The global environment of business is shifting constantly, which requires solid decision-making. You must sharply evaluate the financial viability of a project along with the strategies and investment to get the best output. This is where Cost-Benefit Analysis (CBA) comes into play for anyone looking to assess any financial implications and maximize the return on investment (ROI).

When it comes to getting success, the art of decision-making is the heart of every business. Cost-benefit analysis assists organizations in navigating through various choices, weighing the pros and cons, and choosing the best course of action. A single decision can make or break a company. Thus, businesses can make smart, data-driven decisions that help them balance cost & benefit to maximize profitability.

In this article, I’ll dive deep into CBA and the best possible scenarios to conduct it. Plus, I’ll discuss the steps to perform CBA, the pros & cons, and some real-life applications of it.

This comprehensive guide will help you to understand what is CBA, examining the ideal scenarios for its application, the step-by-step process, its advantages and limitations, and real-world case studies to illuminate its impact on business decision-making.

What is a Cost-Benefit Analysis?

The cost-benefit analysis (CBA) is an organized quantitative process that is implemented to evaluate the financial sustainability of different projects, regulations, or investments. The foundation of this process lies in meticulous economic principles.

This structured approach gives you a comprehensive assessment of the financial costs and benefits related to a specific project. Thus, the analysis will make it easy for you to determine whether your investment makes sense from a business perspective.

Let’s say there are two different projects where the first one has a cost-benefit ratio of 1.5 ($9000/$13500), where the total cost is $9000 and benefits of $13500.

However, another project has a cost-benefit ratio of 1.85 ($12000/22200), with an expense of $12000 and benefits of $20000. Between these two, the second project is more feasible because of its cost-benefit ratio.

An alternative scenario may include deciding to develop a new product at a cost of $150,000 and expecting to sell $120,000 worth of units (at a price of $3 each).

Therefore, the sales advantages come to $240,000. This project selection would have a net benefit of $90,000 ($240,000 – $150,000), meaning it would be profitable.

This kind of data-driven decision-making is applied in both reputed businesses as well as startups. It can be applied to almost any kind of decision-making process, whether it is related to business or any other process.

Key Concepts of CBA

The systematic approach of Cost-Benefit Analysis powers businesses to make the best decision based on an estimated budget against anticipated benefits.

I would like to clarify the key concepts that guide this important instrument for making decisions:

- Identifying Scope: Laying down the precise details of the suggested service offering, new project, program, or strategic initiative.

- Estimating Demographic: Identifying the important stakeholders, parties, and people that the decision will affect. Setting a timeline for the decision-making process.

- Calculating Cost: Calculating the costs, which can be implicit (indirect or intangible costs) or explicit (direct expenses having a definite monetary value).

- Examining Benefits: Calculating the benefits from deciding or action minus the expenses related to the action. Benefits can be intangible or tangible.

- Making Decisions: A quantitative evaluation of the total cost and benefits to figure out if the benefits exceed the expenses.

- Analyzing Sensitivity: Used to ascertain the effects of varying independent variable values on a given dependent variable using a certain set of assumptions.

- Discounting: Used to make a comparison of benefits and costs according to time intervals.

- Evaluating Risks: Each project comes with a unique collection of challenges or risks. A comprehensive risk assessment can assist organizations in anticipating issues and creating plans to address them.

- Reviewing After Implementation: Reviewing the project once it’s been completed and contrast the estimated expenses and benefits with the real ones.

Ultimately, a well-designed CBA is a crucial tool for corporate decision-making. It can highlight possible costs and benefits in a form that is simple to comprehend and compare.

When to Conduct a CBA

Cost-benefit analysis (CBA) is a valuable tool for assessing the economic pros and cons of a decision. It’s particularly useful for significant decisions that could impact your team or project’s success. Here are some instances where a detailed CBA can be beneficial:

Program Effectiveness

A CBA can be carried out if there are doubts about the efficacy of an existing program or if there are alternatives that would provide better results. This study will assist in determining if the existing program is meeting the benefits linked to the costs it is projected to provide.

Latest Investment

To evaluate the sustainability and profitability of new investments, businesses often conduct CBA. Thus, they can assess whether an investment will be successful by projecting cash flows and accounting for time value in the estimated net benefits. It assists in making well-informed judgments regarding proceeding with the investment.

Decision Making

CBA can be effective if you are wondering whether a proposed project will be worthwhile investing time and money. It enables you to make a sound decision by giving you a numerical assessment of the anticipated costs and budgets.

Strategy Modifying

CBA can offer you essential information if you’re willing to modify your marketing, sales, or business strategy. It can help you determine if the anticipated benefit exceeds the anticipated costs and how the modifications are affecting various facets of your company.

New Program or Services

CBA is frequently used when deciding which activities an organization will fund as part of its strategic objectives. Also, it’s employed when considering the launch of a new program or discontinuation of service. Understanding the potential benefits and related drawbacks aids in decision-making regarding new projects.

Comparative Decision-Making

Implement CBA While facing a variety of options or courses of action. One advantage of CBA is comparative analysis, which enables decision-makers to evaluate options based on objectives and choose one that maximizes benefits over costs.

Monetary Value of Time

Since the dollar value of today is not the same as the dollar value of tomorrow, CBA uses discounting procedures. This guarantees that gains and expenses in the future are accurately discounted to their present value. Thus, the project encounters a more realistic picture of the long-term economic effect.

Assessing Programs & Policies

CBA is often used by government organizations to evaluate the projected economic effects of policies or programs. This is especially important when thinking about initiatives that could have broad social effects. Thus, policymakers can make well-informed choices based on economic effectiveness.

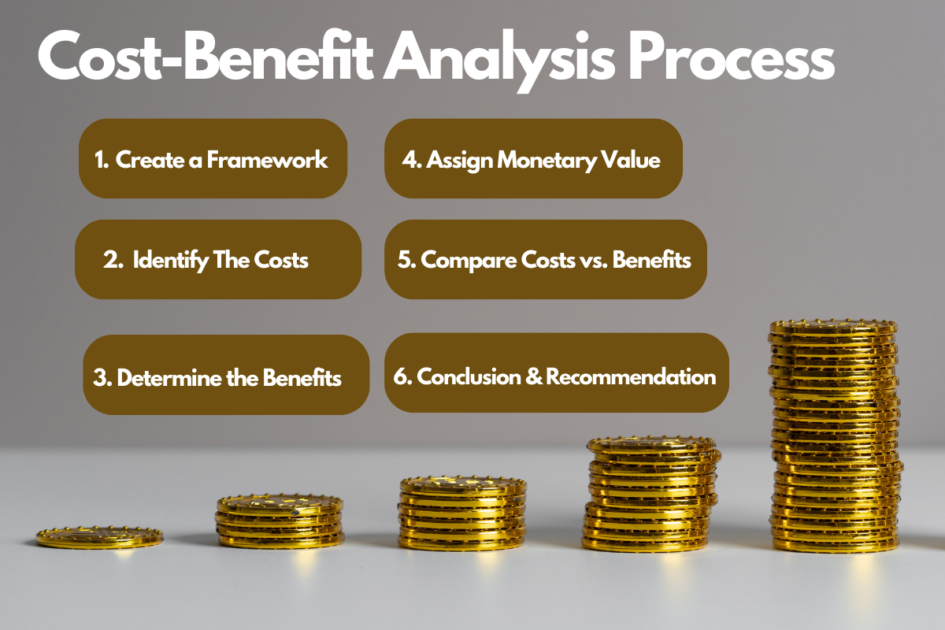

Cost-Benefit Analysis Process: Step-By-Step

Creating a cost-benefit analysis may seem overwhelming, but I’ve made a clear step-by-step approach that will simplify the process. After running through these steps, you can implement CBA precisely to fit the requirements of your project.

#1. Establish a Framework

Setting a framework for your analysis is a crucial step in creating a framework for your CBA. Since it establishes the stage for the whole analytic process, you should carefully set the stage.

This step involves the following stages:

Defining The Issue

Clearly defining the issue or choice is the first step in creating a framework. This might be a proposal for a project, a corporate decision, a policy change, or any other circumstance where costs and benefits are measurable. For instance, a company planning to launch a new product needs to determine if the financial benefits outweigh the costs.

Identifying The Objectives

This stage is for determining the goals once the issue or choice has been identified. What goals do you want to accomplish with the decision or project? How would one define success? The remaining steps of the analytical process will be guided by these goals.

Example: In this instance, the objective is obviously maximizing the profit. A successful launch that expands market share without adversely affecting the company’s financial performance would be considered successful.

Setting The Scope

At this stage, the scope of the analysis is set, which refers to the range of costs and benefits that are taken into account. This might include both immediate and long-term effects, as well as direct and indirect expenses and tangible and intangible benefits, KPIs.

Besides, the scope should be both restricted and wide enough to include all relevant costs and benefits to make the analysis reasonable.

Example: The scope of the analysis should include all expenses related to creating and introducing the new product. These costs are related to marketing, manufacturing, distribution, and research and development.

The benefits can include estimated sales of the new product, market development possibilities, and potential for improved brand awareness.

After establishing the framework, you can move on with identifying, measuring, and comparing the costs and advantages. This will help you make a better choice by putting the framework in place.

#2. Identify The Costs

It’s now time to go over every expense and advantage associated with your choice. Working with stakeholders in this phase can assist you in making use of their specialized knowledge.

The related costs can be categorized into the following types:

Direct Costs

These expenses are directly related to the project or choice. For instance, labor, raw materials, and production overhead are a few instances of direct expenses in a manufacturing operation.

Let’s say you are launching a new product where direct costs can be the cost of raw materials required to craft the product.

Indirect Costs

These costs are linked as a consequence of the project, but they are not directly related to it. Administrative costs, utility bills, and rent could be categorized as indirect costs.

For example, the business may need to recruit more admins and add electricity bills to support the expanded product line.

Fixed Costs & Variable Costs

Fixed expenditures, like rent or salary, are expenses that remain constant regardless of the volume of production. Conversely, variable costs like those associated with raw materials or direct labor vary based on the volume of output.

Spending the rent for the factory of production is a fixed cost. Besides, variable costs will vary according to the units of products made, where the cost of the raw material will also go up.

Opportunity Costs

These are the costs incurred by forging the next best option. For example, if a company chooses to utilize its factory to manufacture a new product line, the opportunity cost can be the return on investment benefit gained by producing a different product.

Sunk Cost

These are the unrecovered expenditures that have already been spent. Since sunk costs cannot be altered, they normally shouldn’t have an impact on the decision-making process. If a business has already invested money in researching the new product line, that spending becomes a sunk cost.

After classifying all possible costs, a business can guarantee a better understanding of the financial consequences of launching a new product. Learn more about the basics of cost accounting to help you identity the above costs.

#3. Determine The Benefits

Finding the benefits is the third stage of a Cost-Benefit Analysis (CBA). This entails figuring out every possible benefit that the undertaking or choice can provide. These benefits fall under the following categories:

Direct Benefits

These benefits are directly connected to your project or business decisions. It can include the money that a business generates by selling the new product line.

Indirect Benefits

These benefits aren’t directly connected with the project, but it is eventually achieved as a consequence of the project. For instance, the introduction of a new product line can boost brand awareness, which can result in higher sales of existing items.

Tangible & Intangible Benefits

Benefits that have a monetary value can be assessed and defined as tangible benefits. One example can be revenue generated from sales, which is a tangible benefit.

Conversely, intangible benefits are those that have worth even if they can’t be valued monetarily. It can include things like higher brand awareness or higher consumer satisfaction.

Monetized Benefits

Benefits that can be exchanged for money are known as monetized benefits. For instance, by figuring out how much the worker’s time costs, the value of the time for the new process can be monetized.

Non-Monetized Benefits

These are benefits that add to the project’s or decision’s total worth, even if they cannot be valued in money. Examples of non-monetized advantages include the value of increased customer happiness or staff morale.

After classifying all the prospective benefits, you will get a thorough knowledge of the possible benefits that you can get out of your project.

#4. Allocate a Monetary Value to Costs and Benefits

This stage is essential because it makes it possible to compare the costs and advantages of a project or choice directly. Having real data or example data from industry trends will surely help you in this phase. Here’s a thorough explanation:

Estimating Costs

This entails putting a monetary value on every expense related to the project. When introducing a new product, for instance, costs could include those related to manufacturing, marketing, distribution, and research & development.

Calculating Benefits

This requires placing a monetary value on the project’s benefits. Launching a new product, for instance, can offer advantages like more sales income, a larger market share, and enhanced brand awareness.

Valuing Intangible Costs & Benefits

Benefits that are hard to measure such as increased staff morale and customer satisfaction. In the same way, a negative impact on a brand’s reputation can count as an intangible expense.

For example, you can evaluate prospective improvements in repeat business and client retention to calculate the value of enhanced customer happiness.

Accounting for Opportunity Costs

Any potential benefits that are lost out on when selecting one option over another are referred to as opportunity costs. A perfect illustration can be the return on investment from other initiatives you have started with the same resources. Give these opportunity costs a monetary value to conduct a more thorough study.

Cost of Potential Risks

Potential risks can include issues related to financial, operational, reputational, etc. So, based on their probability and possible consequences, give these potential hazards a monetary value.

While assigning monetary value, be specific and accurate since these approximations influence the outcome of your analysis significantly.

#5. Comparing Costs vs. Benefits

This phase is exciting since it includes the real cost and benefit analysis. Here are the key concepts to learn about:

Total Costs & Benefits: These represent the total of all the costs and benefits that you have determined and valued in terms of money.

Net Cost-Benefit: This is determined by deducting all costs from total benefits, but it is sometimes referred to as net benefits.

Net Present Value (NPV): It represents the variation in current value between cash inflows and outflows over a certain duration. Because it takes your net cost-benefit potential for change into account, it’s a more dynamic method of calculating net cost-benefit.

Cost-Benefit Ratio: This illustrates how costs and benefits are related to one another generally across time. The projected total cash benefit is divided by the estimated total cash expenses to arrive at the calculation. Benefits exceed expenses whenever the benefit-cost ratio is greater than one.

Discount Rates: These are utilized to project the long-term changes in the costs and benefits values, such as those brought on by inflation. Plus, they facilitate the conversion of future benefits and expenses into their present value, enabling a more precise assessment of their current value.

Sensitivity Analysis: This establishes the impact of uncertainty on your choices, costs, and revenues. It lets you weigh the worst- and best-case possibilities for your choice. You may investigate ways to lessen some of those hazards if the worst-case scenario contains a greater cost than advantages.

Sometimes, you can simply calculate the cost-benefit output by avoiding complex calculations by skipping the NPV, benefit-cost ratio, discount rates, and sensitivity analysis.

#6. Conclusion & Recommendation

This is an important stage since it helps you make a well-informed choice based on your cost-benefit analysis findings. Here’s an in-depth explanation:

Analyze the Results

Examine your benefit-to-cost ratio, net present value, net cost-benefit, and the outcomes of your sensitivity study. What can you infer about the feasibility of your project or choice from these results?

Draw a Conclusion

Draw a conclusion according to the outcome of the analysis you’ve made. The project or choice is deemed feasible if the benefit exceeds the costs (that is, if the benefit-cost ratio is more than one, the net cost-benefit is positive, and the net present value is positive).

Consider Other Factors

Keep in mind that you should weigh more than just the cost-benefit analysis while making decisions. It is important to take into account other elements, including influence on stakeholders, risk tolerance, and strategic fit.

Implement the Recommendations

Implement the project or decision if it turns out to be feasible. This might include creating a schedule, assigning resources, and creating a project plan.

If it is decided that the project or choice is not feasible, try to find solutions to cut costs or improve benefits. This might include making modifications to your idea, looking at other options, or choosing not to go further.

Review and Modify

After a choice or initiative has been put into action, it’s critical to evaluate the results and make any required adjustments. Did your projections match the real expenses and benefits? If not, what circumstances led to the difference? Make future judgments using this knowledge to improve your cost-benefit analysis procedure.

Note that reaching a conclusion and putting the advice into practice is meant to help you make an educated choice that maximizes benefits and minimizes Costs. However, it’s crucial to take into account other variables and to periodically evaluate and modify your strategy.

Cost-Benefit Analysis Examples

I will now present you with a simple example of a cost-benefit analysis that includes all the necessary steps:

Establish a Framework

The company is considering purchasing a new machine that could increase production efficiency.

Identify The Costs

- Purchase cost of the machine: $100,000

- Installation and training costs: $10,000

- Increased annual maintenance costs: $5,000

Determine the Benefits

- Increased production: The new machine could increase production by 20%. If the company currently makes $500,000 in sales annually, this could lead to an additional $100,000 in sales.

- Reduced labor costs: The new machine could reduce labor costs by $30,000 annually.

Allocate Monetary Value

I’ve already provided the monetary value in all the steps.

Compare Cost vs Benefits

- One-time costs (Purchase + Installation): $100,000 + $10,000 = $110,000

- Annual costs: $5,000

- Annual benefits (Increased sales + Reduced labor costs): $100,000 + $30,000 = $130,000

As a result, the business must pay $110,000 upfront and $5,000 yearly, but it can also earn $130,000. This implies that in less than a year, the project would begin to pay for itself.

Conclusion and Recommendations

Based on these projections, it seems that the business would benefit financially from investing in the new equipment. However, the business should also take into account other elements, including the machine’s dependability, sales steadiness, and any other hazards or difficulties.

This is a very simple example of cost-benefit analysis, but it provides you with a sense of how the process works. A real-life example can be more complex compared to this example.

Advantages of Cost-Benefit Analysis

A business or organization can decide to use cost-benefit analysis in their decision-making process for various good reasons. Here are some key advantages of cost-benefit analysis:

Well-Informed Decisions: It offers a precise framework for comprehending the costs and benefits, aiding in informed decision-making.

Defining all Cots and Benefits: CBA makes an effort to put a monetary value on every cost and benefit, enabling comparison between different prices and advantages directly.

Optimal Resource Allocation: CBA ensures responsible resource distribution by weighing costs and benefits.

Risk Analysis: By assisting in the identification of possible hazards, CBA enhances the management and mitigation process.

Transparency: CBA offers an understandable process for assessing decisions. Benefiting Stakeholder engagement.

Assessment of Alternatives: CBA makes it possible to compare many options, which helps in determining the most economical course of action.

Let’s now explore some of the disadvantages of cost-benefit analysis.

Limitations of Cost-Benefit Analysis

Though CBA is a powerful tool, it does have some limitations. Therefore, you should also consider the limitations and then minimize those factors before decision-making. Here are some limitations to think about:

Accuracy of Estimates: The accuracy of CBA relies mostly on the accuracy of the cost and benefit estimation.

Measuring Intangible Costs and Benefits: Assigning monetary value to intangible costs and benefits can be challenging.

Time & Resource Intensive: Conducting a complete CBA can be time and resource-intensive when it comes to complicated decision-making.

Risk & Uncertainty: Although CBA can assist in identifying possible hazards, it cannot adequately capture the uncertainty pertaining to these risks. Plus, there is some uncertainty related to the change in monetary value over time.

Biased Estimation: The analysts conducting CBA can mistakenly evaluate the findings by overestimating benefits or underestimating costs.

Overlooking Other Factors: CBA primarily focuses on economic costs and benefits, potentially overlooking ethical, environmental, or social concerns.

Real-World Applications of CBA

Cost-benefit analysis is a versatile decision-making tool that can be used to get greater output from different industries out there. Here are some real-world applications of CBA:

Government Project: The government often implements CBA while assessing major infrastructure projects like constructing roads, bridges, or public transit networks. It helps in figuring out if the financial benefit exceeds the costs of building and maintaining.

Healthcare Industry: CBA is used by healthcare organizations and legislators to evaluate the implementation of new medical procedures, technology, or healthcare initiatives. It helps determine if the expenditures paid are justified by the health benefits.

Business Investment: Companies use CBA to assess the likelihood of profitability of a given initiative, tactics, or investment. For instance, to determine whether to introduce a new product, make an equipment purchase, or look at possible mergers and acquisitions.

Educational Projects: To assess the economic viability of educational initiatives, activities, or changes, policymakers and educational institutions use CBA. It aids in optimizing the resource distribution. Educational institutions may use specialized school accounting software to addresses their unique financial needs

Energy Sector: When the energy sector is thinking about investing in sources of clean energy programs, CBA can assist in weighing the execution costs against the long-term benefits like lower carbon emission and energy savings. Incorporating carbon accounting software into this process allows companies to accurately measure and track their greenhouse gas emissions.

Environmental Regulations: The economic feasibility of different measures to safeguard the environment, such as pollution prevention or preservation efforts, is often assessed in environmental economics using CBA.

Final Thoughts

Cost-benefit analysis is a systematic approach that helps businesses understand the economic implications of a decision. Even if cost-benefit analysis itself is a tool, you should implement project management tools to ease the entire process.

The reason is simple: you cannot monetize all the related costs and benefits of your project. But the more effective your CBA is, the greater the benefit you can expect out of your investment and resources.