Wave Accounting

Wave is an accounting and bookkeeping software that helps you manage your business’s finances. It is suitable for small businesses, freelancers, consultants, contractors, and startups. I’ll review Wave in this article and share my experience to help you decide if it is a good fit for your business.

Features

-

Create professional invoices to match your brand.

-

Get paid through cards, Apple Pay, ACH.

-

Create estimates using ready-made templates.

-

Monitors income and expense transactions using double-entry accounting.

-

Provides Customizable sales taxes.

-

Ensures consistency and transparency in financial reporting.

-

Run payroll for your employees and contractors.

Pros

-

Offers unlimited invoicing, receipts, and income and expense tracking.

-

Free plan enables the management of cash flow and customers in a single dashboard.

-

Supports multi-currency to issue invoices or make purchases.

-

Manage transactions on the go with the Wave mobile app.

Cons

-

Extra fees for features such as running payroll and outsourcing a bookkeeper.

-

Does not offer built-in inventory management or audit trails.

Accounting Software Review Methodology

Geekflare tested the core features of Wave Accounting through hands-on subscriptions. We evaluated essential features and calculated a combined overall rating for each. To ensure an unbiased review, we gathered factual data from official websites and analyzed user feedback from various sources to provide comprehensive insights and detailed reviews.

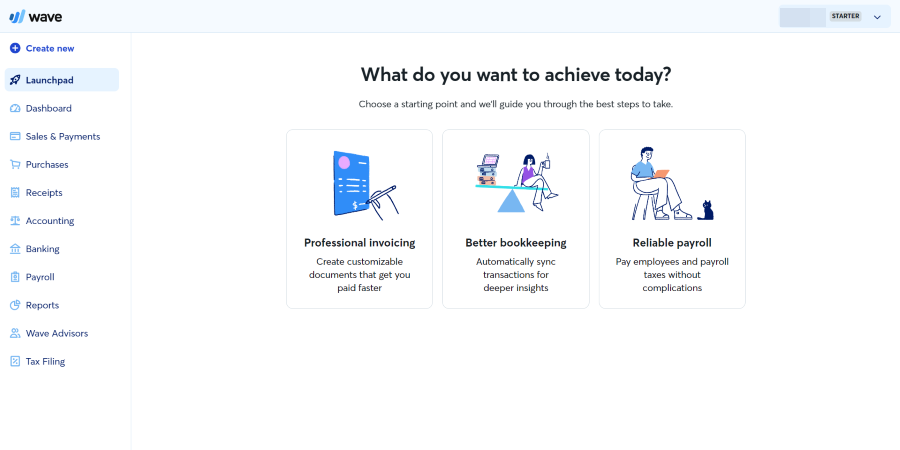

What Is Wave Accounting?

Wave Accounting is a cloud-based double-entry accounting software with a suite of tools and services that streamline bookkeeping and invoicing. It also allows users to accept online payments and easily manage payroll and taxes without having specialized knowledge.

Wave, headquartered in Toronto, Canada, launched the accounting software in 2010. It is only available to users in the US and Canada.

Wave allows you to access it on any device with a modern browser and an internet connection. You can use it on your desktop and laptop to invoice and track payments and expenses. It also has a dedicated mobile app for Android and iOS devices.

10 Best Wave Accounting Features

Key features that make Wave Accounting popular among users are listed below.

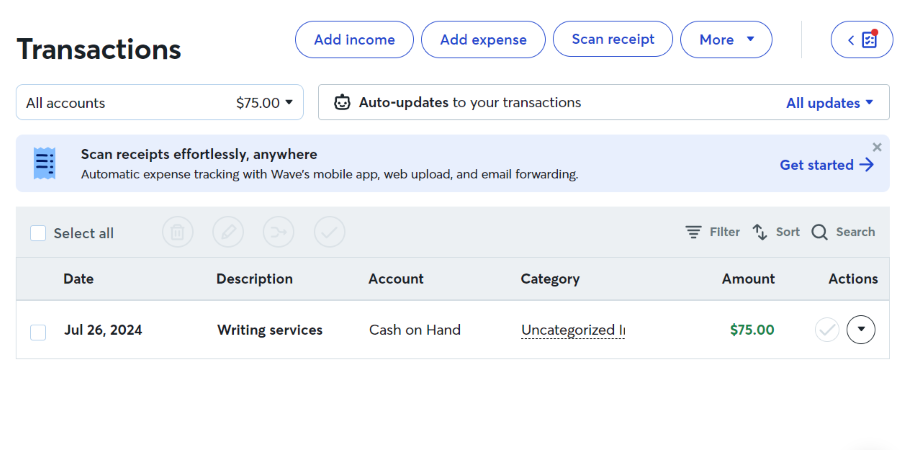

1. Income and Expense Tracking

Wave Accounting allows you to manually enter your income and expenses or import your bank and credit card transaction for tracking.

Then, you can generate reports to gather valuable insights for better decision-making and to monitor your business finances.

2. Customizable Sales Taxes

The software allows you to set sales tax rates based on where you operate your business and automatically calculate tax on any invoice, bill, or transaction. This leads to greater efficiency and accuracy when dealing with sales tax. You can edit and delete it anytime using the web or mobile app.

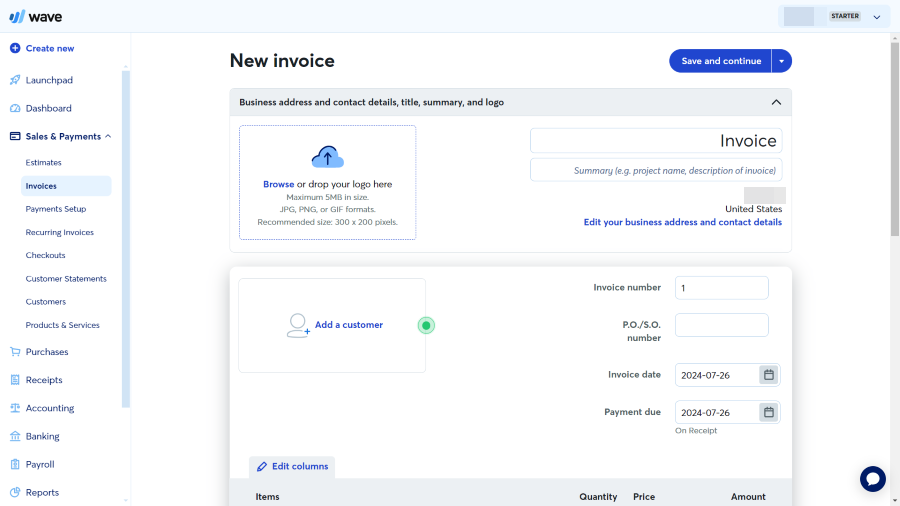

3. Invoicing

In Wave Accounting, you can easily create professional-looking invoices. You can send as many invoices as you like, and if you’re using the Pro Plan, you can schedule them to simplify recurring payments from repeat customers.

Furthermore, the software automates sending invoice reminders to customers if they have overdue invoices. That way, you’re not chasing busy payments but getting paid and focusing on your business.

4. Payments

With Wave Accounting, you can accept payments online via bank deposit, credit card (Visa, Mastercard, and American Express), and Apple Pay. While each transaction has a processing fee, it’s not more than 3% (detailed pricing below in Pricing section).

When you send your customers an invoice, they will see the “Pay Now” button. Once they click it and pay, the funds will appear in your account in 1-2 business days. Meanwhile, Wave is keeping track of every payment in the background using the double-entry method.

The best part of using Wave is, you don’t have to worry about a payment gateway like Stripe. You can use Wave Payments to receive payments for your invoices.

5. Accounting

Wave uses double-entry accounting to monitor transactions based on income and expenses. This allows you to maintain a comprehensive ledger of all your financial activities, organize and categorize your financial transactions, and monitor your cash flow accurately.

This leads to the automatic creation of the Chart of Accounts (COA), which the software auto-updates as you continue transacting. You can even edit it manually by adding and removing accounts to suit your business needs.

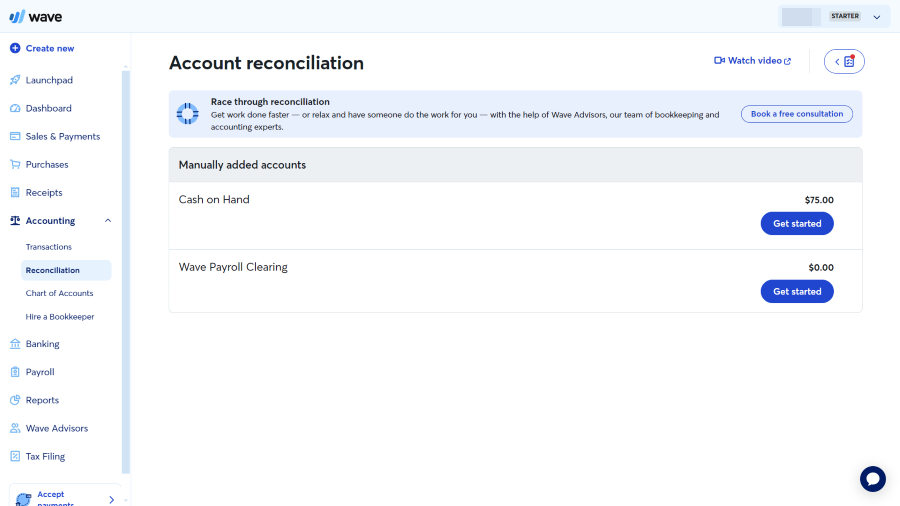

6. Automated Bank Reconciliation

Wave Accounting automatically matches your accounting records with your financial ones, such as bank and credit card statements, to ensure consistency and accuracy in financial reporting.

It also allows you to generate reports on all reconciled records and any discrepancies that need handling. So, if there is a problem with your accounts, Wave Accounting will let you know.

7. Bank Connection

Wave allows you to import transactional data from your bank account or credit card. You can add as many bank accounts and credit cards as you need. Then, you can categorize and analyze your banking data to extract cash flow insights and ascertain your business’s financial status.

8. Mobile Receipts

With the scanner built into the mobile app, you can easily scan up to 10 receipts at a time using OCR technology. The receipts are stored on the cloud, which gives you peace of mind since they’re safe and can be accessed anytime.

Furthermore, this provides another way to track expenses and stay on top of your taxes. It also allows you to easily organize and categorize your receipts, making them easier to find when searching.

9. Payroll

Wave Accounting’s payroll feature helps you manage paying your employees, independent contractors, and yourself. This includes setting up direct deposits, generating W-2 and 1099 tax forms, and tracking leave time and accrual.

You can process all the payments with a single click, which saves time and reduces manual errors. Wave Accounting also offers an automated tax service. This robust feature can automatically pay and file taxes in select states, including California, New York, Arizona, Texas, and Washington.

You can also get detailed reports on your payroll activities based on factors such as the employees on your payroll and the expense type.

Learn more about payroll accounting.

10. Access to Advisors

Wave Accounting has a service where you get personalized bookkeeping service support and accounting coaching from in-house experts.

The bookkeeping support provides you with a professional (based in North America) who handles your accounting needs. Accounting coaching, on the other hand, ensures you have the knowledge you need to use Wave Accounting to manage your books with confidence.

What are the Benefits of Using Wave Accounting Software?

The benefits of Wave accounting software are unlimited invoices and income tracking, financial reporting, double-entry accounting, invoicing, and more.

- Unlimited invoices and income tracking: Wave Accounting functions as invoicing software, allowing you to create invoices without restrictions. The customization options ensure that your invoices look professional. You can also track as many transactions as you want and categorize them in ways that accurately reflect your business’ finances.

- Double-entry accounting: Wave records your debits and credits in the background, allowing you to automate double-entry accounting, even if you don’t know what it is. This accurately tracks your income, expenses, assets, and liabilities all in one place.

- Financial reports: Wave Accounting allows you to generate financial statements, such as balance sheets, cash flow, and income statements, to obtain all the important financial insights you need.

- Simple setup: Wave Accounting does not require your credit card information; you create your account, and that’s it. You don’t need to download, install, and configure any software—it works on any modern browser.

- Easy invoicing: Creating an invoice in Wave Accounting takes a few minutes. You pick one of the many customizable templates and add the necessary details (customer and service or product information) and payment terms. When it’s ready, you send it to your customer and wait for payment.

- Mobile app: The mobile app allows you to do bookkeeping on the go. You can send invoices, track finances, accept credit card payments, scan receipts, and remind clients about overdue payments, among other things.

- Bank and credit card connection: By allowing you to connect your bank account and credit card, Wave Accounting can automatically track transactions. This saves you the time and effort of doing it manually and enhances accuracy by reducing manual errors.

- Payment processing: With Wave Accounting’s payment processing, you can ensure you never miss or lose a payment. Since it lets customers pay you online through several payment methods, it increases the likelihood of getting paid faster.

- Bank-grade security: When sending data between your device and Wave Accounting’s servers, it is encrypted using 256-bit encryption. This is the same level of encryption used by major banks with online banking services. Also, the servers that store your information use state-of-the-art security protocols and technology and strict access control measures.

- PCI Level-1 certified: The PCI Level-1 certification assures you that Wave Accounting meets the highest standards when handling your credit card information. That means you have to worry less about fraud and data breaches.

Wave Accounting Pros

- The free plan is an excellent choice for freelancers, startups, and businesses with a limited budget since most features are free.

- Double-entry accounting ensures accurate financial records.

- Several customizable reports to choose from (e.g., profit and loss, balance sheet, cash flow, sales tax, income per customer, and overdue invoices).

- The lack of hidden fees when processing payments increases cost savings.

- Automated reconciliation streamlines matching bank transactions with accounting records.

Wave Accounting Cons

- Not scalable since it lacks many features a growing business needs, such as inventory and project management, time tracking, and audit trail.

- It’s only available in the US and Canada, limiting functions like payroll due to only supporting USD and CAD.

- The free plan has limited customer service—live help is locked behind the Pro Plan or purchase of add-ons.

Wave Pricing

Wave accounting offers two plans: Starter and Pro, the offerings of which are explained below.

| Plan | Pricing (monthly) | Offerings | Best for |

|---|---|---|---|

| Starter | Free | Create unlimited estimates, invoices, bills, and bookkeeping records, Option to accept online payments, Invoice on-the-go via the Wave app, Manage cash flow and customers in one dashboard | Freelancers, Solopreneurs, Independent contract |

| Pro | $16 | Option to accept online payments at a discounted rate, Auto-import bank transactions, Auto-merge and categorize bank transactions, Digitally capture unlimited receipts and track expenses, Automate late payment reminders | Small businesses, Startups |

I would strongly advise you to start with the Starter plan and once you are happy with the platform, you can upgrade to the Pro plan.

Wave Payments fees depend on transaction payment methods and your subscription plan.

| Plan | Visa, Discover, or Mastercard | Amex card | Bank payments (ACH/EFT) |

|---|---|---|---|

| Starter | 2.9% + $0.60 per transaction | 2.9% per transaction | 1% per transaction |

| Pro | 3.4% + 0.60 per transaction | 3.4% per transaction | 1% per transaction |

Credit card processing fees under the Pro plan are cheaper than Stripe. Stripe charge 2.9%+$0.30 per transaction, where Wave is just 2.9%. You save 30 cents per transaction. However, if you need to accept internationally and need more payments methods, then

How to Access Wave Accounting for Free?

To access the free version of Wave Accounting, head to the website and click the “Sign Up” button in the top-right corner. You can sign up using an email and password or your Google account.

Afterward, you need to complete the onboarding steps. This involves describing your business (e.g., name, location, industry, and number of employees). After this, you will have access to the web version of the software.

Wave Accounting Customer Support

If you’re using the free plan, you can only access self-service help. Also, it offers a handy FAQ section that contains solutions to common problems. Furthermore, you have round-the-clock access to Mave, Wave Accounting’s AI-powered chatbot (available on both desktop and mobile).

Email and live chat support are available if you have any optional add-ons (e.g., Wave Payroll or Bookkeeper), successfully set up online payments, or are subscribed to the Pro Plan. You can contact the team from 9 AM to 4:45 PM EST Monday through Friday.

Wave Accounting Integrations

Wave Accounting integrates with several applications that can enhance its functionality and streamline your workflow.

Wave Connect

Wave Connect is a Google Sheet add-on that lets you download your COA, customers, invoices, and products to a spreadsheet. You can also upload transactions, customers, invoices, and products from Google Sheets to your Wave account.

It was designed to help you move data between Wave Account and other platforms. For instance, it can help if you want to download transactions from Wave Accounting to Google Sheets and upload the spreadsheet to Zoho Books.

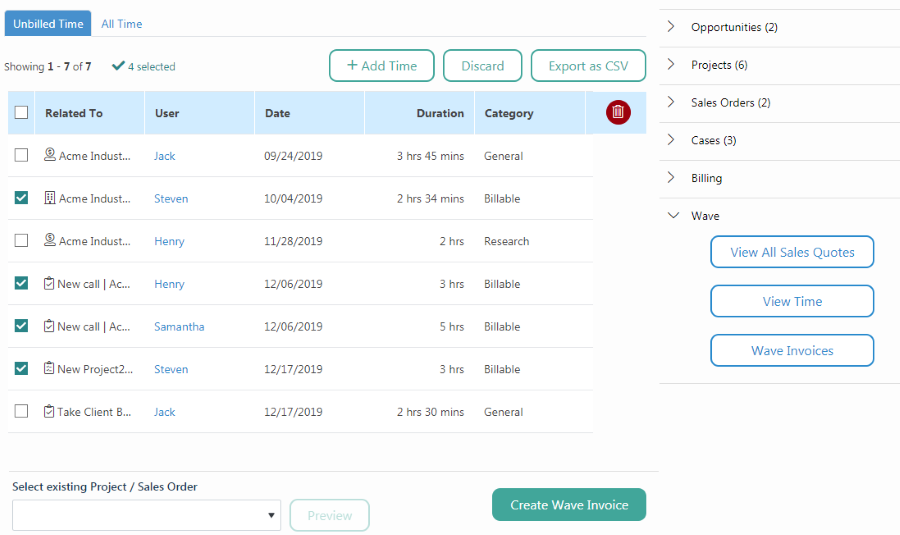

BlueCamroo

You can integrate Wave into BlueCamroo, a free CRM tool, to sync your customers and contacts. This allows you to create sales quotes based on Wave data, which you can then send to your customers. After the client approves, you can send it to Wave to automatically create an invoice.

Since BlueCamroo has a time tracker, you can also generate a Wave invoice based on the billable hours.

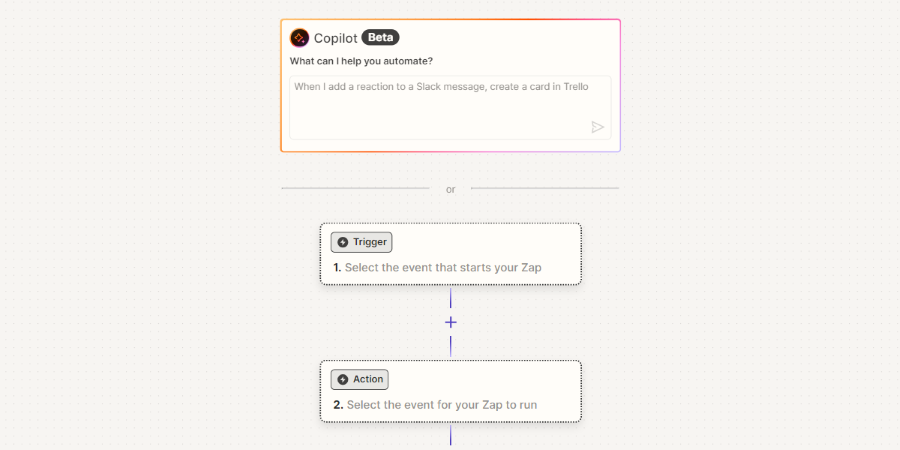

Zapier

You can set up an automated workflow (Zap) in Zapier and then use it to connect Wave Accounting with your favorite business app. For example, when an invoice is created in Wave Accounting, this can trigger the Zap. Then, a predefined action will occur in another app.

For example, invoice details can be added to a spreadsheet or Notion database. At the same time, employees on Slack, Telegram, or WhatsApp can be notified that an invoice has been created and sent to a particular customer.

Does Wave Accounting have Mobile Apps?

Yes, it has an Android and iOS mobile app for bookkeeping and invoicing while on the move.

Can I Import My Data From Other Accounting Apps Like QuickBooks?

Yes. You can export data in CSV or other compatible formats from QuickBooks and other accounting apps and then import the document into Wave Accounting.

If you have Wave Advisor with bookkeeping support, a trained, in-house professional can help you. This ensures a smooth transition of your financial records from one system to the other.

Wave Accounting Alternatives

Here are some alternatives to Wave Accounting that you might consider for your business needs.

QuickBooks Online

QuickBooks Online is a complete accounting software that’s considered better than Wave when it comes to advanced features and scalability. It has tools that are not available in Wave, such as inventory management, project tracking, and budgeting.

Furthermore, QuickBooks can be integrated with over 750 apps. So, while Wave Accounting is ideal for small businesses and freelancers on small budgets, larger businesses prefer QuickBooks. However, QuickBooks doesn’t have a free plan. The lowest-paid plan starts at $17.50. It does have a 30-day free trial, though.

Read our QuickBooks Online review.

Zoho Books

Zoho Books is a cloud-based accounting software that offers a comprehensive suite of accounting and business management tools. Its top features include invoicing, expense management and tracking, receipt management, bank reconciliation, payroll, and tax compliance (sales tax tracking and 1099 reporting).

Zoho Books also has a time tracker, multiple-currency support, inventory tracking, project management, and CRM. The best part is that it has a free plan that you can use forever. There’s even a 30-day trial to test the premium features.

Furthermore, Zoho Books is available outside the US and Canada. If you try creating an account with Wave Accounting outside these countries, it will onboarded in Zoho Books instead (Zoho and Wave have a collaboration).

So, Zoho Books is a great alternative to Wave Accounting since it has all the basic accounting features. However, it also allows companies to scale with tiered plans that provide advanced features lacking in Wave Accounting.

Read our Zoho Books review.

Xero

Xero is feature-rich accounting software with all the best features of Wave, such as payments, invoices, bank connections, payroll, sales tax, reporting, bank reconciliation, and bill and receipt capture.

Xero also offers inventory, project management, contact management, sales quotes, and multiple currencies. It allows you to create and track purchase orders and fixed assets.

Xero has an app store with dozens of apps built to extend the software’s functionality and streamline business processes. You have apps for time tracking, inventory management, practice management, clinic management, e-commerce, debtor tracking, specialized reporting, and more.

While Xero has no free plan, you can utilize the 14-day free trial to try the advanced features. Its lowest plan starts at $30 per month, but, unfortunately, it does not offer unlimited invoices (something Wave offers in the free Starter plan).

However, it is suitable for businesses who want to scale since the pricier tiers offer the needed features.

Who Should Use Wave Accounting?

Wave is suitable for anyone who needs robust accounting software on a budget. This includes small businesses with less than 10 employees (e.g., marketing agencies and consulting firms), self-employed entrepreneurs, freelancers, independent contractors, and various service-based ventures.

Who Shouldn’t Use Wave Accounting?

Wave accounting is not for businesses with complex needs, such as high-volume transactions and multiple currencies. Those who rely heavily on integrations (e.g., communication, CRM, and project management tools) may not be able to work with Wave’s limited integrations.

Also, anyone outside the US and Canada or operating a medium-to-large organization should look into alternative business accounting software like QuickBooks and Zoho Books.

Wave Ratings and Recognition

Wave is rated above 4.0 out of 5 stars on Google, G2, App Store, and Capterra.

| Review Platform | Rating |

|---|---|

| Google Workplace Marketplace | 4.4 |

| G2 | 4.3 (295+ reviews) |

| Capterra | 4.4 (1640+ reviews) |

| App Store | 4.5 (2000+ reviews) |

Wave Accounting Verdict

Wave Accounting is an easy-to-use online accounting software ideal for businesses seeking a cost-effective solution for their accounting work. Its free features make it a valuable tool for managing finances without high costs.

However, businesses with complex needs or those operating outside the US and Canada might need other alternatives.

Recognized for its exceptional value and efficiency,