Xero

Xero is a cloud accounting software for small businesses and freelancers. It offers features such as invoicing, mileage tracking, expense tracking, project expense prediction, budgeting, reporting and analytics, time tracking, tax filing, and bank reconciliation. Xero allows you to collaborate with your accountants and offers a friendly UI.

I’ve tested the features of Xero software to see how they function. In this Xero review, I’ll provide a comprehensive analysis of the software and tell you if it lives up to its promises.

Features

-

Create customizable recurring invoices

-

Claim management and mileage tracking

-

Project management with time tracking

-

Generate customizable reports to predict financial health

-

Cash flow tracking and bank account reconciliation

Pros

-

Simple dashboard and user-friendly interface

-

Integration support for 1000+ apps

-

Document management through Hubdoc

-

Task breakdown, budget estimate for projects

-

AI-based predictions for financial health

Cons

-

Limited invoice customization

-

Complete audit log not available

-

Workflow automation is not available

-

Live chat and phone support are not available

-

No dedicated estimation and proposal features

Accounting Software Review Methodology

Geekflare tested the accounting features of Xero through hands-on subscriptions. We evaluated essential features needed for small businesses and calculated a combined overall rating for each. To ensure an unbiased review, we gathered factual data from official websites and analyzed user feedback from various sources to provide comprehensive insights and detailed reviews.

Top Xero Features

Xero’s key features include online invoicing, project tracking, bill payment, expense claims, and more. Here are my top picks from Xero features.

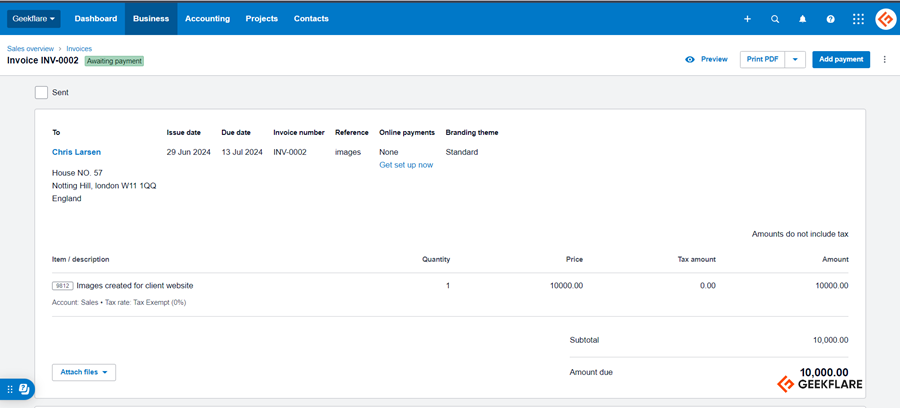

1. Online Invoicing

Xero’s built-in invoicing lets you create customized invoices by including the company logo, custom message, and added fields. I like how your clients can click on the Pay Now button on the invoice to make payments using a credit card, debit card, direct debit, or any other payment method of their choice.

Xero displays notifications when the client views the invoice and the invoice is paid. It even allowed me to enable settings for sending multiple reminders to clients for due and overdue invoices. You can choose preferred intervals for sending reminder emails, which include an invoice PDF link and a button for online invoices.

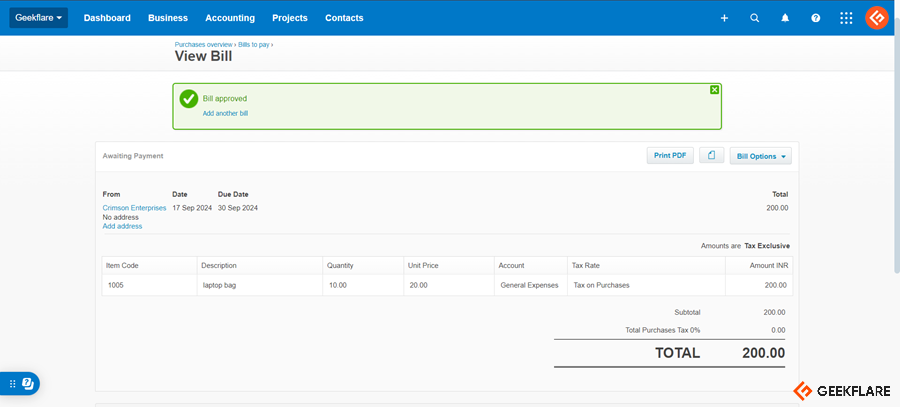

2. Paying Bills

Xero offers a clear overview of your company’s accounts payable and cash flow. It lets you access bills online from anywhere and pay them on time. I am impressed by its batch bill payment and bill scheduling features. These will definitely save time and spare you from performing repetitive tasks. Paperless record-keeping is also feasible by emailing bills to the file’s inbox.

Besides an overview of unpaid bills, expenses, and purchase orders, Xero displays bills in different categories, such as draft, waiting for approval, or ready to be paid. I could organize the bills in folders and view bills on-screen while entering the data. Xero enables you to set up recurring bills by replicating the last bills from a supplier and modifying them as needed.

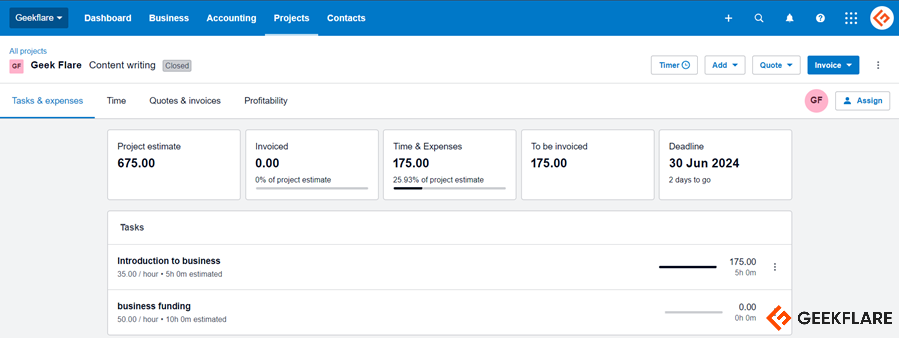

3. Project Tracking

Though Xero is not a project management software, it offers project planning, budgeting, time tracking, expense monitoring, quoting, and invoicing features to help you manage various projects. I’ve noticed that it lets you conduct a cost-benefit analysis here to evaluate the financial viability of projects and ensures that you track the time that you’ve invested in a particular task.

You can manually add the tracked time to their tasks. Xero Projects features show the project profitability and generate reports on different aspects of a project, including project summary and project details.

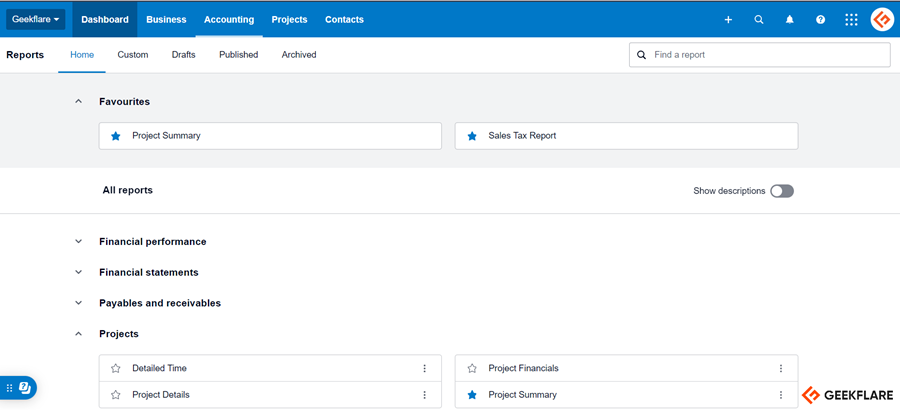

4. Accounting Reports

Xero has an extensive reporting feature for creating reports on various aspects of financial performance, financial statements, projects, payables and receivables, taxes and balances, and transactions. I marked some report types as favorites which allowed me to find them instantly whenever I wanted to access them later. You can even quickly access drafts, published, and archived reports through dedicated tabs.

While Xero is primarily focused on financial accounting, understanding different types of accounting—such as cost or managerial accounting—can help businesses tailor their use of Xero’s features to their specific needs.

5. Multi-currency Accounting

Companies operating in multiple countries or dealing with multinational companies can use Xero’s multi-currency accounting feature. It makes international transactions easy by allowing you to send invoices, quotes, and purchase orders in over 160 currencies.

I am impressed by the fact that Xero automatically gets hourly currency conversion rates to provide you with real-time insights into gains and losses. It also enables you to manage global businesses accurately by setting up foreign currency bank accounts and viewing currency movements.

6. Claim Expenses

Xero Expenses allows you to track and claim your expenses. It supports paperless expense tracking by letting your employees scan receipts and auto-filling claims from the scanned copy. With Xero, admins can review and approve expense claims submitted by employees.

The Xero Me app enables quick claim submission and approval by employees and employers. For expense organizations, you can also add tags to the expenses.

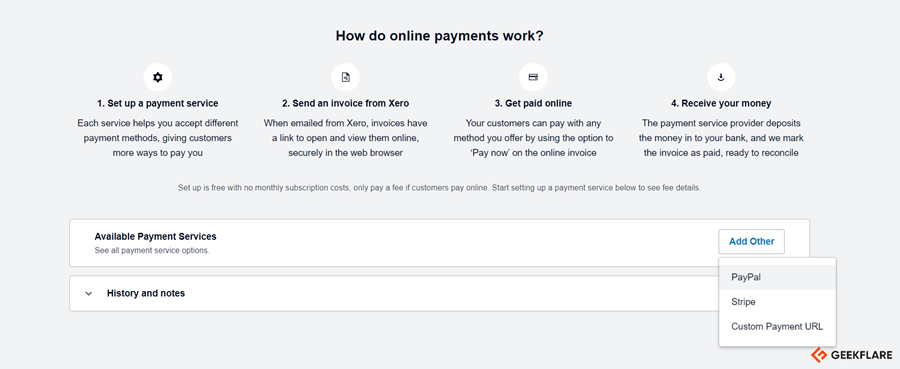

7. Accept Payments

To accept payments from clients, Xero allows you to connect to payment services without any monthly subscription. Your clients can make online payments using debit cards, direct debit using GoCardless, credit cards, and Apple Pay or Google Pay using Stripe. You can stay worry-free as Xero uses encryption and strong security measures to protect you against fraud.

8. Bank Reconciliation

Xero reconciles daily bank transactions by getting a live bank feed. Now, this feature caught my attention as many accounting applications do not have it, and you need to manually download the bank data for reconciliation.

If the banks or financial institutions do not connect to Xero, you can manually import bank statements for reconciliation. Xero uses rules to match bank statements with invoices or bill payments. Bulk sorting and grouping of transactions before reconciliation and receiving alerts for suggested matches are other useful features on Xero.

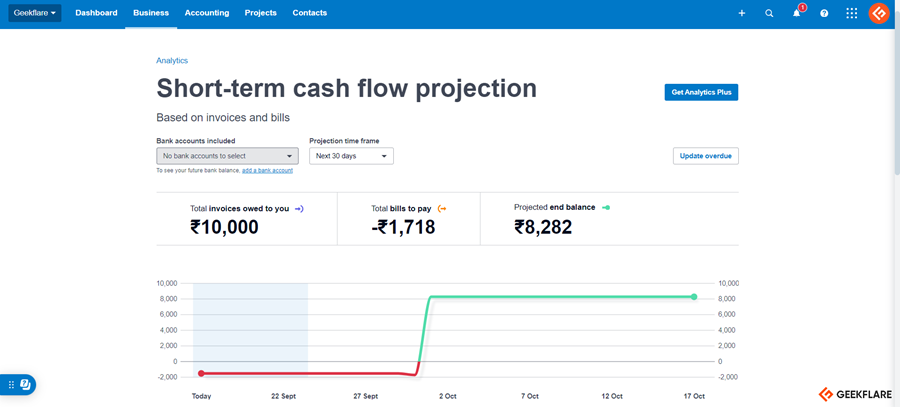

9. Reporting For Future Cash Flow and Financial Health

Using the Xero Analytics feature, you can generate reports on the financial health of your organization. It gives you an idea about short-term cash flow and shows the impact of invoices and bills on your finances. You can track income and expense metrics to identify trends and get help with financial health. For more customization and AI-powered predictions, you can switch to Xero Analytics Plus.

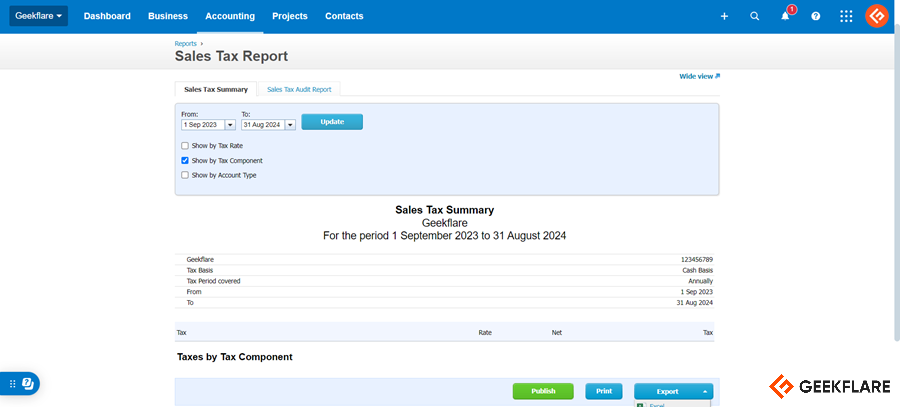

10. Sales Tax

Xero automatically calculates sales tax on your company’s transactions and prepares sales tax returns on the company’s behalf using sales tax reports. I like that you can set up as many sales taxes as you want, and the software will record them automatically.

Xero allows you to set up default rates for contacts, inventory items, and accounts, get tax summaries based on rate, account, or component, get sales tax based on cash or accrual, and view an audit report to see the individual transactions.

What are the Benefits of Xero Accounting Software?

Xero is designed to simplify financial management tasks for small businesses. I’ll mention some significant benefits of Xero accounting software below.

1. Managing Payments

As an Xero user, you’ll benefit from streamlined invoicing and payment processing that simplify payment management. Creating and sending invoices and tracking payment status from the same platform reduces manual data entry and accelerates cash flow. Xero offers you the flexibility and convenience of tailoring payment options with integration support for multiple payment gateways.

2. Expense Management

You can automate expense tracking and management with Xero, saving time and reducing the risk of manual errors. You can categorize expenses, attach receipts, and assign them to specific projects or employees to ensure better organization and accountability. Xero functions as a centralized system for the overview of spending, enabling businesses to identify cost-saving opportunities.

3. Multiple Payment Options

Xero lets you accept payment from your customers using multiple methods, increasing the chance of getting paid on time. It also supports accepting payments directly from the online invoice and reduces the time spent chasing payments. While sending the invoice, you have the freedom to choose the most suitable payment method for each of your customers, enhancing the overall invoicing experience.

4. Bank Reconciliation

With Xero’s bank reconciliation feature, the transactions and financial records are automatically verified and matched, reducing errors in the financial records. It minimizes manual effort and ensures you peace of mind with its reliability and accuracy. This feature lets you supervise your cash flow and transaction activities while adhering to accounting standards and regulations.

5. Inventory Management

Xero enables you to count the stocked items and shows you their total value, saving you time and reducing errors. If you’re looking for a more robust solution, integrating Xero with a cloud-based inventory management tool will enhance tracking, ordering, and managing inventory across locations. With detailed inventory reports, you can quickly assess product performance while its editable invoice ensures efficiency in your sales process.

6. Financial Management

Xero’s robust financial management features allow you to manage your finances effectively and confidently. By automating regular tasks like invoicing and expense tracking, it frees up financial professionals to work on strategic planning and analysis. If you seek more specialized invoicing capabilities, explore these best invoicing software.

7. Bank Integration

Xero’s integration with over 21,000 global financial institutions allows you to effortlessly import bank transactions. With secure, encrypted connections and the ability to link multiple bank accounts, you can maintain accurate financial records with minimal effort. For a bank that does not support a direct feed connection with Xero, it enables bank data import in OFX, QIF, QBO, QFX, or CSV format for smooth operations across various institutions.

8. Collaboration

Xero is popular for its support for collaborative tasks. It allows you to work with your colleagues, clients, and other stakeholders in a collaborative workspace by inviting them. Hence, everyone stays on the same page and works efficiently.

9. Being Compliant

It is reasonable to be concerned about Xero’s data security because it deals with sensitive personal and banking information. Xero complies with ISO/IEC 27001:2013, SOC 2, PCI DSS v3.2, and SAQ A standards. These certifications ensure that your financial data is protected, giving you peace of mind while managing business finances.

How Much Does Xero Cost?

Xero pricing starts from $2 per month. They have 3 plans as detailed below.

Early | Growing | Established | |

Sole traders, new businesses, and self-employed | Self-employed and growing businesses | Established businesses of all sizes | |

$2 | $4.7 | $8 |

Xero is giving 90% OFF for 6 months.

Can I Use Xero for Free?

Xero doesn’t offer a free forever plan, but you can take advantage of one month free trial.

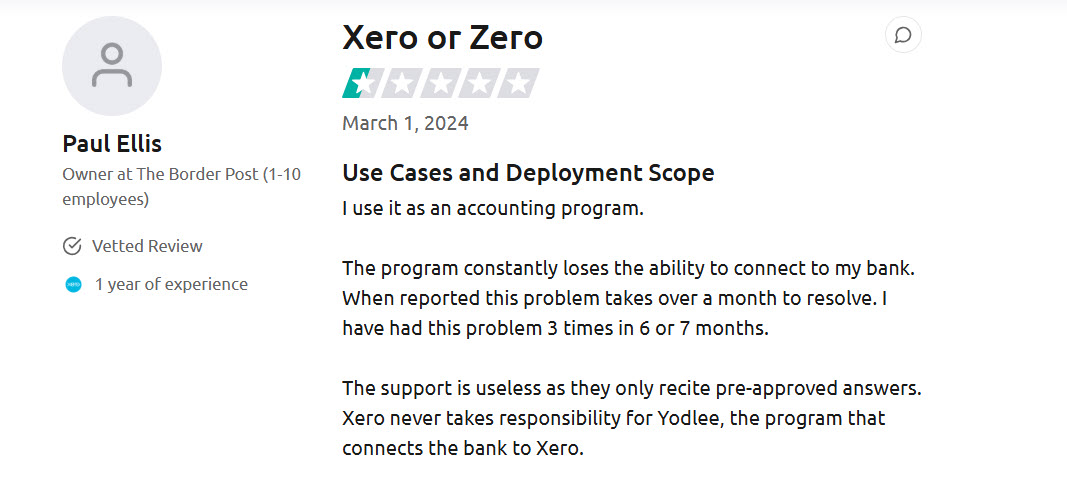

Xero Support

Xero offers customer support primarily through email. When I contacted Xero with a login issue, I got a delayed reply, which could have been resolved sooner.

It has no phone support number, but you can request a callback from Xero if necessary.

Xero does not offer live chat support either, which could have helped users who need instant solutions. However, it has an active community forum and a collection of support articles that are beneficial to the users.

Xero Alternatives

Based on my experience using Xero, the software is completely capable of managing the accounting needs of a small business or freelancer. However, you may want to use some Xero alternatives for additional features like unlimited invoices. In that case, other options, such as QuickBooks Online and FreshBooks, are available.

I have compared Xero and its popular alternatives: QuickBooks Online, FreshBooks, and Wave. I’ve chosen the features of the starting pricing plan to compare.

|  |  |  | |

20 invoices | Unlimited | Unlimited for up to 5 clients | Unlimited | |

Stripe, PayPal, Cards | Cards, ACH, PayPal | Cards, Stripe, PayPal, ACH | Cards, ACH | |

$2 | $17.50 | $6.30 | $16 | |

Geekflare’s editorial team determines ratings based on factors such as key features, ease of use, pricing, and customer support to help you choose the right business software. | ||||

In a nutshell, here is what I’ve made of the comparison table:

- If you are a small business that needs the Stripe payments feature, go for Xero.

- If your accounting needs are basic and do not include Stripe payments, choose QuickBooks.

- If you have less than 5 clients, choose FreshBooks.

- If you have basic accounting needs and don’t want to pay a fee for payment transactions, go for Wave.

Who Should Use Xero?

Freelancers, sole traders, self-employed, and small businesses will find Xero perfect for their accounting needs. Its invoicing, reporting, project costing, Stripe payment acceptance, and bank reconciliation features help businesses. Xero is ideal for businesses in professional services, retail, non-profits, hospitality, and manufacturing sectors.

Who Shouldn’t Use Xero?

Xero is not suitable for large companies or enterprises. If you need highly specialized accounting features or advanced inventory management features, Xero is not for you. It is not ideal for companies with complex financial structures or large teams. Construction companies and schools should consider using construction accounting software and school accounting software, respectively, that offer tailored features for these niches.

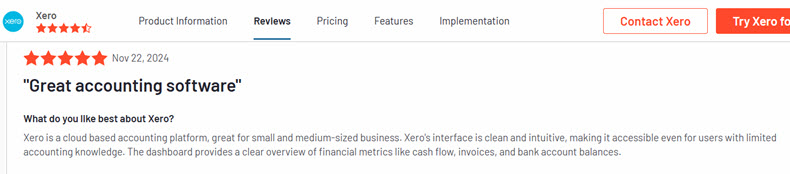

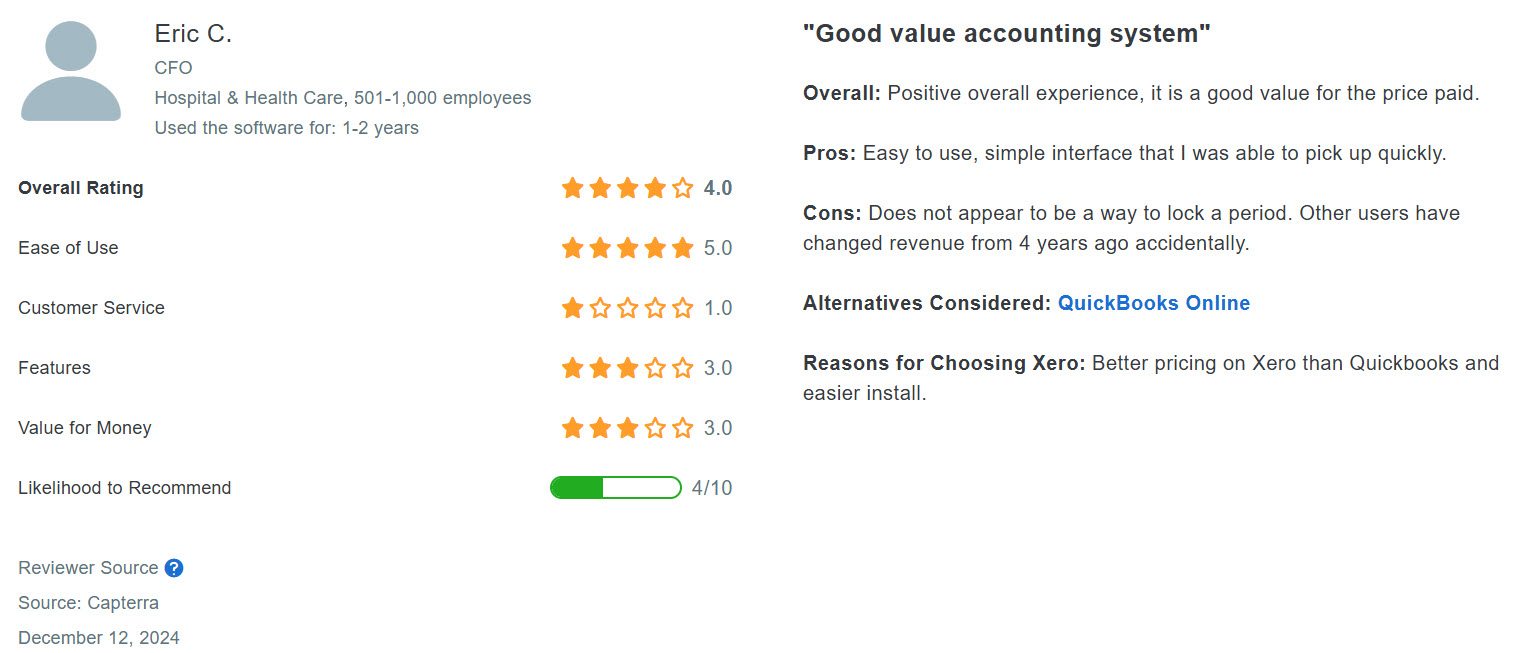

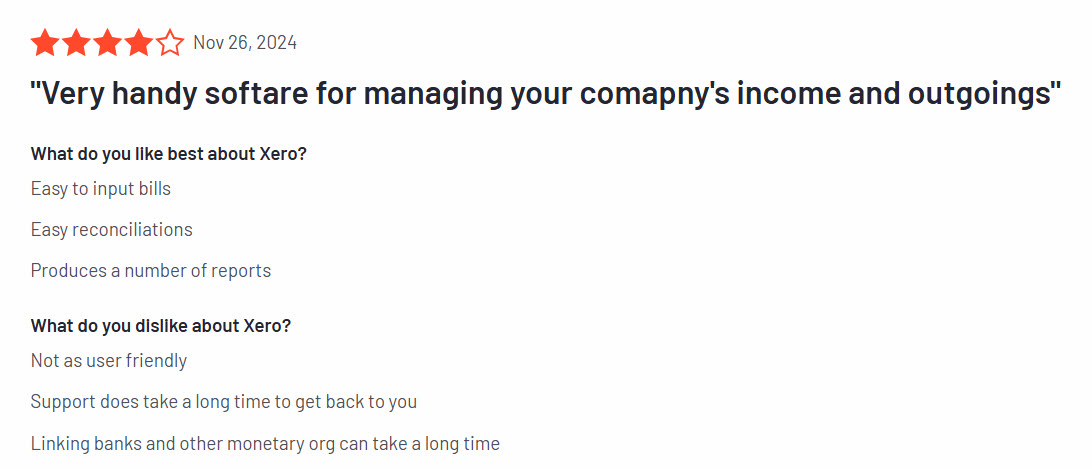

Xero Ratings

Here is how users have rated Xero on different software review websites:

- G2: 4.3/5 based on 716 reviews.

- Capterra: 4.4/5 based on 3,100 reviews.

- Gartner: 4.2/5 based on 26 reviews.

- TrustPilot: 3.7/5 based on 7,721 reviews.

- TrustRadius: 8.3/10 based on 781 reviews.

What I Like About Xero

When I started to use Xero, its simple interface and easy-to-understand navigation caught my attention. I did not have to go through any training resources to learn how to use it. As I checked each of its features, I was able to use them without any difficulty or challenge. Xero’s user interface is popular among its existing client base.

Xero’s customizable dashboard is a very useful feature for any business. You can easily personalize it and check the important metrics at a glance as soon as you open the software.

I appreciate that Xero offers project tracking functionalities despite not being a project management software. You can use it if you have basic project tracking needs such as budgeting, time tracking, and project planning.

What I Did Not Like About Xero

While my overall experience of using Xero was positive, I noticed some platform limitations. Xero allows Starter plan users to send only 20 invoices. Since this plan is ideal for freelancers, removing the restriction will surely encourage more freelancers to opt for Xero.

As mentioned earlier, I received a delayed response when I contacted Xero with a login issue. I thought that I’d received a late reply because I was a trial user. But, I noticed many customers also complain about Xero customer support.

FAQs

Small businesses, freelancers, and micro businesses should use Xero, while QuickBooks is ideal for startups, SaaS, eCommerce, and growing nonprofits. Read our detailed QuickBooks review to know more.

Yes, Xero is an intuitive software that even beginners can use without training.

If you have accounting knowledge, Xero should be sufficient for your small business. In case you have complex accounting needs, you will still need an accountant to manage bookkeeping and taxation.

Xero Verdict

Xero is an accounting application with an easy-to-use user interface. I recommend it that small businesses and freelancers for necessary accounting tasks, such as expense tracking, invoicing, bill payment, bank reconciliation, document storage, and reporting.

Xero offers additional features like project management, payroll, and inventory management, though it is not dedicated software for these functions. Xero receives the Geekflare Innovation Award.

What’s next?

After understanding Xero accounting features, let’s explore more software guides to streamline your accounting requirements.

-

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.