QuickBooks is an accounting software developed by Intuit for small and mid-sized businesses. Its parent company, Intuit, launched QuickBooks in 2001. QuickBooks is popular for streamlining essential financial tasks such as invoicing, expense tracking, and payroll, saving business owners time and hassle.

What is QuickBooks?

QuickBooks is an accounting software offering features like automated bookkeeping, invoices, billing and expenses, time tracking, and payroll processing. QuickBooks Online is a cloud-based suite available in almost all countries.

One major exception is India, where it stopped operating in April 2023. QuickBooks is available in 11 languages, including English, French, Italian, Spanish, Chinese, Arabic, German, and Japanese.

Who Should Use QuickBooks?

QuickBooks is ideal for small and medium businesses needing an accounting software application. Companies that need to streamline invoicing, bill payment, financial reporting, and expense tracking will benefit from this software.

QuickBooks is helpful for industries including restaurants, construction, retail, churches, nonprofits, legal, professional services, manufacturing, and wholesale due to its features like inventory management, payroll, project cost tracking, donation management, budgeting, client billing, time tracking, and purchase order management.

Who Shouldn’t Use QuickBooks?

Freelancers and businesses that only need an invoicing feature will find QuickBooks overwhelming. Hence, it is not the right choice for them. Also, businesses with complex inventory management needs, a high volume of transactions, and a need for in-depth financial analysis or custom reports should not use QuickBooks.

QuickBooks Popular Products

The QuickBooks products are Accounting (QuickBooks Online), QuickBooks Payroll, Bookkeeping (QuickBooks Live), QuickBooks Time, and QuickBooks Enterprise.

- Accounting (QuickBooks Online): QuickBooks Online is cloud-based accounting software that enables businesses to manage their accounting tasks, including chart of accounts management, bill payment, invoice sending, accounts payable and expense tracking. It also helps with tax deduction, job costing, and inventory management. Read more in this detailed QuickBooks online review.

- QuickBooks Payroll: Syncs with QuickBooks Accounting to set up payroll and pay the team from one place. It also assists with HR support, contractor payment, hiring and management, and the workforce portal.

- Bookkeeping (QuickBooks Live): QuickBooks Live is an online bookkeeping service that works as the connector between small businesses and QuickBooks-certified virtual bookkeepers. They offer guidance and services based on company requirements.

- QuickBooks Time: QuickBooks Time is a time-tracking software that manages multiple timesheets to track, submit, and approve time. It lets users create job schedules, track job progress, and get alerts for schedule changes.

- QuickBooks Enterprise: QuickBooks Enterprise is a complete suite for enterprises that includes accounting, inventory management, job costing, payroll, reporting, pricing rules, and time tracking. It offers the capacity to cater to 1 million customers and has complete control over the company data

Apart from these, QuickBooks offers other products like QuickBooks Payments, QuickBooks Online Advanced, and QuickBooks Commerce. Here is a quick comparison table to give you an idea about product use case and starting price.

| Product | Use Cases | Starting Price |

|---|---|---|

| Accounting (QuickBooks Online) | Manage income and expenses, suitable for SMBs | $17.5/month |

| QuickBooks Payroll | Running payroll for the team | $42.5/month + $6/employee/month |

| Bookkeeping (QuickBooks Live) | Bookkeeping guidance by virtual bookkeepers | $300/month |

| QuickBooks Time | Time tracking | $10/month + $8/user/month |

| QuickBooks Enterprise | Multi-company management | $1922/year |

Benefits of Using QuickBooks for Accounting and Invoicing

The benefits of using QuickBooks are scalability, ease of use, accessibility, financial management, and more.

Ease of Use and Accessibility

QuickBooks has a user-friendly interface that simplifies accounting tasks even for those without extensive financial experience. Users can easily navigate menus as the sections have been categorized properly in the menu panel. QuickBooks Desktop is another version available for users who prefer desktop-based solutions. QuickBooks offers a mobile app, too, facilitating accessibility and convenience.

Comprehensive Financial Management

QuickBooks offers a powerful suite for managing all financial needs. Companies can track cash flow and expenses, categorize transactions for seamless organization, reconcile bank statements, manage inventory, pay bills, and generate insightful reports on the financial health of the business—all from the same platform.

Time-Saving Automation Feature

QuickBooks users can free themselves from manual data entry using its automation features. Some common automation features of QuickBooks include recurring invoices, automatic invoice reminder emails, automatic transaction categorization, scheduled bill payments, automatic pay runs, and receipt data capture on its mobile app.

Integration With Other Tools and Applications

While QuickBooks is a pretty self-sufficient software, its power lies in its ability to integrate with different third-party applications. Users can integrate it with 750+ business tools to enhance their workflow and efficiency. These allow QuickBooks to fetch data, connect sales channels, and automate accounting tasks.

Scalability for Different Business Sizes

QuickBooks offers multiple subscription plans suitable for different business sizes. Hence, solopreneurs, SMBs, and startups can pick their suitable plans. Many of its features are available as add-ons, so users can pay only if they need them.

QuickBooks Core Features

QuickBooks’s major features are invoicing and payments, expense tracking, accounting, bill management, and more.

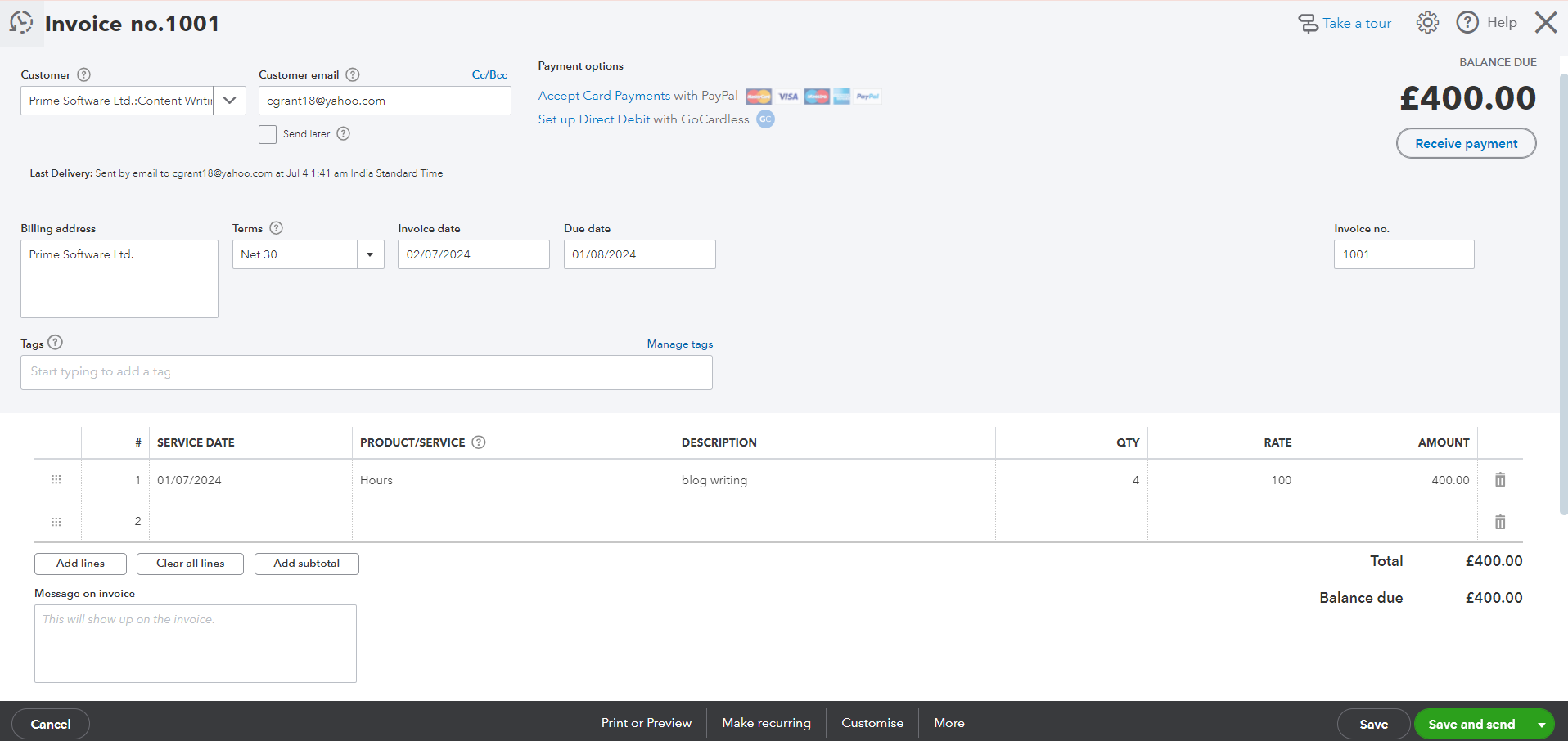

Invoicing and Payments

QuickBooks functions as an invoicing software, letting users create professional invoices with custom logos and colors. It supports adding billable hours from QuickBooks Time and Google Calendar. The invoices are instantly payable via debit and credit cards, ACH, Apple Pay, PayPal, and Venmo.

Users can also set up recurring invoices in preferred intervals. Additional invoicing features include progress invoicing to split up estimates into multiple invoices based on project milestones, automatically tracking the total amount on an estimate, and tracking partial payments and payment progress.

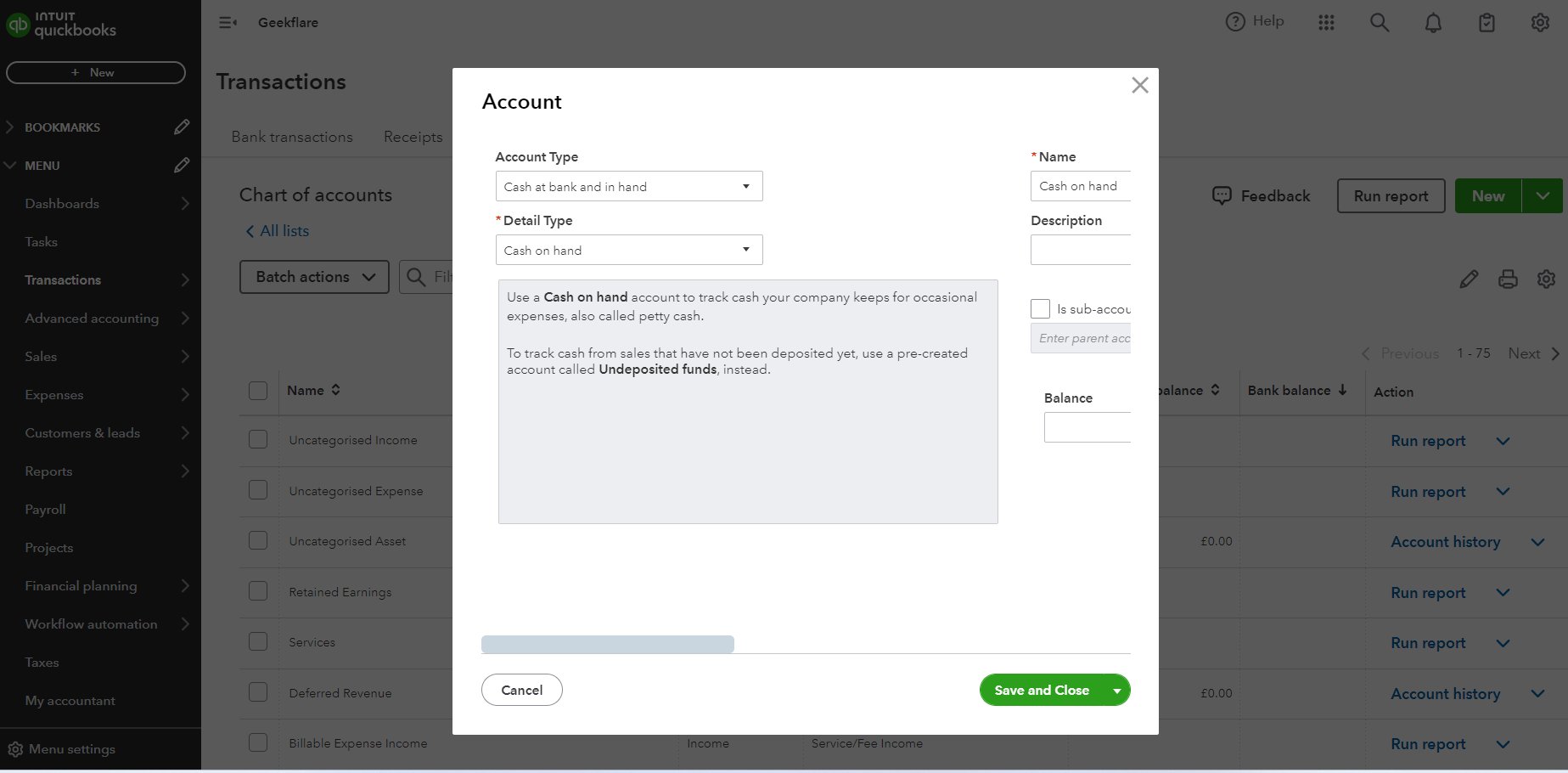

Accounting

QuickBooks is a complete accounting software for tracking expenses and managing invoices. It offers charts of accounting features for tracking assets and liabilities while categorizing transactions to automate the bookkeeping process. Companies can set up rules to categorize recurring transactions and create custom tags for income and expense tracking.

QuickBooks also provides users with an idea about project profitability. It has advanced accounting features like managing fixed assets. QuickBooks supports multi-currency business in 155 currencies. It connects with bank accounts to automate income and expense tracking.

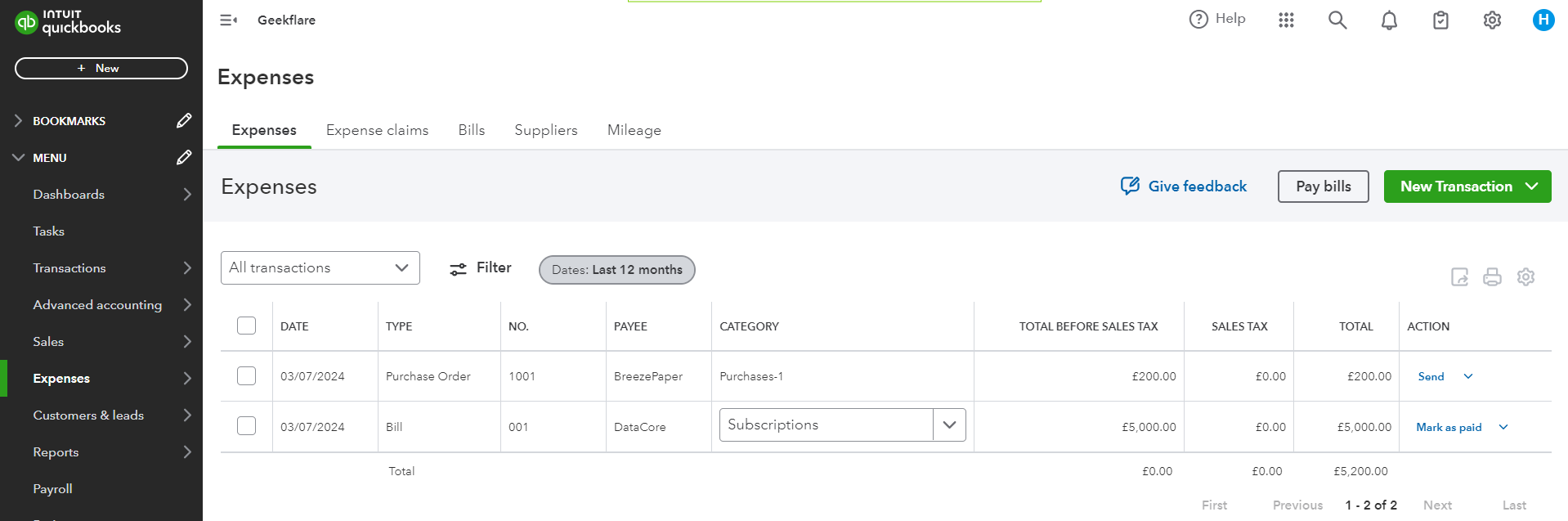

Expense Tracking

Businesses can track various expenses, such as bills, checks, purchase orders, supplier credits, credit card credits, supplier refunds, pay down credit cards, and bill imports, using QuickBooks. Users can filter the expense data based on category, date, payee, status, and delivery method for easy understanding.

It offers a mileage tracking facility where users can enter the trip data for automatic deduction calculation. QuickBooks mobile app also supports taking pictures of receipts to match its information with existing transactions. QuickBooks lets users view bills, expense claims, suppliers, and mileage separately.

Bill Management

QuickBooks enables organizing, tracking, and paying bills from one platform. Its bills dashboard provides a one-glance look at what you owe and to whom.

QuickBooks also records the paid bills by connecting with the vendors in the QuickBooks Business Network to import bills automatically. QuickBooks supports partial bill payments and shows when the remaining bill is due.

Bank Reconciliation

QuickBooks users can perform a bank account reconciliation to compare transactions with bank statements. For that, they can connect their bank accounts, PayPal, Square, and other accounts with QuickBooks for automatic transaction import.

After the reconciliation, QuickBooks automatically generates a reconciliation report. It also generates the Reconciliation Discrepancy Report, the Missing Checks Report, and the Transaction Detail Report to quickly identify discrepancies.

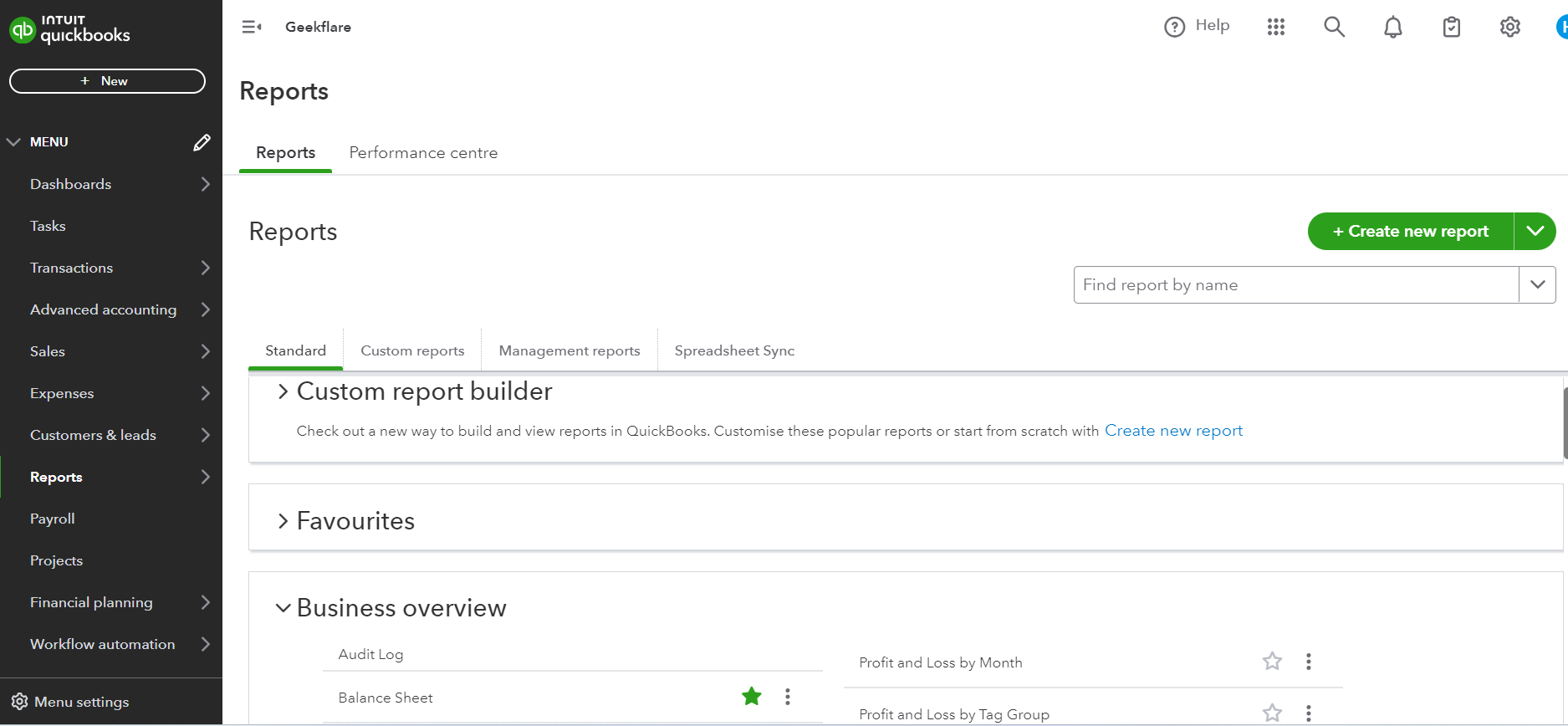

Reporting

QuickBooks generates presentation-ready reports that users can customize to track business performance and make informed business decisions. To make things easier, it offers report templates for business overviews, cash flow statements, sales and customers, balance sheets, expenses and suppliers, employees, payroll, HMRC, etc.

Users can create visual charts on expenses by time, revenue by time, cash flow, net profit, etc., from its performance center section. Moreover, QuickBooks allows the creation of new reports on invoices, sales, bills, expenses, etc.

Tax

QuickBooks users do not have to worry about tax calculation as the software does that automatically based on the sales tax rate for product or service type, date, location, and customer. All the related information is available in the Sales Tax Liability Report. Businesses can also get live tax expert assistance from QuickBooks to help with tax filing.

Here are some more tax planning software to help you with tax liability calculation.

QuickBooks Advanced Features

QuickBooks’s advanced features include payroll processing, time tracking, inventory tracking, and project management.

Payroll Processing

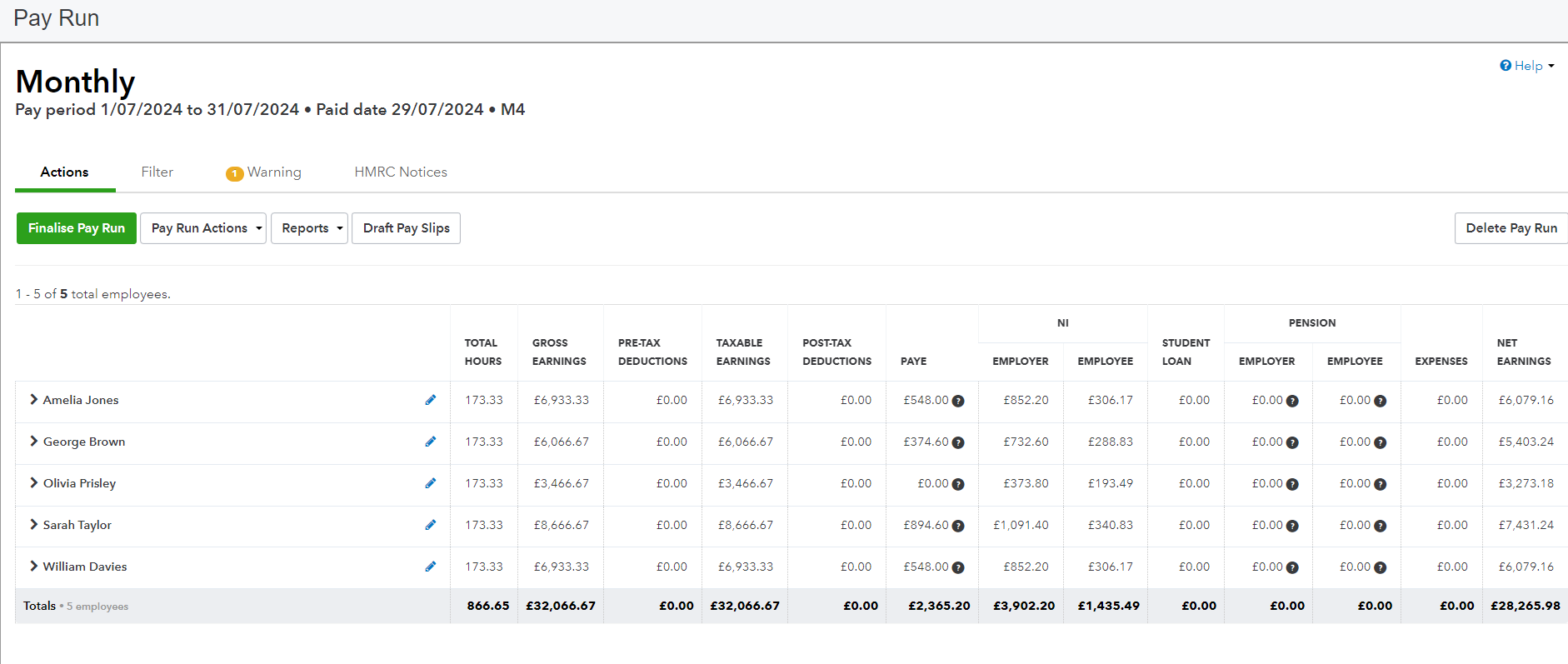

QuickBooks also functions as payroll software for companies that need to utilize the feature. Users can run payroll anytime or set it up for automatic run, ensuring the teams get paid on time or on the same day through direct deposit. It also supports filing payroll taxes.

QuickBooks also syncs with the QuickBooks Workforce app so employees can track their time and use that for payroll. It supports e-filing of 1099-MISC and 1099-NEC forms.

Inventory Tracking

QuickBooks‘ inventory management system keeps businesses automatically up-to-date with available quantities. Its inventory calculator ensures that users are not overstocking or understocking. It warns companies with low stock alerts and converts the purchase order into the bill when the inventory arrives. Users can access reports on best sellers, total sales, and taxes for on-demand inventory insights.

Time Tracking

Using the QuickBooks Time app, creating employee schedules, tracking projects, and managing time-offs becomes easy. Businesses can sync this app with QuickBooks Payroll to save time or manually enter employee time into projects.

For employees, there is the QuickBooks Workforce app that allows them to submit their clock-in and clock-out time with features like geofencing.

Project Management

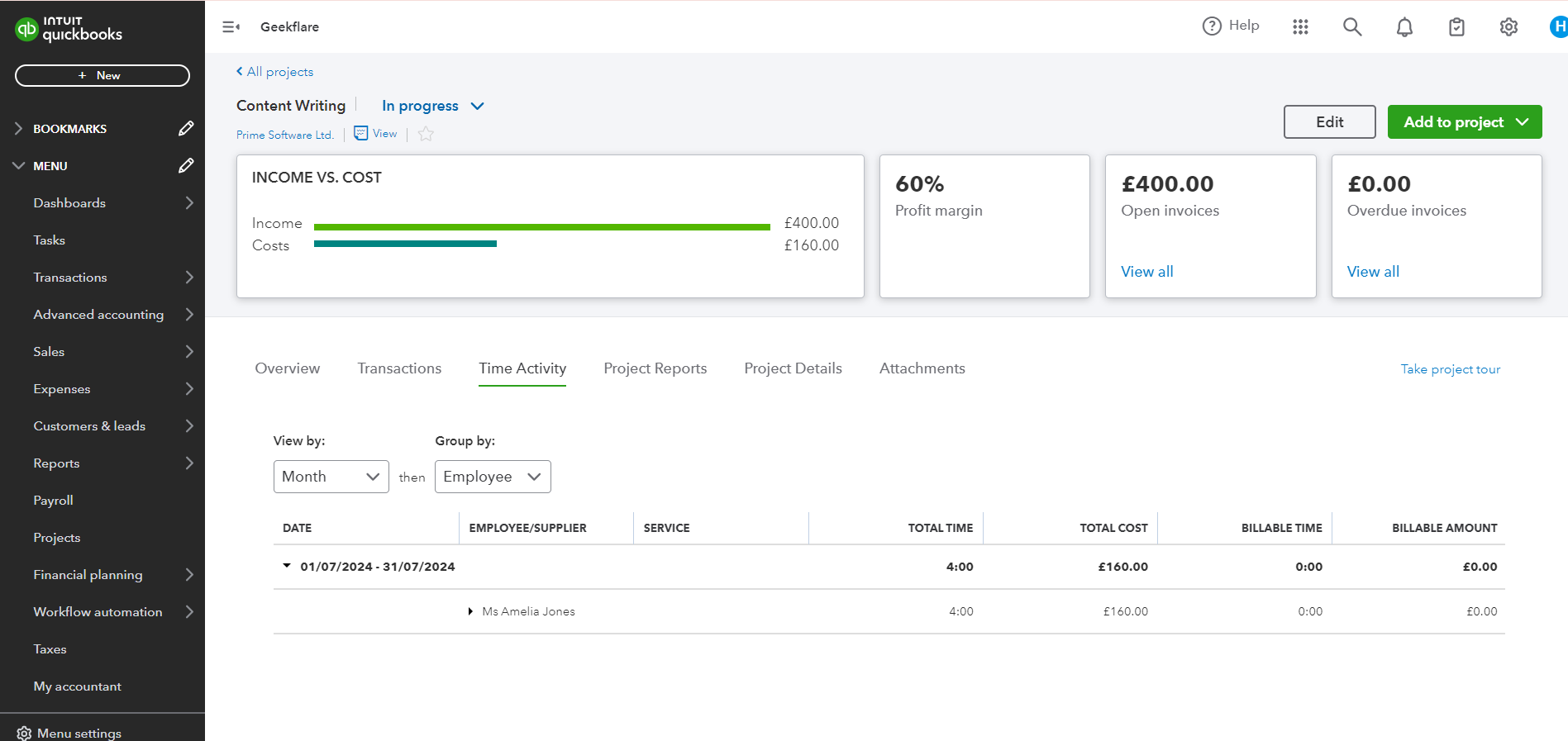

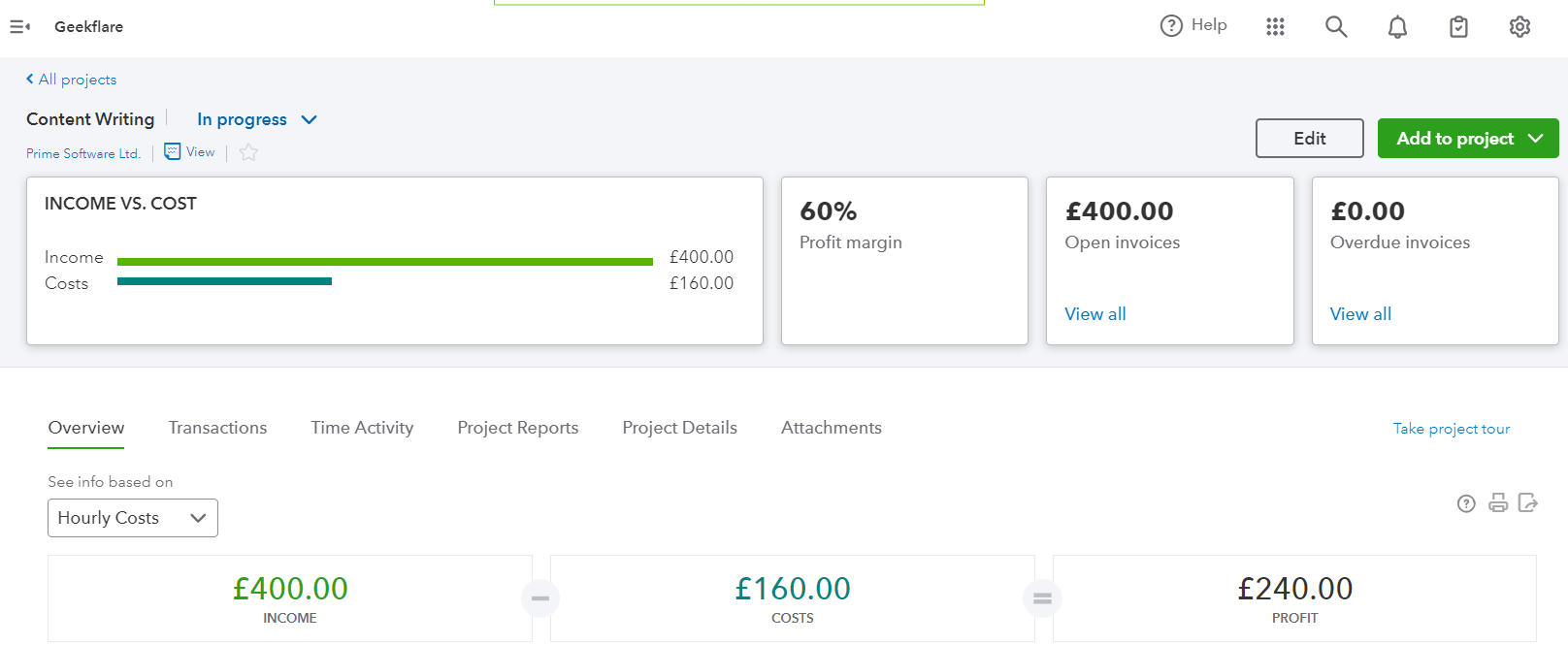

QuickBooks is not a dedicated project management software, but offers project profitability and job costing through synchronization with QuickBooks Payroll and QuickBooks Time. Companies can add invoices, estimates, expenses, time, bills, purchase orders, etc., to store all the necessary information about a project in one place.

QuickBooks also stores time activities, attachments, and transactions associated with each project. Businesses can generate reports on project profitability, time cost by employees, and unbilled time and expense for individual projects.

QuickBooks Pricing and Plans

The QuickBooks pricing and plans are outlined below.

QuickBooks Online Pricing

| Plan | Pricing (monthly) | Suitable for |

|---|---|---|

| Simple Start | $17.50 | Companies that need to add less than 3 users. |

| Essentials | $32.50 | Companies dealing with multiple currencies. |

| Plus | $49.50 | Companies require financial planning, inventory management, and project expense tracking. |

| Advanced | $117.50 | Businesses that need workflow automation. |

QuickBooks Payroll Pricing

| Plan | Pricing (monthly) | Suitable for |

|---|---|---|

| Payroll Core + Simple Start | $42.50 | Companies that have to pay the team and get the payroll taxes done. |

| Payroll Core + Essentials | $57.5 | Companies that need time tracking and expert review |

| Payroll Premium + Plus | $92 | Companies requiring access to on-demand experts and tax protection. |

QuickBooks Time Pricing

| Plan | Pricing (monthly) | Suitable for |

|---|---|---|

| Elite | $20 | Companies that need real-time project collaboration, geofencing, and mileage tracking |

| Premium | $10 | Companies looking for easy time tracking and team attendance from anywhere |

QuickBooks Integrations

QuickBooks supports integration with 750+ apps of different categories and industries. Users can add apps for marketing, income management, loans, commission management, business insights, document management, legal and regulatory compliance, contract management, purchase order management, and data management.

QuickBooks caters to a large number of industries, such as accounting, administration, agriculture, construction, health, energy and materials, manufacturing, professional services, real estate, retail, and technology.

QuickBooks Customer Support

QuickBooks offers technical support to its users. It has a knowledge base that explains most topics step-by-step and a community forum where fellow users and experts are available 24/7 to assist users. Its live chat facility allows users to get in touch with humans. QuickBooks has a customer support phone number, allowing users to request a callback. However, It does not offer email support.

QuickBooks For Accountants

QuickBooks For Accountants is an online portal that provides all the tools to manage their practice. Here, accounting professionals can track all their work by accessing client files in real time. It lets users communicate and share documents securely. It also offers self-paced advisory training to become trusted advisors.

QuickBooks For Accountants’ month-end review automatically identifies and resolves common bookkeeping issues so accountants can close the book accurately. It also helps them visualize and compare their clients’ business performance.

QuickBooks Ratings and Recognition

QuickBooks hails high ratings from prominent software review websites.

Platforms | Ratings Geekflare’s editorial team determines ratings based on factors such as key features, ease of use, pricing, and customer support to help you choose the right business software. |

|---|---|

Geekflare | |

G2 | |

Capterra |

QuickBooks Alternatives

While QuickBooks is a popular and powerful accounting software, it’s crucial to choose the software that best fits your business requirements and budget.

- Use Wave, Zoho Invoice, FreshBooks if you are a consultant, freelancer or small business and need an invoicing tool. Alternatively, try Geekflare Invoice Generator if you just have to generate an online invoice.

- Use Zoho Inventory, Fishbowl Inventory, Cin7 Core if you need to manage business inventory. Check in-depth review of popular inventory management software.

- Use NetSuite, Sage Intacct, AccountsIQ if you are an enterprise and need to manage complex financial requirements.

QuickBooks is offering 50%OFF and a 30-days free trial.