Invoicing software helps you to produce bills for products or services you offer. This can be a standalone invoicing tool or part of accounting software and used by businesses, freelancers, and consultants to send invoices electronically and get paid.

Invoicing Software Comparison

Below is a quick comparison of the main features of the invoicing software. I have compared them based on expense tracking features, whether they allow you to schedule recurring invoices, integration with payment services and their starting price.

|  |  |  |  |  |  |  |  |  |  |  |  |  | |

✅ | ✅ | ✅ | ✅ | ❌ | ✅ | ❌ | ✅ | ❌ | ✅ | ❌ | ✅ | ✅ | ❌ | |

✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ❌ | ✅ | ✅ | ✅ | |

Stripe, PayPal, GoCardless | NetSuite, Sage Intacct, QuickBooks | PayPal, Stripe, QuickBooks | Stripe, Payoneer, Authorize.Net | Stripe, Payoneer, Authorize.Net | Stripe, PayPal, WePay | Stripe, PayPal, Authorize.Net | Intuit Payments, Stripe, PayPal | Square | Stripe, PayPal, Authorize.Net | PayPal | Stripe, PayPal | Worldpay, Stripe, PayPal | Authorize.Net, PayPal | |

Geekflare’s editorial team determines ratings based on factors such as key features, ease of use, pricing, and customer support to help you choose the right business software. | ||||||||||||||

$2 | $45 | $4.99 | $6.30 | $5.99 | $9.99 | FREE | $17.50 | $29 | $12 | 2.99% on cards | $16 | $61.92 | $69.95 (one-time payment) | |

I’ve reviewed the following best options considering invoicing templates, automation, scheduling, payment integrations and ease of use.

- 1. Xero – Best for Startups and Small Businesses

- 2. BILL – Best for Recurring Invoices

- 3. Invoice Simple – Best for Mobile Invoicing

- 4. FreshBooks – Best for Freelancers and Consultants

- 5. Invoice2go – Invoicing, Estimation and Business Bank Account

- 6. Invoicely – Best for Time Tracking and Invoicing

- 7. Zoho Invoice – Best Free Invoicing Software

- 8. Intuit QuickBooks – Best for Accounting Integration

- 9. Square Invoices – Best for Integrated Payments

- 10. Invoice Ninja – Accept Payments through Stripe, PayPal and More

- 11. PayPal Invoicing – Best for PayPal Business users

- 12. Wave – All-in-one Accounting and Invoicing Tool

- 13. Sage 50 – Best for Accounting, HR, and Payroll

- Show less

You can trust Geekflare

At Geekflare, trust and transparency are paramount. Our team of experts, with over 185 years of combined experience in business and technology, tests and reviews software, ensuring our ratings and awards are unbiased and reliable. Learn how we test.

1. Xero

Best for Startups and Small Businesses

Xero is a cloud-based intuitive invoicing software. It is an affordable solution with all the basic invoicing features and scalability required for small and medium businesses. Founded in 2006, Xero now has 3.95 million subscribers.

Xero supports multiple payment methods, such as debit cards, credit cards, and direct debit. It allows users to choose intervals for sending payment reminder emails to the clients while providing quick identification of unpaid invoices from the mobile app. Users can view if the client has viewed or paid the invoice.

Above is a screenshot of Xero’s invoicing tool dashboard. You can add and edit invoice details, including contact information, items, prices, tax rates, and payment options. Users can save, preview, approve, or email the invoice directly from the interface, ensuring a smooth invoicing workflow. Their tips and tricks feature is very helpful for beginners.

More information about Xero is mentioned in our detailed review of Xero accounting.

Top Features

- Design professional invoices, with logos, custom fields, and standard messages.

- Automate Recurring Invoices

- Generate and send invoices on the go using mobile invoicing app.

- Track paid and pending invoices, with automated reminders before and after due dates.

- Send multiple invoices at once and import invoices in bulk using CSV.

- Convert customer quotes into invoices instantly.

Pros

24/7 online support for prompt guidance on any issue.

Android and iOS apps for any-time access.

Pay Now button for one-click payment.

Cons

Lacks complex features required by large enterprises.

No phone support.

Xero Pricing

Xero offers 3 plans.

Starter: $2/mo

Standard: $4.7/mo

Premium: $8/mo

2. BILL

Best for Recurring Invoices

BILL is a proficient financial management platform with powerful invoicing functionality. Ideal for small and medium businesses, it automates back-end financial processes. It simplifies how businesses connect with their clients and suppliers. 85 of the top 100 US accounting firms use BILL.

BILL allows users to generate invoices quickly with its built-in templates. They can customize the templates using their brand logo, choosing the necessary fields and organizing them as they choose. BILL also supports saving customized templates for future use so users do not have to create from scratch whenever they want to send an invoice.

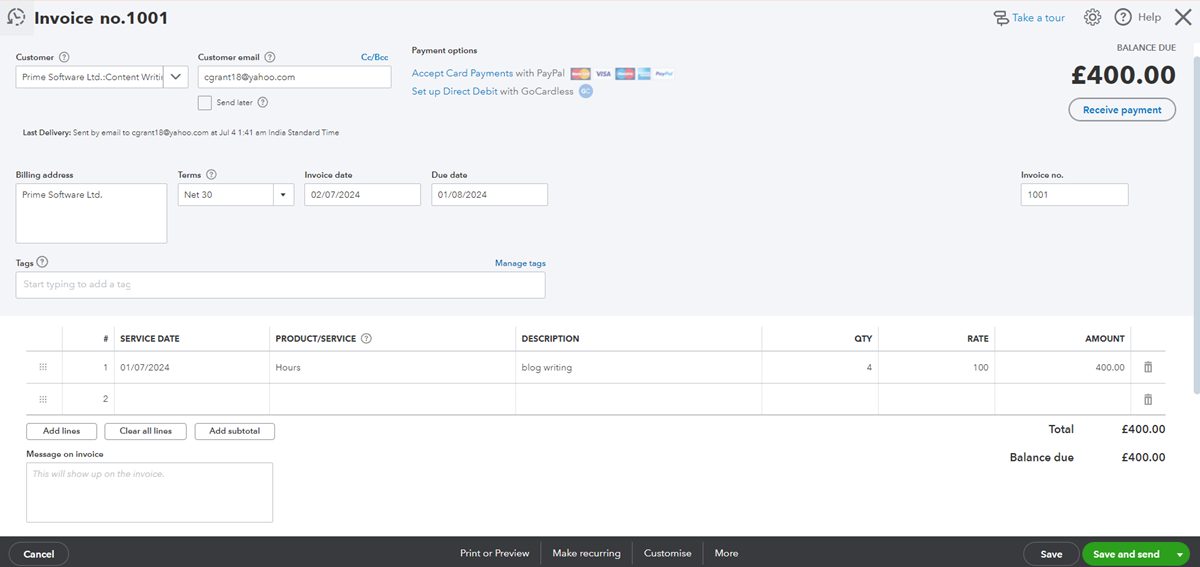

Here’s a screenshot of Bill’s invoicing tool. It allows users to create and customize invoices by adding customer details, selecting payment methods, setting invoice frequency, and listing charges. You can use different templates and customize them accordingly.

Top Features

- Create, manage, and send invoices with a preset schedule

- Intuitive payment portal to send money via credit cards or ACH

- Direct deposit of paid invoice into the bank account

- Professionally designed invoice templates with customization options

- Recurring direct debit from customer’s bank account (with their consent)

- Track invoice status with email notifications and invoice tracker

- Support sending recurring invoices to regular clients

Pros

Integration with accounting tools like Xero, QuickBooks, and Sage Intacct

Monitor incoming payments to know when to expect payments

Automatically send payment reminders to the clients

Cons

Email support is not available

Does not offer 24/7 customer support

Available only in the US

BILL Pricing

BILL offers 4 plans.

- Essentials: $45/user/mo

- Team: $55/user/mo

- Corporate: $79/user/mo

- Enterprise: Custom

3. Invoice Simple

Best for Mobile Invoicing

Invoice Simple is an app-focused invoicing tool that’s most helpful to freelancers, contractors, and small business owners to send invoices on the go. It offers a estimation tool to send estimates for approval and convert them into invoices automatically as soon as the estimate is approved by the client. It also has an expense tracker that lets you upload your receipts and automatically captures expenses from them.

Invoice Simple offers multiple customization options to let you upload logos and select colors as per your brand. It has reporting features to show you itemized list of amounts due and amounts paid sorted by clients.

As you can see in the above screenshot, our team has created a sample invoice with the Geekflare logo and our brand color theme. Users can also request reviews by enabling the ‘Request Review’ option from clients, enhancing their business credibility while managing invoices efficiently.

The PayPal toggle, if enabled, lets customers pay directly through PayPal using their credit cards, debit cards, or PayPal account. This feature allows businesses to collect payments faster and more conveniently by integrating an online payment gateway instead of relying on manual bank transfers or cash payments.

Top Features

- Customized invoice templates

- Integration with PayPal to enable quick payments

- Estimate creation for client approval before product/service delivery

- Automatic conversion of estimates to invoices

- Expense tracking by uploading receipts and details captured through OCR

- Itemized reports of payments made and payments due

- Andoid an iOS apps for mobile invoicing.

Pros

Free profit margin calculator to help you set the right price on your estimate

Invoice templates in multiple formats – pdf, Google Docs, Google Sheets, Word, Excel Etc.

Data encryption to ensure your data is always safe.

Unlimited estimates on all plans.

Cons

Restrictive pricing, forcing small businesses sending around 50 invoices per month to opt for the Premium plan

Users on G2 have complained about delays in customer support and cancellation.

Online payments available only in limited countries

Pricing

Invoice Simple offers 3 plans.

- Essentials: $4.99/mo offering 3 invoices

- Plus: $13.49/mo offering 10 invoices

- Premium: $19.99/mo offering unlimited invoices

Discount Offer: 50% OFF for the first 3 months

4. FreshBooks

Best for Freelancers and Consultants

FreshBooks allows you to create customized yet professional-looking invoices for your organization or brand. FreshBooks features, like automated invoicing, payment reminders, and accounting integration, help streamline the invoicing process for businesses and freelancers.

FreshBooks offers a mobile app to send and track invoices from anywhere. It provides users offer discounts wherever applicable. The software enables the forecast of workload and collects retainers in advance. It provides options to schedule reminders to send to clients.

Read our detailed FreshBooks Review.

FreshBooks’ invoice tool is easy to use and has all the necessary options, including invoice customization, recurring billing, payment reminders, and online payment acceptance. The layout is clear, making it simple to create and manage invoices efficiently.

Top Features

- Create customized invoices by adding logo and brand color

- Automatic tax calculation for compliance.

- Choose your preferred currency for payment.

- Request clients to upfront deposit a flat amount or percentage of the invoice value.

- Set up recurring invoices.

- Track time and easily include the expense in the invoice.

Pros

Duplicate invoice feature to save time.

Preview the invoice before sending it to avoid human error.

Customize payment terms as the business needs.

Automatic inventory update based on invoiced items.

Phone support to help you when you need it.

Cons

No native integration support for QuickBooks.

Limits on users and billable clients.

Pricing

FreshBooks has 4 pricing plans:

- Lite: $6.3/mo

- Plus: $11.4/mo

- Premium: $19.5/mo

5. Invoice2go

Invoicing, Estimation and Business Bank Account

Invoice2go is an application designed to facilitate rapid payment through the swift sending of invoices. For US users, Invoice2go offers a no-fee small business bank account to ease payments and receipts.

With Invoice2go, users can share invoices through social media platforms like Facebook Messenger and WhatsApp. It is possible to accept payments using mobile apps through credit cards, debit cards, PayPal, Google Pay, and Apple Pay (iOS app).

Invoice2go sets up automatic reminders for unpaid invoices to avoid chasing the clients manually. It allows client approval and deposits into invoices automatically.

Above is a sample invoice generated by Invoice2go. It is more suitable for quick invoice generation on mobile. You can set the currency before getting started, use different templates, and choose the best one for you. It also allows you to add discounts and other necessary details quickly.

Top Features

- Customize invoice with company name, logo, and brand color.

- Quickly send invoices from any location.

- Send invoices via email, text, or other platforms.

- Notification upon invoice viewing.

- Track outstanding and unpaid invoices.

- Track time and include that in the invoice.

Pros

Import customer information from the phone to the software.

Money-back guarantees on plan cancellation within 30 days of purchase.

Support through multiple channels like email, chat, and phone.

Cons

Basic invoicing features suitable only for SMBs.

3.5% card payment fees for the Starter plan.

Restrictive pricing, with only 3 and 5 invoices in the starter and professional plans, which hardly meets the needs of a small business.

Pricing

Invoice2go’s pricing plans are listed below.

- Starter: $5.99

- Professional: $9.99

- Premium: $39.99

6. Invoicely

Best for Time Tracking and Invoicing

Invoicely is one of the few invoicing tools offering a free forver plan, making it very useful for freelancers, contractors and startups to send invoices. It allows the user to track time worked and send hourly billed invoices to clients. Invoicely has iOS and Android mobile invoicing apps to allow ease of billing and status checking.

Invoicely offers useful reports like monthly and yearly summaries of earnings and expenses, accounts payable and receivable to let you have a bird’s-eye view of how your business is performing.

Invoicely’s invoicing interface, as shown above, offers features like client management, expense tracking, and business settings for customization. The “Track” feature helps businesses keep an eye on payments and invoices, ensuring better cash flow management. The “Estimate” feature enables users to create and send professional estimates or quotes to clients, which can be converted into invoices upon approval.

Top Features

- Customizable invoices in multiple languages and currencies

- Estimate feature to get client’s approval at the beginning of a contract and conversion to invoice after approval

- Recurring invoice feature to send periodic invoices and payment reminders

- Expense tracking to have control over business expenditure

Pros

Generous free forever plan with 5 invoices per month in multiple currencies and upto 3 clients

256-bit HTTPS encryption to ensure data security

Multiple payment gateway support to receive payments

Multiple businesses supported from within the same Invoicely account.

Cons

Support is available only via email, no phone support

Limited customization options

Pricing

Invoicely offers a free plan with features sufficient for a freelancer or a startup with limited clients and invoices. For more clients and advanced features like recurring invoices, it offers 3 paid plans as given below.

- Basic: $9.99/mo

- Professional: $19.99/mo

- Enterprise: $29.99/mo

7. Zoho Invoice

Best Free Invoicing Software

Zoho Invoice is a free invoicing software. It offers 4 template designs for invoices.

You can upload the organizational logo and choose the colors for the template background, label, and font. So, if personalization is your priority, Zoho Invoice is the best software for customizable invoices.

Zoho Invoice provides a self-service portal for clients to view invoices and make payments. It allows users to generate 30+ real-time business reports to track business performance. They are able to track unbilled expenses to get reimbursed by the clients. It provides an option to log billable minutes in a straightforward calendar format.

Zoho Invoice has a simple and organized interface for creating and managing invoices. You can easily add items, set due dates, and track payments. It also supports recurring invoices, payment links, and advanced billing features as shown in the below sample invoice we have generated.

Top Features

- Create a professional invoice from a gallery of templates.

- Automate the process of recurring invoices.

- Send invoice using email, text, customer portal, or sharing link.

- Track the invoice status.

- Automated payment reminders to follow up.

- Convert approved quotes into projects or invoices.

- Dashboard with graphs and charts.

- Software UI is available in 20+ languages.

Pros

Small business invoicing software is available for free.

PCI-DSS compliant platform with 256-bit SSL encryption.

Two-factor authentication for better security.

Regular detection of viruses and intrusion.

Android and iOS apps for on-the-go service.

Cons

No integration support with Zoho Inventory.

Not suitable for managing a high volume of invoices.

8. Intuit QuickBooks

Best for Accounting Integration

Intuit QuickBooks Online is an accounting software that functions as a smart invoice software for small businesses. It lets you create customized invoices quickly and saves time for SMBs with limited manpower.

Given its popularity as accounting software, QuickBooks Online eliminates the need for organizations to adopt a separate invoicing application, making it an ideal choice for small and medium-sized businesses.

With Intuit Quickbooks, you can receive payments through QuickBooks Payments at a 4x faster speed. You can manage invoices and payments from one platform, and also create progress invoicing to get paid on project milestones. It allows tracking of partial payments and payment progress automatically as per the original estimate.

The sample invoice generated by Intuit QuickBooks shows how it lets users create detailed invoices with customizable fields for service dates, detailed descriptions, and pricing. It provides multiple payment options, including card payments via PayPal and direct debit via GoCardless, making it easier for clients to make payments.

Intuit QuickBooks is not really an invoicing software but a full-fledged accounting tool of which invoicing is one part. You need to purchase the full accounting software to be able to use the invoicing feature.

Top Features

- Create customized invoices with logos, colors, and font.

- Automatically include billable hours from QuickBooks Time and Google Calendar.

- Track invoice status in real-time for customer view and payment.

- Set up recurring invoices at your preferred intervals.

- Options to print the invoice later and include unbilled charges.

Pros

30-day free trial.

Free mobile apps to manage business on the go.

Payment dispute protection.

If you use Intuit Quickbooks accounting, invoicing is included as part of the package.

Cons

No free plan.

Limited integration support.

This is not a standalone invoicing software, so if you are using other accounting software, this may not be the best choice

Intuit Quickbooks Pricing

Intuit Quickbooks Online offers the below plans that include the invoicing feature with unlimited invoices.

- Simple Start: $17.50/mo

- Plus: $49.50/mo

- Advanced: $117.50/mo

9. Square Invoices

Best for Integrated Payments

Square Invoices is an invoicing solution that offers POS hardware, software, and an online store app. You can easily integrate Square Invoices with these services to streamline the business process and seamlessly receive payments. If you are looking for an invoicing app that can easily integrate with your online store, Square Invoices is the best app for you.

Square Invoices integrates with QuickBooks, Xero, FreshBooks, PandaDoc, and other business apps. It allows clients to pay through credit card, ACH bank transfer, Apple Pay, Google Pay, or Square gift card. It automatically applies tax and discounts to your invoice items while supporting connection with Square Hardware to accept in-person card payments.

As shown in the above image, Square Invoices provides a simple interface for creating and sending invoices, allowing users to add customers, invoice details, and personalized messages, along with an AI assistant. The right-side panel offers flexible options, including scheduling invoices, selecting accepted payment methods (credit, debit, ACH, Cash App), and saving payment details for future transactions, making payments easier for clients.

Top Features

- Create and send online invoices via email, text, and shared link.

- Real-time invoice status tracking.

- Convert approved estimates into invoices.

- Recurring billing is set up for daily, weekly, monthly, and yearly intervals.

- Request a part of the invoice amount as an upfront deposit.

- Itemized digital or paper receipts.

- Batch invoicing and multi-package estimate.

- Customize invoices with preferred fields, fonts, colors, and layouts.

Pros

Free plan with no monthly fees.

Free Square Invoices app.

Direct refund issue from app or dashboard.

Item library to add items in invoices in one click.

Cons

Does not support partial payment.

Apply processing fees for online transactions.

Pricing

Square invoices have 3 pricing plans, as listed below.

- Free Plan

- Plus: $29+Processing Fee

- Premium: Custom

10. Invoice Ninja

Accept Payments through Stripe, PayPal and More

Invoice Ninja is a suite of tools essential for invoicing. Invoice Ninja is the ideal invoicing software for freelancers and small businesses, as it allows them to send unlimited invoices for up to 20 clients with its free plan. Invoice Ninja has over 200K users worldwide.

Invoice Ninja allows users to choose from a large collection of templates for every industry and receive online payments through Stripe, PayPal, Apple Pay, Square, and more. It has a client-side portal to view invoices, documents, and payment history and provides automatic currency exchange and sales tax calculation.

Above is a sample invoice generated by our team on Invoice Ninja. It offers features like discounts, partial payments, and purchase order tracking, allowing for greater flexibility in billing.

The left-side menu includes options for recurring invoices, quotes, credits, vendors, and expense tracking, making it useful for businesses managing multiple clients and financial transactions. Additionally, the platform supports projects and task management, helping users track both invoicing and workflow management in a single dashboard.

Top Features

- Product library tool to generate invoices and quotes.

- Attach files to client invoice.

- One-click payment from the invoice.

- Accept payments from credit card, ACH, and PayPal.

- Notification upon invoice viewing by clients.

- Instant update upon receiving payments.

- Customization with company logo and changing the invoice color.

- Recurring invoices for automatic billing of long-term clients.

- Create custom invoice fields like client details and invoice products.

- Automatic conversion of quotes into payable invoices.

- Bulk email invoicing and product item library.

Pros

Separate apps for Windows, Mac, Linux, iOS, and Android.

Integration with thousands of apps through Zapier, Integrately, Pabbly, etc.

Invoice clients in all major global currencies and languages.

Multi-factor authentication and secure login for security.

Generous free plan with 20 clients and unlimited invoicing

Cons

Not scalable enough for large companies.

It is a bit difficult to set up for those who are not tech-savvy.

Pricing

Invoice Nija offers the below paid plans in addition to a free forever plan.

- Ninja Pro: $12/mo

- Enterprise: $16/mo

11. PayPal Invoicing

Best for PayPal Business users

PayPal Invoicing is a feature of PayPal, an online payment system for sending and receiving money across geographies. It offers an integrated payment system, which makes it easier to get paid through the same platform, making it the best software for online payment integration.

PayPal invoicing allows users to send invoices using emails, sharable links, or QR code. It manages everything from the merchant dashboard and offers payment methods like credit/debit cards, installments, Apple Pay, and Venmo. PayPal invoicing is available in more than 200 countries.

Top Features

- Customizable invoice templates.

- Real-time preview with invoice creation guide.

- Save invoices as templates.

- Add shipping details.

- Choose from 25+ global currencies to get paid.

- Add taxes, discounts, and special notes to the invoice.

Pros

Clients can pay without a PayPal account.

No monthly subscription fees.

An easy-to-use platform for anyone.

PayPal Business app.

Cons

Complex transaction fee structure.

Only template customization is available.

Pricing

PayPal charges 2.99% + $0.49 per USD transaction on card payments and Apple Pay.

12. Wave

All-in-one Accounting and Invoicing Tool

Wave is a small business invoicing software that allows companies and individuals to set up recurring invoices and automatic credit card payments for repeat customers. It allows you to switch between automatic and manual billing at any time. For these reasons, Wave is the top choice for subscription billing.

Wave provides a single dashboard to manage customers and cash flow. It allows users to accept online payments at a discounted rate with expense tracking by digitally capturing receipts. Wave supports Visa, Visa Debit, Mastercard, Mastercard Debit, and American Express.

We tried creating a sample invoice with our logo and preferred brand colours and it looked pretty impressive. The left-side menu includes features like sales & payments, accounting, payroll, tax filing, and reports, helping businesses handle their entire financial workflow in one place.

The banking option allows users to connect their bank accounts for automated transaction tracking, making reconciliation and financial management seamless. It also offers a tax filing option to help you file taxes directly from Wave without requiring a separate third-party tool.

Top Features

- Create unlimited invoices and bills with a history

- Custom invoices with logo and brand color.

- Create bookkeeping records.

- Automatically import bank transactions.

- Generate reports to get insight.

- Categorize and auto-merge bank transactions.

- Accept online credit card payments or in person.

- Recurring billing with automatic payments.

- Instant notification on invoice view, payment, or due.

- Automated reminder emails.

Pros

Web-based software with mobile apps.

PCI-DSS Level 1 service provider.

256-bit SSL encryption.

Email and live chat support for customers.

Cons

Phone support is not available.

Live chat support is not available 24/7.

Pricing

Wave offers a free starter plan and a Pro Plan costing $16 a month if you would like to use the bank transaction auto-import feature.

13. Sage 50

Best for Accounting, HR, and Payroll

Sage 50 offers an impressive invoicing tool for small businesses with a focus on accounting automation. Sage 50 helps to automate processes such as creating invoices from accepted quotes, setting up recurring invoices at scheduled intervals, and pulling data from uploaded receipts, making it the best software for invoice automation.

Sage 50 allows sending custom reminders to the customers and the attachment of documents to invoices for promotion. It integrates with Google Drive and allows the addition of an association logo to show accreditation.

As seen in the above sample invoice generated, Sage 50 provides a detailed sales invoicing system with customizable invoice fields, allowing users to set invoice dates, references, and billing addresses.

The top menu includes options like Summary, Sales, Cashbook, Contacts, Banking, and Reports, helping businesses manage financial transactions, customer relationships, and cash flow efficiently. The invoicing system supports categorizing line items under different sales or income types, enabling better financial tracking.

Top Features

- Create beautiful and professional invoices.

- Track invoice status like unpaid invoices.

- Convert approved quotes into invoices.

- Customize invoices with line items, headings, colors, and company logos.

- Automatic recurring invoice to avoid the manual error.

- Invoice status shows if it is viewed and paid.

- Allow payment from the invoice.

- Live exchange rates to convert currencies.

- Invoice tracking on the go with mobile apps.

Pros

Stripe-powered Pay Now button for one-click payment.

Desktop and mobile apps.

Advanced reporting.

Cons

The user interface is slightly complex

The mobile app lacks features like bank feeds and foreign currency invoicing.

The invoicing feature is bundled with the accounting software and it cannot be used as a standalone feature.

Pricing

Sage 50 is a full-fledged accounting software that includes the invoicing feature. It offers 3 plans.

- Pro Accounting at $61.92/mo

- Premium Accounting at $103.92/mo/user

- Quantum Accounting at $177.17/mo/user

Other Notable Invoicing Software

In addition to the above, the below invoicing software deserve honorable mentions.

- Invoice Expert – Best Windows Invoicing Tool

- NCH – Best Desktop Invoicing Software

- BillingPlatform – Best for Enterprise Billing

- Paymoapp – Best for Agencies and Consulting firms

- Payoneer – Worldwide coverage (190 countries and 70+ currencies)

- Bonsai – Best for Freelancers

- Harvest – Best for Time Tracking and Invoicing

What is Invoicing Software?

Invoicing software simplifies the invoicing process, which includes creating, sending, and tracking invoices. Most online invoicing software applications offer invoice templates with customization facilities. Thus, companies can quickly generate an invoice for various use cases while being consistent with branding using the company logo and brand color.

Invoicing software programs also support automatic tax calculation, duplicate invoices, recurring invoices on pre-determined intervals, invoice download, invoice sharing via email, and sending automatic reminders to clients.

Many invoicing software tools enable users to check the real-time status of invoice viewing and making payments. The mobile app feature allows access to invoice data on the go. These applications also generate reports and analytics data to offer insights into different aspects of the invoice. Understanding the basic accounting terms will help maximize the use of these tools for managing the business’ finances effectively.

How To Choose an Invoice Software?

To select the right invoice software for your business, it’s essential to start by evaluating your business needs. While doing that, you must consider industry-specific requirements, the number of invoices, and the complexity of tasks and consider these 11 features.

- Customization of invoices or invoice templates

- Automation of invoicing tasks

- Payment processing fees

- Reporting and analytics

- On-the-go access through mobile devices

- Free trial to check the software functionality

- User-friendly interface with no learning curve

- Helpful customer support and resources

- Scalability to accommodate your growing business needs

- Security and compliance features to protect customer data

- Integration with your existing technical stack

How Do Invoice Software and Billing Software Differ?

Invoicing software and billing software serve almost similar purposes in generating an invoice or bill against some products or services. However, there are some differences between invoice software and billing software, which are as follows:

- Invoicing software generates invoices for B2B clients. Billing software creates bills for B2C scenarios.

- Invoicing software creates invoices before the transaction. Billing software generates bills after the transaction.

- Invoice applications are used in long-term projects, bulk purchases, and contract services. Billing software is used in retail services and one-time upfront payments.

- With invoicing tools, users create complex invoices with detailed breakdowns of services. Billing software creates much simpler bills with only basic information.

To learn about billing applications ideal for other use cases, read this article on the best subscription billing software.

What Are the Best Billing Software for Team Managers?

Harvest is the best billing software for team managers, as it lets them track the time invested by the team members into certain tasks and create invoices accordingly. Harvest also converts timesheets into invoices automatically.

You may read this article on time billing software to learn about other time-tracking applications.

To choose the right billing software for team managers, make sure the software offers the following features:

- Integration with project management or task management tools

- Time tracking of team members and generating invoices based on the tracked time

- Collaboration with team members for access and contribution

- Approval workflow for invoices to set a maximum limit for expenditure

- Access control for each user to avoid unauthorized access to sensitive data

Frequently Asked Questions (FAQs)

No, invoicing software is not the same as accounting software because both have different purposes to serve. Invoicing software, also known as billing software programs, allows users to create, manage, and send invoices to clients more efficiently and flexibly. Additionally, for managing incoming payments and customer balances, businesses may also need dedicated accounts receivable software to streamline their cash flow and collections process.

Accounting software is a comprehensive application that manages all the financial aspects of a business. It is a suite of features, including accounts payable/receivable, payroll processing, inventory management, quotation sharing, banking and reconciliation, income statements, bookkeeping, invoicing, and financial reporting. It adheres to established accounting principles, which govern how financial data is recorded and reported.

Yes, FreshBooks is better than QuickBooks Invoice. While both offer invoicing services, FreshBooks comes with some unique features, such as upfront deposit, automatic tax calculation, and late fee inclusion where applicable. QuickBooks offers limited integration support.

The biggest advantage of FreshBooks is its intuitive user interface. Anyone can start using it without any training. Comparatively, QuickBooks comes with a steep learning curve.

Read this detailed comparison of these applications in this FreshBooks vs QuickBooks article.

The cost of invoicing software varies from application to application. While some invoicing tools are free, others come with different subscription tiers.

For example, plans for invoicing software like Xero and FreshBooks start from $3.76 and $5.7,, respectively. There are also mid-range invoicing programs like Wave (starts at $16) and Bonsai (starts at $21).

Yes, Zoho Invoice, Harvest, Invoice Ninja, and Invoice Expert offer free plan with the basic features. Alternatively, you can use Geekflare online invoice generator to create a FREE invoice in few seconds.

Yes, Bonsai is a CRM software with an online invoice generator feature. While it lets you manage your existing clients and keep projects organized, you can also use the invoice generator to bill clients.

The invoice generator tool allows you to include the client name, address, quantity, unit price, tax, and due date to create a full-fledged invoice in a few seconds. It also lets you download the invoice to share with the clients.