Zeni

Zeni is the frontrunner in transforming bookkeeping and financial management by integrating AI-powered automation into the traditional manual process. Its mission is to simplify bookkeeping and accounting through intelligent and automated systems that save time, improve accuracy, and give businesses real-time financial visibility.

Zeni is disrupting traditional bookkeeping by offering a centralized, AI-driven platform that integrates spend management, credit cards, tax services, and customizable financial reports in real time. This approach reduces month-end close times, minimizes human error, and keeps your business audit-ready with minimal effort.

A 2024 study shows that 37% of financial services reported improved operational efficiencies using AI, while almost 33% of companies mentioned getting a competitive edge by incorporating AI into their system. It is evident from the data that it is high time for the companies to include AI to automate their accounting process using Zeni.

How exactly does Zeni help you with automation? What benefits do you get by using Zeni? Let’s learn the answers to these questions in this Zeni Review.

Features

-

AI-powered bookkeeping for auditing, management, and insights.

-

Bill payment, reimbursement, and business checking accounts.

-

AI business credit card with cashback and no hidden fees.

-

CFO, taxation, and payroll services for human expertise.

-

Real-time financial insights and custom reports.

Pros

-

Supports payments to both domestic and international vendors.

-

Zeni Checking Accounts offers FDIC Insurance for up to $3 million.

-

Supports same-day ACH payouts and 160 currencies for reimbursements.

-

SOC 2 Type II compliant and uses military-grade 256-bit SSL/TLS encryption.

Cons

-

Currently available to US-based entities only.

-

Does not comply with GDPR.

-

No affordable plans for small businesses.

Zeni Review Methodology

Geekflare evaluated Zeni’s AI-powered bookkeeping functionalities, financial dashboards, integrations, and bill payment. We carefully reviewed its interface, user-friendliness, automation capabilities, and pricing to deliver a balanced, unbiased review. Our analysis combines hands-on experience with insights from verified user feedback, enabling businesses to make informed decisions about whether Zeni suits their specific needs.

What is Zeni?

Zeni is an all-in-one financial operations platform. It goes beyond just tracking the numbers — it actively learns from your financial data, automatically categorizes transactions, reconciles accounts daily, and produces clean books without constant manual input. Hence, startup founders and finance teams can shift their focus from paperwork to strategic decision-making.

It’s a blend of smart technology and expert human oversight that offers an efficient, scalable, and modern finance operation for startups and SMBs. Trusted by over 600 organizations, including Avoma, Matician, 1build, and Rel, Zeni saves an average of $100,000 every year.

What Problems Does Zeni Solve With AI?

If you choose to use Zeni, it can resolve the following problems.

Automated Bookkeeping

One of the most significant problems Zeni solves with AI is bookkeeping, an error-prone task that often consumes significant time. With this AI accounting software, businesses need to spend fewer hours manually entering data, categorizing expenses, or reconciling transactions, thanks to its AI-powered automation and a dedicated finance team that delivers accurate books in real-time.

From receipt analysis, transaction categorization, and invoice processing to vendor verification and journal entry management, Zeni’s intelligent algorithms, which learn and adapt to your business’s specific patterns, can easily perform the tasks.

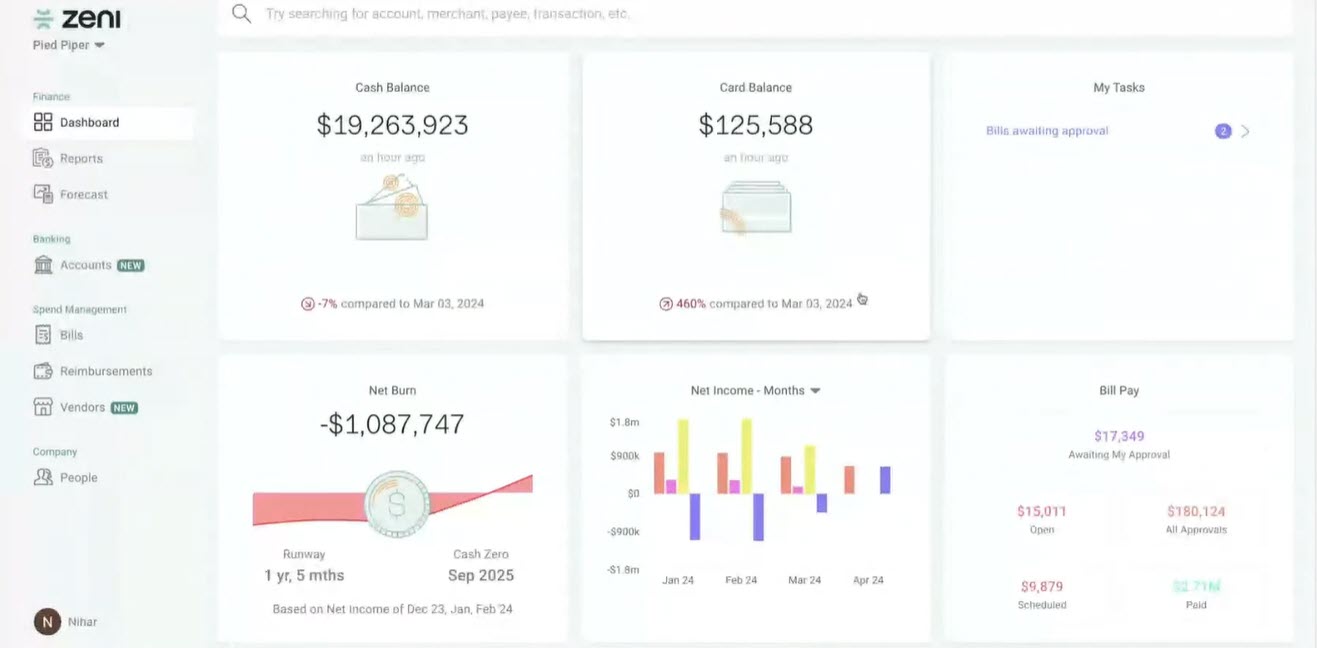

The benefits go far beyond just automation — it helps businesses scale effortlessly, make faster decisions, and confidently control their business finances without the stress. With real-time financial data insights, Zeni keeps your Profit & Loss statements, balance sheets, and cash flow reports up to date. These features offer instant visibility into your company’s financial health.

This bookkeeping AI assistant has an AI Audit Bot feature that constantly verifies transactions for accuracy, flags discrepancies, and ensures compliance with GAAP standards. It reduces your risk and increases trust in your numbers. Moreover, if you need a closer look at anything, there is a dedicated team of experts ready to guide you.

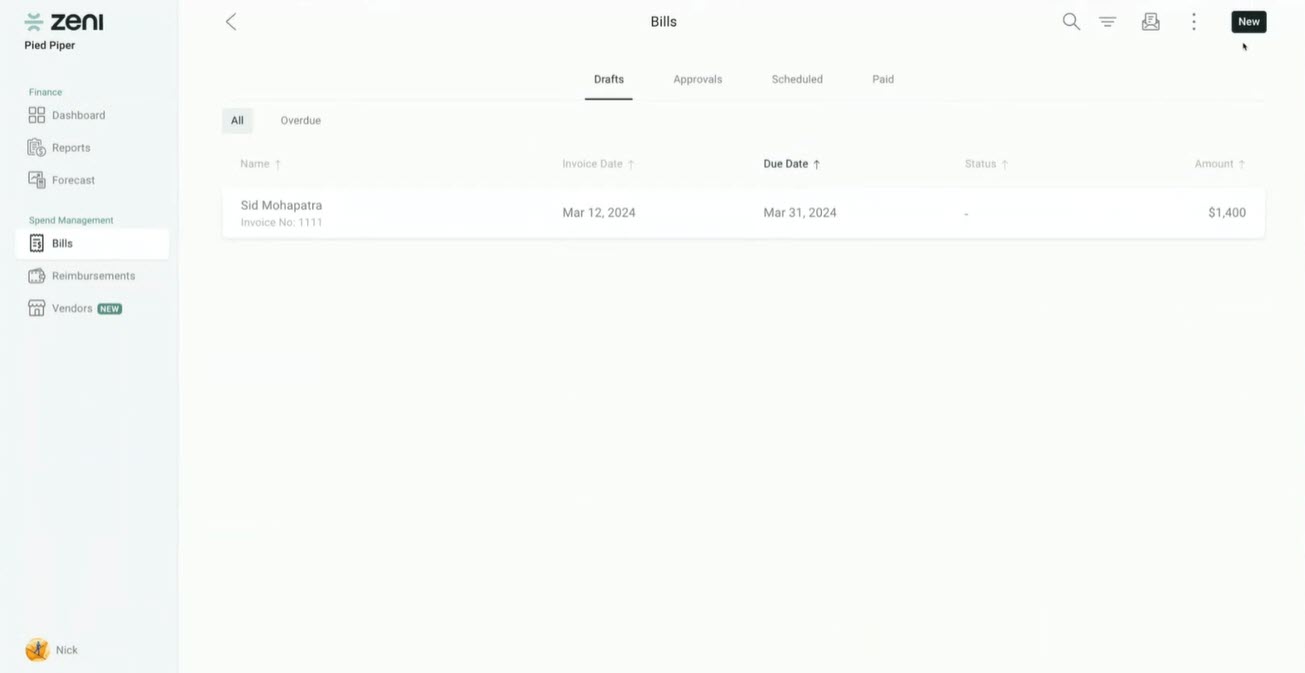

Automated Bill Payments

Zeni tackles one of the most time-consuming and error-prone areas of business finance — automated bill payments, and it does so by turning it into an AI-powered, intelligent process. The traditional vendor bill management process or AP automation solutions involve a lot of manual entry, approval delays, and the risk of late or missed payments. Zeni completely transforms this experience with its AI-driven Bill Pay system.

Using ZeniGPT, the software automatically captures bill details, categorizes them, and even recommends vendors. This means you no longer have to spend hours keying in data or worrying about duplicate entries.

Its automated approval flow allows your business to set up custom rules for reviewers and approvers of bills before making payments, ensuring control and accountability without costly bottlenecks. In addition, Zeni does not charge any platform or ACH fees, and if you use Zeni Checking Accounts, you even get free multi-currency support for international payments in 160 currencies — great for companies with global operations.

Want to know about a bonus feature? Its dashboard offers a real-time view of vendor spend trends, so if there is a sudden spike in monthly payments, you can immediately check out the detailed breakdown. With the assistance of dedicated financial experts, you can manage everything from bill payments to reimbursements and credit cards in one unified platform. If you own a growing business, this means fewer mistakes, faster payments, and complete peace of mind around cash flow management.

Expense & Reimbursement Management

Employee expense and reimbursement management is one of the biggest pain points for growing businesses. Zeni turned this slow and tedious process into a faster, smoother, and stress-free one with its AI-powered reimbursement management system.

Instead of manually inputting data or chasing down receipts, your employees can simply submit multiple receipts together, and Zeni’s AI takes care of the rest through expense information auto-population. On the admin side, you can set up custom multi-level approval workflows reflecting your internal policies to keep things compliant and efficient.

With same-day ACH reimbursements, you can pay your employees within the same day, sometimes within hours. It makes your employees satisfied and improves organizational reputation. Real-time sync with Zeni’s dashboard gives finance teams a clear view of reimbursement statuses, spending trends, and overall financial health. Ultimately, Zeni replaces the usual delays, confusion, and clutter with a fast, centralized, and user-friendly experience.

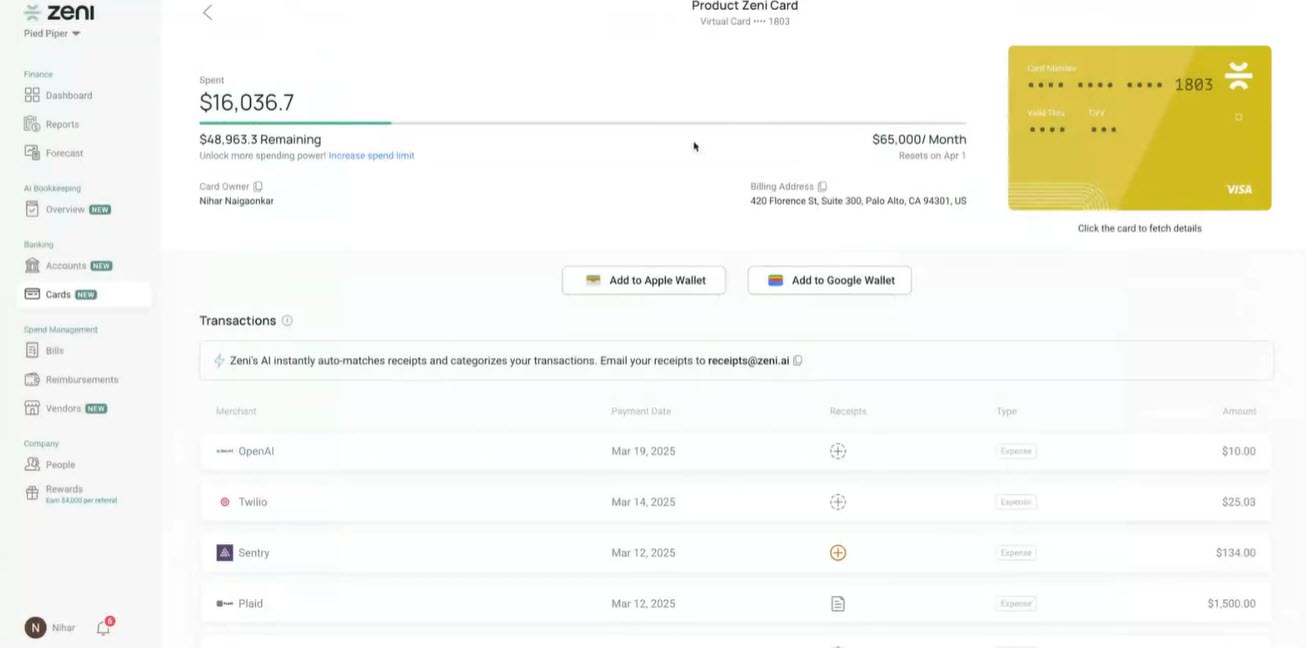

Zeni redefines expense management with the power of AI. Every transaction is instantly categorized, vendors are recognized, and reconciliation happens automatically, resulting in books that are clean and updated in real-time. You can even issue unlimited virtual cards instantly, assign department-specific limits, and see where every dollar goes with real-time visibility.

Integrated Business Accounts & Cards

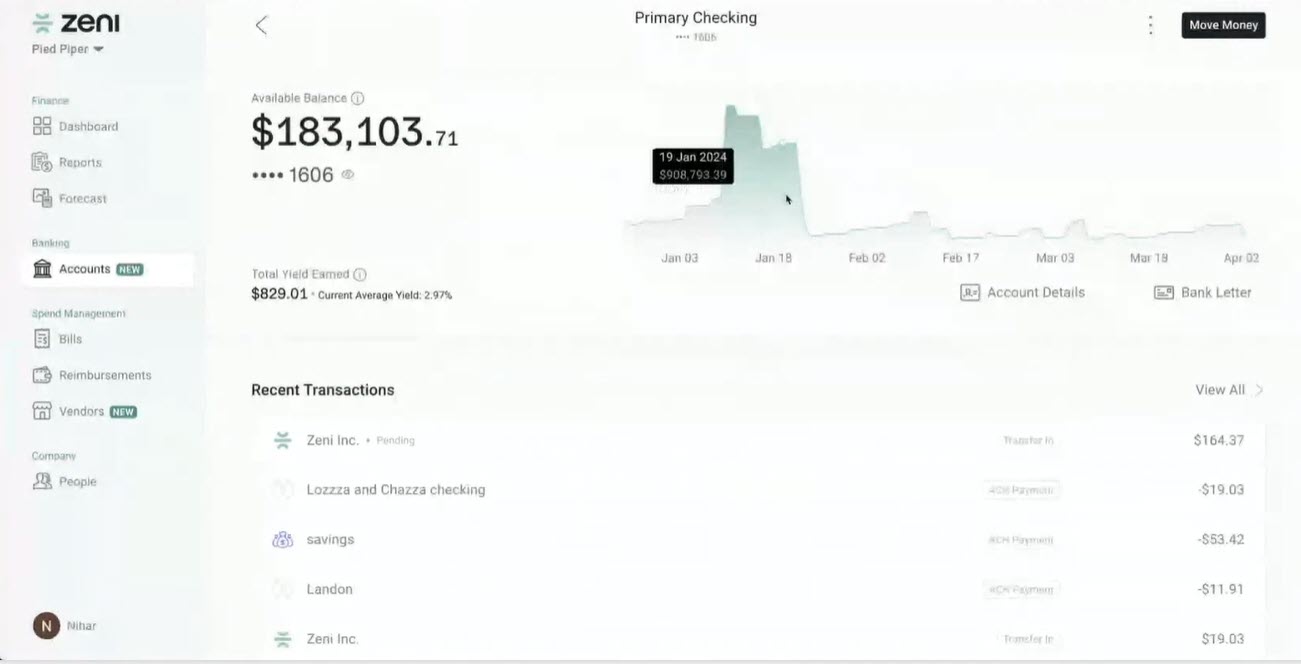

Zeni offers an integrated, AI-powered approach to business banking and credit card management, solving a major challenge for startups and growing businesses. Traditionally, tracking expenses and optimizing cash flow involved juggling multiple systems, inefficiencies, hidden fees, and a lack of visibility.

Zeni brings business checking accounts and credit cards into a unified platform that works seamlessly with the rest of its financial tools. The result? You get a centralized financial ecosystem that provides more control, better insight, and smarter spending, without the typical hassles of traditional banking. It generates financial statements for accounts payable & receivable while performing bank reconciliation, cash flow forecasting, and financial health analysis.

Unlike the conventional corporate card providers that often come with complex reward structures and credit checks, Zeni offers a more transparent and flexible alternative. With its Business Credit Card, you can earn a 1.75% cashback on every purchase, without any confusing rules or hidden annual fees. Moreover, there’s no credit check or personal guarantee required, an ideal scenario for startups that are yet to establish a credit score.

Zeni’s AI-powered checking accounts don’t just offer 3.34% APY and free wire transfers; they also simplify your operations by syncing effortlessly with bill payments, reimbursements, and bookkeeping, all while protecting up to $3M in FDIC insurance.

3 Zeni Services

If you are an SMB or startup that does not have a budget to hire full-time professionals for high-level strategy or daily bookkeeping, here’s a closer look at the services that Zeni provides.

1. Fractional CFO

Zeni’s Fractional CFO service is the perfect option for startups that need senior-level financial guidance without the expense of hiring a full-time executive. Whether you’re just getting started, gaining traction, or scaling rapidly, their fractional CFOS provide expert insights, clear reporting, and smart strategies, without the hefty cost of hiring in-house.

Its unique capability of centralizing your real-time bookkeeping, accounting, reporting, and CFO support in one platform removes the constant back-and-forth communication and data exchange between separate teams. As a result, your finance operations become more streamlined, efficient, and collaborative.

Whether you’re preparing for a board meeting, planning your next round of funding, or trying to get a clearer picture of your cash flow, Zeni’s experienced fractional CFOs or digital CFOs have you covered. By opting for this service, you can get assistance in building custom financial reports, performance dashboards, and strategic presentations so that you can be well-prepared and confident in front of investors or stakeholders.

Fractional CFOs also help you break down big-picture goals into concrete, data-driven action plans by performing financial planning, budgeting, and forecasting tasks. As your business grows, Zeni makes it easy to make informed decisions through their support for cash flow analysis, risk management, investor reporting, and even M&A planning.

2. Payroll Processing

While managing payroll can be stressful and complex for startups and growing businesses, Zeni can step in as your reliable managed payroll partner who takes away these headaches. Even if you’re overwhelmed by more pressing matters, Zeni professionally handles the AI-powered payroll management and does so accurately and on time.

From calculating taxes and benefits deductions to adjusting for raises and offering direct employee support, it manages all your company payroll tasks. It even comes with add-ons like filing 1099s and W-2s, setting up payroll systems, and consultation on payroll challenges.

Its biggest benefit is its expert-led support, which means you have real professionals, not just software, that help you stay compliant across all 50 states. So, if you are planning to get an outsourced accounting professional or incorporate accounting automation into your business operation, I would recommend Zeni. Especially for startups with remote teams or employees scattered across different jurisdictions, this is a plus point.

Zeni manages the entire employee lifecycle, starting from their onboarding tasks such as verifying employment eligibility and setting up direct deposits. It also handles termination steps such as final paychecks, benefits cancellation, and exit paperwork. Zeni even supports international contractors besides helping you with state-based compliance.

3. Tax Accountant

Managing taxes can be incredibly complicated, and not every business has the budget to hire a full-time tax accountant. For them, Zeni offers Tax Accountant services to help with complex tax matters without the stress of handling everything themselves. Working with Zeni means pairing with a certified tax professional who actually understands your business and helps you with automated tax preparation, tax strategy, tax advisory, and tax filing automation.

Whether you run a C-Corp, S-Corp, or LLC, its team navigates the tax landscape on your behalf, making sure you maximize your credits, avoid penalties, and stay fully compliant with both federal and state regulations. The team consists of real humans who can walk you through annual tax filings, federal and state income taxes, R&D tax credits, and even foreign reporting.

I am impressed by the performance of their proactive tax accountant team, which makes Zeni stand out. They’ve already helped businesses capture over $6.5 million in R&D tax credits and avoid $70,000 in penalties, that too with a record of 100% on-time filings and zero IRS audits. With add-on support for sales tax, handling monthly, quarterly, or annual reporting based on your needs, you can stop worrying about tax deadlines or tax compliance issues.

Is Zeni a Bank?

No, Zeni is not a traditional banking institution. Instead, Zeni partners with Thread Bank for bank integration to offer business checking accounts and FDIC insurance coverage up to $3 million via a sweep network.

Zeni Pricing

Zeni AI bookkeeping pricing starts from $494/month. It has various pricing plans for the products and services it offers.

| Service | Starter | Growth |

|---|---|---|

| AI Bookkeeping | $494/month | $719/month |

| Fractional CFO | $1350/month + $2,000 setup | $2610/month + $6,000 setup |

| Taxes | $2499/year | $3899/year |

| Payroll | $199/month |

While Zeni offers an impressive all-in-one AI financial solution, its pricing is on the higher side and may not be suitable for small businesses or early-stage startups with limited budgets.

Compared to alternatives like Bench, which offers bookkeeping services at nearly half the cost, or Gusto, which provides US payroll services starting at just $40 per month, Zeni’s comprehensive solution can feel financially out of reach for lean teams. Given the value it provides, I expect to see Zeni introduce a more affordable plan tailored to startups, offering core features like basic bookkeeping, automated expense tracking, and US payroll services.

Zeni Integrations

Zeni offers seamless integrations with the popular accounting software QuickBooks Online Plus. It allows Zeni to pull data automatically from other applications and offers you a unified financial view with minimal manual input. Zeni also supports API integration with QBO Pro, Avalara, Plaid, Stripe, PayPal, and Square.

Best Zeni Alternatives for AI Bookkeeping and Accounting

Zeni is not the only AI-powered accounting and bookkeeping software out there. In fact, you can consider several top-tier alternatives to this software.

- Vic.ai uses advanced AI to automate invoice processing and approval workflows, making it ideal for finance teams who want to reduce manual data entry and improve accuracy.

- Booke.ai is an ideal fit for accounting firms managing multiple clients because of its real-time error detection, revenue & expense categorization, and client communication tools.

- Bill AI streamlines accounts payable processes, bill payments, vendor payment automation, and audit readiness for mid-sized businesses.

- Pilot delivers tailored solutions for startup accounting with a blend of AI and expert support.

- Bench combines software with human bookkeepers to provide simplified financial statements and year-end tax support. If you own a small business and are a sole proprietor looking for hands-off bookkeeping, this should be your go-to option.

Should You Use Zeni?

If you own a startup or small to mid-sized business (SMB) that handles a high volume of bookkeeping tasks and already pays over $500–$600/ month in accounting fees, Zeni is suitable for you. Switching to Zeni will not only reduce costs but also automate financial operations, free up time, and improve accuracy.

Zeni’s AI dashboard gives you real-time visibility into automated cash flow insights, spending, revenue insights, and financial forecasting for easier decision-making. Its combination of human supervision and AI provides efficiency and reliability. However, Zeni is not the right fit for very small businesses with tight budgets or those currently spending less than what Zeni charges. In these cases, it won’t make financial sense to upgrade a working and affordable system simply for AI-powered features.

Zeni received 4.7 out of 5 based on 65+ reviews on G2. There, users laud its automated financial updates, efficiency support team, and clean interface. However, Zeni users seemed to be unhappy with the approaches by account managers, journal entries, and limited metrics.

Zeni Verdict – My Opinion

Zeni is an innovative SaaS accounting solution backed by AI that simplifies the complex financial needs of growing businesses. With features like automated accounting, real-time dashboards, smart employee reimbursement, and AI-driven categorization, Zeni brings the financial clarity and efficiency that smaller teams need but usually lack.

My personal favorite feature of Zeni is its blend of technology with human expertise. This means that you are not blindly relying on algorithms; there are dedicated finance professionals who know your business and can help you whenever necessary. This hybrid approach makes a huge difference, especially for complicated finances. That’s why Zeni receives the Geekflare Innovation Award.

Though branded as a software designed to help startups and SMBs, it may not be affordable to many of these businesses. In fact, the cost of the starting plan of Zeni might seem expensive and unaffordable to many small businesses and new ventures.

So, if you are a mid-sized business that wants to free your team from manual bookkeeping or if you are already spending more money on CFOs and tax accountants than Zeni’s pricing, go for it. With finance automation on the rise across industries, tools like Zeni will soon become essential.

-

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.

EditorRashmi Sharma is an editor at Geekflare. She is passionate about researching business resources and has an interest in data analysis.