Expense management software helps businesses track, manage, and report expenses in a single platform. It brings visibility into the company’s expenses to understand spending patterns and reduce errors in managing them.

The main problem with the manual expense management process is the involvement of data entry tasks across adding bills, applying for reimbursements, settling claims, etc. Even small errors can mess with your expense tracking and efforts to control budgets. Moreover, it doesn’t give visibility into expense management, making it difficult to find errors to fix.

An expense management software controls expenses by avoiding manual errors using automation. You also identify opportunities to save costs as finance teams focus on strategic decision-making for cost savings rather than administrative tasks.

Geekflare has researched the top expense management software that enables you to gain visibility into business expenses for better financial decisions.

- 1. Rippling Spend – All-in-one HR, IT Payroll and Expense Management

- 2. Moss – Best for Financial Transparency and Control

- 3. Wallester Business – Financial Solution to Control Corporate Expenses

- 4. Zoho Expense – Best for Small Businesses

- 5. Precoro – Best for Small to Medium Businesses

- 6. Pleo – Best for European Companies

- 7. Emburse – Best for Mobile Expense Management

- 8. Payhawk – Best to Optimize Company Budgets

- 9. BILL – Best for Real-Time Expense Tracking

- 10. Expensify – Offers Corporate Card with Cash Back

- Show less

Expense Management Software Comparison

Below is a comparison table of the top expense management platforms based on multi-currency support, travel expense management and integration options.

|  |  |  |  |  |  |  |  |  | |

✅ | ❌ | ✅ | ✅ | ✅ | ❌ | ✅ | ✅ | ✅ | ✅ | |

✅ | ✅ | ✅ | ✅ | ❌ | ✅ | ✅ | ✅ | ✅ | ✅ | |

600+ tools, including accounting and payroll | 50+ including Accounting, ERP, and HRIS | Via API | 35+ HRMS, accounting, and ERP tools | NetSuite, Xero, QuickBooks, Amazon, Slack, Power BI | Accounting, NetSuite, HRIS | NetSuite, Sage, QuickBooks, Xero, Salesforce | Accounting and ERP systems, Via API | Accounting, ERP, HRIS systems | Accounting, ERP, HR, Banking | |

Custom | Custom | Free forever | $4 (Free forever plan available) | $499 | £39 | On Request | On Request | Free | $5/user | |

Geekflare’s editorial team determines ratings based on factors such as key features, ease of use, pricing, and customer support to help you choose the right business software. | ||||||||||

You can trust Geekflare

At Geekflare, trust and transparency are paramount. Our team of experts, with over 185 years of combined experience in business and technology, tests and reviews software, ensuring our ratings and awards are unbiased and reliable. Learn how we test.

I will now review the expense management tools in detail along with their features, pros and cons, and overall user experience.

1. Rippling Spend

All-in-one HR, IT Payroll and Expense Management

Rippling helps you control your business expenses by automating the reviewing and blocking out-of-policy expenses. It focuses on helping you implement your expense policy using approval chain workflows, trigger actions to notify policy limits, issue payments, and more.

With Rippling, you can integrate payroll and reimbursement to simplify employee management. It integrates with its HR and accounting software ecosystem, further helping with auditing and compliance in a single platform.

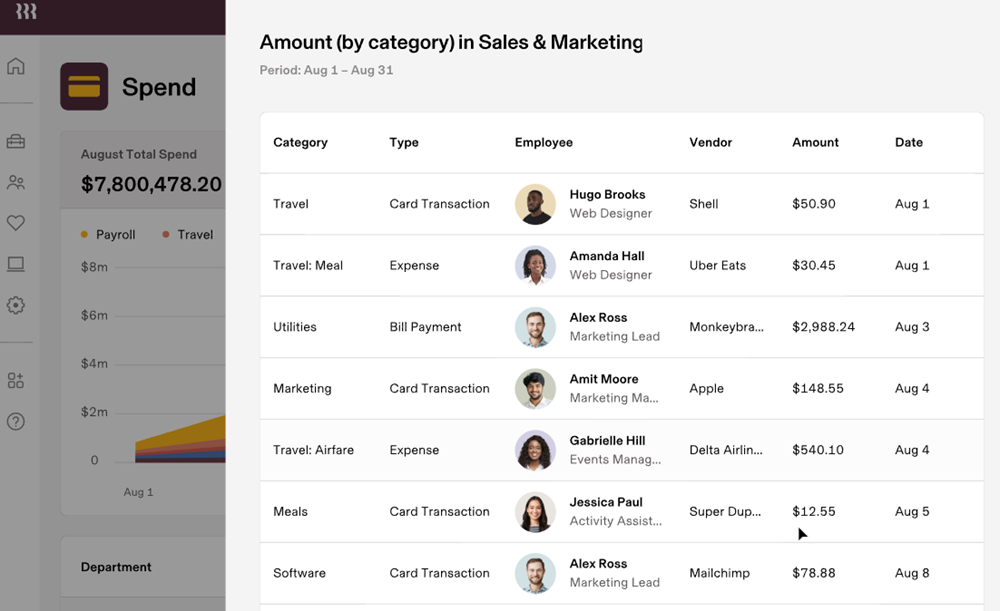

Above is Rippling Spend’s dashboard showing a detailed category-level breakdown that lets you monitor where your team’s money is going—whether it’s meals, airfare, or software. While trying the demo, I liked how each transaction is automatically tagged by type and linked to the respective employee, making it easy to conduct audits. The clean layout and automatic categorization help catch irregularities at a glance.

Top Features

- Custom policies: Implement tailored rules and restrictions on what each employee can see and adapt as employee role changes.

- Automated approval chains: Implement approval workflows to review expenses with role-based rules.

- Multi-currency support: Reimburse expenses across 100+ countries while your dashboard reads the currency of your choice, helping global companies operate effectively.

- Cross-currency reconciliation: Automatically convert expenses into the reviewer’s currency, streamlining the reconciliation process for foreign transactions.

- Report builder: Generate real-time expense reports and answer reimbursement queries directly within the payroll system.

Pros

Unified platform for implementing custom expense policy

Robust features focus on self-servicing

Integrated platform with HR, analytics, payroll, LMS, help desk, surveys, and more

Can purchase apps separately as per business requirements

Cons

Too many features increase the learning curve and set up time

Users report inadequate international payment options

Email-first support leads to a lack of human assistance and an increase in resolution time

Difficult user navigation

2. Moss

Best for Financial Transparency and Control

Moss’s expense management software focuses on accounting and bookkeeping functions. You can sync your accounting system by supporting it with data from receipts, expense tracking, and budgeting efforts.

It allows you to issue credit cards with custom limits and approval policies tailored to employee roles. This digitizes data for easy month-end closing calculations, thus improving the productivity of finance teams.

With Moss, you can issue employee cards and control the spending, manage the expenses, automate invoice payments, and create custom workflow. Moss is suitable for UK and European companies.

Trying out Moss’s expense management tool’s demo, I felt the reimbursement module neatly groups each trip and lets you itemize expenses with categories like mileage or business purchases. The interface makes it easy to edit or add new line items without jumping between tabs. Everything you need to submit an accurate reimbursement is right there in one place.

Top Features

- Corporate credit cards: Issue employee cards with customizable limits to maintain spending oversight.

- Manage receipts: Use Moss’s mobile app to capture data from offline receipts. Also allows automatic sync using direct integration with Gmail/Outlook.

- Payout options: Allows bundling employee expenses and reimbursements with multiple payout options like Apple Pay.

- Month-end closing automation: Integrates with accounting software and automatically categorizes corporate credit card spending data.

- Enhanced security measures: Moss’s platform is GDPR-compliant and uses multi-layer defenses like multifactor authentication, contactless payments, Single-Sign-On (SSO), and more.

Pros

Easy to add receipts and success ratio of recognition with mobile app

Responsive customer support

Good for accounting and finance teams’ productivity

Data sync features make accounting easy

Budget control features

Single platform pricing, irrespective of the number of users

Cons

Involves learning curve

Inadequate expense reporting features

Takes time to set up with credit card allocation, dashboard design, adding team members, and more.

Inadequate forecasting features

3. Wallester Business

Financial Solution to Control Corporate Expenses

Wallester offers business expense management software to make corporate finance management easy and efficient. Companies can track all their expenses in real-time and stay on top of their budget. 99% of its client companies have improved business performance and 97% of companies using Wallester have greater control over their expenses.

Wallester functions as an all-in-one expense control platform to monitor all kinds of corporate spending. It allows companies to create virtual cards for their employees using the mobile app or the website within minutes. All the expenses made by the card can be tracked in a unified system.

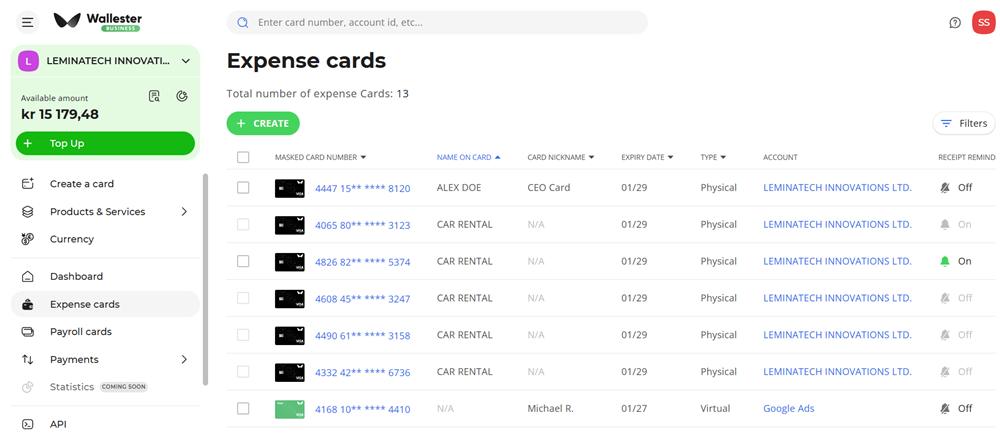

Below is a screenshot from Wallester showing an overview of expense cards issued under the company account. The interface provides details such as cardholder names, masked card numbers, types (physical or virtual), expiration dates, and receipt reminders, helping businesses track and manage expenses efficiently.

While trying out, I liked how you can toggle receipt reminders, sort cards by nickname or expiry, and even filter them by account or card type. It gives finance teams precise control over who spends what, and on which account.

Top Features

- Virtual Cards with Shared Access: Allow shared access to virtual cards to multiple employees or different projects simultaneously.

- Real-time Control: Display card fund flow and expenses instantly so companies can keep track of the expenditure.

- Flexible Settings: Manage corporate expenses and access to payment methods and cash withdrawals for different employees.

- Instant Notification: Get instantly notified when someone makes a payment with the cards to reduce the chances of fraud.

- Supports Cash Payment: To make cash payments, withdraw money from the corporate card and upload the invoice photo in the mobile app after making the purchase with that money.

Pros

Free plan, which includes 300 free virtual cards, makes it ideal for companies of all sizes.

Multilingual live support is available on any preferred messenger.

Special features designed for the marketing industry (personalized BINs, 3Ds whitelisting), the travel industry, and e-commerce.

API for integration to accountant soft or CRM.

Daily and monthly limit-setting facility for cards and accounts.

Spending policy management for multiple cards.

Multi-level 3D secure 2.0 system to protect all business cards.

Simplified online media purchase facility for ad campaigns.

Cons

Steep learning curve for novice users

White-label visa card program launch can take up to 8 weeks.

Its service is not available in Asia.

4. Zoho Expense

Best for Small Businesses

Zoho Expense is part of Zoho’s Finance product suite, which focuses on travel and expense management for businesses. It provides dedicated expense management tools for handling online and offline travel workflows in a single platform.

Zoho provides a cost-effective solution to consolidate business expenses across trips, purchase requests, reimbursements, and more. With its powerful reporting, integrations, and collaboration features, finance teams can make informed decisions about their expense management.

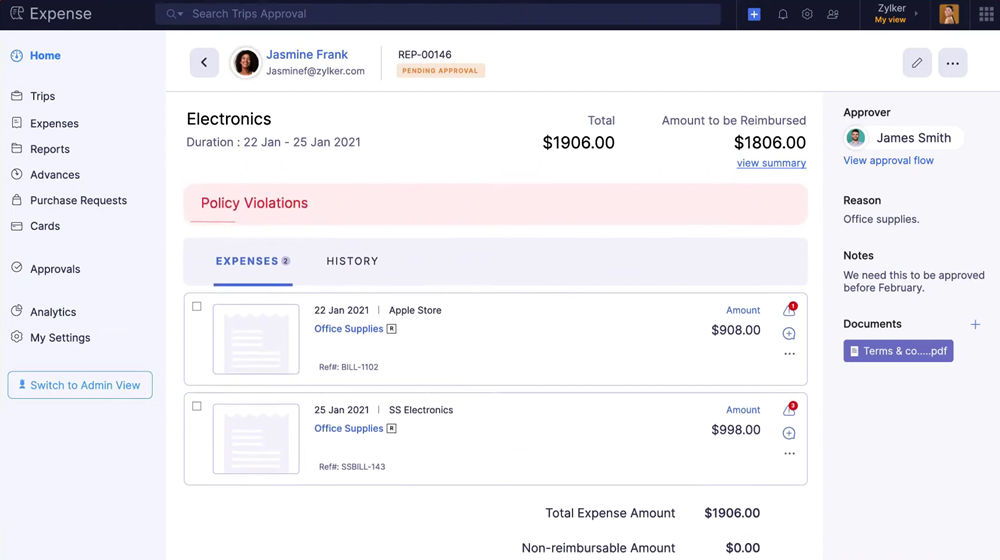

Zoho Expense makes policy enforcement effortless—while trying its demo, I immediately noticed how it flags violations right at the top of the report, so nothing slips through. I liked how each expense line comes with attached documents, a clear audit trail, and the ability to drill down into the approval flow. The layout also makes collaboration smooth, with notes and reimbursement summaries all neatly organized on the same screen.

Top Features

- Multi-Currency Support: Ideal for businesses operating in different countries.

- Establish expense rules: Set regular limits on per diem or expense amounts for employees to control expenses. You can notify them as they reach their expense limit.

- Mobile Accessibility: Allows expense tracking on the go via a mobile app.

- Customize and control: Implement custom roles and approvals workflows and design custom dashboards based on employee access hierarchy or expense category.

- Card management: Centralize and reconcile personal and corporate credit card management in real-time.

Pros

Generous free trial provides key features to test expense management automation

Good accuracy of auto-scan feature for uploading bills and receipts

Option to add travel expenses based on per diem or mileage

Cons

Inadequate expense reporting features

Issues syncing the mobile app with updates done on the web app

Initial setup is time-consuming

Inadequate integration to streamline payroll and reimbursement payments

5. Precoro

Best for Small to Medium Businesses

Precoro provides visibility and predictability into your employee expenses. It is one of the best apps for business expenses to track, manage, and automate expense management workflows via the dashboard.

Procure’s features target budgeting efficiency in procurement and employee management to help your business make informed financial decisions. It adjusts as per your industry use cases, company size, and purchase model, thus providing flexibility in your finance and budgeting strategy.

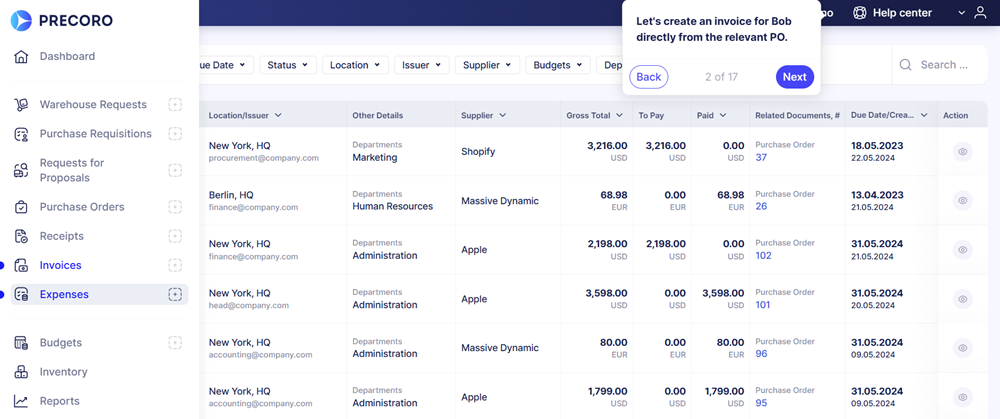

Below is a screenshot of the Precoro invoice management section, displaying a list of invoices categorized by location, supplier, department, and payment status.

I found Precoro’s UI easy to use for managing expenses. It clearly shows what’s paid, what’s pending, and which documents are linked, which helps avoid any confusion during reconciliation. Filters for suppliers, departments, and issuers add precision, especially when working across multiple teams or locations.

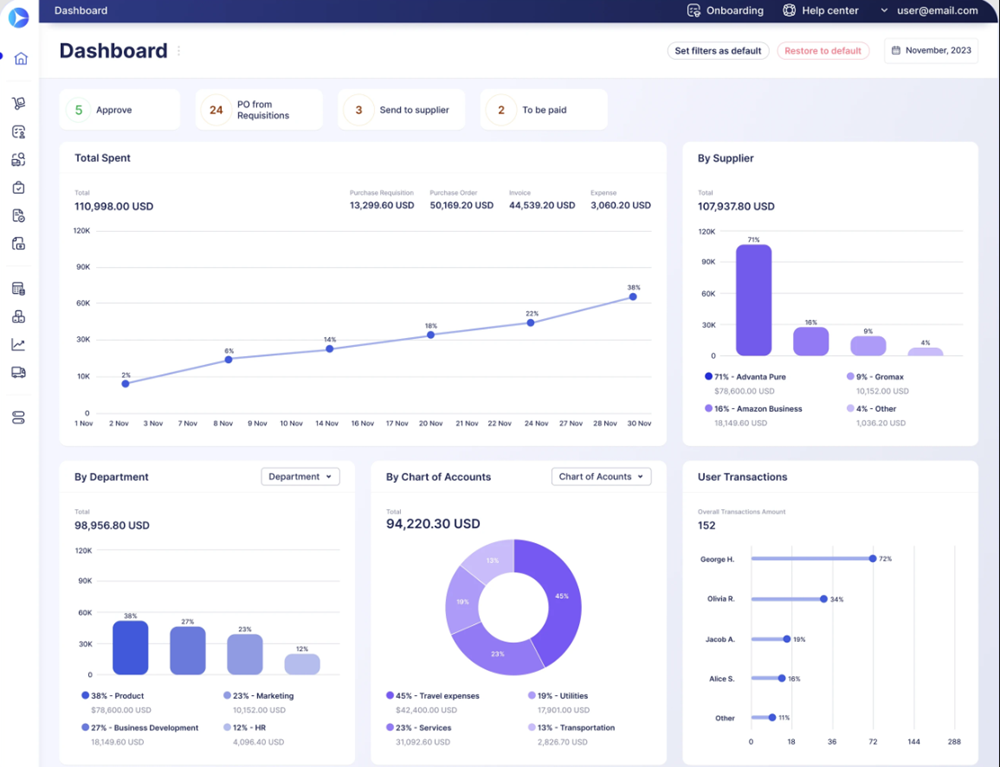

This dashboard offers a visual summary of total spend by supplier, department, and account category, making it easy to spot trends and anomalies. The interactive charts help teams quickly understand who’s spending the most and where.

Top Features

- Unify purchases: Easy to add and edit employee expenses with approval workflows to process all transactions in a single platform.

- Customize workflows: Create custom fields, approval workflows, and dashboard designs based on user roles and permissions.

- Supplier management: Centralizes supplier information, making managing contracts and maintaining vendor relationships easier.

- SSO and Google login: It enables secure login access. You can also limit IP addresses, helping manage multi-location employee posting.

- OCR technology: Autoscan receipts and digitize paperwork to avoid manual data entry.

Pros

User-friendly dashboard for non-finance teams

Organized design and easy to use

Cost-effective pricing for small business expense tracking

Ideal for procurement workflows

Streamlines procurement activities in one platform for better visibility.

Cons

Inadequate invoicing and reporting features

Lacks dedicated travel booking and expense management features

No bulk import feature for adding purchase orders

6. Pleo

Best for European Companies

Pleo is the best expense management software for European companies, and it centralizes digital payments, invoices, expense tracking, and reimbursements into a single platform. This makes accounting easy, including for multi-entity expenses, thus making finance teams more productive.

With spending controls and insights, the business can strategize to ensure it meets budgets as decided. A unique feature includes subscription management, where it can remove duplicates and handle recurring payments.

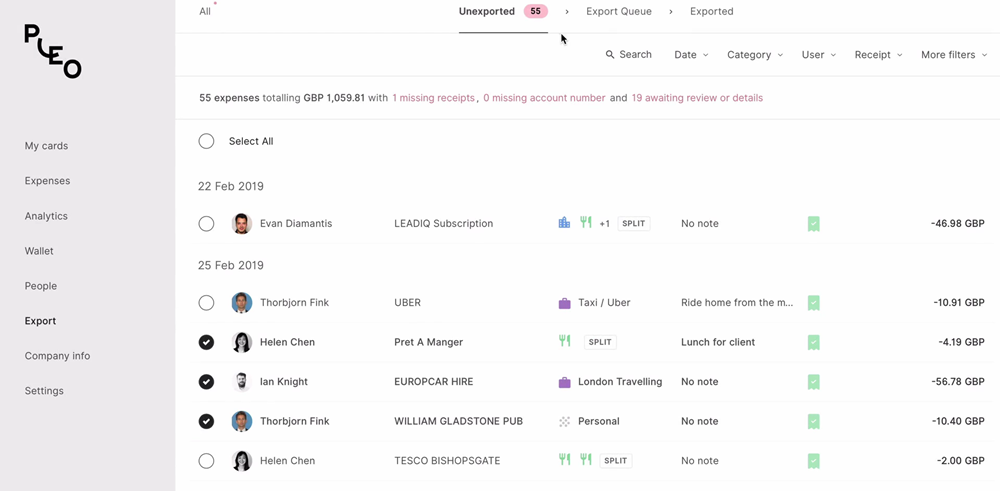

Below is Pleo’s expense management dashboard, giving a clean view of expenses incurred by each employee. It also flags items with missing receipts or pending reviews. Each transaction includes category tags, user info, and even context like “Lunch for client” or “Ride home,” which helps during reconciliations. The ability to split expenses and bulk-select them for export speeds up month-end reviews significantly.

Top Features

- Real-time expense tracking: Helps get real-time insights on expenses for making informed decisions to avoid overspending.

- Pleo company cards: Use physical, temporary, or virtual cards that allow employees to make purchases directly. Finance teams can maintain control by setting spending limits.

- Multi-entity expense management: Manage expenses across different entities or offices from a single account.

- Automate receipt management: Captures and syncs every expense data across subscriptions, invoices, offline spending, or daily expenses with your accounting tool.

- Streamline out-of-pocket expenses: Helps track expenses as per defined company policy with approval workflows and spend alerts.

Pros

Provides real-time auditing and bookkeeping features

Effective receipt management features

Simple setup with an intuitive user interface

Provides 1% cashback for every expense on the purchase of annual plans

Integration of virtual card expenses and accounting software reduces manual work

Cons

Pleo positions itself as a ‘spend management platform’, making it unsuitable for enterprises

Inadequate tax management features

Limited acceptance of virtual cards

Users report unreliable fetching of receipts from emails

7. Emburse

Best for Mobile Expense Management

Emburse provides a mobile app to help manage expenses and reimbursements on the go. Using its ‘adaptable expense policy’ feature, you can tailor its expense management software to your industry.

Its travel expense management features make it ideal for organizations with frequent employee travel requirements. It also provides physical and virtual cards that make controlling employee spending more seamless and integrated.

When I checked the demo version, I found that Emburse lets you fill in expense details quickly without jumping between screens. It’s easy to add categories, business purpose, and team info all in one place. Submitting receipts is simple – you can drag and drop or upload them straight from your gallery.

Top Features

- Optimize travel expenses: Leverage useful features like tracking and rebooking lower fares to save travel costs.

- ERP integration: Seamlessly digitize with expense management software and increase its functionality by integrating with existing accounting, invoicing, HR, and other systems.

- Virtual cards: Get a physical or virtual corporate card that allows you to easily control expenses using spending limits.

- Mobile receipt capture: Employees can submit expenses as they happen using the intuitive mobile app, enabling real-time receipt capture for accurate reimbursements.

- Dashboards: Make informed decisions by creating custom expense reports and tracking vital metrics using dashboards.

- Telecom Expense Management: Helps track telecom costs and usage patterns to keep telecom costs under control.

Pros

User-friendly desktop and mobile app

Adequate resources to learn Emburse’s expense management tools

Ideal for companies looking to add/edit travel expenses on the go with a mobile app

Active customer support that considers feedback

Cons

Features in desktop and mobile apps are not in sync

Inadequate reimbursement workflows

Difficult to navigate reporting features

No bulk import option

You need to upload receipts one by one, making it still a manual process

8. Payhawk

Best to Optimize Company Budgets

Payhawk offers to streamline your financial budget and efforts to control it with its expense management software. By creating budget management per cost center, you can track business expenses made under it in real-time.

Further, you can automate subscription management and restrict spending by adding limits as per expense policy. With Payhawk, the finance team can also create personalized expense reports across cost centers, teams, employees, or expense categories, which help with audits.

Payhawk’s interface provides a clear breakdown of payments, fees, and due amounts while enabling users to review transactions, add comments, and collaborate efficiently. It clearly shows FX and POS fees, so there are no surprises during reconciliation. I also liked the comment thread feature on the right; it’s super handy when finance teams need clarification or follow up.

Note: For businesses registered in EEA or UK/I with less than 50 employees, can test Payhawk for 24 months at £149/month.

Top Features

- Individual and team cards: Issue debit or credit cards with strict spending limits to control expenses and digitize transactions for easy accounting and reconciliation.

- Real-time expense tracking: Get a dashboard with live expense monitoring that centralizes all transactions.

- ESG reporting support: Payhawk automatically tracks carbon emissions to back up your ESG reporting and sustainability efforts.

- Subscription management: Track and handle recurring payments. You get insights into expenses such that it gets predictable, thus helping with better financial decisions.

- Custom approval chains: Implement custom spend policies by designing approval workflows and spend limits across transaction categories.

Pros

Features track expenses to enable better budget control and optimization

Active product and customer support team

Multi-currency support

Documentation features reduce paperwork

Provides cashback on expenses

Cons

Inadequate data export options

Users report slow software, delays in updating data, and occasional glitches.

Complex integrations setup

Allows uploading only one receipt per transaction

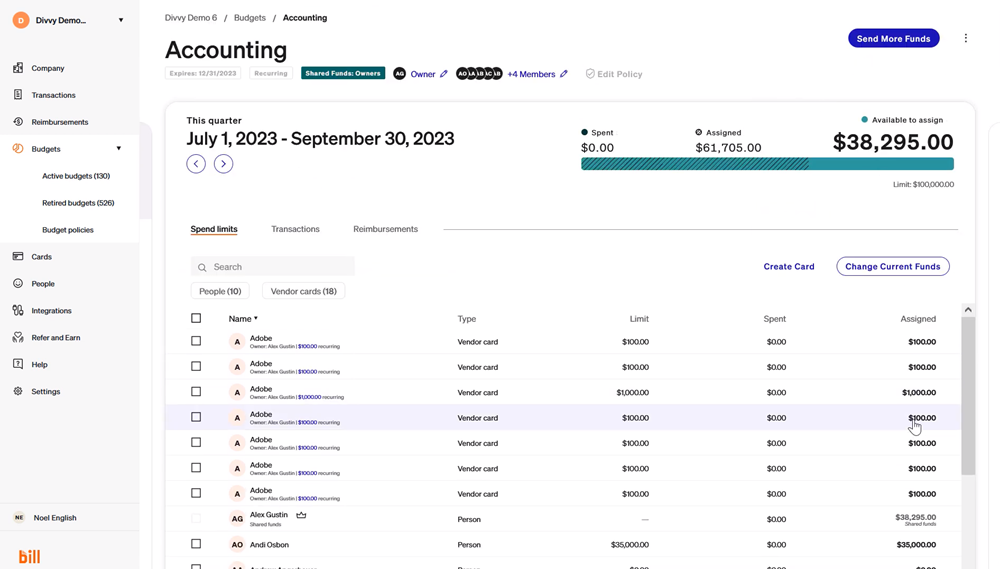

9. BILL

Best for Real-Time Expense Tracking

BILL offers free expense management tools that centralize streamlining transactions across company credit cards, reimbursements, and tracking expenses. It also provides dedicated features to handle travel booking and expense tracking using the BILL Divvy Corporate Card.

BILL helps with real-time expense tracking, such that you can forward this data to its Account Payables or Account Receivables software for further accounting. It integrates with multiple third-party software, thus helping you make informed decisions with additional functionalities.

BILL’s dashboard gives a neat overview of assigned budgets vs. available funds, and lets you quickly issue or adjust cards. It’s super handy when you need to keep track of multiple subscriptions or team spend all in one place. The interface shows the spend limits, transactions, and reimbursements for various vendor cards and users.

Top Features

- Mobile app for receipt tracking: Complete and track transactions on the go using BILL’s mobile app to update expenses.

- Virtual cards: The BILL Divvy Corporate Card helps save from any exposure to fraud and controls expenses with spending limits.

- Expense policy: Use budgeting and expense management control features to implement your company’s expense and reimbursement policy.

- Accounting software integrations: Sync and share data with ERP and accounting software like NetSuite, QuickBooks Online, Sage Intacct, and more.

- Handle reimbursements: Bring all out-of-pocket expenses together and reimburse employees or vendors on time with ACH payments or payroll system.

Pros

Being free enables small business expense tracking

Saves money and time for big monthly expenses with petty cash transactions

Fraud prevention features on virtual cards

Offers a rewards program on expenses done using a virtual card

Cons

Doesn’t track personal expenses

Bugs in the accuracy of uploading receipts

Lacks notification feature to alert about budget constraints

Cannot set limits on receipts

Does not support multi-entity expense management

Inadequate budgeting and expense hierarchy

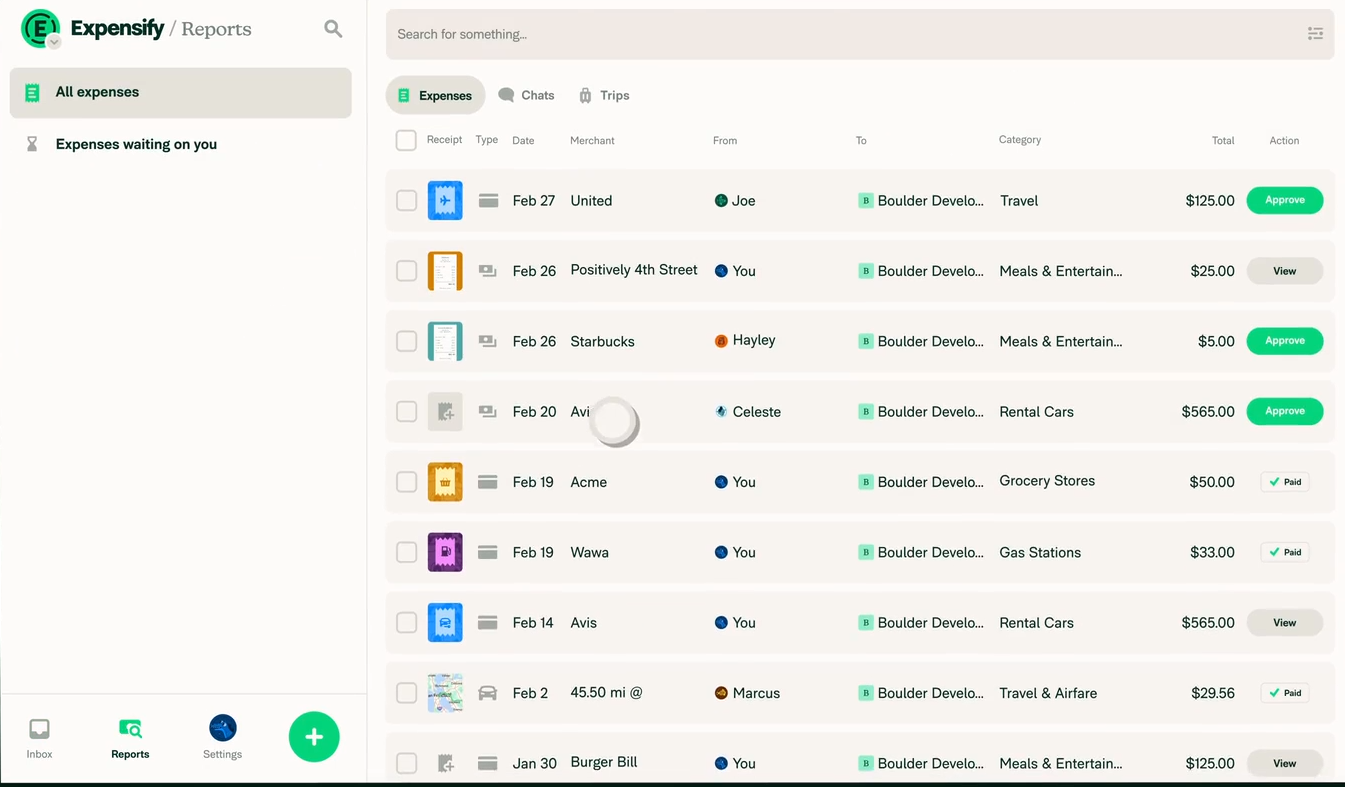

10. Expensify

Offers Corporate Card with Cash Back

Expensify provides an expense management platform for both individuals and businesses. You can track receipts, prepare expense reports, automate invoices, and manage travel workflows in a single platform.

With budget-friendly pricing and a free expense management tool for individuals, it is good to get started. It also offers cashback on their corporate credit card expenses – thus, further helping you reduce investment into expense management software.

Expensify’s dashboard, as shown above, is simple to understand and get started. During the demo, I was impressed by how neatly the software organizes expenses into specific categories, making it easy to understand spending patterns at a glance. The approval buttons are placed directly beside each expense, and it shows the status in one glance (approve/paid/view). This makes reviewing and processing simple, speeding up the reimbursement workflow significantly.

Top Features

- Collaboration tools: Centralize communication with employees, vendors, customers, etc via chat, emails, or messages.

- Global reimbursements: Supports payments across 190+ countries in their local currencies.

- Travel management: Streamlines booking accommodations and travel via flights. Allows adding spending limits on travel bookings and flexible payment options.

- 40+ integrations: Enhance functionality and avoid data migration by integrating directly with ERP and accounting software like Xero, Quickbooks, NetSuite, Workday, Sage Intacct, and more.

- Virtual cards: Issue corporate cards to handle employee expenses for easy accounting and budget control.

Pros

Directly fetches expenses from credit cards, emails, and receipts

Less yet effective features make it easy to use

Good reporting capabilities

Includes personal expense tracking features

Provides a dedicated email address to send receipts directly to the app

Cons

Difficult setup and navigation

Small business users report poor and limited customer service

Mobile apps have limited features compared to desktop

Users report occasional bugs and glitches

Per-user pricing plans make it expensive for large teams

Other Notable Expense Management Platforms

In addition to the above, the below expense management platforms deserve honorable mentions for their popularity and unique features offered.

- SAP Concur – Best for Large Enterprises

- Veryfi – AI-powered Receipt Data Extraction

- Everlance – Best for Self-Employed Expense Tracking

- Rydoo – AI-Powered Expense Monitoring

- Fyle – Best for Intelligent Expense Reporting

What is an Expense Management Software?

Expense management software provides visibility into your business and employee expenses across operations. It tracks expenses, aggregates transactions, and integrates them with accounting software to streamline expense tracking to maintain clean financials.

For this, expense management software often uses AI technologies like OCR for offline receipts, and statements from corporate and virtual cards, to capture expenses. This automates transaction entry and compliance checks.

Thus, with accurate expense data, financial teams can easily generate expense reports to make financial decisions and optimize business expenditures.

What are the Benefits of Using Expense Management Software?

An expense management software translates the gained visibility into expenses into the below benefits:

Save Time

The best business expense tracking apps allow users to use mobile apps to capture receipts data using OCR technology.

Without this simple automation, your employees and financial teams have to perform manual tasks:

- Uploading receipts

- Maintaining paperwork for invoices or receipts

- Data entry of expenses in the required company format

- Clean data to remove duplicates

- Review expenses for policy compliance

- Follow-up with employees or vendors for re-checking expenses

- Match transaction data with banks and credit cards

- Remove or edit expense data to accommodate changes

- Sending data to generate reports

- Sharing data with other accounting software

With just one expense automation workflow, your business effectively removes these 10 manual tasks!

Enforce Compliance

An expense management software with built-in policy enforcement features ensures that all expenses adhere to company guidelines and regulatory requirements. The software automatically flags non-compliant submissions and helps follow up with flagged expenses to investigate issues more deeply. This reduces the risk of fraud or unauthorized spending.

Another way business tracking apps ensure compliance is by restricting spending by adding spend limits or rules on assigned credit cards. It also notifies employees when they reach expense limits so that they are mindful of their ongoing expenditures.

Increase Business Visibility

Expense management software provides real-time visibility into spending patterns across business operations. Finance teams can access dashboards that display current expenses, trends, and budget utilization.

With this visibility, they can make informed financial decisions.

For example, finance teams can quickly identify that travel expenses have surged in a particular department. With this insight, they can investigate further and implement measures to curb unnecessary travel costs.

Optimize budgets

Cloud-based software to track expenses helps save, categorize, and organize data in real-time. One can use AI or data analytics tools on this historical data to determine trends and ways to reduce expenses. Based on these insights, finance teams can set budget limits for different categories and receive alerts when approaching those limits.

For example, a company may find that its marketing department consistently overspends on events. With this insight, they can adjust future budgets or implement stricter approval processes for event-related expenses.

What is the Difference Between Expense Management and Spend Management Software?

Spend Management Software and Expense Management Software help automate and streamline business expenditures. The key difference lies in which area of finances they focus on, which we will understand using this table:

| Criteria | Expense Management Software | Spend Management Software |

|---|---|---|

| Scope | Focuses on tracking and monitoring of employees expenses. | Focuses on individual projects and their spending. |

| Primary features | Tracking expenses, settling claims, managing bills, expense reporting, travel booking, mileage tracking, tax calculations, and more. | Managing supplier contracts, budgeting, procurement optimization, vendor management, financial projections, and more. |

| Use case example | Purchase of stationery or travel expenses of employees on official work. | Focuses on expenses from the company’s point of view. |

| Spending type | Day-to-day operational costs | Capital expenditures, operational budgets, or indirect procurement costs – all related to project management. |

| Users involved | Typically used by employees, HR, and finance teams. | Comparing quotes from vendors and determining impact on project costs or tracking project costs versus actual spending. |

| Policy tracked | Enforces expense policies for employee submissions of receipts. | Enforces procurement policies and supplier contracts to ensure compliance. Includes on-ground project execution rules and associated costs. |

| Kind of reports prepared | Generates reports focused on employee expenses, travel expenses, and metrics to track reimbursements. | Provides detailed reports on overall spending trends, supplier performance, and budget adherence. |

What are the Best Practices for Managing Corporate Expenses?

Even if you procure the best Expense Management Software, you must know how to implement it effectively to maximize corporate expense savings and return on investment:

Set a Clear Expense Policy

The first requirement is to draft an expense policy by considering minimum and average expenses for the task. Do include cases where expenses might offshoot. Then, optimize your spending limits in this range based on real expense values.

Based on these values, your policy should outline:

- What constitutes an approvable expense

- Reimbursement limits

- Required documentation for expense submissions

Make sure employees and other stakeholders are aware of the expense policy. Explore setting up alerts in the expense management software when spending limits are approaching.

Encourage Mobile App Adoption

Choose expense management software with a mobile app to facilitate receipt collection and submission. This helps employees quickly add receipts as they happen. The mobile app’s AI extracts required data instantly and submits or shares it with accounting software for further processing.

A mobile app increases the pace at which finance teams receive expense data for making on-time financial decisions.

For this, training sessions should be conducted with employees to highlight the ease of submitting expenses directly from their smartphones. These benefits include faster processing times and reimbursements.

Enforce Timely Submissions

Sometimes, employees lack the discipline to submit expenses on time. Even if they manage to submit them before the end of the month, it’s a lot of work for finance teams to review and process approvals.

In addition, such late submissions negate the benefit of gaining visibility into employee expenses. Finance teams cannot make informed decisions in real-time about controlling budgets and maintaining cash flow.

For this, set up automated notifications within your expense management software that remind employees of upcoming submission deadlines. For example, if reports are due on the 5th of each month, send reminders a week before to ensure compliance.

Conduct Regular Expense Reviews and Audits

Expense management software accurately captures expense data across operations, quickening the pace of expenditure reviews to identify anomalies and prevent fraudulent claims.

Explore expense management software like Zoho Expense, Pleo, and Rydoo, which provide dedicated expense auditing features. For other software, you can use analytics features to generate reports on spending trends.

Set Spending Limits

The best way to control expense budgets is to implement spend limits and alert workflow as follows:

- Define spending limits for different categories within assigned virtual cards or other payment modes.

- Set up automated alerts that notify managers when an employee’s expenses approach these predefined limits. Allow for follow-ups in the software to include exceptions.

- Conduct training for employees to adhere to these limits and ensure they understand these exceptions.

- Review and adjust these spending limits to accommodate changing markets and SOPs.

Such a proactive approach allows for timely interventions if spending exceeds budgetary constraints.

Offer Corporate Cards

Adopting expense management software that offers corporate debit or credit cards helps employees make purchases directly without needing to front costs. This is crucial because sometimes employees may feel uncomfortable bearing costs or may not have the required finances when performing a task. It also helps track and sync expense data in real-time.

With corporate cards, you simplify the reimbursement process as they are easier to monitor than individual reimbursements.

Explore expense management software like Moss, Pleo, Emburse, Payhawk, BILL, Expensify, and Rydoo, which provide dedicated corporate credit or virtual cards as a part of their ecosystem.

Frequently Asked Questions (FAQs)

Corporate cards help in expense management, as every transaction made by an employee is visible in real-time to the employer. This reduces claim related delays and eliminates the need for a manual reimbursement and approval process. Corporate cards help in automatic matching of receipts and month-end account reconciliation. It also lets employers set expense limits for each employee, which in turn keeps the company’s spending under control.

Telecom expense management (TEM) is the process of monitoring telecom usage by employees — voice, VoIP, internet costs etc, related to work. Many corporate roles involve using employees’ personal devices for official purposes. Companies also provide mobile devices and laptops to employees, who may at times use them for personal purposes. Clearly identifying personal usage and official usage, and approving only official telecom-related expenses is a complex process; therefore, telecom expense management is a crucial part of the overall expense management. Of the tools discussed in this article, Emburse offers telecom expense management feature. Apart from this, there are specialized Telecom expense management solutions offered by Genuity, Brightfin, and Tangoe.