In the world of digital transactions, PayPal has long been a go-to option for individuals and businesses alike. However, recent changes in policies, coupled with rising transaction costs and customer support challenges, have prompted many users to seek alternatives.

In this article, we’ll share a comprehensive overview of the best PayPal alternatives. We’ll discuss how they are solid PayPal competitors in categories like—transaction fees, limited availability, account limitations, and accessibility. Before we dive into the nitty-gritty, here’s a quick TL;DR

- Best for International Transfers: Wise, Payoneer, Revolut, Skrill, OFX, Paysera

- Best for Businesses: Stripe, Airwallex, 2Checkout, Tipalti, Helcim

- Best for Specific Regions: Venmo (USA), Zelle (USA), Razorpay (India)

- 1. Wise – Best Overall

- 2. Airwallex – Best for Business Financial Solutions

- 3. Payoneer – Best for Freelancers

- 4. Stripe – Best for Online Payment Processing

- 5. Revolut – Best for Multi-Currency Accounts

- 6. Skrill – Best for Digital Wallet Services

- 7. OFX – Best for Large International Transfers

- 8. 2Checkout – Best for Global E-commerce Payments

- 9. Paysera – Best for Low-Cost International Transfers

- 10. Tipalti – Best for Accounts Payable Automation

- 11. Helcim – Best for Transparent Merchant Services

- 12. Venmo – Best for Peer-to-Peer Payments

- 13. Zelle – Best for Instant Bank Transfers

- 14. Razorpay – Best for Indian Market Payment Solutions

- Show less

You can trust Geekflare

At Geekflare, trust and transparency are paramount. Our team of experts, with over 185 years of combined experience in business and technology, tests and reviews software, ensuring our ratings and awards are unbiased and reliable. Learn how we test.

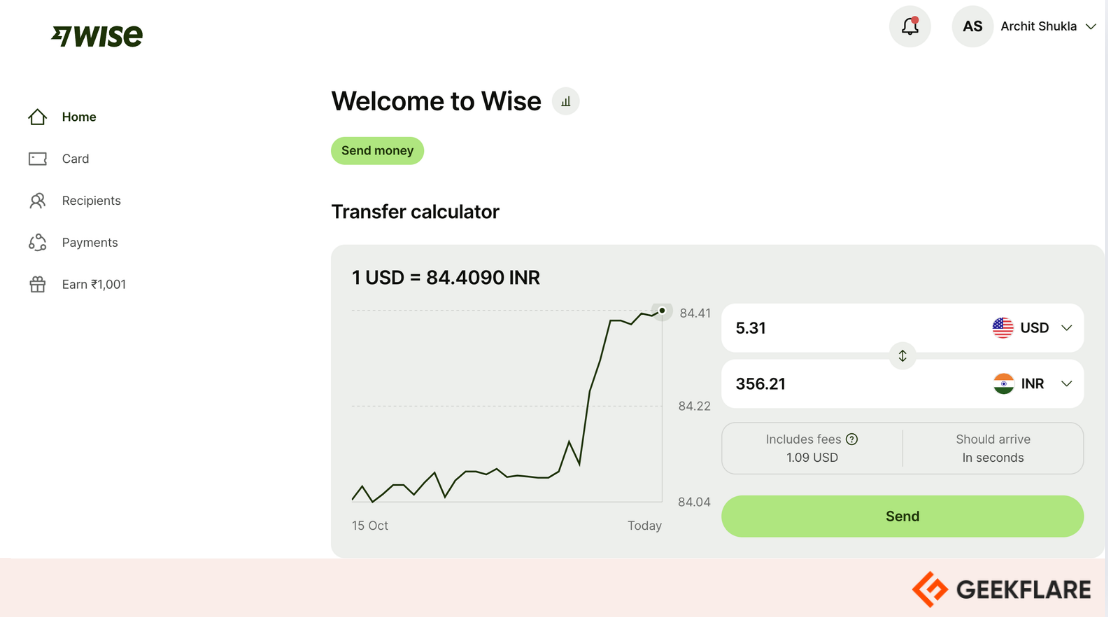

1. Wise

Best Overall

Wise, previously known as TransferWise, is a peer-to-peer payment platform that allows you to send, receive, hold, and manage transactions in over 40+ currencies to 160+ countries.

Wise is a popular PayPal alternative among millennials, freelancers, and businesses operating internationally that need efficient multi-currency management from one platform. It charges a percentage of the amount you send. The fee varies from currency to currency but typically starts at 0.33%.

Wise stands out as a PayPal alternative due to its transparent fees, fast transfer speeds, and the option to receive funds without needing a Wise account. Like PayPal, Wise provides a debit card, making it an excellent choice for international travellers and expatriates.

Wise Key Features

- Low-cost transfers with options to convert money at the mid-market exchange rate.

- Support Auto Conversions when the market hits a rate you choose.

- Hold money with Wise’s program bank network and earn a steady 4.45% interest annually.

- Set up exchange rate notifications so you can send money at the best time for you.

- Create invoices using the free Wise invoice generator or invoice templates.

- Instant, same-day transfers, with 90% of transactions completed within 24 hours.

- Batch payment processing for up to 1000 people.

Pros

Allows to hold and exchange over 40 currencies (PayPal limits to 25 currencies)

Discounted charges on higher monthly transaction volume.

Provide real-time exchange rates at the mid-market rate.

Multi-currency account management.

Cons

Pretty automated customer service, limiting availability and responsiveness.

Impose fees for ATM withdrawals beyond a certain limit.

Wise Pricing

| Fee Type | Charges |

|---|---|

| Business Account Registration | Free or $31 |

| Sending Money (Variable Fee) | ~1.7% (varies by currency) |

| Receiving USD via Wire and Swift | Free or $6.11 |

| Receiving USD via ACH | Free |

| Wise Debit Card Ordering | $9 (one-time) |

| ATM Withdrawals | Free for first 2; then $1.50 each |

2. Airwallex

Best for Business Financial Solutions

Airwallex is a global payments platform that provides financial products and payment solutions for businesses. The platform is built for tech-forward companies that would benefit from a suite of APIs for programmatically managing your global payments and financial operations.

Airwallex APIs come along high-quality developer tools, straightforward documentation, and cloud-native solutions that easily integrate with your existing apps and workflows. You can open an account with local bank details in over 12 currencies, including USD, EUR, AUD, and more, avoiding costly conversion and transaction fees.

The best part is that you can use Airwallex’s infrastructure to create custom financial services, enhancing customer offerings without extensive resources or regulatory knowledge. It issues multi-currency corporate cards for employees, allowing real-time expense management and control over spending.

Airwallex Key Features

- Automate approvals for bill and vendor payments in multiple currencies at market-leading FX rates.

- Integrate end-to-end payment solutions for your platform or marketplace.

- Create shareable payment links for easy fund collection from customers globally.

- Built-in fraud detection mechanism to identify suspicious transactions and chargeback protection.

- Integrate with popular accounting platforms like Xero and QuickBooks for streamlined financial management.

Pros

A developer-friendly finance software solution.

Country-specific rates and lower FX charges than PayPal.

Support virtual and physical cards for business expenses

Cons

Airwallex does not support ATM withdrawals.

Restrict services in some countries, which may affect global usability for certain businesses.

Airwallex Pricing

| Plans | Monthly Pricing | Offerings |

|---|---|---|

| Explore | $0 (if you deposit at least $5k/month or hold a minimum balance of $10k) or $29 | For small businesses. Open multiple accounts per entity, Collect and hold in 20+ currencies, Free transfers to 120+ countries, Access to interbank FX rates |

| Grow | $99 | For growing businesses. Expense Management, Manage domestic and international bills, Automated receipt and bill data extraction, Customizable approval workflows, Batch payments |

| Accelerate | $499 | For larger businesses. Centralized financial management, Single sign-on, Expenses and Bills sync with NetSuite, HRIS platform integrations, Dedicated accounts manager. |

3. Payoneer

Best for Freelancers

Payoneer facilitates international transactions for freelancers, gig workers, marketplaces, and online businesses with a global clientele.

Payoneer, trusted by top businesses and marketplaces like eBay, Amazon, UpWork, Etsy, Walmart, and Fiverr, provides versatile checkout integration options. It supports shopping cart plugins for popular e-commerce platforms, including Shopify and WooCommerce, and a hosted payment page.

Payoneer offers intelligent dispute management with pre-dispute alerts and a dedicated chargeback protection team. Its transaction fees range from 1% to 3%, depending on the type of transaction, which can be more economical than PayPal’s flat fees.

Payoneer Key Features

- Facilitates global transactions across over 200 countries and 150 local currencies.

- Supports integrated, third-party, and escrow payments with API compatibility.

- The anti-fraud system actively protects payments using advanced risk intelligence.

- Payment Request tool allows businesses to create and send professional invoices with diverse payment options.

Pros

Low currency conversion fees compared to PayPal.

Maintains robust customer support through email, live chat, and phone.

Partnership with 2000+ marketplaces, including Fiverr, UpWork, AirBnB, and more.

Cons

The service charge for incoming payments is slightly higher compared to PayPal.

Lacks a payment gateway or POS system.

Payoneer Pricing

| Fee Type | Charges |

|---|---|

| Credit Cards (all currencies) | 3.99% for credit cards in all currencies; |

| ACH bank debits (US only) | 1% |

| Annual fee (if 12 months pass and you have received less than 2,000.00 USD (or equivalent) in payments) | $29.95 |

| Withdrawal Fees | Up to 3% of transaction amount (including a 2% forex markup) |

4. Stripe

Best for Online Payment Processing

Stripe is best suited for businesses in need of payment processing solutions rather than direct money transfers. It is designed to integrate with your website or online store, allowing customers to perform the entire checkout process without leaving your website or app.

Stripe offers a comprehensive suite of payment processing tools, including APIs for online payments, subscription billing, and point-of-sale transactions.

Just like PayPal, Stripe provides shareable payment links, along with 100+ other options to receive payments, including major credit cards and digital wallets (like Apple Pay and Google Pay), but with lower fees.

Stripe also allows you to customize the on-site payment gateway to match your shop’s brand and aesthetic. In comparison, PayPal requires a paid upgrade for users who want a custom-integrated checkout experience.

However, setting up Stripe’s gateway can be challenging and may require coding knowledge. You can consult your in-house developer or hire one from Fiverr for as little as $20.

Stripe Key Features

- Support for recurring payments.

- Offers in-depth sales and customer behaviour insights through the built-in Stripe Sigma analytics tool.

- Provides financial reconciliation tools, including deposit tagging and accounting tool integrations.

Note: Stripe doesn’t offer a native pay-later option but integrates with third-party platforms like Affirm, Afterpay, and Klarna instead—each of which charges a fee of around 6% plus $0.30 per installment.

Pros

Developer-friendly platform with well-documented APIs.

Ensure high-level security with PCI Service Provider Level 1 certification, safeguarding sensitive payment information.

Well-integrated with e-commerce platforms like Wix, Shopify, WooCommcer, and more.

Cons

Require technical expertise for advanced customization.

Provides limited customer support.

Stripe Pricing

| Fee Type | Charges |

|---|---|

| Domestic Cards and Wallets | 2.9% + $0.30 per transaction (U.S.) |

| International Card Fee | +1% |

| ACH debit, ACH credit, or wire transfers. | 0.8% (capped at $5) |

| Currency Conversion Fee | 1% |

| Buy Now Pay Later | Starting at 5.99% |

| Monthly Fee | $0 (no monthly fee) |

| Chargeback Fee | $15 (refunded if won) |

5. Revolut

Best for Multi-Currency Accounts

Revolut is an all-in-one financial app that allows you to send and receive international payments for personal and business use. Its chat-style interface, similar to Google Pay, makes sending, receiving, and splitting money as simple as messaging.

For freelancers and gig workers working with international clientele, Revolut accepts 25+ currencies and offers tools for budgeting, automated investing, insurance, and discounted online shopping. It offers virtual and physical cards for secure online and in-store purchases.

Revolut’s multi-currency business account is an upgrade from personal finances. With a business account, you can handle high-value international transactions and exchange receivables in multi-currencies while confirming the platform as per the business payment structure.

Revolut Key Features

- Control access to how team members can view and spend based on their assigned roles and spending limits.

- Get audit confirmations, expenses, and monthly statements integrated with your accounting software for a secure, accurate flow of your important information.

- Receive in-app alerts when currencies reach your target rates.

- Lock in exchange rates with forward contracts and secure a fixed rate for up to 12 months ahead.

Pros

Support cryptocurrency trading and investments directly within the app.

Offer disposable virtual cards for enhanced online transaction security.

Provide real-time currency exchange at interbank rate

Cons

Limit customer support options, with no live telephone assistance available.

Experience occasional technical issues, including app outages.

Revolut Pricing

| Plans | Monthly Pricing | Offerings |

|---|---|---|

| Basic | Free forever | Ideal for small businesses. Send, receive and exchange 25+ currencies, issue physical and virtual cards, limited local payments, basic expense management |

| Grow | $30 | For businesses needing expanded capabilities. Exchange up to $10,000 monthly at great rates, Get a no-fee transfer allowance, Access spend controls and approvals, Bulk payments |

| Scale | $119 | Suited for scaling businesses. Exchange up to $50,000 monthly at great rates, Business API, FX allowances, integration with payroll and accounting software, advanced expense management |

6. Skrill

Best for Digital Wallet Services

Skrill is ideal for Forex trading, cryptocurrency transactions, and online gambling. It supports over 40 cryptocurrencies. It offers prepaid Visa/Master cards and VIP club benefits for frequent users. If you prioritize having a low-fee digital wallet with a linked debit card, Skrill is the best PayPal alternative for you.

Alongside, Skrill also partners with all major gaming sites, shopping carts and e-commerce platforms to conveniently transfer money across websites. It offers a loyalty program, Skrill Knect, where users earn points on transactions.

To comply with PSD2 regulation, Skrill provides APIs enhanced with state-of-the-art authentication and authorization flow that secures access to your data.

Skrill Key Features

- Supports transactions in over 40 currencies.

- Over 100 local payment methods, including credit and debit cards, bank transfers, and eWallets.

- Quick checkout process with features like one-touch payments through Skrill 1-Tap.

- Offers chargeback protection service to mitigate risks associated with transaction disputes.

Pros

Generally offers free or lower fees for deposits and transactions.

Excellent for trading in cryptocurrencies.

Offers loyalty programs that allow users to earn points on transactions.

Cons

Maximum and minimum withdrawal limits make Skrill unappealing to businesses and freelancers.

Charge relatively high fees (3.99%) on currency conversion.

Skrill Pricing

| Fee Type | Charges |

|---|---|

| Account Maintenance | No monthly fee |

| Deposit Fees | No fees (third-party fees may apply) |

| Withdrawal Fees | Bank transfer: $5.96; Skrill to Skrill: Free |

| Currency Conversion | 3.99% above the market rate |

| Inactivity Fee | $5.00 after 12 months of inactivity |

7. OFX

Best for Large International Transfers

OFX is a financial services platform specialising in international money transfers and foreign exchange. Unlike apps like PayPal, OFX does not charge upfront transfer fees. It also charges about 1.5% or less for currency conversion for international fund transfers.

OFX’s tiered pricing model appeals to individuals and SMBs as they can make large sum transfers at fixed monthly charges, making transfers more cost-effective than PayPal. Additionally, it offers advanced features such as forward contracts and limit orders that help businesses manage currency risk effectively.

OFX Key Features

- Hold and manage multiple 30+ currencies in one account.

- Access accounts and make transfers at any time with a dedicated mobile app.

- Send transfers to multiple vendors with batch-pay functionality.

- Set up approval workflows for high-value transactions.

- Dedicated currency specialists for forex support and guidance.

- Integrations with spend management, automation, and accounting apps.

Pros

Unlike PayPal, you get a personal account manager with OFX.

Excellent 24/7 multilingual support at any time.

A responsive mobile app for easy finance money management.

Cons

Minimum transfer limit of AU$250 and additional fees for transfer amount less <AU$10,000.

Limited payment options are available other than local bank transfers.

OFX Pricing

| Plans | Monthly Pricing | Offerings |

|---|---|---|

| Business | Free forever | Collect payments in 30+ currencies, Local bank accounts, Virtual cards, Xero integration, Batch payments |

| Business Plus | $15 per user | Approval workflows, Invoicing, Expense and vendor management, Payroll integration, |

| Configure | Custom pricing | Ability to handle 50+ users and high volume transactions |

👀 Note: OFX monthly plans are limited to the number of monthly cost-free transactions.

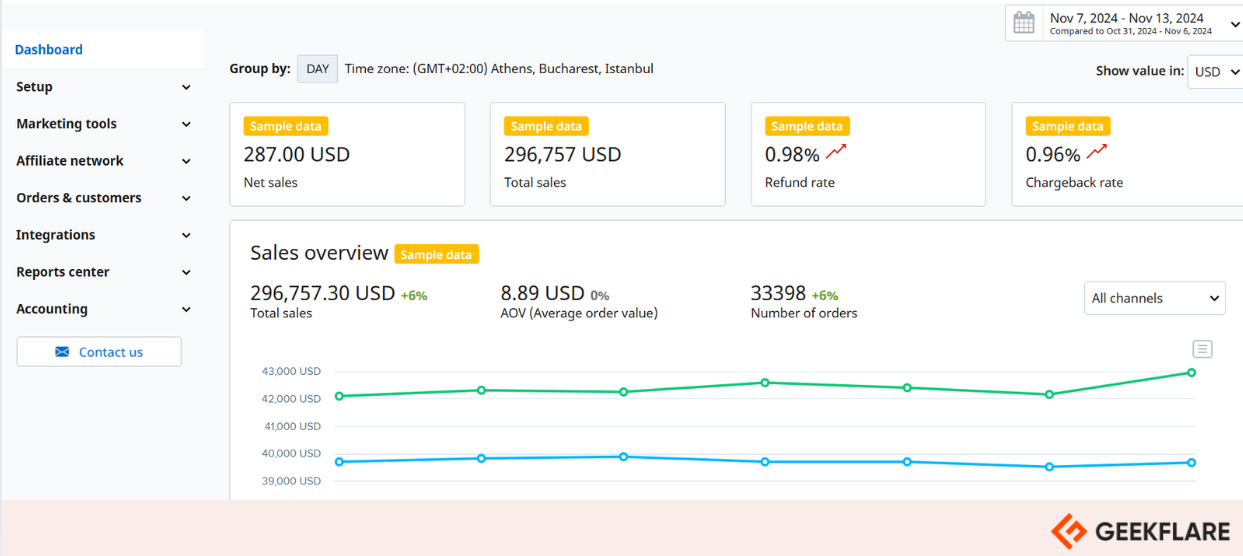

8. 2Checkout

Best for Global E-commerce Payments

2Checkout, now known as Verifone, is a global payments platform and an attractive choice for businesses looking to sell online. It supports several payment models, including one-time purchases, subscriptions, and digital goods sales.

2Checkout also handles back-office operations, including global tax management, GDPR and PCI compliance, fraud and chargeback protection. SaaS providers and digital product sellers can choose debit/credit card payments or subscription billing for timely payments.

Unlike PayPal’s standard options, 2Checkout allows more customization options and supports a wider array of payment methods and currencies. It offers three core products: Sell, Subscribe, and Monetize, which e-commerce businesses can integrate into their checkout pages.

2Checkout Key Features

- Sell physical or digital products in over 200 countries and accept payments in over 45+ payment types in 130+ currencies.

- Use real-time Geo-IP detection to localize checkout experiences and branding components.

- Accept payment for recurring bills and easily manage subscriptions.

- Get instant insights into sales, trends, and renewals using ready-made, customizable reports.

Pros

Enable customizable checkout to enhance the user experience.

Flexible integration with more than 120 shopping carts and offers API support for developers

Built-in tools for optimizing conversions, invoice management, and more administrative functions.

Cons

Unlike PayPal, 2Checkout does not facilitate in-person card transactions.

Charges a percentage of sales as a fee may not impress cost-conscious users.

2Checkout Pricing

| Plans | Per Sale Fees | Offerings |

|---|---|---|

| 2SELL | 3.5% + $0.35 | For businesses aiming to sell globally. Sell instantly in 200 countries/territories, Integrate quickly with 120+ carts, Access to recurring billing |

| 2SUBSCRIBE | 4.5% + $0.45 | For subscription-based businesses. Smart subscription management tools, Manage renewals and upgrades, Subscription analytics |

| 2MONETIZE | Custom pricing | For companies selling digital goods globally. Global tax & regulatory compliance, Invoice management, Access to 45+ payment methods, |

9. Paysera

Best for Low-Cost International Transfers

Paysera offers a comprehensive financial platform for freelancers, online businesses, and individuals looking to manage global transactions. It provides a cost-effective solution for money transfers, payment processing, and currency exchange, all accessible through a convenient mobile app.

With competitive exchange rates and low fees for international transfers, Paysera is a top alternative to PayPal for freelancers and businesses.

You also benefit from a Paysera IBAN account, which is free for private clients and businesses registered in SEPA countries. Private clients get unlimited free Euro transfers in terms of amount and number. It offers business accounts with customizable payment solutions and API integrations for e-commerce platforms.

Paysera Key Features

- A virtual multi-currency account keeps money in several currencies at once.

- Real-time currency exchange to 30+ different currencies.

- Contactless payment cards for safe payments

- Discounted exchange rates for high-value transactions.

Pros

Support a multi-currency account system, facilitating transactions in over 30 different currencies.

Charge low fees for international money transfers.

Ensure compliance with EU financial regulations

Cons

Users struggle with Paysera’s long onboarding processes.

Incidents of random account freezing and unreliable customer support.

Paysera Pricing

| Fee Type | Charges |

|---|---|

| Account Maintenance | Free |

| Incoming Transfers (SEPA) | Free |

| Outgoing Transfers (SEPA) | $0.11 |

| Currency Exchange | 0.5% – 2% depending on currency |

| ATM Withdrawals | $2.11 + 1% of the amount |

| Card Issuance | $5.33 (approx.) |

| Monthly Card Maintenance | Free for the first card; $1.60 for additional cards (approx.) |

| Payment Processing Fees | 2.5% of the transaction amount |

| International Transfers | $32 for standard processing (Varies by country and method) |

10. Tipalti

Best for Accounts Payable Automation

Tipalti focuses on an integrated approach to financial management. It is best for businesses requiring accounts payable setup and automation capabilities.

Tipalti is a solid alternative to PayPal because it focuses on automating processes. It provides end-to-end automation for accounts payable, invoicing, reconciliation, mass payment, and tax management.

Alongside, Tipalti AI assists you in every step, from auto-routing invoices to auto-populating required fields, identifying duplicate bills, and much more. It is ideal for small to large enterprises dealing with large volumes of payments or requiring vendor management services.

Tipalti Key Features

- Automate data entry and invoice processing using advanced OCR and workflow automation tools.

- Pay to contractors, freelancers, and other stakeholders across 196 countries in over 120 currencies.

- Use procurement management tools to control spending and reduce financial risks associated with maverick purchases.

- Allow employees to submit expense reports easily, with quick approval processes for managers.

Pros

Integrated AI capabilities make payments more efficient and less manual.

Integrates with various ERP and accounting systems, including NetSuite, QuickBooks, and Sage.

Enterprise-grade security and fraud protection.

Cons

The initial setup and integration of Tipalti can be complex and time-consuming.

Lacks real-time notifications, especially for cancelled approval requests.

Tipalti Pricing

| Plans | Monthly Pricing | Offerings |

|---|---|---|

| Starter | $99 | Supplier portal for self-onboarding, AI Smart Scan invoice processing, Flexible bill approval rules builder, Integrations with leading ERPs |

| Premium | Custom pricing | Unlimited intake requests, 2 & 3-way PO matching, Global multi-entity & multi-currency infrastructure, Option to add Mass Payments |

11. Helcim

Best for Transparent Merchant Services

Helcim supports multi-currency payments both in-person and online with competitive processing rates. A unique feature is its reliance on the customer’s bank for currency conversion, reducing exchange fees for e-commerce store owners.

While apps like PayPal charge flat-rate fees, Helcim uses an interchange-plus pricing model, in which as transaction volumes increase, the fees decrease, leading to lower transaction costs for businesses.

Along with providing hardware for collecting payments at POS via debit/credit cards, Helcim offers several ways for online stores to accept payments: virtual terminals, invoices, checkout pages, and subscription-based payouts.

Helcim Key Features

- Access a range of business tools for customer management, invoicing, inventory management, and analytics.

- Accept credit cards and ACH payments via mobile app.

- Send customized invoices with private payment links via email or text.

- Use Subscription Manager to set up recurring payment plans that automatically bill customers on due dates.

Pros

Economical pricing structure for businesses processing large volumes.

Reliable support via phone and email, with options to schedule callbacks.

Offers tools for invoicing, subscription management, APIs, and developer tools for customization.

Cons

Limited to CAD/USD and does not allow transactions in local currencies from other countries.

Impose higher fees for low-volume businesses

Helcim Pricing

Helcim charges vary based on monthly sales volume. For example, if your monthly sales are less than $40k, here are what fees and charges you pay:

| Fee Type | Charges |

|---|---|

| Average In-Person Transaction Cost | Starting at 1.83% + $0.08 per transaction |

| Average Online Transaction Cost | Starting at $2.27% + $0.25 per transaction |

| ACH Acceptance | 0.5% + $0.25 per transaction |

| Monthly Fee | No monthly fee for standard accounts |

| Chargeback Fee | $15 per chargeback |

12. Venmo

Best for Peer-to-Peer Payments

Venmo is a popular digital payment platform for peer-to-peer transactions across the U.S.A. Its user-friendly interface and social features are built for a younger audience that prefers quick, informal payments, which isn’t the case with PayPal.

Like Google Pay or Apple Pay, Venmo lets you split expenses, receive money, send gifts, and more. Venmo’s social feed adds a layer of engagement that PayPal lacks, making transactions feel more connected.

Venmo Key Features

- Send or request money from friends and family without any fees or charges in the U.S.A.

- Create groups for people who you send, receive, or split money with regularly.

- Buy, hold, and sell certain cryptocurrencies directly through the app.

- Add Vimeos as a payment method on your website or app checkout pages.

Note: Venmo does not allow users to send or receive payments from outside the United States. Therefore, if you are receiving a payment from outside the U.S., you cannot use Venmo for that transaction.

Pros

Free and instant transfers within the U.S.

Get purchase protection without any extra costs.

A familiar Google Pay style interface makes adoption easy among freelancers and small contractors.

Cons

Lacks international payment capabilities; limited to U.S. users.

Daily withdrawal limit from ATMs using the Venmo debit card is $400.

Venmo Pricing

There are no fees for receiving personal payments from other Venmo users within the U.S., any payments identified as for goods and services incur a fee of 2.99%.

| Fee Type | Charges |

|---|---|

| Monthly and per purchase fees | N/A |

| ATM withdrawal fees (out-of-network) | $2.50 per transaction |

| Instant transfers | 1.75% (min. $0.25 / max. $25) |

| Credit card transactions | 3% |

13. Zelle

Best for Instant Bank Transfers

Zelle is a digital payment network that enables fast, secure, and convenient money transfers between bank accounts in the U.S. It operates within U.S. boundaries and allows you to send/receive/split money between friends, family, and local shops.

Zelle is integrated into over 2,000 banking apps in the U.S., making it accessible to a large user base without needing a separate app. With Zelle, users can send funds using just an email address or a U.S. mobile phone number, eliminating the need for complex account details.

Zelle Key Features

- Instant bank transfers at no cost.

- Send/receive money in the U.S. for free.

- Dedicated mobile app for easy financing.

- Qualifying imposter scams may be eligible for reimbursement.

Pros

Facilitates instant money transfers between U.S. bank accounts

Dedicated mobile app for quick and efficient transactions.

Requires only the recipient’s email address or U.S. mobile number to initiate a transfer

Cons

Does not support transactions outside the U.S.

Lacks purchase protection

Zelle Pricing

Zelle is free to use. Like other digital payment platforms, such as Google Pay and Apple Pay, it allows users to send and receive money from friends and family within the US borders.

14. Razorpay

Best for Indian Market Payment Solutions

Razorpay is among the best PayPal alternatives for Indian businesses. It stands out for its 100+ local payment methods, including UPI, net banking, and various digital wallets, which are crucial in India’s digital payment ecosystem.

Razorpay’s developer-friendly API makes it easy to embed payment buttons and links into websites and mobile applications. Additionally, you can access business banking services through RazorpayX and tools for managing vendor payouts.

Razorpay Key Features

- Accept international payments in nearly 100 foreign currencies.

- Automate recurring billing and invoicing for subscription-based payments.

- Get real-time insights into transactions, cash flow management, and customer behaviour via dashboards and reports.

- Use the Instant settlement feature to receive funds directly into their bank accounts within minutes.

- Dedicated expert team for forex funding.

Pros

Lower transaction fees compared to PayPal.

Dedicated systems like instant settlements help quickly resolve conflicts and provide chargeback protection.

Automate disbursals and vendor payments.

Support recurring billing and subscription management.

Cons

Face occasional downtime and technical issues.

Manual verification and KYC documentation are required, which may delay the onboarding process.

Razorpay Pricing

| Fee Type | Charges |

|---|---|

| International payments | Starting at 1.5% per transaction (excl. taxes) |

| Razorpay POS | Starting at 1.30% (plus taxes) |

| Subscriptions | 0.9% per transaction + platform fees |

Best PayPal Alternatives Comparison

Here, we compare best paypal alternatives based on supported currencies, key features and pricing.

| Payment Platform | Supported Currencies | Key Features | Starting Price |

|---|---|---|---|

| Wise | 40+ supported currencies including GBP, USD, EUR, AUD, NZD | Low fees for international transfers, Multi-currency account, Interest on balances | Free; $31 |

| Payoneer | Supports 150+ currencies | Checkout integration, Mass payouts, Compliance support | Free; 3% of transaction amount |

| Stripe | Over 135+ currencies supported | 100+ payment options, Robust API, Recurring payments, Built-in analytics | 0.5% per transaction |

| Revolut | 25+ supported currencies | Multi-currency accounts, Crypto trading, budgeting tools | Free; $30/month |

| Skrill | Support 40 different currencies | Online wallet, International money transfers, Prepaid cards, Forex and crypto trading | Free |

| OFX | Support 30+ currencies | Batch-pay functionality, Automated approval workflows, Vendor management, Integrations with spend management & accounting apps. | Free; $15/month |

| Airwallex | Support international transfers in 60+ currencies including USD, EUR, AUD, and more | Create custom financial services, Automate approvals for bill payments, Built-in fraud detection | Free, $29/month |

| 2Checkout | Supports 130+ currencies | Supports over 45 payment types, Real-time Geo-IP detection, Instant insights, Integrates with 120+ shopping carts | 3.5%+0.35$ per transaction |

| Paysera | to 30+ different currencies. | Virtual multi-currency account, Contactless payment cards, Discounted exchange rates for volume transactions | Free; $0.11 per transaction |

| Tipalti | Supports 120+ currencies | Integrated AI for data entry and invoice processing, procurement management tools, 2 & 3-way PO matching. | $99/month |

| Helcim | Based on virtual terminal configuration | Customer and inventory management, POS solutions, Secured card vault. | 1.83% + $0.08/transaction |

| Venmo | Supports US Dollars and Cryptocurrencies | Chat style interface, Send and Receive money/crypto with a click, Integrate Venmo on your website or app. | Free; 2.99% per transaction |

| Zelle | Supports transaction within U.S. boundaries | Instant bank transfers at no cost, Send/receive money in the U.S. for free, Dedicated mobile app | Free |

| Razorpay | Supports over 100 foreign currencies | Automate recurring billing and invoicing, Cash flow management, Dashboards and reports. | 1.5% per transaction |

Why Look for PayPal Alternatives?

We dug into some first-hand PayPal user reviews, and here’s why you must consider alternatives to PayPal.

High Fees

PayPal has a complex fee structure with relatively high transaction charges and additional fees for co-services. It imposes a standard fee of 3% to 4%, plus a potential markup on the exchange rate, which can increase total costs significantly.

Account Limitations

PayPal account limitations are temporary restrictions that can severely impact your ability to send, receive, or withdraw funds. These limitations are usually triggered by concerns about fraudulent activity, non-compliance with PayPal’s policies, or a high number of buyer claims and chargebacks. While these measures are a step toward complying with PSD2 regulations, they often lead to a poor user experience due to unexpected account freezes.

Customer Support Issues

Users often express dissatisfaction with PayPal’s customer support in resolving these issues, citing difficulty in getting timely responses or solutions.

Other Paypal Alternatives to Consider

If you’re looking for an easy-to-use and smooth alternative to PayPal, consider digital payments like Google Pay, Amazon Pay, and Apple Pay. Each of these services lets consumers make fast and easy purchases in stores and online.

Google Pay

With Google Pay, you can pay in physical stores and online by using near-field communication (NFC) technology, commonly referred to as NFC mobile payments. The platform is also a go-to choice for person-to-person transactions.

Amazon Pay

Amazon Pay is primarily targeted at businesses or individuals who shop on Amazon. It is activated by default for users with Amazon accounts who accept the Amazon Pay user agreement and make purchases using Amazon Pay on third-party websites.

Apple Pay

Apple Pay is an excellent choice for online shoppers seeking a seamless checkout process. Beyond facilitating payments on websites and within applications, Apple Pay also supports person-to-person transfers.

Cryptocurrencies as a PayPal Alternative

A large number of users are switching to cryptocurrencies for online payments. Crypto is a fast, secure, and cost-effective alternative to traditional methods. Platforms like Coinbase and Binance are leading the race, with their digital payment apps: Coinbase Commerce and Binance Pay, respectively.

Explore More Payment Solutions

-

EditorNarendra Mohan Mittal is a senior editor & writer at Geekflare. He is an experienced content manager with extensive experience in digital branding strategies.

EditorNarendra Mohan Mittal is a senior editor & writer at Geekflare. He is an experienced content manager with extensive experience in digital branding strategies.