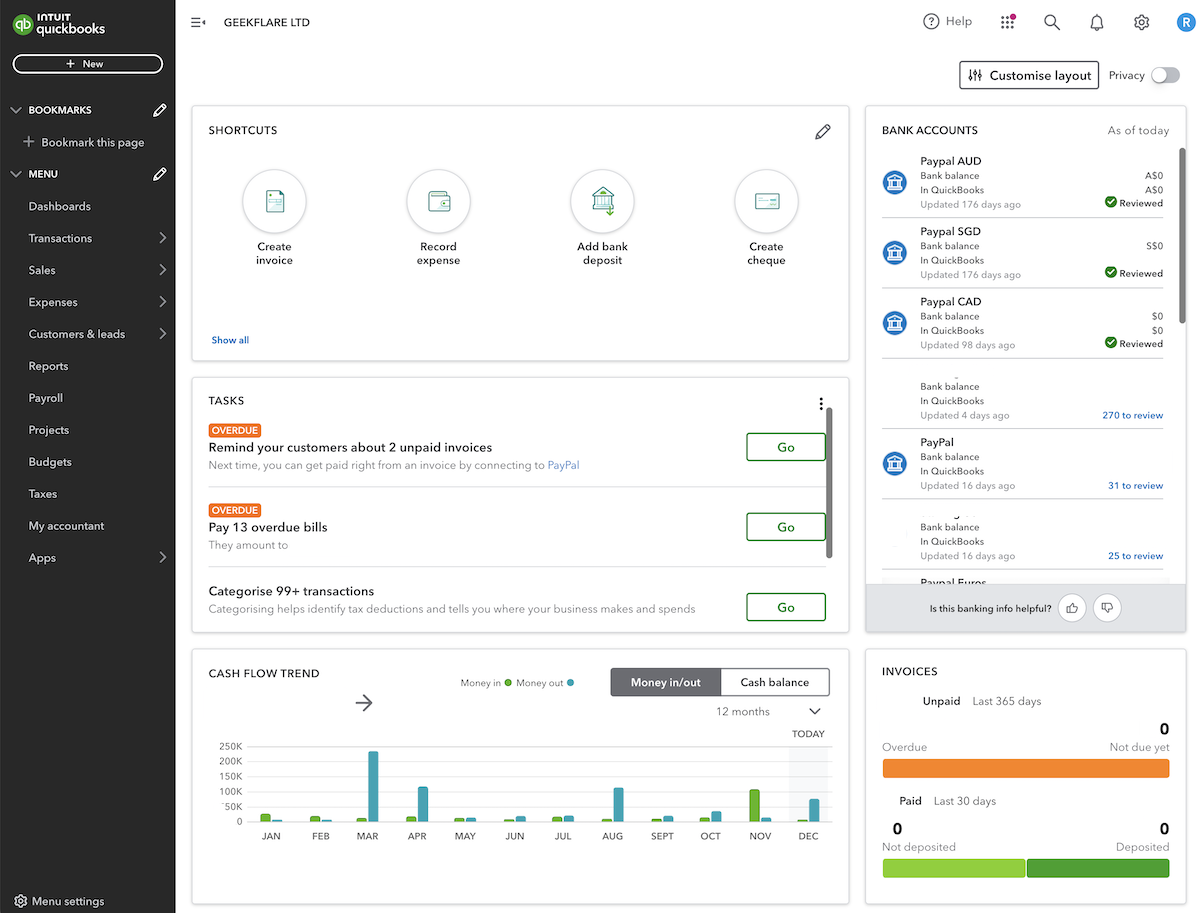

QuickBooks lets you check cash flow to spot trends and keep them growing. It shows historical cash flow data, so you can understand when they need to spend or save. You can see the cash balance, money in and out, right on the dashboard.

And, for detailed cash flows statement, you can generate a report using Reports option.

6. Tax Management

QuickBooks Online automatically calculates tax from invoices, so you do not have to perform that manually. To determine the sales tax rate, invoice date, location, product or service type, and customer are used. QuickBooks Online offers a Sales Tax Liability Report for sales tax information.

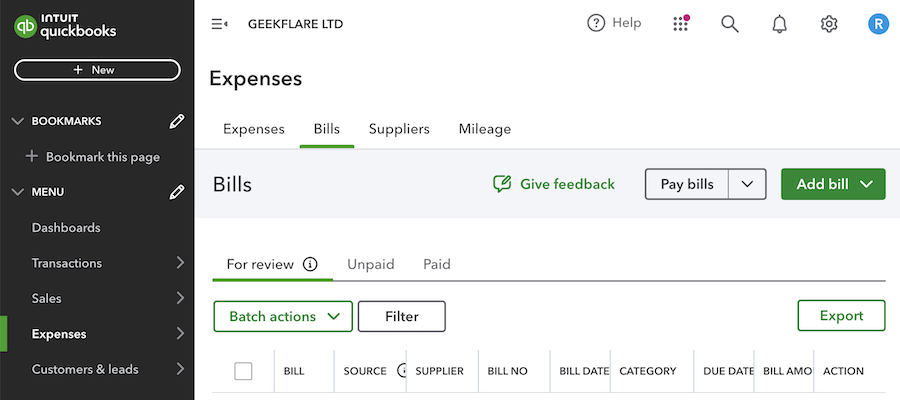

7. Bill Management

Whether paying bills or tracking them, you can manage entire billing to keep a track of expenses. All you got to do is connect your business bank accounts, Apple Pay or PayPal to QuickBooks. Then, QuickBooks will import the bill payments and match them to invoices provided by the vendors. After making the payments, it automatically tracks the owed amount and its due date.

8. Inventory Management

If you need to manage inventory, you got to subscribe to the Plus plan. It makes sense to use QuickBooks to manage inventory if you are using it for accounting and payroll, so you manage everything from one place.

You get real-time updates and enhanced reports on their inventory stock levels. It automatically updates the quantities to prevent a stock shortage. Its inventory calculator allows you to know whether they are understocking or overstocking. You get notification alert when the stock is low and converts the purchase order into a bill when the inventory arrives. It integrates with Amazon, Etsy, and Shopify to help eCommerce businesses.

I must warn you, QuickBooks inventory is very basic and for complex requirement, you should go for dedicated inventory management software.

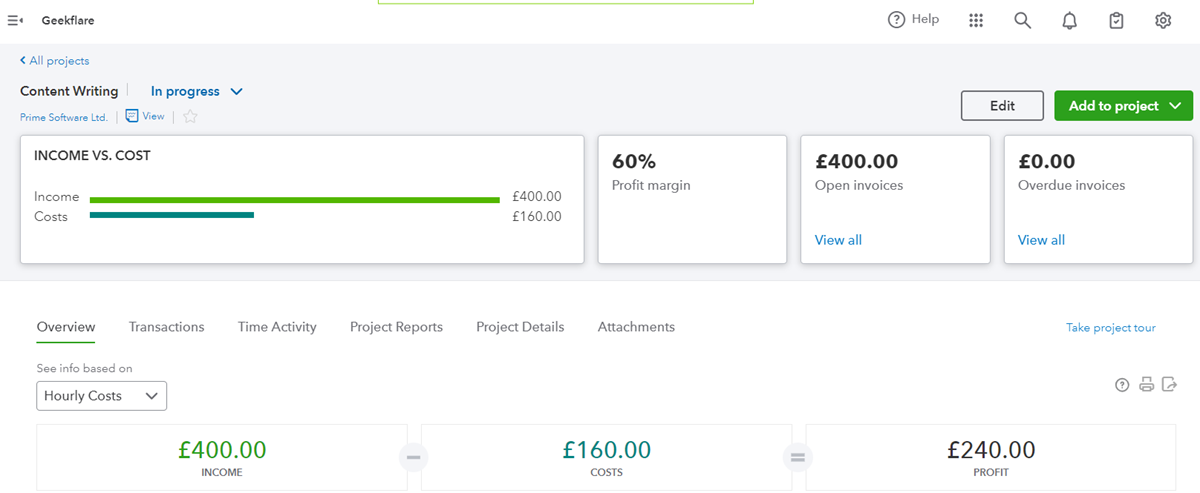

9. Project Profitability

QuickBooks Online lets its you monitor all their projects from one place. This helps you track labor costs, payroll, and expenses to determine job costs. With the ability to perform a thorough cost-benefit analysis, businesses can assess whether project expenses are justified by the potential returns. With clear dashboards and informative detailed reports, determining project profitability at a glance becomes easy with QuickBooks.

10. Financial Planning

QuickBooks helps create and manage budgets for a project or company finances from scratch. Businesses can do that by uploading data from a spreadsheet or using the spreadsheet sync feature. QuickBooks Online supports collaboration between the team and accountant right inside the software. This budget management feature with updated performance data assists organizations in making the right decisions.

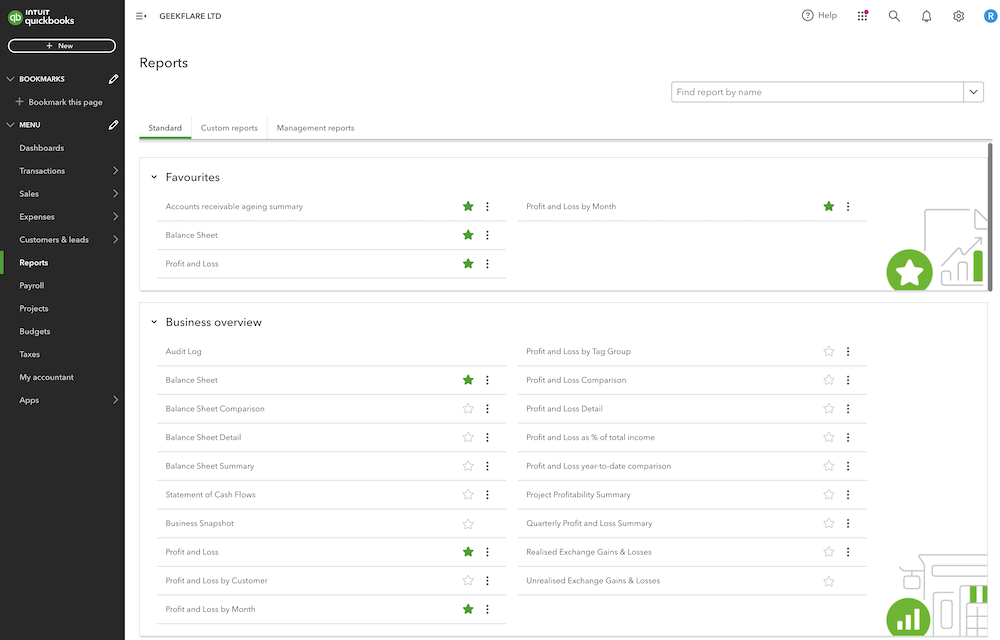

11. Reporting

As a founder, accountant or business owner, you can’t live without checking your business financial report and QuickBooks does an outstanding job in reporting. You can generate various reports and if needed, you can create a custom report and configure to get that sent to you on a monthly or at interval.

My favorite reports are:

- Balance sheet

- Profit and loss

- Sales and Expenses performance

- Cash flows statement

I get an idea of my business financial situation with the above reports, and I check them almost every month.

12. Data Sync With Excel

This is only available in the Advanced plan and most suitable for accountants or if you are migrating accounting from Excel to QuickBooks.

You can add large batches of data to an Excel spreadsheet and sync it to import the data into QuickBooks. They can use Excel to create custom charts and graphs using QuickBooks data to track business performance. QuickBooks offers pre-made templates to generate consolidated reports for multiple companies.

13. Employee Expenses

QuickBooks can manage an organization’s employee expenses. Employees can submit their business expenses directly to QuickBooks, and the admins can later review, track, and approve the expense records from the same platform. This saves time for both parties and reduces the chances of errors through manual data entry. Moreover, it’s easy to find the information one needs as the expense records are stored in one place.

14. Workflow Automation

Automation of significant accounting tasks is a valuable feature of QuickBooks. You can set to receive reminders for invoices, payments, or deposits on the due date. It notifies once you get the payments. You can also set invoice approval workflows to ensure smooth and quick processing.

What are the Benefits of QuickBooks Online Accounting Software?

The benefits of QuickBooks Online accounting software are the automation of accounting tasks, financial management, dashboard customization and reporting, data security, and more.

Financial Management

You get all the necessary features to manage your company finances under one umbrella. Its powerful suite allows you to track cash flow and expenses, organize transactions through categorization, reconcile bank statements, manage invoices, pay bills to vendors, and produce data-driven financial assessments.

Accounting Tasks Automation

QuickBooks eliminates the need for redundant manual data entry and frees up employees’ precious time by automating various accounting tasks. You benefit from automatic recurring invoices, transaction categorization, invoice reminder emails, bill payment scheduling, pay runs, and receipt data capture.

Customizable Dashboard

I like the QuickBooks Online dashboard. It gives me a high-level of reports for critical financial metrics, and I can customize the way I like by adding or removing widgets.

Each section you see above is a widget, which allows you can add, remove and change the window size.

Access From Anywhere, Any Device

You have unparalleled flexibility as it allows access to the company’s financial data from any location. Whether in the office, at home, or on the go, you can effortlessly log in to their QuickBooks account with an internet connection. Thus, the entire team stays informed about the business’s financial health, makes decisions, and performs any crucial task, regardless of their physical location.

I like the QuickBooks mobile apps and I would suggest installing it so you can access your account whenever and wherever you like.

Collaboration to Improve Efficiency

QuickBooks Online supports accountant collaboration by allowing you to invite your accountants to log in separately without sharing usernames and passwords. It enables you to get assistance from accountants or tax professionals. You can also mark any transaction, so the accountants can follow up later.

You can create custom access for employees, managers, and partners. QuickBooks allows users to be granted separate access for efficiency and data privacy. It also generates limited access reports to share with investors and other stakeholders.

Data Security

QuickBooks Online offers unique Always-On Activity Log and Audit Trail features that a regular user cannot turn off. It records a complete record of activities, including every login instance, and tracks the history of changes to a specific transaction. So, companies do not have to worry about the data security from the internal level.

On an external level, QuickBooks’ parent company, Intuit, employs professional staff and automated tools to monitor service 24/7. Its servers are secured with 24/7 physical security staff, video surveillance, and alarms. Additionally, it has power supply backup generators, a fire suppression system, and complex smoke and flood detection.

How Much Does QuickBooks Online Cost?

QuickBooks Online offers four pricing plans and depending on your business size and requirement, you can pick one. I’ve summarized them by business size suitability to help you pick the right plan.

Simple Start | Essentials | Plus | Advanced | |

Micro business, Startups | Growing small business, Startups | Established small business | Medium business | |

1 | 3 | Unlimited | Unlimited | |

1 | 3 | 5 | 25 | |

P&L, Balance sheets | AP, AR, Sales | Inventory, profitability | Financial performance | |

$17.50 | $32.50 | $49.50 | $117.50 |

I would recommend taking a 30-days free trial and starting with the Simple Start plan and upgrading as you grow.

QuickBooks Online Integration

QuickBooks integrates with over 750 business apps. Some popular apps to integrate are:

- Customer management – Insightly CRM, Method CRM, Jobber, Acuity Scheduling

- Stock management – Shopify, SOS Inventory, BigCommerce, Precoro

- Payment – Wise, PayPal, Payhawk, Corpay One

- eCommerce – WooCommerce, EasyStore, A2X

You can view all the connected apps on the Overview tab under the Apps menu.

Customer Support

QuickBooks has extensive documentation, but 24×7 support is only available on the Advanced plan. This is where QuickBooks lacks when you compare with its competitors like FreshBooks or Xero.

What I don’t like is, they have chat and customer care for pre-sales but not for product support.

QuickBooks Online Alternatives

I am happy with QuickBooks as whatever they promise, it works, and I never had to contact their support. However, if you need an QuickBooks alternative, there is no shortage. For example, if you are a freelancer, consultant, or running a service business, you may like FreshBooks more due to its features and lower cost.

Here is a comparison table comparing QuickBooks with its competitors FreshBooks, Xero, Wave, and Sage 50. I’ve picked the starting pricing plan features to compare.

| |||||

Unlimited | 20 | Unlimited to 5 clients | Unlimited | Unlimited | |

Cards, ACH, PayPal | Cards, Stripe, PayPal | Cards, Stripe, PayPal, ACH | Cards, Stripe, PayPal, ACH | Cards, ACH | |

Simple Start – $17.50 | Early – $1 | Lite – $4.75 | Pro – $52 | Pro – $16 | |

Geekflare’s editorial team determines ratings based on factors such as key features, ease of use, pricing, and customer support to help you choose the right business software. | |||||

So to summarize and help you with the decisions:

- If you have less than 5 clients and need time tracking, go for FreshBooks.

- If you are a small business and need to accept Stripe payments, go for Xero or Sage 50.

- If you require basic accounting and need to save on payment transaction fee, go for Wave.

- If you need basic accounting but aren’t concerned about Stripe payments or time tracking, go for QuickBooks.

Who Should Use QuickBooks Online?

SaaS, startups, eCommerce, manufacturing, restaurants, construction, publishers, nonprofit at growing stage or established as small businesses are best suited for QuickBooks Online.

I would suggest checking out this list of top accounting software for more options.

Who Shouldn’t Use QuickBooks Online?

Freelancers, consultants, or microbusinesses that require basic invoicing and payment collection should be better off with FreshBooks or Wave as it costs less.

Medium to large, global enterprise with complete business management requirement should look for NetSuite or Sage Intacct.

QuickBooks Online Verdict

QuickBooks Online is great for small businesses with basic accounting needs. Based on my experience and after reviewing feedback from external sources like G2, Capterra ,and Reddit, QuickBooks Online receives the Geekflare Value Award.

I recommend taking a free trial and once you are happy with their offering, you can start the subscription.

What’s Next?

Once you sort out your business accounting, read the following guides to take your financial to the next level.