As a business owner or freelancer, you know the importance of finding the right business software to manage your finances. QuickBooks and FreshBooks are two of the most popular accounting software choices – but which one is right for you?

Both accounting software offers essential invoicing, expense tracking, and business reporting features. However, they have distinct strengths and weaknesses that make them better suited for different sizes of businesses and needs.

You can trust Geekflare

At Geekflare, trust and transparency are paramount. Our team of experts, with over 185 years of combined experience in business and technology, tests and reviews software, ensuring our ratings and awards are unbiased and reliable. Learn how we test.

FreshBooks vs. QuickBooks Comparison Table

|  |

FreshBooks | QuickBooks |

FreshBooks is the leading invoicing and accounting software for freelancers and self-employed. | QuickBooks is a popular all-in-one accounting software for small to medium business. |

What are the Best Invoicing Software besides QuickBooks and FreshBooks?

Zoho Invoice, Wave, Harvest, and Invoice2go are good invoicing software, in addition to QuickBooks and FreshBooks.

What is FreshBooks?

FreshBooks is a cloud-based accounting software for small business owners, freelancers, and self-employed professionals. It offers an intuitive interface for invoicing, time tracking, and financial reporting tasks.

FreshBooks connects with over 100 business apps to offer a complete solution for managing business finances. It offers features like sending customized invoices, receiving payments, project monitoring, and financial reporting. It simplifies accounting processes with automated billing and customizable templates.

You can read our detailed FreshBooks review to know more.

What is QuickBooks?

QuickBooks, by Intuit, is a specialized accounting software designed for small and medium-sized businesses and accountants. It provides extensive tools like detailed financial reporting, professional invoicing, expense tracking, payroll management, and advanced inventory management.

QuickBooks integrates with over 750 business applications like Shopify, Stripe, Bill.com, HubSpot, etc., making it a versatile and reliable solution for various business requirements.

12 Key Differences Between FreshBooks and Quickbooks

FreshBooks and QuickBooks have their own sets of pros and cons. The following differences are considerable when comparing the two best accounting software for your business.

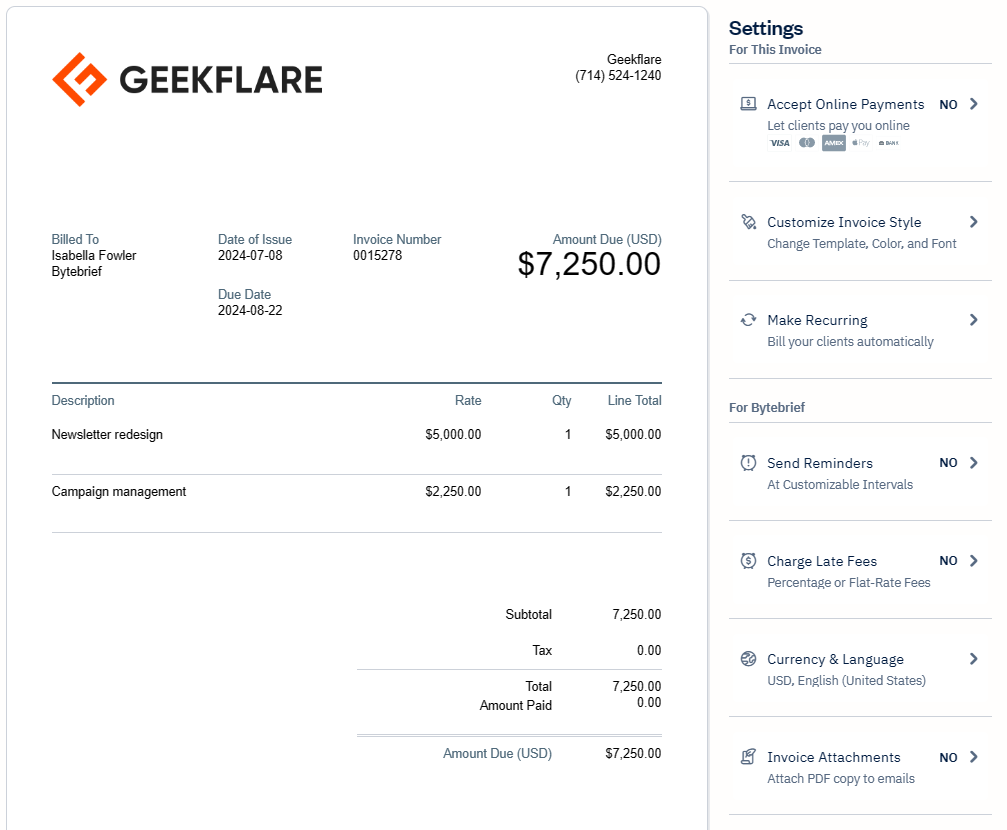

1. Invoicing and Payments

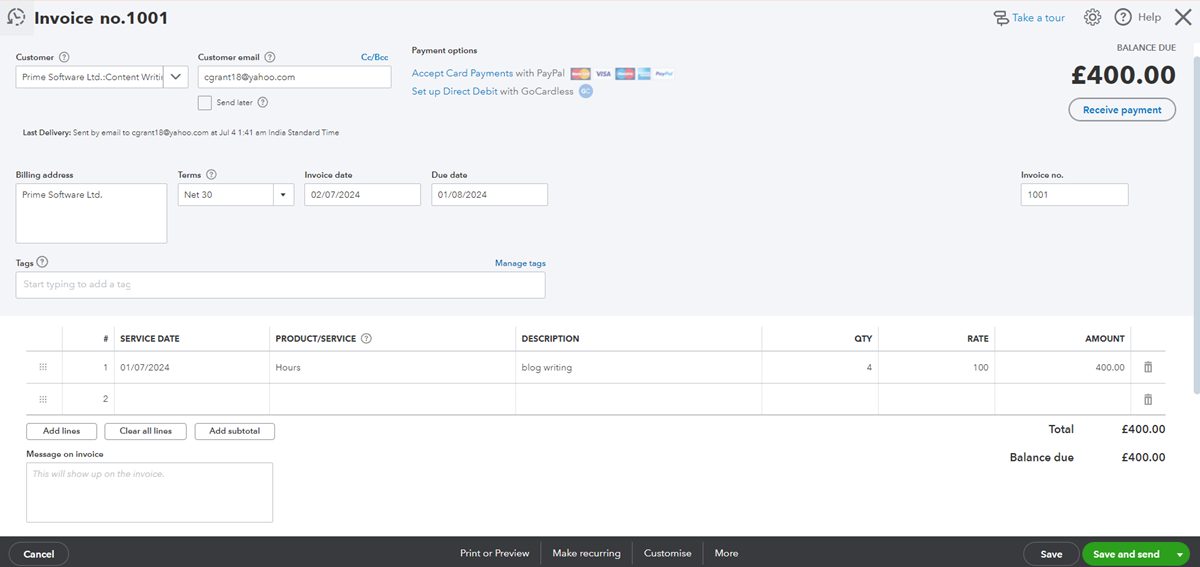

FreshBooks allows users to create professional invoices with customizable templates, including company logos and personalized messages. It retrieves data directly from the timekeeping feature. It also offers automated functions such as recurring invoices for billable hours and follow-up emails for outstanding payments.

FreshBooks allows users to track payments, send automatic payment reminders, and accept various payment options for invoices. Integration with Stripe and PayPal allows clients to pay instantly using different methods such as credit cards, debit cards, PayPal, Apple Pay, and Google Pay.

QuickBooks invoice builder allows customization to match branding, with payment options including Apple Pay, credit card, or ACH. It also allows for previews before sending invoices and reminders for overdue payments.

2. Accounting

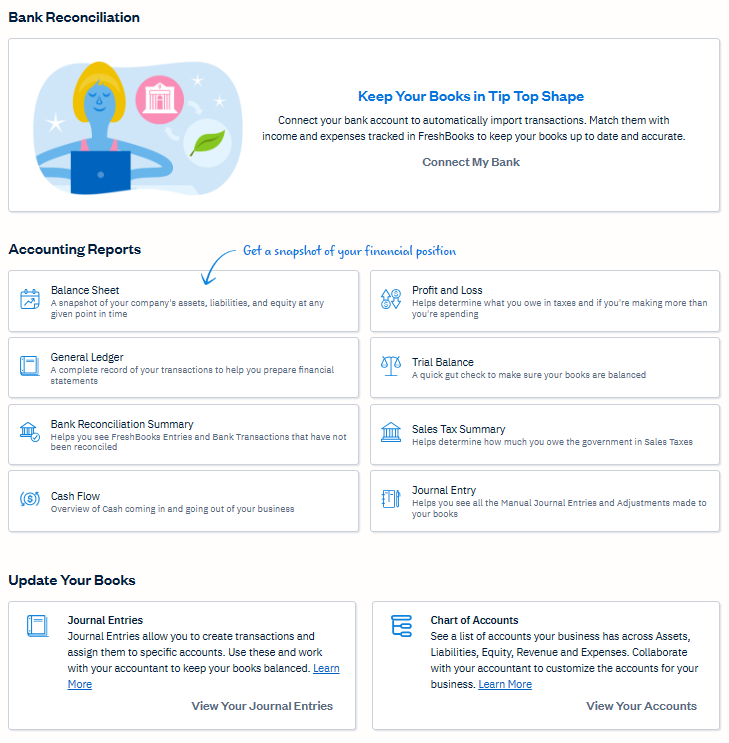

FreshBooks offers double-entry accounting, enabling users to track revenue and expenses accurately and providing valuable insights into profits and losses.

FreshBooks simplifies organizing and managing financial data by allowing users to import and categorize transactions, transfers, equity, and refunds. Users can also add accountants for exclusive access to the account for oversight and support.

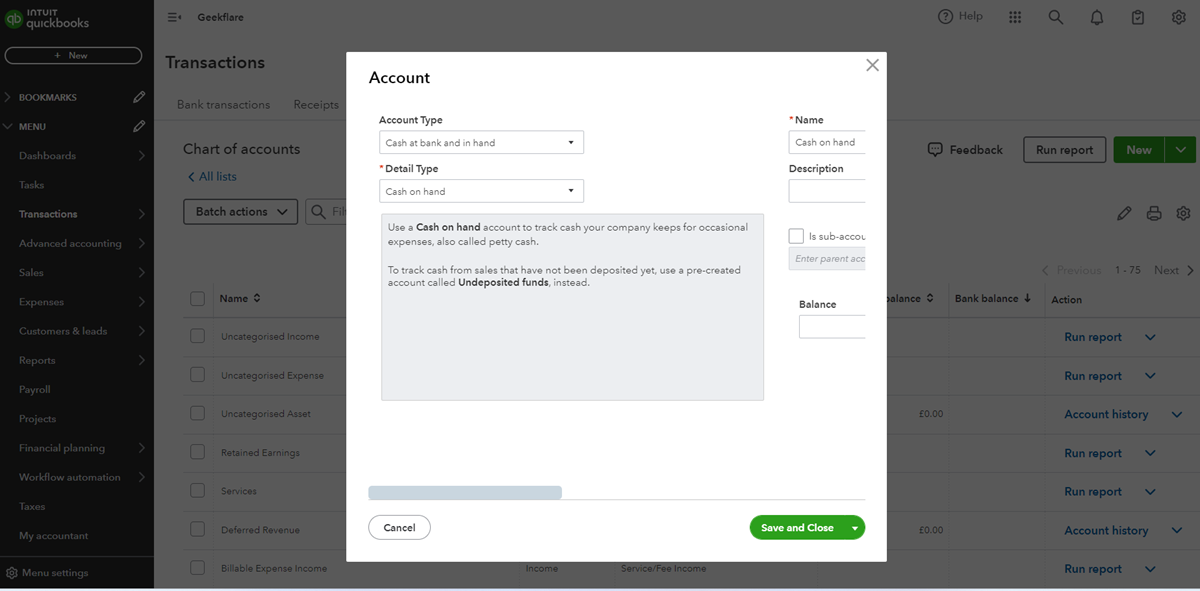

On the other hand, QuickBooks tracks all expenses by sorting transactions and separating them into tax categories. It also allows users to link photos of receipts to the corresponding transactions, streamlining the record-keeping process.

QuickBooks can generate reports using raw data, providing valuable financial performance and management insights.

3. Time Tracking

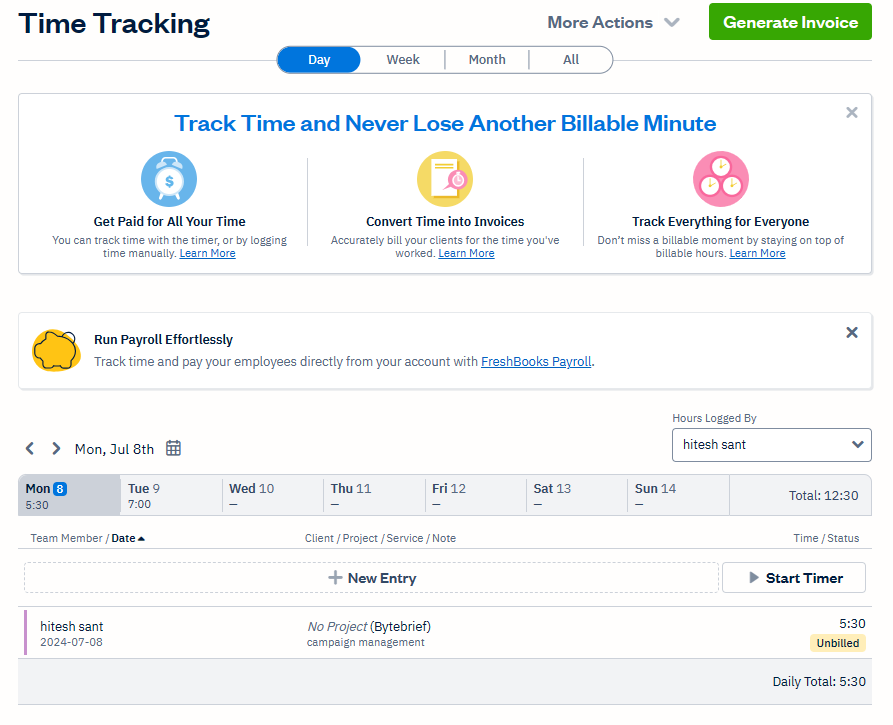

FreshBooks’s built-in time tracker is ideal for client-based and project-based businesses where workers track billable time and related expenses.

FreshBooks’s time tracker allows users to monitor individual employees’ work progress, helping managers track productivity and make project management decisions.

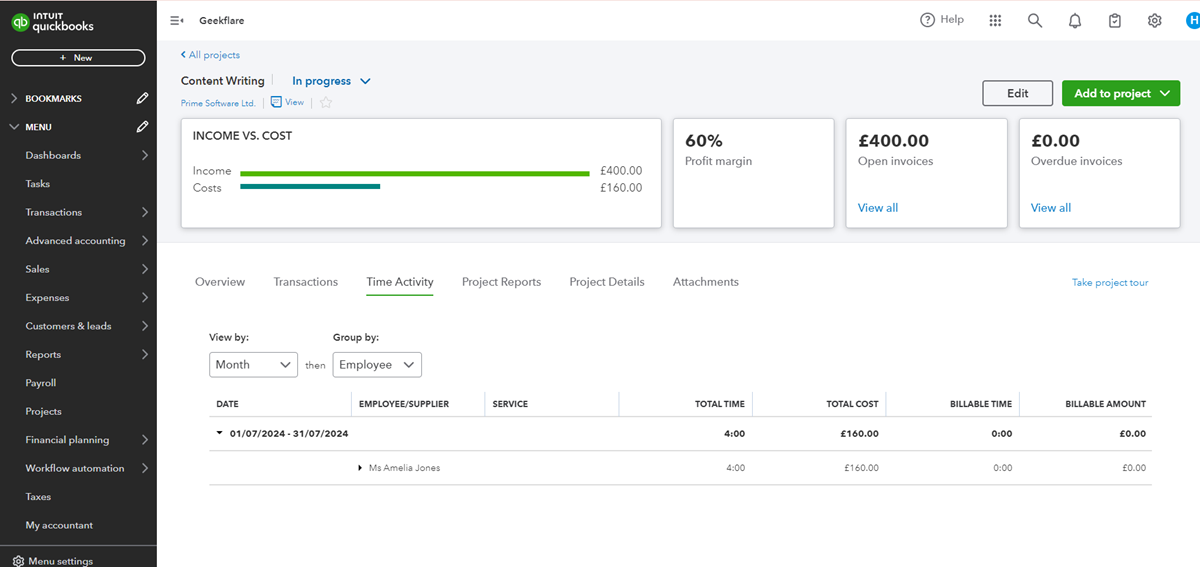

QuickBooks offers a time-tracking tool called “QuickBooks Time” for remotely monitoring team members’ attendance and work hours. It provides accurate insights into your team’s activities and duration of work.

QuickBooks Time offers two plans: “Premium” for $20/month and “Elite” for $40/month. Users with a QuickBooks Online Payroll plan can access this tool for free.

4. Expense Tracking

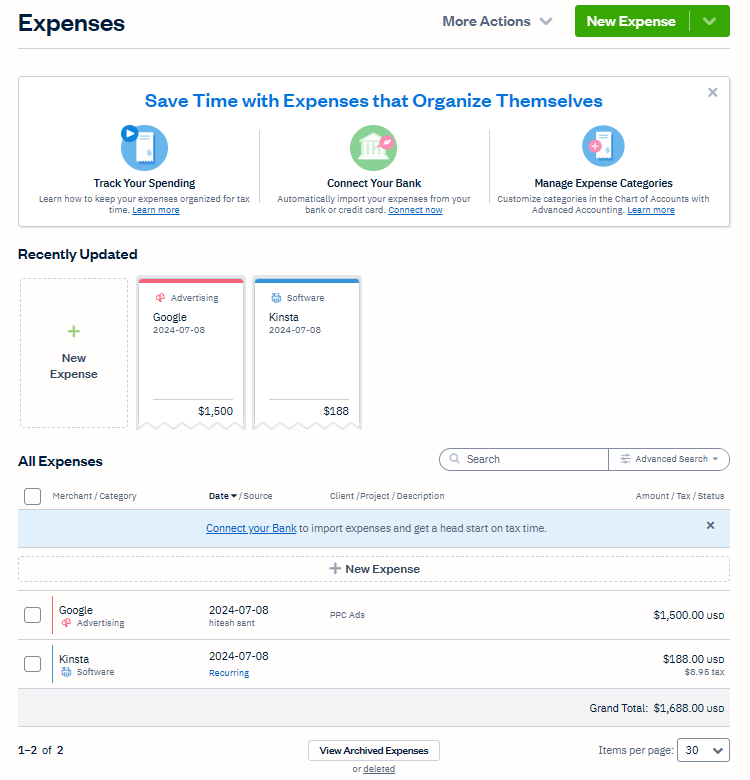

FreshBooks can track your business expenses smoothly once you connect it with your bank account. It automatically imports all the transactions from your bank account, sorts them into dedicated categories, and provides the complete report on the dashboard.

FreshBooks allows you to track billable business expenses, create markups, and use them on client invoices. It also supports multi-currency expenses, recurring expenses, and secure receipt storage on the cloud.

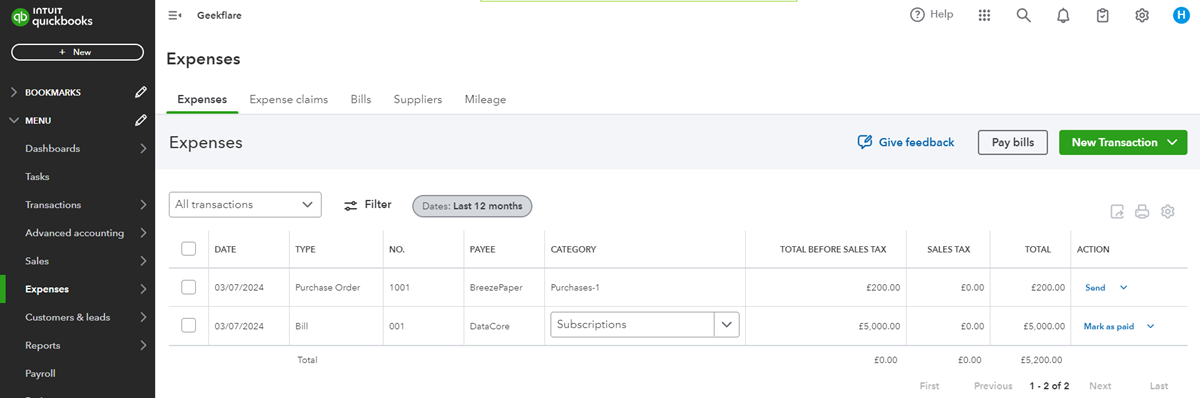

QuickBooks expense tracking lets you easily import and categorize business expenses by connecting bank and credit card accounts. You can manually set specific categorization rules and classify your business’s expenses to understand each transaction clearly.

With the free QuickBooks mobile app, you can take photos of your receipts anytime, and the app will automatically scrape the important data and save it in your account.

QuickBooks enables the creation of detailed expense reports for budgeting and financial analysis. Users can customize these reports by choosing specific expense categories, time periods, or projects.

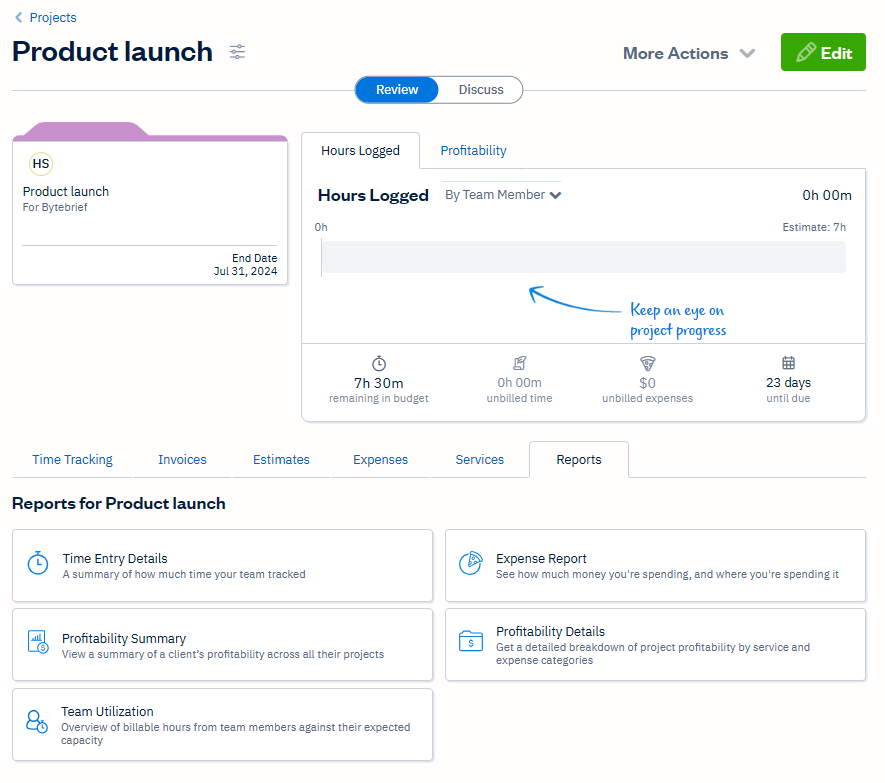

5. Project Management

FreshBooks project management tool improves team collaboration and project tracking. It provides centralized file storage, project discussions, and real-time chat for team members, contractors, and clients. This ensures all project-related communications are organized in one convenient location.

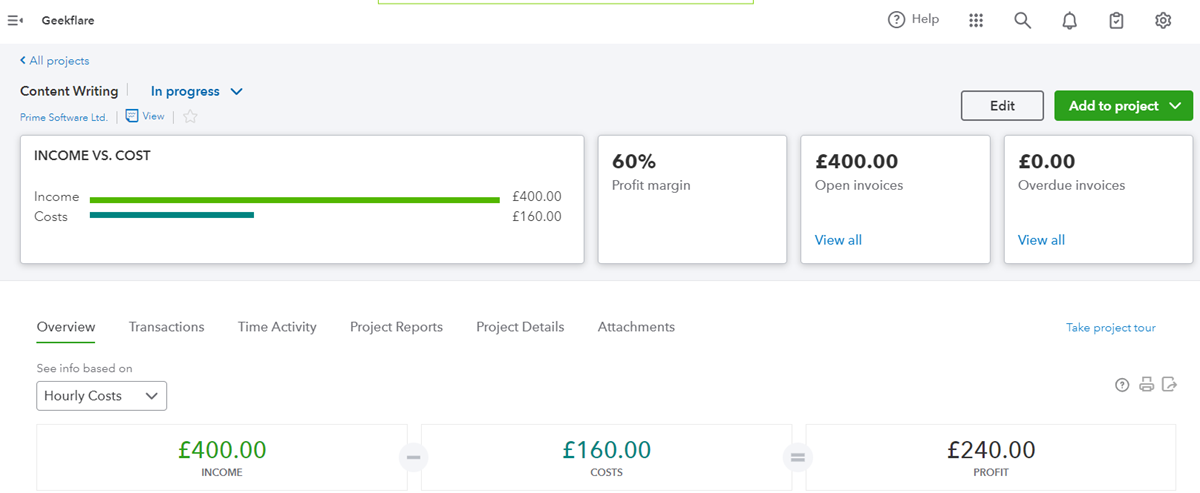

QuickBooks users can create and manage projects, track expenses, compare estimates to actuals, create project cost estimates, track income and expenses, and convert estimates into invoices.

If your business requires managing complex projects, you should leverage leading project management software instead of the built-in software offered by accounting software.

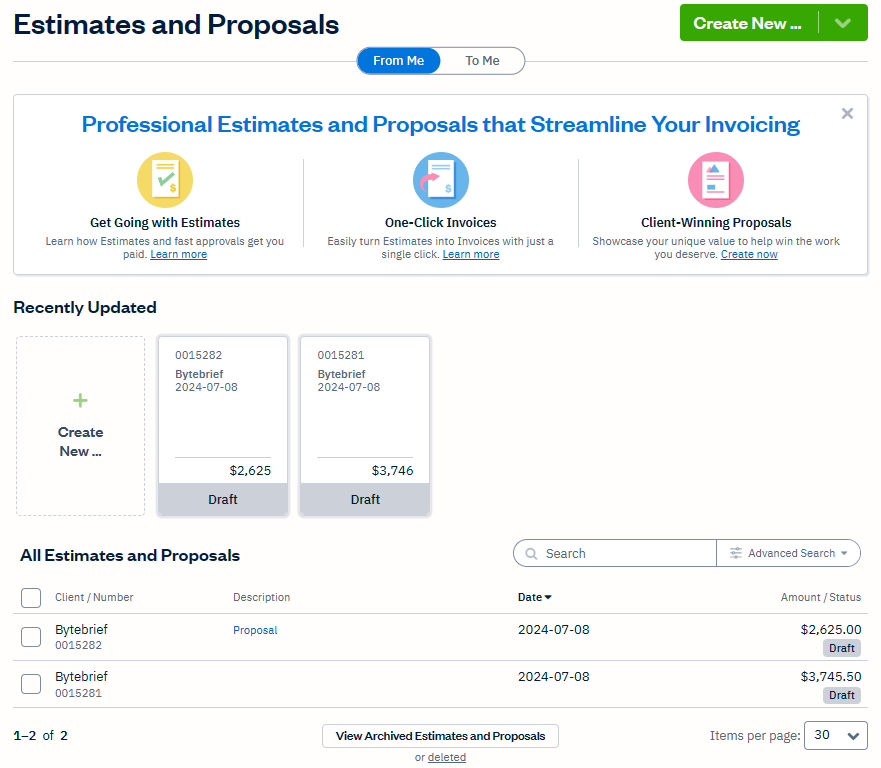

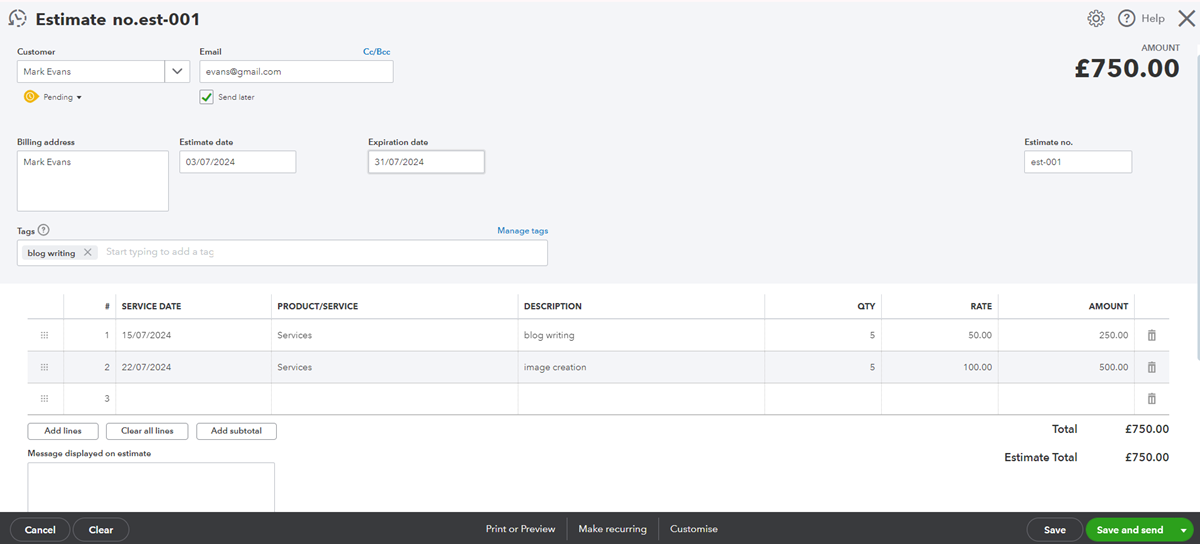

6. Estimation and Proposal

FreshBooks lets you create detailed estimates that outline the project scope, timelines, and costs. Once clients approve, these estimates are converted into invoices for a smooth transition from planning to billing.

FreshBooks supports rich text content, images, and e-signatures in proposals, making them visually appealing and professional. Its easy customization lets you add a company logo and tailor sections to fit specific client needs.

FreshBooks‘ in-app commenting and status tracking keeps clients informed and engaged throughout the proposal process.

QuickBooks offers an estimates and proposals feature for businesses to create professional documents outlining project details and cost estimates, which is ideal for service-based businesses, contractors, and freelancers. You can create project cost estimates, track expenses, and convert accepted estimates into invoices to reduce duplicate data entry.

If you are into cost accounting, check out some cost accounting tips and tricks.

7. Mileage Tracking

FreshBooks offers an automated mileage tracking feature on Android and iOS apps, allowing users to easily track and categorize their trips as business or personal for potential tax deductions.

FreshBooks generates and downloads mileage reports directly from the app to stay organized and compliant with tax regulations. You can manually add trips, edit trip details, and sort trips by date range for better management.

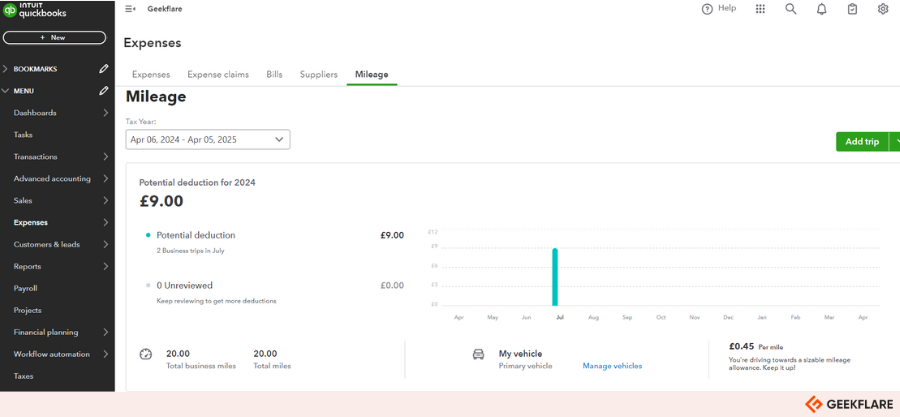

QuickBooks‘ mileage tracking feature uses GPS to automatically record and categorize business and personal trips for tax deductions. It also allows manual editing and generates detailed reports on iOS and Android devices.

8. Tax Management

FreshBooks automatically calculates sales tax invoices to establish default tax rates for various locations. You can monitor and report collected taxes to simplify the tax filing. It is suited for businesses focusing on sales tax and seeking tax filing support.

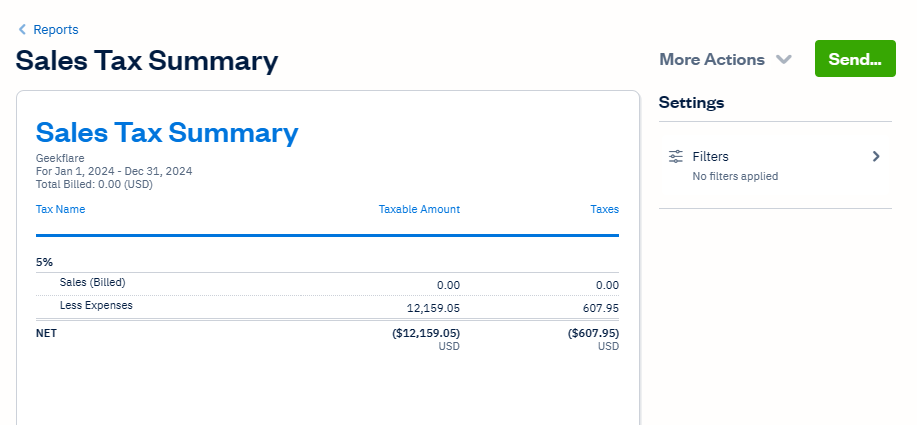

QuickBooks helps you categorize expenses and income to automatically calculate quarterly taxes, track sales tax, and add payable taxes to invoices. It is good for businesses needing comprehensive tax management with automation.

9. Integrations

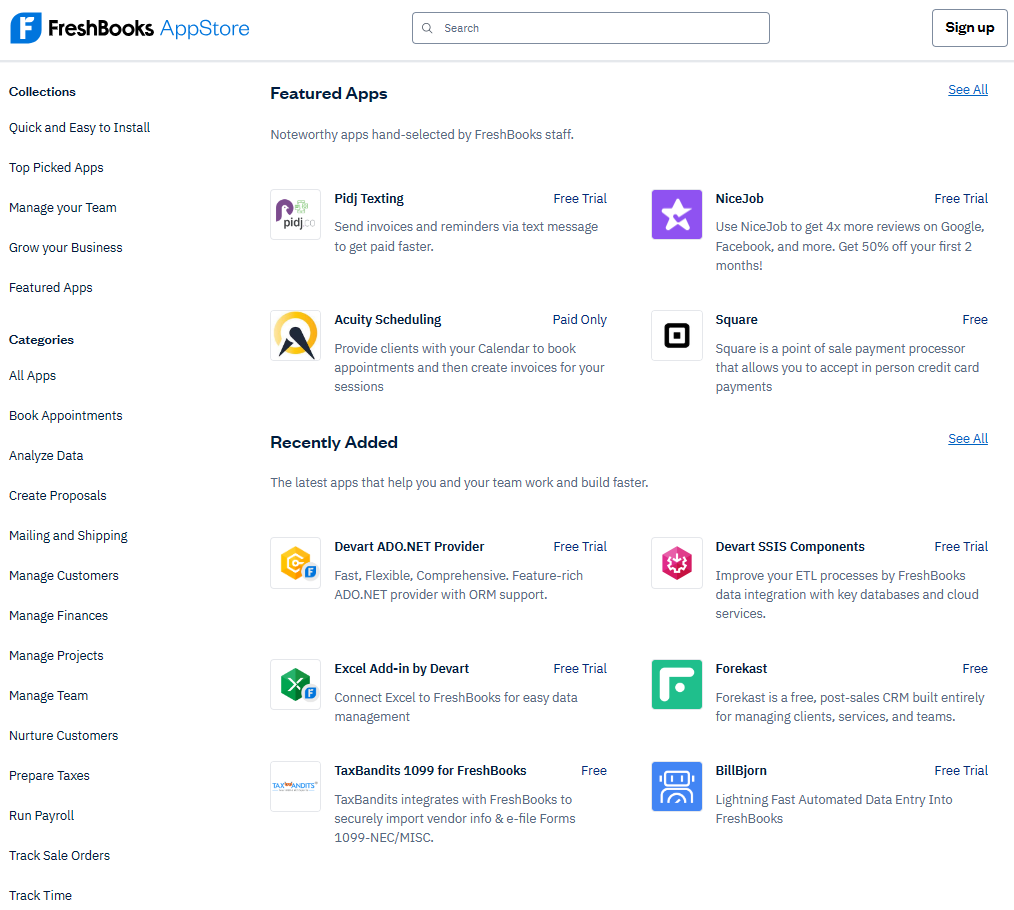

FreshBooks provides over 100 integrations for small business owners and freelancers, making connecting the app to tools like tax filing software, HR platforms, payroll services, and invoicing systems easy.

Integrating FreshBooks with various systems, such as CRM, project management tools, e-commerce platforms, and payment gateways, allows users to streamline processes, improve communication, and ensure accurate billing and financial reporting.

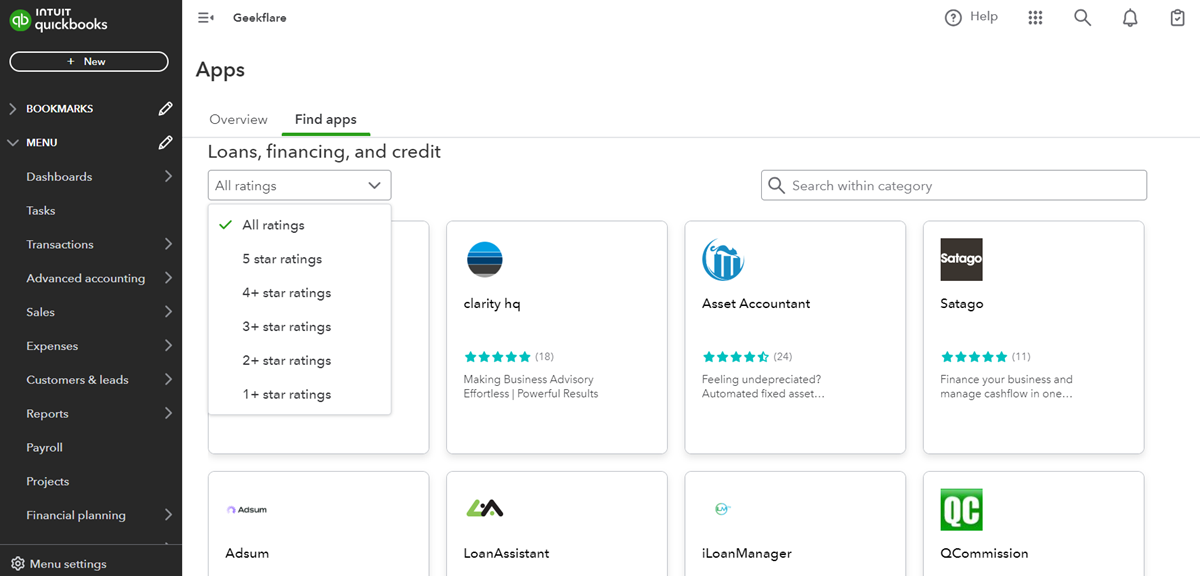

QuickBooks offers over 750 business app integrations, including banking, payment processing platforms, e-commerce, and CRM. It allows automatic data syncing from platforms like Amazon, PayPal, Square, and Shopify, simplifying inventory management, automatic stock updates, sales tracking, and analytics.

Overall, QuickBooks delivers a unified and simplified accounting experience for businesses of all sizes.

10. Payroll

FreshBooks has a full-service payroll feature that can automatically process employee payrolls, generate reports, and download forms for both state and federal taxes. It saves all the transactions to your account, keeping your books and reports organized and accurate. It comes with automatic tax filing and tax compliance support.

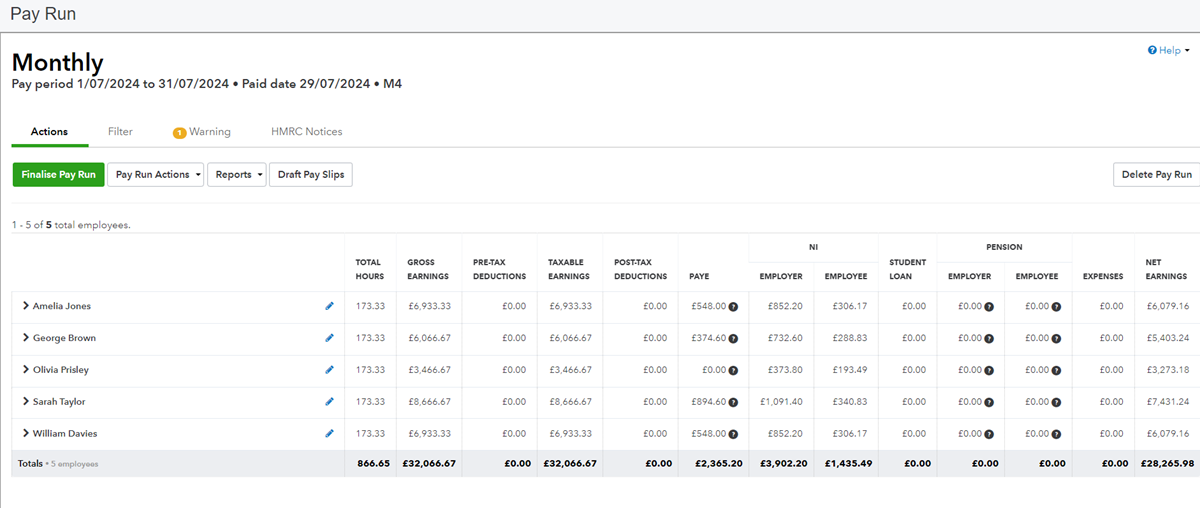

QuickBooks provides a full-service payroll plan add-on with unlimited payroll runs and end-of-year forms. It includes auto-calculated taxes, an online portal for employees to access tax data and pay stubs, and support for garnishments and deductions.

QuickBooks payroll premium plan offers same-day direct deposit, employee company administration, support, and historical data report downloads.

11. Reporting and Dashboards

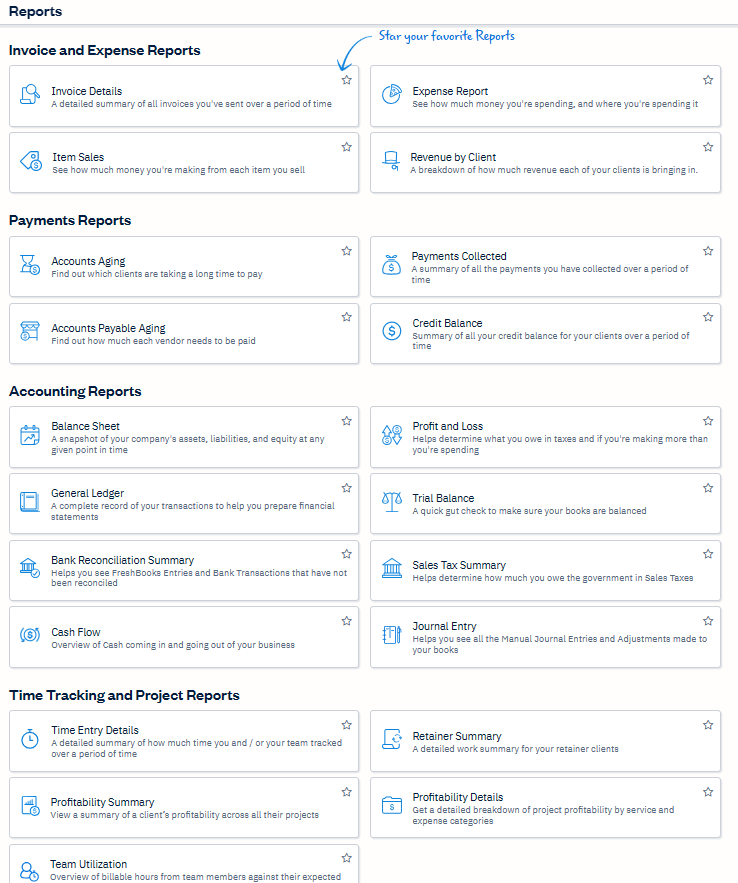

FreshBooks allows users to generate reports on financial data such as profit, sales tax summaries, expenses, and payments collected. The dashboard provides important information in easily readable charts and graphs, enabling business owners and accountants to monitor financial health and make informed decisions.

FreshBooks‘ interactive dashboards visually represent your financial data, making it easy to identify trends and patterns at a glance. You can create a personalized dashboard that aligns with your business goals with customizable widgets and charts.

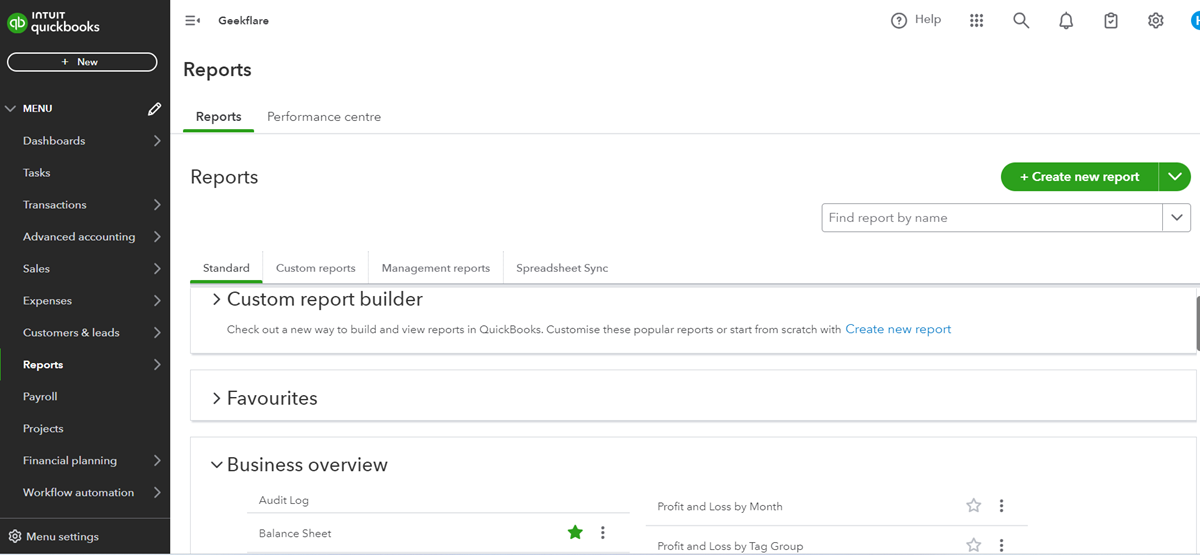

QuickBooks offers a Reports Center with preset templates that can be customized to specific needs, including balance sheets, sales tax reports, cash flow statements, profit and loss, budget overviews, and various customer reports.

12. Ease of use

FreshBooks offers a neat user interface that is perfect for small businesses and individuals. It comes with an intuitive dashboard that makes navigation straightforward. You can easily manage invoices, expenses, and time tracking, even if you’re a beginner. It also offers automated expense tracking and recurring invoice processes to save time.

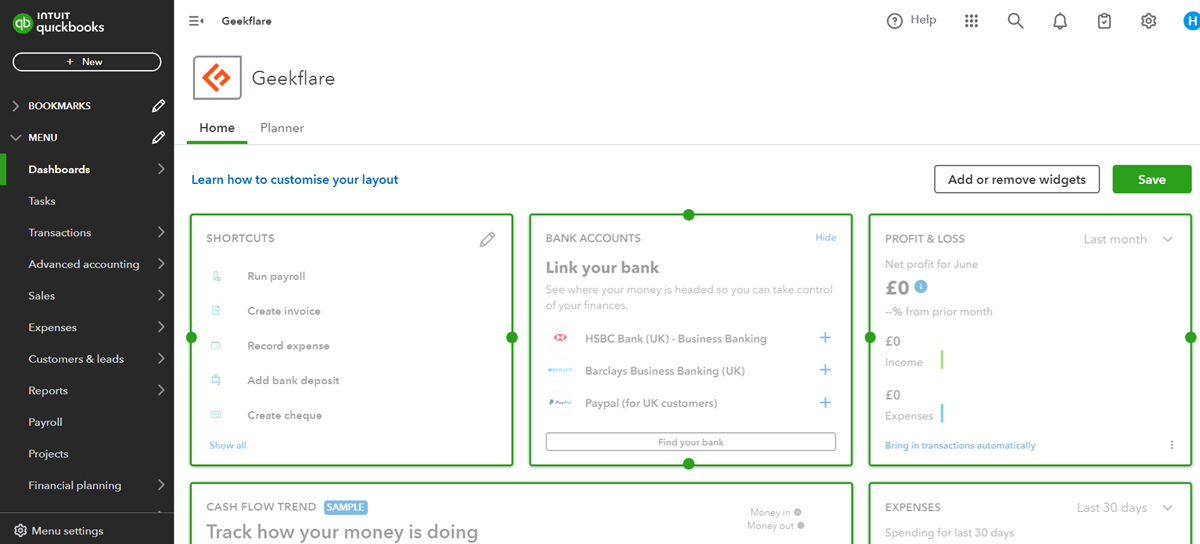

QuickBooks provides detailed reports on the dashboard, allowing for monitoring expenses, transactions, projects, team tasks, and payrolls. It is suitable for small to medium-sized businesses with diverse needs.

QuickBooks offers step-by-step tutorials, customizable dashboards, and automated processes to streamline accounting tasks.

When to Choose QuickBooks

If you’re running a small or mid-sized business and need a simple tool to handle your finances, QuickBooks is a great option. It helps you manage bookkeeping, invoicing, payroll, and taxes all in one place. I like how easy it is to use, with clear features and detailed reports. Plus, it works well with other apps, so you can add tools as your business grows.

Freelancers and startups will appreciate that it’s affordable and customizable. You can choose between the cloud version for flexibility or the desktop version if you prefer offline access. QuickBooks makes it simple to stay compliant with tax rules while keeping your financial processes accurate and under control.

When to Choose FreshBooks

If you’re a freelancer, small business owner, or self-employed professional, FreshBooks is a great choice for managing your accounting needs. It’s easy to use and makes invoicing, expense tracking, and time management simple. You can even set up recurring invoices and payment reminders automatically.

I like FreshBooks because it’s beginner-friendly, works well on mobile, and connects with apps like PayPal and Stripe. The interface is straightforward, so you don’t need to be an accounting expert to get started. If you want something that grows with your business and offers helpful customer support, FreshBooks is a solid option. Plus, it’s great for working on projects with your team or clients.

Can I Generate an Invoice for FREE?

Yes, you can use the Geekflare invoice generator tool to create a simple invoice, which can be handy if you need to create a quick invoice to send to your clients.

Is There Any Free Accounting Software Available?

There are several free accounting software available for small businesses. For example, Wave offers unlimited invoicing, receipt scanning, and expense tracking. It integrates with bank accounts to import transactions automatically to keep financial records up-to-date. While the core accounting features are free, Wave offers optional paid services such as payroll and payments, which can be useful as your business grows.

Another free accounting software to consider is Manager.io, a desktop-based platform for small to medium-sized businesses. It includes invoicing, expense tracking, payroll, and inventory tracking modules. It is a cross-platform software available on Windows, macOS, and Linux.

More on Accounting

-

EditorNarendra Mohan Mittal is a senior editor & writer at Geekflare. He is an experienced content manager with extensive experience in digital branding strategies.

EditorNarendra Mohan Mittal is a senior editor & writer at Geekflare. He is an experienced content manager with extensive experience in digital branding strategies.