A hosted gateway payment is an online solution for businesses to accept payments through a secured platform in multiple ways, like credit/debit cards, mobile wallets, banking transfer crypto, etc.

A hosted payment gateway offers ease of integration for businesses into their websites or applications without investing in new infrastructure and security measures, and allows payments to be received anywhere across the globe in various denominations.

The purpose of a hosted gateway payment is to facilitate all forms and sizes of businesses in conducting financial transactions through their website or applications quickly and securely by abiding by standards and regulations.

If you are really looking forward to having a trustworthy and hassle-free online transaction experience, then a hosted payment gateway would be the solution for your business.

A hosted payment page streamlines online transactions by guiding customers from checkout to a secure PSP page for payment authorization, then to a payment processor for transaction confirmation, and finally back to the merchant’s site with the payment outcome, facilitating direct fund transfers upon approval.

Top features of payment gateways

- Customer-friendly interface and easy checkout process

- Multiple payment options, such as credit/debit cards, mobile wallets, bank transfers, etc.

- Advanced security in terms of encryption and fraud detection tools

- A global reach with multi-currency support

- Easily integrate with existing apps such as CRM, bookkeeping, accounting, etc.

- Transaction analytics and reports

What Does Hosted Payment Mean?

Hosted payment services are third-party vendor-conceived and hosted online payment solutions that enable the acceptance of payments from different transaction modes such as credit/debit cards, e-wallets, bank transfers, cryptos, etc.

In hosted payment, a model is structured as an online payment gateway service on a website, where the checkout information gets redirected to another payment processor to complete the financial transaction.

What Are the Other Terms for Hosted Payment?

Other terms for hosted payments are hosted payment gateway, external checkout, third-party checkout, or even an external payment page. A hosted payment page is basically being hosted by a third party and, like payment gateway methods, is also found outside the merchant’s website, thus being known as a third-party checkout and an external checkout page or gateway.

What is the Purpose of Hosted Payment?

The purpose of hosted payment is to accomplish a secure end-to-end checkout procedure, allow wide payment options such as credit/debit cards, mobile wallets, bank transfers, etc., to cover as much of the audience as possible, and ease integration into existing systems.

With hosted gateways, all sensitive payment information is securely processed from all risks and the necessity of being PCI-compliant. Moreover, integration with hosted gateways is much easier than building your own secure payment system. Companies no longer have to worry about the headache of maintaining the technical part, thus saving a lot in building and maintaining the infrastructure.

How Does a Hosted Payment Work?

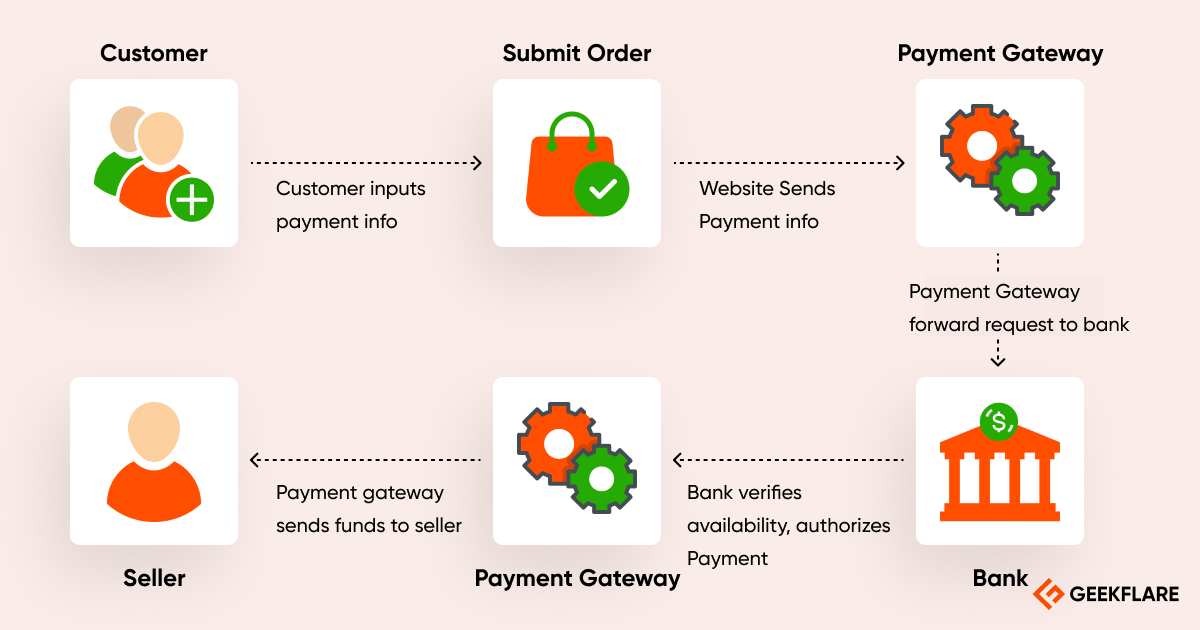

Hosted payment gateway works as per below steps.

- Payment Initiation: After the customer selects the items they wish to purchase, they click the “Checkout” button. They are then redirected to the hosted Payment Service Provider (PSP) page to select a payment method and enter payment details securely.

- Information Transmission: The hosted PSP securely collects and transmits the customer’s payment details through the payment gateway to the relevant acquiring bank or payment processor.

- Information Verification: The gateway validates the payment information, including card details and security codes, and then forwards the request to the bank.

- Payment Processing: The bank processes the request to verify availability of funds or credit limit and authorizes the payment.

- Money Transfer: The payment gateway transfers the funds to the merchant’s account.

Why do Businesses use Hosted Payment Pages?

Businesses adopt hosted payment pages for the following reasons.

- A hosted payment page is easy to integrate into their website or app with little or no technical knowledge.

- They offer multiple payment types like credit/debit cards, bank transfers, mobile wallets, crypto, etc.

- Hosted Payment Pages follow PCI DSS (Payment Card Industry Data Security Standard) standards to protect from data breaches and fraudulent activities.

- Hosted payment pages either come with built-in fraud detection and prevention tools or are offered in association with those, which would help in preventing the potential leaking of such sensitive financial data.

- Hosted payment pages support multi-country and multi-currencies, helpful to businesses with a global footprint

- The cost and complexity associated with establishing payment infrastructure and necessary security measures for payment processing systems can be significantly reduced with hosted payment pages.

What are the Criteria for Choosing Hosted Payment?

Below are the key criteria while choosing a hosted payment gateway.

- Payment Types: Check the types of payments the hosted payment gateway supports according to the nature of your business. A hosted payment should support all leading major credit and debit cards like Visa and MasterCard, as well as popular wallets such as Apple Pay, Amazon Pay, Google Pay, etc. Check-in case your business has a global reach so that multiple currencies are supported. If your business deals with online subscriptions or recurring payments, consider integrating with virtual card providers to offer secure and flexible payment options for your customers.

- Pricing Structure: Ensure the payment gateway provider has a transparency with fair pricing. Always get breakdowns of monthly fees with transaction fees and other charges, such as chargeback or Gateway fees. Negotiate volume discounts if your business is experiencing high volumes.

- Security: Look for PCI-DSS compliance that guarantees the safety of the user’s financial data. Simultaneously, tools for preventing fraud will help businesses by not permitting unauthorized transactions.

- User Experience and Branding Multilingual support: It can really boost user satisfaction due to an internationally oriented user base. Customization should be checked accordingly, following the business branding and messaging requirements.

- Integration: Verify if your accounting, CRM, or shopping cart software can integrate with the hosted payment gateway.

- Scalability: Check if the said gateway can handle your volumes, both in the present and future, when the business scales up.

- Importantly, if there are plans for international expansion, check if the gateway covers the target markets and the respective currencies required. Other than that, be sure to understand the requirements for subscription payments and recurring payments.

When to Use Hosted Payment?

A hosted payment page can be used by businesses of nearly any size and type who want to have one unified payment processing system for their online website or applications.

Use a hosted payment system in the following scenarios.

- Businesses who aim to have a faster checkout process with robust security and compliance like PCI DSS (Payment Card Industry Data Security Standards).

- Businesses aim to accept varied methods of payment such as credit cards, debit cards, mobile payments, etc.,

- Businesses that want to easily integrate with their pre-existing software and applications can prefer a hosted payment page.

- Businesses that want a cost-effective payment system and a quick and easy setup.

- Businesses that accept payments worldwide in multiple currencies and don’t want to invest in additional infrastructure can go for a hosted payment page.

What are the Features of a Hosted Payment Page?

- Multiple Payment methods: A hosting payment page provides multiple payment choices, including credit/debit cards, e-wallets, pay later, ACH processing, etc., such that at no point in time will a customer be forced to leave the merchant portal due to unavailable payment methods.

- Security and Compliance: While conducting any transaction online, the utmost important factor is security; this is well taken care of by a hosted payment page. The financial data is secured through encryption, as standard compliance such as PCI DSS and GDPR at the same time. Not only that, but a hosted payment page also uses cutting-edge fraud-detection software to reduce the level of risk involved in fraudulent activities.

- Customization and Mobile responsiveness: These hosted payment pages are flexible enough to customize the web page elements to enhance the visual appearance and user experiences that help to increase .

- Integration: If your business consists of software and applications, like CRM, shopping cart, bookkeeping, etc., then there is a high chance that a hosted payment page will enable easy integration of third-party software for uninterrupted business operations.

- Error Handling: The function of error handling is, actually, one of the most important features of a hosted payment gateway. A hosting payment page will take care of errors that may occur during processing, including those related to declined payments and validation on the payment form.

What Sets Hosted Payment Apart From Other Payment Gateways?

A hosted payment gateway differs from other types of payment gateways, such as self-hosted payment gateways and API-hosted payment gateways, in several key ways.

- Customer Journey: Under hosted, the customer will have to go to a secure page provided by the gateway provider and give all the details regarding his/her payment. They, therefore, influence the brand journey of the customer that he was actually making with that specific merchant. Conversely, non-hosted payment gateways enable the client to stay on the website for consistent checkout experiences where inputs are directly done and are thus seamless for brand continuity.

- Branding and Customization: Hosted gateways may lack full flexibility because of limited control over branding, which can, unfortunately, compromise complete brand continuity. Non-hosted solutions offer all the customization options in your merchant brand to give your users a seamless experience.

- Technical Requirements: The hosted platform does easier integration by having pre-built plugins and straightforward APIs; non-hosted could need more technical expertise and development resources.

- Security and compliance: In a hosted gateway, sensitive data is handled by the provider, but in a non-hosted system, secure transmission rests on the whim of the merchant. On the other side, in the non-hosted option, all responsibilities for full security and compliance are the responsibility of merchants, who must have enlarged resources and expertise to handle it effectively.

- Customization of the Checkout Process: Where hosted solutions have meager grounds for the customization of layout, messaging, and flow, non-hosted solutions will allow full customized flexibility to embrace any element according to individual preferences.

What is an Example of a Hosted Payment Gateway?

Examples of hosted payment gateways are PayPal, Stripe, Authorize.Net, Stax, Helcim, Square, etc.

- PayPal: Providing the most popular online hosted payment gateway with a transparent checkout experience.

- Stripe: Best for any modern business for variety of payment forms together with the most customizable system approachable for developers in terms of implementation.

- Authorize.Net: Mobile optimized hosted payment gateway, this old-service provider makes available a solid payment processing feature set.

- Stax: With the Stax payment gateway, free access to fully customizable hosted payment pages is possible. Furthermore, Stax unifies the whole payment experience with business solutions that are personalized and holistic.

- Helcim: Helcim-hosted payment pages are customizable, allowing hosted page functionality to fully reflect your brand.

- Square: Square’s legacy point-of-sale (POS) and integration of payment gateway have other amazing features of making invoices and accepting international payments to assist in making the transaction process smooth.

For businesses seeking PayPal alternatives, tools like Stripe, Square, and Helcim offer comparable hosted gateway experiences with added flexibility, lower transaction fees, or enhanced customization options depending on business needs.

In addition to these, businesses might also consider partnering with reputable Credit Card Processing Companies that offer hosted payment solutions. These companies specialize in handling credit card transactions securely and efficiently, providing additional services like fraud detection, chargeback management, and detailed transaction reporting.

Is PayPal a Hosted Payment Service?

Yes, PayPal qualifies as a hosted payment service, and here’s the reason.

- Transaction process redirection: During the checkout process, customers are redirected to an externally hosted payment page by a PayPal provider, which is a third-party company.

- Easy and Quick Integration: It is easy and simple to integrate PayPal buttons or functions into websites; even merchants with no to low coding knowledge will be able to do that effortlessly.

- Security and compliance: PayPal process system is PCI compliance, which is mandatory for card transactions.

- Global reach: Hosted gateway supports a global customer base; PayPal helps businesses reach over 200 countries, and it supports 25 currencies.

What are the Advantages of a Hosted Payment Gateway?

- Best-In-Class Security and Reduced Compliance Burden: By including security on their secure servers, hosted payment gateways completely remove the burden of PCI compliance from the shoulders of the merchants and difficult, tedious audit processes. On top of this, hosted gateways provide tools and systems to prevent fraudulent transactions.

- Strong Credibility: Noted hosted payment gateways like PayPal, stripe, etc; being in the industry for a longer duration makes customers feel secure and trustworthy at the time of checkout.

- Convenience for Customers: A hosted payment page means incredible convenience for your customers with a manifold range of payments that may include credit/debit cards, mobile wallets, and other alternative modes from all over the world with the provision of accepting multiple currencies.

- Supports multiple payment methods: It supports multiple payment options, such as credit/debit cards, e-wallets, bank transfers, and many others. It really assists the merchant in escaping the bounce rate at the final stage of transactions.

- Integration capabilities: Prebuilt plugins and APIs with hosted gateways enable integration of the payment gateway as well as shopping carts, CRMs, account tools, etc., all of which would allow merchants to easily incorporate payment functionality within their e-commerce platforms. The prebuilt integration saves costly person-hours and resources compared to a non-integrated approach where custom development is done.

What are the Disadvantages of Hosted Payment Gateway?

- Limitations on the checkout process: Using a hosted payment gateway comes with constraints on the checkout process and issues related to maintaining brand uniformity. These gateways often emphasize their own branding, reducing the ability to customize the checkout page. This can make it more difficult for customers to identify the merchant’s brand.

- Additional charges: Almost every processed payment through the hosted payment gateways incurs a transaction fee, and, in a few cases, even a monthly fee is levied. All such recurring charges may have a bearing on the profit margins, especially for businesses with high transaction volumes.

- Directing customers: Redirection to an external page during the checkout process by hosted payment gateways might confuse customers and create trust issues and, hence, leads to cart abandonment.

- Dependency: Mostly, merchants rely completely on the appointed hosted gateway service provider for the quality of the services. Any problem in the gateway or technological bottleneck may upset payment processing and business operations.

Are Hosted Payment Pages Secured?

Yes, the hosting payment pages are secure, and the reason is as follows.

- Hosted payment gateway services meet PCI DSS (Payment Card Industry Data Security Standard) compliance requirements to protect financial data.

- Hosted Payment Gateways provide advanced security through secure infrastructures, encryption technologies, fraud detection tools, and adherence to strict industry regulations.

- The hosted payment gateways will receive a continuous check-up as well as an update of their secure servers and infrastructure to check for any technical issues, vulnerabilities, and bottlenecks.

Is Hosted Payment a Good Choice for Online Payment?

Yes, a hosted payment is a good choice for online payment solution, for the reasons outlined below.

- A hosted method of payment is suitable for every type and size of establishment. Its implementation is simple and without maintenance costs. So, such hosted payments do not require an extra dollar to administer complex payment systems.

- Hosted gateways use secure servers that decrease the PCI compliance burden on the merchant’s part and reduce data breach risks inherent in safe card information handling.

- A hosted payment includes easy integration through pre-built plugins and friendly APIs for both user and technical levels of businesses without having to add new infrastructure or new technicalities.

- Consumers usually trust popular gateways, which means they have a familiar indication of secure checkout, which may help them gain confidence and possibly more conversions for the business.

- Globally dispersed businesses can rely on a hosted payment gateway to accept payments without managing any additional parameters.

What is the Difference Between Hosted and Non-Hosted Payments?

The below table explains the differences between hosted and non-hosted payment gateway.

| Features | Hosted Payment Gateway | Other Payment Gateways (Self-Hosted, API Payment Gateway) |

|---|---|---|

| Transaction Process | Directed to a hosted payment page | Happens on a merchant’s page |

| Speed of Transaction | Depends on a hosted payment page | Depends on a merchant site or app |

| Customization | Limited checkout and UI customization | Full control over customization |

| Security | Adopted PCI compliance and Encryption | Merchant is responsible for implementing security standards |

| Integration | Easy to plug and use | Requires technical expertise and additional expertise |

| Merchant Branding | Gateway provides limited branding options | Merchant has full control over complete branding customization |

| Setup and Transaction Fees | Lower setup fees and would incur higher transaction fees for high-volume businesses | The initial setup can be higher, and transaction costs would be lower in the long run |

| Global Reach | Depends on a gateway provider, and the merchant has no control over it | Merchant can scale as per their business requirement |