Xero and QuickBooks are popular accounting software solutions for small to medium businesses, offering features like invoicing, bank reconciliations, tax management, financial reports, payroll, inventory management, bill payments, and project accounting.

Both Xero and QuickBooks are top accounting solutions, but which one do you choose? Geekflare evaluated both based on key aspects such as core accounting needs for small businesses, pricing, customer service, ease of use, integration, and financial reports to help you pick the best accounting software.

You can trust Geekflare

At Geekflare, trust and transparency are paramount. Our team of experts, with over 185 years of combined experience in business and technology, tests and reviews software, ensuring our ratings and awards are unbiased and reliable. Learn how we test.

Xero vs. QuickBooks Comparison Table

|  |

Xero | QuickBooks |

Xero is a cloud-based accounting software for small businesses and self-employed | QuickBooks is a popular all-in-one accounting software for small to medium business. |

What is Xero?

Xero is a cloud-based accounting software for small businesses that helps manage expenses, track invoices, and automate tasks like reporting and invoicing. It provides users with a complete picture of their finances on a single screen with up-to-date data

Xero simplifies end-year tax returns by allowing users to import bank transactions into their accounting software securely and automatically. It also offers add-ons like Xero Projects and Xero Expenses for business planning and connections to third-party apps for financial management.

Xero allows real-time cash flow updates and online collaboration with bookkeepers, employees, and accountants for tasks like submitting expenses and sending invoices.

What is QuickBooks?

QuickBooks is an online accounting software that helps users track receipts, bank transactions, and income. It is popular among small to medium-sized businesses and offers cloud-based and on-premises applications.

QuickBooks simplifies finance management by allowing users to organize receipts and track mileage easily using its mobile application.

QuickBooks allows users to tag things while working to track projects, locations, events, and more. Users can run custom reports related to the tags to get an instant picture through the insights.

What is the Difference Between Xero and QuickBooks?

We will examine the differences between Xero and QuickBooks in detail and determine the best accounting software.

Invoicing and Payments

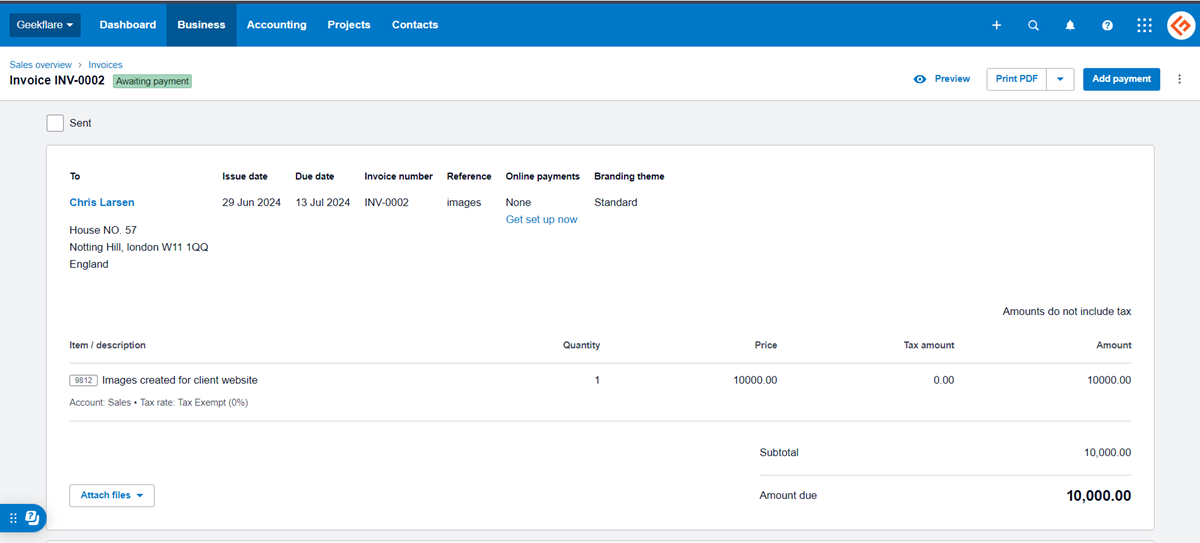

Xero offers a built-in invoicing feature where users can create invoices and customize them using the company logo, custom message, and added fields. The invoices contain a Pay Now button for one-click payment using their preferred payment mode, including credit card, debit card, and direct debit.

Xero also shows when a client views the invoice and alerts businesses when the invoice is paid. Users can set the software to send multiple reminders to the clients for due and overdue invoices at their preferred intervals. They can include an invoice PDF link and a button to online invoice in the reminder email.

Xero allows users to connect to payment services with no monthly subscription costs. It supports online payments using debit cards, credit cards, direct debit using GoCardless, and Apple Pay or Google Pay using Stripe. It uses encryption and strong security measures to protect against fraud.

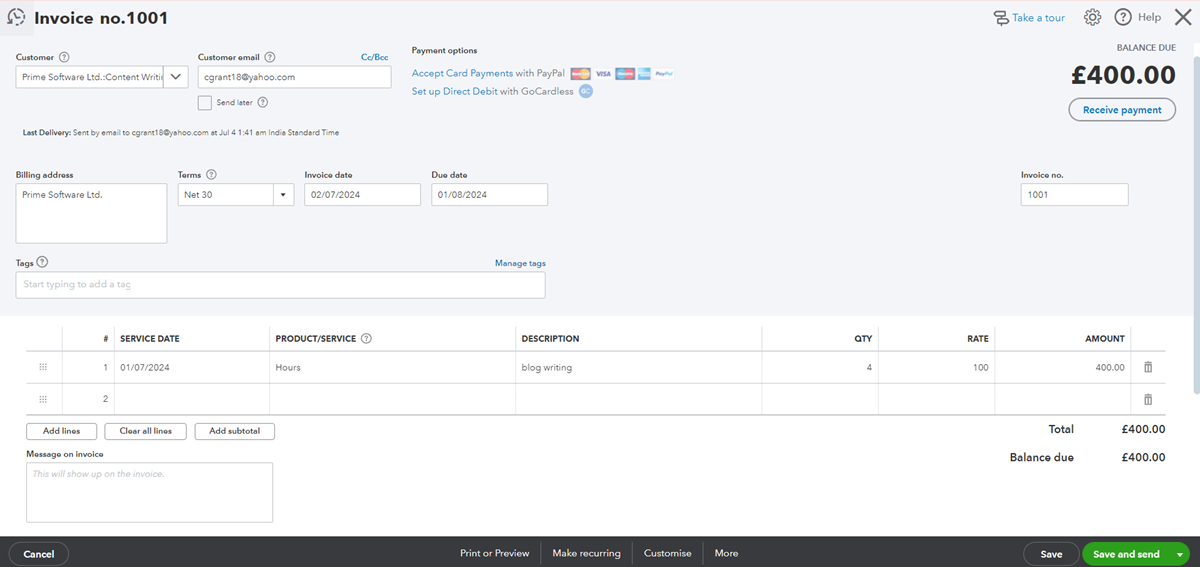

QuickBooks offers advanced invoicing features such as customization, recurring invoices, email sending, and payment options. Users can add customer information, choose payment methods, add service details, and send invoices via WhatsApp or a link after saving them.

QuickBooks allows users to customize their invoices by selecting templates, adding logos and brand colors, choosing fonts, and editing sections. Users can also personalize their email to send invoices electronically.

QuickBooks supports in-person payments using the QuickBooks GoPayment app and mobile credit card reader. It allows companies to accept payments through credit cards, debit cards, ACH payments, Apple Pay, PayPal, or Venmo.

Accounting

Xero is primarily an accounting software that offers payments in over 160 currencies, making it ideal for international business. It provides instant currency conversion, helps manage exchange rates for better cash flow, and allows users to view reports in local or foreign currency. It supports foreign exchange bank accounts and payments in any currency.

Xero updates the exchange rate every hour and revalues the company balance. It lets users view transactions, invoices, or bills in a foreign currency. Users get insights into business cash flow with the status of expense claims, bills, and details of money coming in with charts and graphs.

Xero also tracks all transactions across currencies and access reports to analyze monthly trends and identify areas for improvement.

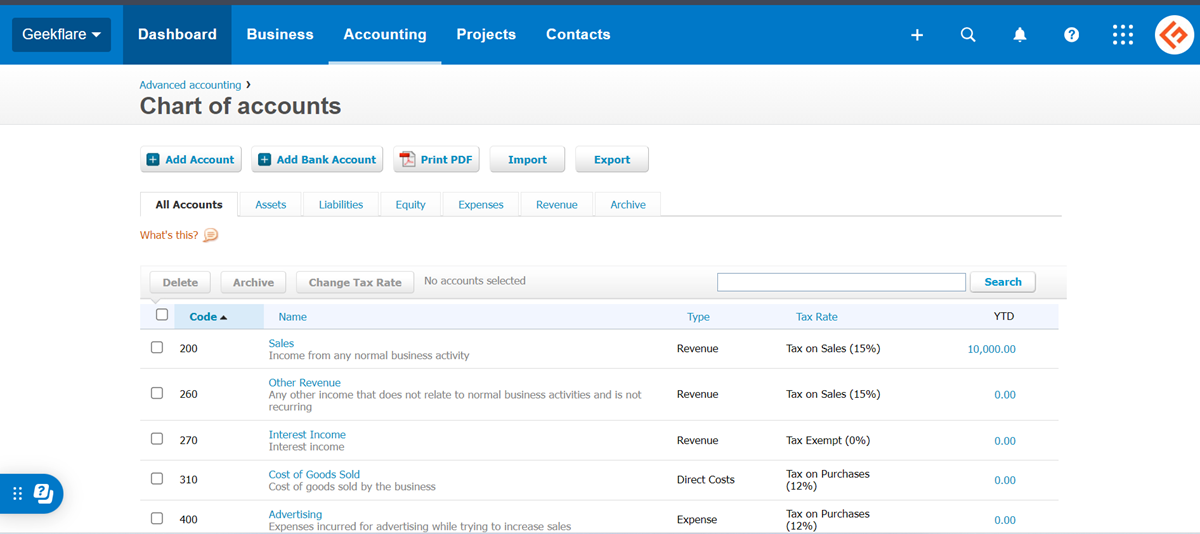

QuickBooks is advanced accounting software that can manage a company’s fixed assets. It supports business transactions in 155 currencies. Users can connect their bank accounts to automate income and expense tracking. It also tracks receipts through Google Drive and email.

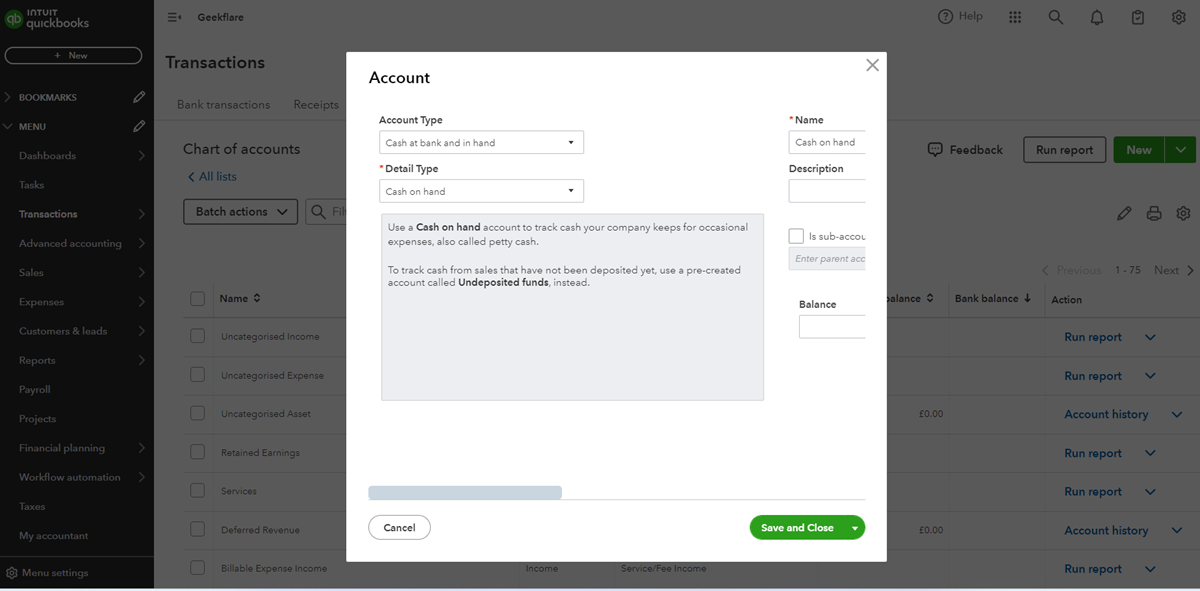

QuickBooks offers charts of accounting to track assets and liabilities using balance sheet accounts and categorize transactions with income and expense accounts. It automates the bookkeeping process by sorting business expenses into the right categories and setting up rules to categorize recurring transactions. It allows users to create custom tags to track income and expenses.

Bank Reconciliation

Xero enables daily bank reconciliation through live bank feed or manually import bank statements if the bank does not connect to Xero. It supports matching bank statements to invoices or bill payments using rules or accepting a suggested match. Users can sort and group transactions in bulk before reconciling them and receive alerts for suggested matches.

QuickBooks offers a bank account reconciliation feature that lets users connect their bank accounts, PayPal, Square, and other accounts with QuickBooks to import transactions automatically. It allows users to compare transactions with bank statements and check them off one by one until the difference between them is zero.

Once the reconciliation is complete, QuickBooks automatically generates a reconciliation report. It also helps users identify discrepancies quickly through the reconciliation discrepancy report, the missing checks report, and the transaction detail report.

Time Tracking

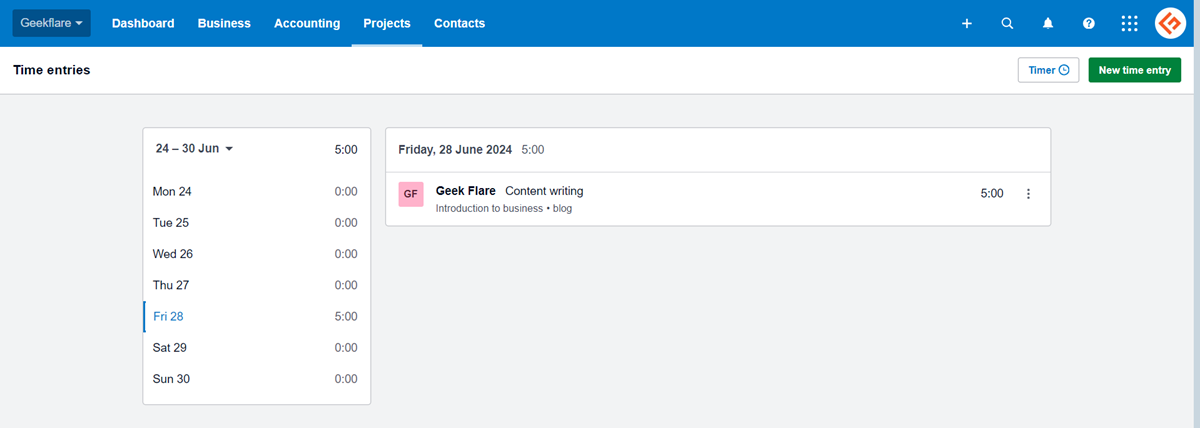

Xero’s time-tracking feature is included in its project management tool. As users track their time using its time tracker tool, it allows users to view how much time was spent daily or weekly on projects in one place. It also provides a staff time overview to monitor individual employee efficiency.

QuickBooks offers a time-tracking app called QuickBooks Time for employers to create schedules, track projects, and manage time-offs. It syncs with QuickBooks Payroll and allows employees to enter their time manually or through the QuickBooks Workforce app.

Expense Tracking

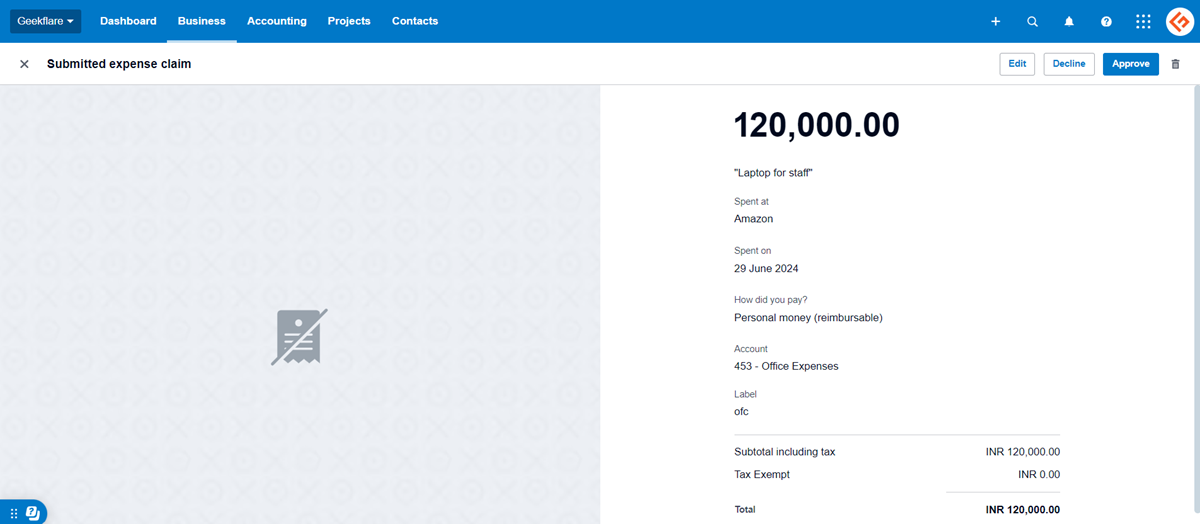

Xero makes expense tracking paperless by scanning receipts and auto-filling claims from the scanned copy. After employees submit an expense claim, admins can review and approve it in seconds.

With real-time notifications, reports, and insights, companies can get a forecast to manage cash flow. Users can also use labels to keep the expenses organized. Quick claim submission and approval are also possible from the Xero Me app.

QuickBooks allows users to track and manage various expenses, including bills, checks, purchase orders, etc. Users can filter expense data by category, status, date, payee, and delivery method and view related information such as bills, expense claims, suppliers, and mileage.

Using the QuickBooks mobile app, users can take pictures of receipts, and the software will automatically match its information with existing transactions.

Project Management

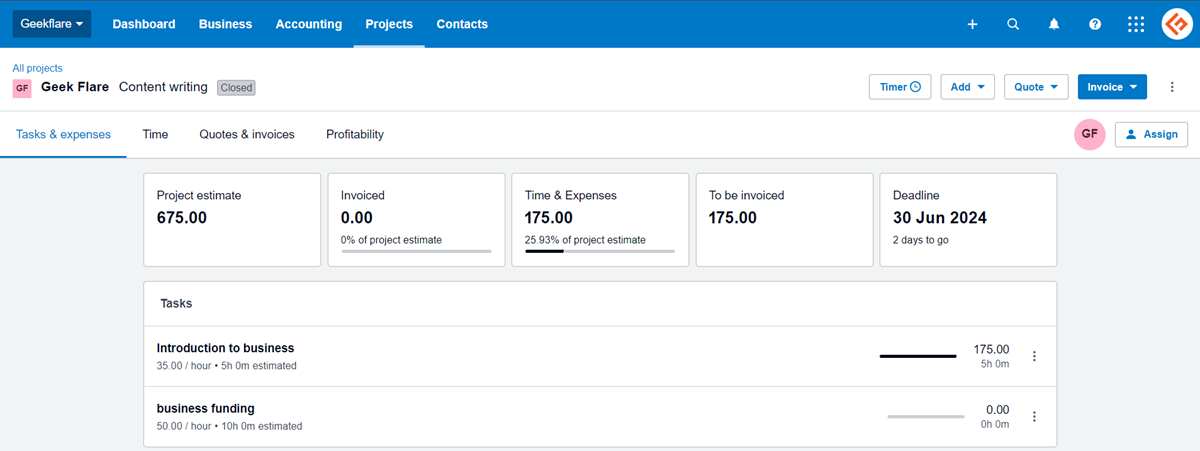

Xero is not an alternative to project management software, but it has some useful project management features for companies involved in various projects. It offers tools for time tracking, project planning, budgeting, expense monitoring, quoting, and invoicing.

Xero also has a built-in timer to track time invested in a particular task. Users can add the tracked time to their tasks easily. It also shows the profitability of a project and allows users to generate reports on project summary, project details, etc.

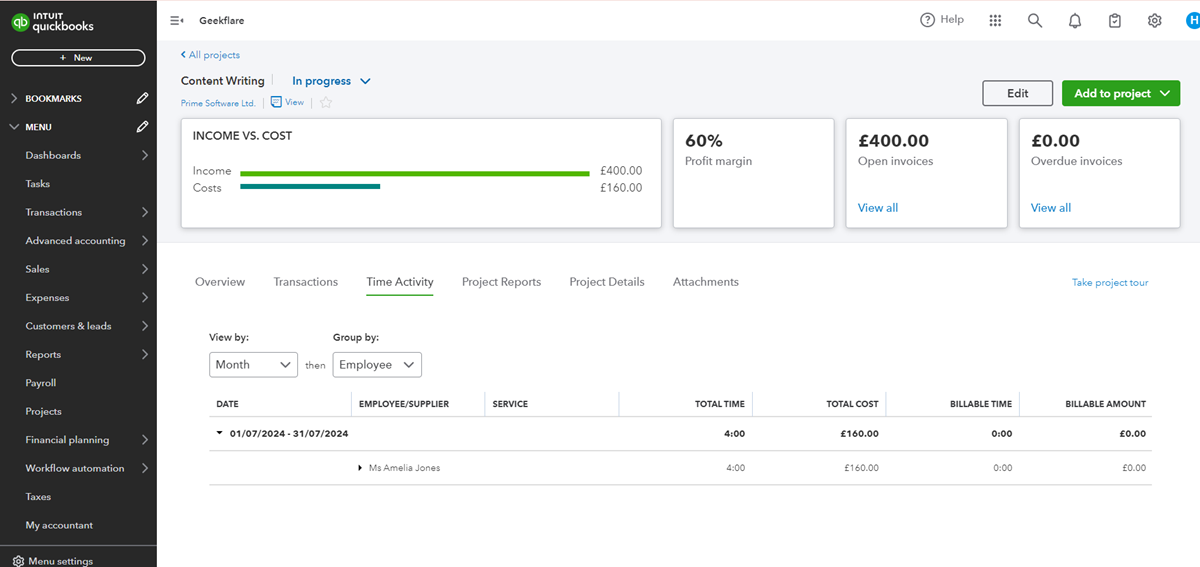

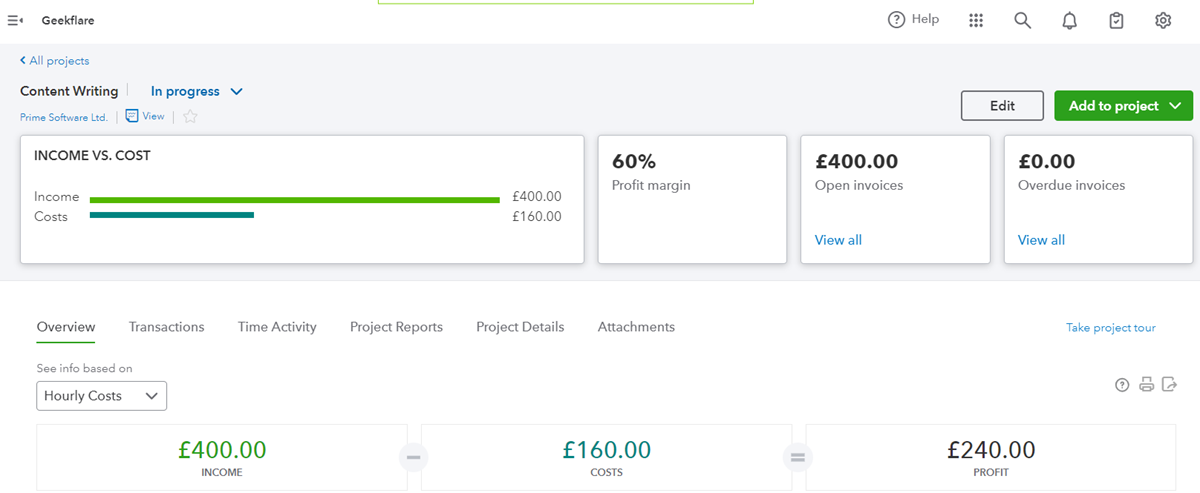

QuickBooks allows users to include project details to calculate profitability. Users can add invoices, estimates, expenses, time, bills, purchase orders, etc., into a project. It also generates reports on project profitability, time cost by employee, and unbilled time and expense for individual projects.

QuickBooks Projects also stores time activities, attachments, and transactions associated with each project.

Estimation and Proposal

Xero does not offer an estimation feature, but users can fill out the form on its website to download a free estimate template in editable PDF format.

Xero has no built-in proposal feature but can integrate with third-party proposal software. Users can use its quotation feature for simple projects with basic scope and pricing details.

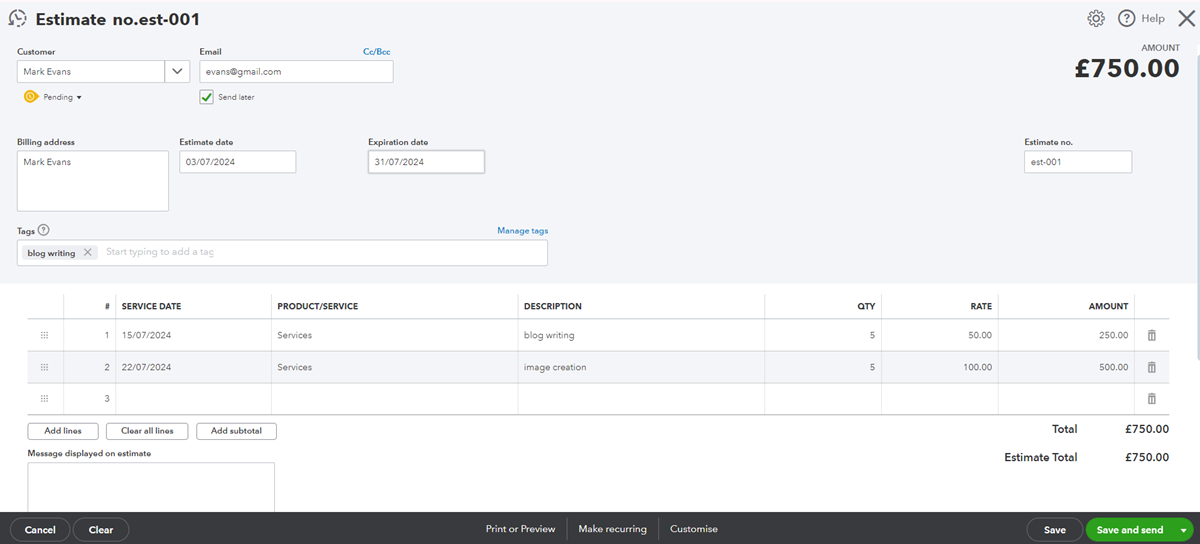

QuickBooks allows companies to create and send estimates on different products and services seamlessly. Users can turn the same estimate into an invoice in one click if approved. It even offers a free estimate template.

QuickBooks is not designed for proposal writing, but users can turn estimates into proposals by attaching files or adding messages. Integrating with third-party proposal applications is also an option.

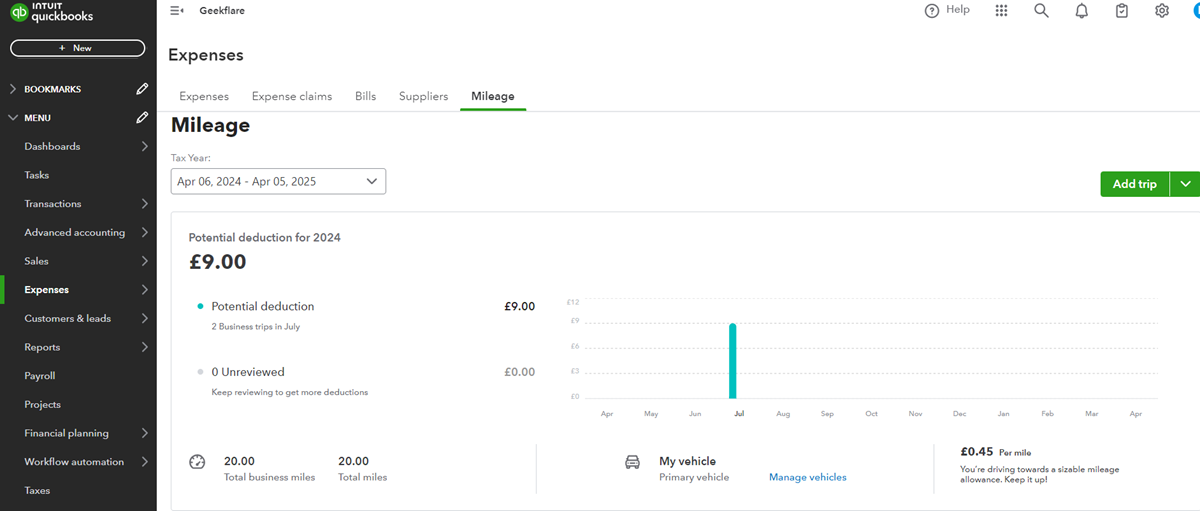

Mileage Tracking

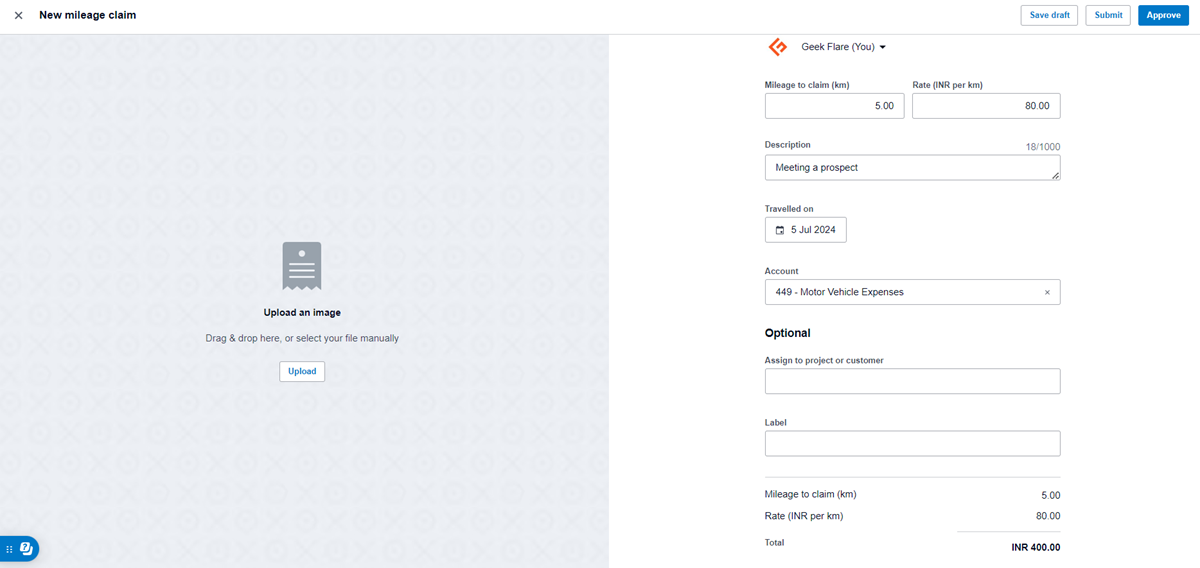

Xero allows seamless mileage tracking by letting its users enter the start and destination locations on the map. Admins can review and approve mileage claims to reimburse employees quickly. It also sends notifications, accepts receipt photos, and offers analytics data to monitor employee spending.

QuickBooks supports mileage tracking with its mobile app, which enables automatic GPS tracking from mobile phone locations. Users can also add trips manually and categorize trips as businesses for tax deductions.

QuickBooks generates sharable mileage reports with a breakdown of miles and potential deductions. It also lets users keep a mileage log according to the IRS’s requirements.

Tax Calculations

Xero allows companies to set up sales tax rates to calculate sales tax automatically. Users can also generate sales tax summaries, edit tax rates whenever needed, and prepare tax reports for return.

QuickBooks automatically calculates tax from invoices using date, location, product or service type, and customer as the base for sales tax rate. Users can access sales tax information from the Sales Tax Liability Report and get assistance from live tax experts for tax filing.

Integrations

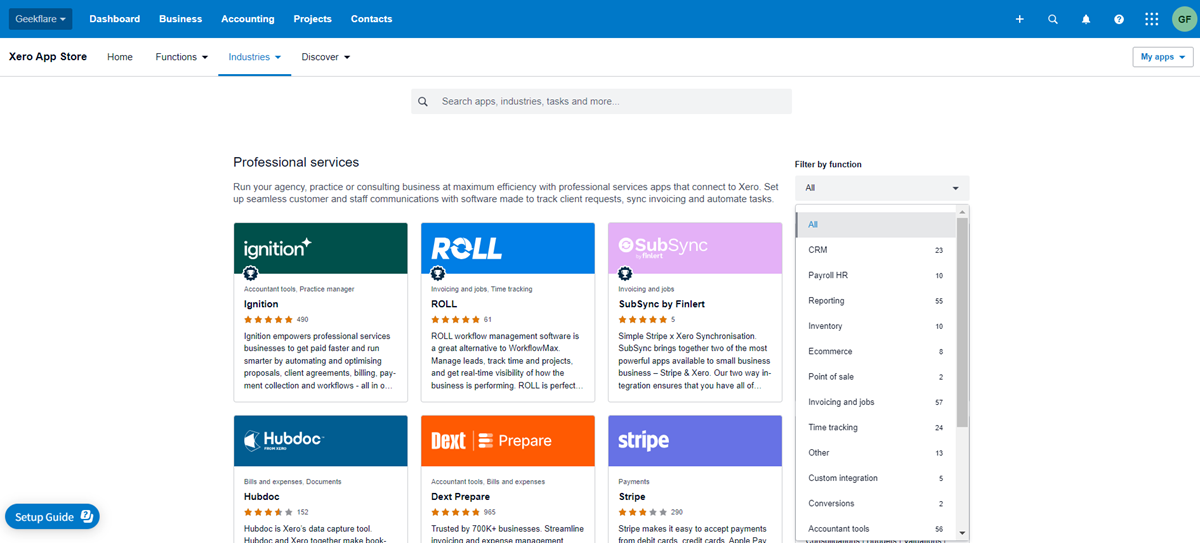

Xero integrates with various certified apps categorized by industry and function, like CRM, invoicing, inventory, and payroll. The Xero App Store allows users to filter and customize apps to suit their industry and needs. These integrated apps support flexible workflows and data syncing for a comprehensive business overview.

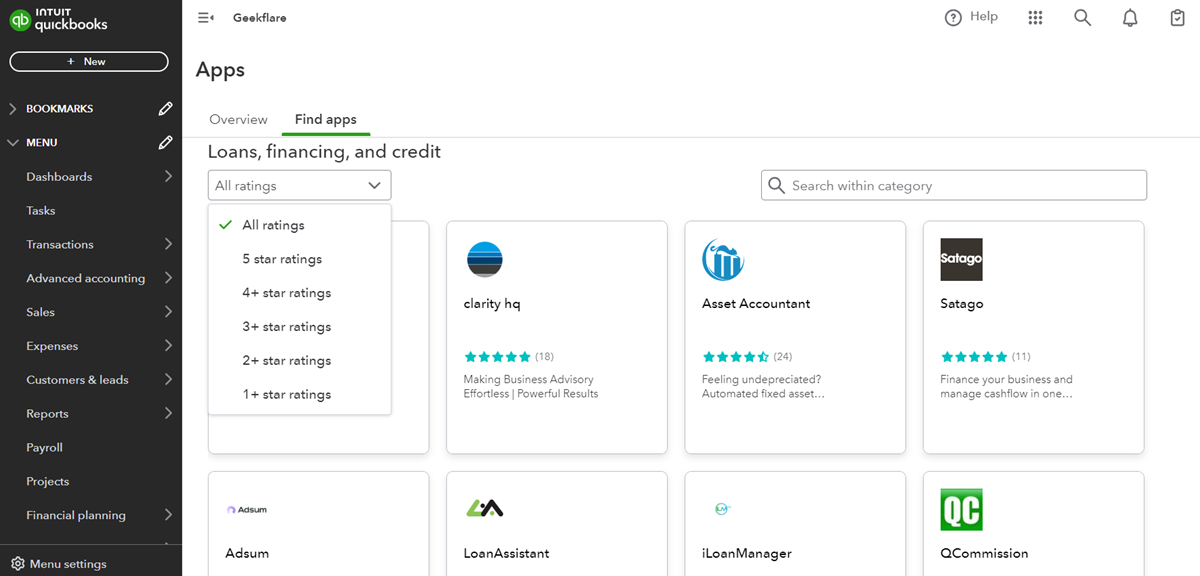

QuickBooks integrates with 750+ business apps, including Amazon Business Purchases, PayPal, Square, Etsy, Shopify, eBay and more. These integrations streamline tasks like inventory management, time tracking, and accounting, enhancing users’ financial management capabilities.

Users can access these apps in the My Apps section, which is categorized for easy navigation.

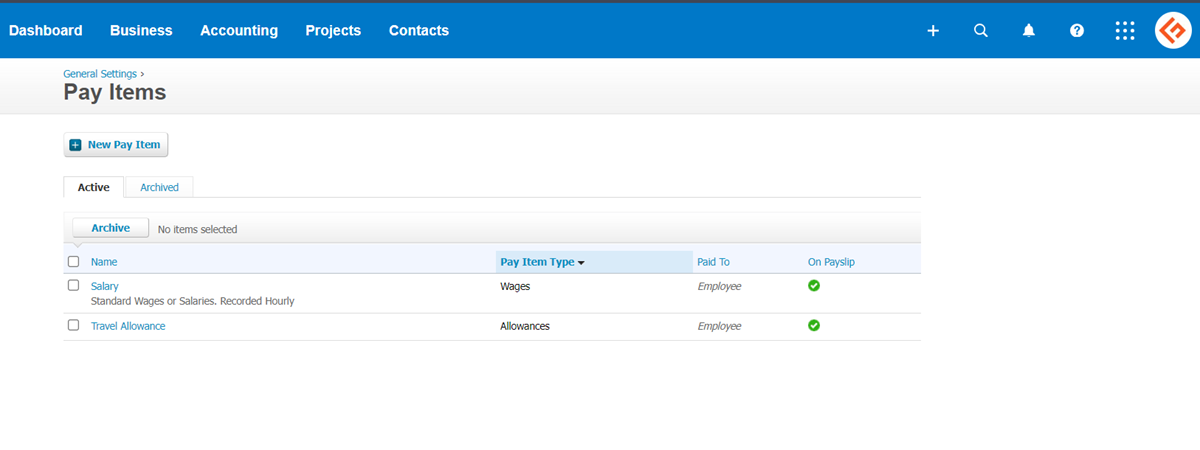

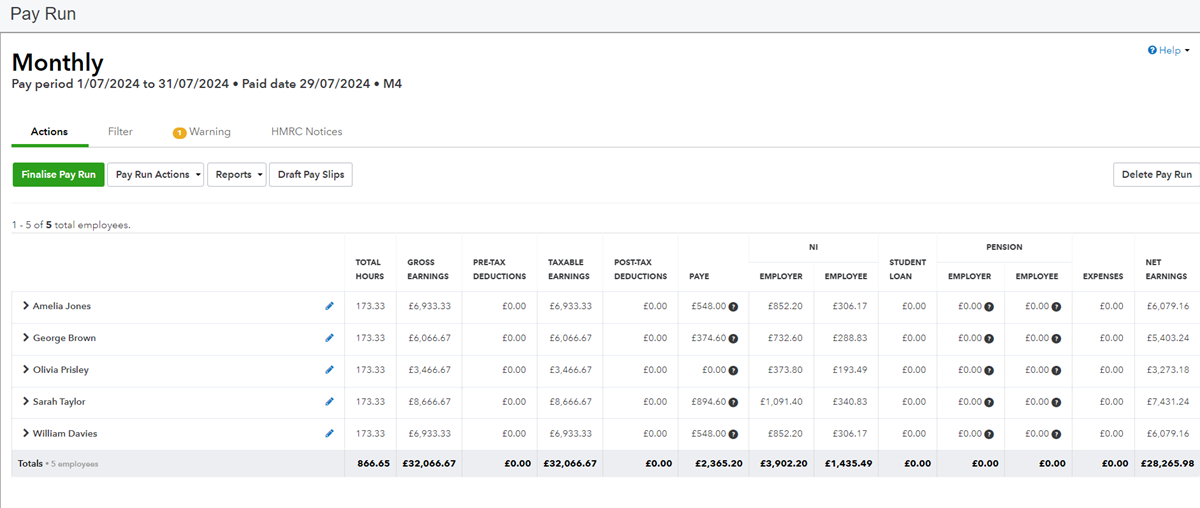

Payroll

Xero automates recurring online pay runs and stores employee data, personal details, and payroll records. While Xero doesn’t include built-in payroll accounting functionality, it integrates smoothly with Gusto for streamlined payroll processing. Users need to integrate third-party applications for advanced accounting features.

The QuickBooks payroll feature streamlines payday tasks by setting up the payroll to run automatically. Users can run payroll anytime, and the teams will get paid on time or the same day through direct deposit.

QuickBooks also accurately calculates, files, and pays payroll taxes with tax penalty protection. It also syncs with the QuickBooks Workforce app to track time for payroll.

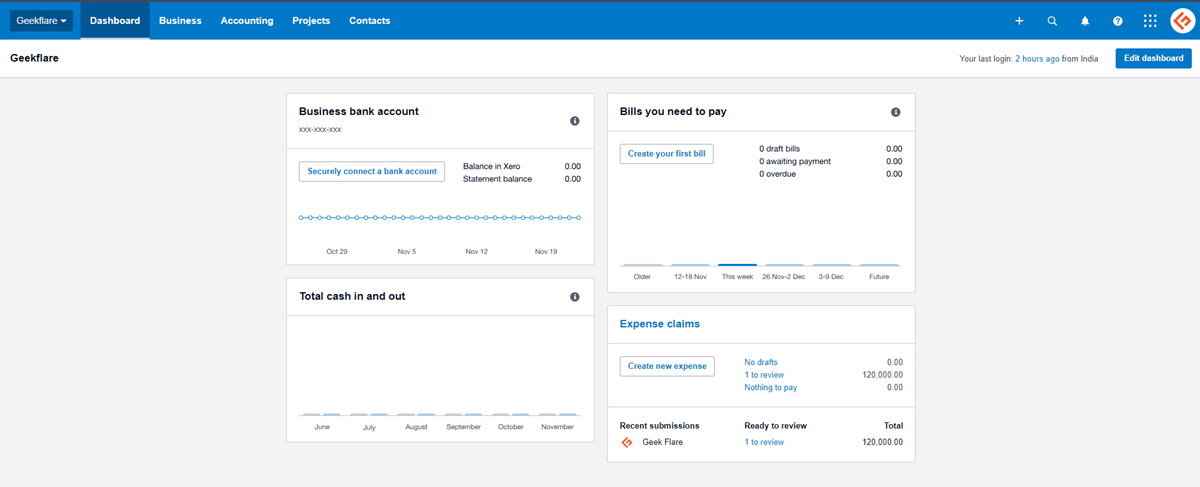

Dashboard and Reporting

Xero has an editable dashboard that lets users choose their preferred sections. Users can search and filter their contacts, transactions, invoices, bills, and purchase orders from there.

Xero also has an extensive reporting feature that lets companies create reports on various aspects of financial performance, financial statements, projects, payables and receivables, taxes and balances, and transactions. Users can mark report types as favorites and quickly access drafts, published, and archived reports through dedicated tabs.

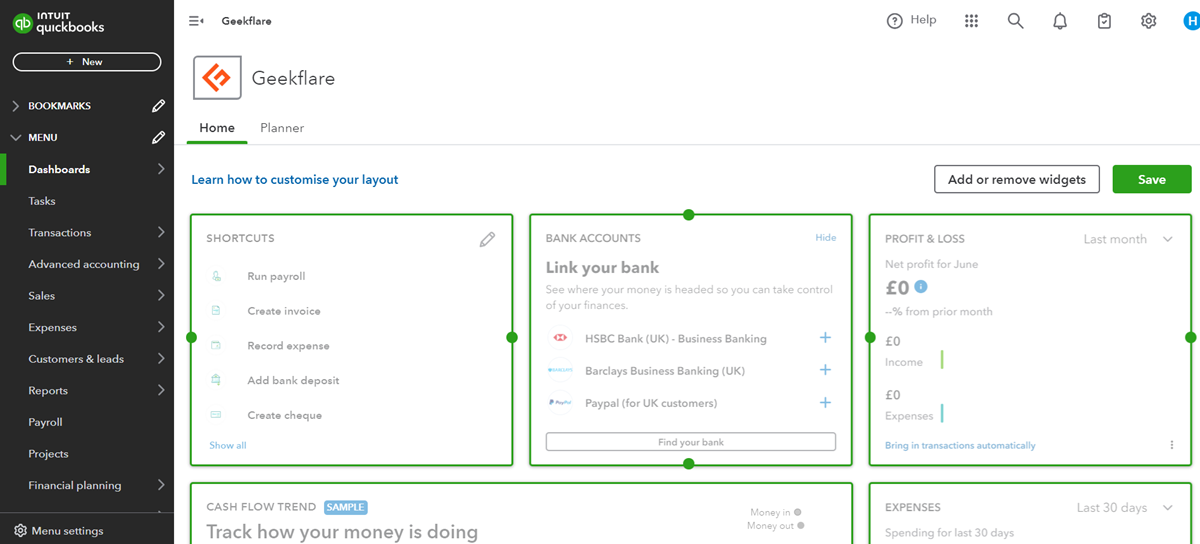

QuickBooks dashboard has a customizable home page with widgets and a planner page, allowing a real-time cash flow view. Users can personalize widget placement and hide the menu panel for distraction-free work. The dashboard also displays all activities from the audit log.

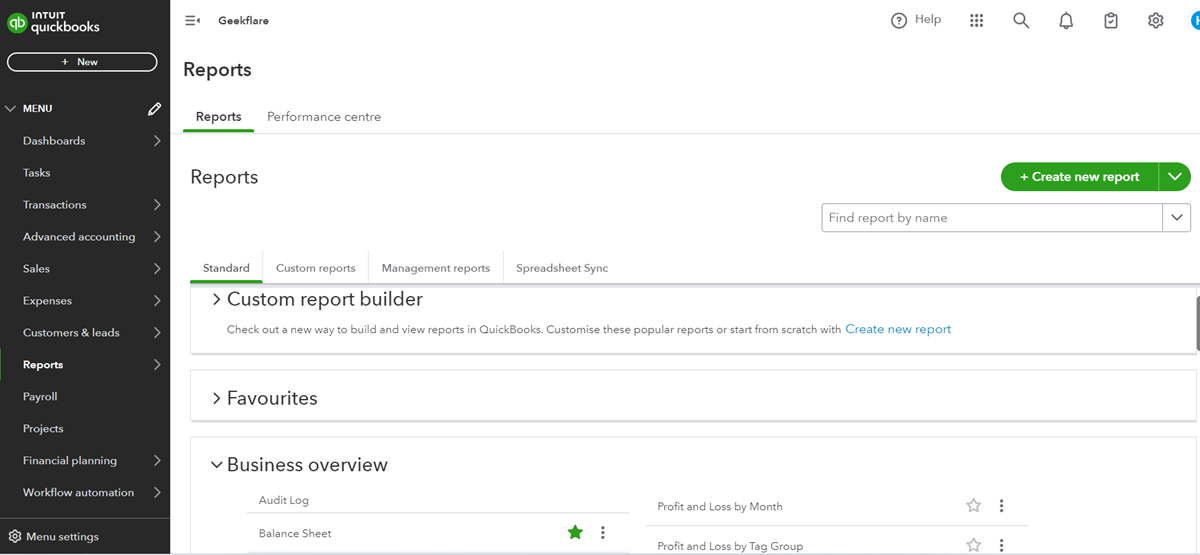

QuickBooks provides report templates for different categories, such as business overview, sales, expenses, employees, payroll, and more, to cater to various use cases.

QuickBooks also has options for management reports, custom reports, and creating new reports on invoices, sales, bills, expenses, etc. It also has a performance center section to generate visual charts on expenses, revenue by time, cash flow, net profit, etc.

Ease of Use

Xero has a clean, distraction-free interface where users can find what they want. Each dashboard section has an ‘i’ button containing basic information about it. It also offers one-click access to help articles that users can refer to anytime. However, novice users will find it difficult to navigate the software because its menu bar contains a few options.

QuickBooks interface is comparatively easier to navigate as its menu panel consists of all the key components, making it easier for anyone to find the preferred section. Notifications, tasks, searches, and settings are readily accessible from the dashboard.

When to Choose Xero

Xero is ideal for small businesses and self-employed looking for easy-to-use accounting software to perform daily bank reconciliation, bookkeeping, unlimited user access, accept Stripe payments, multi-currency support, advanced reporting, and project costing features. Learn more about Xero in our full review of Xero accounting.

When to Choose QuickBooks

QuickBooks is ideal for small and medium-sized businesses needing inventory management, tax compliance, payroll processing, and integration capabilities. It is popular among accounting firms and businesses with less than 25 users, requiring advanced invoicing customization and industry-specific features.

What are the Best Invoicing Software besides Xero and QuickBooks?

When looking for the best invoicing software besides Xero and QuickBooks, the best options will vary based on the business size. Freelancers may find Invoice2go and Bonsai to have user-friendly features, while Zoho Invoice and FreshBooks offer a comprehensive feature set suitable for small to medium-sized businesses.

Is There Any Free Accounting Software Available?

Yes, there are free accounting software applications available for companies and freelancers. Some popular options include Wave, Manager, and NCH Express Accounting, which all offer free services to their customers.

Which Accounts Payable Automation Software is Good for Streamline Payments?

Both Bill.com and Melio are reliable accounts payable automation software options. Bill.com enhances financial efficiency for small and midsized businesses by facilitating invoice sending, bill payments, and expense management. Melio is ideal for nonprofits, contractors, freelancers, and SMBs, offering robust management of business payments for clients.

-

EditorNarendra Mohan Mittal is a senior editor & writer at Geekflare. He is an experienced content manager with extensive experience in digital branding strategies.

EditorNarendra Mohan Mittal is a senior editor & writer at Geekflare. He is an experienced content manager with extensive experience in digital branding strategies.